AAA Auto Insurance Review for 2026

Our AAA auto insurance review found minimum rates from $45 per month for Classic or Plus members, with up to 30% off for good drivers and 14% discounts for students with strong grades. The American Automobile Association also offers up to 15% off VIN etching and roadside service that won’t affect your rate.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated December 2025

This AAA auto insurance review shows how Classic and Plus members can start with minimum coverage at just $45 a month, which includes helpful perks like 100-mile towing.

- AAA waives rate hikes with accident forgiveness for qualifying drivers

- Rental car coverage is included while your vehicle is under repair

- PIP coverage is only available in select states, like Utah

If you’ve had a clean driving record for five years, you could save up to 30% with AAA, and students with at least a 3.0 GPA may qualify for a 14% discount.

AAA roadside assistance service is built into membership and stays separate from your car insurance policy, so using it will never raise your premiums. To see how your rates compare, use our free comparison tool now.

Comparing AAA Auto Insurance Rates

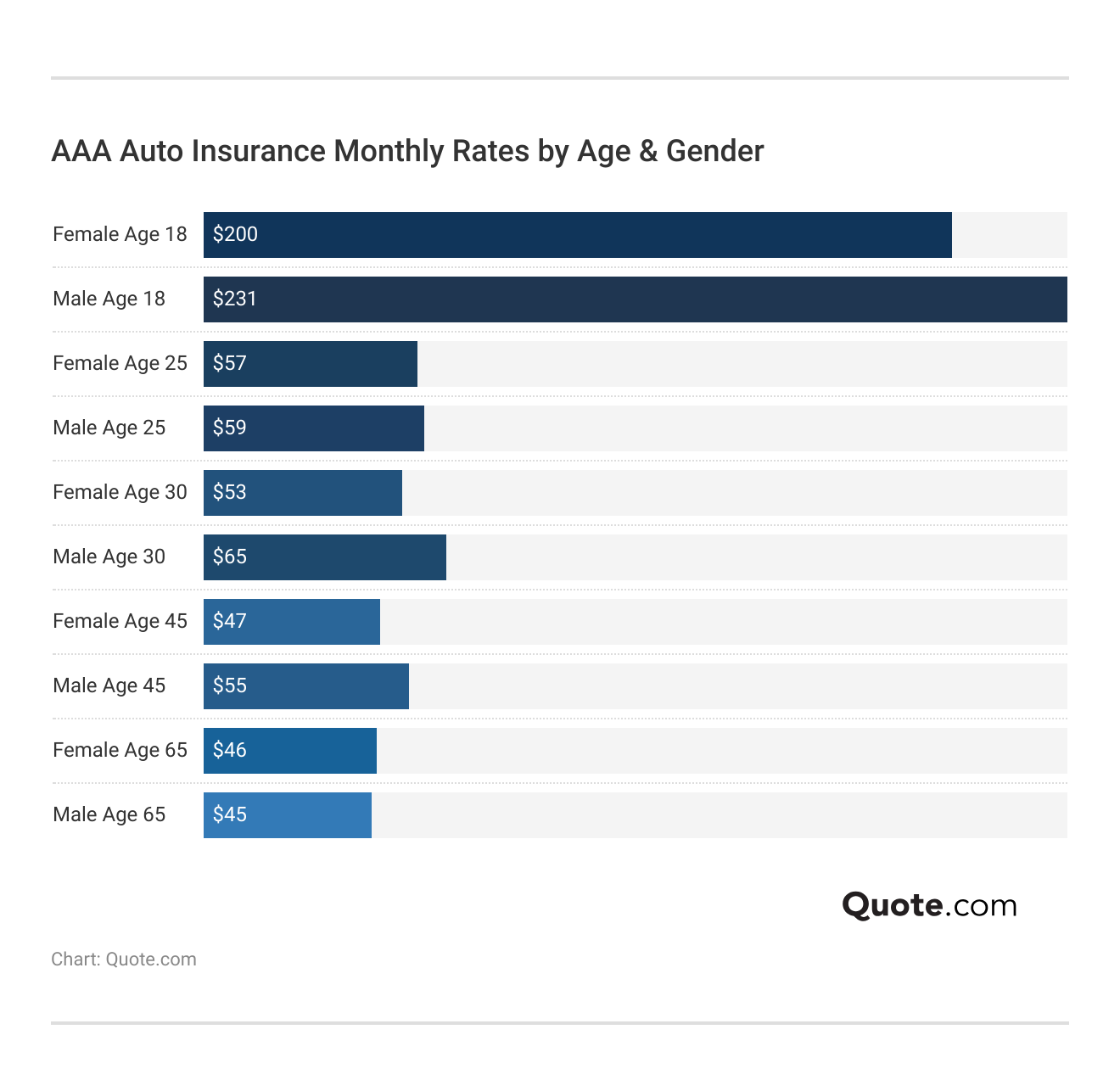

If you’re wondering how much your age and gender can shape your AAA auto insurance rate, this chart clearly explains it.

Young drivers get hit the hardest, especially 18-year-old guys, who pay around $231 a month.

Based on accident data, insurers see new teen drivers as higher risk. But once you hit 25, things settle down, and rates drop nearly in half, showing that experience pays off.

However, your AAA rate can spike fast if you get a ticket or cause an accident, and it adds up quicker than you’d think. This chart shows how each type of violation affects what you’ll pay.

AAA vs. Top Competitors: Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $65 | $58 | $71 | $81 |

| $87 | $103 | $124 | $152 | |

| $62 | $73 | $94 | $104 |

| $76 | $95 | $109 | $105 | |

| $43 | $56 | $71 | $117 | |

| $96 | $116 | $129 | $178 |

| $63 | $75 | $88 | $129 | |

| $56 | $74 | $98 | $75 | |

| $47 | $53 | $57 | $65 | |

| $53 | $72 | $76 | $112 |

AAA starts around $65 per month if your record’s clean, which is pretty middle-of-the-road. For example, after one accident, AAA only bumped up to $71, while some competitors jumped much higher.

And even with a DUI on your record, AAA’s $81 rate is noticeably lower than Liberty Mutual or Geico, making it a more forgiving option if you’re trying to get back on track.

Trying to figure out which company gives you the most for your money? This breakdown makes it easier. AAA lands in the middle, with full coverage averaging $122 monthly.

It’s not the cheapest, but it might be worth the extra few bucks, considering that roadside help and travel perks are included.

AAA vs. Top Competitors: Auto Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

If keeping costs low is your top priority, Geico’s $43 minimum coverage is hard to beat, which is why it’s often listed among the best car insurance companies.

AAA, though, is cheaper than Allstate and Farmers, but with more benefits than stripped-down options. If you want solid perks like roadside help but don’t want to overpay, AAA is still one of the top providers to consider.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best AAA Auto Insurance Discounts

AAA makes saving easy if you’re smart about how you drive and pay. If you’ve browsed through AAA car insurance reviews, you’ll see people save by making everyday choices like bundling policies or setting up AutoPay.

AAA Auto Insurance Discounts| Discount |  |

|---|---|

| Good Driver | 30% |

| Multi-Car | 25% |

| Bundling | 15% |

| Pay-in-Full | 15% |

| Safety Features | 15% |

| Defensive Driving | 14% |

| Good Student | 14% |

| Loyalty | 12% |

| Distant Student | 10% |

| Anti-Theft | 8% |

| Affinity Group | 7% |

| AutoPay | 5% |

| Paperless | 5% |

Keeping a clean driving record could save up to 30%, knocking over $500 off your yearly bill.

Families insuring multiple cars can get 25% off their AAA auto insurance cost, and parents of college students who live away from home without a car can trim another 10%.

Students living away from home without a car may qualify for distant student discounts—just make sure to ask.

Michelle Robbins Licensed Insurance Agent

Looking for tips to pay less for car insurance? Even small steps, like paying in full or joining an employer-affiliated group, can cut 5–7% off your premium and add up quickly.

If you’re considering making the switch, requesting an AAA quote can help you see exactly how these discounts apply to your situation.

- Bundling Discount: Combine auto insurance with AAA home or renters insurance to unlock bundling savings. It’s a simple way to streamline bills and shrink costs.

- Good Student & Distant Student Discounts: Teens with a B average or college students living over 100 miles away without a car qualify for solid savings.

- Pay-in-Full or AutoPay: Paying your premium upfront or enrolling in automatic payments nets a small but steady discount. You also avoid potential late fees or billing hiccups.

- Multi-Car Discount: Insure two or more cars under the same AAA policy and save nearly a quarter of your premium. This discount is ideal for families or shared households.

- Safe Driver Discount: Avoiding tickets and accidents can earn you AAA’s highest discount tier. A clean driving record could save you over $500 per year on full coverage.

These are proven ways to make AAA’s already robust coverage more affordable. If you compare auto insurance companies, stacking these discounts can give AAA the edge without giving up the extras.

And it’s not just the savings people love. AAA also earns praise for its 4.5-star-rated customer service, travel discounts, and member perks like hotel deals and trip planning tools.

More Tips to Lower Your AAA Auto Insurance

Discounts aren’t your only option to save on AAA auto insurance. A few smart changes to your policy can shave dollars off your bill without cutting critical coverage.

For instance, don’t double up on roadside help. If your credit card or car warranty already includes roadside service, opt out of AAA’s version to avoid paying twice.

- Drop Comprehensive on Older Cars: Did you get a car worth less than $3,000? Skipping comprehensive might make sense if it costs more than you’d get back in a claim.

- Raise Your Collision Deductible: Bumping your deductible to $1,000 could drop your premium if you don’t file claims often. It’s a good move if you’re okay covering minor repairs out of pocket.

- Skip Rental Coverage If You Have a Spare Car: You won’t need to pay for rental reimbursement if you have another car you can use while one’s in the shop.

- Use AAA’s Low-Mileage or Telematics Program: Drive under 8,000 miles annually. AAA has usage-based plans that can lower your rate just for driving less.

You don’t have to overhaul your entire policy to save. Just tightening a few parts of your AAA coverage can help you spend less while staying protected.

See More: What to Do If You Can’t Afford Your Auto Insurance

AAA Auto Insurance Coverage Options

Wondering what AAA covers? From essential protections to smart add-ons, AAA lets you tailor a policy to fit your lifestyle.

Getting a triple-A insurance quote is a smart way to see how these options impact your price before finalizing your coverage.

AAA Auto Insurance Coverage Options| Coverage | What It Covers |

|---|---|

| Liability | Other drivers' injuries and property damage you cause |

| Collision | Your car's damage from collisions |

| Comprehensive | Damage from theft, fire, weather, vandalism |

| Uninsured/Underinsured Motorist | Your injuries caused by uninsured drivers |

| Medical Payments (MedPay) | Your and passengers’ medical bills |

| Personal Injury Protection | Medical costs, lost wages, essential services |

| Rental Reimbursement | Temporary transportation while car is repaired |

| Roadside Assistance | Emergency help for breakdowns or lockouts |

| Gap Insurance | Remaining loan balance after total loss |

| Custom Equipment | Damage to custom or aftermarket parts |

| New Car Replacement | Same make/model if car totaled |

| Accident Forgiveness | No rate increase after one accident |

Liability insurance helps pay for damage or injuries you cause to someone else, and it’s something most states require you to have to drive legally. However, AAA tends to be pricier here, partly because even its minimum policies include built-in roadside assistance.

Collision auto insurance coverage helps cover the cost of fixing your car after a crash, even if you were the one who caused it. Comprehensive coverage handles damage from theft, fire, hail, or anything that isn’t a crash.

It’s great for newer cars or leases, but not always worth it for older vehicles. If your car’s only worth a couple of thousand dollars and you’re spending a few hundred a month on collision and comprehensive coverage, you might pay more premiums than the car’s worth.

Gap insurance helps if you’re financing a car and owe more than it’s worth, covering the difference if the vehicle is totaled. Accident forgiveness prevents your rate from rising after your first at-fault accident, offering peace of mind for safe drivers.

AAA Roadside Assistance Plan Breakdown

AAA’s roadside assistance is what most members enjoy. If you’re stuck with a flat tire, a dead battery, or locked out of your car on a holiday weekend, help usually arrives within 30 minutes.

Even better, using this service won’t raise your insurance rates because it’s tied to your membership, not your policy. For drivers who need help more than once a year, that’s a huge win.

Then there’s the Global Discounts Program: members get year-round savings on hotels, car rentals, dining, and entertainment, including popular theme parks and national retailers.

Combine that with their car-buying program, and you’ll have access to exclusive deals, which are especially helpful if you’re shopping during the best time to buy a new car, like year-end clearance sales or model changeovers.

If you compare auto insurance companies, AAA stands out for benefits beyond basic coverage and supports you in everyday driving situations. Getting an AAA car insurance quote online is a smart first step to see how these extras stack up against the cost.

AAA insurance may not be the cheapest, but perks like VIN etching discounts, trip planning, and bundling add real value. AAA rewards drivers who make their cars harder to steal. You can get up to 15% off by having your VIN etched into your windows.

Customer Reviews and Ratings of AAA

These ratings show how AAA performs when it’s time to use your insurance. Its 0.58 complaint index from the NAIC is a big deal when it comes to filing AAA insurance claims.

It shows that fewer people report issues compared to the industry average, which means less frustration when handling claims or billing.

AAA Auto Insurance Ratings & Customer Reviews| Agency |  |

|---|---|

| Score: 706 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: 0.58 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

That consistency can make a big difference when you’re stressed after an accident. The A+ rating from the Better Business Bureau shows AAA quickly resolves complaints and treats customers fairly when problems arise.

And with an A from A.M. Best, you know the company is financially solid if you ever need to file a significant claim. It’s worth considering when you’re ready to buy auto insurance, especially if long-term reliability matters to you.

Comment

byu/SerenityJoyMeowMeow from discussion

inInsurance

On Reddit, one user shared their AAA experience after breaking down on a holiday weekend. They said a tow truck showed up in under 30 minutes. While they admitted AAA wasn’t the cheapest, they felt the fast help and travel perks made it worth it.

Others in the thread said AAA’s roadside service had saved them during stressful moments. It’s not always about paying less. That kind of reliability is important when you need it most.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of AAA Auto Insurance

AAA auto insurance stands out for extras like roadside help and travel discounts. Whether it’s getting help fast when your car breaks down or knowing your upgraded stereo system is covered, AAA goes beyond standard policies with coverage that fits your life.

- Robust Coverage Menu: AAA includes specialized add-ons like new car replacement and custom equipment protection, which is ideal for those who’ve invested in mods.

- Fast Emergency Response: Several Reddit users shared that they received help in under 30 minutes, even on busy holidays, giving peace of mind in high-stress breakdowns.

- VIN Etching Discount: AAA offers up to 15% off your comprehensive premium if you etch your car’s VIN into the windows, which is an affordable theft deterrent that lowers claims risk.

That said, AAA’s value depends on how much you’ll use the extras. While the features are impressive, not everyone needs them, and the pricing structure reflects the bundled perks. Other common AAA auto insurance complaints include:

- Limited Value for Low-Risk Drivers: If you don’t use trip-planning tools, hotel perks, or frequent emergency assistance, you may pay more for services you’ll never tap into.

- Mandatory Membership Requirement: Unlike other insurers, AAA requires a separate annual membership to access insurance, even if you’re not using their travel discounts or roadside services.

Overall, AAA is a strong pick for drivers who want support, protection, and peace of mind built into every part of the plan. Just make sure to compare auto insurance companies to see if those extras match what you need.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Find Affordable Coverage With AAA Auto Insurance

AAA offers strong coverage and extras like fast roadside assistance and member travel discounts. It’s best suited for drivers who want value-added perks and consistent support, not just basic liability.

One standout? AAA’s low 0.58 NAIC complaint index, proof of fewer claim issues than most. To save money, use AutoPay for a 5% discount or etch your VIN for up to 15% off comprehensive coverage. Good drivers could also knock 30% off their premiums.

Using VIN etching as a theft deterrent not only adds security but also unlocks unique insurance savings.

Melanie Musson Published Insurance Expert

Enter your ZIP code to see how to get multiple auto insurance quotes online and compare AAA side-by-side against top insurers in your area.

You may also want to call an agent directly as some discounts aren’t shown upfront on the website, so speaking to someone ensures you get the lowest rate possible.

Frequently Asked Questions

What is the average cost of AAA car insurance per month?

You’ll typically pay around $122 monthly for full coverage with AAA, while minimum coverage averages $65 per month. Rates can be higher for young drivers; 16-year-old males may pay up to $664 per month, making it essential to compare options based on your age and record.

Is AAA car insurance a reliable choice?

AAA stands out for its 4.5-star rated customer service, low 0.58 NAIC complaint index, and benefits like roadside assistance and trip planning. It’s ideal if you value dependable claims handling and perks beyond standard auto policies.

Should you choose AAA or American Family for car insurance?

AAA may be a better fit if travel perks, roadside help, and student discounts matter to you. But if you’re after more personalized options, our AmFam insurance review highlights highly customizable home and auto bundles, and unlike AAA, you won’t need to pay a separate membership fee to access those perks.

What are the key differences between AAA and Safe Auto?

While Safe Auto focuses on basic, low-cost policies, AAA provides extras like free battery jump-starts, trip interruption coverage, and up to 15% off for VIN etching. If you need more than just minimum liability, AAA delivers stronger value.

How does AAA compare to 21st Century insurance for everyday drivers?

AAA delivers layered benefits—like accident forgiveness and rental reimbursement—plus exclusive hotel discounts through membership. 21st Century may cost less per month but lacks the travel and roadside perks to save you long-term money.

Does AAA offer any pet insurance plans?

Yes, AAA partners with providers to offer pet insurance that covers emergency vet visits, wellness checks, and chronic conditions. Some plans reimburse up to 90% of costs and work well for families with high veterinary bills. AAA’s partnership options can be a convenient add-on for existing members looking to protect their furry companions compared to other pet insurance companies.

How does accident forgiveness work under AAA policies?

AAA’s accident forgiveness keeps your premium from increasing after your first at-fault accident. This feature is especially helpful if you’ve had a clean record for several years and want rate protection for unexpected mistakes.

Can you buy AAA auto insurance if you live in Utah?

Yes, AAA auto insurance is available in Utah, though policy types and discounts, like multi-car or good student savings, may vary by ZIP code. Calling an agent ensures you don’t miss out on regional offers or hidden discounts.

Is AAA insurance better than Geico for your needs?

AAA may be better if you value travel perks, 24/7 roadside help, and strong customer service. However, Geico generally offers lower monthly rates and wider national availability without requiring a separate membership. Explore everything you need about Geico to see how it stacks up in coverage, pricing, and convenience.

What are the disadvantages of AAA?

You’ll need to pay for a membership to access AAA insurance, even if you don’t use other services. Also, AAA tends to have higher monthly premiums than discount carriers, especially if you only want basic liability coverage.

Why is AAA insurance so expensive in some states?

Is AAA or Progressive better?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.