Best Classic Car Insurance in 2026

Liberty Mutual, Nationwide, and Amica offer the best classic car insurance. Monthly rates start at $42 with Mercury. These top classic car insurance companies stand out for their agreed-value coverage and flexible policy options. They also offer safe-driver discounts and accident-free savings of up to 25%.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

The best classic car insurance is offered by Liberty Mutual, Nationwide, and Amica, combining specialized coverage with high customer satisfaction.

- Mercury has the cheapest classic car insurance for $42 a month

- High-value classic autos can cost up to $290 per month to insure

- Low mileage and classic car club membership discounts can save up to 40%

Liberty Mutual is the best classic car insurance company overall due to its exceptional customer service as well as comprehensive coverage.

Nationwide offers up to 40% accident-free discounts with strong agreed-value coverage, while Amica provides fast claims and flexible repairs.

Top 10 Companies: Best Classic Car Insurance| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 730 / 1,000 | A | Flexible Repairs |

| #2 | 729 / 1,000 | A+ | Agreed Value | |

| #3 | 718 / 1,000 | A+ | Superior Claims | |

| #4 | 716 / 1,000 | A++ | Trusted Service | |

| #5 | 716 / 1,000 | A+ | Senior Drivers |

| #6 | 701 / 1,000 | A | Budget Classics | |

| #7 | 697 / 1,000 | A++ | Online Savings | |

| #8 | 693 / 1,000 | A+ | Collector Coverage | |

| #9 | 691 / 1,000 | A++ | Premium Protection | |

| #10 | 690 / 1,000 | A | Custom Options |

Together, these companies offer the best auto insurance for classic cars, which is a unique type of car insurance designed to protect the increasing value and customization of antique and collector vehicles.

Start comparing affordable classic car insurance options by entering your ZIP code into our free quote comparison tool today.

Compare Classic Car Insurance Rates

Classic car insurance rates vary widely, but the best classic car insurance companies stand out for offering consistently low monthly premiums.

Mercury Insurance is the cheapest overall, with rates for minimum coverage starting at $42 and full coverage at $110 per month.

Classic Car Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $65 | $215 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $42 | $110 | |

| $63 | $164 | |

| $47 | $123 | |

| $61 | $161 |

| $53 | $141 |

Geico is close behind with comparably low rates at $43 per month for minimum and $114 per month for full coverage, along with robust online tools and availability in all 50 states.

State Farm also provides affordable premiums of $47 and $123 per month. Its competitive policy bundling discounts can bring these rates down even more, so always compare multiple companies to find the right price for you.

Travelers and Nationwide charge more for full coverage auto insurance, averaging $141 to $164 per month, but offer flexible options like agreed value protection for classic cars.

Other companies like Allstate, Liberty Mutual, and The Hartford are on the high side of pricing. However, Liberty Mutual provides better claims service and more policy customization than other providers on this list.

How a Classic Car’s Value and Condition Impact Insurance Rates

Classic car insurance rates are influenced by common factors that impact the cost of standard insurance, including the make, model year, vehicle age, and mileage, as well as how you intend to use the vehicle.

Modern classics (1996–2005) are the most affordable to insure, with rates starting at $40 per month. Fair-condition cars are more likely to get the cheapest car insurance.

Classic Car Insurance Monthly Rates by Value & Condition| Value Tier (Typical Age) | Excellent | Good | Fair |

|---|---|---|---|

| Modern (1996–2005) | $75 | $55 | $40 |

| Established (1986–1995) | $90 | $65 | $50 |

| Vintage (1976–1985) | $105 | $80 | $65 |

| Collectible (1975 & Prior) | $125 | $95 | $80 |

Established models manufactured between 1986 and 1995 remain affordable, but vintage cars from before 1985 and collectible autos from 1975 or earlier have the highest rates.

Classic auto insurance usually costs less than standard policies since classic collectors tend to drive their vehicles less. However, rates can rise based on the car’s age, condition, or usage.

Insurance Rates for Popular Classic Cars

Monthly insurance premiums for the most popular classic cars range based on rarity, market valuations, and collectibility (Learn More: Auto Insurance Rates by Vehicle).

Cheaper models, such as the 1957 Chevy Bel Air and 1969 Chevy Nova SS, cost less than $60 a month for minimum coverage, while full coverage insurance costs between $130–$135 per month.

Most Popular Classic Cars: Monthly Auto Insurance Rates| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| 1957 Chevy Bel Air | $55 | $130 |

| 1963 Chevy Corvette Sting Ray | $60 | $145 |

| 1965 Ford Mustang Fastback | $58 | $140 |

| 1966 Pontiac GTO | $59 | $142 |

| 1967 Shelby GT350 | $65 | $160 |

| 1967 Shelby GT500 | $95 | $250 |

| 1969 Chevy Camaro SS | $62 | $148 |

| 1969 Chevy Nova SS | $57 | $135 |

| 1969 Dodge Charger Daytona | $90 | $215 |

| 1969 Ford Mustang Mach 1 | $60 | $145 |

| 1969 Plymouth Road Runner | $58 | $140 |

| 1969 Pontiac Firebird | $59 | $142 |

| 1970 Chevy Chevelle SS | $63 | $150 |

| 1970 Dodge Challenger R/T | $61 | $148 |

| 1970 Plymouth Hemi ’Cuda | $120 | $290 |

Classic car insurance quotes factor in a collector car’s worth, age, and rarity, but the requirements for classic car insurance, such as limited use, can drive up the cost of coverage.

Mid-range classics such as the 1965 Ford Mustang Fastback, 1969 Pontiac Firebird, and 1970 Dodge Challenger R/T cost slightly more to insure.

Classic car insurance may not offer market value settlements or usage-based rates. However, mileage limits and secure storage can help lower premiums while protecting your car’s value.

Dani Best Licensed Insurance Agent

Full coverage exceeds $200 a month in some cases, with more exclusive and powerful cars commanding much higher premiums.

For instance, full coverage for a 1970 Plymouth Hemi ’Cuda reaches up to $290 per month.

Classic Auto Insurance Rates for High-Value Models

The most expensive classic cars to insure have high monthly premiums because they’re so rare, carry such high market value, or are historically important.

At the top is the 1970 Plymouth Hemi ’Cuda, with rates starting at $120 per month, largely attributed to the fact that only 652 models were manufactured, making this car very hard to repair or replace in the event of a claim.

Most Expensive Classic Cars to Insure| Make & Model | Rank | Monthly Rate | Reason |

|---|---|---|---|

| 1970 Plymouth Hemi ’Cuda | 1 | $120 | Ultra-rare model |

| 1969 Dodge Charger Daytona | 2 | $90 | Limited production |

| 1967 Shelby GT500 | 3 | $95 | High-value Shelby |

| 1967 Shelby GT350 | 4 | $65 | Performance Shelby |

| 1970 Chevrolet Chevelle SS | 5 | $63 | Big-block demand |

Shelby models are also far and away the most popular high-cost tier, with the 1967 Shelby GT500 at $95 monthly and the GT350 at $65 per month, both prized for their performance legacy.

If you own one of these iconic vehicles, use our guide on how to buy auto insurance to pick out a policy that covers the higher financial risk.

Affordable Classic Cars With Cheap Insurance

Classic cars with lower insurance premiums tend to be widely available models, have moderate market values, and are easier to maintain or repair.

The 1957 Chevrolet Bel Air ranks as the least expensive to insure at $55 per month, thanks to its accessible replacement parts. The 1969 Chevrolet Nova SS is also just behind at $57, as it is not valued nearly as highly as more rare muscle cars.

Least Expensive Classic Cars to Insure| Make & Model | Rank | Monthly Rate | Reason |

|---|---|---|---|

| 1957 Chevrolet Bel Air | #1 | $55 | High availability |

| 1969 Chevrolet Nova SS | #2 | $57 | Lower value |

| 1965 Ford Mustang Fastback | #3 | $58 | High production |

| 1969 Plymouth Road Runner | #4 | $58 | Common muscle |

| 1966 Pontiac GTO | #5 | $59 | Easier repairs |

These cars also come with timeless design and affordable ownership costs, making them ideal picks for enthusiasts seeking lower insurance costs (Learn More: Auto Insurance Guide).

The 1965 Ford Mustang Fastback and 1969 Plymouth Road Runner, both at $58 per month, benefit from high production numbers and strong aftermarket support, which help keep repair costs manageable.

Classic Car Insurance Rates by Driver Age

Liberty Mutual and Allstate are the most expensive, while Geico and Mercury offer the lowest rates (Read More: Allstate vs. Geico Auto Insurance).

Geico and Mercury are the cheapest classic car insurance options, no matter your age group.

Classic Car Insurance Monthly Rates by Driver's Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $148 | $102 | $92 | $87 | |

| $118 | $81 | $78 | $65 | |

| $142 | $98 | $84 | $76 | |

| $72 | $50 | $46 | $43 | |

| $165 | $119 | $103 | $96 |

| $75 | $52 | $46 | $42 | |

| $121 | $81 | $69 | $63 | |

| $88 | $60 | $51 | $47 | |

| $112 | $77 | $67 | $61 |

| $92 | $62 | $56 | $53 |

Geico consistently offers the lowest rates, with premiums starting at just $72 per month for 18-year-olds and decreasing to $43 per month for drivers aged 45.

Mercury is not far behind, costing only $75 per month at 18 years of age and then slowly decreasing to only $42 per month by the time you reach 45 years, providing excellent value across the board.

Classic car insurance rates usually decrease with age due to lower risk. Younger drivers often pay more. For example, a 45-year-old may pay $42 monthly, while an 18-year-old pays $72 a month.

Brad Larson Licensed Insurance Agent

State Farm also has appealing prices, especially for drivers ranging from their mid-20s to mid-40s, when rates are still fairly low and competitive.

Travelers and Amica become more price-competitive as drivers get older, with their rates substantially lower for drivers in their 30s and 40s.

Classic Car Insurance Rates by State

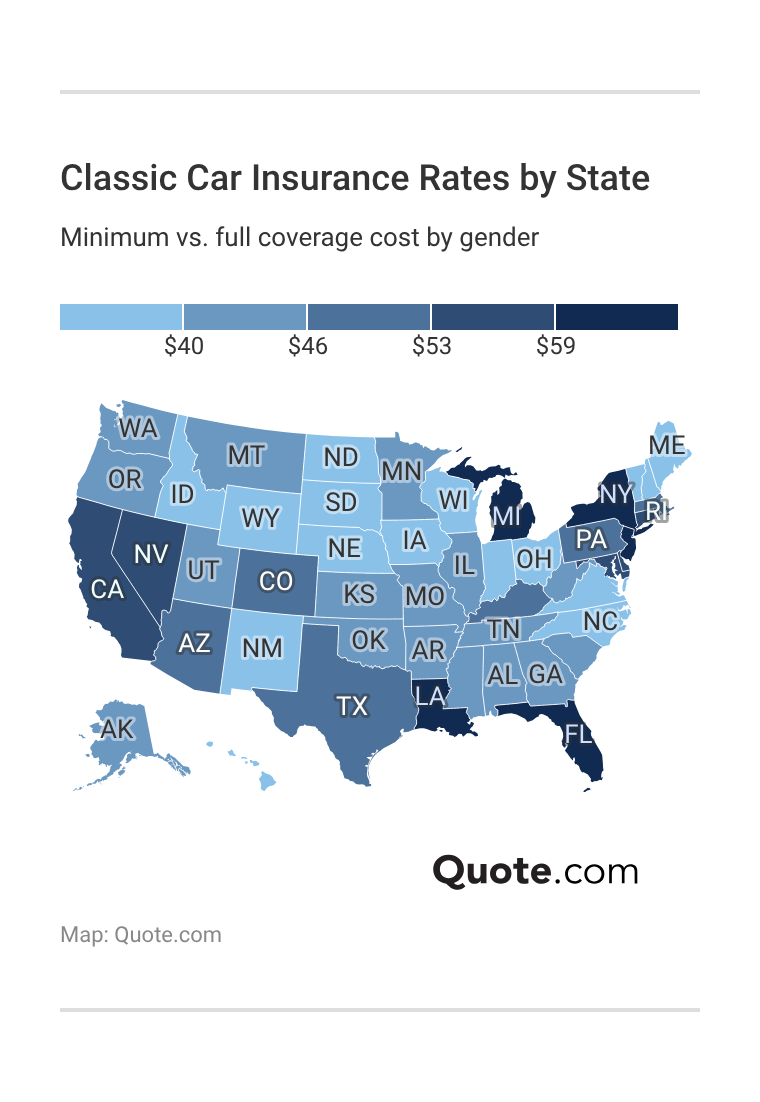

Classic car insurance rates differ significantly by state due to local insurance laws and requirements (Read More: Auto Insurance Rates by State).

In all 50 states, full coverage classic car insurance costs double, and men consistently pay slightly higher rates than women, even in states where gender is not allowed to impact insurance rates.

Kansas stands out as the most affordable, with monthly premiums around $40 per month for minimum coverage and under $100 monthly for full coverage policies.

Florida is one of the most expensive states, with full coverage costing almost $150 a month. Florida car insurance is so high due to weather-related risks and a high number of uninsured drivers.

Washington has moderate insurance rates, with females paying $46 for minimum and $108 for full coverage, and males paying $50 and $114 (Learn More: Best Auto Insurance Companies in Washington).

You can use our free quote comparison tool to compare classic auto insurance costs in your state. Just enter your ZIP code to begin.

How Driving Record Affects Classic Car Insurance Costs

In the comparison of classic car insurance rates by driving record, it appears that Mercury, Geico, and State Farm are the best options, no matter what kind of infraction has occurred.

Mercury provides the cheapest rates overall, with minimal increases for drivers with one accident, DUI, or ticket. Its rates remain impressively low even after a DUI, rising only to $70 per month from a $42 per month base.

Classic Car Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $65 | $99 | $123 | $81 | |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $42 | $62 | $70 | $52 | |

| $63 | $88 | $129 | $75 | |

| $47 | $57 | $65 | $53 | |

| $61 | $89 | $93 | $74 |

| $53 | $76 | $112 | $72 |

Geico also delivers competitive pricing, especially for drivers with a clean record, at just $43 per month. Even after a DUI, its $117 per month premium is still more affordable than most (Read More: Cheap Auto Insurance After a DUI).

State Farm is notable here for stability overall, boasting some of the lowest increases from a clean record to DUI violations or speeding tickets.

Amica and Travelers are also competitive mid-priced options, while Allstate and Liberty Mutual tend to charge more.

The easiest way to keep your classic auto insurance costs low is to maintain a clean driving record after any infractions.

Credit Score Impact on Classic Car Insurance Rates

Mercury is a standout for providing the lowest and most consistent rates for drivers in all credit tiers.

Its rates rise modestly from $42 per month for excellent credit to $74 per month for poor credit.

Classic Car Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $87 | $104 | $128 | $156 | |

| $65 | $78 | $95 | $118 | |

| $76 | $91 | $112 | $137 | |

| $43 | $51 | $63 | $77 | |

| $96 | $116 | $142 | $175 |

| $42 | $50 | $61 | $74 | |

| $63 | $76 | $93 | $114 | |

| $47 | $57 | $69 | $85 | |

| $61 | $74 | $91 | $111 |

| $53 | $64 | $78 | $95 |

Geico remains a competitive option, keeping rates below the average cost of auto insurance, with monthly premiums rising modestly from $43 to $77 as credit scores drop.

State Farm is also a strong option from the pool, even for those with fair or poor credit, with under $90 per month rates on our list’s worst tier.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Classic Auto Insurance Coverage Explained

Standard policies use depreciated actual cash value. Unlike standard auto insurance, classic car policies are based on agreed-value coverage and not depreciation.

Classic car insurance companies compensate you for the entire value of your vehicle, including modifications and upgrades.

Classic vs. Standard Auto Insurance: Key Differences| Feature | Classic | Standard |

|---|---|---|

| Claims payout | Full agreed value | Depreciated value |

| Mileage limits | Limited annual miles | No mileage limits |

| Premium structure | Lower, usage-based | Risk-based pricing |

| Storage requirements | Secure indoor storage | No storage requirement |

| Usage restrictions | Non-daily driving | Daily driving allowed |

| Vehicle value | Agreed value | Actual cash value |

Classic policies also limit annual mileage and restrict use to non-daily driving, which lowers risk and allows for usage-based insurance premiums that are often cheaper.

Standard auto insurance, by comparison, allows unlimited mileage and daily use, but a classic car insurance comparison shows it’s often priced higher over time due to greater risk ratings.

Classical insurance policies typically do not cover external storage to maintain the condition of a car and its value. But regular policies have no storage requirements.

Overall, insurance for collectible cars is designed to preserve a vehicle’s collectible value, while standard auto insurance is intended for everyday transportation needs.

How to Qualify for Classic and Collector Car Insurance

Not every type of vehicle qualifies for classic auto coverage, and each company has different rules for what it considers a classic or collector car for insurance.

Most providers put storage requirements or vehicle age and mileage limits on their policies in order to reduce risk and ensure that the listed vehicle is actually a classic auto.

Antique cars are typically at least 45 years old and often built before or just after World War II. Their historical value and craftsmanship make them ideal candidates for the best antique car insurance.

Classic cars are typically 20-40 years old, have sentimental or monetary value, are properly stored, and are usually driven infrequently. Classic trucks and utility vehicles, like vintage pickups and early SUVs, are growing in popularity among collectors.

Common Classic & Collector Vehicle Types| Type | Description |

|---|---|

| Antique Vehicle | Historic collector vehicle |

| Classic Car | Older collectible car, limited-use insured |

| Classic Truck / Utility | Older pickups/SUVs with collector value |

| Hot Rod / Restomod | Classic body, modified drivetrain/style |

| Modern Collector Car | Newer collectible with rising value |

| Muscle / Pony | Performance-era American favorites |

| Replica / Kit / Tribute | New build replicating a classic model |

| Vintage Vehicle | Pre-war or early post-war vehicles |

Hot rods and restomods are classic on the outside with modern mechanics, which means they require customizable classic car insurance coverage for custom parts.

Replica, kit, and tribute cars are new vehicles that have been created to look similar to classic ones, and also require a unique policy for custom parts.

Read More: Best Auto Insurance for Luxury and Exotic Vehicles

Recommended Classic Car Insurance Coverage

Classic cars are much more than mere transportation; they’re valuable investments and symbols of automotive history. The value, as well as the rarity of use, makes them anything but your average auto insurance.

Classic car insurance protects the risks posed by vintage vehicles with customized coverage that can include agreed value, spare parts, and special towing.

- Agreed Value Coverage: Ensures you get the full insured amount for a total loss, no depreciation, and no hassle.

- Comprehensive Coverage: Guards against non-collision damage events like theft, vandalism, caustic birds, or natural disasters.

- Collision Coverage: Pays for damage to your car when you hit another vehicle or an object, regardless of who is at fault.

- Roadside Assistance & Towing: Offers emergency services like towing and jumpstarts, often including flatbed towing designed for classic cars.

- Spare Parts Coverage: Pays for the repair or replacement of rare or valuable classic car parts and accessories.

Understanding the key classic car insurance coverage options can help owners preserve both the beauty and the value of their vehicle for years to come.

Covering a classic car means more than meeting legal requirements; it ensures your investment is covered in any scenario, including accidents, disasters, or with roadside assistance coverage during emergencies.

With coverages like agreed value protection, spare parts reimbursement, and classic-specific roadside assistance, owners can enjoy peace of mind knowing their vehicle is fully protected.

By choosing the best policy features, classic car enthusiasts can avoid costly surprises and keep their prized vehicle in pristine condition, ready for the next cruise, show, or generation.

How Classic Car Insurance Settlements Are Calculated

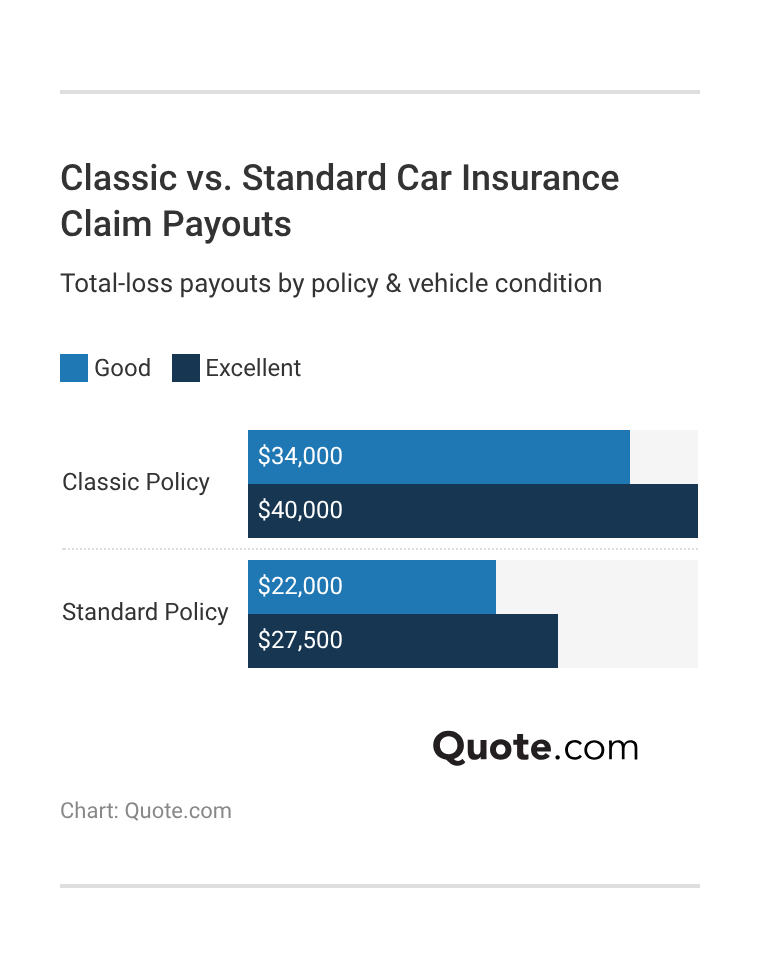

Claim payouts differ by policy type, with the best auto insurance companies for claims handling offering more reliable agreed value settlements for classic cars.

Classic car insurance is agreed value, resulting in higher and more predictable payouts, usually between $34,000 and $40,000, based on the vehicle’s condition and the pre-set insured amount.

Standard insurance, on the other hand, relies on actual cash value, which includes depreciation and typically results in lower settlements of $22,000 to $27,500 for similar vehicles.

This is why classic policies are more appropriate for those who have a finished product and want to be fully covered for the collectible or restored value of their vehicle.

How to Save on Classic Car Insurance

Classic car owners can significantly reduce their insurance premiums by using these tips for exclusive discounts and choosing the right policy for collecting classic cars.

Using classic car insurance mileage limits can cut costs, with Nationwide offering up to 40% off and Geico, Liberty Mutual, and State Farm offering 30% discounts.

- Bundle With Other Policies: Your insurance company will give you a better rate if you buy another kind of policy from them, like homeowner’s, auto, or umbrella coverage.

- Choose Agreed Value Coverage Wisely: Setting an accurate agreed value, not over- or under-valued, ensures fair premiums without paying extra for inflated coverage.

- Join a Classic Car Club: Some companies reduce premiums for policyholders who belong to an approved car club, which suggests responsible ownership and low risk.

- Limit Annual Mileage: Trim down driving your classic car; if you only drive for show or on weekends, it can save on premiums as mileage-based discounts may apply.

- Store Your Vehicle Securely: Storing your vehicle in a locked garage or climate-controlled storage can impact how you are seen as low risk, therefore decreasing your premium.

Owners can also bundle policies, store vehicles in secured garages, or maintain excellent driving records to unlock further discounts.

To secure the best vintage car insurance, owners can maximize savings through bundling, low-mileage use, secure storage, club membership, and agreed-value discounts.

Top Classic Car Insurance Discounts| Company | Low Mileage | Membership | Multi-Policy | Storage |

|---|---|---|---|---|

| 30% | 10% | 25% | 5% | |

| 25% | 5% | 30% | 5% | |

| 10% | 10% | 20% | 5% | |

| 30% | 25% | 25% | 5% | |

| 30% | 10% | 25% | 5% |

| 20% | 5% | 20% | 5% | |

| 40% | 15% | 25% | 5% | |

| 30% | 5% | 25% | 5% | |

| 10% | 10% | 20% | 5% |

| 20% | 10% | 25% | 5% |

Bundling your classic car insurance with other policies can save 25–30%, especially with providers featured in the best auto and home insurance bundles like Amica and Nationwide.

Joining a well-known classic car club is another way to go, with Geico and Nationwide offering 25% and 15% off in reward for responsible ownership.

Best Insurance Companies for Classic Cars

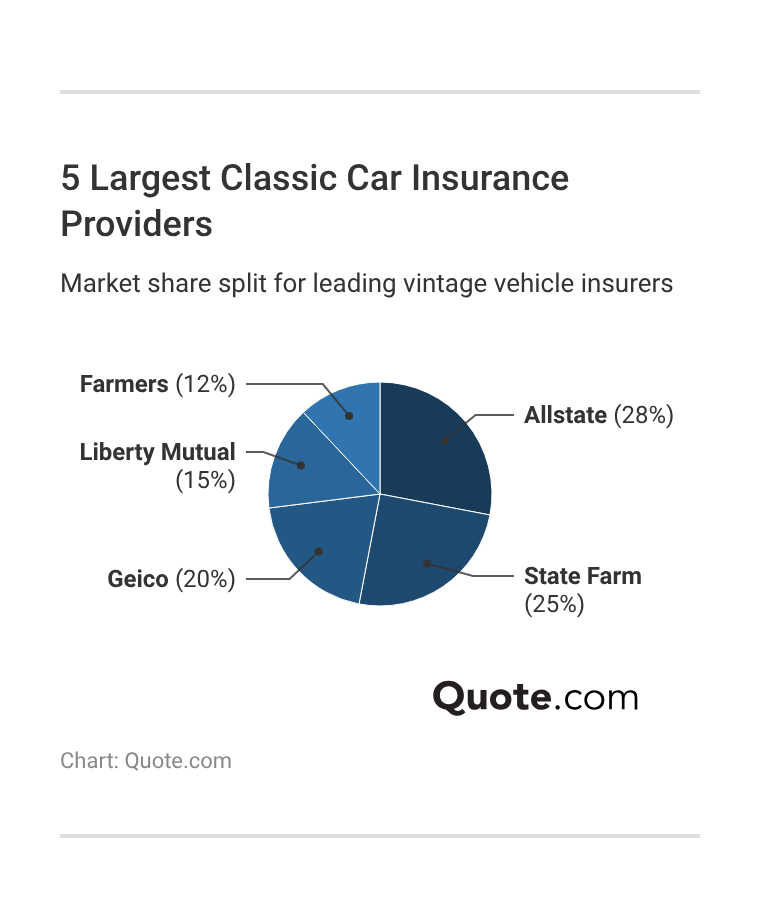

Allstate, State Farm, and Geico are still popular choices among the majority of drivers thanks to their nationwide availability, custom coverage options, and affordable rates.

With their strong agent networks, bundling benefits, and digital tools, these service providers are easily accessible and dependable for hobbyists looking to remain versatile and convenient.

Liberty Mutual holds a decent piece of the market for its customization and claims service, but regional providers like Amica and Mercury don’t have the national reach of some of these companies.

Shopping around is by far the best thing you can do to get the right mix of agreed-value coverage, mileage limits, and discounts tailored to your vehicle and driving habits. Use this list to find affordable comprehensive auto insurance for your vehicle.

#1 – Liberty Mutual: Top Pick Overall

Pros

- Flexible Claims Process: Renowned for being able to cater to unique repair requirements, which benefits owners of rare or modified classic cars.

- Custom Shop Choice: Liberty Mutual offers classic car owners the option to pick their own repair shop, which is perfect if you use restoration experts.

- Decent Low Mileage Discount: Provides up to 30% for low use, perfect if you only drive occasionally. Compare more discounts in our Liberty Mutual review.

Cons

- Lower Spare Parts Support: Reduced freedom in parts replacement may not be a prospect for rare classic car types.

- Slower Claim Payouts: Filing for claims repair when your classic car is in a non-partner shop can take longer, according to some users.

#2 – Nationwide: Best for Agreed Value

Pros

- Agreed Value Stability: Guarantees full payout of the agreed value for a total loss, making it ideal for high-value classic cars that depreciate less predictably.

- High Mileage Discount: Offers up to 40% off for low-mileage classic car owners, a top mileage discount. Find the full list of discounts in our Nationwide Insurance review.

- Bundling Savings: Customers can save 25% if they bundle classic car insurance with homeowners or standard auto.

Cons

- Claims Processing Time: Classic car customers have said their claims take longer to process, particularly with agreed-value claims.

- Selective Eligibility: Not all classic cars, especially heavily modified or replica models, qualify for agreed value coverage under Nationwide’s guidelines.

#3 – Amica: Best for Superior Claims

Pros

- Fast Claims Response: Known for fast, responsive claims, ideal for classic car owners who need quick resolutions.

- Low Rate Increases: Despite an infraction such as a ticket, classic car insurance through Amica only goes up to $81 monthly. See how quotes compare in our Amica review.

- Multi-Policy Discount: Bundle classic auto coverage with home or other policies to save up to 30%, perfect for those needing multiple types of protection.

Cons

- Fewer Custom Add-ons: Amica classic car policies may not have specialized offerings, such as higher agreed-value cap options found from some specialty insurers.

- Basic Storage Discount: While Amica offers a 5% discount for secure storage, classic car owners may find better incentives with providers that reward advanced storage setups.

#4 – State Farm: Best for Trusted Service

Pros

- Fair Credit Pricing: Even the drivers with bad credit scores can score rates that are as low as $85 per month, which is less than half of what some competitors charge at $150+.

- Stable Rates: Classic car insurance premiums stay consistent, with full coverage from $123 per month to $47 per month by age 45, ideal for long-term owners.

- Agent Support: State Farm provides local agent support tailored to classic car needs, plus bundling help. Find a local office in our State Farm auto insurance review.

Cons

- Minimal Custom Add-Ons: State Farm offers fewer classic car add-ons, such as spare parts or restoration coverage, than specialized collector insurers.

- No Club Discount: Unlike some competitors, State Farm doesn’t offer extra discounts for classic car club memberships, missing a savings opportunity for enthusiasts.

#5 – The Hartford: Best for Senior Drivers

Pros

- Senior-Focused Discounts: Rates start at $61 per month for minimum coverage and $161 per month for full coverage for senior classic car drivers.

- AARP Partnership Perks: AARP members get added savings and classic car policy benefits, ideal for drivers 50+.

- Vehicle Replacement Coverage: Covers classic cars up to the agreed value with replacement options. This feature is covered in our The Hartford insurance review.

Cons

- Eligibility Restrictions: Some of The Hartford’s top features require AARP membership, limiting access to the best classic car rates and perks for non-members.

- Strict Storage Requirements: Classic car policies may require garage storage to qualify for full coverage, limiting accessibility for owners without secure storage facilities.

#6 – Mercury: Best for Budget Classics

Pros

- Low Starting Rates: For minimum coverage, classic car insurance can start at $42 per month, and for full coverage at $110 per month, so Mercury is a budget-friendly choice.

- Consistent Pricing: Although prices for the classic car can fluctuate in that same policy, the premiums themselves remain steady (Read More: Mercury Insurance Review).

- Accident Tolerance: Rates stay low after an incident and rise to just $70 per month for a DUI.

Cons

- Few Custom Options: Mercury offers fewer collector-focused custom options, so you may not have as many ways to customize your policy for a rare or modified classic car.

- Basic Digital Tools: The platform lacks robust online account features, making policy management less convenient for tech-savvy classic car enthusiasts.

#7 – Geico: Best for Online Savings

Pros

- Online Convenience: Classic car owners can easily compare classic car insurance quotes and manage policies online, no agent needed.

- Strong Affordability: Geico is rated as one of the most affordable options for insuring your classic car when you compare quotes across age, credit score, and driving record.

- Quick Quote Tools: Fast online quote tools let classic car owners compare coverage and find low rates quickly. Find low rates in our Geico insurance review.

Cons

- Storage Requirements: Some classic car policies may still require secure garage storage to qualify for the lowest rates.

- Basic Coverage Focus: Geico prioritizes low-cost classic car coverage over premium add-ons, making it better for budget-focused owners than high-end collectors.

#8 – Allstate: Best for Collector Coverage

Pros

- Strong Claims Support: Reputation matters when you have a claim, crucial for high-value classic car losses. Check out our Allstate insurance review to see why it’s a strong option.

- Custom Policy Options: Permits the addition of riders and enhancements on classic cars, such as agreed value endorsements.

- Bundling Savings: Classic car policyholders can reduce costs by bundling their policy with home or auto insurance, helping to offset higher base rates.

Cons

- Usage Restrictions: Classic car policies could also have very limited mileage and driving limitations.

- Price Sensitivity: Budget-focused classic car owners may find Allstate less appealing due to higher baseline rates.

#9 – Travelers: Best for Premium Protection

Pros

- Flexible Mileage Plans: Offers customized low-mileage options ideal for classic car use, starting at $49 per month for minimum coverage.

- Reputation for Stability: Good financial ratings appeal to classic car policyholders who want stability from their insurer.

- High-Value Coverage: Agreed-value coverage for classic cars, starting at $141 per month. Find more coverage details in our Travelers auto insurance review.

Cons

- Fewer Local Agents: With fewer in-person agents than Allstate or State Farm, Travelers may not be a suitable choice for classic car owners who prefer face-to-face support.

- Average Tech Tools: Travelers’ digital tools and mobile app are more basic, which may limit ease of policy management for tech‑savvy classic car owners.

#10 – Farmers: Best for Custom Options

Pros

- Flexible Coverage Limits: Farmers offers customizable coverage limits with classic car policies, and rates begin at $76 per month for individuals with a clean driving record.

- Restoration Coverage: Offers optional coverage during classic car restoration, a rare perk among providers. Get all the details in our Farmers Insurance review.

- Accident Forgiveness: Available for eligible classic car drivers, preventing rate increases after the first at-fault accident.

Cons

- Minimal Custom Bundles: If you like to bundle, you may have fewer options for specialized bundles than you might with a company such as State Farm or Amica.

- Average Value Cap: Agreed-value options may have lower maximum limits than specialty insurers, limiting coverage for high-value classic cars.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Explore the Best Coverage for Classic Cars

The best classic car insurance offers a good combination of value, flexibility, and trustworthy service. Amica, Nationwide, and Liberty Mutual also offer strong coverage options and customer satisfaction.

Amica stands out among the best car insurance companies for its excellent service and well-rounded policies, while Nationwide earns its place with generous accident-free discounts and agreed value protection.

Liberty Mutual offers classic-specific perks and flexible repairs, but at higher rates. Mercury is best for budget-focused drivers, with $42 monthly rates and basic features.

Choosing the right classic car insurer depends on your vehicle’s needs and your priorities for cost, coverage, and support. Compare insurance rates today by entering your ZIP code into our free comparison tool.

Frequently Asked Questions

Which company has the best classic car insurance?

The best classic car insurance companies are Liberty Mutual for overall coverage, Nationwide for agreed-value options, and Amica for its customer service. Compare insurers to make sure you’re getting the best coverage for your car’s value, as well as your usage and storage needs.

Who has the cheapest classic car insurance rates?

Mercury and Geico offer the cheapest classic car insurance, with rates starting around $42 per month, but since costs vary by driver and vehicle, it’s important to learn how to compare auto insurance companies to find your best rate.

How much does classic car insurance cost per month?

The average cost of classic car insurance is $40 to $125 per month, depending on the vehicle, policy, and driver. Modern classics are usually cheaper to insure, whereas rare or vintage cars are more expensive. Reduced rates for low mileage, secure storage, and bundling can all work to lower your rate.

Stop overpaying for classic car insurance. Enter your ZIP code to get the lowest prices in your area.

What are the mileage and usage limits on classic car insurance?

Classic car insurance comes with agreed-value payouts, collision auto insurance, comprehensive damage, liability, and some extras like spare parts or roadside assistance. It’s designed to protect the collectible value of the car, rather than merely shield it for regular use.

How can I save money on classic car insurance?

Yes, classic auto insurance tends to be cheaper than standard car insurance because classic cars are not driven as much and are better maintained, but the costs vary according to factors such as mileage, where the vehicle is stored, its value, and how it’s used.

Can you insure a classic car used for daily driving?

Classic car insurance imposes mileage restrictions, usually between 1,000 and 5,000 miles a year, and limits on usage (like only driving to car shows or for pleasure). Construct insurance amount limits are also based on an agreed value you decided with the insurer.

What types of vehicles qualify for classic car insurance?

To get the best low-mileage auto insurance discounts, limit annual mileage, bundle policies, and secure your vehicle. Otherwise, joining a classic car club and picking wisely could also reduce your premium.

What types of cars are covered by classic car insurance?

The average classic car insurance policy features a car on the road that is more than 25 years old and used as an additional vehicle. Eligibility is typically a function of how old the car is, its condition, and restricted annual mileage.

How old does a car have to be to qualify for classic car insurance?

In order to qualify for classic car insurance, the typical vehicle must be between 10 and 25 years old, though these requirements can vary by insurer. Unlike cheap auto insurance for teens, classic auto policies are based on collectible value and restricted usage rather than age or driving history.

What is the annual mileage limit for classic car insurance?

Annual mileage is limited to between 1,000 miles and 5,000 miles for many traditional car insurance policies. These limits can help keep premiums low since they restrict the amount of time the car is used.

Does Liberty Mutual offer classic car insurance?

Who does Progressive use for classic car insurance?

What qualifies a car as a classic or antique for insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.