Best Auto Insurance for Buicks in 2026

Erie, USAA, and Nationwide offer the best auto insurance for Buicks, with rates starting at $58 a month. Buick car insurance varies by driver and model, with the Buick Enclave insurance cost being among the highest. Safe drivers can earn discounts up to 40% through usage-based programs from State Farm and Safeco.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated March 2026

You can get the best auto insurance for Buicks from Erie, USAA, and Nationwide, with rates starting at $58 a month for eligible drivers.

- Nationwide protects new Buicks with total loss replacement

- USAA has the cheapest Buick auto insurance for military families

- State Farm covers Buick OnStar tech with no surcharge

USAA and Erie are the cheapest Buick car insurance companies, while Nationwide offers the best coverage for new Buicks. Keep reading to compare auto insurance companies that specialize in Buick insurance.

Amica offers full glass repair with no deductible and no premium increase, OEM parts replacement, and up to 20% annual policyholder dividends.

Top 10 Companies: Best Auto Insurance for Buicks| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A+ | Rate Lock |

| #2 | 741 / 1,000 | A++ | Military Savings | |

| #3 | 729 / 1,000 | A+ | New Models | |

| #4 | 718 / 1,000 | A+ | Low Rates | |

| #5 | 716 / 1,000 | A+ | Usage Based | |

| #6 | 711 / 1,000 | A+ | Leased Models | |

| #7 | 702 / 1,000 | A | Teen Drivers |

| #8 | 691 / 1,000 | A++ | Hybrids & EVs | |

| #9 | 690 / 1,000 | A | Discounts | |

| #10 | 672 / 1,000 | A | Custom Parts |

Auto-Owners stands out with unlimited roadside assistance, accident forgiveness, gap coverage for financed Buicks, and complimentary rental reimbursement, while State Farm is a popular pick for low-mileage and usage-based insurance (UBI) discounts.

If you’re ready to shop for auto insurance, enter your ZIP code now to uncover affordable Buick insurance options near you.

Comparing Buick Car Insurance Rates

Insurance rates for Buicks impact monthly budgets by over 50%, depending on the plan. USAA and Erie offer the lowest rates, but they aren’t available to every driver.

Your Buick insurance cost will also vary based on age, driving record, and the model you drive. The Buick Enclave insurance cost is among the most expensive, so use insurance comparison websites to compare quotes from multiple companies side by side.

Minimum & Full Coverage Buick Insurance Costs

Amica’s $65 monthly minimum coverage means lower upfront costs, which is ideal for Buick owners who drive less or use their cars seasonally.

On the other hand, Farmers charges $185 per month for full coverage, which is $40 a month more than USAA’s rate, making it harder to justify for an older Buick model.

Buick Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $72 | $175 |

| $65 | $160 | |

| $68 | $168 | |

| $62 | $155 |

| $75 | $185 | |

| $70 | $178 | |

| $66 | $165 | |

| $64 | $162 | |

| $67 | $170 | |

| $58 | $145 |

Nationwide’s $178 monthly full coverage may suit new Buick owners seeking perks like total loss replacement, but it’s not the best choice for an older model. Explore real solutions for what to do if you can’t afford your auto insurance.

State Farm’s full coverage at $162 a month falls into the affordable tier, especially for those who qualify for its 30% usage-based discount.

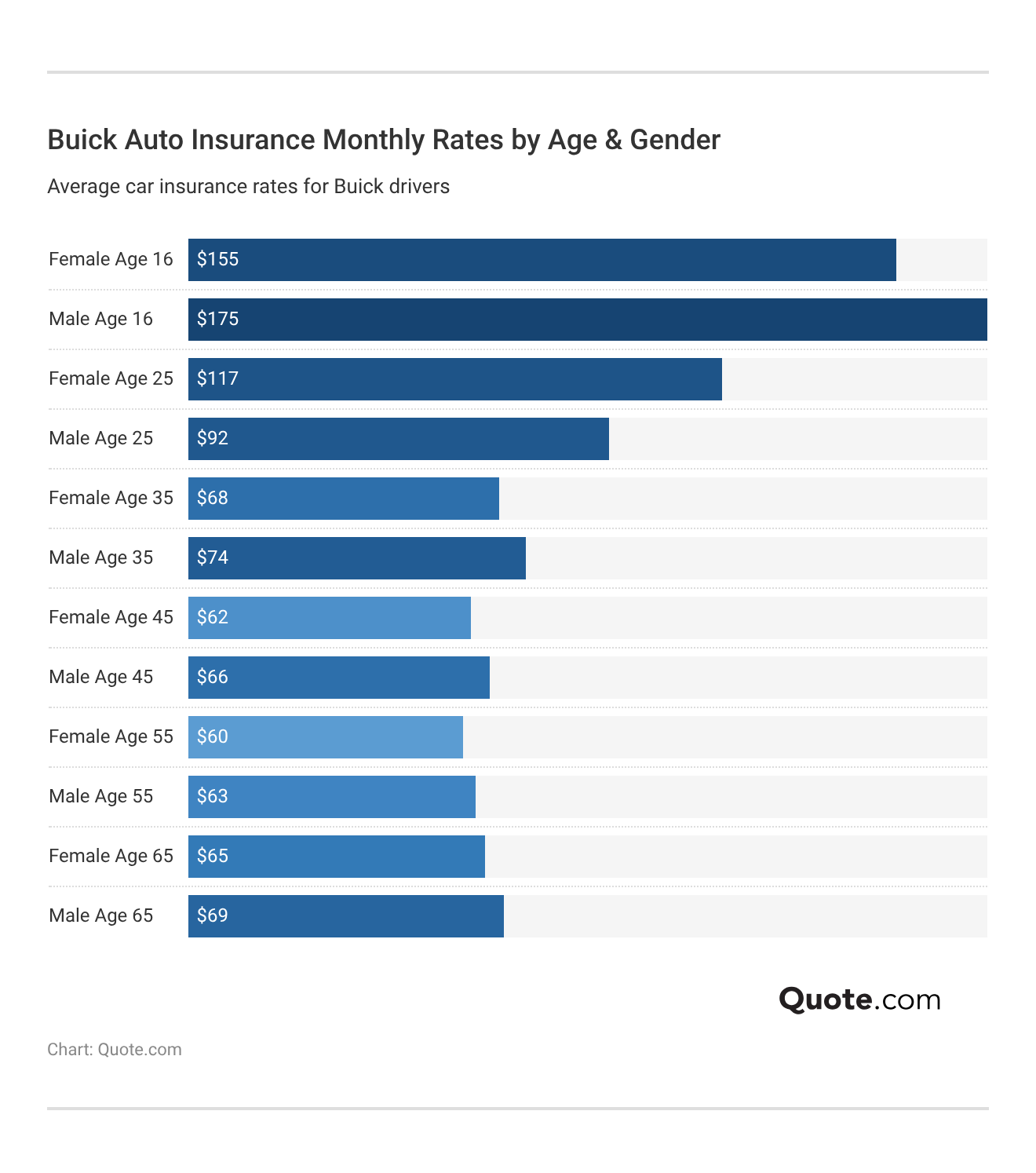

Buick Insurance Rates for Teens vs. Mature Drivers

Insurance quotes shift dramatically based on age, with younger drivers often absorbing most of the risk.

A 16-year-old pays closer to $170 a month for minimum coverage, compared to $62 a month for a 45-year-old driver.

Shopping around with more than one company can help you find cheap auto insurance for teens. For example, American Family offers competitive student discounts to lower rates and provides a teen driving app to improve driving habits.

Young drivers can also benefit from Nationwide and State Farm UBI programs that track driving patterns and encourage good habits to lower rates.

How Driving History Impacts Buick Premiums

Even one ticket or accident can add thousands to your premiums over just a year. Minimum coverage with a DUI can cost close to $160 a month, $100 more monthly than a peer with a clean record, totaling $1,200 or more per year.

USAA remains the most affordable for high-risk drivers in the military, while Erie and State Farm have the lowest rate increases after a violation.

Buick Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $72 | $97 | $119 | $151 |

| $65 | $88 | $107 | $137 | |

| $68 | $92 | $112 | $143 | |

| $62 | $84 | $102 | $130 |

| $75 | $101 | $124 | $158 | |

| $70 | $95 | $116 | $147 | |

| $66 | $89 | $109 | $139 | |

| $64 | $86 | $106 | $134 | |

| $67 | $90 | $111 | $141 | |

| $58 | $78 | $96 | $122 |

Is it bad to cancel car insurance as a high-risk driver? Yes, because it can increase your rates in the long run when you try to start coverage again.

Instead, shop around with providers like Erie, USAA, State Farm, and Nationwide, which won’t raise Buick insurance rates as high after a claim or DUI.

Buick Insurance Prices for Different Models

Are Buicks expensive to insure? Premiums can be higher because they reflect how each Buick is built, what it costs to repair, and how risky it is to insure.

Comparing premiums for different Buick car names can help you avoid overpaying when it’s time to buy auto insurance. Choosing the right model could save you close to $1,000 a year in premiums.

Buick Auto Insurance Monthly Rates by Model| Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Buick Cascada | $68 | $165 |

| Buick Enclave | $72 | $168 |

| Buick Encore | $65 | $158 |

| Buick Envision | $70 | $162 |

| Buick Envista | $66 | $160 |

| Buick LaCrosse | $61 | $155 |

| Buick Lucerne | $60 | $152 |

| Buick Regal | $63 | $158 |

| Buick Regal Sportback | $64 | $160 |

| Buick Roadmaster | $75 | $180 |

| Buick Verano | $59 | $150 |

Insurance rates for Buick Encore drivers average $158 a month for full coverage, while Buick Envision car insurance costs $162 monthly, which is cheaper than other models because they’re smaller, safer, and less expensive to fix.

Buick Verano car insurance is also one of the most affordable policies, starting at $59 a month for minimum coverage and $150 monthly for full coverage. Buick Regal car insurance, specifically for the Sportback, comes in at $160 a month.

Buick Enclave and Buick LaCrosse car insurance premiums are closer to $170 monthly, due to their size and upscale features.

A $45 gap between the newest and oldest Buick models may seem small monthly, but it adds up to over $500 per year.

Heidi Mertlich Licensed Insurance Agent

Monthly Buick premiums decrease consistently as the vehicle ages, but weigh how much you save on insurance against repair costs and actual cash value when comparing model years.

For instance, the 2025 Buick Envista insurance cost will be much higher, while the Buick Verano and Buick LaCrosse are the most reliable used Buick models for low rates. However, classic models like the Roadmaster don’t necessarily come cheaper.

Learn More: Best Classic Car Insurance

Buick Enclave Car Insurance Compared to Other SUVs

The Buick Enclave insurance cost is one of the steepest. Full coverage averages $168 a month with a clean record, which is higher than Hyundai and Volkswagen.

However, it is cheaper to insure than Chevy or GMC SUVs since it’s a smaller make and causes less damage in a collision. Important Details: Best Auto Insurance for GMCs

Buick Enclave vs. Similar SUVs: Auto Insurance Monthly Rates| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Buick Enclave | $72 | $168 |

| Acura MDX | $74 | $172 |

| Chevy Traverse | $68 | $172 |

| GMC Acadia | $70 | $170 |

| Hyundai Palisade | $66 | $160 |

| Kia Telluride | $68 | $165 |

| Mazda CX-70 | $70 | $168 |

| Lincoln Navigator | $80 | $185 |

| Volkswagen Atlas | $67 | $162 |

| Volvo XC90 | $76 | $178 |

Buick Enclave insurance is slightly higher than the Buick Envision insurance cost because it’s slightly larger in size, but it still costs less than comparable models because it isn’t the largest SUV on the market.

The bigger your vehicle, the more damage it can cause in a collision, which will raise your rates. Driving a Buick SUV like the Enclave can keep your premiums affordable without sacrificing too much space.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance Coverage Buick Drivers Need

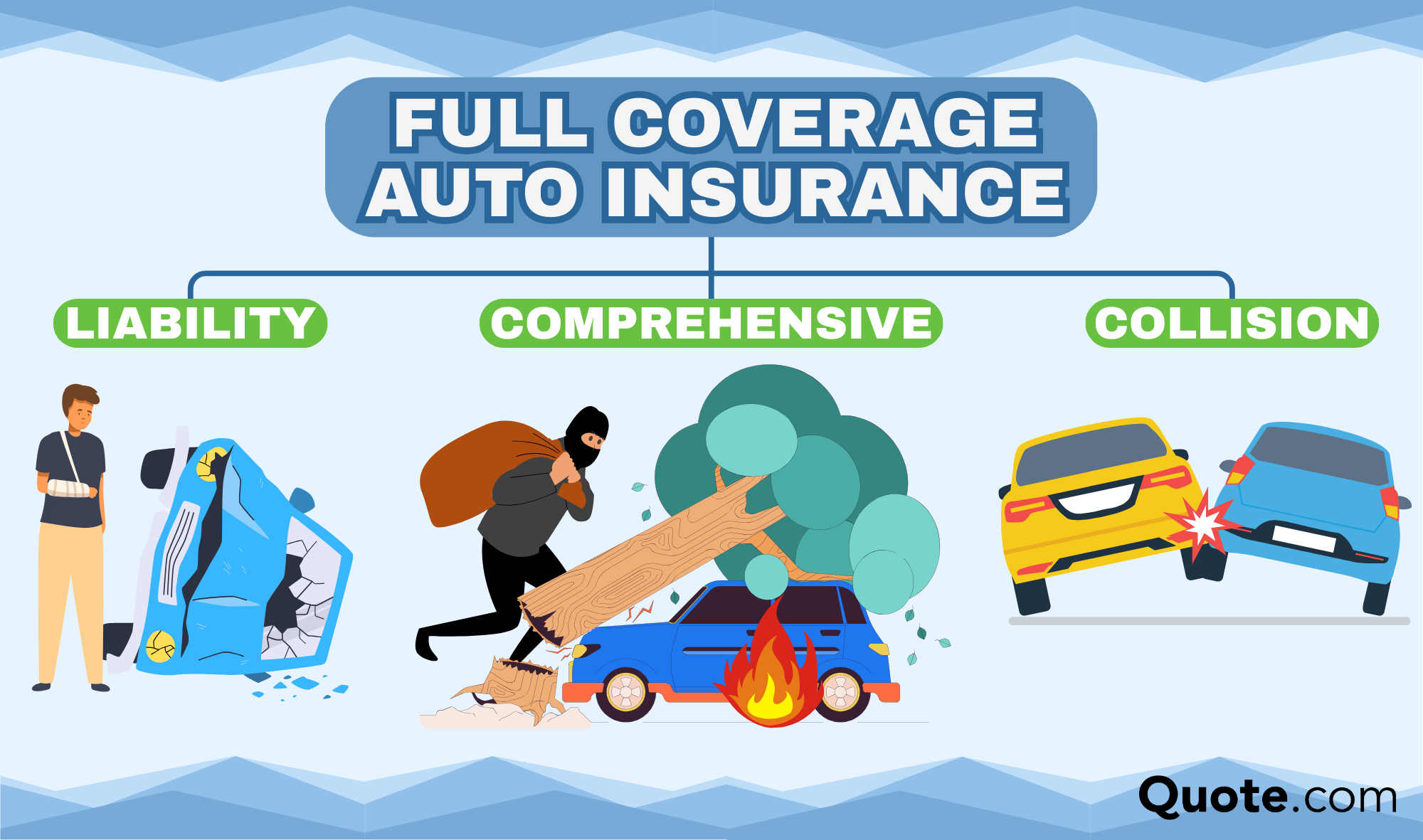

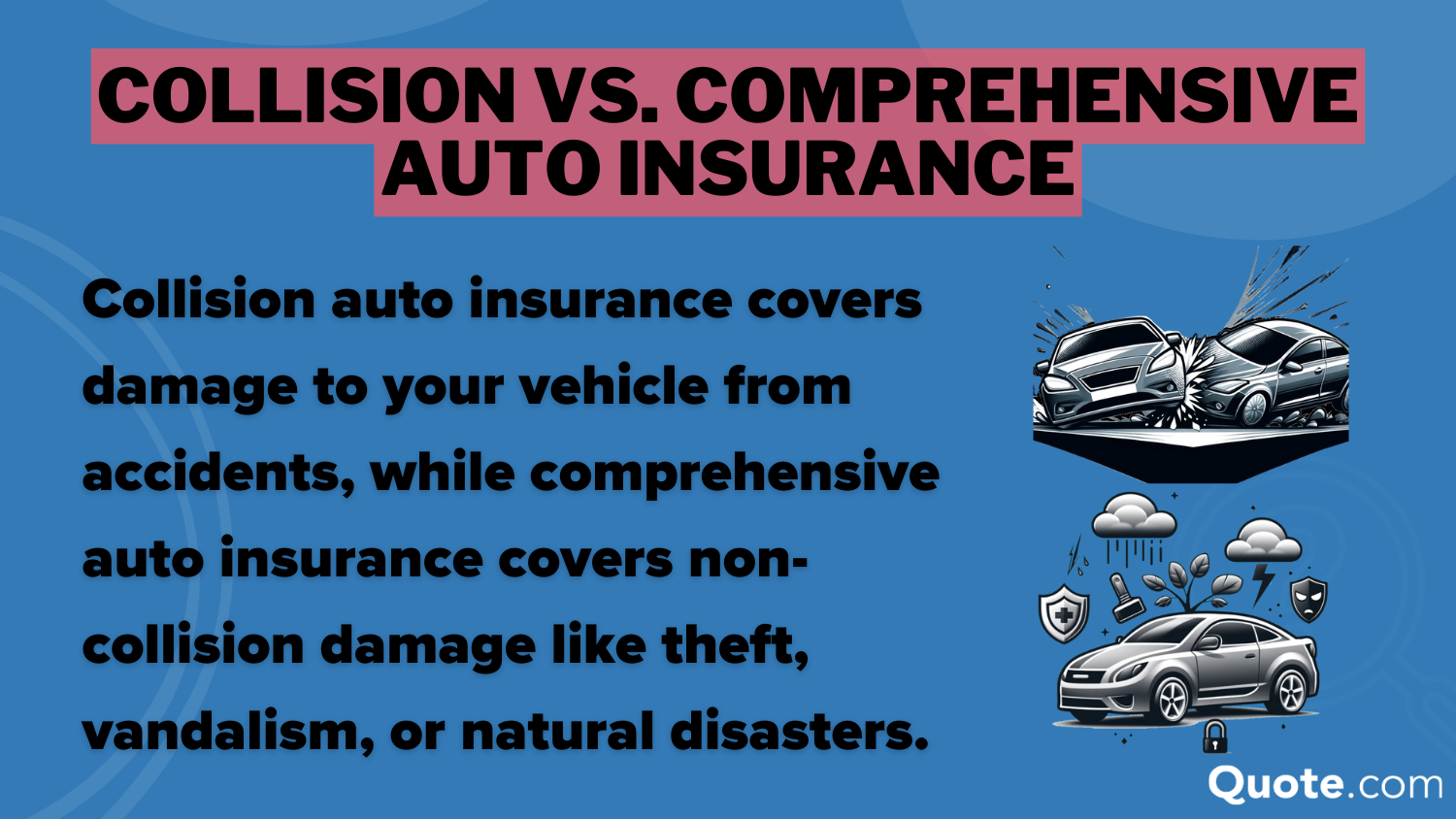

Each one of these core coverage types protects you from a different kind of loss, and skipping the wrong one could leave you with a bill you can’t afford.

Liability auto insurance is legally required in most states and protects you if you cause an accident, covering up to hundreds of thousands in injury or property damage, so you’re not paying out of pocket.

Auto Insurance Coverage Options for Buicks| Coverage Type | Description |

|---|---|

| Collision | Covers damage to your car in a crash |

| Comprehensive | Covers theft, vandalism, weather, etc. |

| Gap Insurance | Covers the loan balance if your car’s totaled |

| Liability | Covers others’ injuries and property damage |

| Medical Payments | Pays your medical bills after an accident |

| Personal Injury | Covers medical costs and lost wages |

| Rental Reimbursement | Pays for rental car if yours is in the shop |

| Roadside Assistance | Helps with towing, flat tires, lockouts, etc. |

| Uninsured Motorist | Covers you if the other driver has no insurance |

Lenders frequently require collision coverage and Comprehensive car insurance on financed Buicks. Combine these three standard policies to have full coverage on a Buick.

Fortunately, Buick reliability ratings are high, especially for the Envison and Encore. This helps keep full coverage Buick Encore insurance premiums low when you’re financing a new model since it’s affordable to repair or replace after a claim.

Your state laws may also require uninsured motorist protection and certain types of medical protection, which would be included as part of your liability coverage.

Uninsured motorist coverage kicks in if someone hits you and has no insurance. Medical payments and personal injury protection (PIP) cover ER visits, surgeries, or income loss if you can’t work.

Gap coverage is essential if your Buick is financed. It pays the difference on the loan if the Buick is totaled and worth less than what you owe. Our guide on the best time to buy a new car explains more.

Buick Auto Insurance Coverage Options by Provider| Company | Claim Forgiveness | Gap Plans | OEM Parts | Rideshare |

|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ |

| ❌ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | ❌ |

| ✅ | ❌ | ✅ | ❌ | |

| ❌ | ❌ | ✅ | ❌ | |

| ✅ | ❌ | ✅ | ❌ | |

| ✅ | ❌ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

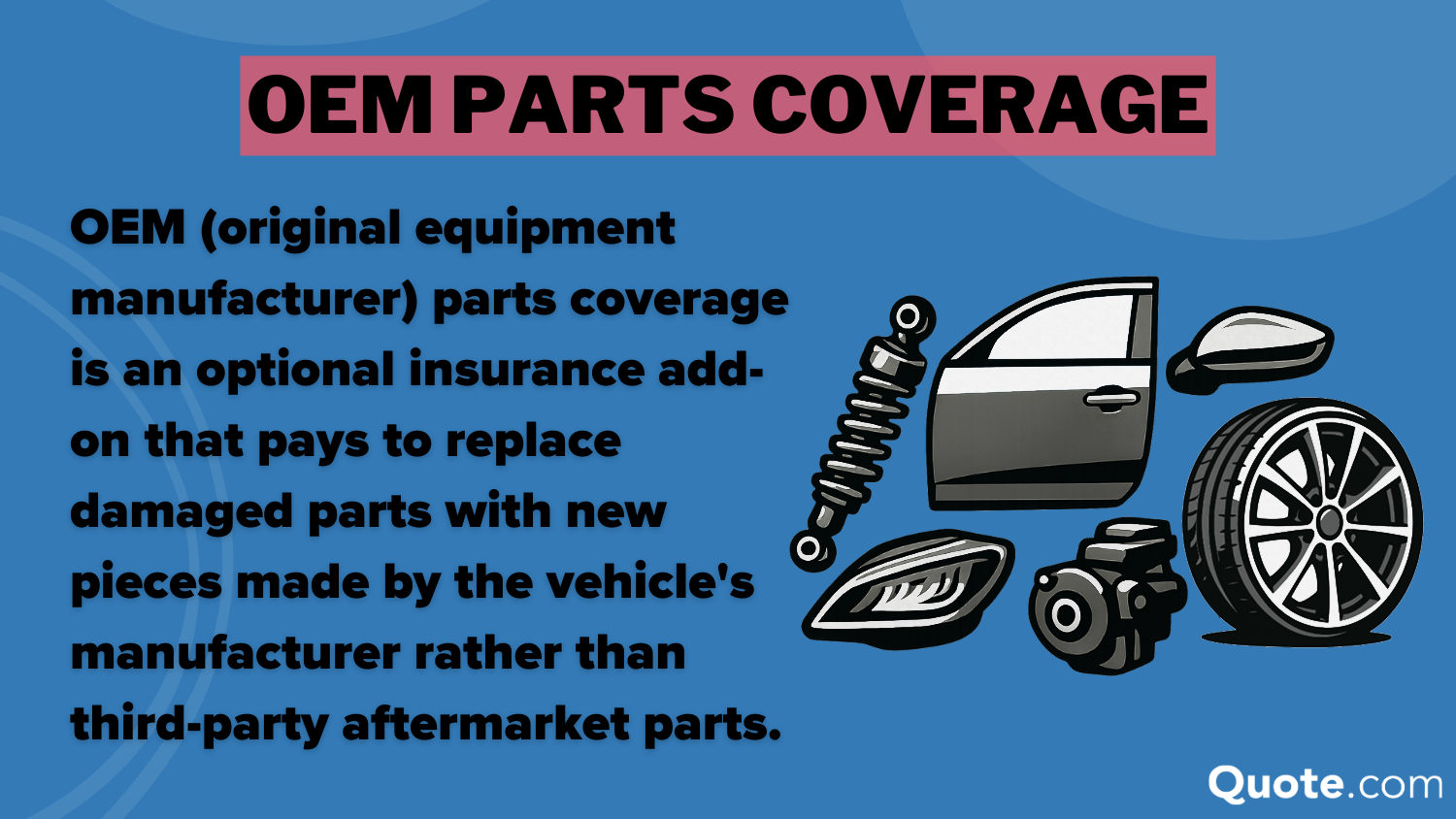

Other essential add-ons for newer Buicks include OEM parts coverage, which covers original-market parts for repairs to maintain your Buick’s integrity and performance.

OEM plans aren’t available with Amica and Auto-Owners, although these two providers offer other types of protection for Buicks.

Adding OEM, gap, rideshare, or claim forgiveness coverage will increase your monthly quotes but may be necessary if you drive a new car or use your Buick for work.

USAA, AmFam, and Travelers are the only Buick insurance companies that offer the most popular add-ons, so shop around if you’re looking for more than standard coverage.

How to Get Cheaper Buick Auto Insurance

Wondering how to lower your Buick Regal insurance cost? No matter what model of Buick you drive, there are a few things you can do to get better rates.

Your coverage levels and driving habits matter, and a few improvements can significantly lower your Buick auto insurance cost.

- Drop Unnecessary Coverage: Drivers with older Buicks should consider dropping collision and comprehensive if their car would cost more to repair than it’s worth.

- Get Multiple Quotes: Get an anonymous insurance quote from at least three different providers and compare them to your Buick premiums to get a lower rate.

- Maintain a Good Driving Record: Safe drivers who avoid traffic citations and filing claims get the lowest rates and can also qualify for exclusive good driving discounts.

- Qualify for Discounts: Along with good driving, Buick drivers can earn claim-free, age-related, and member affiliate discounts based on where they work or went to school.

One of the best hacks to save money on car insurance is knowing which discounts count and how they align with your driving habits, payment options, and profile.

With rate differences reaching over $100 per month between some companies, Buick owners can save significantly by leveraging discounts. However, not all discounts are created equal. Some shave just a few dollars, while others cut Buick premiums in half.

Top Auto Insurance Discounts for Buick Drivers by Provider| Company | Bundling | Military | Pay-in-Full | Usage Based |

|---|---|---|---|---|

| 25% | 12% | 20% | 30% |

| 30% | 10% | 15% | 20% | |

| 16% | 10% | 12% | 30% | |

| 25% | 12% | 5% | 30% |

| 20% | 20% | 10% | 30% | |

| 20% | 15% | 15% | 40% |

| 15% | 25% | 15% | 30% | |

| 17% | 25% | 15% | 30% | |

| 13% | 10% | 15% | 30% | |

| 10% | 30% | 20% | 30% |

Nationwide’s 40% UBI discount is the highest on the list, potentially saving over $75 per month for low-mileage Buick drivers.

State Farm Drive Safe & Save UBI is also competitive with a 30% discount, and State Farm also won’t raise rates for tracking bad driving habits.

Usage-based discounts like SmartRide or Drive Safe & Save reward actual driving behavior, which is ideal for low-mileage or safe Buick drivers.

Brad Larson Licensed Insurance Agent

American Family’s 25% bundling deal can drop a $274 full coverage premium to around $205 when paired with homeowners insurance coverage, making it a smart move for property-owning drivers.

Paying in full with AmFam also yields up to 20% off, which is ideal for Buick owners looking to skip monthly billing fees.

The Best Buick Insurance Companies

Erie, USAA, and Nationwide are the top picks for the best car insurance for Buicks. With monthly rates starting as low as $58, USAA is also one of the most popular Buick providers.

State Farm stands out as another popular company, with a 30% discount available through its Drive Safe & Save program. Compare Now: State Farm vs. Farmers, Geico, Progressive, & Allstate Review

Erie and Nationwide aren’t available in all states, which impacts their market share but gives them the ability to provide a better customer service experience than Geico or Progressive customers.

Erie has the highest claims satisfaction score despite its regional limitations, and its Rate Lock program locks in low rates regardless of claims or driving history.

If you need more affordable Buick Lacrosse insurance, Amica provides full glass repair with no deductible and up to 20% in annual policyholder dividends.

Auto-Owners includes diminished value coverage and rental reimbursement at no added cost, ideal for newer Buicks, especially the Buick Envista 2025 model or newer.

The best way to find savings for your specific model is to compare personalized Buick auto insurance quotes online. Enter your ZIP code to get free quotes today.

#1 – Erie: Top Pick Overall

Pros

- Rate Lock Guarantee: Erie offers the best Buick car insurance by locking in low rates regardless of driving record or claims, unless coverage changes.

- Multi-Policy Discount: Buick owners bundling home and auto enjoy one of the largest combo savings offered. Explore rates and discounts in our Erie auto insurance review.

- Erie Auto Plus: Adds diminishing deductible, locksmith service, and first-accident forgiveness for Buicks at an affordable rate.

Cons

- Only Available in 12 States + D.C.: Buicks in most western or southern states can’t be insured through Erie.

- Slower Digital Claims: Buick owners must initiate most claims via phone, not an app or online portal.

#2 – USAA: Best for Military Savings

Pros

- Affordable Premiums: USAA has the cheapest Buick auto insurance rates for drivers in the military, starting at $58 monthly.

- Stored Vehicle Discount: Buicks stored during deployment receive up to 60% off comprehensive-only policies. There’s a full list of discounts in our USAA insurance review.

- Emergency Road Service Add-On: Offers 24/7 towing and locksmith coverage tailored for Buicks when selected.

Cons

- Military-Only Access: USAA is not available to civilian Buick owners unless their spouse or parent is active duty or a veteran.

- Limited In-Person Support: Buick claims and questions must be handled online or by phone due to fewer branches.

#3 – Nationwide: Best for New Buicks

Pros

- Total Loss Replacement Coverage: New Buicks under two years old are replaced with a new or similar model if they’re totaled in a claim.

- SmartRide Discount: Nationwide offers the best Buick auto insurance for drivers looking for usage-based programs. It has the biggest discount of up to 40%.

- Vanishing Deductible: Avoid filing Buick car insurance claims to see your deductible drop $100 every year. Our Nationwide insurance review explains how it works.

Cons

- Device Compatibility: Some older Buick models may not meet SmartRide telematics requirements.

- Delayed Total Loss Reimbursement: Replacing totaled Buicks can take 10–14 business days, longer than competitors.

#4 – Amica: Best for Low Rates

Pros

- Cheap Buick Insurance: Amica has low rates for minimum and full coverage car insurance for Buicks, with up to 20% annual earnings on dividends.

- Passive Restraint Discount: Buick drivers with factory-installed airbags and automatic seatbelts can qualify for an 11% discount. See More: Amica Insurance Review

- Platinum Choice Auto: Amica’s Buick protection plan covers OEM parts and includes identity fraud protection, new car replacement, and full glass repairs with a $0 deductible.

Cons

- No Rideshare Coverage: Amica does not offer rideshare add-ons for Buick drivers using platforms like Uber or Lyft for work.

- Limited Mobile App Features: The app lacks real-time roadside assistance and Buick auto insurance claims tracking.

#5 – State Farm: Best for Usage-Based Coverage

Pros

- Steer Clear Program: Buick drivers under 25 can qualify for discounts by completing this safe driving course.

- Drive Safe & Save Program: Our State Farm auto insurance review explains how Buick drivers can earn up to 30% off for safe driving through in-app or OnStar monitoring.

- Passive Restraint Discount: Safety-equipped Buicks qualify for additional savings through passive safety systems.

Cons

- Optional Add-Ons: Drivers must purchase separate rental reimbursement and roadside assistance, and it often costs more than at other Buick auto insurance companies.

- Not Available Everywhere: State Farm may not write new Buick insurance policies in California, Florida, Massachusetts, and Rhode Island.

#6 – Auto-Owners: Best for Leased Buicks

Pros

- Loan/Lease Gap Coverage: Covers the remaining loan balance if a financed Buick is totaled in a covered loss, and it costs less than $5 a month.

- Passive Restraint Discount: Buick models equipped with airbags and automatic belts qualify for a 10% discount.

- Personal Auto Plus Package: According to Auto-Owners reviews, Buick drivers add this for rental reimbursement, trip interruption, and identity theft protection.

Cons

- Limited Digital Management: Buick insurance can’t be managed fully online, and policy changes must be handled through an agent.

- Regional Coverage: Auto-Owners is available in 26 states, limiting access for Buick owners outside that range.

#7 – American Family: Best for Teen Drivers

Pros

- Teen Safe Driver App: Buick teen drivers can reduce premiums by up to 10% using mobile-based driving reports.

- Discounts for Good Students: Full-time students in high school and college who drive Buicks and maintain a B average or higher qualify for savings.

- Bundling Discount: Families insuring Buicks and homes under American Family save up to 25%.

Cons

- Device Monitoring Required: Buick discounts tied to teen behavior require active mobile tracking.

- Premium Spikes for Teen Accidents: At-fault crashes involving Buicks driven by teens can raise rates by 30% or more. Learn More: AmFam Insurance Review

#8 – Travelers: Best for Hybrid Buicks

Pros

- Hybrid Vehicle Discount: Buicks like the Envision Hybrid qualify for eco-friendly benefits, including premium discounts and coverage add-ons.

- IntelliDrive Discount: Buick drivers earn significant savings of up to 30% by enrolling in this 90-day telematics program.

- Passive Restraint Discount: Buicks with built-in airbags and passive belts automatically earn 7% off premiums.

Cons

- Telematics Penalties: Risky driving habits tracked by IntelliDrive can increase Buick insurance costs.

- High Starting Rates: Initial quotes for Buicks tend to be above the market average before applying discounts. Compare quotes for free in our Travelers auto insurance review.

#9 – Farmers: Best for Discount Stacking

Pros

- Signal App Discount: Buick drivers who track their driving habits using the usage-based app receive discounts of up to 30% based on real-time behavior data.

- Multi-Line Discount: Combining auto, life, and renters coverage slashes Buick premiums by 20%.

- Affordable OEM Coverage: This optional endorsement ensures new Buick parts are used after repairs and costs less than at other companies.

Cons

- Default $1,000 Deductible: Buick policies often default to this higher deductible unless manually adjusted through a Farmers agent.

- Three-Day Rental Cap: Basic policy only includes rental car coverage for three days unless upgraded. Explore policy options in-depth in our Farmers Insurance review.

#10 – Safeco: Best for Custom Equipment

Pros

- Custom Equipment Coverage: Safeco protects aftermarket parts added to Buicks, such as audio systems or navigation units.

- RightTrack Program: Buick drivers earn up to 30% off with this usage-based discount program. Our Safeco auto insurance review walks you through the sign-up process.

- Diminishing Deductible Program: Deductible reduces by $100 each year you avoid filing a Buick insurance claim.

Cons

- Limited OEM Parts Coverage: May require policy upgrades to ensure original parts are used after repairs.

- Below-Average Customer Service: Buick auto insurance customer service ratings are lower than any other provider on this list.

Frequently Asked Questions

Who offers the best auto insurance for Buicks?

Erie offers the best car insurance coverage for Buicks, with a rate lock guarantee and top-tier roadside assistance that includes accident forgiveness.

Read More: Erie vs. MetLife Insurance

Are Buicks more expensive to insure?

Buicks are not considered expensive to insure. Full coverage rates average $170 per month for a newer model, which is cheaper than average.

Is $200 a month a lot for Buick auto insurance?

Yes, $200 a month is high unless you’re insuring a new Buick with full coverage. Farmers charges $185 monthly for full coverage, while Amica auto insurance costs $160 a month. Overpaying without shopping around is one of the top ways you’re wasting money on your car.

Which company has the cheapest Buick auto insurance?

USAA, Erie, State Farm, and Amica have the most affordable Buick car insurance, often offering minimum coverage under $70 a month with multi-vehicle and safe-driving discounts. Enter your ZIP code to find the cheapest Buick auto insurance company near you.

What is the cheapest full coverage auto insurance for Buicks?

USAA provides the cheapest full coverage car insurance for Buicks at $145 per month, but it’s only available to military members. Erie and Amica are the next-cheapest options at around $155-$160 monthly.

How do I get a better deal on Buick auto insurance?

Yes, Buick drivers can save over $100 monthly by switching providers, bundling with homeowners insurance, and using telematics like State Farm’s Drive Safe & Save. Learn how it works in our guide to usage-based car insurance.

Is State Farm cheaper than Geico for Buick auto insurance?

Geico is often cheaper than State Farm for Buicks, but State Farm offers a 30% safe-driving discount through Drive Safe & Save, which can offset higher base rates.

Is Allstate cheaper than Geico for Buicks?

Geico insurance is typically cheaper than Allstate for Buicks, with rates averaging $30 to $50 lower per month when paired with discounts like multi-policy or good driver.

Is Geico or Progressive better for Buick insurance coverage?

Geico is best for budget-conscious Buick drivers with a clean record, while Progressive insurance offers better flexibility for high-risk drivers and optional accident forgiveness.

Why is my Buick car insurance so high with a clean record?

Even with a clean record, rates can be high due to ZIP code risk factors, insuring a newer model, low deductibles, or lack of usage-based program participation. Find out what to do when you’re denied insurance coverage.

What is the best way to get cheap Buick auto insurance?

What is the cheapest Buick auto insurance for seniors over 60?

What color of Buick is the cheapest to insure?

At what point is Buick car insurance not worth it?

What is the average Buick Envista insurance cost per month?

How much is Buick Cascada car insurance?

How much does Buick Encore insurance cost?

How much is Buick Lucerne car insurance?

Are Buicks reliable compared to other mid-size vehicles?

Which Buick auto insurance company denies the most claims?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.