10 Best Auto Insurance Companies in Kentucky for 2026

Erie, Nationwide, and State Farm are the best auto insurance companies in Kentucky. Drivers must carry 25/50/25 liability limits, with monthly rates starting at $35. Kentucky car insurance companies in Louisville and Lexington also offer telematics programs that reward safe drivers with discounts of up to 40%.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

Erie, Nationwide, and State Farm lead the pack for the best auto insurance companies in Kentucky.

- Erie is Kentucky’s top pick for affordable auto insurance

- The best auto insurance companies in Kentucky support rideshare coverage

- The best car insurance rates in the state, starting at $35 per month

Erie stands out for consistently high claims satisfaction scores. Nationwide adds value through accident forgiveness and telematics programs that reward safe driving habits.

State Farm further strengthens the mix with safe driver discounts up to 30% and proven long-term financial stability.

Our Top 10 Picks: Best Auto Insurance Companies in Kentucky| Company | Rank | Claims Satisfaction | A.M. Best | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 718 / 1,000 | A+ | Customer Satisfaction | Erie |

| #2 | 691 / 1,000 | A+ | Accident Forgiveness | Nationwide | |

| #3 | 677 / 1,000 | A++ | Local Agents | State Farm | |

| #4 | 670 / 1,000 | A++ | Budget Shoppers | Geico | |

| #5 | 666 / 1,000 | A | Policy Customization | Farmers | |

| #6 | 654 / 1,000 | A+ | UBI Savings | Allstate | |

| #7 | 645 / 1,000 | A+ | High-Risk Drivers | Progressive | |

| #8 | 641 / 1,000 | A++ | Financial Strength | Auto-Owners | |

| #9 | 626 / 1,000 | A | New Cars | Liberty Mutual |

| #10 | 606 / 1,000 | A++ | Industry Experience | Travelers |

Together, these top insurers consistently provide Kentucky drivers with affordable coverage and meaningful long-term savings.

Save more on coverage when you enter your ZIP code and find trusted providers where you can buy auto insurance quickly.

Getting the Best Kentucky Auto Insurance Rates

Insurance costs in Kentucky can look very different depending on whether you go with minimum coverage or full coverage.

Minimum plans keep monthly bills low, but they may leave you with big out-of-pocket costs after an accident. That’s why it’s important to understand what each option really offers before deciding.

Kentucky Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $104 | $287 | |

| $47 | $124 | |

| $40 | $125 |

| $87 | $240 | |

| $35 | $97 | |

| $74 | $204 |

| $81 | $224 | |

| $49 | $135 | |

| $43 | $119 | |

| $62 | $169 |

With Geico, the lowest minimum rate starts at just $35 a month, which works if you drive an older car or want to meet the minimum insurance requirements in Kentucky.

Geico is also the cheapest for full coverage at $97 monthly, followed by Erie and State Farm, which have better customer satisfaction ratings than Geico.

Location in Kentucky matters more than most realize, with rates in Louisville averaging $185 monthly compared to just $120 in Lexington.

Jeff Root Licensed Insurance Agent

It’s always smart to estimate your car insurance cost in Kentucky so you know which coverage level actually fits your budget.

Compare the best auto insurance providers in Kentucky to find the right balance of service and price. Taking the time to shop around ensures you won’t overpay for the coverage you truly need.

How Age Impacts Kentucky Car Insurance

Age is one of the biggest factors when comparing the best car insurance in Kentucky. Premiums shift dramatically as experience builds.

Teen drivers pay the most, while older drivers with claim-free records often qualify for the cheapest auto insurance. Finding the best auto insurance for young adults can be tricky, as younger drivers usually face higher rates because they’re considered riskier and less experienced behind the wheel.

Kentucky Auto Insurance Monthly Rates by Age| Company | Age 16 | Age 25 | Age 35 | Age 45 | Age 55 | Age 65 |

|---|---|---|---|---|---|---|

| $447 | $123 | $114 | $104 | $98 | $103 | |

| $260 | $60 | $55 | $47 | $45 | $46 | |

| $136 | $38 | $35 | $40 | $30 | $31 |

| $522 | $113 | $104 | $87 | $83 | $86 | |

| $159 | $43 | $40 | $35 | $33 | $35 | |

| $373 | $78 | $73 | $74 | $70 | $73 |

| $332 | $104 | $97 | $81 | $77 | $80 | |

| $578 | $72 | $67 | $49 | $46 | $49 | |

| $185 | $55 | $51 | $43 | $41 | $43 | |

| $808 | $77 | $70 | $62 | $58 | $61 |

Travelers charges up to $808 per month for a 16-year-old, while State Farm and Erie are more lenient on new drivers under 25. For families, adding a teen can be overwhelming at these prices.

Many parents explore discounts or bundled family policies to help offset the extra cost. This makes comparing multiple insurers especially important when a young driver is on the policy.

How Bad Driving Raises Kentucky Car Insurance Costs

Your driving record also has a major impact on insurance costs in Kentucky. Teens are considered high-risk for car insurance in Kentucky since they’re more likely to get into an accident, but older drivers with accidents or speeding tickets will also see their premiums go up significantly.

State Farm has cheap auto insurance for high-risk drivers, keeping monthly rates between $43 and $47 regardless of record.

Kentucky Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $104 | $147 | $176 | $123 | |

| $47 | $69 | $72 | $57 | |

| $40 | $55 | $82 | $48 |

| $87 | $124 | $121 | $109 | |

| $35 | $61 | $104 | $36 | |

| $74 | $113 | $89 | $79 |

| $81 | $123 | $166 | $94 | |

| $49 | $100 | $63 | $72 | |

| $43 | $51 | $47 | $48 | |

| $62 | $70 | $112 | $75 |

Progressive flips the pattern of increasing rates, with DUI coverage averaging $63 a month compared to $100 monthly after an accident, showing how insurers weigh risk differently.

Even a single ticket or minor accident can raise monthly payments, while a DUI often leads to the sharpest increases. This auto insurance guide helps show what those differences mean for drivers across the state.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky Auto Insurance Coverage Requirements

Kentucky law only requires drivers to carry a few basics. These limits are enough to keep you legal on the road, but they can fall short in a major accident.

Bodily injury liability helps cover medical bills if you hurt someone in an accident, such as hospital visits or rehab. Property damage liability helps pay to fix someone else’s car or property, like a fence or storefront.

- Bodily Injury Liability: $25,000 per person and $50,000 per accident

- Property Damage Liability: $25,000 per accident

- Personal Injury Protection (PIP): $10,000 per person

Together, these coverages form the core of Kentucky’s insurance requirements, but they don’t cover every situation. That’s where personal injury protection comes in.

Personal injury protection is part of Kentucky’s no-fault system, paying your medical expenses and part of your lost income after an accident, no matter who caused it.

While these minimums keep you legal, they can run out quickly in a bad accident that exceeds your policy limits.

That’s why many Kentucky drivers choose higher limits with trusted KY car insurance companies to avoid paying thousands out of pocket when costs go beyond the state requirements.

Ways to Save on Car Insurance in Kentucky

To get cheaper Kentucky car insurance rates, focus on how you set up and manage your policy.

These savings are some of the most practical tips to pay less for car insurance if you know how to use them.

- Raise Your Deductible: Many Kentucky drivers save 10–15% on premiums by increasing deductibles, though it requires keeping extra savings set aside for claims.

- Shop Around Each Renewal: Rates can vary by more than $400 a year in Kentucky, so comparing Erie, Geico, and State Farm before renewing often reveals the cheapest auto insurance.

- Adjust Coverage on Older Cars: Dropping collision coverage on vehicles worth less than $3,000 prevents Kentuckians from paying more than the car’s actual value.

- Try Telematics Programs: Apps like State Farm’s Drive Safe & Save or Progressive’s Snapshot track driving habits and can lower bills by as much as 30%.

- Bundle Auto With Home Insurance: Bundling home and auto policies with top Kentucky insurers is one of the most effective ways to save, unlocking discounts of up to 25% through Erie and Allstate.

Along with bundling, qualifying for other discounts can also make Kentucky insurance costs feel more manageable.

Nationwide’s 40% low-mileage discount is perfect for drivers who don’t put many miles on their car, since fewer trips can nearly cut a bill in half. Even smaller breaks, like defensive driving credits, can make a policy much more affordable over time.

Top Auto Insurance Discounts in Kentucky| Company | Bundling | Defensive Driving | Good Driver | Low Mileage | Usage- Based |

|---|---|---|---|---|---|

| 25% | 10% | 25% | 30% | 30% | |

| 16% | 5% | 25% | 30% | 30% | |

| 25% | 5% | 23% | 30% | 30% |

| 20% | 10% | 30% | 10% | 30% | |

| 25% | 15% | 26% | 30% | 25% | |

| 25% | 10% | 20% | 30% | 30% |

| 20% | 10% | 40% | 40% | 25% | |

| 10% | 30% | 30% | 30% | 20% | |

| 17% | 15% | 25% | 30% | 30% | |

| 13% | 20% | 10% | 20% | 30% |

Families receive some of the biggest relief from Allstate, where bundling auto and home policies can trim premiums by 25%.

Erie rewards consistency with a 23% good driver discount that turns safe habits into steady savings year after year. These options show that saving isn’t just about collecting discounts.

View this post on Instagram

Kentucky drivers can strategically manage coverage and habits in ways that make premiums more affordable long-term.

Even small steps, like using a usage-based app, can add up to big savings over time. Comparing options regularly is another simple way to make sure you’re still getting affordable car insurance quotes online.

10 Best Auto Insurance Companies in Kentucky

When you buy auto insurance in Kentucky, pay attention to the kind of support and options your insurer can give you.

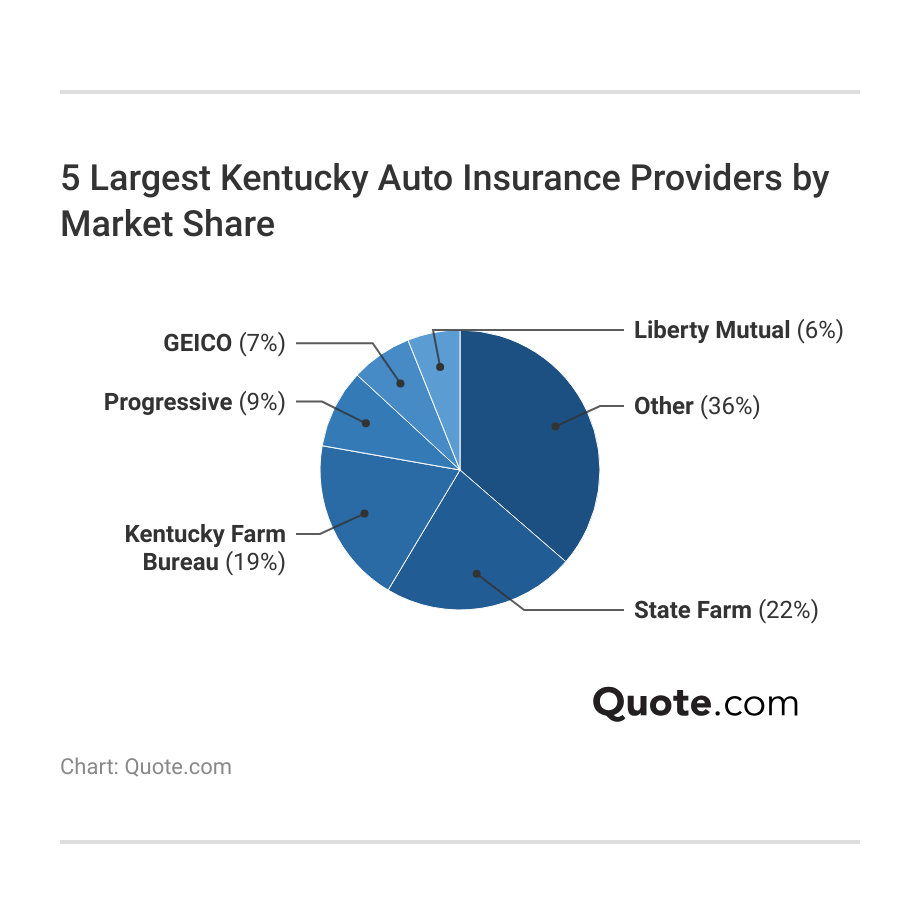

State Farm leads with 22% of the market, which means that numerous local agents are available. However, being the largest doesn’t always mean it’s the best match for everyone.

Smaller insurers still make up 36%, showing that many Kentuckians still prefer flexible coverage and personal service from regional companies like Erie.

Make sure you check multiple auto insurance quotes if you want the best deal. Comparing both big and small providers gives you a better chance of finding the right mix of price, service, and coverage.

#1 – Erie: Best for Customer Satisfaction

Pros

- Highest Satisfaction: Erie scored 718/1,000 for claims satisfaction in Kentucky. Discover more auto insurance ratings inside our Erie auto insurance review.

- Low Premiums: Kentucky full coverage with Erie averages $125 a month. It’s not the cheapest, but it’s still cheaper than most of the companies on this list.

- Strong Financial Stability: With an A+ A.M. Best rating, it provides Kentucky drivers with confidence when filing claims.

Cons

- No Rideshare Coverage: Kentucky drivers using their cars for work cannot add Uber, Lyft, or other rideshare endorsements to their insurance policies.

- Smaller Network: Erie car insurance is only available in 12 states. If you move from Kentucky, you may have to switch providers and lose any loyalty benefits.

#2 – Nationwide: Best for Accident Forgiveness

Pros

- Forgiveness Add-On: Accident Forgiveness can be added to any policy regardless of driving history. Find key policy features explained in our Nationwide auto insurance review.

- Multi-Policy Discount: Bundling home and auto cuts Kentucky insurance rates by 20%.

- Strong Financial and Claims Stability: Nationwide is top-rated for financial strength and auto insurance claims in Kentucky.

Cons

- Coverage Restrictions: Certain optional add-ons, such as gap insurance, may not be available in Kentucky.

- Limited Telematics Impact: Nationwide SmartRide UBI in Kentucky requires a safe driving record to qualify for savings.

#3 – State Farm: Best for Local Agents

Pros

- Wide Agent Network: Over 250 agents provide in-person support to Kentucky drivers.

- Drive Safe & Save UBI: Kentucky drivers can save up to 30% with telematics discounts. See a discount list in our State Farm auto insurance review.

- Safe Driver Benefits: Along with UBI, safe drivers can earn 25% off their premiums by avoiding claims, accidents, and speeding tickets.

Cons

- Expensive for Teens: Kentucky teen drivers face premiums that are, on average, 35% higher than those of adults.

- Limited Digital Tools: Some Kentucky customers report that the mobile app lacks advanced claims features.

#4 – Geico: Best for Budget Shoppers

Pros

- Lowest Starting Rate: Geico offers the cheapest starting rate in Kentucky at $35 per month.

- DriveEasy UBI Program: Telematics gives safe Kentucky drivers up to 25% discounts. Learn about rates and discounts in our Geico insurance review.

- Online Convenience: Geico is one of the best car insurance companies in Kentucky for mobile policy management and claims filing through its app.

Cons

- Limited In-Person Support: Kentucky lacks Geico’s in-person branch network.

- Rideshare Endorsements: An extra premium is required for rideshare drivers in Kentucky.

#5 – Farmers: Best for Policy Customization

Pros

- Custom Add-Ons: Kentucky drivers can add accident forgiveness and glass coverage. Discover more in our Farmers Insurance review.

- Multi-Policy Savings: Bundling auto and home insurance can save Kentucky households up to 20%.

- Local Agent Support: Knowledgeable local agents can handle Kentucky car insurance claims and policy changes in person.

Cons

- Limited Low-Mileage Savings: Farmers only offers 10% discounts to low-mileage drivers, compared to 30% discounts from other top car insurance companies in Kentucky.

- Confusing Options: Too many endorsements may overwhelm drivers looking for basic minimum insurance in Kentucky.

#6 – Allstate: Best for UBI Savings

Pros

- Drivewise UBI Discounts: Kentucky drivers earn up to 25% off with usage-based tracking through Allstate Drivewise.

- Low-Mileage Discounts: Allstate also offers Milewise pay-per-mile insurance to Kentucky drivers who do not want to track their driving habits.

- Deductible Rewards: Allstate lowers deductibles by $100 each year Kentucky drivers remain claim-free. Learn more in our Allstate insurance review.

Cons

- Expensive Monthly Premiums: Allstate has the most expensive auto insurance in Kentucky, with minimum coverage at $104 monthly and full coverage at $287 a month.

- Limited Savings Opportunities: Kentucky drivers must qualify for UBI or pay-per-mile programs to maximize savings.

#7 – Progressive: Best for High-Risk Drivers

Pros

- Competitive High-Risk Rates: Drivers with accidents or tickets will get affordable car insurance for high-risk drivers

at Progressive. - SR-22 Coverage: Progressive files SR-22 forms for Kentucky DUI and violation cases. Explore coverage options in our Progressive auto insurance review.

- Affordable Roadside Assistance: Available in Kentucky to cover towing and lockout services affordably.

Cons

- Low Claims Satisfaction Score: Progressive earned 645/1,000 in Kentucky satisfaction surveys.

- UBI Limitations: Only drivers with claim-free and clean driving histories can sign up for Progressive Snapshot UBI.

#8 – Auto-Owners: Best for Financial Strength

Pros

- Superior A.M. Best Rating: Auto-Owners’ A++ financial rating is the highest among top Kentucky car insurance companies.

- Annual Dividend Payments: Kentucky policyholders are eligible for annual dividend returns on their premiums with Auto-Owners.

- Personal Umbrella Coverage: Kentucky drivers can extend liability protection beyond standard limits. Our Auto-Owners Insurance review outlines all of your options.

Cons

- No Usage-Based Telematics: Kentucky drivers miss out on app-based safe driver programs and UBI discounts.

- Limited Availability: Auto-Owners is only available in 12 states, so if you move from Kentucky, you could lose any loyalty and dividend rewards.

#9 – Liberty Mutual: Best for New Cars

Pros

- New Car Replacement: Covers the full value of new cars totaled in Kentucky with its New Car Replacement and Better Car Replacement endorsements.

- Bundling Savings: Kentucky families save up to 20% by combining auto and home insurance.

- RightTrack Program: Liberty Mutual’s usage-based insurance in Kentucky rewards safe driving with discounts up to 30%. Learn how to qualify in our Liberty Mutual review.

Cons

- Limited Availability: Certain optional benefits, such as accident forgiveness, may not be available in all Kentucky ZIP codes.

- Low Claims Score: Liberty Mutual’s low 626/1,000 J.D. Power rating trails top Kentucky providers for satisfaction.

#10 – Travelers: Best for Industry Experience

Pros

- 100 Years of Experience: Our Travelers auto insurance review breaks down how the provider has specialized in personal insurance for more than a century.

- Strong Financial Stability: With an A++ A.M. Best rating, Travelers is one of the strongest auto insurance companies in Kentucky for handling claim payouts.

- IntelliDrive UBI App: Safe Kentucky drivers get up to 30% off with telematics, while select drivers may qualify for mileage-based IntelliDrive Plus.

Cons

- Limited Accident Forgiveness: This coverage option is not consistently available to Kentucky policyholders in all ZIP codes.

- Limited Local Support: Fewer Kentucky agents compared to networks like State Farm’s and Farmers’.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Between KY Auto Insurance Companies

Erie, Nationwide, and State Farm stand out as the best auto insurance companies in Kentucky because each helps drivers save in different ways.

They’ve also built strong reputations across the state, giving drivers peace of mind when it comes to both pricing and reliability. Compare car insurance rates by state to learn more.

Finding the best auto insurance in Kentucky means looking beyond just the cheapest price and focusing on what really fits your needs.

It’s not only about cost. Pick a company that gives solid support and discounts that match the way you drive. Here are a few things to keep in mind:

- Evaluate Claims Satisfaction: Erie earned a 718/1,000 satisfaction score in Kentucky and carries an A+ A.M. Best rating, giving local drivers confidence that their claims will be handled quickly.

- Use Telematics to Lower Rates: Nationwide Drivewise and State Farm’s Drive Safe & Save often save Kentucky drivers up to 30%, especially in rural counties with lower annual mileage.

- Seek Accident Forgiveness Programs: Nationwide offers accident forgiveness, which helps Kentucky drivers avoid big jumps after their first at-fault accident, especially in higher-traffic areas like Bowling Green.

- Leverage Multi-Policy Discounts: Bundling auto with home through Erie or Geico can cut costs up to 25%, saving Kentucky families in Richmond and other suburbs hundreds yearly.

- Compare ZIP Code-Specific Rates: In Louisville’s 40214, full coverage averages $185 a month, but in Lexington’s 40511, it’s closer to $120, proving Kentucky addresses change premiums by $60 or more.

The best auto insurance companies in Kentucky give you savings, strong claims support, and discounts that fit local driving habits across Louisville, Lexington, and beyond.

Use our free quote tool to compare local Kentucky car insurance quotes and find the best deal near you.

Frequently Asked Questions

What is the best auto insurance in Kentucky?

Erie is often ranked the best auto insurance in Kentucky, offering full coverage as low as $125 per month and top-rated claims satisfaction. Which insurance company in Kentucky has the highest customer satisfaction? Erie ranks highest in Kentucky with a 718/1,000 J.D. Power claims satisfaction score.

Who is the most reliable auto insurance company in Kentucky?

State Farm is one of the most reliable providers, especially for auto insurance for multiple vehicles, serving over 32% of Kentucky drivers.

What insurance company has the most complaints in Kentucky?

Which Kentucky auto insurance company rejects the most claims? Allstate and Liberty Mutual report some of the highest complaint ratios in Kentucky, according to the NAIC, with issues primarily tied to claims handling and settlement delays.

What is the average cost of car insurance in Kentucky?

So, what’s the average car insurance cost in Kentucky? In Kentucky, drivers pay around $97 a month for minimum coverage and about $224 for full coverage.

Your ZIP code, driving record, and even credit score can push those numbers up by $60 or more, especially if you add comprehensive auto insurance to protect against things like theft, hail, or flooding.

How much should a 55-year-old male pay for car insurance in Kentucky?

A 55-year-old Kentucky driver with a clean record may pay around $30 monthly with Erie, $33 with Geico, or $41 with State Farm. These lower premiums reflect a safe driving status and years of experience.

Is Geico a good auto insurance company in Kentucky?

Geico offers the most affordable auto insurance in Kentucky, with minimum coverage starting at $35 monthly. Safe drivers can save up to 25% with the DriveEasy telematics program.

Is Farmers a good Kentucky auto insurance company?

Farmers is a good option for drivers who want customizable policies, offering add-ons like accident forgiveness and glass coverage. However, rates average $ 120 or more monthly, higher than those of competitors like Erie and Geico, unless you apply smart hacks to save money on your premium through discounts and policy adjustments.

What are the best-rated insurance companies for home and auto in Kentucky?

State Farm, Nationwide, and Allstate are top-rated for home and auto bundles in Kentucky. They offer up to 25% in multi-policy discounts that save families hundreds each year.

What is the best comprehensive car insurance in Kentucky?

Erie provides the best comprehensive auto coverage in Kentucky, protecting against theft, hail, and flood damage. Rates average $125 per month, and policies include options such as glass repair with no deductible.

What is considered full coverage car insurance in Kentucky?

Full coverage in Kentucky usually includes liability, PIP, collision auto insurance, comprehensive, and uninsured/underinsured motorist coverage. This protects drivers from medical bills, at-fault accidents, and non-collision events, such as theft or weather damage.

Why is auto insurance so high in Kentucky?

How do you find the best car insurance in Kentucky?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.