26 Hacks to Save Money on Auto Insurance in 2026

There are plenty of reliable hacks to save money on auto insurance, from making sure you only buy the coverage you need to avoiding coverage lapses that raise rates. Minimum coverage rates can start as low as $22 per month at the cheapest auto insurance companies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated January 2026

Looking for hacks to save money on auto insurance? Over the last few years, auto insurance industry rates have steadily increased, and this year, experts predict they will rise even higher. Luckily, there are plenty of car insurance hacks to save money, from raising your deductible to comparison shopping.

The industry-wide rate spike has made it challenging for the average car owner to find affordable car insurance that provides the coverage they need. If your car insurance premiums continue to mount in spite of your pristine driving record, you are not the only one.

Use these 26 insurance hacks to save more money on car insurance, whether you are shopping for the best auto insurance for Acuras or teenage drivers.

- One of the top insurance savings hacks is to only carry coverage you need

- Comparison shopping every year ensures you have the cheapest rate

- Applying for multiple discounts will help lower rates as well

Want to find cheap auto insurance today? Enter your ZIP code in our free quote comparison tool to get started.

#1: Only Buy the Coverage You Need

The first step in our guide to cheap car insurance is to make sure you are only carrying the coverage you need. If you have an older vehicle, you can just get the cheapest liability auto insurance coverage required by your state. If your state requires liability insurance, you could face fines, a suspended driver’s license, or even jail time for driving without it.

A good rule to follow is to cancel collision and comprehensive coverage if the total amount you pay annually is 10% or more of the value of your car.

Dani Best Licensed Insurance Producer

Consider adding or dropping collision and comprehensive coverage in no-fault states. No-fault insurance doesn’t cover car repairs, so add collision coverage only if your car is worth it. Take a look at liability versus full coverage insurance with collision and comprehensive insurance below.

Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (<580) |

|---|---|---|---|---|

| $65 | $72 | $94 | $98 | |

| $61 | $68 | $86 | $95 |

| $68 | $75 | $103 | $101 | |

| $56 | $62 | $78 | $88 | |

| $59 | $65 | $92 | $91 |

| $60 | $66 | $84 | $92 | |

| $58 | $64 | $90 | $90 | |

| $53 | $59 | $83 | $85 | |

| $66 | $73 | $98 | $99 | |

| $50 | $55 | $72 | $82 |

One way how to cheat car insurance is to not use or refuse PIP. To keep premiums low, drivers in some states can select their health insurance as the primary payment for medical bills and only use Personal Injury Protection (PIP) after exceeding those limits.

In Texas, you have the right to refuse PIP in writing. The Affordable Care Act offers unlimited coverage for injuries sustained in car accidents, but ensure your deductible is low enough to make waiving PIP worthwhile.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2: Check if You Qualify for Group Insurance

Ask HR if you can avail yourself of the company’s group auto insurance plan. Larger corporations often offer group rates for full-time employees.

Check professional and alumni associations for group rates. The respective professional associations of teachers, nurses, policemen, and firefighters typically make group car insurance rates available to members.

For example, the American Nursing Association (ANA) provides members with up to 4% off insurance rates through Nationwide.

Credit unions may offer group rates. If you bank at a credit union, ask if member benefits include group rates on car insurance.

You should also get your military discounts. Whether you are an active member, a veteran, or a family member of either, most insurers offer discounts to those in the military. USAA is one of the best providers for military and veteran drivers. You can read more about it in our USAA auto insurance review.

#3: Avoid Coverage Lapses

If your auto insurance policy lapses, you will have to pay late fees, and may be labeled as a high-risk driver. Repurchasing a policy also means loyalty discounts disappear, and your rates could go up.

Therefore, some important auto insurance hacks are to renew your policy early or switch companies no less than 10 days before your current policy expires (Read More: How to Buy Auto Insurance).

#4: Use Your Auto Club for Towing

Roadside assistance from auto clubs is one of the many tricks to make car insurance cheaper, such as getting your roadside assistance from AAA (Learn More: AAA Auto Insurance Review). Some insurers consider the availability of roadside assistance as a factor when adjusting your premium.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5: Buy Cars That Are Cheap to Insure

Another one of the best insurance hacks is to consider rates on various cars before buying. According to Forbes, the five cheapest cars to insure are:

- Subaru Forester 2.5i AWD

- Jeep Patriot Sport 2WD

- Buick Encore 2WD

- Jeep Cherokee Sport 2WD

- Subaru Outback 2.5L AWD

There are also great ways to save money on the car you already own. Check out the top 7 ways you’re wasting money on your car to see them.

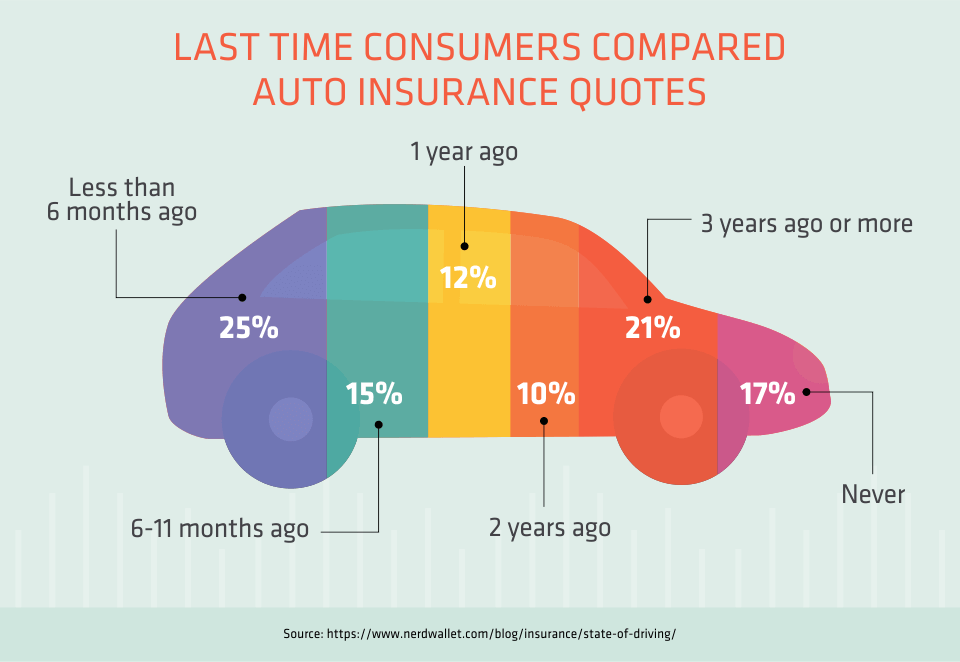

#6: Comparison Shop

One vital step in how to make your car insurance as cheap as possible is to shop around. Yet, so few people do it. Shop around for better insurance premiums every year. A recent study by J.D. Power found that customers could save almost $400 per year by comparison shopping on insurance rates.

In order to successfully comparison shop for the cheapest car insurance, gain a solid understanding of the ways to measure coverage, research rates, and compare prices.

#7: Take a Defensive Driving Course

One of the powerful tips for buying affordable car insurance now is to complete a certified driver’s training course. Some states mandate that insurers lower rates if you participate in a driving program.

For example, complete a defensive driving course in New York and reduce your rate by 10% for three years. If you’re 60 years or older, take an accident prevention course in Connecticut and take 5% on your premium.

Read More: Cheap Auto Insurance for Seniors

These courses not only save you money on your premiums, but they may also save your life.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

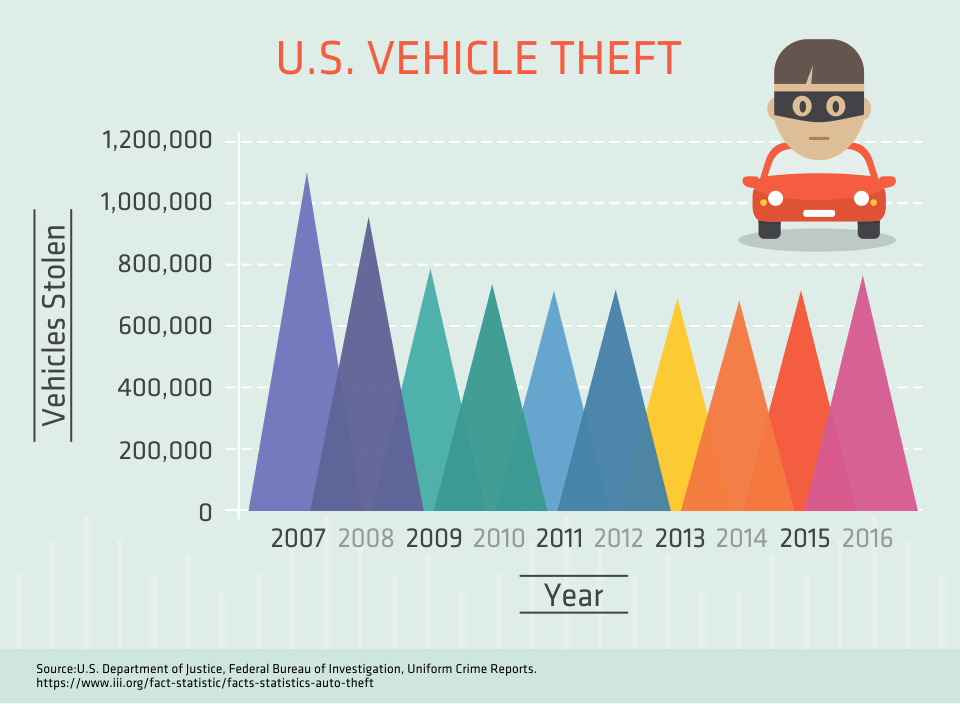

#8: Get an Anti-Theft System

Most insurers offer discounts on cars with anti-theft systems (Learn More: Best Anti-Theft Auto Insurance Discounts). Think your car is too average to attract thieves?

According to the National Insurance Crime Bureau’s (NICB) 2016 Hot Wheels Report, Honda Accords and Civics account for 42% of all car thefts on their top ten list. Therefore, one of the tricks for cheaper car insurance is to make sure your car has anti-theft devices like a GPS tracking system.

#9: Bundle Policies

Bundling car insurance with homeowner’s insurance coverage is a great auto insurance hack that saves an average of 16%, or $322 per year.

Based on the 91% of car/renter’s insurance bundlers who renew their policies, the savings and convenience of having more than one policy with the same insurer are well worth it.

If you purchase a home, add homeowner insurance to your existing auto policy for great savings.

#10: Insure Multiple Cars

The more cars on one policy, the more savings you get. Not unlike bundling homeowner insurance with auto insurance, adding additional cars to your policy can save money compared to having separate policies for each car.

For example, Geico offers up to 25% off if you insure more than one car. You can also check out our guide on everything you need to know about Geico for more information.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#11: Keep Mileage Low

Walking or biking instead of driving is good for your health and your wallet. Many insurers provide savings if your car maintains a low mileage (Read More: Best Low-Mileage Auto Insurance Discounts).

For example, Safeco offers a low-mileage discount if you drive fewer than 8,000 miles per year. The exact mileage depends on the company.

#12: Maintain an Excellent FICO Score

Insurers use your credit score to determine your rate. The lower your credit score, the higher your car insurance rates. Why? Because insurers use your credit score to assess how likely you are to file a claim (Learn More: The Worst States for Auto Insurance Claims).

According to Consumer Reports, single drivers with “good” credit scores (700-799) paid $67-$526 more on average than those with the “best” scores (800 or more).

#13: Increase Your Deductible

Increasing your deductible will lower your auto insurance premium. This is a guaranteed savings if you can afford to pay a higher deductible (Read More: Tips to Pay Less for Car Insurance).

For example, increasing your insurance deductible from $500 to $1,000 could drop your premiums significantly.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#14: Pay Upfront or Twice a Year

Some insurers offer discounts for paying all at once instead of in monthly instalments. Safeco provides a discount for paying for your policy in full, and Progressive offers a discount for paying your six-month policy upfront (Learn More: Progressive Auto Insurance Review).

#15: Contact Your Insurer as You Reach Life Milestones

Take advantage of life’s milestones with car insurance savings. Turning 25 can save you up to 40% on your premium, while getting married means you can combine policies with your spouse, granting you multi-vehicle savings (Read More: The Ultimate Insurance Cheat Sheet).

#16: Join a Parent’s Policy

Young drivers have extremely high rates if they purchase their own auto insurance, which is unaffordable for most young drivers (Learn More: What to Do If You Can’t Afford Your Auto Insurance). However, a cheaper rate for a new driver is possible with an older person on your policy.

Teen drivers will have the lowest rates if they join a parent's existing auto insurance policy.

Daniel Walker Licensed Insurance Agent

Adding a young driver to a parent’s policy can save young drivers thousands, and you can thank them by driving to the store to pick something up whenever they ask.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#17: Maintain Good Grades

Most insurers offer discounts for students with high grade point averages (Learn More: Car Insurance Discounts You Can’t Miss).

If you maintain a solid B average at school, your auto insurance company could offer a significant percentage off your policy.

#18: Get a Distant Student Driver Discount

Students under the age of 25 and (at least) 100 miles away from home for the school year can stay on their policy at a discounted rate. Allstate offers a distant student discount of up to 20% (Read More: Allstate Auto Insurance Review).

#19: Cut Rental Car Insurance

One of the life hacks for your car insurance is that if your policy includes collision and comprehensive coverage, you can probably waive the insurance on a rental car (Learn More: Collision vs. Comprehensive Auto Insurance).

If your policy doesn’t cover rental car insurance, perhaps you have a credit card that does. If you rent cars often, apply for a credit card that covers rental insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#20: Prove You Are a Good Driver

Another one of the premium hacks for cheap auto insurance rates is to be a good driver. Most insurers provide lower rates for drivers with no claims or violations for five years (Read More: Best Auto Insurance for Good Drivers). For example, Geico offers up to 26% off on most coverage if you have been accident-free for five years.

Take a look at how rates are much lower for good drivers below.

Insurers are now also using “telematics” to track safe driving behavior, like State Farm’s Drive Safe & Save program, which can cut rates by up to 50%.

Telematics is a new, compelling technology that may revolutionize the way insurers calculate premiums in real time.

#21: Explore Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) offers rates based on your mileage. Like tracking safe driving behavior, UBI utilizes telematics to determine what you pay for coverage, usually helping drivers save 15% or more on car insurance.

Metromile — a UBI company — claims that 65% of drivers overpay to compensate for high-mileage drivers, so the company’s base policy is $29 per month, with drivers charged per mile on top of that. So the less you drive, the more you save on auto insurance.

Read our guide on the best pay-as-you-go auto insurance for an in-depth look at UBIs and more, and how to save money on car insurance tips.

#22: Compare Loyalty Discounts to Rates from Other Insurers

Even with a loyalty discount, you may still get a better rate with a different company. A cheap auto insurance trick is to compare rates from multiple companies, especially if you are seeking cheap auto insurance for high-risk drivers.

Insurance lawyer Michele Ross told the Huffington Post that “loyalty discounts should not be blindly trusted, because you might get a better deal by switching.” Ross suggests compiling a range of quotes before clicking “renew” on policies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#23: Automate Payments and Go Paperless

One of the last steps in how to make your auto insurance cheaper is to get discounts for automatic payments and/or signing up for electronic documents. Automated systems make policy renewals easy, so insurers encourage customers to sign up, like the 10% you get off for Allstate’s eSmart discount just for agreeing to read your policy documents online.

It also makes things easier if you have multiple cars on one policy, as your payments will all be processed at once (Read More: Cheap Auto Insurance for Multiple Vehicles).

#24: Get the Cheapest Insurance Offered in Your State

Insurance rates differ state-to-state, so a cheap policy in one state could be expensive in another. For example, in Washington, Progressive is the cheapest auto insurance company besides USAA (Read More: Best Auto Insurance Companies in Washington).

Note: The coverage you purchase in your state will meet all the requirements of any state you travel to.

#25: Don’t be Pressured into Buying Family Policies

You are insuring your car, not the person driving. If a family member is not living with you, you do not need to add them to your insurance.

Or, if you have a high-risk driver in your family, you may have high rates or be denied insurance, making it better for them to purchase their own auto insurance policy.

Learn More: What to Do When You’re Denied Insurance Coverage

Companies may persuade customers to purchase family car insurance policies when it is completely unnecessary.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#26: Contact an Independent Insurance Agent

The last of our cheap auto insurance tips is to contact an independent insurance agent. Independent insurance agents can provide quotes from a variety of insurers.

Captive insurance agents work for one company, but independent agents sell insurance from many different companies and can give you a wider array of quotes (Learn More: How to Get Multiple Auto Insurance Quotes).

Before contacting an agent, checking out our online auto insurance comparison tool can help you prepare and protect yourself from inflated car insurance policy rates. Enter your ZIP in our free tool to get started on finding cheap auto insurance today.

Frequently Asked Questions

What are the best ways to get cheaper auto insurance?

Our top three cheap car insurance hacks are to only buy the auto insurance coverage you need, see if you qualify for group insurance, and avoid coverage lapses.

How can I get a discount on my auto insurance?

One of the car insurance saving hacks is to apply discounts to your auto insurance. You may be able to save hundreds on your automotive insurance by applying for good driver discounts, low mileage discounts, bundling discounts, and more.

Some discounts will be applied automatically to your auto insurance policy, while others you may have to provide proof of qualifications, like a student transcript for a good student discount.

How can I get cheap Jeep Patriot insurance?

You will find the best answers for cheap car insurance on a Jeep in our guide to the best auto insurance for Jeeps. We cover cheap companies, discounts, and more. You can also use our free quote comparison tool to shop for cheap Jeep Patriot insurance in your area.

How can you get cheap auto insurance for nurses?

Nurses can check if their auto insurance provider offers a discount for nurses. To find affordable auto insurance as a nurse, simply enter your ZIP code in our free quote tool.

What are car insurance hacks for new drivers?

Some insurance hacks for new drivers to save on car insurance include joining a parent’s policy and applying for good student discounts. Another tip for how to get cheap car insurance at 21 is to make sure to get plenty of insurance quotes for new drivers.

What are New York auto insurance hacks?

New York auto insurance can be expensive. If you are looking into how to save money on New York car insurance, the best thing you can do is comparison shop by getting quotes from different auto insurance providers.

This will help you quickly find which provider offers the best rate and save money on your New York car insurance (Read More: Best Auto Insurance Companies in New York).

How can I get cheap auto insurance for firefighters?

Firefighters may be eligible for a first responder auto insurance discount at certain companies. They can also follow cheap insurance hacks like shopping around for coverage, raising deductibles, and being a good driver.

Can you get a free car insurance quote with no credit check?

Yes, you can get a free no-credit-check car insurance quote, although the insurance company you sign up with may check your credit score afterwards.

When should you drop full coverage?

A car insurance hack to save money is to carry liability insurance only; however, not all drivers will benefit from this approach (Read More: Liability vs. Full Coverage Auto Insurance).

We recommend dropping full coverage only if you have an older vehicle that is of lower value. If your collision and comprehensive payments will soon match your vehicle’s value, then it is best to drop full coverage.

Is it better to have a $500 deductible or $1,000?

Having a $1,000 deductible will help you with saving money on auto insurance, as it will lower rates. However, you must be able to pay $1,000 out of pocket for repairs after an accident. If you can’t, it’s best to keep a $500 deductible.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.