10 Best Auto Insurance Companies in New Mexico for 2025

The best auto insurance companies in New Mexico are AAA, Nationwide, and State Farm, with minimum coverage rates starting at $43 monthly. NM drivers may also consider Geico and Allstate, which offer savings through their DriveEasy program and their Accident Forgiveness program, respectively.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated November 2025

The best auto insurance companies in New Mexico are AAA, Nationwide, and State Farm. AAA stands out for its tiered roadside assistance, travel discounts, and locksmith services.

- AAA provides roadside help within 18 minutes across New Mexico

- Nationwide gives the biggest usage-based discount of 40%

- Safe drivers get accident forgiveness after 36 claim-free months

Nationwide pairs SmartRide telematics with vanishing deductibles and optional accident forgiveness to reduce costs for safe drivers.

State Farm complements Drive Safe & Save with Steer Clear training for new drivers and offers meaningful multi-policy savings to families who bundle home and auto insurance.

Top 10 Companies: Best Auto Insurance in New Mexico| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 676 / 1,000 | A | Roadside Assistance |

| #2 | 661 / 1,000 | A+ | Usage Based | |

| #3 | 648 / 1,000 | A++ | Customer Service | |

| #4 | 635 / 1,000 | A | Loyalty Discounts |

| #5 | 634 / 1,000 | A++ | Comprehensive Coverage | |

| #6 | 628 / 1,000 | A+ | Senior Benefits |

| #7 | 627 / 1,000 | A+ | Add-On Coverages | |

| #8 | 626 / 1,000 | A++ | Hybrids & EVs | |

| #9 | 624 / 1,000 | A++ | Low Rates | |

| #10 | 623 / 1,000 | A | Safe Drivers |

State Farm and Geico have the cheapest car insurance in New Mexico, starting at $43 a month, but drivers with good credit and clean records can get lower rates with discounts and policy rewards.

Find affordable auto insurance in New Mexico by entering your ZIP code to compare trusted providers side by side.

Find the Cheapest Insurance in New Mexico

If you want the best New Mexico car insurance rates, go with a minimum coverage plan. Costs start at $43 a month with Geico and $46 monthly with State Farm.

However, minimum plans won’t cover your vehicle or medical bills. Full coverage car insurance adds collision and comprehensive protection for a higher rate.

New Mexico Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $57 | $128 |

| $49 | $118 | |

| $54 | $119 |

| $53 | $110 | |

| $55 | $122 | |

| $43 | $96 | |

| $47 | $109 | |

| $46 | $101 | |

| $48 | $115 |

| $52 | $113 |

New Mexico car insurance requirements are low at 25/10/15 in liability coverage, but full coverage often requires higher liability limits for young drivers. Lenders typically expect comprehensive and collision coverage to remain in effect until the loans are paid.

Your auto insurance in New Mexico will vary based on your policy deductibles, mileage, and telematics choices. If you have a clean record and bundle multiple policies, you can usually shave another $8 to $15 off your monthly costs.

NM Auto Insurance Costs for Young Drivers

Teen drivers in New Mexico typically pay more for coverage. Minimum rates average around $160 monthly at 18, but steadily drop as drivers get older.

American Family is the cheapest New Mexico car insurance company for teens, and teen drivers whose parents add them to an existing policy get additional loyalty discounts.

New Mexico Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $165 | $96 | $72 | $57 |

| $153 | $90 | $68 | $49 | |

| $112 | $64 | $54 | $54 |

| $134 | $81 | $64 | $53 | |

| $138 | $83 | $68 | $55 | |

| $153 | $58 | $49 | $43 | |

| $121 | $69 | $58 | $47 | |

| $115 | $66 | $56 | $46 | |

| $142 | $84 | $65 | $48 |

| $140 | $79 | $60 | $52 |

State Farm and Geico car insurance in New Mexico reward safe teens through telematics programs such as Drive Safe & Save and DriveEasy.

Maintaining a clean record, low mileage, and defensive driving habits can help lock in cheap auto insurance for teens throughout New Mexico.

NM Car Insurance Cost Based on Driving History

Maintaining a clean driving record keeps minimum coverage rates the most affordable statewide, but a single DUI can double your premium.

Geico has the best car insurance rates in New Mexico for high-risk drivers, even with a DUI. Monthly rates after a DUI are $80, which is $10-$20 less than the competition.

New Mexico Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $57 | $80 | $159 | $70 |

| $49 | $60 | $95 | $56 | |

| $54 | $62 | $102 | $57 |

| $53 | $76 | $142 | $68 | |

| $55 | $65 | $110 | $58 | |

| $43 | $56 | $80 | $45 | |

| $47 | $71 | $119 | $61 | |

| $46 | $73 | $134 | $64 | |

| $48 | $64 | $90 | $53 |

| $52 | $68 | $117 | $59 |

Careful driving and low-mileage habits help lower those rates over time. Usage-based programs, like SmartRide or SmartMiles from Nationwide, reward safe drivers by tracking speed, braking, mileage, and daily driving consistency.

If your record isn’t spotless, it’s smart to shop around since rate hikes vary depending on each insurer’s forgiveness policy.

State Farm and AAA both offer accident forgiveness to long-term customers who maintain a clean driving history after one at-fault crash, which can stop your rates from going up if this is your first offense.

Always compare New Mexico car insurance quotes online after a crash or speeding ticket to find the company that best fits your budget.

How Credit Score Affects NM Auto Insurance Rates

Those maintaining excellent credit can pay up to 30% less each month than other drivers in New Mexico with fair or poor credit histories.

Insurers like Geico and State Farm consider good credit and driving history to provide the lowest rates.

New Mexico Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $57 | $64 | $81 | $98 |

| $49 | $55 | $69 | $91 | |

| $54 | $56 | $70 | $87 |

| $53 | $61 | $75 | $92 | |

| $55 | $58 | $73 | $88 | |

| $43 | $48 | $61 | $77 | |

| $47 | $59 | $72 | $89 | |

| $46 | $60 | $74 | $90 | |

| $48 | $53 | $67 | $82 |

| $52 | $59 | $72 | $86 |

Geico starts at $43 a month and goes up to $77 monthly, which is a steep jump but still costs $20 less a month than the competition.

Companies such as Nationwide and AAA often reward responsible credit behavior with tier upgrades and lower deductibles after multiple renewals.

Improving credit to the “good” range can unlock cheaper rates that rival preferred pricing without requiring high policy limits.

With steady credit management, like paying premiums on time, and safe driving, policyholders can maintain cheap car insurance in New Mexico.

Read More: How to Buy Auto Insurance

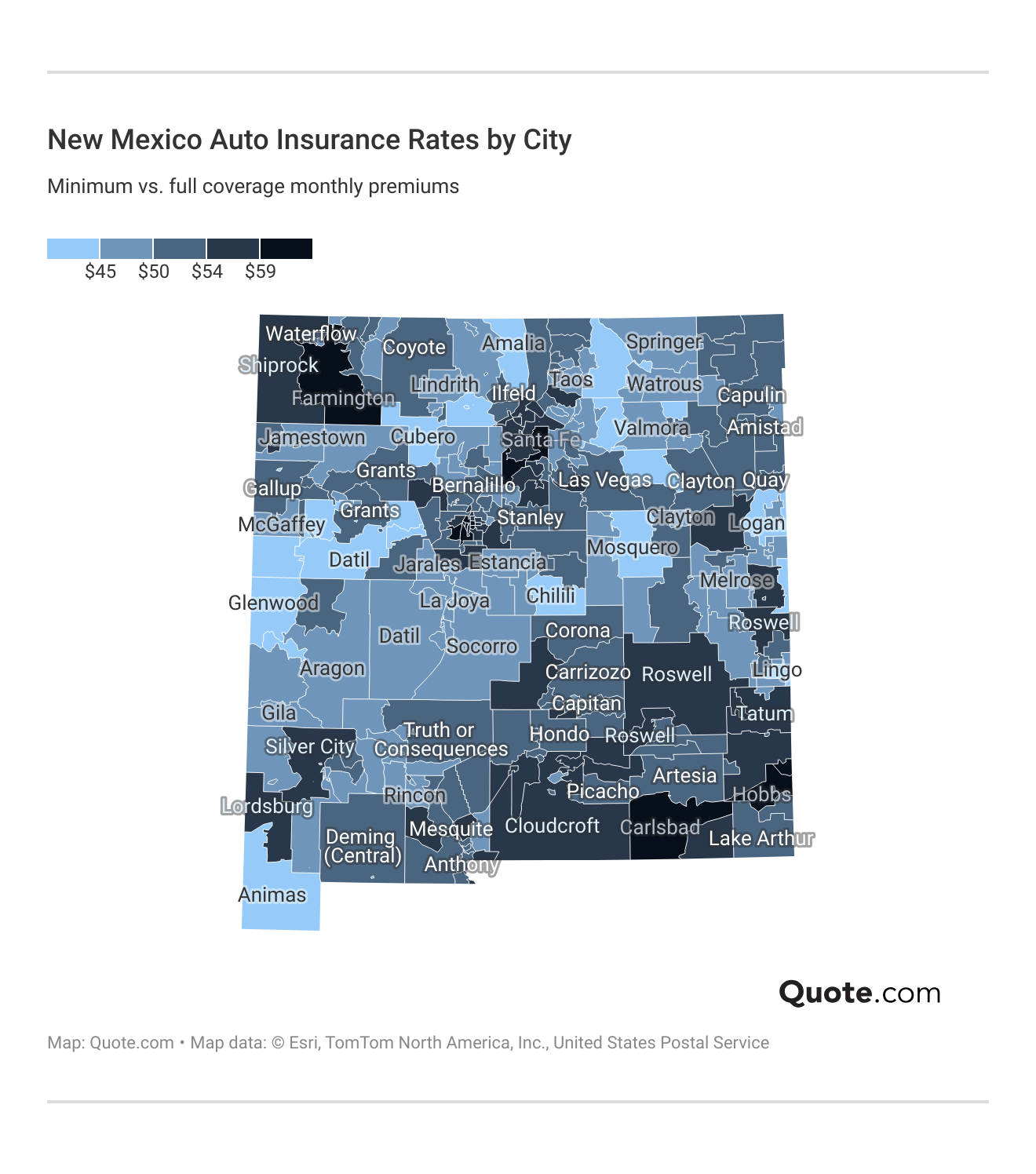

NM Auto Insurance Rates Across the State

New Mexico minimum auto insurance maintains predictable monthly rates that don’t vary much, depending on where you live and drive, because traffic and claim risks remain minimal.

Full coverage costs vary more, with bigger cities like Santa Fe or Roswell averaging higher rates due to frequent commuting, higher collision rates, and increased theft.

However, for drivers with clean records, many insurance companies in New Mexico balance lower risk from age and experience with local traffic conditions.

Overall, auto insurance in New Mexico is cheaper than the national average due to less traffic and fewer claims. Compare auto insurance rates by state to learn more.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New Mexico Car Insurance Requirements

New Mexico sets minimum insurance standards to ensure drivers can cover basic costs after an at-fault accident. These limits outline the lowest amount of protection every driver must carry.

- Bodily Injury Liability per Person: $25,000 covers medical expenses for one injured person in another vehicle.

- Bodily Injury Liability per Accident: $50,000 helps pay medical costs for multiple people hurt in an accident you cause.

- Property Damage Liability: $10,000 pays for repairs to another driver’s vehicle or damaged property.

- Uninsured Motorist Coverage (Optional): Protects you if you’re hit by a driver who doesn’t carry insurance.

- Personal Injury Protection (Optional): Helps cover medical bills for you and your passengers regardless of fault.

These requirements provide a basic safety net, but many New Mexico drivers choose higher limits and optional coverages for stronger protection on the road.

New Mexico Auto Insurance Coverage Options

In New Mexico, you’ve got a few key coverage options to help protect your car, your wallet, and the people riding with you. Here’s a quick breakdown of New Mexico car insurance coverage policy:

- Liability Coverage: Pays for injuries and damage you cause to other people or their property and is required in New Mexico.

- Collision Coverage: Helps fix or replace your car if it’s damaged in a crash, no matter who caused the accident.

- Comprehensive Coverage: Covers damage from things like theft, hail, fire, falling objects, or vandalism when there isn’t a crash.

- Uninsured/Underinsured Motorist Coverage: Steps in to help if you’re hit by a driver who has no insurance or not enough to cover your costs.

- Medical Payments (MedPay): Helps pay medical bills for you and your passengers after an accident, regardless of fault.

- Personal Injury Protection (PIP): Adds extra help for things like medical costs, lost wages, and rehab after a covered accident.

- Roadside Assistance: Gives you backup for breakdowns, like towing, jump-starts, flat tires, or lockouts.

- Rental Reimbursement: Helps cover a rental car while your vehicle is in the shop for a covered claim.

Putting together the right mix of these options helps New Mexico drivers stay protected from surprise bills and feel more confident every time they hit the road.

Read more: Liability Auto Insurance

Ways to Save on Car Insurance in New Mexico

Drivers in New Mexico can often qualify for extra savings when combining loyalty perks, paperless billing, and insuring multiple vehicles on one policy.

- Sign Up for Automatic Renewal: Drivers in New Mexico can earn loyalty discounts for automatically renewing their coverage online every six months.

- Choose Auto-Pay for Paperless Discounts: Linking your bank account to your insurance account for direct monthly payments can reduce New Mexico car insurance rates by 5%-10%.

- Reduce Your Annual Mileage: New Mexico drivers with fewer than 11,000 miles on the road per year pay less for their reduced risk of collisions and claims.

- Sign Up for Usage-Based Insurance: Consistent participation in telematics programs for two to three years leads to bigger discounts over time.

Insurance companies in New Mexico often add bonuses that aren’t listed online, like renewal discounts for staying claim-free or switching incentives worth up to $200 in credits if you start a policy with a new company.

Discounts are the easiest way to get the best car insurance rates in New Mexico, with savings of up to 40% for good driving behavior.

Top Auto Insurance Discounts in New Mexico| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 8% | 15% | 30% | 30% |

| 10% | 25% | 25% | 40% | |

| 25% | 25% | 25% | 20% |

| 12% | 16% | 25% | 30% | |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 5% | 20% | 40% | 40% | |

| 15% | 17% | 25% | 30% | |

| 10% | 5% | 15% | 20% |

| 15% | 13% | 10% | 30% |

Nationwide stands out for its broad discount range, offering strong rewards through SmartRide and long-term loyalty credits for clean driving records.

AAA also shines for policyholders who maintain memberships, bundling home and auto insurance to maximize multi-policy benefits and renewal reductions.

Ask about mileage-based plans if you drive less than 8,000 miles a year. In particular, rural drivers in New Mexico benefit most.

Daniel Walker Licensed Insurance Agent

Some providers also give rate reductions to drivers who complete certified safety courses or maintain low annual mileage over several renewals.

Always compare rates and discounts from multiple car insurance companies in New Mexico in order to find the right balance of savings based on your policy needs and driving habits.

10 Best Auto Insurance Companies in NM

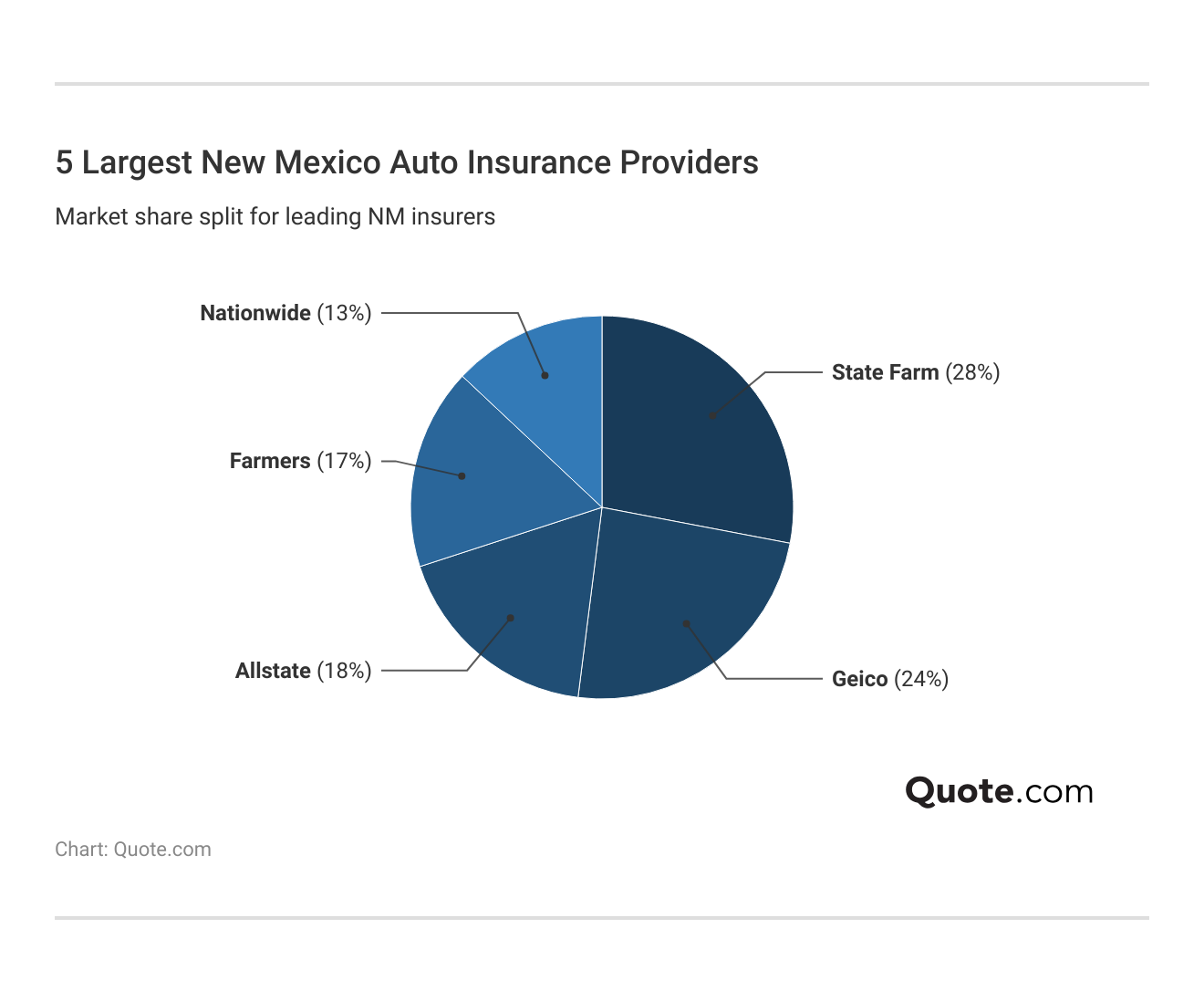

The largest auto insurance companies in New Mexico shape how monthly rates vary across coverage levels, discounts, and risk categories.

Drivers insured through State Farm and Geico, for instance, typically see lower monthly average auto insurance costs since these large companies can spread risk across more drivers in the state.

Finding the best car insurance in New Mexico is easy with our guide to top providers offering great coverage, savings, and benefits for NM drivers.

Here are the top companies that deliver the best value and protection across the state of New Mexico.

#1 – AAA: Top Pick Overall

Pros

- Reliable Help in NM: AAA’s roadside coverage is hard to beat, with towing up to 200 miles and fast locksmith or battery service.

- Membership Rewards: Longtime members can save up to 20% when bundling home and auto insurance. See more details in our AAA auto insurance review.

- Strong Financial Backing: Backed by an A+ A.M. Best rating, AAA offers steady protection and dependable claims service across NM.

Cons

- Higher Upfront Costs in NM: New customers in NM might pay a little extra upfront, usually around $15–$25 more per month before discounts apply.

- Limited Tech: While AAA’s benefits are great, its telematics app isn’t as advanced as Nationwide’s SmartRide for tracking driving habits in NM.

#2 – Nationwide: Best for Usage-Based Plans

Pros

- SmartRide Discounts: Drivers in NM can save up to 40% through the SmartRide program by keeping mileage low and braking smoothly.

- Low-Mileage Rewards: Nationwide SmartMiles rewards New Mexico drivers by charging them only for the miles they drive per month.

- Vanishing Deductible Benefit: Accident-free drivers in NM can reduce their deductibles by $100 every year. Find out more in our Nationwide auto insurance review.

Cons

- Mileage Caps: Going over the annual mileage limit can raise rates by about 8%–10%, especially in busier areas like Albuquerque.

- Tech Learning Curve: Some NM drivers say SmartRide takes time to understand, and syncing data can be tricky during setup.

#3 – State Farm: Best for Customer Service

Pros

- Elite Customer Service: Local State Farm agents in New Mexico help drivers update coverage and file claims, with an above-average claim satisfaction rating from J.D. Power.

- Drive Safe & Save: According to our State Farm review, NM drivers who maintain safe driving habits can cut premiums by as much as 30% through Drive Safe & Save.

- Steer Clear for Young Drivers: New or younger NM drivers can save another 15% by completing State Farm’s Steer Clear course, which helps improve driving confidence.

Cons

- Fewer Loyalty Discounts: State Farm doesn’t offer as many long-term renewal or loyalty rewards for NM customers.

- Rate Hikes After Claims: Even with telematics, drivers in NM may see rates climb 12–20% after a recent claim or accident.

#4 – American Family: Best for Loyalty Discounts

Pros

- Loyalty Credits: Customers who stay with AmFam long-term or add new drivers to an existing policy can earn 10% discounts. Learn more in our American Family review.

- Smooth Claims: American Family’s average claim turnaround in New Mexico is about 7–10 days, faster than several larger insurers.

- Great for Families: Multi-car households in NM can save up to 23% when bundling vehicles, making it easier for families to manage costs.

Cons

- Outdated App: The mobile app feels a bit sluggish compared to others, and some New Mexico drivers say policy updates can take a while to show up.

- Slightly Higher Premiums: Starting rates can be $10–$20 higher each month before discounts kick in, especially for single-vehicle policies.

#5 – Auto-Owners: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: NM drivers get access to valuable extras like full glass protection, OEM parts replacement, and diminished value coverage.

- A++Financial Strength: Auto-Owners provides NM drivers with confidence that their claims will be paid promptly. Read more in our review of Auto-Owners insurance.

- Local Agent Focus: Auto-Owners works through independent agents who offer hands-on help in NM, often resolving claims in under six days.

Cons

- Limited Tech Features: The lack of a telematics app can make it less appealing for New Mexico drivers who want usage-based discounts.

- Not Everywhere in NM: Availability is still expanding, so drivers in more rural areas of the state might have fewer nearby agent options.

#6 – The Hartford: Best for Senior Benefits

Pros

- Exclusive AARP Partnership: The Hartford partners with AARP to give drivers in New Mexico over 50 exclusive discounts, often cutting premiums by 15%–20%.

- Lifetime Renewability: Eligible seniors in New Mexico enjoy guaranteed renewals as long as they keep a clean record. Find insights in our The Hartford review.

- Strong Financials: Backed by an A+ A.M. Best rating, The Hartford offers dependable claims handling and coverage stability in NM.

Cons

- Higher Starting Premiums: Monthly rates can start about $12–$18 higher than competitors like State Farm or Geico for similar full coverage in NM.

- Limited Appeal for Younger Drivers: The Hartford’s programs focus on mature or retired drivers and won’t underwrite policies for younger drivers without an AARP membership.

#7 – Allstate: Best for Add-On Coverages

Pros

- Add-On Protection: Allstate’s full coverage in NM includes optional gap insurance, accident forgiveness, and new car replacement within the first two model years.

- Drivewise in NM: NM drivers can earn up to 25% back through the Drivewise app for safe habits like consistent braking and limited night driving.

- Trusted Reputation: With an A+ A.M. Best rating, Allstate maintains strong financial security. For more information, read our Allstate Insurance review.

Cons

- Premium Gaps: Initial rates in NM tend to be 10%–18% higher before safe-driving discounts are applied.

- Claims Timelines: Some customers in New Mexico report longer-than-expected claim resolutions compared to regional averages.

#8 – Travelers: Best for Hybrids & EVs

Pros

- Hybrid and EV Discounts: NM drivers who insure electric or hybrid vehicles get up to 10% off premiums. Learn more by checking out our Travelers review.

- IntelliDrive App: Travelers’ telematics app helps lower New Mexico car insurance by up to 30% with real-time tracking for braking, acceleration, and phone use.

- A++ Financial Rating: Travelers’ strong financial foundation ensures reliable claims handling across New Mexico.

Cons

- Higher Deductibles: Some drivers in New Mexico note deductibles ranging from $750 to $1,000 for lower-cost plans.

- Less Personal Support: Travelers operates fewer local offices, leading to less one-on-one assistance for rural NM customers.

#9 – Geico: Best for Low Rates

Pros

- Cheapest Car Insurance in NM: Geico’s minimum coverage averages around $48 per month, one of the lowest among major car insurance companies in New Mexico.

- DriveEasy App Benefits: Drivers who maintain consistent safe driving patterns can save up to 25% at renewal. Find out more in our Geico insurance review.

- Seamless App Management: Geico’s top-rated mobile app makes it easy for NM drivers to pay bills, file claims, and track policy changes on the go.

Cons

- Limited Local Agents: Geico’s online-first setup offers fewer in-person offices for NM policyholders who prefer face-to-face help.

- Rate Increases After Claims: One at-fault accident can push premiums up by 15%–20%, even though it has the cheapest auto insurance in New Mexico for high-risk drivers.

#10 – Farmers: Best for Safe Drivers

Pros

- Signal App Savings in NM: Farmers’ Signal app helps safe drivers save up to 30% for good driving habits and low phone distraction scores.

- Wide Range of Add-Ons: NM drivers can add new car replacement, accident forgiveness, and OEM parts coverage for better repair quality.

- Strong Ratings: Farmers holds an A rating from A.M. Best, offering financial stability and reliable claims handling in NM. Read more in our Farmers review.

Cons

- Higher Monthly Rates: Average minimum coverage in NM runs about $10–$15 more than competitors like State Farm or Geico.

- Inconsistent App Experience: Some drivers in New Mexico report occasional app glitches while syncing Signal data.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Car Insurance Companies in NM

New Mexico drivers have a real choice among the best auto insurance companies in the state, with AAA, Nationwide, and State Farm standing out with the biggest savings and firm local support.

Usage-based programs, such as Nationwide SmartRide and State Farm Drive Safe & Save, can trim premiums by 30%–40%. Bundling often reduces the cost of car insurance in New Mexico by 15–25%, and anti-theft discounts add 8–25% to the savings.

Credit-based pricing affects NM rates by up to 30%. In particular, strong credit can unlock better terms.

Melanie Musson Published Insurance Expert

Pricing still hinges on personal driving habits. A single ticket raises New Mexico car insurance costs by 10%–20%, while a DUI more than doubles them. A strong credit score can commonly lower New Mexico auto insurance bills by up to 30%.

Get the cheapest car insurance in New Mexico fast by entering your ZIP code to compare trusted providers in your city.

Frequently Asked Questions

What is the best car insurance company in New Mexico?

AAA, Nationwide, and State Farm are ranked as the best car insurance companies in New Mexico. They provide dependable coverage and affordable rates. Compare State Farm and Progressive auto insurance for more reviews.

Who is the most trusted auto insurance company in New Mexico?

State Farm is considered the most trusted auto insurance company in New Mexico due to its A++ A.M. Best rating, strong claims handling, and extensive agent network throughout the state.

How much is car insurance in New Mexico per month?

The average cost of auto insurance in New Mexico is about $95 per month for full coverage and $43 per month for minimum coverage. Rates vary based on ZIP code, age, and driving record. Compare trusted auto insurance companies in New Mexico now by entering your ZIP code for fast quotes.

Is Geico or Progressive better in New Mexico?

Geico or Progressive may be better options in New Mexico, depending on coverage needs. However, Geico generally offers lower monthly rates, while Progressive Insurance in New Mexico provides stronger options for high-risk drivers who want flexible add-ons or Snapshot savings.

What insurance provider denies the most claims in New Mexico?

No single insurance provider is officially confirmed to deny the most claims in New Mexico, but state regulatory data often shows smaller nonstandard insurers with higher denial ratios compared to major carriers. Discover the best auto insurance companies for claims handling.

How do you get the best deal on car insurance in New Mexico?

New Mexico drivers can get the best car insurance deal by comparing quotes, bundling home and auto policies, maintaining clean records, and joining telematics programs that lower monthly rates.

What car insurance company has the most complaints in New Mexico?

The car insurance company with the most complaints in New Mexico varies each year, though NAIC reports typically show regional and nonstandard insurers with higher complaint levels than large national companies.

Does Progressive cover New Mexico?

Progressive covers New Mexico and offers minimum liability, full coverage, SR-22 filings, roadside assistance, and Snapshot telematics options for drivers statewide.

What is the most expensive state for car insurance compared to New Mexico?

Louisiana remains the most expensive state for car insurance compared to New Mexico due to high accident frequency, severe weather exposure, and elevated claim costs. Explore proven hacks to save money on auto insurance and start paying less each month.

Which car insurance coverage is best in New Mexico?

The best car insurance coverage in New Mexico often includes full coverage—liability, collision, and comprehensive—because it protects both other drivers’ damages and repairs to the policyholder’s own vehicle.

What is Central Insurance in New Mexico?

What is the best health insurance in New Mexico?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.