How to Sign up for Medicare in 2025

You can sign up for Medicare online, by phone, or in person three months before you turn 65. If you already receive Social Security benefits, you'll be enrolled automatically. Call (855) 634-0435 to speak with a licensed insurance agent and apply for Medicare while enrollment is open.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Expert

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated December 2025

You can apply for Medicare online or through Social Security at 65. If you already get Social Security, you’re automatically enrolled in Parts A and B four months before you turn 65.

- Certain people on disability for 24 months qualify for Medicare

- Late Medicare enrollment can mean lifetime premium penalties

- You can sign up for Medicare three months before you turn 65

We’ll guide you through the Medicare application process step by step, covering eligibility requirements, plan options, and enrollment periods. Read our complete guide to health insurance with Medicare.

Call (855) 634-0435 today to speak with a licensed insurance agent about your options and learn how to enroll in Medicare for the first time. You can also enter your ZIP code to explore plans available in your area.

Step-by-Step Guide to Medicare Enrollment

To get Medicare coverage, contact Social Security or apply online three months before your 65th birthday, unless you’re automatically enrolled. Keep reading for our simple step-by-step guide to enrolling in Medicare.

Step #1: Check Eligibility and Enrollment Periods

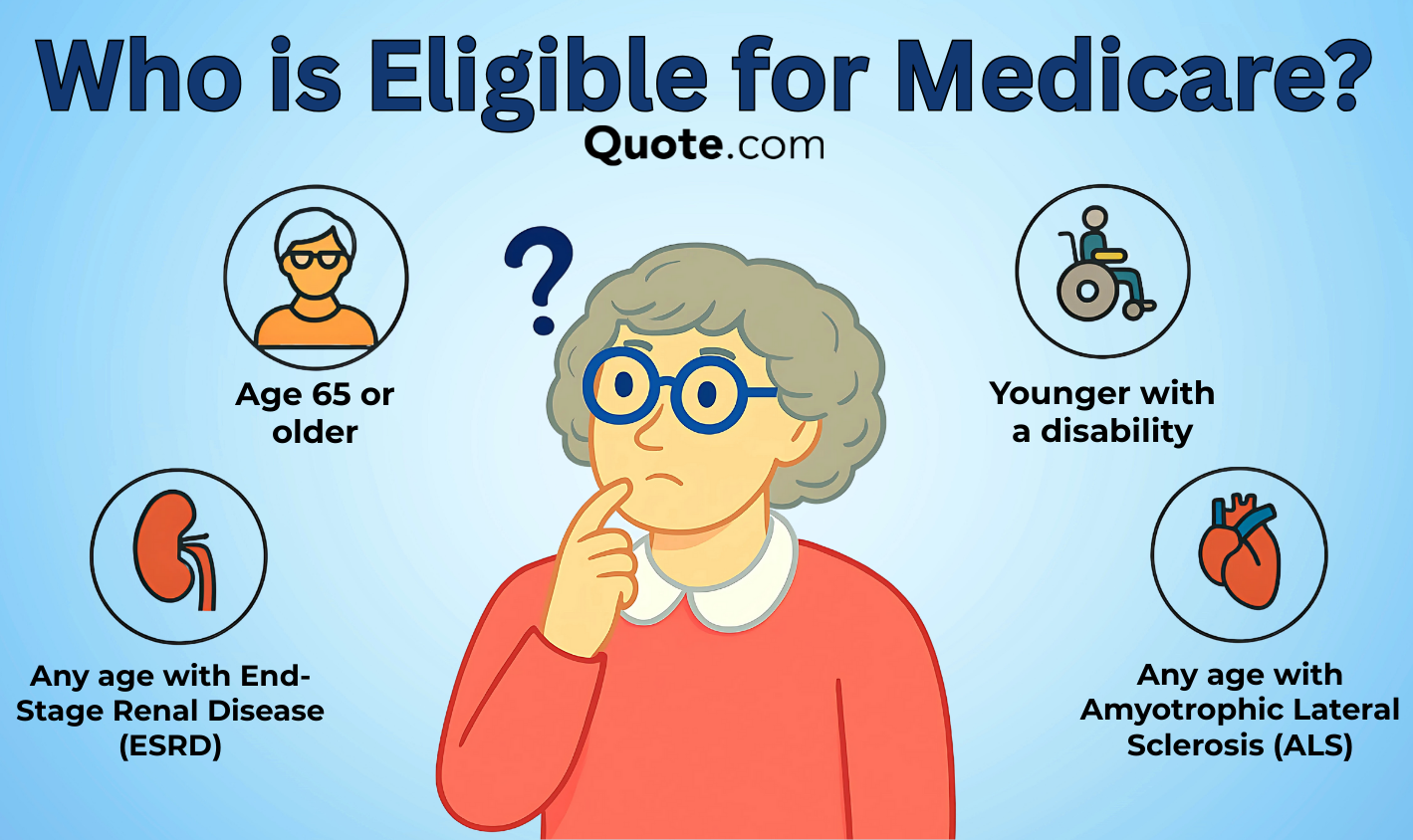

Who’s eligible for Medicare? Anyone 65 or older is eligible to apply for Medicare if they’re a U.S. citizen or legal resident. Applicants under 65 with certain disabilities may also qualify.

If you’re covered under another creditable plan at that time, such as through your employer or a spouse’s employer, you can defer enrollment until that coverage ends.

The Initial Enrollment Period (IEP) is the first step in signing up for Medicare. It begins three months before your 65th birthday and ends three months after.

When does Medicare coverage start? If you qualify for premium-free Part A, your coverage begins the first day of the month you turn 65. If your birthday falls on the first of the month, coverage starts one month earlier.

What happens if you miss Medicare enrollment? If you miss your IEP and don’t qualify for a Special Enrollment Period (SEP), you’ll need to wait until the General Enrollment Period (GEP) to sign up, which may result in a Medicare late enrollment penalty.

Step #2: Choose the Right Medicare Plan for You

Choosing the right Medicare coverage is essential, as it determines which doctors you can see, the coverage you receive, and your out-of-pocket costs.

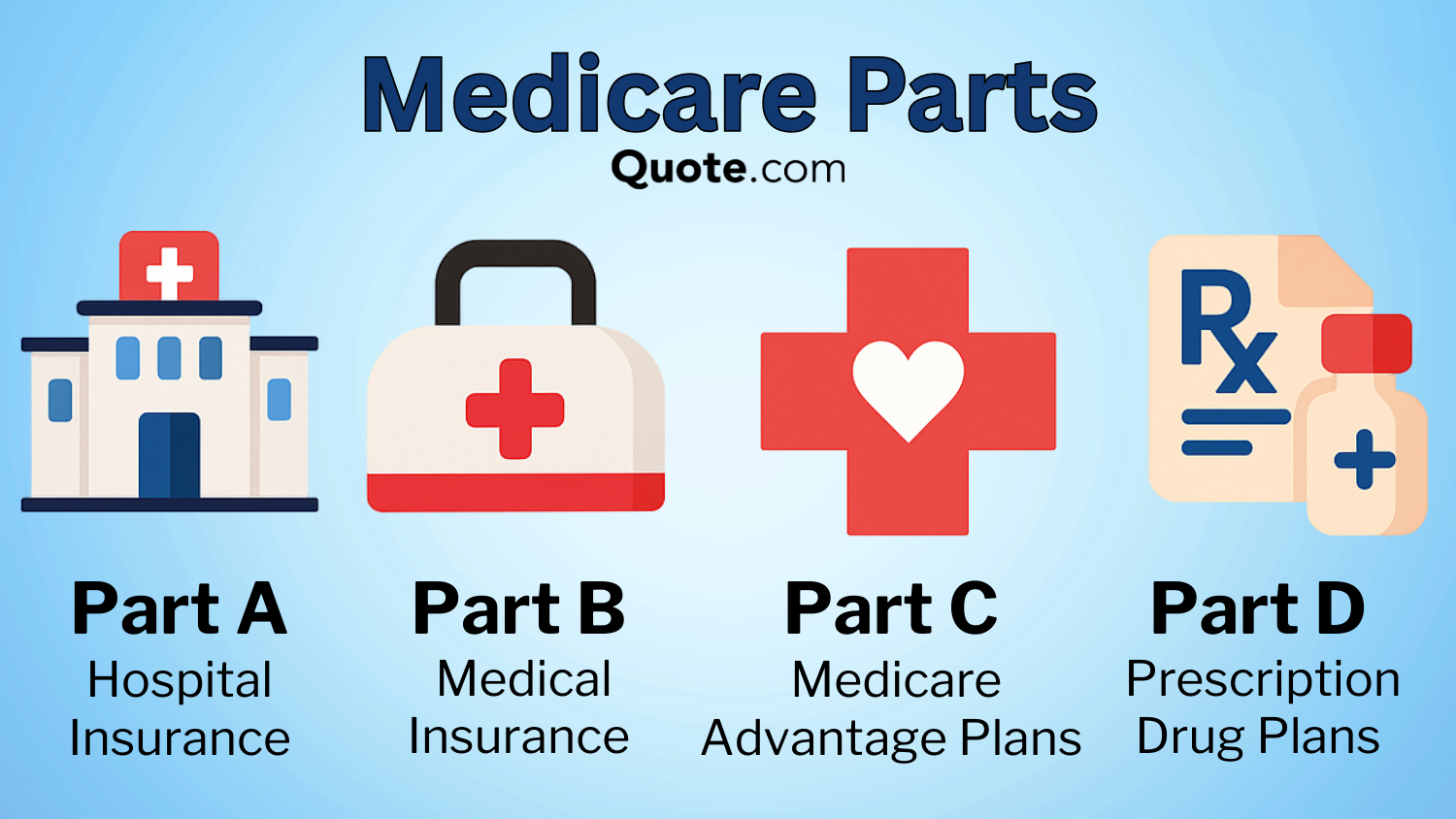

The parts of Medicare include:

- Medicare Part A: Covers inpatient hospital stays, skilled nursing care, hospice, and some home health care.

- Medicare Part B: Pays for doctor visits, outpatient care, preventive services, and medical equipment.

- Medicare Part C: Also called Medicare Advantage, it combines Medicare Parts A and B, and may offer extra benefits.

- Medicare Part D: Covers prescription medications.

- Medicare Supplement: Also known as Medigap, it helps pay out-of-pocket costs like deductibles, copays, and coinsurance.

It’s important to evaluate your Medicare options before enrolling in a plan. For example, you might decide to get Part A for hospital care but skip Part B if your employer plan covers doctor visits.

Call (855) 634-0435 to speak with a licensed agent and find the best coverage options for your budget and health care needs.

Read on to learn more about the different parts of Medicare and what they’ll cover for certain medical services.

Medicare Parts A and B (Original Medicare)

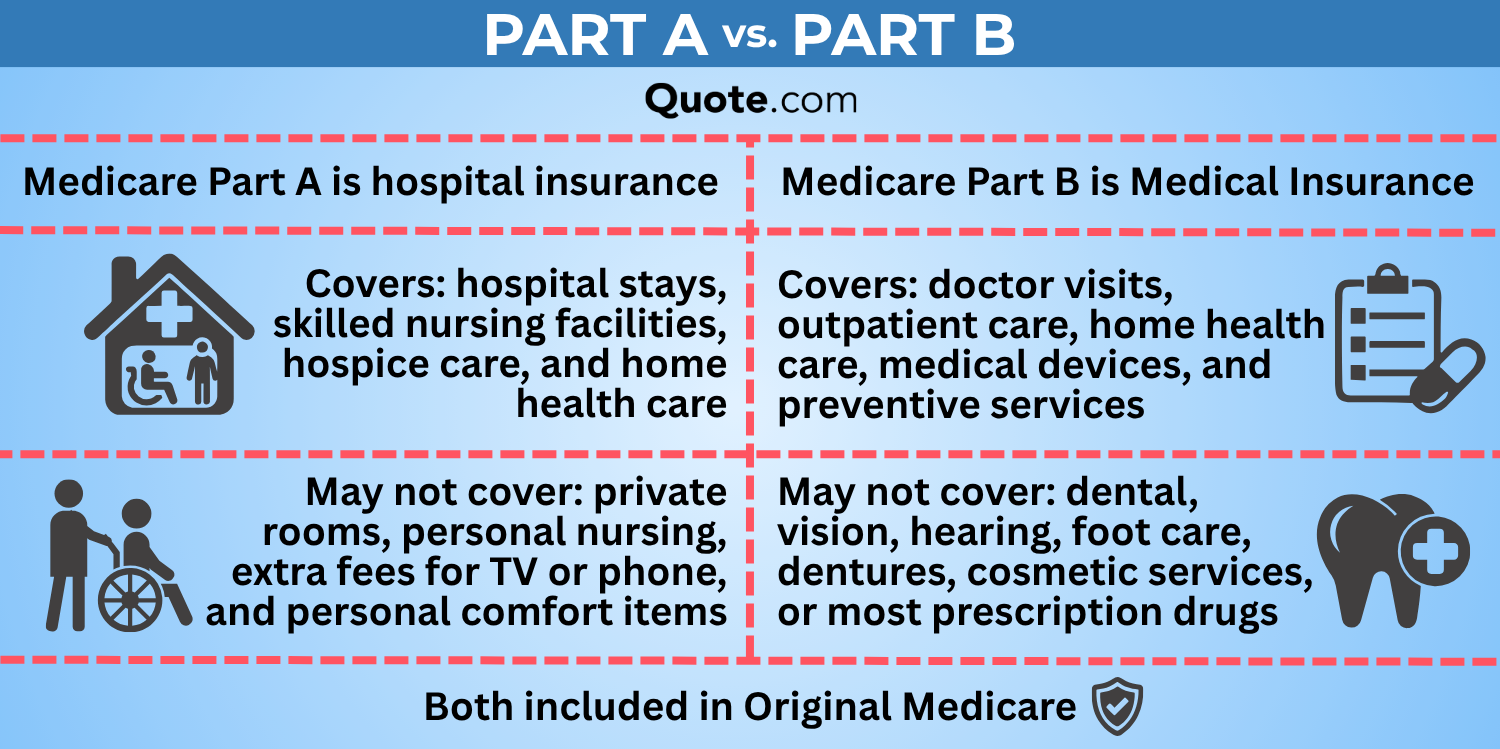

Original Medicare combines Medicare Part A and Part B, each covering different types of care:

- Part A (Hospital Insurance): Covers inpatient hospital stays, nursing care, hospice, and home health. Most people don’t pay a premium for Part A if they or their spouse paid Medicare taxes for at least 10 years.

- Part B (Medical Insurance): Pays for doctor visits, outpatient care, preventive services, and medical equipment. The standard monthly premium is $185, but savings programs can lower costs.

With Original Medicare, you can see any doctor in the U.S. who accepts Medicare. However, you may still be responsible for deductibles, copays, and coinsurance.

For example, Medicare Part A has a deductible for each benefit period. A benefit period begins the day you’re admitted to the hospital and ends after you’ve been out 60 consecutive days. So, if you’re hospitalized for a week, return home for a day, and then go back to the hospital, a new benefit period begins and another deductible applies.

How do Medicare deductibles work? Once the deductible is met, Medicare covers inpatient hospital stays up to 60 days at no cost.

From days 61 through 90, you must pay a $400 daily coinsurance. Beyond 90 days, Medicare covers up to 60 lifetime reserve days, each requiring an $800 coinsurance. In a skilled nursing facility, Medicare covers the first 20 days in full, and from days 21 through 100, you pay a $200 daily copay. Starting day 100, Medicare provides no coverage.

Read More: How to Finance What Your Health Insurance Won’t Cover

Medicare Part B covers outpatient doctor visits and doctor services at 80% once you’ve met your deductible. Part B also covers medical equipment at 80%. Unlike Part A’s deductible, which must be paid with every hospital stay, the deductible with Part B only needs to be met once a year.

Medicare Part C (Medicare Advantage)

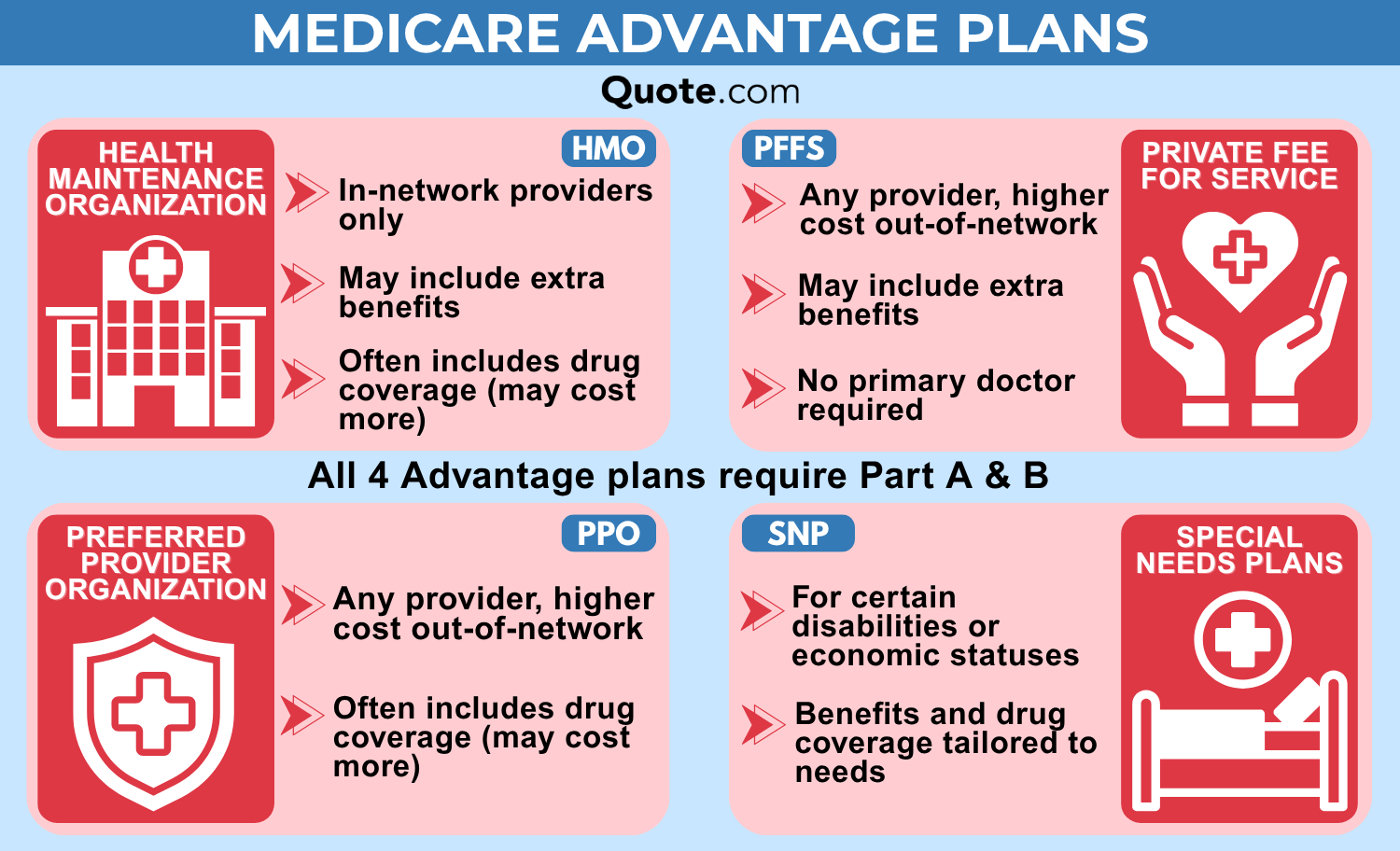

What is Medicare Advantage? Medicare Advantage policies, also called Medicare Part C, are an alternative to Original Medicare. They’re offered by independent insurance companies but must adhere to the same minimum coverage as Original Medicare.

These are the four main types of Medicare Advantage plans:

- Health Maintenance Organization (HMO): HMO plans only cover in-network care, so you can’t see any doctor or hospital except in emergencies. They’re best if you stay local and your providers are in-network.

- Preferred Provider Organization (PPO): PPOs allow you to see any Medicare-approved provider, but in-network doctors and hospitals cost less. Unlike HMOs, PPOs cover out-of-network care.

- Private Fee-for-Service (PFFS): PFFS plans don’t require a primary doctor or referrals. However, out-of-network coverage varies, and it’s usually more expensive than other plans.

- Special Needs Plans (SNPs): SNPs are for people with certain disabilities, chronic illnesses, or in institutional care. Most Medicare enrollees won’t qualify, but if you do, you can switch at any time.

Most individuals who choose a Medicare Advantage plan opt for an HMO or PPO.

What’s the difference between Medicare Advantage vs. Original Medicare? Which plan is better?

A Medicare Advantage plan or Original Medicare with a Medigap and Part D plan are comparable, and both types of coverage provide excellent options.

Medicare Part D (Prescription Drugs)

Original Medicare does not cover prescription drugs, which is where Medicare Part D comes in. You can add a prescription drug plan when you enroll in Medicare.

Part D enrollment is optional, but you could face costly penalties for enrolling late.

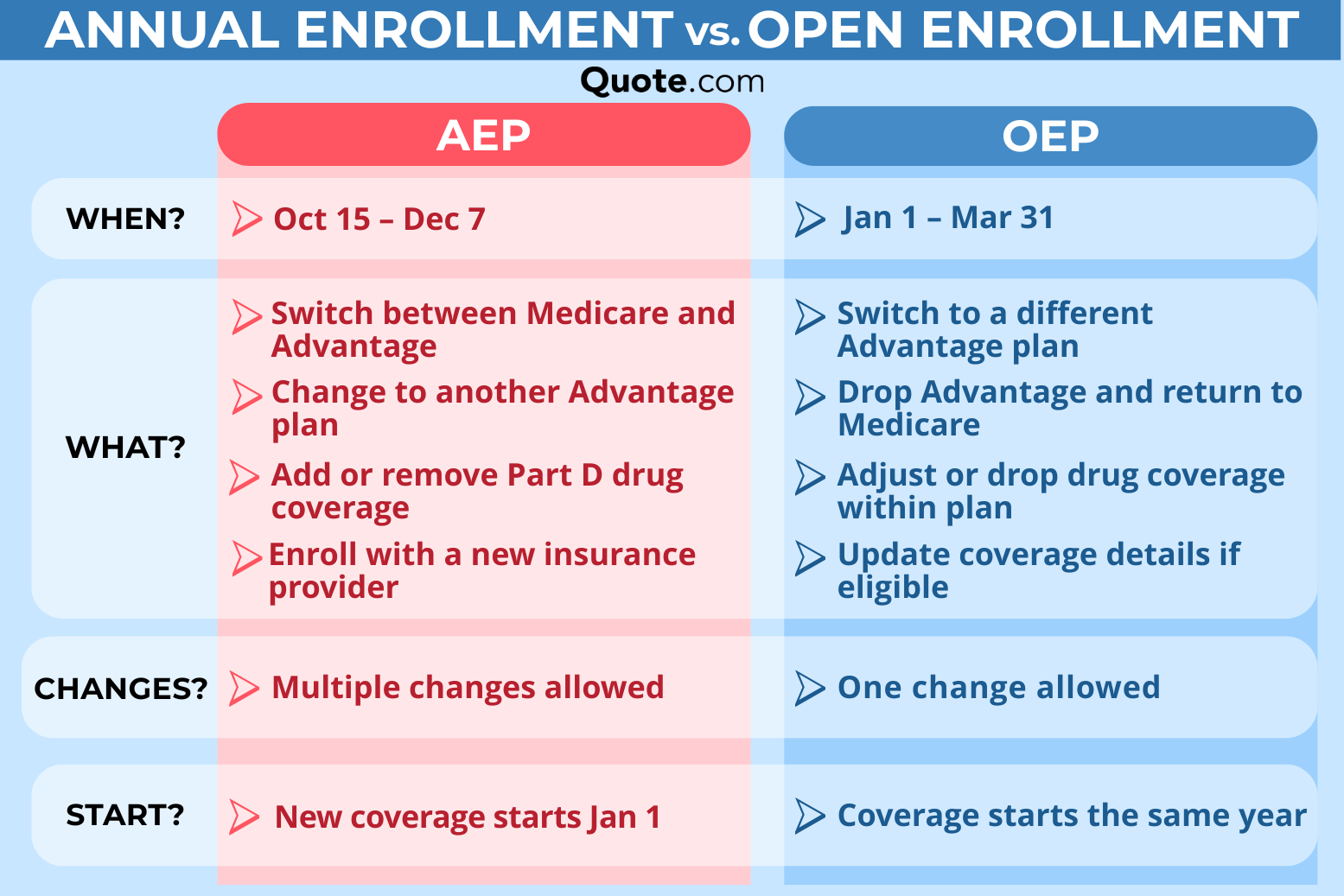

During AEP, you can switch your current Medicare Advantage plan or your Part D plan for any reason.

Adam Lubenow Medicare Broker

If you don’t sign up for Medicare Part D during your initial enrollment and don’t have coverage under another plan, you’ll pay a lifelong penalty of 1% for every month you went without coverage.

Most Medicare Advantage plans already include Part D coverage, so if you choose a Medicare Advantage plan with prescription drug coverage, you don’t need a separate Part D policy.

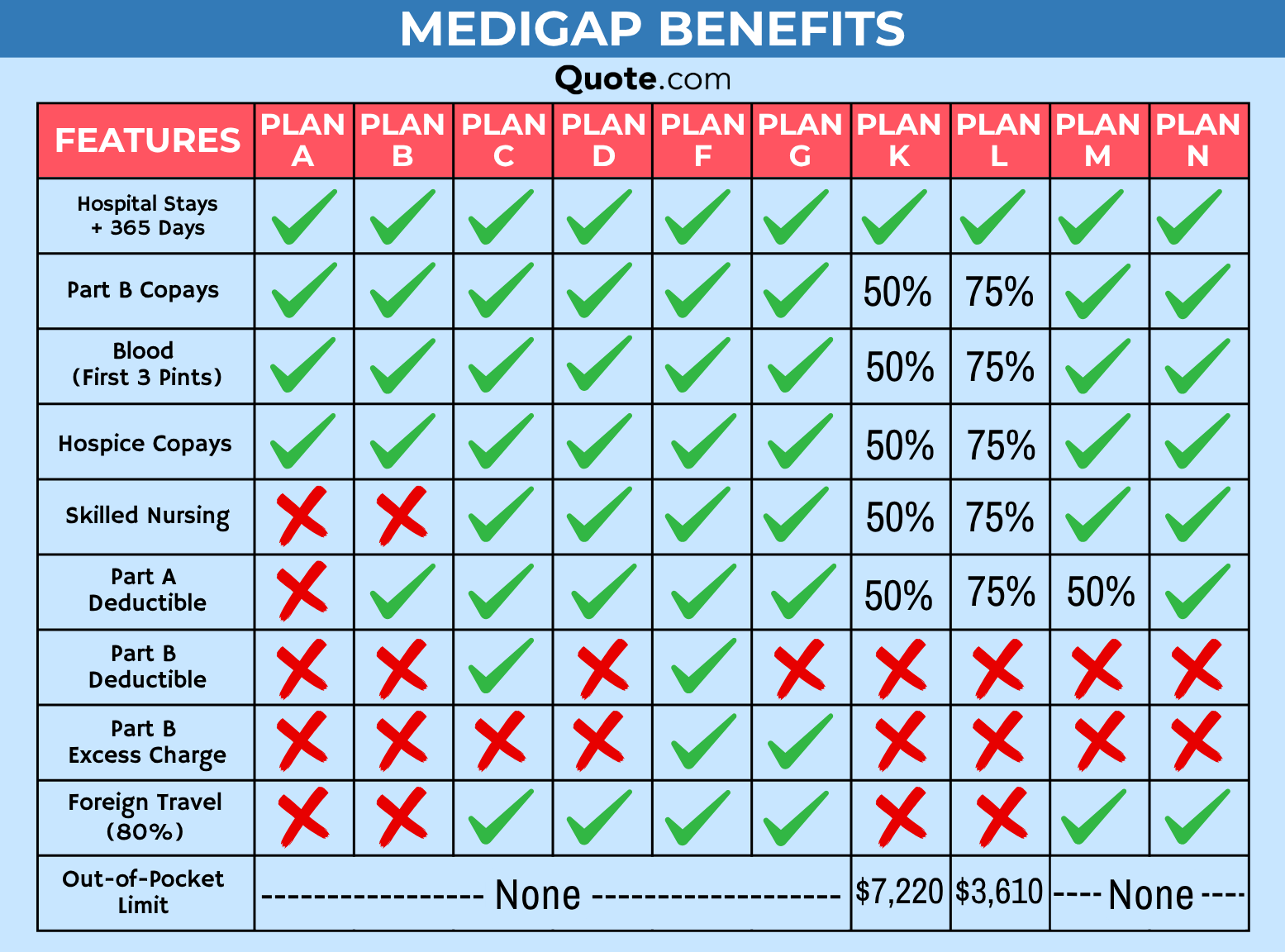

Medicare Supplement (Medigap)

Medigap, also known as Medicare Supplement Insurance, helps fill the “gaps” in Original Medicare by helping pay for deductibles, copays, and coinsurance.

You cannot have both a Medigap plan and a Medicare Advantage plan at the same time.

With Medigap, Medicare covers its share of approved services first, and your Medigap plan then pays for its portion according to your policy terms. It’s one of the easiest ways to finance what your health insurance won’t cover.

Unlike Original Medicare and Medicare Advantage, you can sign up for a Medigap plan at any time. However, if you don’t sign up within six months of enrolling in Part B, insurers may charge higher premiums or deny coverage based on pre-existing conditions.

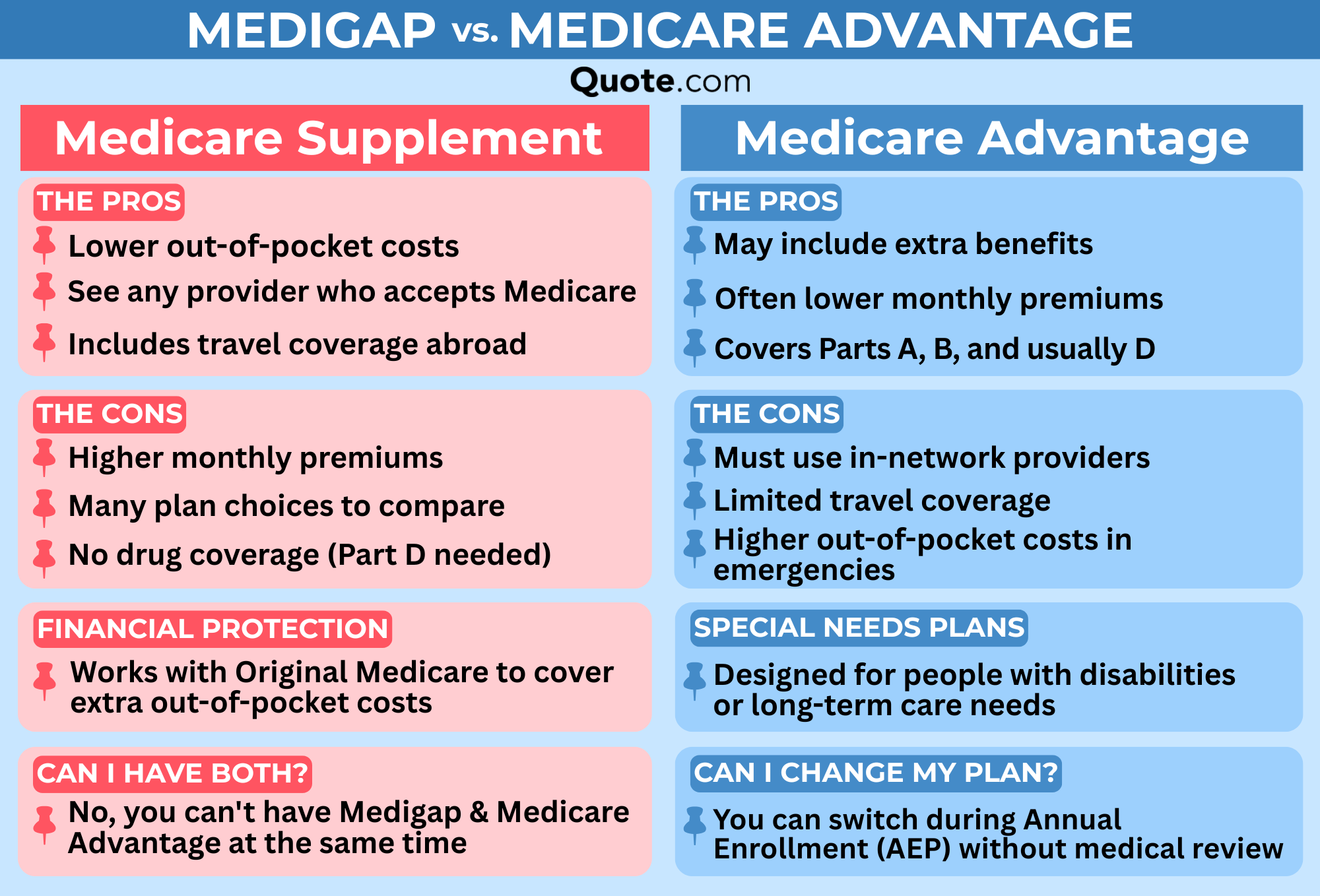

Medigap vs. Medicare Advantage

While both can lower out-of-pocket costs, Medigap and Medicare Advantage work differently.

Medigap supplements Original Medicare, while Medicare Advantage is a private insurance alternative that offers the same coverage as Original Medicare, sometimes with additional benefits.

Medigap plans may be a better option for travelers because they don’t have a preferred network.

Sara Routhier Sr. Director of Content

With Original Medicare and Medigap plans, you usually don’t need prior authorization for hospital stays or procedures.

On the other hand, Medicare Advantage plans often require pre-approval for the same treatments.

Who should consider Medigap? A Medigap policy is ideal for people who don’t want to be restricted to a specific network, as it allows you to see any provider that accepts Medicare.

Some Medigap plans also cover medical costs outside the U.S.

Step #3: Apply Online, by Phone, or in Person

If you’re wondering where to sign up for Medicare, you can apply online, by phone, or in person at your local Social Security office. Call (855) 634-0435 to speak with a licensed insurance agent about your Medicare options, or enter your ZIP code to compare plans.

Be ready to provide personal documents, including your birth certificate or proof of legal residency, Social Security number, and current health insurance information. When filling out the application form, make sure to specify the date you want your Medicare coverage to start.

If you’re comparing health insurance plans and want extra coverage through Medicare Advantage, you can enroll separately during your IEP or during the Annual Enrollment Period (AEP), which runs from October 15 to December 7.

After the Medicare sign-up process is complete, you’ll receive your Medicare card in the mail within 30 days, showing the start dates for your Part A and Part B coverage.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Medicare Enrollment Periods

Medicare Part A and Part B coverage start dates depend on the month you sign up. If you enroll during the three months before you turn 65, coverage begins the month you turn 65.

If you sign up during your birthday month or in the three months after, your Medicare coverage will begin based on the month you enroll.

Medicare Enrollment Periods: Dates & Options| Enrollment Period | When it Occurs | What You Can Do |

|---|---|---|

| Annual Enrollment (AEP) | October 15 – December 7 | Switch or change plans |

| Automatic Enrollment | At 65 with retirement benefits | Auto-enrolled in Part A |

| General Enrollment (GEP) | January 1 – March 31 | Enroll, possibly with penalty |

| Initial Enrollment (IEP) | 3mo before/after 65th bday | Enroll in Part A or B |

| Open Enrollment (OEP) | January 1 – March 31 | Pick Advantage or Original |

| Special Enrollment (SEP) | Employed or 8mo later | Enroll without penalty |

You can buy a Medigap policy during your Medigap Open Enrollment Period (OEP), which lasts six months starting when you turn 65 and enroll in Part B.

Wondering how to sign up for Medicare Part A only? You can decline Part B when signing up for coverage. The application process for Medicare Part A follows the same steps as signing up for any other Medicare coverage.

Your Initial Enrollment Period is your first opportunity to sign up. It lasts seven months, starting three months before you turn 65 and continuing for three months after. The earlier you sign up for Medicare, the sooner your coverage starts.

Special Enrollment Periods allow you to sign up for Medicare or make changes outside the Annual Enrollment Period, but you must meet specific criteria. Common circumstances include:

- You Lose Your Coverage: If you had Medicaid and are no longer eligible, you may qualify for a Medicare Special Enrollment Period (Read More: What is Medicaid?).

- You Move: This may include relocating outside your plan’s coverage area, moving into or out of an assisted living or skilled nursing facility, or switching to a new plan option in your area.

- You’re Covered Elsewhere: If you’re still employed or on a spouse’s health insurance plan, you can keep that coverage and enroll in Medicare later.

- Your Plan Gets Discontinued: If you buy a Medicare Part C plan from a company that no longer offers coverage, you can enroll in Medicare at the end of your policy.

Several other situations qualify you for a special Medicare enrollment process. If you experience a major life change, you should evaluate your eligibility for special enrollment and research how to apply for Medicare insurance outside of the normal enrollment period.

Call (855) 634-0435 to speak with a knowledgeable licensed insurance agent about your Medicare options.

Documents Needed to Apply for Medicare

You’ll need certain details to prove your eligibility for Medicare when you apply, though some of this information may already be on record with Social Security or other agencies.

Required documents:

- Birth certificate, passport, or driver’s license to prove age and identity

- Passport, green card, naturalization papers, Certificate of Citizenship, or U.S. consular report of birth to show U.S. citizenship or legal residency

- Social Security card or number

- W-2 forms, self-employment tax records, or a Social Security statement to verify earnings

Other information you may need, if applicable:

- Admission-departure record for non-citizens

- Alternate proof of age if your birth record isn’t available, such as school or medical records, immunization records, state census records, or old insurance records

- Bank account details if deducting premiums automatically

- Dates and places of marriages or divorces

- Dates of military service before 1968

- Details on Social Security work credits earned in another country

- Health insurance records from an employer, union, or private plan

- Information about any current or future federal pension

- Military discharge papers or service records

- Name and address of each employer from the past two years

- Recent tax returns to help determine whether Part B or Part D surcharges may apply

- Record of any prior Social Security benefit applications made by you or on your behalf

- Two years of income, and an estimate of next year’s earnings if applying between September and December

How to Choose the Best Medicare Plan for You

Selecting the best Medicare plan can be challenging, especially with so many options to consider. Here are some expert tips to guide your decision:

- Assess Coverage Needs: Original Medicare provides only basic coverage, which may not meet your needs. Consider prescription drug coverage and benefits that reduce Medicare copayments for more protection.

- Check for Extra Benefits: Some Medicare plans include added perks beyond basic coverage, such as prescription drugs, dental, vision, hearing, or wellness programs that improve protection and lower costs.

- Compare Costs Beyond Premiums: Don’t just focus on premiums. Consider deductibles, copays, and coinsurance to understand what you’ll pay after receiving certain medical services.

- Consider Travel & Flexibility: If you travel often or own a summer home, you may need a Medicare plan with greater network flexibility, such as a PPO.

- Understand the Parts of Medicare: Learn how Medicare Parts A, B, C, and D work together to cover various types of care and affect your provider options, out-of-pocket costs, and overall coverage.

If you have friends or family on Medicare, ask for their recommendations and do research before purchasing a plan (Read More: The Most Unhealthy City In America).

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Medicare Costs: Premiums, Deductibles, & More

How much does Medicare cost? For most recipients, Medicare Part A has no monthly premium. That’s why enrolling in Part A as soon as you’re eligible makes sense, even if you have other insurance. In most cases, Part A is free and provides essential hospital coverage.

Medicare Costs by Plan Type| Plan | Rate/mo | Deductible | MOOP |

|---|---|---|---|

| Medigap | $35-$488 | $0-$2,800 | $7,500 |

| Part A | $0-$505 | $1,676 | NA |

| Part B | $185 | $257 | NA |

| Part C | $0-$200 | $0-$200 | $8,850 |

| Part D | $34 | $0-$545 | $2,000 |

Along with your Part B monthly premium, it’s important to understand that Original Medicare only covers 20% of your medical expenses. Since there’s no maximum out-of-pocket (MOOP) limit, costs are unlimited, so many people choose a supplemental option like Medigap or Medicare Advantage.

If you don’t sign up for Medicare Part B when you’re first eligible and don’t qualify for a special enrollment period, you’ll pay a penalty added to your monthly premium.

Medicare Savings Programs That Lower Costs

If you can’t afford your Medicare premiums, you may qualify for a Medicare Savings Program (MSP), which can help cover premiums, deductibles, coinsurance, and copays for eligible individuals.

Medicare Savings Programs: Monthly Income Limits| Qualifying Program | Individual | Married Couple |

|---|---|---|

| QI Income Limit | $1,781 | $2,400 |

| QI Resource Limit | $9,660 | $14,470 |

| QMB Income Limit | $1,325 | $1,783 |

| QMB Resource Limit | $9,660 | $14,470 |

| QWDI Income Limit | $5,302 | $7,135 |

| QWDI Resource Limit | $4,000 | $6,000 |

| SLMB Income Limit | $1,585 | $2,135 |

| SLMB Resource Limit | $9,660 | $14,470 |

People who meet income and resource limits may be eligible for assistance. Below are the Medicare Savings Programs and what each offers.

Qualified Medicare Beneficiary (QMB) Program

The QMB program covers Part A premiums (if required) and Part B premiums, deductibles, coinsurance, and copayments for services covered by Medicare. Participants may still owe a copay for Part D prescriptions through Medicaid. QMB enrollees do not qualify for full Medicaid benefits.

QMB+ is also available, which can give eligible individuals full Medicaid benefits. This program is similar to the QMB program but offers a higher level of coverage.

Specified Low-Income Medicare Beneficiary (SLMB) Program

The SLMB program helps cover Part B premiums and provides assistance with prescription drug costs. However, participants must still pay cost-sharing for most services because it does not include full Medicaid benefits.

SLMB+ offers full Medicaid benefits, eliminates Part B premiums, and provides limited state Medicaid assistance with cost-sharing. Services covered by both Medicare and Medicaid require no cost-share.

Qualifying Individual (QI) Program

The QI program covers Part B premiums, but funds are limited and available on a first-come, first-served basis. You must reapply every year, and not all eligible individuals will receive benefits. The program does not cover cost-sharing.

Qualified Disabled Working Individual (QDWI) Program

The QDWI program helps cover Part A premiums for people with disabilities who meet income and eligibility requirements. This program does not cover cost-sharing or offer full Medicaid benefits.

Full Benefits Dual Eligible (FBDE) Program

The FBDE program provides full Medicaid benefits for those who qualify. Some assistance may also be available from Medicaid to help with Medicare cost-sharing.

You may also qualify for help with premiums, copays, and coinsurance if your income meets your state’s guidelines. FBDE support can lower your overall health care costs by filling gaps that Medicare does not cover.

Since coverage varies by state, contact your Medicaid office to learn what benefits you may receive. Read our expert guide to Medicare to learn more.

Get Enrolled in Medicare Coverage Now

You can go online, in person, or call Social Security to sign up for Medicare. Your Initial Enrollment Period is your first chance to enroll and lasts seven months, giving you time to review your options and choose a plan. It also helps you avoid late penalties and ensures continuous coverage when you first qualify.

Consider Medicare supplement plans, also called Medigap, if you need help paying for out-of-pocket costs that Original Medicare doesn’t fully pay for.

These sign-up windows help you ensure your Medicare plan continues to match your evolving health and financial needs. You can also add coverage like Medicare Advantage (Part C) or a Part D prescription plan.

The Annual Enrollment Period and Special Enrollment Period also offer opportunities to adjust your coverage if your circumstances change.

If you already receive Social Security benefits before turning 65, you’ll be automatically enrolled. If not, you’ll need to apply to avoid gaps in coverage.

Read More: The Best States for Employer-Provided Health Insurance

Looking to make your Medicare sign-up simple and stress-free? Get all the guidance you need from licensed insurance agents by calling (855) 634-0435 or entering your ZIP code.

Frequently Asked Questions

How do I sign up for Medicare for the first time?

Wondering how do you sign up for Medicare for the first time? You can enroll in Medicare online as soon as three months before your 65th birthday.

This is when your Initial Enrollment Period starts. If you miss it or still have private insurance, you will have to wait until the Annual Enrollment Period to sign up for Medicare.

Is it mandatory to sign up for Medicare when I turn 65?

It isn’t mandatory to sign up for Medicare at age 65, but you could face penalties and higher premiums if you enroll later.

Call (855) 634-0435 to discuss your options with a licensed insurance agent and get covered today, or enter your ZIP code to get started.

Do you automatically get Medicare when you turn 65?

Yes, you’ll be automatically enrolled in Original Medicare Part A and Part B if you’re already receiving Social Security benefits for at least four months before turning 65. Learn who is eligible for Medicare.

What documents do I need to apply for Medicare online?

When signing up for Medicare benefits, you’ll need your birth certificate, proof of legal residence (like a utility bill or banking statement), Social Security number, and current health insurance information.

Who isn’t eligible for Medicare at age 65?

Not everyone qualifies for Medicare once they turn 65. You may not be eligible if:

- You aren’t a U.S. citizen or legal resident for at least five consecutive years.

- You haven’t worked long enough (usually 10 years) to earn enough Social Security credits for premium-free Part A.

Can I get Medicare at 55?

You generally can’t enroll in Medicare at 55 unless you qualify due to certain disability or serious health conditions. Most people become eligible at age 65.

Can you use Medigap with Medicare Advantage?

You cannot use both coverages. In fact, it’s illegal for someone to sell you a Medigap policy if you have Medicare Advantage. Learn more about Medigap coverage.

What’s the difference between AEP vs. OEP?

The Annual Enrollment Period (AEP) is the time each year when Medicare beneficiaries can switch their Medicare Advantage or Part D plans. The Open Enrollment Period (OEP) is a shorter window that lets people already enrolled in a Medicare Advantage plan change or drop their plan once.

Can you get the same Medigap plan after dropping it?

If you had Original Medicare with Medigap and switch to Medicare Advantage for the first time, you can switch back to your Medigap plan within 12 months if you’re unhappy with your Medicare Advantage Plan. If your Medigap plan is no longer available, you can choose a new one when signing up for Medicare.

Can you use Medicaid with Medicare?

If you’re eligible for Medicaid and Medicare, you can use Medicaid as your supplemental coverage to Medicare. Each state has a different criteria or set of rules for Medicaid eligibility, starting with income requirements.

If you are eligible for Medicaid, services such as personal care and nursing home care would be provided, which are not services covered by Medicare. For more information or to find out if you are eligible for benefits, contact the eligibility office in your state. They will guide you through how to apply for Medicare.

What’s the difference between Medicare Advantage and Medigap?

Can you switch back and forth between Original Medicare and Medicare Advantage?

How do I sign up for Medicare Advantage?

Is Medicare Advantage or Original Medicare with Medigap cheaper?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.