Mechanical Breakdown Insurance in 2026

Mechanical breakdown insurance covers major engine, transmission, and electrical repairs not caused by accidents. Rates start at $13 a month with Geico, but costs vary by deductible, as higher deductibles lower premiums. Your mechanical breakdown insurance cost depends on insurer rules, vehicle age, and mileage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Expert

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated February 2026

Mechanical breakdown insurance (MBI) helps cover engine, transmission, and electrical repairs not caused by accidents, to help prevent costly, unexpected repairs.

- MBI costs vary by deductible, vehicle age, and mileage

- Availability differs by insurer, state, and vehicle type, so comparison matters

- Geico offers mechanical breakdown insurance only through select partners

Premiums vary based on insurance deductibles, vehicle age, mileage, and insurer eligibility rules. Among major providers, Geico offers some of the cheapest MBI rates at $13 per month.

Coverage varies by state and vehicle type, making comparison key to finding the best rates for mechanical breakdown insurance. Get fast and cheap auto insurance coverage today with our quote comparison tool.

Mechanical Breakdown Insurance Meaning

Mechanical breakdown insurance is an optional auto insurance coverage that helps pay for repairs caused by mechanical or electrical failures not related to accidents.

MBI typically covers major vehicle components like the engine, transmission, drivetrain, and onboard electronics that can be expensive to repair or replace.

Unlike standard car insurance, mechanical breakdown insurance does not cover collision damage, routine maintenance, or normal wear and tear.

MBI coverage availability depends on factors such as vehicle age, mileage, insurer rules, and state regulations, and it is usually offered for newer, lower-mileage vehicles.

Important Details: Best Low-Mileage Auto Insurance Discounts

Mechanical Breakdown Insurance Coverage Explained

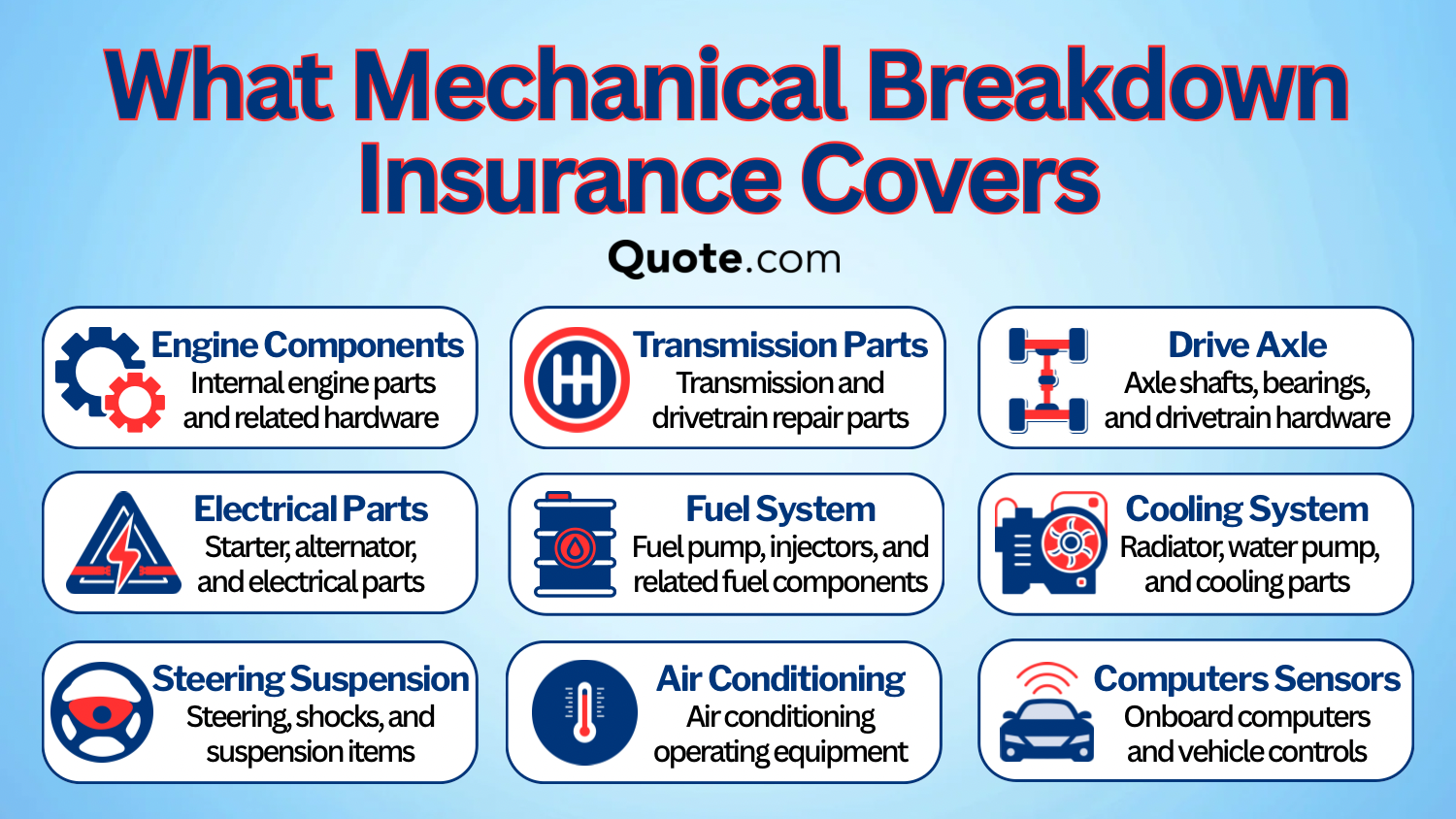

What’s included for mechanical breakdown insurance is damage caused by internal mechanical and electrical failures, rather than accident-related damage.

MBI helps pay for sudden issues that affect a vehicle’s ability to operate safely and reliably, reducing the financial impact of major repair bills. Claims are generally handled through approved repair shops, depending on the insurer’s rules.

Most policies exclude routine maintenance, cosmetic damage, and wear-related issues and are usually limited to newer, lower-mileage vehicles. Coverage varies by insurer, deductible level, and vehicle eligibility requirements, which can significantly affect cost and access.

Learn how to compare multiple auto insurance quotes and review coverage limits, exclusions, and repair options near you before adding MBI protection to a policy.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mechanical Breakdown Coverage Costs

The cost of mechanical breakdown insurance varies widely by insurer and is heavily influenced by deductible selection, with zero-deductible plans costing the most.

Monthly pricing for MBI can range from about $13 with Geico to roughly $120 with AAA, while Allstate averages around $60 a month for similar coverage.

Mechanical Breakdown Insurance Monthly Rates by Deductible Amount| Company | $0 | $50 | $100 | $200 |

|---|---|---|---|---|

| $120 | $112 | $105 | $97 |

| $60 | $56 | $52 | $48 | |

| $16 | $15 | $14 | $13 |

| $20 | $19 | $18 | $16 | |

| $13 | $12 | $11 | $10 | |

| $34 | $32 | $30 | $28 |

| $17 | $16 | $15 | $14 | |

| $38 | $36 | $34 | $32 | |

| $97 | $90 | $84 | $78 | |

| $26 | $25 | $23 | $21 |

State Farm offers mechanical breakdown insurance at around $26 per month, though coverage is typically restricted to newer cars with strict vehicle age and mileage requirements.

Choosing a higher deductible generally lowers premiums, but base pricing still depends on the insurer. For instance, Geico has the cheapest MBI rates, but coverage is not available in most states and is offered only through limited partnerships.

Mechanical breakdown insurance is most valuable for newer cars, where a single engine or transmission failure can cost far more than the policy.

Michelle Robbins Licensed Insurance Agent

Other providers structure coverage differently. Liberty Mutual and Allstate mechanical breakdown insurance is commonly offered through affiliates or as add-on programs rather than as standard coverage, with Liberty Mutual pricing near $34 per month.

AAA pricing is highly regional and varies significantly by local club and state, making comparison especially important. Learn more in our guide: AAA Auto Insurance Review.

How Your Vehicle Impacts MBI Premiums

One of the biggest factors affecting mechanical breakdown insurance cost and eligibility is vehicle age. Newer vehicles between zero and three years old have the lowest average monthly rates at about $22 and are most commonly eligible for coverage.

As vehicles age, premiums increase, and availability becomes more restricted, with rates rising to around $28 monthly for cars less than six years old.

Mechanical Breakdown Insurance Cost & Eligibility by Vehicle Age| Vehicle Age | Monthly Rate | Access Level |

|---|---|---|

| 0–3 years | $22 | Common |

| 4–6 years | $28 | Widespread |

| 7–10 years | $36 | Limited |

| 10+ years | $45 | Rare |

Older vehicles face both higher costs and limited access. Cars between seven and ten years old average about $36 per month and often qualify only under stricter insurer guidelines.

Vehicles over ten years old see rates climb to roughly $45 per month, with coverage becoming rare, as many insurers limit mechanical breakdown insurance to newer, lower-risk vehicles.

Vehicle type plays an important role in determining both the cost and availability of mechanical breakdown insurance. Get the Details: Auto Insurance Rates by Vehicle

Sedans tend to have the lowest average monthly rates at about $27 and are the most commonly eligible, while SUVs average around $32 per month.

Mechanical Breakdown Insurance Cost & Eligibility by Vehicle Type| Body Style | Monthly Rate | Access Level |

|---|---|---|

| Electric | $40 | Rare |

| Hybrid | $37 | Limited |

| Sedan | $27 | Common |

| SUV | $32 | Widespread |

| Truck | $34 | Limited |

Insurers often view sedans and SUVs as lower risk due to lower repair costs and greater availability of common parts for repairs.

Specialty and heavier vehicles typically cost more to insure. Trucks average about $34 per month and often come with limited eligibility. Hybrids and electric vehicles are the most expensive, and coverage is rare due to higher repair costs and specialized components.

Read More: Best Auto Insurance for Hybrid and Electric Cars

How Mileage Affects Mechanical Breakdown Insurance

Mileage is another major factor that affects both the cost and availability of mechanical breakdown insurance.

Vehicles with under 30,000 miles have the lowest average monthly rates at about $23 and are commonly eligible for coverage.

Mechanical Breakdown Insurance Cost & Eligibility by Mileage| Vehicle Mileage | Monthly Rate | Access Level |

|---|---|---|

| Under 30K | $23 | Common |

| 30K–60K | $28 | Widespread |

| 60K–100K | $37 | Limited |

| Over 100K | $47 | Rare |

As mileage increases, premiums rise, and access becomes more limited, with vehicles in the 30,000 to 60,000 mile range averaging around $28 per month.

Higher-mileage vehicles face stricter eligibility and higher costs. Cars with 60,000 to 100,000 miles typically average about $37 per month and often qualify only under limited conditions.

Once a vehicle exceeds 100,000 miles, average monthly costs climb to roughly $47, and coverage becomes rare, as insurers view higher mileage as a greater mechanical risk.

Don’t Miss It: The Definitive Guide to Usage-Based Auto Insurance

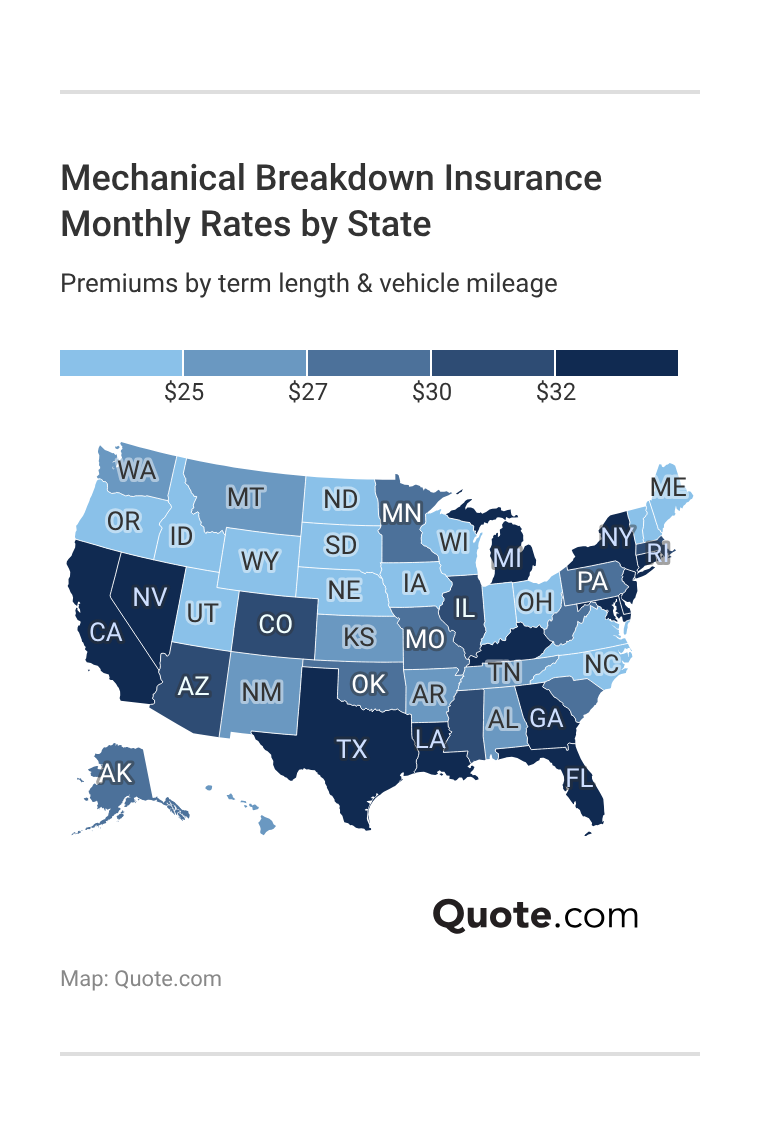

Mechanical Breakdown Insurance Prices by State

Mechanical breakdown insurance costs vary by state due to differences in repair labor costs, insurer availability, vehicle usage patterns, and state regulations.

Average monthly rates generally fall between the mid-$20 and low-$30 range, with some states offering more affordable pricing and others trending higher based on local market conditions and vehicle risk factors.

States with higher repair costs or limited insurer participation tend to see higher premiums with MBI, while regions with broader access and lower labor expenses often have more competitive rates.

Because availability and pricing can differ significantly by location, comparing options within your state is essential to finding the best mechanical breakdown insurance for your vehicle.

Check Out This Page: Auto Insurance Rates by State

When to Buy Mechanical Breakdown Insurance

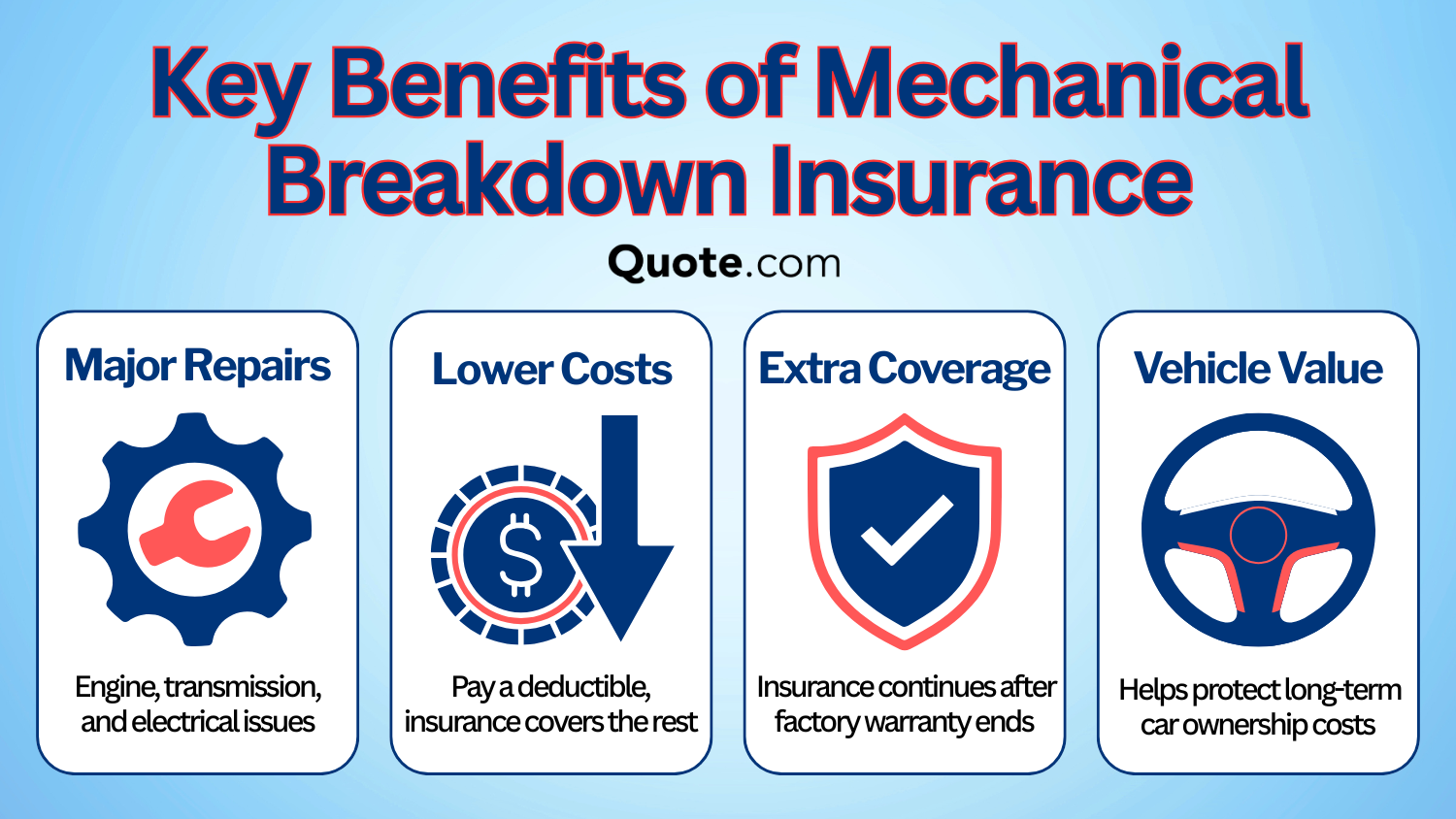

Mechanical breakdown insurance helps protect drivers from large out-of-pocket expenses by covering costly repairs that would otherwise need to be paid in full.

Unexpected vehicle repairs can quickly become a financial burden, especially when major systems fail without warning.

This type of auto coverage can provide peace of mind when driving a newer vehicle outside of factory warranty protection. One of the main reasons to consider MBI coverage is cost control.

Instead of facing unpredictable repair bills, drivers pay a set monthly premium and deductible, allowing for more predictable expenses.

In many cases, mechanical breakdown insurance costs less than extended warranties while offering similar protection. Another key benefit is extended protection beyond the manufacturer’s warranty.

Once factory coverage ends, MBI can help continue financial protection for critical vehicle systems, reducing the risk of expensive repairs during ownership.

Mechanical breakdown insurance fills the gap standard auto policies leave by covering wear-and-tear mechanical failures.

Dani Best Licensed Insurance Producer

This makes it especially valuable for drivers who plan to keep their vehicle long-term. Mechanical breakdown insurance can also support vehicle value by encouraging timely repairs and proper maintenance.

By making major repairs more affordable, MBI coverage helps keep vehicles running safely and reliably, which can reduce long-term ownership costs and protect resale value. Enter your ZIP code to find out where you can get the best mechanical breakdown insurance.

Frequently Asked Questions

What does mechanical breakdown insurance cover?

Mechanical breakdown insurance (MBI) coverage typically pays for repairs to major vehicle components that fail due to normal use, not accidents. This can include the engine, transmission, drivetrain, electrical systems, air conditioning, and onboard technology.

Read More: Auto Insurance Requirements by State

Is mechanical breakdown insurance worth it?

Mechanical breakdown insurance can be worth it if you want predictable repair costs and protection against expensive failures. Many drivers discussing mechanical breakdown insurance in Reddit threads say it’s especially valuable for newer vehicles with advanced technology.

What is an example of a mechanical breakdown?

A common example of a mechanical breakdown is a failed transmission, engine timing issue, or malfunctioning fuel pump caused by wear and tear. These types of repairs are often covered under mechanical breakdown insurance coverage, but would not be paid for by standard auto insurance.

See More: Auto Insurance Guide

Is MBI better than an extended warranty?

Mechanical breakdown insurance is often more flexible than an extended warranty because it’s regulated like insurance and may allow you to use licensed repair shops. Many drivers prefer MBI because it can be added to an auto policy and canceled anytime, unlike dealership warranties.

Will auto insurance pay for a failed engine?

Regular auto insurance will not pay for a failed engine due to wear and tear. However, mechanical breakdown insurance coverage may pay for engine repairs or replacement if the failure meets policy terms. This is one reason many drivers compare who offers mechanical breakdown insurance before purchasing a vehicle.

Learn More: How to Cancel an Auto Insurance Policy

How do I know if I have breakdown coverage?

You can confirm breakdown coverage by checking your insurance declarations page or contacting your insurer directly. Some providers bundle MBI with auto policies, such as AAA mechanical breakdown insurance, while others list it as an optional add-on with a separate premium.

Is transmission covered under mechanical breakdown insurance?

Yes, the transmission is one of the most commonly covered components under mechanical breakdown insurance coverage. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Can you claim a mechanical fault on auto insurance?

You can only claim for a mechanical fault if you have mechanical breakdown insurance in place. Standard liability, collision, and comprehensive policies do not apply. For instance, mechanical breakdown insurance from Geico may cover mechanical faults as long as the issue is not caused by neglect or lack of maintenance.

See Our Article: Geico Insurance Review

What is a red flag in a dealership?

A major red flag is a dealership pushing an extended warranty without clearly explaining coverage exclusions or repair limits. Another warning sign is discouraging comparison shopping when asking who offers mechanical breakdown insurance, since reputable dealerships and insurers should allow you to compare policies openly.

How much does MBI typically cost?

Mechanical breakdown insurance usually costs between $10 and $45 per month, depending on the insurer, deductible, vehicle age, mileage, and location. Lower deductibles increase premiums, while older or higher-mileage vehicles also raise costs.

Can I claim mechanical repairs on my insurance?

Does AAA have mechanical breakdown insurance?

Does Geico still offer mechanical breakdown insurance?

Does Progressive sell mechanical breakdown insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.