10 Best Auto Insurance Companies in North Dakota for 2026

State Farm, American Family, and Auto-Owners are the best auto insurance companies in North Dakota. Rates start as low as $35 a month with Geico, but these top North Dakota car insurance companies provide localized service and claims handling that caters to the state's unique weather-related coverage needs.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated November 2025

The best auto insurance companies in North Dakota are State Farm, AmFam, and Auto-Owners. State Farm’s exceptional claims satisfaction score ensures reliable service statewide.

- State Farm offers safe driver discounts of up to 30%

- American Family and Auto-Owners have a wide, local agent network

- Drivers stay compliant with North Dakota’s 25/50/25 liability limits

American Family adds value with KnowYourDrive telematics that gives personalized discounts based on actual driving behavior and mileage. Auto-Owners stands out with its reliable support and loyalty rewards for North Dakota drivers.

North Dakota drivers can get minimum coverage for as low as $35 per month from Geico.

Top 10 Companies: Best Auto Insurance in North Dakota| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 664 / 1,000 | A++ | Claims-Free Drivers | |

| #2 | 660 / 1,000 | A | Localized Service |

| #3 | 654 / 1,000 | A++ | Reliable Support | |

| #4 | 644 / 1,000 | A+ | Custom Plans | |

| #5 | 641 / 1,000 | A++ | Budget Drivers | |

| #6 | 641 / 1,000 | A | Comprehensive Protection | |

| #7 | 640 / 1,000 | A | Accident Forgiveness |

| #8 | 637 / 1,000 | A+ | Usage-Based Savings | |

| #9 | 632 / 1,000 | A+ | Bundling Options | |

| #10 | 628 / 1,000 | A | Roadside Assistance |

The easiest way to get the cheapest car insurance in North Dakota is through bundling discounts, good driver programs, and usage-based insurance options.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates from top-rated insurers.

North Dakota Car Insurance Cost Breakdown

Drivers can consider several North Dakota insurance companies, such as Geico, State Farm, Progressive, and Auto-Owners, which offer competitive pricing and dependable protection.

Geico stands out for offering the cheapest auto insurance in North Dakota, with average monthly rates of $35 for minimum coverage and $78 for full coverage.

North Dakota Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $46 | $99 |

| $45 | $98 | |

| $43 | $94 |

| $41 | $90 | |

| $44 | $96 | |

| $35 | $78 | |

| $48 | $100 |

| $40 | $88 | |

| $39 | $85 | |

| $38 | $84 |

The difference between these coverage levels depends on how much protection you choose. Minimum coverage only meets North Dakota’s liability requirements, so it costs less but offers limited financial protection after an accident.

Full coverage includes collision and comprehensive insurance, which protects your vehicle from crashes, theft, weather damage, and other losses.

Other factors also influence how much you’ll pay for car insurance in North Dakota, including your age, driving record, and credit score. Comparing quotes online before you buy helps you spot where one insurer may be more forgiving than another, allowing you to choose the types of auto insurance and company that fits your profile best.

Age and driving record play the biggest role in whether you qualify for the cheapest car insurance in North Dakota or pay higher premiums.

Knowing these factors makes it easier for you to compare North Dakota car insurance quotes and ensure you’re not overpaying for coverage.

How Age Impacts North Dakota Car Insurance Costs

Age has the most impact on car insurance costs in North Dakota. Younger drivers, especially those under 25, usually pay more because they have less driving experience.

As North Dakota drivers get older, and if they can maintain their clean records, their auto insurance rates drop steadily.

North Dakota Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $130 | $78 | $59 | $46 |

| $126 | $79 | $60 | $45 | |

| $122 | $60 | $52 | $43 |

| $118 | $55 | $50 | $41 | |

| $124 | $72 | $55 | $44 | |

| $99 | $51 | $42 | $35 | |

| $128 | $74 | $58 | $48 |

| $110 | $59 | $49 | $40 | |

| $105 | $56 | $45 | $39 | |

| $102 | $53 | $44 | $38 |

For example, an 18-year-old might pay around $130 per month with AAA, while a 45-year-old pays closer to $46.

Geico and State Farm have the cheapest car insurance in North Dakota for young drivers, while Allstate is one of the most expensive North Dakota insurance companies for drivers of all ages (Read More: Geico vs. Allstate Auto Insurance).

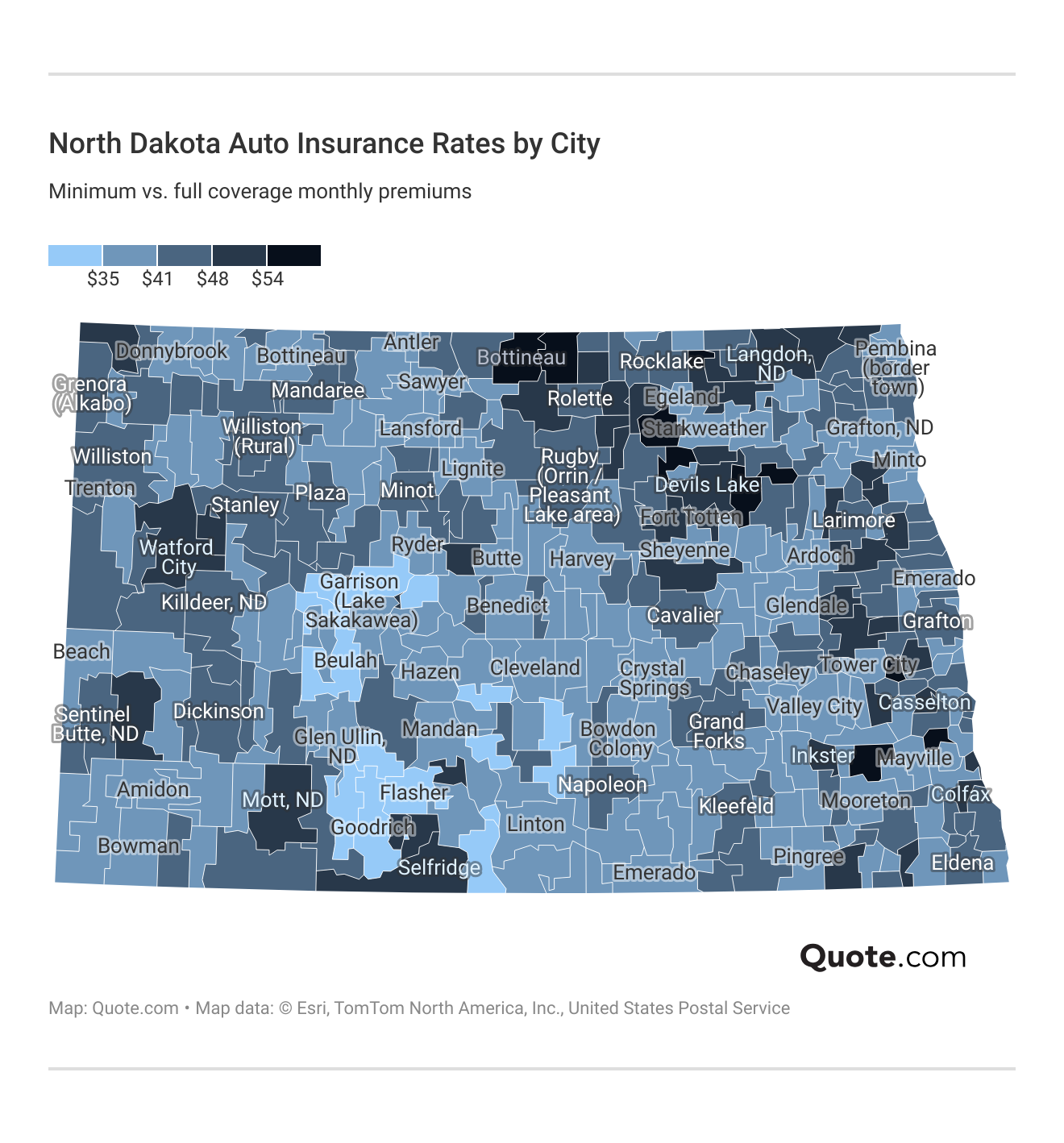

How Location in ND Affects Your Car Insurance Premiums

Where you live in North Dakota impacts your car insurance premiums, with rates varying by as much as 50% between different cities.

Drivers in Fargo, Bismarck, and Grand Forks typically see higher insurance costs due to increased traffic density, higher accident rates, and greater risk of theft or vandalism.

Factors like local crime statistics, weather patterns, road conditions, and population density also contribute to regional rate variations (Learn More: Auto Insurance Rates by State).

The best car insurance companies in North Dakota adjust their rates based on local risk factors, making your ZIP code one of the most important pricing considerations.

How Driving History Impacts Auto Insurance Rates in North Dakota

Drivers with clean records can get rates as low as $35 per month with Geico, while one DUI or accident can raise rates to over $100 a month.

Even a single moving violation can increase your rates by 20-30%, while multiple infractions may make coverage difficult to obtain through standard insurers (Learn More: Cheap Auto Insurance for High-Risk Drivers).

North Dakota Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $46 | $70 | $95 | $56 |

| $45 | $75 | $102 | $55 | |

| $43 | $65 | $85 | $50 |

| $41 | $62 | $83 | $49 | |

| $44 | $72 | $90 | $52 | |

| $35 | $46 | $65 | $37 | |

| $48 | $78 | $117 | $58 |

| $40 | $60 | $81 | $48 | |

| $39 | $55 | $77 | $46 | |

| $38 | $53 | $73 | $45 |

Insurers reward safe drivers with lower premiums, so North Dakota drivers should prioritize safe driving habits and consider defensive driving courses.

Companies like State Farm, AmFam, and Auto Owners offer 25% discounts for accident-free driving.

Improve Your Credit Score for Cheaper North Dakota Auto Insurance

North Dakota drivers with excellent credit, usually above 800, tend to get the lowest rates. Insurers see higher credit scores as a sign of financial responsibility, which often means a lower chance of filing claims.

Improving your credit by paying bills on time, reducing debt, and correcting errors on your credit report can lead to substantial savings over time.

North Dakota Auto Insurance Monthly Rates by Credit Score

| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $46 | $50 | $59 | $72 |

| $45 | $49 | $58 | $70 | |

| $43 | $47 | $55 | $67 |

| $41 | $45 | $53 | $65 | |

| $44 | $48 | $56 | $69 | |

| $35 | $38 | $45 | $57 | |

| $48 | $53 | $62 | $76 |

| $40 | $44 | $52 | $64 | |

| $39 | $43 | $50 | $63 | |

| $38 | $42 | $48 | $60 |

Many insurers offer additional discounts for good credit and responsible payment history, making strong credit one of the easiest ways to lower your North Dakota car insurance (Read More: 17 Tips to Pay Less for Car Insurance).

Some drivers see their premiums drop by hundreds of dollars annually after improving their credit score by just 50-100 points.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

North Dakota Auto Insurance Requirements

North Dakota requires all drivers to carry minimum liability coverage, which includes the following limits:

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $25,000 per accident

- Uninsured/Underinsured Motorist (UM/UIM): $25,000 per person / $50,000 per accident

- Personal Injury Protection (PIP): $30,000 per person

North Dakota also follows a modified comparative fault rule, meaning drivers can recover damages only if they are less than 50% at fault in an accident. If a driver is 50% or more responsible, they cannot collect compensation from the other party.

While this minimum coverage satisfies legal requirements, many of the best car insurance companies in North Dakota recommend higher limits for better protection. Learn more about auto insurance requirements by state.

When comparing ND auto insurance rates, consider that minimum coverage may not fully protect your assets in serious accidents. Full coverage insurance, which includes comprehensive and collision coverage, provides more extensive protection.

Affordable North Dakota car insurance companies, like State Farm, Progressive, Geico, and Nationwide, offer policies that exceed state minimums for under $90 a month.

Optional North Dakota Car Insurance Coverage

Drivers in North Dakota can add optional coverages to strengthen their protection beyond the state-required minimums.

These upgrades help cover repair costs, medical bills, and unexpected expenses that basic liability insurance does not handle.

- Collision Coverage: This pays to repair or replace your vehicle after at-fault accidents, rollovers, or single-vehicle crashes.

- Comprehensive Coverage: It protects against non-collision losses like theft, hail, vandalism, animal strikes, and natural disasters.

- Medical Payments (MedPay): MedPay helps cover medical expenses for you and your passengers regardless of who caused the accident. Learn more about MedPay here.

- Roadside Assistance: This provides towing, jump starts, fuel delivery, and lockout services for emergency situations.

- Rental Reimbursement: This covers the cost of a rental car while your vehicle is being repaired after a covered claim.

Optional protections are especially useful for newer vehicles, high-mileage drivers, and anyone wanting more financial security after an accident.

While these coverages increase premiums, they often save drivers money in the long run by reducing out-of-pocket losses.

Ways to Lower North Dakota Insurance Rates

North Dakota auto insurance costs can be pretty inconsistent, as it all comes down to things like your age, driving record, and even your credit score.

Use some of these cost-cutting strategies that work to get good coverage without breaking the bank and still meet the state insurance requirements:

- Group Your Policies Together: Getting multiple policies from the same company (like your car and home insurance) can save you 15-25% on your payments.

- Keep a Clean Driving Record: If you’ve never been in an accident, or had a ticket or any other kind of trouble on the road, you can qualify for the best rates.

- Sort Out Your Credit: If you have a great credit score in North Dakota, you can save up to 30% on your payments compared to someone with a poor credit history.

- Increase Your Deductible: It’s not the best option, but raising your deductible from $500 to $1,000 can save you 20%-30% on your payments.

- Take Advantage of Telematics: These are usage-based programs that track how you drive, how much you speed, how far you drive, and what time of day you’re on the road.

Usage-based car insurance (UBI) is a popular way to save money on insurance in North Dakota, since the state generally has less traffic and fewer accidents, which helps drivers maintain safe habits.

UBI with telematics also comes with the biggest discount, with companies like Nationwide and Allstate offering up to 40% to drivers who don’t speed or drive at night.

The best car insurance companies in ND offer all sorts of discounts and incentives that can make a big difference if you’re a good driver and know how to take advantage of them.

Liberty Mutual leads the way with a 35% anti-theft discount, while Nationwide offers generous 40% savings for good drivers.

Top Auto Insurance Discounts in North Dakota| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 8% | 15% | 30% | 30% |

| 10% | 25% | 25% | 40% | |

| 25% | 25% | 25% | 20% |

| 12% | 16% | 25% | 30% | |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 40% | |

| 25% | 10% | 30% | $231/yr | |

| 15% | 17% | 25% | 30% |

Bundling multiple policies with one company, like home and auto, can save up to 25% with American Family. The best part is that many drivers qualify for multiple discounts at the same time.

Knowing how to compare auto insurance companies is key to saving money. What one company might charge you a lot for, another provider might offer for a fraction of the price.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top North Dakota Car Insurance Providers

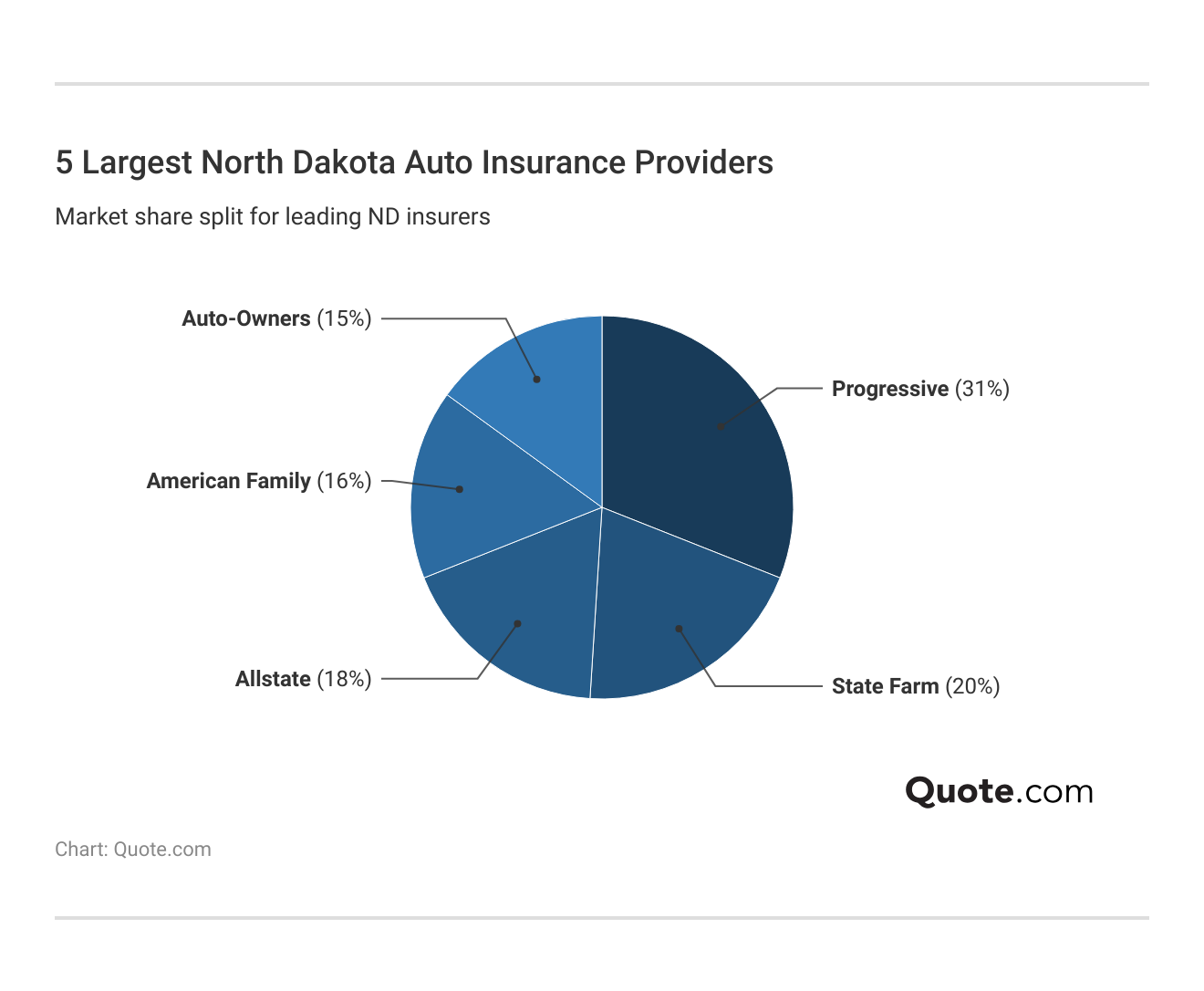

The best auto insurance companies in North Dakota are State Farm, American Family, and Auto-Owners. These three stand out for claims satisfaction, personalized service, and strong financial stability.

State Farm is the top overall pick thanks to its high customer satisfaction scores, which help drivers handle policies and claims smoothly.

Even though American Family and Auto-Owners are not the largest insurers in the state. Their strength comes from regional expertise and consistent customer support.

AmFam offers usage-based savings through its KnowYourDrive telematics program. Auto-Owners is smaller in size but best for reliable claims support, competitive senior driver rates, and financial strength.

Usage-based insurance is great for North Dakota drivers with short commutes and provides discounts of up to 40%.

Jeff Root Licensed Insurance Agent

American Family’s 16% share reflects its regional strength in the Midwest, while Allstate and Auto-Owners maintain solid positions through their network of local agents and personalized service.

These market leaders invest heavily in understanding North Dakota’s unique insurance needs, from harsh winter driving conditions to rural coverage requirements. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

#1 – State Farm: Top Overall Pick

Pros

- Highest Claims Satisfaction: Achieves top claims satisfaction score of 664 out of 1,000 among North Dakota insurers, ensuring smooth claim experiences for policyholders.

- Extensive Local Agent Network: State Farm maintains the largest network of local agents throughout North Dakota, providing face-to-face policy reviews for customers.

- Usage-Based Savings Program: Our State Farm insurance review shows its Drive Safe & Save usage-based program can reduce premiums up to 30% for safe driving habits.

Cons

- Higher Rates After Incidents: Charges higher premiums for drivers with recent accidents or traffic violations compared to budget-focused competitors in North Dakota.

- Limited Digital Tools: Provides fewer digital tools compared to tech-forward insurers, requiring more in-person or phone interactions for policy management tasks.

#2 – American Family: Best for Localized Service

Pros

- Strong Claims Performance: American Family is known for reliable claims handling for North Dakota policyholders statewide.

- Telematics Program: As mentioned in our American Family insurance review, its KnowYourDrive telematics program rewards safe drivers with personalized discounts.

- Weather Expertise: American Family understands North Dakota’s unique weather-related coverage needs, including hail and snow damage protection.

Cons

- Limited Rural Availability: Coverage availability is restricted in certain rural North Dakota counties, which may limit access for some potential customers seeking policies.

- Fewer Discount Options: Offers fewer discount opportunities compared to larger national carriers operating in the North Dakota insurance marketplace.

#3 – Auto-Owners: Best for Reliable Support

Pros

- Excellent Claims Satisfaction: The company reflects a strong commitment to reliable support during the claims process. Learn more in our Auto-Owners insurance review.

- Competitive Senior Rates: Provides competitive rates for mature drivers over 50 years old seeking affordable full coverage insurance options in North Dakota.

- Financial Stability: Maintains excellent financial stability ratings, providing peace of mind that claims will be paid promptly.

Cons

- Basic Digital Platform: Limited online and mobile app functionality compared to digitally advanced competitors in North Dakota’s insurance marketplace.

- Smaller Agent Network: Reduced market presence means fewer local agents available in some North Dakota communities for in-person consultations and service.

#4 – Allstate: Best for Custom Plans

Pros

- Drivewise Rewards Program: Its Drivewise program provides up to a 40% discount for safe driving. See how it works in our Allstate insurance review.

- Accident Forgiveness Coverage: Prevents rate increases after the first at-fault accident for qualifying policyholders in North Dakota.

- Extensive Customization Options: Its customization options include New Car Replacement and Deductible Rewards for individual North Dakota drivers.

Cons

- High Young Driver Rates: Charges above-average base rates for young drivers under 25 compared to more affordable insurance options available in North Dakota.

- Lower Claims Satisfaction: Claims satisfaction score of 644 out of 1,000 falls below top-ranked competitors serving North Dakota customers daily.

#5 – Geico: Best for Budget Drivers

Pros

- Lowest Minimum Coverage Rates: Provides the lowest average rates in North Dakota for drivers seeking basic minimum liability coverage meeting state requirements.

- Superior Digital Experience: Industry-leading digital tools and 24/7 mobile app access make policy management convenient for tech-savvy North Dakota customers.

- Military and Federal Discounts: Military discount of up to 15% plus federal employee discounts help North Dakota’s military and government employees.

Cons

- Below-Average Claims Rating: Claims satisfaction rating lags behind higher-rated competitors in North Dakota. Learn more in our Geico insurance review.

- No Local Agents: Lacks local agents in most North Dakota communities, limiting face-to-face service for customers preferring personal interactions and consultations.

#6 – Farmers: Best for Comprehensive Protection

Pros

- Signal Telematics Savings: Signal telematics app offers personalized discounts up to 30% based on safe driving habits for North Dakota policyholders.

- Rideshare Coverage Option: Rideshare coverage protects drivers during all phases of driving throughout North Dakota. Find more in our Farmers insurance review.

- Flexible Payment Plans: Flexible payment options and multi-policy bundling discounts help North Dakota families reduce overall insurance costs significantly each year.

Cons

- Average Claims Performance: Claims satisfaction score of 641 out of 1,000 indicates room for improvement compared to top-rated North Dakota insurers.

- High-Risk Driver Rates: Charges higher average car insurance costs in North Dakota for drivers with DUIs or multiple violations.

#7 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Best Anti-Theft Discount: Anti-theft device discount helps North Dakota drivers protect vehicles from theft. See our Liberty Mutual insurance review for more.

- Multiple Accident Forgiveness: This program forgives multiple accidents for long-term policyholders with good driving records in North Dakota.

- RightTrack Enrollment Bonus: The RightTrack program offers an initial 10% discount just for enrolling, plus additional savings of up to 30% total based on driving.

Cons

- Lower Claims Satisfaction: Below-average claims satisfaction rating of 640 out of 1,000 compared to top-performing competitors serving North Dakota residents.

- Higher Minimum Coverage Cost: Premium rates are much higher than with other North Dakota auto insurance companies.

#8 – Progressive: Best for Usage-Based Savings

Pros

- Snapshot Program Benefits: Snapshot usage-based insurance program provides immediate discounts and rewards safe driving with savings up to 30%.

- Name Your Price Tool: This helps North Dakota budget-conscious drivers find coverage matching their specific financial constraints easily through an online platform.

- Pet Injury Coverage: Progressive’s pet injury coverage helps North Dakota drivers pay vet bills if their pets are injured in a car accident.

Cons

- Low Claims Satisfaction: Claims satisfaction ranks among the lowest of top competitors serving North Dakota policyholders. Learn more in our Progressive auto insurance review.

- Steep Post-Accident Increases: Rates increase a bit after accidents compared to forgiving competitors in the North Dakota insurance market for similar violations.

#9 – Nationwide: Best for Bundling Options

Pros

- SmartRide Discount Program: As mentioned in our Nationwide insurance review, its SmartRide program offers up to a 40% discount for safe driving habits.

- Vanishing Deductible Feature: This program reduces drivers’ deductibles by $100 annually for each year without accidents or claims.

- Free Policy Reviews: On Your Side Review provides free annual policy consultation for North Dakota customers.

Cons

- Lowest Claims Satisfaction: Claims satisfaction rating of 632 out of 1,000 is the lowest among the top-ranked North Dakota auto insurance providers in the market.

- Limited Rural Presence: Limited local agent availability in smaller North Dakota towns restricts in-person service options for rural customers needing face-to-face assistance.

#10 – AAA: Best for Roadside Assistance

Pros

- Free Roadside Assistance: As mentioned in our AAA auto insurance review, its members-only benefits include free roadside assistance with unlimited towing services.

- Loyalty Reward Program: AAA’s loyalty discounts reward long-term North Dakota policyholders with increasing savings over time.

- Teen Driver Resources: Teen driver programs and educational resources help young North Dakota drivers develop safe habits while managing insurance costs effectively.

Cons

- Lowest Customer Satisfaction: Lowest claims satisfaction score of 628 out of 1,000 among all top-ranked North Dakota auto insurance companies reviewed.

- Membership Fee Required: AAA membership fee on top of insurance premiums, which increases the total annual cost for North Dakota customers.

Frequently Asked Questions

What is the best car insurance company in North Dakota?

State Farm is often considered the best in North Dakota for dependable customer service, strong claims handling, and stable premiums. Geico is another top choice, especially for drivers looking for the cheapest North Dakota car insurance rates.

What is the cheapest car insurance company in North Dakota?

Geico typically offers the cheapest car insurance in North Dakota for minimum coverage, averaging around $35 monthly. However, comparing multiple providers is the best way to find affordable plans, especially when seeking cheap car insurance in North Dakota.

What is the average cost of car insurance in North Dakota?

The average North Dakota car insurance costs ranges from about $35–$100 a month for minimum coverage and $80–$150 a month for full coverage. Rates vary based on age, driving history, ZIP code, and credit score.

What are the requirements for auto insurance in North Dakota?

North Dakota car insurance laws require drivers to carry at least $25,000 per person and $50,000 per accident in bodily injury liability, along with $25,000 in property damage liability. Enter your ZIP code in our free comparison tool to get car insurance quotes in North Dakota.

Do I need insurance to register a vehicle in North Dakota?

Yes, North Dakota requires proof of minimum liability insurance before vehicle registration. Drivers must show valid documentation that meets all state-mandated coverage levels.

Is North Dakota a no-fault state?

Yes, North Dakota is a no-fault state, meaning drivers must use their Personal Injury Protection (PIP) coverage for medical expenses after an accident, regardless of who caused the crash.

What is the best North Dakota car insurance company for roadside assistance?

AAA is widely preferred for roadside assistance in North Dakota, offering services such as towing, battery jumps, fuel delivery, and lockout help. These benefits are especially valuable during severe winter conditions.

Can I insure a car registered in a different state?

Generally no. Most insurers require your vehicle to be insured and registered in the same state where it is primarily driven and garaged to ensure proper rating and legal compliance.

Do you really need comprehensive and collision insurance?

Comprehensive and collision coverage are recommended for new, leased, or financed vehicles where repair or replacement costs would be high. Older vehicles with low market value may not benefit from the added premium.

What is the no-pay-no-play law in North Dakota?

North Dakota does not have a no-pay-no-play law. Uninsured drivers may still file claims but face penalties, fines, and possible license suspension for operating a vehicle without insurance. Get cheap auto insurance in North Dakota today by entering your ZIP code into our free comparison tool.

Do I need uninsured or underinsured motorist coverage in North Dakota?

How to get lower auto insurance costs in North Dakota?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.