Best Auto Insurance for Hybrid and Electric Cars in 2026

Erie, Liberty Mutual, and Nationwide have the best auto insurance for hybrid and electric cars. Depending on your model, hybrid and electric vehicle insurance can start at $32 per month. Insurers offer ways to lower your premiums. For example, State Farm’s Drive Safe & Save UBI program can save you up to 30%.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

The leading companies for auto insurance for hybrid and electric cars are Erie, Liberty Mutual, and Nationwide. Their coverage protects batteries and high-tech features.

- Erie and Nationwide keep EV premiums stable without battery surcharges

- UBI programs cut hybrid and electric car premiums by up to 30%

- EV policies should account for longer repair times and fewer repair shops

Erie helps drivers save with reliable claims handling, while Liberty Mutual offsets higher costs with electric vehicle (EV) incentives and usage-based discounts.

Nationwide can help with the higher repair costs that often come with hybrid and electric cars (Read More: Best Auto Insurance for Teslas).

Top 10 Companies: Best Auto Insurance for Hybrid & Electric Cars| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A+ | Strong Support |

| #2 | 730 / 1,000 | A | Policy Flexibility |

| #3 | 729 / 1,000 | A+ | Smart Coverage | |

| #4 | 716 / 1,000 | A++ | Eco Savings | |

| #5 | 716 / 1,000 | A+ | Reliable Service |

| #6 | 702 / 1,000 | A | Green Benefits |

| #7 | 697 / 1,000 | A++ | Low Premiums | |

| #8 | 693 / 1,000 | A+ | EV Discounts | |

| #9 | 691 / 1,000 | A++ | Tech Features | |

| #10 | 690 / 1,000 | A | Battery Protection |

Since fixes can get pricey, the best insurance for electric cars helps limit what you pay out of pocket after a claim, especially for EVs and hybrids.

To compare auto insurance companies and use our free quote tool, just enter your ZIP code and check your options side by side.

Compare Hybrid and EV Car Insurance Rates

Checking monthly rates gives you a clear idea of what insurance for hybrid and electric vehicles actually costs.

Minimum coverage may seem affordable, but it usually does not pay for repairs to batteries or sensors. Full coverage auto insurance is more expensive since it includes those larger repairs.

Hybrid & Electric Car Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $78 | $175 | |

| $69 | $157 |

| $56 | $128 |

| $74 | $172 | |

| $55 | $126 | |

| $82 | $186 |

| $64 | $151 | |

| $59 | $133 | |

| $63 | $144 |

| $70 | $160 |

Erie is a solid choice and often considered the best insurance for hybrid cars and EVs because its prices remain reasonable, even with more coverage.

It’s a good reminder of why balancing cost and protection is especially important when insuring a hybrid or electric car.

How Age Affects EV Auto Insurance Rates

Your age affects the average hybrid car insurance cost and the overall insurance cost for an electric vehicle, too. Younger drivers pay higher rates because they have less experience, so shop around to find cheap auto insurance for teens.

As you move into your 20s and 30s, your rates usually drop as you gain experience. If you have a safe driving record, hybrid and EV car insurance companies are more likely to offer better prices.

Hybrid & Electric Car Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $172 | $102 | $95 | $78 | |

| $148 | $90 | $85 | $69 |

| $123 | $74 | $69 | $56 |

| $165 | $97 | $89 | $74 | |

| $119 | $72 | $66 | $55 | |

| $183 | $108 | $102 | $82 |

| $139 | $84 | $79 | $64 | |

| $128 | $77 | $70 | $59 | |

| $140 | $83 | $78 | $63 |

| $153 | $91 | $88 | $70 |

If you keep your insurance and avoid filing claims, your costs can go down over time, even if your coverage stays the same. Erie is a good choice because its prices stay competitive for all ages, rather than being much higher for younger drivers.

In the end, being patient, driving safely, and choosing the right insurance company, using an auto insurance guide as a reference, can help make electric vehicle insurance more affordable.

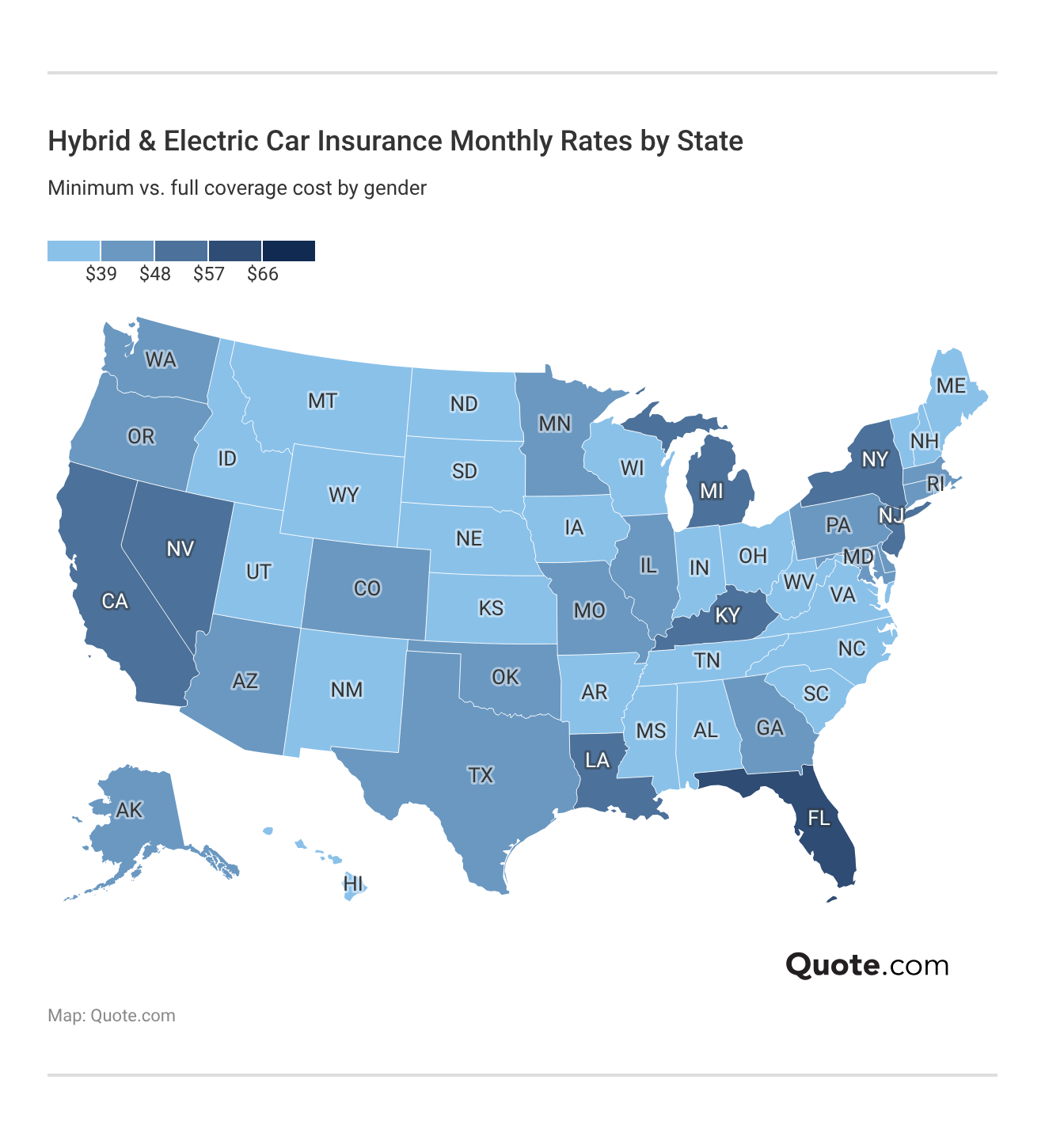

How Drivers in Different States Save on EV Insurance

Insurance costs for hybrids and electric vehicles can vary a lot depending on where you live, often landing above the average cost of auto insurance.

States with more traffic, higher repair costs, and more insurance claims usually have higher premiums.

Areas with fewer accidents and lower labor costs often have lower monthly insurance premiums. You can compare auto insurance rates by state to get a better idea of local premiums.

This means your ZIP code can be just as important as your car or driving record when it comes to insurance costs.

State rules affect EV insurance more than most people expect, especially around credit and pricing models. For instance, some states keep rates more stable.

Michelle Robbins Licensed Insurance Agent

Some states offer better long-term value, especially if you plan to keep your EV for several years.

For this reason, it’s a good idea to compare several local quotes before choosing a policy, particularly if you’re looking for the best EV car insurance in California.

How Driving History Impacts EV Insurance Costs

Your driving record has a big impact on the cost of hybrid and electric car insurance. If you have a clean record, insurers consider you less risky and often give you lower rates for your EV and electric car.

Getting a ticket, having an accident, or a DUI can increase your insurance rate because it shows you might be more likely to make future claims.

Hybrid & Electric Car Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $78 | $105 | $133 | $94 | |

| $69 | $93 | $118 | $84 |

| $56 | $76 | $96 | $68 |

| $74 | $100 | $127 | $90 | |

| $55 | $74 | $94 | $66 | |

| $82 | $112 | $141 | $100 |

| $64 | $87 | $110 | $78 | |

| $59 | $80 | $100 | $71 | |

| $63 | $86 | $108 | $77 |

| $70 | $94 | $119 | $83 |

Erie is a top choice because it usually keeps rate increases lower than those of other insurers.

In the end, careful driving and picking the right insurer can help reduce your costs if something does happen, especially when you are shopping for auto insurance after a DUI.

How Credit Shapes Insurance for an EV or Hybrid

Your credit can affect how much you pay to insure a hybrid or electric car, even if your driving habits do not change. Insurance companies look at your credit score to decide how likely you are to file a claim.

If your score is lower, you will probably pay more each month. Erie is a good option because its prices usually stay steady, regardless of your credit score.

Hybrid & Electric Car Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $78 | $96 | $118 | $147 | |

| $69 | $75 | $93 | $129 |

| $56 | $68 | $79 | $88 |

| $74 | $91 | $112 | $147 | |

| $55 | $67 | $77 | $96 | |

| $82 | $108 | $132 | $165 |

| $64 | $73 | $85 | $107 | |

| $59 | $70 | $81 | $93 | |

| $63 | $72 | $84 | $103 |

| $70 | $81 | $94 | $122 |

Most other insurance companies raise their rates faster if your credit score drops, which can make it harder to keep your budget on track.

The main thing to remember is that improving your credit score can help you pay less for car insurance, just like being a safe driver does.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Costs for Different EV Models

When you compare auto insurance rates by vehicle, you’ll see that the type of hybrid or electric car you pick can make a big difference in your monthly insurance costs.

Insurance companies consider how much it costs to repair a car, how easy it is to get parts, and how much technology the car has.

Auto Insurance Monthly Rates for Popular Hybrid & Electric Vehicles| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Audi e-tron GT | $98 | $210 |

| BMW i7 | $112 | $238 |

| Chevrolet Bolt EV | $54 | $124 |

| Ford Escape Hybrid | $60 | $131 |

| Ford Mustang Mach-E | $78 | $175 |

| Honda Accord Hybrid | $50 | $120 |

| Honda CR-V Hybrid | $62 | $142 |

| Hyundai Ioniq | $47 | $116 |

| Hyundai Kona Electric | $66 | $154 |

| Jaguar I-Pace | $86 | $190 |

| Kia Niro Hybrid | $42 | $106 |

| Lexus RX Hybrid | $82 | $186 |

| Mercedes-Benz EQS | $92 | $198 |

| Nissan Leaf | $39 | $100 |

| Porsche Taycan | $122 | $258 |

| Tesla Model 3 | $74 | $170 |

| Tesla Model S | $104 | $224 |

| Tesla Model X | $132 | $278 |

| Tesla Model Y | $80 | $179 |

| Toyota Camry Hybrid | $61 | $141 |

| Toyota Corolla Hybrid | $36 | $94 |

| Toyota Prius | $31 | $84 |

| Toyota RAV4 Hybrid | $64 | $152 |

| Volkswagen ID.4 | $68 | $158 |

Basic models usually cost less to insure because they’re simpler and cheaper to fix, especially if you’re comparing liability vs. full coverage auto insurance.

Luxury or high-performance electric cars usually have higher insurance rates because repairs to the battery and body can be very expensive.

Full coverage is often more expensive for these cars because insurance companies have to consider the highest possible repair costs.

If you want to keep your insurance costs low, choosing a practical hybrid or electric car is usually the best option.

Why Some EVs Cost More to Insure

Some hybrid and electric vehicles are more expensive to insure because insurers consider them a higher financial risk.

When insurance starts topping $100 a month, it’s usually because repairs aren’t cheap or parts take longer to get.

Most Expensive Hybrid & Electric Vehicles to Insure| Make & Model | Rank | Monthly Rate | Reason |

|---|---|---|---|

| Tesla Model X | #1 | $132 | High Repair Costs |

| Porsche Taycan | #2 | $122 | Luxury Parts |

| BMW i7 | #3 | $112 | Advanced Technology |

| Tesla Model S | #4 | $104 | Performance Risk |

| Audi e-tron GT | #5 | $98 | Expensive Components |

| Mercedes-Benz EQS | #6 | $92 | High Replacement Value |

| Jaguar I-Pace | #7 | $86 | Limited Parts Availability |

All that fancy tech, performance upgrades, and luxury trim can really drive up repair bills pretty fast.

That’s why basic hybrids and EVs usually cost less to insure, and checking the best insurance comparison sites can help you spot those savings faster.

Cheapest Electric Vehicles to Insure

These lower insurance rates really show how much the type of car you drive can affect what you pay each month.

Simple hybrids and EVs usually have fewer claims and cost less to fix, so insurance is more affordable. Reliability plays a big role, too, since vehicles with fewer claims usually get better pricing.

Least Expensive Hybrid & Electric Vehicles to Insure| Make & Model | Rank | Monthly Rate | Reason |

|---|---|---|---|

| Toyota Prius | #1 | $31 | Low Repair Costs |

| Toyota Corolla Hybrid | #2 | $36 | Strong Reliability |

| Nissan Leaf | #3 | $39 | Simple Design |

| Kia Niro Hybrid | #4 | $42 | Affordable Parts |

| Hyundai Ioniq | #5 | $47 | Safety Features |

| Honda Accord Hybrid | #6 | $50 | Moderate Performance |

| Chevrolet Bolt EV | #7 | $54 | Proven Technology |

Toyota is a top choice because its hybrids are reliable and usually cheaper to repair, making auto insurance for Toyotas especially appealing to cost-conscious drivers.

Picking a practical hybrid or EV can help you save on insurance in the long run, and it can also put you closer to finding the cheapest car insurance for hybrid and electric cars.

Insurance for Electric Cars vs. Gas Vehicles

There are several types of hybrid and electric vehicles, and understanding the basics can make your choice easier.

Fully electric cars use only batteries, so you never need gas, but you do have to think about charging.

Types of Hybrid and Electric Vehicles Explained| Vehicle Type | How They Work |

|---|---|

| Battery Electric Vehicle (BEV) | Fully electric; no gas engine |

| Hybrid Electric Vehicle (HEV) | Gas & electric power; no plug-in |

| Mild Hybrid EV (MHEV) | Electric assist only; no EV mode |

| Parallel Hybrid Vehicle | Engine & motor both drive wheels |

| Plug-In Hybrid EV (PHEV) | Plug-in charging with gas backup |

| Range-Extended EV (REEV) | Electric drive with gas generator |

| Series Hybrid Vehicle | Gas engine powers electric motor |

| Series-Parallel Hybrid Vehicle | Blends series and parallel modes |

Traditional hybrids switch between gas and electric power on their own, so you can drive them just like a regular car.

Many people find plug-in hybrids appealing because they let you drive on electricity while still having a gas engine as a backup.

Because hybrid and electric vehicles work differently, your insurance should fit how your car is powered and how you use it, especially when choosing hybrid insurance.

Since fully electric cars depend on batteries, it’s important to have coverage for charging equipment and battery damage. The best car insurance companies make it easier to compare the right options.

Best Types of Insurance for Hybrid and Electric Vehicles| Coverage Area | What’s Included | Policy Type |

|---|---|---|

| Advanced vehicle tech | Sensors, cameras, screens | Comprehensive & collision |

| Battery-related damage | Crash, fire, & theft damage | Comprehensive & collision |

| Charging equipment | All charging equipment | Add-on or home insurance |

| EV roadside assistance | Towing, lockout, & flat tires | Add-on roadside assistance |

| Green vehicle incentives | Discounts for qualifying EVs | Availability varies by insurer |

| Out-of-charge towing | Towing for dead battery | EV roadside assistance plan |

| Driving behavior programs | Mileage & driving monitored | Optional usage-based plan |

Adding EV roadside assistance is a good idea because it covers things like towing if your battery runs out. In the end, the best insurance is the one that fits how you use your hybrid or electric car every day.

The type of powertrain in your car affects your insurance costs. The model you choose can impact repair risks and what you end up paying.

Monthly Auto Insurance Cost Comparison by Vehicle Powertrain| Vehicle Type | Minimum Coverage | Full Coverage |

|---|---|---|

| Electric Vehicle | $60 | $138 |

| Gas Vehicle | $49 | $118 |

| Hybrid Vehicle | $53 | $122 |

| Luxury EV | $113 | $240 |

| Plug-In Hybrid | $56 | $128 |

Electric cars often cost more to insure because repairs for batteries, sensors, and software can be expensive.

In the long run, practical hybrids and basic electric vehicles usually help keep your insurance costs lower.

Hybrid and Electric Car Insurance Coverage

If you’re looking for the best car insurance for a hybrid or electric car, it’s important to know which coverages matter most when choosing insurance for an EV.

Comprehensive and collision coverage are key because they help protect costly batteries, sensors, and electronics if there’s an accident or theft.

You should also think about coverage for your charging equipment, especially if you have a home charger that would be expensive to replace. EV roadside help can assist with towing if your battery dies or your car stops working.

If you do not drive often or keep your car in a safe place, pay-per-mile insurance might save you money. Look for plans that protect your battery first, then add coverage that matches how you use your car.

Ways to Save on Hybrid and EV Insurance

Insurance companies often give discounts on hybrid and electric car insurance to encourage safer driving and lower risk.

Green vehicle discounts help, but you can save even more with programs that watch how much and how safely you drive.

Top Hybrid & Electric Car Insurance Discounts| Company | Green Vehicle | Multi-Policy | Safety Features | Usage-Based |

|---|---|---|---|---|

| 7% | 25% | 20% | 40% | |

| 5% | 25% | 18% | 20% |

| 7% | 25% | 10% | 30% |

| 8% | 20% | 15% | 30% | |

| 5% | 25% | 15% | 25% | |

| 8% | 25% | 12% | 30% |

| 10% | 20% | 18% | 40% | |

| 5% | 17% | 20% | 30% | |

| 10% | 5% | 10% | 20% |

| 10% | 13% | 17% | 30% |

You can also save by bundling your auto insurance with home or renters coverage. Nationwide is a strong choice because its discounts add up, especially if you drive fewer miles.

Discounts aren’t the only way to save on auto insurance for an electric vehicle. After using those, a few smart choices can still help lower your premiums.

- Avoid Extra Tech Add-Ons: Many high-tech features are included in standard plans, so you usually do not need to pay extra.

- Change Your Deductibles: Since many EV claims involve batteries or electronics, changing your deductibles can lower your monthly cost with little extra risk.

- Choose Simpler Models: EVs without speed upgrades or advanced technology are usually cheaper to insure.

- Insure Chargers Separately: Adding your home charging equipment to your home insurance instead of your car insurance can help keep your EV insurance costs lower.

- Keep Your Coverage Active: Even a short gap in coverage can raise your rates, so keeping your insurance in place helps you avoid extra costs.

Discounts are helpful, but you can save more by picking coverage that matches your needs and updating it as your driving habits change, especially with hybrid insurance.

Read More: 17 Tips to Pay Less for Car Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top 10 Companies for Hybrid and Electric Cars

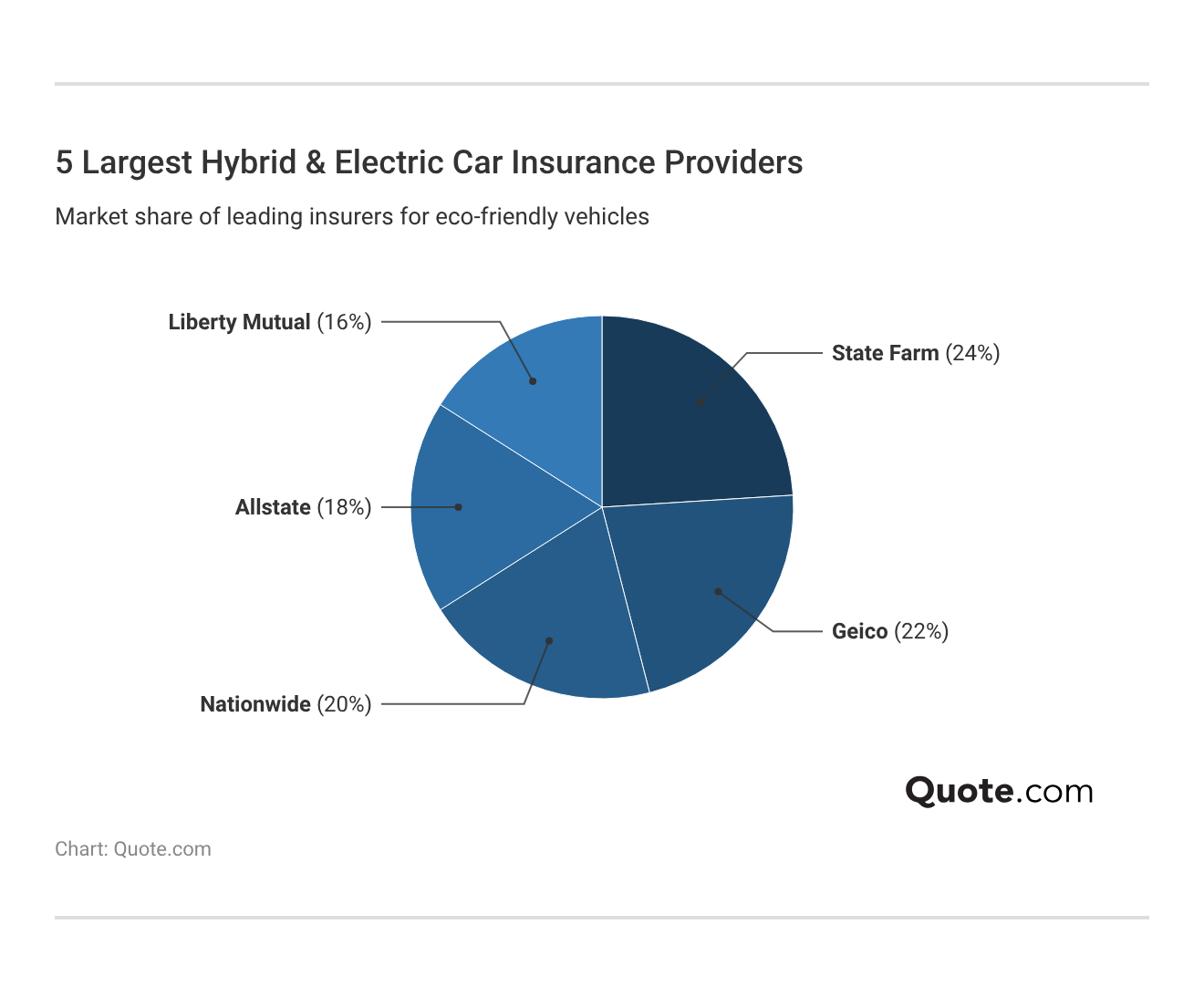

Many people choose well-known companies to insure their hybrid or electric cars. State Farm is a popular option because it offers coverage that’s easy to get and manage in most areas.

Geico and Nationwide are also popular with drivers who want affordable rates and simple online tools for quotes and claims.

Allstate and Liberty Mutual are well-liked because their repair networks have experience with EV repairs. This is important since fixing a battery can cost more than $10,000.

Overall, drivers stick with these companies because they make EV insurance easier to deal with, especially as more people learn how electric cars work and what it takes to repair them.

#1 – Erie: Top Overall Pick

Pros

- Smooth Claims Support: Erie has a 743 out of 1,000 claims score, so hybrid and electric car owners can get battery and electronic repairs approved quickly.

- OEM Parts Access: Erie allows the use of manufacturer parts, which is important when hybrid and electric cars need battery replacements.

- Financial Stability: An A+ A.M. Best rating means Erie can handle large payouts tied to high-voltage battery damage.

Cons

- Limited Availability: Coverage is only available in 12 states. Use our detailed Erie insurance review to find a policy near you.

- Basic Digital Experience: Owners of tech-heavy hybrid and electric cars get fewer mobile claims tools than competitors.

#2 – Liberty Mutual: Best for Policy Flexibility

Pros

- Customizable Policy Structure: Liberty Mutual lets owners of hybrid and electric cars adjust deductibles, rental coverage, and limits to fit their battery risk.

- Alternative-Fuel Discount: According to our Liberty Mutual insurance review, hybrid and electric cars may qualify for EV discounts that help lower premiums.

- Financial Strength: An A rating from A.M. Best supports higher-cost claims involving hybrid and electric car electronics.

Cons

- Repair Network Gaps: You might have to drive a bit farther to find Liberty Mutual shops that are EV-certified.

- Premium Creep: Adding things like new car replacement or gap coverage can make your premium climb quickly above the base price.

#3 – Nationwide: Best for Smart Coverage

Pros

- Telematics-Based Pricing: Nationwide’s SmartRide program tracks your driving habits, which can help hybrid and electric car owners lower their base rates over time.

- Steady Claims Handling: Nationwide has a 729 out of 1,000 satisfaction score and usually handles hybrid and electric car repairs without repeated delays.

- Strong Financial Backing: Nationwide’s A+ rating from A.M. Best shows it can cover costly battery replacement claims.

Cons

- Delayed Savings: Owners of hybrid and electric cars need to finish a monitoring period before they get SmartRide discounts.

- Limited EV Perks: Direct EV incentives are more limited than those of some competitors (Learn More: Nationwide Insurance Review).

#4 – State Farm: Best for Eco Savings

Pros

- Usage-Based Savings: Drive Safe & Save rewards safe driving, so hybrid and electric car owners can lower their premiums by up to 30% by simply driving well.

- Exceptional Financial Strength: State Farm has an A++ rating from A.M. Best, which means it can cover total-loss claims for hybrid and electric car batteries.

- Local Claims Support: Local agents can help owners of hybrid and electric cars when repairs get complicated. See how it stands out in our State Farm review.

Cons

- Higher Starting Rates: Premiums for hybrid and electric cars are often higher at first, before discounts apply.

- OEM Part Limitations: Some hybrid and electric cars may require additional coverage to ensure factory-battery parts are used.

#5 – The Hartford: Best for Reliable Service

Pros

- Predictable Claims Handling: With a 716 out of 1,000 claims score, hybrid and electric cars are less likely to have reopened or delayed claims.

- Strong Financial Capacity: The A+ rating from A.M. Best means the company can handle EV battery claims over $10,000. Get full ratings in our The Hartford insurance review.

- Charging Equipment Coverage: Hybrid and electric cars can be covered with permanently installed chargers through endorsements.

Cons

- Limited Discount Access: Hybrid and electric cars owned by younger drivers may not qualify for Hartford-specific programs.

- Few EV Incentives: There’s no standalone alternative-fuel discount for hybrid and electric cars.

#6 – American Family: Best for Green Benefits

Pros

- Emissions-Based Discounts: Hybrid and electric cars can get green-vehicle savings based on their emissions ratings.

- Usage-Based Pricing: DriveMyWay may lower premiums for hybrid and electric cars by up to 25%, depending on how much and how safely you drive.

- Low-Mileage Advantage: Hybrid and electric cars driven fewer miles can see added savings, which fits drivers who rely on EV efficiency for short trips.

Cons

- Weaker Claims Results: The company scored 702 out of 1,000, which means repairs for hybrid and electric cars may take longer.

- State-by-State Variability: As highlighted in our American Family review, green benefits for hybrid and electric cars can vary a lot depending on where you live.

#7 – Geico: Best for Low Premiums

Pros

- Lower Entry Pricing: Geico typically offers lower starting premiums for hybrid and electric cars due to its underwriting approach.

- Top Financial Strength: Geico’s A++ rating from A.M. Best means it can handle unexpected battery replacements for hybrid and electric cars.

- Fast Digital Claims: You can use Geico’s app to send photos for repair estimates, which helps speed up approvals for hybrid and electric car repairs.

Cons

- Minimal EV Endorsements: Hybrid and electric cars lack coverage for batteries. Our Geico insurance review compares policy options.

- Below-Average Claims Score: A 697/1,000 rating means hybrid and electric cars may need extra follow-ups.

#8 – Allstate: Best for EV Discounts

Pros

- Dedicated EV Discount: If you have a hybrid or electric car, Allstate gives alternative-fuel discounts in certain states.

- Telematics Savings Potential: With Drivewise, you can save money for safe driving, with discounts as high as 40%.

- New Car Replacement Option: Hybrid and electric car owners can add new car replacement coverage to help cover faster depreciation tied to EVs.

Cons

- Higher Base Rates: Hybrid and electric cars usually have higher starting rates before any discounts are applied. Compare quotes for free in our Allstate insurance review.

- Claims Inconsistency: The 693 out of 1,000 score shows that repair times for specialized parts can be inconsistent.

#9 – Travelers: Best for Tech Features

Pros

- Advanced Telematics: IntelliDrive prices hybrid and electric cars using braking, acceleration, and mileage over 90 days.

- Excellent Financial Strength: An A++ A.M. Best rating supports high-cost hybrid and electric cars’ losses.

- Fully Digital Tools: Hybrid and electric car owners can file claims, upload photos, and track repairs in Travelers’ app.

Cons

- Delayed Discounts: Our Travelers insurance review found that hybrid and electric cars won’t see any savings until the monitoring period ends.

- No EV Discount: Travelers doesn’t offer an alternative-fuel discount, so hybrid and electric cars won’t get an automatic price break.

#10 – Farmers: Best for Battery Protection

Pros

- Battery-Specific Endorsements: You can add coverage to help pay for battery damage caused by crashes or failures.

- Custom Equipment Coverage: Farmers offers coverage for aftermarket or upgraded battery parts that other policies may not include.

- Agent-Guided Claims: Hybrid and electric car owners receive hands-on support for specialized repairs.

Cons

- Lowest Claims Score: A 690 out of 1,000 rating means claims for hybrid and electric cars may take longer to resolve.

- Rising Costs With Add-Ons: As explained in our Farmers Insurance review, adding battery coverage can raise premiums for hybrid and electric cars.

Buying Insurance for a Hybrid or Electric Car

Ensuring a hybrid or electric car goes beyond looking at the price. Erie stands out for fast EV claim handling and allowing factory battery parts, while Liberty Mutual and Nationwide offer flexible coverage options to manage repair costs.

These three tend to stand out with the best auto insurance for hybrid and electric cars because they handle battery issues, electronics, and longer repair times better than most insurers.

You can save money on auto insurance for a hybrid or electric car by driving fewer miles, keeping your policy active, and choosing a model with simpler technology. Raising your deductible and skipping extras you don’t really need can also help lower costs.

Comparing a few policies makes it easier to find coverage that fits how you actually drive, so go ahead and use our free quote tool.

Frequently Asked Questions

Is car insurance higher on electric cars?

Yes, electric cars usually cost more to insure. Battery replacements can run $10,000 or more, and repairs often need EV-certified technicians.

Which insurance is best for EV cars?

Erie, Nationwide, and Liberty Mutual are solid options for electric car and hybrid insurance. They have strong claims scores, an A or higher A.M. Best ratings, and offer coverage options that work well for electric vehicles (EV).

Which electric car is the cheapest to insure?

The Nissan Leaf is usually the cheapest electric car to insure. Auto insurance for Nissans tends to be more affordable overall since they have lower repair costs, fewer performance upgrades, and parts are easy to find.

Is AAA cheaper than State Farm for EV insurance?

AAA can be cheaper in certain states, but State Farm often comes out ahead thanks to its Drive Safe & Save program, which can lower EV premiums by up to 30%.

Why are insurance companies not insuring electric cars?

Some insurers are cautious about electric cars because battery replacements are expensive, EV repair shops are harder to find, and fixes usually take longer.

Is Geico more expensive than Progressive for EV insurance?

Geico is often less expensive than Progressive for electric vehicle insurance, especially for drivers with clean records and lower mileage, according to our Progressive auto insurance review.

What are the three disadvantages of owning an electric vehicle?

Three common drawbacks of owning an electric vehicle are higher insurance costs, limited repair networks, and expensive battery replacements.

Does insurance go down with an electric car?

Your insurance costs may decrease if your EV has strong safety ratings, lower repair costs, or qualifies for a mileage- or usage-based program.

Which insurance company denies the most EV insurance claims?

No insurer shares EV-specific denial rates. When you file an auto insurance claim, the outcome depends on your policy details, the type of damage, and whether you meet the policy terms.

At what point is full coverage not worth it for electric vehicles?

Full coverage might not be worth it if your hybrid is more than ten years old or your EV’s market value is less than what you pay each year for premiums and deductibles combined. Shop around for cheap full coverage auto insurance if you want to maintain higher policy limits.

Does a credit score affect EV and hybrid car insurance?

How can I lower my hybrid and electric car insurance premiums?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.