10 Best Auto Insurance Companies in Arkansas for 2026

State Farm, American Family, and Allstate are the best auto insurance companies in Arkansas, with rates starting at $36 per month. Arkansas drivers must carry minimum liability coverage of 25/50/25, and top providers offer usage-based discounts that can lower premiums by up to 40%.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated November 2025

The best auto insurance companies in Arkansas are State Farm, American Family, and Allstate. State Farm offers the lowest rates, at just $36 per month.

- State Farm and AmFam are the top auto insurance companies in AR

- Arkansas drivers must carry minimum liability coverage of 25/50/25

- Safe driving gets you the best Arkansas car insurance discounts

State Farm stands out as the top choice overall for affordability, strong claims satisfaction, and reliable local agents.

American Family ranks highly for its flexible policies and solid discounts tailored to Arkansas drivers. Allstate delivers value through its Drivewise program, offering usage-based savings of up to 40%.

Top 10 Companies: Best Auto Insurance in Arkansas| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 664 / 1,000 | A++ | Local Agents | |

| #2 | 660 / 1,000 | A | Custom Policies |

| #3 | 644 / 1,000 | A+ | Drivewise Program | |

| #4 | 641 / 1,000 | A++ | Budget Rates | |

| #5 | 641 / 1,000 | A | Safe Drivers | |

| #6 | 640 / 1,000 | A | Add-On Options |

| #7 | 637 / 1,000 | A++ | High-Risk Drivers | |

| #8 | 632 / 1,000 | A+ | Usage Discounts | |

| #9 | 628 / 1,000 | A | Roadside Assistance |

| #10 | 597 / 1,000 | A | Online Tools |

Rates vary across the state depending on age, driving history, and coverage level, but these three providers consistently balance price and protection.

By comparing rates and discount opportunities, you can find affordable auto insurance, no matter your driving record, by entering your ZIP code into our free quote comparison tool.

Compare Arkansas Auto Insurance Costs

The average cost of auto insurance in Arkansas changes a lot depending on whether you choose a basic plan or full protection.

Basic coverage keeps your payment low each month, but it may not be enough if you’re in a serious crash. Full coverage costs more, but it includes extra protection that can save you from paying large repair bills later.

Arkansas Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $189 |

| $78 | $226 | |

| $66 | $191 |

| $79 | $231 | |

| $43 | $126 | |

| $48 | $138 |

| $61 | $178 | |

| $63 | $183 | |

| $38 | $101 | |

| $38 | $112 |

Safeco and State Farm have the lowest price for minimum coverage in Arkansas at $38 per month, making them the most affordable choices.

Safeco also comes in first for full coverage at $101 per month, followed by State Farm at $112 monthly and Geico at $126 a month.

In Arkansas, minimum coverage keeps premiums low, but full coverage gives stronger protection for repairs, theft, and storm damage.

Kristine Lee Licensed Insurance Agent

When picking between the two types of coverage, Arkansas drivers should think about their budget, driving record, and how much risk they’re willing to take if an accident happens.

Always compare Arkansas car insurance rates before you buy to see which company offers you the best rate based on your age, driving history, and the city you live in.

Arkansas Car Insurance Rates Vary by Age

Age is one of the biggest factors affecting car insurance rates in Arkansas. Younger drivers often face the highest premiums because of limited driving experience, while drivers over 25 typically start seeing more affordable rates, especially with a clean record.

Adding a young driver to a policy can raise costs quickly, which is why it’s smart for Arkansas families to compare multiple companies and take advantage of available discounts. By age 25, Safeco offers the cheapest minimum coverage in Arkansas at $46 per month, making it a smart choice for younger drivers looking to save.

Arkansas Auto Insurance Monthly Rates by Age| Company | Age: 25 | Age: 35 | Age: 45 | Age: 55 |

|---|---|---|---|---|

| $59 | $55 | $65 | $43 |

| $95 | $88 | $78 | $74 | |

| $82 | $77 | $66 | $61 |

| $102 | $95 | $79 | $75 | |

| $53 | $49 | $43 | $40 | |

| $54 | $50 | $48 | $45 |

| $81 | $75 | $61 | $57 | |

| $95 | $88 | $63 | $57 | |

| $46 | $42 | $39 | $36 | |

| $52 | $47 | $38 | $36 |

Rates begin to ease at age 35, when many insurers offer more competitive prices, dropping into the $40 to $95 range. By age 45, Safeco remains the cheapest at $39 per month, with State Farm a close second at $38, making both highly competitive options for mid-aged drivers.

At age 55, Safeco and State Farm tie for the lowest rate at $36 per month, giving older drivers the most affordable coverage options in the state.

Comparing rates and discounts from multiple providers is crucial for young drivers to find cheap auto insurance for teens.

This wide gap shows families why comparing providers is crucial when adding young drivers and why safe driving discounts and bundled policies can make a big difference in lowering costs.

Arkansas Auto Insurance Costs for High-Risk Drivers

Your record on the road has a big influence on what you’ll pay for car insurance in Arkansas. A clean history leads to the lowest prices, but even one accident or ticket can raise your monthly bill.

A DUI usually causes the biggest jump, though some companies weigh risks differently. Nationwide raises rates the most after a DUI, while State Farm charges hundreds less per month after the same offense.

Arkansas Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $65 | $71 | $81 | $58 |

| $78 | $107 | $105 | $91 | |

| $66 | $99 | $109 | $77 |

| $79 | $113 | $110 | $99 | |

| $43 | $92 | $138 | $47 | |

| $48 | $77 | $91 | $64 |

| $61 | $92 | $135 | $70 | |

| $63 | $116 | $73 | $87 | |

| $39 | $49 | $59 | $67 | |

| $38 | $45 | $44 | $42 |

State Farm and Safeco offer the most stable rates, keeping monthly costs under $50 even with an accident or ticket.

Geico is very affordable for drivers with clean records, but jumps to $138 a month after a DUI, showing how much risk can change premiums.

Progressive stands out because a DUI costs less than an at-fault accident, with rates at $73 monthly compared to $116 per month after a crash. Not all car insurance companies in Arkansas view violations the same way, so always compare quotes before choosing a policy.

Read More: Cheap Auto Insurance for High-Risk Drivers

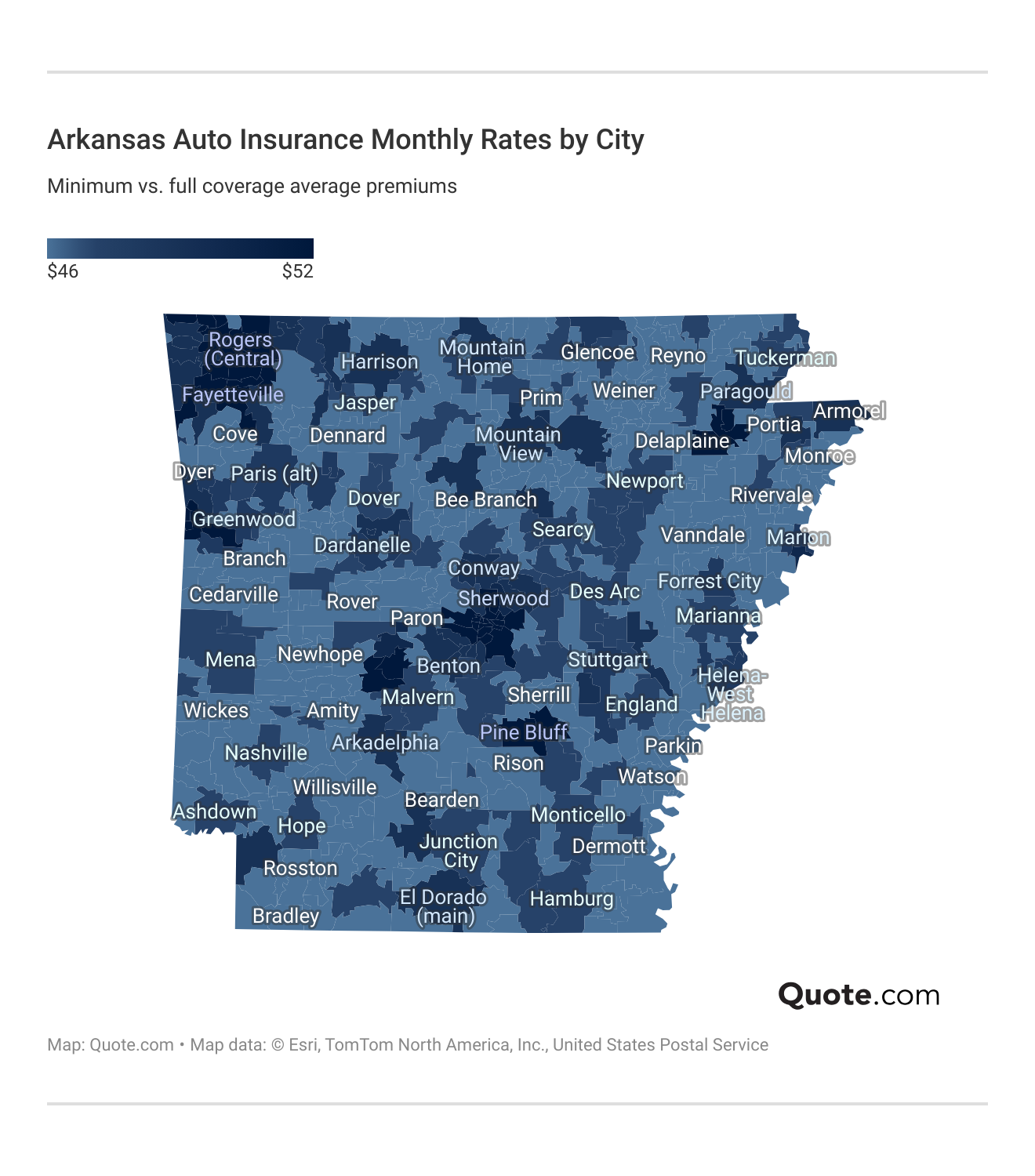

Auto Insurance Rates Throughout Arkansas

Where you live in Arkansas can influence how much you pay for car insurance. Urban areas with higher traffic and accident risks often see higher premiums, while smaller towns may enjoy slightly lower averages.

Drivers in counties with more traffic density or higher claims history usually face higher prices, while rural areas generally see more affordable coverage. Most cities in Arkansas fall within a narrow range, with average rates between $46 and $52 per month.

Central areas such as Little Rock, Conway, and Pine Bluff lean toward the higher end, while smaller communities like Safeco, Sheridan, and Green Forest trend lower.

Comparing quotes across the best auto insurance providers is especially important for Arkansas drivers living in busier regions since the right insurer can offset the added cost of city-based risk.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Requirements in Arkansas

To drive legally in Arkansas, every driver must have liability insurance. This type of insurance helps pay for injuries and property damage if you cause an accident.

The state minimum coverage, also called 25/50/25, which means $25,000 for injury to one person, $50,000 total for injuries in one accident, and $25,000 for damage to property.

These amounts are the least you can carry, but they may not be enough if a crash causes serious damage or medical bills. Many drivers in Arkansas choose higher limits or add extra options for better protection.

Choosing only the minimum keeps costs low, but more coverage can save you from large bills after an accident (Learn More: Auto Insurance Requirements by State).

Optional Auto Insurance Coverage in Arkansas

While Arkansas law only requires liability insurance, many drivers choose to add more protection, like collision insurance and uninsured motorist coverage.

Extra coverage helps cover costs that the state minimums don’t pay for, giving drivers more financial security after an accident.

- Collision Coverage: Collision auto insurance pays for damage to your car if you hit another vehicle or object, which is helpful in busy Arkansas cities where accidents are more common.

- Comprehensive Coverage: Comprehensive auto insurance covers non-collision losses such as theft, vandalism, hail, or deer accidents, which are frequent in rural areas of Arkansas.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if another driver has no insurance or too little, an important safeguard since AR has a higher-than-average rate of uninsured drivers.

- Medical Payments Coverage (MedPay): MedPay helps pay for medical expenses for you and your passengers, no matter who caused the accident.

- Rental Reimbursement: Covers the cost of a rental car if your vehicle is in the shop after an accident, which is useful for commuters in areas with limited public transportation.

Adding these coverages gives Arkansas drivers peace of mind by filling the gaps left by the state’s 25/50/25 minimums.

Whether you live in Little Rock with heavy traffic or a rural county where hitting wildlife is common, these options can save you from paying large expenses out of pocket.

Ways to Lower Arkansas Insurance Rates

Lowering your auto insurance bill in Arkansas isn’t just about grabbing discounts. Drivers can also save in other ways, including safe driving habits and good credit.

Even with a bad driving history, you can still lower rates with higher deductibles. Here are tips to pay less for car insurance:

- Keep a Clean Record: Arkansas drivers with accident-free and ticket-free records consistently pay the lowest rates.

- Choose a Higher Deductible: Raising your deductible can cut monthly payments for Arkansas policyholders willing to pay more out of pocket after a claim.

- Drive Fewer Miles: Reducing annual mileage helps Arkansas drivers, especially commuters, qualify for lower premiums.

- Improve Your Credit Score: Insurers in Arkansas often give better rates to drivers with stronger credit histories.

- Shop Around Often: Comparing quotes from several Arkansas insurers makes it easier to find affordable coverage.

Arkansas drivers can lower costs by taking advantage of company discount programs. Liberty Mutual offers up to 35% off anti-theft devices.

Usage-based discounts have the biggest savings for safe drivers, with most providers offering up to 30%. Allstate, as one of the best car insurance companies in Arkansas, offers the biggest discount of 40%, along with Nationwide.

Top Auto Insurance Discounts in Arkansas| Company | Anti- Theft | Multi- Policy | Multi- Vehicle | Usage- Based |

|---|---|---|---|---|

| 8% | 15% | 25% | 30% |

| 10% | 25% | 10% | 40% | |

| 25% | 25% | 23% | 20% |

| 10% | 20% | 12% | 30% | |

| 25% | 25% | 25% | 25% | |

| 35% | 25% | 25% | 30% |

| 5% | 20% | 15% | 40% | |

| 25% | 10% | 12% | $231/yr | |

| 20% | 15% | 20% | 30% | |

| 15% | 17% | 20% | 30% |

Multi-policy discounts also help Arkansas families save when bundling auto with home or renters insurance. Companies like Geico and American Family offer up to 25% off when combining multiple policies, making them appealing choices for households looking to lower their overall insurance costs.

These savings, combined with safe driving and smart coverage choices, help make auto insurance more affordable across the state.

Best Car Insurance Companies in Arkansas

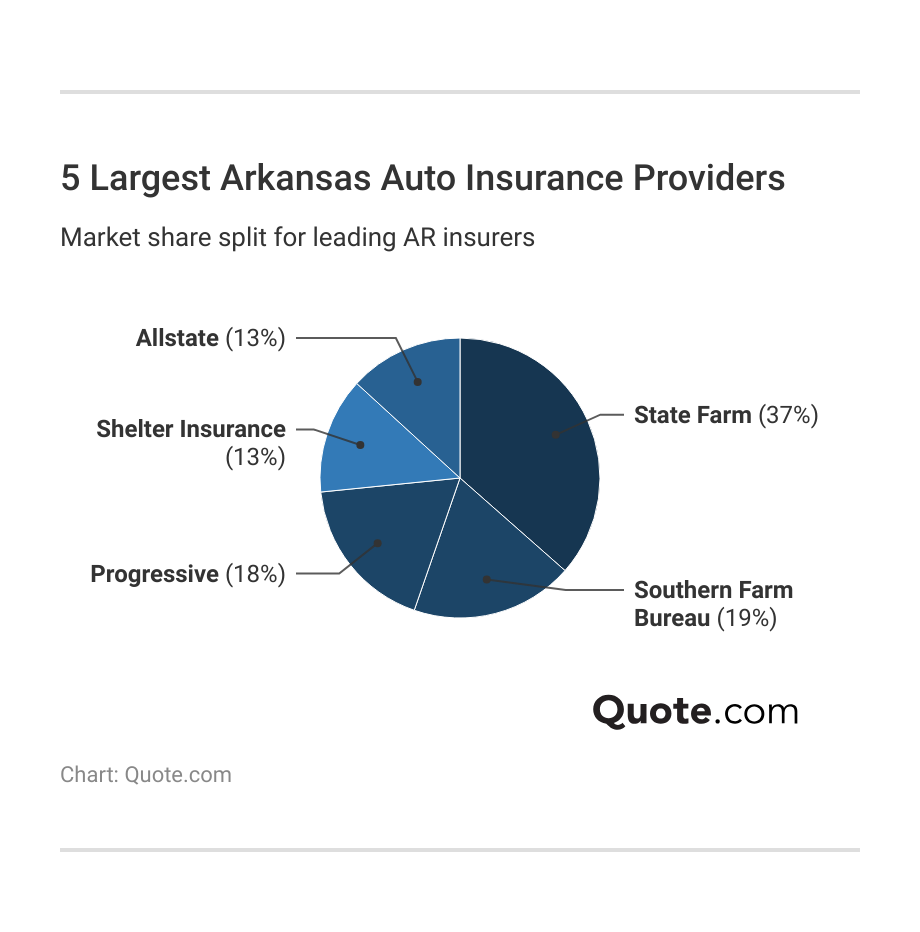

When shopping for auto insurance in Arkansas, it helps to know which companies hold the most market share and what that means for drivers.

State Farm leads with 37%, making it the biggest insurer in Arkansas. This large share means plenty of local agents and strong name recognition, but it doesn’t always mean it’s the best choice for every driver.

Even though the top five control most of the market, smaller insurers remain important in Arkansas. Many drivers turn to regional or local companies for flexible policies or more personal customer service.

To find the best fit, Arkansas drivers should compare quotes from both large and small insurers. Checking rates, service, and coverage side by side is the easiest way to balance cost and protection.

Learn More: Hacks to Save More Money on Car Insurance

#1 – State Farm: Top Overall Pick

Pros

- Local Agent Support: State Farm has the strongest network of local agents in Arkansas, making it easy for drivers to get in-person help with claims and coverage.

- Low Monthly Rates: State Farm offers one of the cheapest minimum coverage rates in Arkansas at $38 per month, keeping costs affordable for budget-conscious drivers.

- Strong Multi-Vehicle Discounts: Get up to 20% off for multiple cars on the same policy, which is a major benefit for Arkansas families. See a discount list in our State Farm Insurance review.

Cons

- Higher Full Coverage: At $112 per month, full coverage is higher in Arkansas compared to Safeco or Geico.

- Limited Digital Tools: State Farm’s online platform in Arkansas is not as advanced as competitors like Geico or Liberty Mutual.

#2 – American Family: Best for Custom Policies

Pros

- Custom Policy Options: American Family offers flexible coverage that Arkansas drivers can tailor to their specific needs. Get more quotes in our American Family insurance review.

- Affordable Minimum Coverage: With minimum rates at $66 per month, Arkansas drivers are provided with solid value compared to Allstate and Farmers.

- Discount Variety: American Family gives up to 25% off bundling and 23% off multi-vehicle policies, offering strong savings opportunities for Arkansas households.

Cons

- Higher Full Coverage: At $191 per month, American Family’s full coverage costs more in Arkansas than State Farm or Safeco.

- Limited Availability: Fewer offices in Arkansas make it harder for some drivers, especially in rural areas, to access in-person support.

#3 – Allstate: Best for Drivewise Program

Pros

- Usage-Based Discounts: Allstate’s Drivewise program can save drivers in Arkansas up to 40%, one of the highest savings in the state. Browse more in our Allstate insurance review.

- Minimum Coverage Availability: At $78 per month, Allstate’s minimum coverage is pricier in Arkansas but includes additional features that add value.

- Strong Liability Coverage: Allstate meets Arkansas’s 25/50/25 liability requirements and offers options that go beyond the minimums.

Cons

- High Premiums: At $226 per month for full coverage, Allstate is one of the most expensive options in Arkansas.

- Claims Satisfaction: With a score of 644/1,000, Allstate ranks lower in Arkansas compared to State Farm and American Family.

#4 – Geico: Best for Budget Rates

Pros

- Budget-Friendly: Geico’s minimum coverage costs only $43 per month, making it one of the cheapest choices for Arkansas drivers.

- Affordable Full Coverage: At $126 per month, Geico offers better rates in Arkansas compared to Farmers or Allstate. Learn about rates and discounts in our Geico insurance review.

- Digital Access: Geico’s mobile app and online tools make managing policies easy for drivers in Arkansas who prefer digital service.

Cons

- Rate Spikes After DUI: A DUI raises Geico’s premiums to $138 per month, showing higher risk penalties in Arkansas.

- Limited Local Agent Network: Geico doesn’t have as many physical agents in Arkansas compared to State Farm.

#5 – Farmers: Best for Safe Drivers

Pros

- Safe Driver Discounts: Farmers rewards clean driving records in Arkansas with savings of up to 30%. Discover more in our Farmers Insurance review.

- Liability Coverage Options: Farmers’ minimum coverage starts at $79 per month in Arkansas, and it is backed by strong customer service.

- Policy Add-Ons: Arkansas drivers can choose accident forgiveness and new car replacement for more protection.

Cons

- High Full Coverage: At $231 per month, Farmers is the most expensive provider for full coverage in Arkansas.

- Limited Budget Value: Minimum coverage is higher in Arkansas than at Safeco or State Farm.

#6 – Liberty Mutual: Best for Add-On Options

Pros

- Extensive Add-On Options: Liberty Mutual offers gap insurance, accident forgiveness, and better car replacement to drivers in Arkansas.

- Affordable Minimum Coverage: Minimum coverage costs $48 per month, a competitive option for Arkansas drivers who want extras. Explore how to qualify in our Liberty Mutual review.

- Anti-Theft Savings: Liberty Mutual provides up to 35% off with anti-theft devices, the highest discount available in Arkansas.

Cons

- Claims Satisfaction: With a score of 640/1,000, Liberty Mutual ranks below State Farm and American Family in Arkansas.

- Higher Full Coverage: At $138 per month, full coverage in Arkansas is more expensive than Safeco or State Farm.

#7 – Progressive: Best for High-Risk Drivers

Pros

- Coverage for High-Risk Drivers: Progressive covers drivers with DUIs or tickets, with minimum coverage starting at $63 per month in Arkansas.

- Snapshot Program: Arkansas drivers can lower costs through Progressive’s usage-based Snapshot, which adjusts rates by driving habits.

- Flexible Policy Options: Progressive lets Arkansas drivers adjust deductibles and coverage levels to fit their budgets. Read our Progressive auto insurance review for more coverage options.

Cons

- High Teen Driver Costs: In Arkansas, a 16-year-old with Progressive can face premiums over $600 per month, making it costly for families.

- Accident Rate Increases: One accident can raise monthly costs from $63 to $116 in Arkansas.

#8 – Nationwide: Best for Usage Discounts

Pros

- Usage-Based Savings: Nationwide’s SmartRide program can save Arkansas drivers up to 40% with safe driving habits.

- Reasonable Minimum Coverage: At $61 per month, Nationwide is more affordable than Allstate or Farmers in Arkansas.

- Multi-Policy Discounts: Bundling home and auto insurance can save households in Arkansas up to 20%. Our Nationwide auto insurance review explains key policy features.

Cons

- Full Coverage Costs: At $178 per month, Nationwide’s full coverage is more expensive in Arkansas than Geico or Liberty Mutual.

- Claims Satisfaction: With a score of 632/1,000, its claims service ranks below several competitors in Arkansas.

#9 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA’s membership benefits include towing, lockout, and fuel delivery, which is valuable for Arkansas drivers.

- Affordable Minimum Coverage: At $65 per month, AAA’s rates in Arkansas are close to the state average. See what stands out in our expert AAA auto insurance review.

- Multi-Vehicle Discounts: AAA offers up to 25% off when Arkansas drivers insure multiple cars under one policy.

Cons

- High Full Coverage: At $189 per month, AAA is more expensive in Arkansas than State Farm or Safeco.

- Membership Fee: Arkansas drivers must pay an annual membership fee to access AAA auto insurance.

#10 – Safeco: Best for Online Tools

Pros

- Easy Online Tools: Safeco makes it simple for Arkansas drivers to file claims and manage policies online. Gather more details in our Safeco auto insurance review.

- Lowest Minimum Coverage: At $38 per month, Safeco ties with State Farm as the cheapest minimum coverage in Arkansas.

- Affordable Full Coverage: Safeco offers the lowest full coverage option in Arkansas at $101 per month.

Cons

- Limited Agent Access: Safeco doesn’t have as many in-person agent options in Arkansas, which can be a drawback for drivers who prefer face-to-face help.

- Lower Claims Satisfaction: With a score of 597/1,000, Safeco ranks last in claims satisfaction among the top companies in Arkansas.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Right Insurance Provider in Arkansas

State Farm, American Family, and Allstate are among the best auto insurance companies in Arkansas because they combine affordable rates, helpful discounts, and strong support for local drivers.

These insurers also have long-standing reputations across Arkansas, giving drivers confidence in both pricing and service. See full details about the best good driver auto insurance discounts.

Still, the right choice isn’t always the cheapest. Finding the right auto insurance in Arkansas is about getting coverage that matches your driving needs and budget.

Here are a few things drivers should look at to find the best Arkansas car insurance companies before they buy:

- Check Claims Satisfaction: State Farm earned a 664/1,000 satisfaction score with an A++ financial strength rating, helping Arkansas drivers trust their claims will be handled fairly.

- Use Telematics for Savings: Allstate’s Drivewise and Nationwide’s SmartRide can lower Arkansas rates by up to 40% when drivers practice safe habits.

- Look for Accident Forgiveness: Farmers offers accident forgiveness, helping Arkansas drivers avoid steep rate hikes after their first crash.

- Take Advantage of Bundling: Bundling auto with home through American Family or Geico can cut Arkansas premiums by as much as 25%.

- Compare Local Rates by ZIP Code: Drivers in Little Rock often pay higher premiums than those in Fayetteville, proving that where you live in Arkansas makes a real difference.

Auto insurance companies in AR provide more than cheap rates, discounts, dependable claims service, and coverage tailored to local driving needs across the state.

Comparing quotes is the easiest way to make sure you’re not overpaying. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Frequently Asked Questions

What is the best car insurance in Arkansas?

State Farm has the best Arkansas auto insurance, offering rates as low as $38 per month for minimum coverage, strong claims satisfaction, and local agent support across the state.

Read More: Cheap Auto Insurance for Multiple Vehicles

What is the most trusted Arkansas car insurance company?

State Farm and American Family are the most trusted insurers in Arkansas thanks to their long history, financial stability, and reliable claims handling.

What are the 5 most popular Arkansas auto insurance companies?

The top five Arkansas auto insurance companies are State Farm, American Family, Allstate, Geico, and Farmers, each standing out for affordability, discounts, or coverage options.

Who has the best auto insurance rates in Arkansas?

Safeco and State Farm have the cheapest car insurance in Arkansas, starting at $38 a month.

Read More: Auto Insurance Rates by State

Who has the cheapest full coverage auto insurance in Arkansas?

Safeco offers the cheapest full coverage auto insurance in Arkansas at about $101 per month, followed by State Farm at $112.

What is the average cost of car insurance in Arkansas?

Arkansas drivers pay around $65 per month for minimum coverage and $183 per month for full coverage, though rates vary by age, driving record, and location.

Is State Farm cheaper than Geico car insurance in Arkansas?

Yes, State Farm car insurance in Arkansas is cheaper than Geico.

Learn More: State Farm vs. Farmers, Geico, Progressive, & Allstate Auto Insurance

Which Arkansas car insurance company has the best reputation?

State Farm and Geico have the best reputations in Arkansas, with State Farm known for strong local service and Geico for low rates and digital tools.

What car insurance is required in Arkansas?

Arkansas auto insurance requires minimum liability coverage of 25/50/25, which equals $25,000 per person, $50,000 per accident, and $25,000 for property damage (Learn More: Liability Auto Insurance).

What are the car insurance laws in Arkansas?

Arkansas auto insurance laws require drivers to meet minimum requirements. Failure to do so can result in a fine between $250 and $500. You may also be required to file SR-22 insurance to prove you have coverage.

What Arkansas insurance company is the most reliable?

Why is car insurance so high in Arkansas?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.