17 Car Insurance Discounts You Can’t Miss in 2026

Car insurance discounts offer potential savings of up to 40% on premiums. Key discounts include safe driver, multi-vehicle, and bundling policies, which significantly reduce costs for insured parties. Taking advantage of safe driver or multi-vehicle discounts can help you reduce costs significantly.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated January 2026

Car insurance discounts provide a strategic way to reduce your premiums. With discounts like multi-car, safe driver bonuses, and premium bundling, you can reduce your rates by as much as 30%.

Our Top 17 Picks: Car Insurance Discounts| Discount | Rank | Savings Potential | Description |

|---|---|---|---|

| Safe Driver | #1 | 40% | No accidents or violations |

| Telematics (Usage-Based) | #2 | 30% | Monitor driving habits with a device |

| Bundling | #3 | 25% | Bundle auto with other policies |

| Good Student | #4 | 20% | Discount for good grades |

| Accident Forgiveness | #5 | 15% | Avoid rate hike after first accident |

| Employer/Association | #6 | 15% | Discount through employer or association |

| Hybrid/Electric Vehicle | #7 | 15% | Own a hybrid or electric car |

| Low Mileage | #8 | 15% | Drive fewer miles annually |

| Military | #9 | 15% | For active military and veterans |

| New Car | #10 | 15% | Purchase a new car with safety features |

| Anti-Theft Device | #11 | 10% | Install anti-theft devices |

| Defensive Driving | #12 | 10% | Complete a safety driving course |

| Homeownership | #13 | 10% | Own your home |

| Loyalty | #14 | 10% | Stay with the same insurer |

| Paid-in-Full | #15 | 10% | Pay the full premium upfront |

| Senior Citizen | #16 | 10% | For drivers 55+ years old |

| Paperless Billing | #17 | 5% | Opt for paperless billing |

A good driver discount often provides the highest rate reduction for the most substantial savings, rewarding safe driving habits with lowered costs. Compare quotes in our guide to the best auto insurance for good drivers.

- Auto Insurance Discounts

- Best Discounts for Vehicle Garaging and Storing in 2026

- Best Good Driver Auto Insurance Discounts in 2026

- Best Multi-Vehicle Auto Insurance Discounts in 2026

- Best Electric Vehicle (EV) Insurance Discounts in 2026

- Best Good Student Auto Insurance Discounts in 2026

- Best Defensive Driving Insurance Discounts in 2026

- Best Anti-Theft Auto Insurance Discounts in 2026

- Best Low-Mileage Auto Insurance Discounts in 2026

- How Airbags Affect Auto Insurance Rates in 2026

Understanding and applying these hidden auto insurance discounts ensures you get the best monthly rates on your car insurance policy.

- Unlock up to 40% savings on premiums with car insurance discounts

- Get significant savings with safe driver and multi-car discounts

- Bundle your policies to unlock bigger discounts and reduce overall costs

Get the right policy at the best price — enter your ZIP code to shop for free car insurance quotes from the top providers.

Comparing Popular Car Insurance Discounts

Car insurance discounts differ significantly by provider. Some insurers are better than others when it comes to savings. Telematics-based safe driver discounts, for example, can go as high as 40%, as with Geico and Allstate. American Family and Liberty Mutual have the most significant bundle discounts, up to 29% and 25%, respectively.

Car Insurance Discounts From Top Providers| Insurance Company | Anti- Theft | Bundling | Defensive Driving | Good Driver | Good Student | Military | Multi- Vehicle | New Car | Paperless | Pay-in Full | Safe Driver |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 10% | 25% | 10% | 25% | 35% | 25% | 10% | 10% | 3% | 10% | 18% | |

| 25% | 25% | 5% | 25% | 25% | 12% | 23% | 15% | 4% | 20% | 18% |

| 10% | 20% | 10% | 30% | 20% | 20% | 12% | 12% | 3% | 10% | 20% | |

| 25% | 25% | 15% | 25% | 26% | 15% | 25% | 10% | 3% | 10% | 15% | |

| 35% | 25% | 10% | 20% | 12% | 10% | 25% | 8% | 3% | 12% | 20% |

| 5% | 20% | 10% | 40% | 15% | 25% | 15% | 15% | 3% | 15% | 12% | |

| 25% | 10% | 30% | 30% | 10% | 15% | 12% | 10% | 4% | 15% | 10% | |

| 15% | 17% | 15% | 25% | 25% | 25% | 20% | 15% | 3% | 15% | 20% | |

| 15% | 13% | 20% | 20% | 10% | 10% | 8% | 8% | 3% | 15% | 15% | |

| 15% | 10% | 5% | 15% | 30% | 30% | 10% | 10% | 3% | 20% | 10% |

USAA continues to offer the top good driver discount at 30%, while Geico and Nationwide stand out with safe driver discounts of up to 40%. Bundling discounts reach their peak with American Family at 29%, providing significant savings for multi-policy customers. Liberty Mutual leads in anti-theft discounts. (Read More: Liberty Mutual vs. Nationwide Auto Insurance).

Geico and Allstate offer telematics-based programs so that safe driving habits can translate into the most savings potential. Simply identifying these top discounts allows drivers to better target their insurance search to each provider’s savings potential.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Discounts Lower Car Insurance Rates

Car insurance has many personal and vehicle-type discounts, and each one can have a huge impact on your premium. As an example, USAA monthly rates are the lowest, with auto insurance discounts for veterans at $56.

Liberty Mutual and Geico priced the highest post-discount at $68 and $60, respectively (Read More: USAA Insurance Review).

Auto Insurance Monthly Rates With Discount| Insurance Company | Original Monthly Cost | Discount Percentage | Final Monthly Rate |

|---|---|---|---|

| $80 | 17% | $66 | |

| $75 | 17% | $62 | |

| $78 | 19% | $63 | |

| $85 | 29% | $60 | |

| $90 | 24% | $68 |

| $82 | 21% | $65 |

| $79 | 22% | $62 | |

| $82 | 22% | $64 | |

| $85 | 25% | $64 | |

| $70 | 20% | $56 |

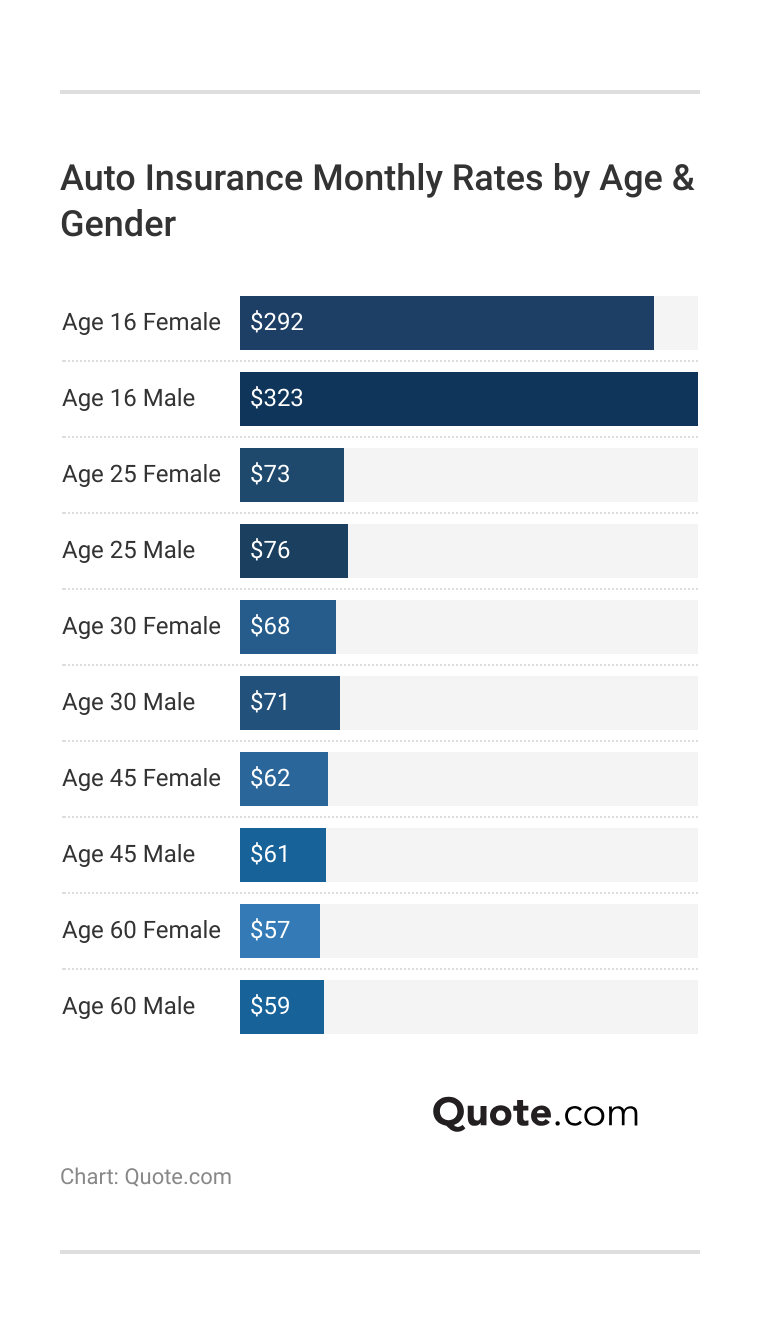

Age and gender are also critical to your car insurance quotes. A 16-year-old boy gets a quote of $195 a month for minimum coverage, and a 45-year-old woman gets a quote of $175 a month, demonstrating how important it is to ask for auto insurance discounts for teens to lower rates for young drivers.

Older drivers pay the least for insurance by qualifying for car insurance discounts for seniors. Many providers offer exclusive savings for drivers over 65 who complete defensive driving courses or remain claim-free. Compare cheap auto insurance for seniors to find the lowest rates.

Key Car Insurance Discounts to Reduce Premiums

While auto insurance options can be tricky, taking advantage of the best car insurance discounts can help drivers save quite a bit on their premiums. It pays to be a low-mileage driver or a student who excels at school, and there are plenty of discounts that can shave your monthly premiums. Here are the car insurance discounts you should ask about:

- Defensive Driving Discounts: You may qualify for up to 10% off when you complete a state-approved defensive driving program. These courses improve your driving skills and make you safer while driving.

- Low Mileage Discounts: If you drive less than 12,000 miles, you could receive discounts averaging 11%. Shop with the best pay-as-you-go auto insurance companies for more competitive low-mileage discounts.

- Autopay Discounts: Many insurers offer a discount when setting up automatic payments. This ensures timely payments and can typically save you about 4% on your premiums.

- Bundling Discounts: Combining multiple policies, such as home and auto insurance, with the same provider can lead to significant savings—sometimes as much as 20% off the total cost of your premiums.

- Good Student Discounts: To qualify for car insurance discounts for students, have a teen driver on your policy who maintains a “B” average or higher (Learn More: Best Good Student Auto Insurance Discounts).

Leveraging discounts for auto insurance is a smart way to make it more budget-friendly. Each discount can save significant costs, but safe drivers qualify for the best car insurance discounts.

Knowing more and asking your insurer directly about auto insurance discounts can help you secure the cheapest car insurance.

Smart Strategies for Reducing Car Insurance Costs

Adding multiple cars to your insurance policy can provide discounts that also make your expenses easier to keep track of. Instead of tracking each policy down for each vehicle in your house, grouping them under one policy can help you save time and money.

Taking eco-friendly measures, like signing up for paperless billing or switching to a hybrid car, can also shave another 4%-10% off your premiums. Security upgrades like installing anti-theft devices can also lower your rates, as they reduce the risk your insurer faces.

Choosing safer vehicles, like small SUVs or minivans, instead of sports cars, can decrease your premiums. Maintaining a clean driving record without accidents or tickets could make you eligible for safe driver discounts, often requiring a spotless record for five to seven years. To save more money on car insurance, consider raising your deductible, which lowers monthly payments but increases out-of-pocket costs for repairs.

Other Ways to Save on Car Insurance

If you’re looking for additional ways to save, consider taking a defensive driving course. In many states, completing a 5–6 hour safety course can reduce your risk of accidents and qualify you for a discount of up to 10%. Confirm with your state and insurer whether this discount applies (Learn More: Best Defensive Driving Insurance Discounts).

Reducing how much you drive can also lower your premiums. Driving under 12,000 miles might save you around 11%, and minimizing commuting days can cut costs by another 4%.

Car insurance policies or discounts for those who work from home and rarely drive?

byu/emo-ghostface inremotework

Setting up automatic payments is another simple option and saves you about 4%. Bundling your auto insurance with home or life insurance can lead to even more significant discounts, sometimes up to 20%. Students or recent graduates may qualify for discounts of roughly 4% by maintaining good grades or earning a degree.

Always compare discounts across providers, and consider bundling policies and opting for higher deductibles to lower your premiums.

Jeff Root Licensed Insurance Agent

Many providers will also offer discounts based on professional memberships or careers, such as car insurance discounts for nurses or teachers. If your current insurer doesn’t offer professional discounts, it may not be a bad idea to cancel your car insurance and look for a provider that recognizes and rewards these efforts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Your Expert Guide to the Best Car Insurance Discounts

When it comes to saving the most money on car insurance, taking advantage of available discounts is essential. Multi-car, safe driver, bundling, and other discounts can add up to 40% or more off your premiums.

View this post on Instagram

Each insurer has its own discounts and savings potential, making it wise to compare multiple quotes from the best car insurance companies to find the one that rewards your lifestyle. See if you’re getting the best deal on auto insurance by entering your ZIP code here.

Frequently Asked Questions

Which insurance company offers the most discounts?

Top providers known for significant discounts include Farmers, Geico, Allstate, and State Farm. However, the best car insurance discounts depend on individual circumstances such as driving history, location, and the type of vehicle insured. Compare State Farm vs. Farmers, Geico, Progressive, and Allstate auto insurance to learn more.

What are the six car insurance discounts you should ask about?

Insurance companies often offer discounts for bundling multiple policies, good driving records, completion of driver safety courses, installation of anti-theft devices, enrollment in paperless billing, and teen drivers who maintain good grades.

What is an early quote discount?

An early quote discount is a reduction in premiums offered when you obtain a quote and secure your policy before your current one expires. This encourages proactive policy management, rewarding drivers who plan ahead with lower rates for their next term.

How does the car insurance loyalty discount work?

The car insurance loyalty discount offers a percentage off premiums for customers who stay with the same insurer over time. This is one of the best tips to pay less for car insurance because it helps long-term customers reduce their overall insurance costs as a reward for continued business. While specific savings vary by provider, the longer the loyalty, the bigger the potential discount.

What are the best car insurance discounts for new drivers?

New drivers often benefit most from good student discounts, driver education course savings, and being added to a parent’s existing policy for a multi-vehicle discount. These discounts reduce costs while ensuring adequate coverage for inexperienced drivers.

What are the best car insurance discounts for seniors?

Senior drivers benefit greatly from discounts such as the mature driver discount, retirement discounts, and low-mileage discounts.

How do I negotiate lower car insurance rates?

Maintain a clean driving record, complete a defensive driving course, and bundle your auto insurance with home or renters insurance. Additionally, opt for low-mileage discounts if you don’t drive frequently. If you cannot afford your auto insurance, exploring these specific discounts can help you manage and reduce your costs effectively.

How do I get auto discount quotes for car insurance?

What steps should I take to get car insurance discounts? Start by comparing rates online, contacting insurance agents directly, or using tools provided by insurance websites. Always specify that you’re looking for discounted rates when providing your vehicle and driver information. Enter your ZIP code to see who has the best discounts near you.

Who actually has the cheapest auto insurance?

State Farm and Geico typically have the lowest rates, but you can find cheap auto insurance by exploring commonly available discounts such as multi-policy bundles, safe driver rewards, and low-mileage reductions.

How does discount auto insurance differ from standard policies?

Discount auto insurance typically offers the same core coverage as standard policies, but at lower premiums due to specific qualifications. For example, drivers with clean records or multiple vehicles insured with the same company may receive discounts that reduce their monthly rates without sacrificing coverage quality. Use a visual guide to auto insurance to better understand these options.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.