American Access Casualty Company Review for 2026

American Access Casualty Company, a Kemper subsidiary, offers minimum coverage starting at $61 per month to high-risk drivers who need SR-22 insurance in Arizona, Illinois, and other states. This American Access Casualty Company review compares DUI rates and shows how drivers can get fast, 24/7 claims support.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the...

Heidi Mertlich

Updated September 2025

High-risk drivers can use this American Access insurance review to find nonstandard auto insurance that meets their needs and state-specific legal requirements.

American Access Auto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.2 |

| Business Reviews | 4.0 |

| Claims Processing | 2.9 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.7 |

| Coverage Value | 3.2 |

| Customer Satisfaction | 1.8 |

| Digital Experience | 3.0 |

| Discounts Available | 4.3 |

| Insurance Cost | 3.8 |

| Plan Personalization | 3.0 |

| Policy Options | 2.2 |

| Savings Potential | 4.0 |

American Access Casualty Company (AACC) was acquired by Kemper Corporation in April 2022, but continues to operate under its original name in Arizona, Illinois, Indiana, Nevada, and Texas.

Available in only five states, American Access provides cheap auto insurance for high-risk drivers with accidents or DUIs.

- American Access Casualty Company provides SR-22 forms upon request

- A $25 nonrefundable policy fee applies to all new AACC customers

- Nevada drivers must meet 25/50 BI and 20 PD minimum liability limits

AACC starts at an affordable monthly rate, but if you need more affordable high-risk car insurance, enter your ZIP code to see if there are cheaper providers near you.

American Access Auto Insurance Rates

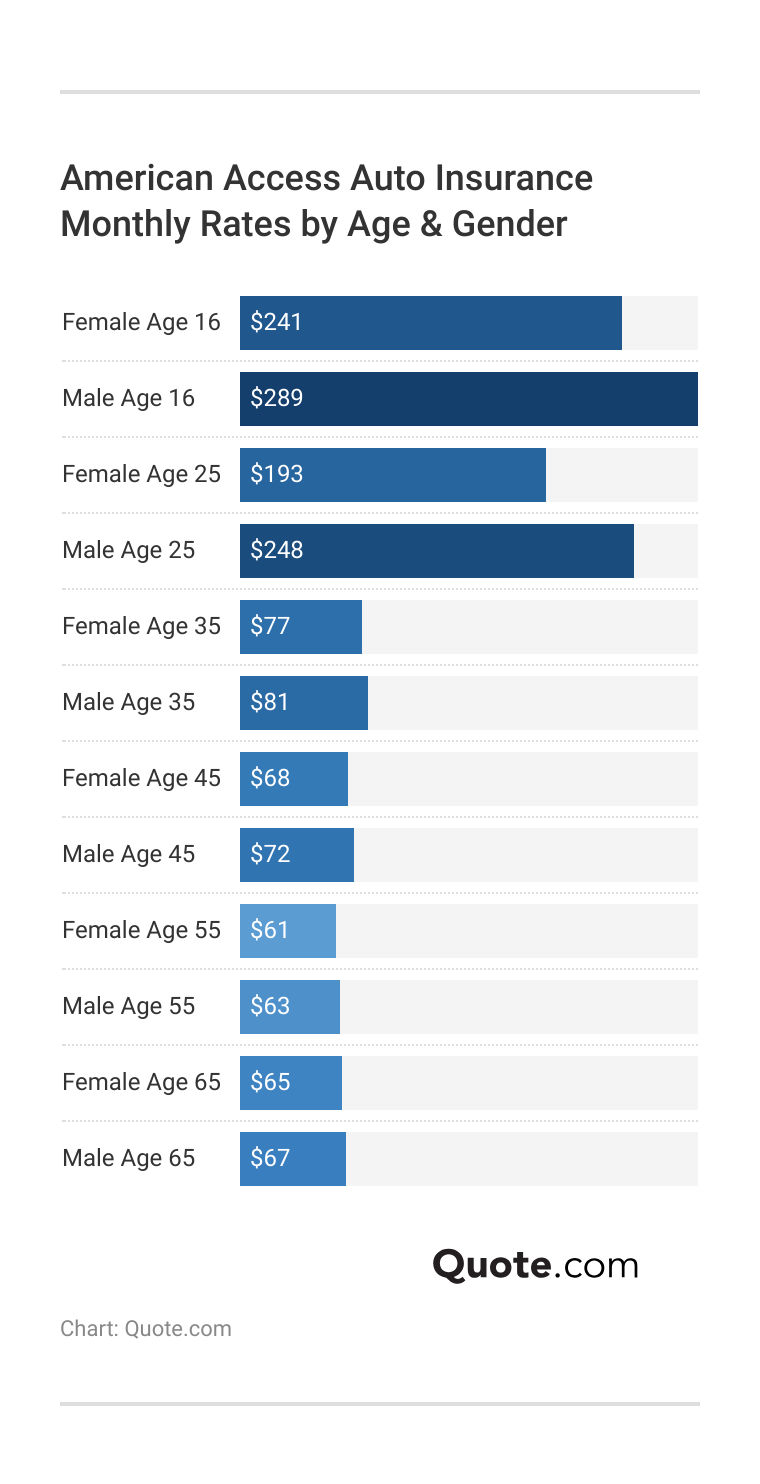

Young drivers, like 16-year-old males, have the highest rates with American Access at $289 per month. Older individuals typically have the lowest premiums, indicating that they are at lower risk over time.

When talking about well-known brands, Kemper is certainly one of them. However, if you are a driver looking to save money, there might be other brands that are better, depending on the type of coverage you’re looking for. Some others also do better when it comes to flexible plans or features that help drivers.

American Access vs. Top Competitors: Auto Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $72 | $178 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $65 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

USAA, Geico, and State Farm have cheap auto insurance for good drivers, but American Access Insurance specializes in high-risk policies, making it a better option for drivers who may have claims or speeding tickets on their records.

American Access High-Risk Auto Insurance Rates

If you have a clean driving record or if you’ve had tickets, accidents, or DUIs, insurance companies react in different ways to the risk.

American Access Auto Insurance vs. Top Competitors: Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $72 | $102 | $138 | $91 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

Kemper is one of many insurers where some competitors give more rewards for clean records, and others are less strict with DUIs.

This guide helps drivers easily identify trends, so they can find providers that fit their history better. See how to get multiple auto insurance quotes to find high-risk driver savings now.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Access Insurance Coverage

American Access focuses on standard car insurance but also provides a range of auto policies to help drivers with less-than-perfect records, including SR-22 filings for drivers who need it after a suspended license.

American Access is a specialized provider that focuses only on nonstandard auto insurance and offers fewer additional choices than other companies.

- SR-22 Insurance: To get SR-22 auto insurance, call the American Access insurance phone number and have an agent file it for you with the DMV.

- Rental Reimbursement: Covers the cost of a rental car when your own vehicle is in repair following a covered claim.

- Roadside Assistance: Provides towing, jumpstarts, flat tire changes, and lockout help in emergencies.

- International Coverage: Covers drivers with an international or no driver’s license traveling back and forth from the U.S. to Mexico or Canada.

Unlike other insurers, AACC does not provide services for homeowners, renters, or life insurance. Instead, it offers important coverages and programs designed for high-risk drivers.

Its parent company, Kemper Corporation, sells business and life policies as well as car insurance. However, American Access only sells auto insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How to Save on American Access Insurance

If you are a high-risk driver seeking cheap auto insurance, American Access Casualty Company offers various options to help lower your premium. Their basic rates are good for drivers who need SR-22 filings, but you can save even more with these proven tips:

- Insure Multiple Vehicles: Get up to 15% off your total premium with a multi-car discount if you insure more than one vehicle on the same AACC policy.

- Maintain a Clean Driving Record: While AACC specializes in high-risk coverage, maintaining a clean driving record for three years can help move you into a lower risk category and get lower rates.

- Pay-in-Full Option: If you pay all your premiums at once instead of in monthly parts, you avoid extra fees and might get a discount one time.

- Paperless Documents: If you choose to get your policy documents through email, you may get a small discount.

- SR-22 Compliance: Sending your SR-22 form through AACC right after a suspension can help you avoid delays and potential price increases due to late submission.

American Access offers budget-friendly options for high-risk drivers who need state-mandated auto insurance. While there aren’t many discount options, you can keep rates under control by insuring multiple cars and maintaining a safe driving record.

American Access Insurance Customer Service and Financial Ratings

American Access Casualty Company reviews from accredited businesses provide insight into what customers say about its service and financial stability. Discover how to buy auto insurance using trusted consumer ratings as your guide.

American Access Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: B Fair Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 78/100 Positive Customer Feedback |

|

| Score: 725 / 1,000 Above Avg. Satisfaction |

|

| Score: 1.35 Higher Than Average Complaints |

The company has a B rating from A.M. Best, showing good financial stability. It also received an A+ rating from the BBB for its customer satisfaction. Consumer Reports gave it a 78/100, and J.D. Power scored it 725 out of 1,000 for average claims experience.

Comment

byu/tawayyesterday from discussion

inInsurance

However, the NAIC reported a complaint ratio of 1.35, which is slightly higher than the average and indicates areas that require improvement. This American Access Casualty Company review on Reddit offers a straightforward perspective on insurance companies, stating that most handle claims similarly and that the agent plays a crucial role.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deciding to Buy American Access Insurance

American Access Casualty Company stands out by offering a 15% discount for multi-car owners and has a special SR-22 filing program to help high-risk drivers become compliant fast. Explore tips to pay less for car insurance while managing SR-22 requirements.

AACC appeals to drivers needing SR-22 with fast filings and no delays. In particular, that speeds reinstatement greatly.

Jeff Root Licensed Insurance Agent

Some American Access insurance reviews suggest that its agents need to handle claims service more effectively, but its A+ rating from the BBB indicates solid business operations. AACC receives higher customer satisfaction ratings than its parent company, Kemper Insurance. However, a higher complaint index still shows room for improvement.

AACC does not sell any other type of insurance, and American Access auto insurance is only available in AZ, IL, IN, NV, and TX. Enter your ZIP code to find affordable insurance companies in your state.

Frequently Asked Questions

Is American Access a good insurance company?

Is American Access a good company? American Access is a solid choice for high-risk drivers needing SR-22 filings, offering liability coverage starting at $61 per month.

Is American Access Insurance the same as Kemper?

What is the relationship between American Access Casualty Company and Kemper? American Access auto insurance is owned by Kemper but operates independently.

What insurance carrier is AACC?

AACC stands for American Access Casualty Company, a carrier that specializes in nonstandard auto insurance. Enter your ZIP code to find affordable high-risk coverage near you.

How does the American Access Casualty Company payment process work?

The American Access Casualty Company payment process allows policyholders to pay monthly premiums online, by phone, or at authorized retail locations. Learn what to do if you can’t afford your auto insurance.

What is the American Access Casualty provider portal used for?

The American Access Casualty provider portal is designed for agents and partners to manage policies, view claims, and assist customers efficiently.

Is American Access Casualty Company part of CNA?

American Access Casualty Company is not part of CNA. It operates as a subsidiary of Kemper Corporation, specializing in nonstandard auto insurance.

What is the phone number for American Access Casualty Claims?

The American Access insurance phone number for claims is (630) 645-7755.

How do I file a claim with American Access insurance?

Call the American Access insurance claims phone number, which is available 24/7 for reporting auto accidents. Learn how to file an auto insurance claim quickly and easily.

How are American Access Casualty Company claims handled?

American Access Casualty Company claims are filed through the claims department, which operates 24/7 to assist with auto accident reporting and resolution. American Access insurance claims are typically processed in 14 days.

Is Kemper insurance pulling out of states?

Why is Kemper closing? Kemper has exited several low-performing states, retaining operations in regions where its high-risk book maintains profitability above 8%. Find out what to do when you’re denied insurance coverage.

Is Kemper good insurance?

Why is Kemper insurance so expensive?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.