10 Best Auto Insurance Companies in Minnesota for 2026

The best auto insurance companies in Minnesota are State Farm, American Family, and Auto-Owners, with minimum car insurance costs as low as $41 a month. Safe drivers can also benefit from affordable full coverage car insurance in Minnesota and save up to 40% by taking advantage of usage-based discounts statewide.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated November 2025

State Farm, American Family, and Auto-Owners are the best auto insurance companies in Minnesota. State Farm ranks highest for quick claims and strong customer satisfaction.

- The cheapest Minnesota car insurance is with Geico at $41 a month

- The best auto insurance companies in Minnesota offer local support

- Minnesota drivers must carry at least 30/60/10 liability and PIP

American Family gives Minnesota drivers reliable local service and solid savings on bundled policies. Auto-Owners is known for dependable claims support and competitive full coverage options.

These are the top ten best car insurance companies for Minnesota drivers looking to save on coverage without sacrificing protection.

Top 10 Companies: Best Auto Insurance in Minnesota| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 664 / 1,000 | A++ | Claims-Free | |

| #2 | 660 / 1,000 | A | Local Support |

| #3 | 654 / 1,000 | A++ | Customer Service | |

| #4 | 644 / 1,000 | A+ | Accident Forgiveness | |

| #5 | 641 / 1,000 | A++ | Budget Drivers | |

| #6 | 641 / 1,000 | A | Reliable Service | |

| #7 | 640 / 1,000 | A | New Drivers |

| #8 | 637 / 1,000 | A+ | Usage-Based | |

| #9 | 632 / 1,000 | A+ | Vanishing Deductible | |

| #10 | 585 / 1,000 | A++ | Roadside Assistance |

Drivers in Minnesota can save up to 40% with good driver and multi-policy discounts. Comparing rates from these trusted providers helps drivers find quality coverage at the best price.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Minnesota Auto Insurance Rate Comparison

Auto insurance rates in Minnesota change based on the coverage you choose and the company you pick. On average, 45-year-old drivers pay about $49 each month for minimum coverage and around $109 a month for full coverage.

Geico offers the lowest rates overall at $44 a month for minimum and $98 monthly for full coverage, but remember to compare quotes before buying auto insurance in Minnesota to balance cost, coverage, and customer service.

Minnesota Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $56 | $123 | |

| $52 | $111 |

| $49 | $115 | |

| $50 | $110 | |

| $44 | $98 | |

| $47 | $105 |

| $51 | $112 | |

| $49 | $107 | |

| $48 | $106 | |

| $46 | $102 |

State Farm also provides affordable options with stronger claims satisfaction than Geico, at $48 per month for minimum coverage. For drivers seeking local support and personalized service, AmFam and Auto-Owners remain competitive at $52 and $49 a month.

Meanwhile, Allstate has higher premiums at $56 and $123 monthly, but includes additional benefits like accident forgiveness and vanishing deductibles.

Experienced Drivers Get Cheaper MN Auto Insurance

Age plays a major role in determining auto insurance rates in Minnesota. Costs are generally highest for drivers in their teens and 20s, with monthly premiums ranging from $69 with Geico to $108 with Allstate.

As drivers move into their 30s, rates drop noticeably. By their 40s, drivers benefit from some of the cheapest car insurance rates in the state. Geico, State Farm, and Travelers are strong options for cheap car insurance in Minnesota.

Minnesota Auto Insurance Monthly Rates by Age| Company | Age: 25 | Age: 35 | Age: 45 | Age: 55 |

|---|---|---|---|---|

| $108 | $78 | $56 | $52 | |

| $77 | $62 | $52 | $46 |

| $73 | $58 | $49 | $44 | |

| $99 | $72 | $50 | $46 | |

| $69 | $53 | $44 | $41 | |

| $101 | $76 | $47 | $44 |

| $83 | $64 | $51 | $47 | |

| $72 | $55 | $49 | $44 | |

| $79 | $61 | $48 | $44 | |

| $95 | $70 | $46 | $43 |

Your age directly impacts what you pay for Minnesota auto insurance, so always compare quotes as you get older and reach certain milestones, like graduation or marriage.

For drivers looking for extra savings, exploring low-income car insurance in Minnesota can provide affordable coverage without sacrificing essential protection.

High-Risk Drivers Pay More for Car Insurance in MN

Driving record is one of the most important factors affecting auto insurance rates in Minnesota, especially for 45-year-old male drivers with minimum coverage.

A clean record brings the lowest premiums, with Geico offering $44 per month, followed closely by Travelers and State Farm.

Minnesota Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $56 | $76 | $139 | $64 | |

| $52 | $75 | $120 | $72 |

| $49 | $102 | $128 | $85 | |

| $50 | $100 | $100 | $71 | |

| $44 | $67 | $107 | $53 | |

| $47 | $82 | $135 | $58 |

| $51 | $70 | $125 | $63 | |

| $49 | $86 | $141 | $62 | |

| $48 | $69 | $69 | $59 | |

| $46 | $104 | $133 | $60 |

However, even a single accident can lead to noticeable increases, with most companies raising rates by $20 to $40 monthly.

A DUI has the biggest impact, with rates jumping to $141 a month at Progressive and $139 monthly at Allstate, showing how serious violations significantly raise costs.

In Minnesota, even one DUI can make your insurance rates skyrocket, so adding extra coverage early can help protect your finances long-term.

Brad Larson Licensed Insurance Agent

A single speeding ticket also causes rate increases, though less severe. Geico still offers cheap auto insurance for high-risk drivers at $53 per month after a ticket.

Maintaining a clean driving record is one of the best ways to keep Minnesota insurance costs affordable and unlock the lowest possible rates.

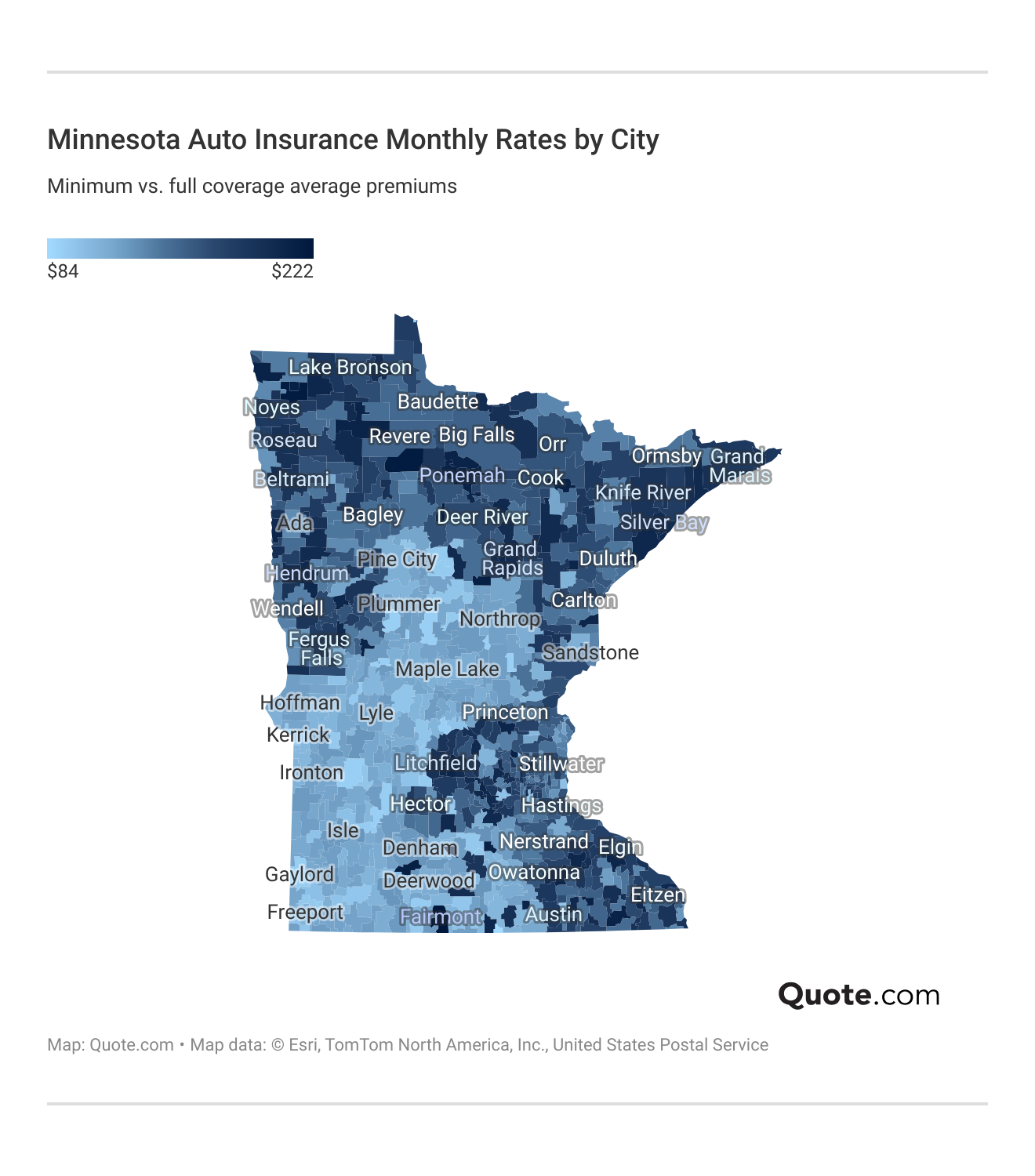

Compare Minnesota Car Insurance Costs in Your City

Auto insurance rates in Minnesota can change a lot depending on the city you live in and the ZIP code on your insurance policy. The average cost of auto insurance in some places is as low as $84 per month for minimum coverage.

Bigger cities like Minneapolis and St. Paul tend to have higher monthly premiums because of heavier traffic, more accidents, and more claims.

Smaller towns and rural areas usually offer lower rates, while coastal areas like Duluth can see premiums rise to over $200 per month for the same coverage.

This wide gap shows why it’s smart for Minnesota drivers to compare rates by ZIP code. Auto insurance rates by state are impacted by local risks and discount availability, so shopping around can help you find the best and most affordable coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minnesota Auto Insurance Minimums

Minnesota auto insurance laws say every driver must have at least 30/60/10 liability coverage.

These Minnesota car insurance requirements ensure that basic costs are covered in the event of an accident.

- Liability Coverage: Covers injuries and property damage you cause to others, and Minnesota requires at least 30/60/10

- Personal Injury Protection (PIP): Pays for your medical expenses, lost wages, and related costs, no matter who’s at fault

- Uninsured/Underinsured Motorist Coverage: Protects you if the at-fault driver has little or no insurance

Minnesota law also requires personal injury protection (PIP), which helps pay for medical expenses, lost wages, and other related costs after an accident, regardless of who was at fault.

In addition, drivers must carry uninsured and underinsured motorist coverage to protect themselves if they’re hit by a driver who has little or no insurance.

However, many drivers opt to purchase higher coverage limits or add optional protections, like collision and comprehensive coverage. Collision coverage pays for damage to your own vehicle if you’re in an at-fault accident or collision, while comprehensive auto insurance covers non-collision damage such as theft, vandalism, or storm damage

Meeting these coverage requirements is not only mandatory in Minnesota but also key to avoiding legal penalties and financial stress after a crash. Comparing quotes from multiple insurers can also help secure the best Minnesota car insurance rate for the coverage you need.

How to Get Cheap Minnesota Car Insurance

Several top car insurance companies in Minnesota offer generous discounts that can make a big difference in lowering monthly premiums.

Nationwide leads with one of the highest good driver discounts at 40%, while Geico, American Family, and Liberty Mutual also offer strong savings through bundling, usage-based car insurance programs, and anti-theft discounts.

Top Auto Insurance Discounts in Minnesota| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 10% | 25% | 25% | 40% | |

| 25% | 25% | 25% | 20% |

| 12% | 16% | 25% | 30% | |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 40% | |

| 25% | 10% | 30% | $231/yr | |

| 15% | 17% | 25% | 30% | |

| 15% | 13% | 10% | 30% |

American Family, Geico, and Auto-Owners stand out for their well-rounded savings on bundling and good driver programs, each offering discounts of up to 25%.

Farmers and Progressive provide solid rewards for safe driving and usage-based insurance, giving responsible drivers more opportunities to save. Liberty Mutual also offers up to 35% off with anti-theft discounts, a big advantage for Minnesota drivers.

Discounts can make full coverage car insurance in Minnesota more affordable for drivers with auto loans or a lease.

Melanie Musson Published Insurance Expert

Minnesota auto insurance discounts may vary based on where you live, so always ask to see a full list of savings programs before you buy to know which ones you qualify for.

These savings can add up quickly, especially when combined across multiple categories. Beyond discounts, drivers can take additional steps to reduce the car insurance cost in MN:

- Safe Driving Record: Avoiding accidents, tickets, and claims helps keep rates low over time.

- Higher Deductible: Choosing a higher deductible can lower your monthly premium if you can afford the out-of-pocket costs.

- Vehicle Choice: Driving a car with strong safety features and low repair costs can help you qualify for a Minnesota auto insurance reduction and lower your overall premium.

- Continuous Coverage: Keeping insurance active without lapses shows insurers you’re a low-risk driver.

- Mileage Management: Driving fewer miles lowers your risk level and can lead to lower premiums.

Using smart strategies and taking advantage of discounts can help Minnesota drivers save a lot on auto insurance.

Comparing quotes regularly ensures you’re always getting the best deal, while maintaining good habits can keep costs down long term. By combining multiple savings methods, drivers can secure affordable coverage without compromising protection.

Top Minnesota Car Insurance Providers Ranked

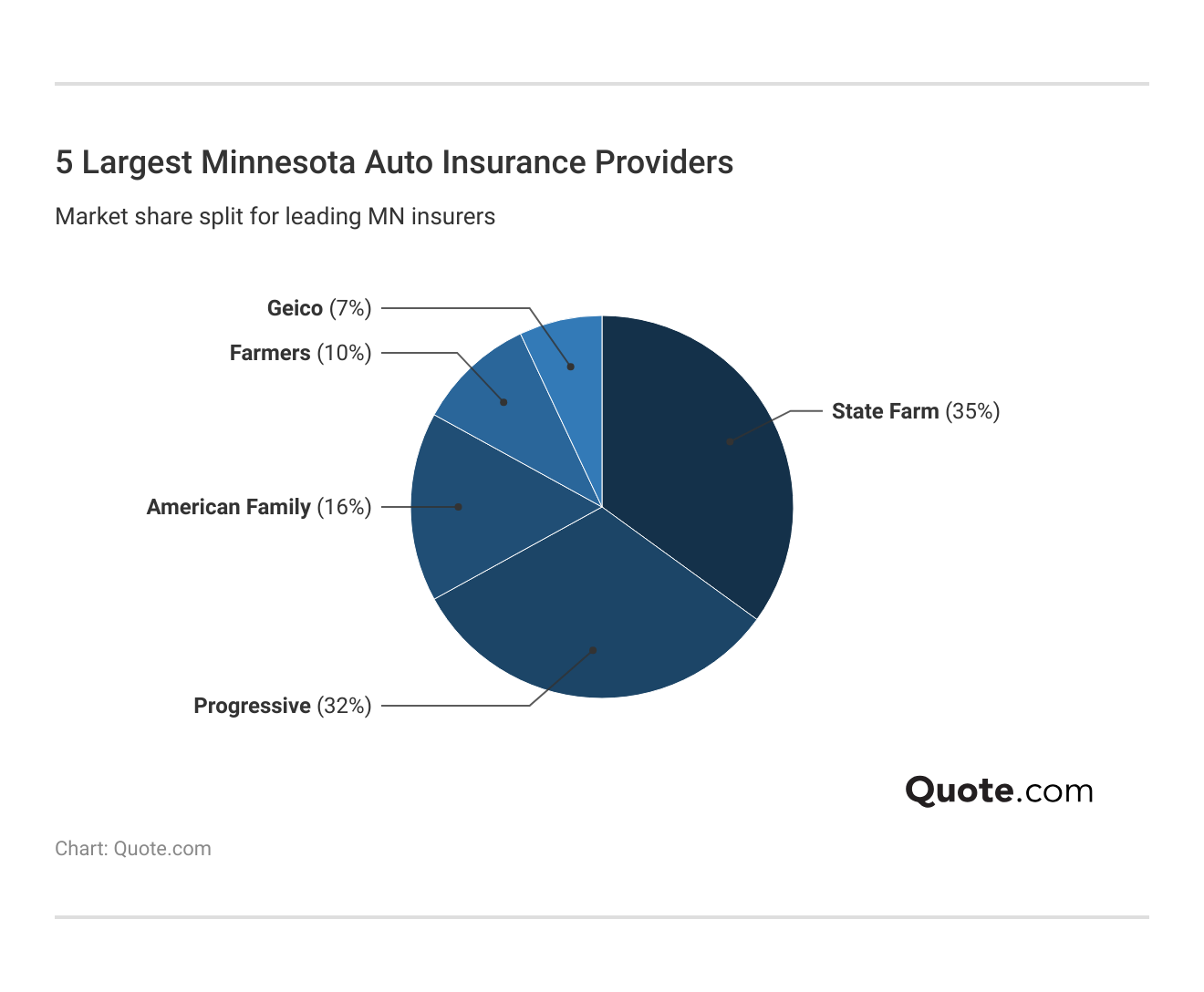

The five largest auto insurance providers in Minnesota are State Farm, American Family, Auto-Owners, Allstate, and Geico. Together, they make up a major share of the state’s auto insurance market.

State Farm car insurance in Minnesota leads with its strong agent network, competitive rates, and high claims satisfaction, cornering a quarter of the market.

American Family follows with the best home and auto insurance in Minnesota, offering strong bundling options and supporting its local presence with hands-on agents.

These companies play a central role in how Minnesota drivers secure coverage and manage their overall insurance costs. That’s why it’s important to compare multiple insurance companies.

#1 – State Farm: Top Overall Pick

Pros

- Claims-Free: State Farm offers claims-free discounts for drivers with no recent accidents or tickets, helping Minnesota drivers keep minimum coverage rates at $48 per month.

- Affordable Rates: MN drivers benefit from one of the lowest average premiums for drivers with a clean record, keeping costs predictable over time.

- Customer Support: With strong claims satisfaction and plenty of local agents, MN drivers can expect quick help with claims and personal support when they need it.

Cons

- Discount Limits: Some discounts, such as bundling or multi-policy savings, are smaller compared to Geico or Nationwide in Minnesota.

- Rate Increases: A single at-fault accident can cause rates to rise significantly in Minnesota. See full ratings in our State Farm auto insurance review.

#2 – American Family: Best for Local Support

Pros

- Local Service: Strong agent network makes coverage easy to manage across Minnesota at $52 minimum coverage. Explore full insights in our American Family review.

- Competitive Rates: American Family provides affordable coverage for mid-level risk drivers in MN, often undercutting larger national carriers for families and homeowners.

- Discount Variety: MN drivers can stack bundling, safe driver, and loyalty discounts for savings of up to 25% off premiums.

Cons

- Limited Availability: Rural Minnesota areas may have fewer dedicated agents or slower in-person service.

- Price Jumps: Drivers in MN with accidents or tickets may see premium spikes that exceed increases from Auto-Owners or State Farm.

#3 – Auto-Owners: Best for Customer Service

Pros

- Reliable Claims: Auto-Owners is known for fast, straightforward claims handling in Minnesota, often resolving claims in less than 10 days, with minimum coverage at $49.

- Low Premiums: The company’s base rates for clean-driving MN drivers are among the lowest in the state, often undercutting larger competitors.

- Local Presence: A strong agent network in MN offers hands-on service, especially valuable in smaller cities and rural areas (Learn more: Auto-Owners Insurance Review).

Cons

- Limited Digital Tools: The mobile app and online account management in MN offer fewer features than Geico or Progressive.

- Discount Access: Some savings, like paid-in-full discounts, are harder to qualify for in Minnesota due to stricter eligibility requirements.

#4 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Helps Minnesota drivers avoid premium hikes after their first at-fault accident, with $56 minimum coverage.

- Financial Strength: Backed by an A+, Allstate provides MN drivers with financial stability for large claims. Check the Allstate insurance review to see coverage benefits.

- Coverage Options: Minnesota drivers can choose from a variety of add-ons, including accident forgiveness, new car replacement, and roadside assistance.

Cons

- Higher Rates: Minimum coverage at $56 per month is higher than Geico or State Farm, making it less competitive for budget shoppers in MN.

- Bundling Savings: Bundling discounts in MN are smaller about 20%, which is lower than the savings offered by Nationwide or Liberty Mutual.

#5 – Geico: Best for Budget Drivers

Pros

- Low Rates: Geico has the cheapest minimum coverage in Minnesota at $44 per month, making it ideal for cost-conscious drivers.

- Driver Discounts: MN drivers can save up to 25% through safe driver, defensive driving, and anti-theft discounts. Compare quotes in our Geico insurance review.

- Digital Access: Geico’s highly rated mobile app lets Minnesota drivers file claims, view ID cards, and manage policies quickly.

Cons

- Agent Access: Geico doesn’t have many local agents in MN, which can be a problem for drivers who like face-to-face help.

- Personalization: Coverage options are less tailored for Minnesota drivers compared to insurers with strong local networks like American Family.

#6 – Farmers: Best for Reliable Service

Pros

- Claims Handling: Delivers dependable claims support for Minnesota drivers with $50 minimum coverage. Find everything you need to know about Farmers Insurance.

- Flexible Coverage: MN drivers can add popular options like accident forgiveness, roadside assistance, and rental reimbursement.

- Discount Programs: Good-driver and bundling discounts in Minnesota can lower premiums by up to 30%.

Cons

- Higher Cost: Base rates are slightly higher than Geico or Travelers, making it less appealing for budget-conscious MN drivers.

- Limited Digital Tools: Online features are not as advanced, and some processes still require contacting an agent in Minnesota.

#7 – Liberty Mutual: Best for New Drivers

Pros

- New Driver Focus: Liberty Mutual provides coverage designed for young or first-time Minnesota drivers, with minimum coverage at $47 per month.

- Discount Options: MN drivers can save up to 35% with anti-theft, good student, and usage-based discounts. Our Liberty Mutual insurance review provides a full list.

- Claims Service: Liberty Mutual is known for reliable claims processing, which can be especially valuable for inexperienced drivers in Minnesota.

Cons

- High-Risk Premiums: You could see your Minnesota auto insurance increase by more than 40% after an accident or speeding violations.

- Limited Regional Offers: Liberty Mutual provides fewer local Minnesota-based discounts compared to American Family.

#8 – Progressive: Best for Usage-Based

Pros

- Snapshot Program: Progressive’s usage-based program can help safe Minnesota drivers save up to 30% off their $49 minimum coverage premium.

- Custom Policies: Flexible coverage lets MN drivers choose deductibles and coverage levels to match their budget. Get details in our Progressive auto insurance review.

- Online Tools: Minnesota drivers benefit from advanced mobile tools, including real-time driving feedback and claim tracking.

Cons

- Rate Spikes: Drivers in MN with accidents may face rate increases up to $50/month after a single claim.

- Service Variation: Customer satisfaction ratings vary widely depending on the location in Minnesota.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Deductible Savings: Safe drivers in Minnesota can reduce their deductible by $100 for each year of accident-free driving, with minimum coverage starting at $51.

- Bundling Deals: Up to 40% off for MN drivers who combine auto with home or renters insurance. See a full list in our Nationwide auto insurance review.

- Stable Rates: Nationwide gives safe drivers steady prices in Minnesota, even after small violations.

Cons

- High-Risk Premiums: Rates can increase significantly for MN drivers with major violations or DUIs.

- Limited Local Reach: Nationwide has fewer physical offices in Minnesota, which can affect service accessibility.

#10 – Travelers: Best for Roadside Assistance

Pros

- Roadside Coverage: Travelers provides strong roadside assistance in Minnesota, including towing, lockout help, and jump-start services, with minimum coverage at $46.

- Low Rates: Among the most affordable insurers in MN, making it appealing for budget-conscious drivers. Get insights from the Travelers auto insurance review.

- Flexible Options: Offers customizable coverage levels, including accident forgiveness and rental reimbursement for Minnesota drivers.

Cons

- Fewer Discounts: Travelers offers fewer discount categories in MN compared to Nationwide or Geico.

- Rate Variation: Premiums can be less competitive for high-risk Minnesota drivers, especially those with multiple violations.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Minnesota Insurance Companies

Find the best cheap car insurance in Minnesota by comparing quotes from different insurers to see who offers the best price for the coverage you need. State Farm, American Family, and Auto-Owners are our top picks for claims satisfaction and competitive rates.

Minnesota car insurance rates can change a lot between companies, even with the same coverage. Look at customer reviews and claims satisfaction ratings so you know the insurer will be there when you need help.

Check for discounts like safe driver, bundling, and usage-based programs to lower your monthly costs. For the biggest savings, check out our guide on the best good driver auto insurance discounts.

By comparing prices, checking coverage, and using discounts wisely, Minnesota drivers can get good protection at a better price. Explore the best auto insurance companies in Minnesota online by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

What is the best auto insurance in Minnesota?

The top auto insurance companies in MN are State Farm, American Family, Auto-Owners, Allstate, and Geico. These companies lead the market because they offer affordable rates, reliable claims service, and a wide range of coverage options.

Read More: State Farm vs Farmers, Geico, Progressive, and Allstate Review

Who is the most trusted insurance company in Minnesota?

State Farm is often considered the most trusted insurer in Minnesota. It holds the largest market share in the state and is known for its strong customer support, reliable claims handling, and affordable coverage options.

What company has the cheapest auto insurance in Minnesota?

Geico typically offers the cheapest car insurance in MN, with minimum coverage starting around $44 per month. Travelers and State Farm also offer competitive rates for many driver profiles.

How much is car insurance in Minnesota per month?

The average cost of auto insurance in Minnesota is around $49 per month for minimum coverage and $109 per month for full coverage. Enter your ZIP code to compare rates based on factors like your driving record, age, location, and the type of car you drive.

Why is Minnesota car insurance so expensive?

Car insurance in Minnesota can be more expensive because of severe winter weather, rising repair costs, and higher accident rates in urban areas. These factors increase the risk for insurers, which raises premiums.

Learn More: Collision vs. Comprehensive Auto Insurance

Does AARP offer car insurance in Minnesota?

AARP partners with The Hartford to sell auto insurance in Minnesota for seniors. Read our The Hartford Insurance review for details.

What coverage is required for car insurance in Minnesota?

Minnesota drivers must carry at least 30/60/10 liability coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage. This ensures protection for both you and others in case of an accident.

How can I lower my auto insurance rates in Minnesota?

Keeping a clean driving record, bundling multiple policies, using usage-based programs, and raising your deductible if you can afford it are easy ways to pay less for car insurance. Comparing quotes from several companies can help you find the best car insurance in MN.

Can I negotiate my auto insurance rate in Minnesota?

Unlike a claim settlement, you cannot negotiate your car insurance rates with an agent. However, if you show your current provider a competing quote at renewal, they may offer you the same premium in order to keep you as a customer.

Does my credit score affect Minnesota auto insurance?

Yes, your Minnesota car insurance rates could go up if your credit score drops. Try out usage-based or pay-as-you-go car insurance to offset credit-based rate increases.

How do I choose the best auto insurance company in Minnesota?

How often should I compare Minnesota auto insurance quotes?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.