Best Auto Insurance for Chevrolets in 2026

Liberty Mutual, Nationwide, and State Farm have the best auto insurance for Chevrolets. The cheapest Chevrolet car insurance starts at $57 a month, and you can get lower rates with anti-theft discounts from American Family and Geico. Chevrolet insurance rates will be higher if you drive a Camaro or Corvette.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated February 2026

Liberty Mutual, Nationwide, and State Farm have the best auto insurance for Chevrolets. Geico has the cheapest auto insurance for Chevrolets at $58 a month.

- Nationwide has high Chevy car insurance claim satisfaction

- Liberty Mutual provides 35% off for Chevys with anti-theft systems

- Geico has cheap full coverage Chevrolet insurance for $145 a month

Geico keeps premiums low for Chevy Malibu and Chevrolet Traverse car insurance by offering discounts for features like lane departure warnings and anti-lock brakes.

However, Nationwide and State Farm have higher customer service ratings from drivers who’ve filed Chevrolet car insurance claims.

Top 10 Companies: Best Auto Insurance for Chevrolets| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 730 / 1,000 | A | Custom Plans |

| #2 | 729 / 1,000 | A+ | Deductibles |

| #3 | 716 / 1,000 | A++ | Low Mileage | |

| #4 | 716 / 1,000 | A+ | Senior Drivers |

| #5 | 702 / 1,000 | A | Claims Service |

| #6 | 697 / 1,000 | A++ | Cheap Rates | |

| #7 | 693 / 1,000 | A+ | New Chevys | |

| #8 | 691 / 1,000 | A++ | Hybrids/EVs | |

| #9 | 690 / 1,000 | A | OEM Coverage | |

| #10 | 673 / 1,000 | A+ | Usage Based |

Liberty Mutual has the highest claims satisfaction among Chevy auto insurance companies, and it offers customizable options for new Chevys. Learn more in our guide: Liberty Mutual vs. Nationwide Auto Insurance

Looking for Chevrolet car insurance at a great price? Enter your ZIP code to see what’s available near you.

Compare Chevrolet Car Insurance Rates

When you’re shopping for the best car insurance for Chevrolets, picking the right policy could save you hundreds each year.

Shop around and compare anonymous auto insurance quotes from both local and national providers to see which company can get you the best Chevy insurance policy in your budget.

Cost of Minimum vs. Full Coverage for Chevys

While minimum liability insurance will meet your state’s legal requirements, you may want to carry full coverage if you have a brand new Chevy or drive an expensive model, like the Corvette or Silverado.

Geico has the best cheap car insurance for Chevys at $58 per month. Its minimum coverage works well if you want cheaper Chevy Malibu insurance rates and just need the basics to stay legal.

Chevrolet Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $72 | $175 | |

| $62 | $155 |

| $75 | $185 | |

| $58 | $145 | |

| $70 | $170 |

| $61 | $160 | |

| $63 | $158 | |

| $60 | $152 | |

| $68 | $168 |

| $64 | $162 |

Geico is also the cheapest for full coverage, followed by State Farm. AmFam’s $155 per month for full coverage is a smart middle ground if you drive a truck or SUV. It offers solid protection without the risk of you overpaying for Chevrolet Avalanche car insurance.

Liberty Mutual is one of the most expensive Chevrolet car insurance companies, costing over $170 per month for full coverage.

However, Liberty Mutual is the top company for customizable full coverage options, including classic insurance for Chevrolet Camaro, Corvette, and other collector models.

Finding the cheapest Chevrolet auto insurance will depend on how much coverage you need, where you live, and your driving record. Get multiple car insurance quotes online to narrow down which provider is the best fit.

How Driving History Affects Chevrolet Insurance Costs

If you drive a Chevrolet, your record has a big say in your monthly insurance bill. Read our article for more details: High-Risk Auto Insurance

On average, Chevy drivers pay $60-$70 per month for minimum coverage, but just one speeding ticket bumps that up to over $100 monthly with some providers.

Chevrolet Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $72 | $101 | $122 | $158 | |

| $62 | $87 | $105 | $138 |

| $75 | $105 | $128 | $165 | |

| $58 | $81 | $99 | $127 | |

| $70 | $98 | $119 | $154 |

| $61 | $85 | $104 | $134 | |

| $63 | $88 | $107 | $139 | |

| $60 | $84 | $102 | $132 | |

| $68 | $95 | $116 | $149 |

| $64 | $90 | $109 | $142 |

If you have multiple violations, you could see your rates increase even more, with minimum coverage costing almost $650 more per year for Chevy drivers with more than one accident or DUI.

If you’re not sure how driving habits affect pricing, our definitive guide to usage-based car insurance explains how tracking tools can lower your rate.

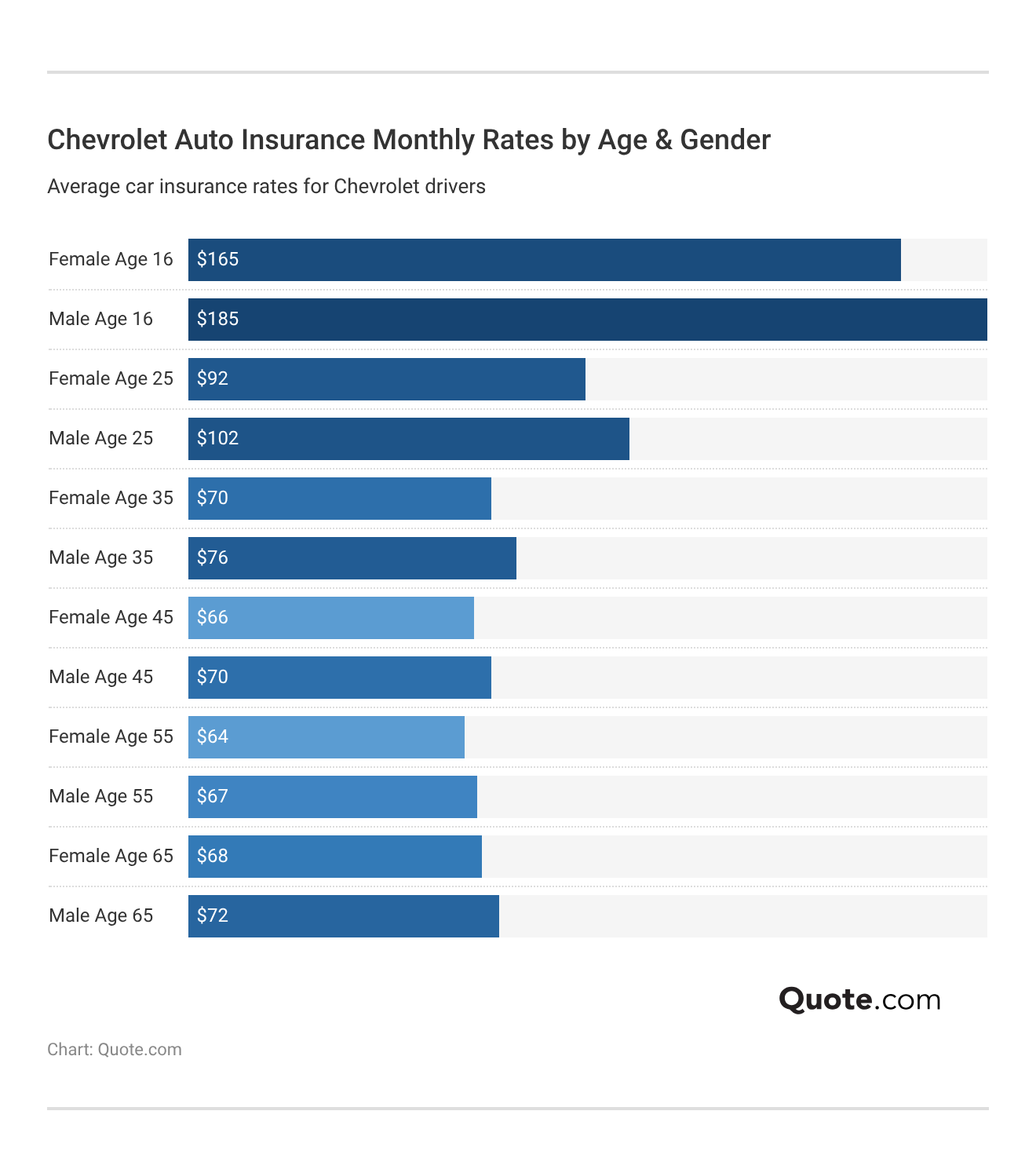

Average Chevrolet Car Insurance Rates by Age Group

Most Chevy models have affordable insurance rates, but teen drivers pay significantly more due to their lack of experience on the road.

Teen males under 18 have the highest Chevrolet car insurance rates, climbing as high as $185 a month for minimum coverage, which is more than double what experienced drivers pay.

Insurers consider teens and any young driver under 25 to be high-risk for accidents and claims. You can compare insurers online to find cheap auto insurance for teens.

Chevrolet auto insurance rates are cheapest for drivers in their 40s and 50s. If you maintain a clean driving record as you get older, you’ll enjoy cheap Chevy car insurance for longer.

How Chevy Insurance Prices Vary by Model

Chevrolets have some of the most expensive models to insure. The newer your Chevy, the more you’re likely to pay each month, mostly because those modern parts and sensors aren’t cheap to replace. Check Out: The Best Time to Buy a New Car

A brand-new Chevrolet can run you as much as $306 per month for full coverage, which makes sense with all the built-in tech and higher repair costs.

Insurance for a Corvette, for example, runs almost $200 per month for full coverage, the highest on the list, and no surprise — it’s fast and expensive to fix. Chevy Impala rates start low, but can climb for classic models and on Chevrolet Impala Limited car insurance.

Chevy Cruze insurance rates are more competitive at $150 a month since these smaller vehicles are easy to repair. Full coverage insurance for 2014 Chevy Cruze drivers will be much cheaper than those driving a new model.

Chevrolet Spark car insurance is the cheapest, while Chevrolet Colorado car insurance is more pricey because it’s an SUV. Insurance for the Chevrolet Camaro, another sporty model, comes in at $180 a month.

Chevrolet Auto Insurance Monthly Rates by Model| Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Chevrolet Blazer | $66 | $165 |

| Chevrolet Bolt EV | $70 | $178 |

| Chevrolet Camaro | $72 | $180 |

| Chevrolet Colorado | $67 | $170 |

| Chevrolet Corvette | $78 | $195 |

| Chevrolet Cruze | $60 | $150 |

| Chevrolet Equinox | $64 | $160 |

| Chevrolet Impala | $62 | $155 |

| Chevrolet Malibu | $61 | $152 |

| Chevrolet Silverado | $70 | $178 |

| Chevrolet Sonic | $59 | $148 |

| Chevrolet Spark | $57 | $145 |

| Chevrolet Suburban | $75 | $188 |

| Chevrolet Tahoe | $74 | $185 |

| Chevrolet Trailblazer | $63 | $158 |

| Chevrolet Traverse | $68 | $172 |

| Chevrolet Trax | $60 | $150 |

| Chevrolet Volt | $66 | $168 |

Car insurance for Chevy Silverado drivers is also pretty steep, with even higher rates for Chevrolet Silverado 3500HD CC car insurance. Compare quotes in our guide to the best insurance for trucks to find a better price on coverage.

Chevy Bolt EV premiums climb to $178 per month since electric vehicles cost more to repair. Chevrolet Volt insurance costs slightly less for a hybrid vehicle at $168 monthly.

Car insurance for a Chevy Malibu is more affordable at $152 a month, making it one of the cheapest options for drivers, but still not cheaper than Chevrolet Cruze car insurance.

Chevy drivers should match their coverage to the age, value, and use of their vehicle. Older models may only need liability.

Heidi Mertlich Licensed Insurance Agent

Chevrolet Silverado insurance is also affordable for most drivers, especially when compared to Chevrolet Tahoe car insurance. Coverage for smaller SUVs, like the Chevy Colorado, strikes a better balance for everyday use.

How much does Chevy Equinox insurance cost? Chevrolet Equinox car insurance is affordable at $160 a month for full coverage. You may qualify for cheaper Chevy Equinox insurance rates, given its smaller size and high safety ratings.

Chevy Traverse insurance rates are higher because large SUVs are more likely to cause more damage in a collision. Quotes can climb as high as $172 for full coverage, so always compare car insurance rates by model to find the best price.

Chevrolet Traverse Insurance Cost vs. Other SUVs

SUV insurance costs more than coverage for sedans because these are larger vehicles that cause more damage in a claim. The Chevy Traverse specifically has more expensive repairs, which drives up full coverage costs.

Chevrolet Traverse insurance may not be the most expensive, but rates are higher than other comparable models, especially for full coverage. Full coverage for a Traverse costs more to insure than the Ford Explorer and Toyota Highlander.

Chevy Traverse vs. Similar SUVs: Auto Insurance Monthly Rates| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Chevrolet Traverse | $68 | $172 |

| Ford Explorer | $78 | $170 |

| GMC Acadia | $72 | $165 |

| Honda Pilot | $75 | $168 |

| Hyundai Palisade | $70 | $160 |

| Kia Telluride | $73 | $167 |

| Mazda CX-90 | $75 | $170 |

| Subaru Ascent | $74 | $168 |

| Toyota Highlander | $76 | $170 |

| Volkswagen Atlas | $71 | $162 |

However, the minimum insurance rate is only $68 a month, showing that the Traverse costs more to repair than its competitors

If you’re in the market for a new Chevy, compare auto insurance rates by vehicle to ensure that it’s the model for you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Easy Ways to Save on Chevrolet Insurance

If you drive a Chevy, the right discounts can seriously cut your insurance bill. Students, safe drivers, and those bundling multiple policies get the best savings.

However, not all providers offer the same discounts, and a few stand out more than others with car insurance discounts you can’t miss.

Top Auto Insurance Discounts for Chevrolet Drivers by Provider| Company | Anti-Theft | Bundling | Good Student | Safe Driver |

|---|---|---|---|---|

| 10% | 25% | 22% | 18% | |

| 25% | 25% | 20% | 18% |

| 10% | 20% | 15% | 20% | |

| 25% | 25% | 15% | 15% | |

| 35% | 25% | 12% | 20% |

| 5% | 20% | 18% | 12% |

| 25% | 10% | 10% | 10% | |

| 15% | 17% | 35% | 20% | |

| 15% | 13% | 8% | 17% |

| 10% | 5% | 12% | 8% |

State Farm’s 35% good student discount could shave off over $40 a month if you’ve got a teen driving a Chevy Impala.

If you’ve completed a defensive driving course, Progressive’s 31% discount can lower full coverage on a Camaro by close to $80 monthly.

Stacking smaller discounts like a bundling deal with a clean driving record is one of the easiest ways to reduce Chevrolet full coverage costs.

Jimmy McMillan Licensed Insurance Agent

Have an anti-theft system in your Silverado? Liberty Mutual’s 35% discount makes them a solid pick for trucks parked overnight.

If you don’t qualify for some or all of these discounts, don’t worry. Here are some other easy ways to lower Chevrolet auto insurance rates, even if you have claims or accidents on your record.

- Choose Higher Deductibles: Consider how much you could reasonably pay out of pocket for a claim, and adjust your deductible to $1,000 or more to drastically cut rates.

- Park in a Garage: Keeping your Chevy in a garage or secure lot will reduce the risk of theft or vandalism and help lower your full coverage rates.

- Reduce Coverage: If you drive an older or reliable model, like the Chevy Tahoe or Malibu, you may want to carry liability-only insurance to pay the lowest rates.

The best way to find affordable coverage is to shop for Chevrolet insurance quotes online. Use the best insurance comparison websites to get multiple quotes at once.

Comparing multiple companies side-by-side will help you find the right policy at the lowest price.

Insurance Coverage Chevy Drivers Need

The coverage you choose can make a big difference to your Chevrolet car insurance cost. Minimum liability is the cheapest, but it won’t protect your Chevy in an accident.

If you’re unsure what coverage you need, this quick guide to auto insurance highlights the options that matter most for Chevy owners.

- Collision/Comprehensive Coverage: Full coverage includes collision and comprehensive insurance to cover repairs after a collision or if your Chevy is stolen.

- Gap Coverage: Gap insurance protects newer models if you still have an auto loan when your Chevy is totaled.

- Medical Payments/Personal Injury Protection: MedPay covers medical bills after a claim, and PIP pays for medical bills, lost wages, and household care after an accident.

- OEM Parts: OEM parts coverage ensures Chevy repairs use factory-original components, helping preserve resale value.

Chevy owners in some states are required to carry uninsured/underinsured motorist coverage, but you may want to add it even if it’s not required. If someone else causes the damage and they’re uninsured, UM/UIM coverage keeps you from footing the bill.

If you drive a collector auto, like the ’53 or ’57 Chevy Corvette, you’ll want classic car insurance to protect your investment. The best Corvette insurance options will include coverage for traveling to car shows.

Classic car insurance is often cheaper than standard minimum or full coverage policies, which can bring down Chevrolet Impala car insurance rates, but may limit your use or mileage.

Not every top Chevrolet car insurance company offers the same coverage, so shop around to find the provider with the right policy for you.

Chevrolet Auto Insurance Coverage Options by Provider| Company | Claim Forgiveness | Classic Auto | Gap Plans | Rideshare Coverage |

|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ✅ |

| ✅ | ✅ | ❌ | ❌ | |

| ❌ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ❌ | ❌ |

| ❌ | ✅ | ❌ | ❌ | |

| ✅ | ❌ | ✅ | ✅ | |

| ✅ | ❌ | ❌ | ✅ | |

| ❌ | ✅ | ❌ | ❌ |

| ✅ | ❌ | ✅ | ✅ |

If you drive a collector auto, many of the best car insurance companies for Chevrolets don’t offer classic policies themselves but partner with other providers who specialize in antique autos.

For example, Geico partners with Assurant, while Allstate and The Hartford work with Hagerty. Other companies don’t offer policies at all, so shop around to find the provider that offers what you need.

Top Insurance Companies for Chevrolets

Nationwide, Liberty Mutual, and State Farm have the best car insurance for Chevrolets, offering the lowest rates in most states.

State Farm is also the largest Chevy car insurance provider, followed by Geico and Progressive. Read More: State Farm vs. Progressive Auto Insurance

However, just because a provider is popular doesn’t mean it’s the right fit for you. Compare multiple companies to see the quotes and policies available in your area.

Your rates will vary by where you live and the model you drive, so explore our list for the best companies for hybrid Chevys, senior drivers, and customer satisfaction.

#1 – Liberty Mutual: Top Pick Overall

Pros

- Custom-Built Coverage: Chevy drivers can enhance coverage with unique add-ons like better car replacement, which replaces a totaled car with a newer model with fewer miles.

- Deductible Fund: Chevrolet policyholders earn $100 off their deductible the first year and $50 each subsequent year without a claim.

- Insurance for Teachers: Educators with Chevys get exclusive discounts and coverage for incidents that happen at school. Find out if you qualify in our Liberty Mutual review.

Cons

- Low Customer Satisfaction Scores: Liberty Mutual consistently ranks below other Chevrolet car insurance companies when it comes to claim satisfaction.

- Premium Variability: Liberty Mutual premiums for Chevrolets with previous claims or aftermarket modifications tend to fluctuate sharply.

#2 – Nationwide: Best for Deductible Rewards

Pros

- Vanishing Deductible: Deductibles on Chevrolet claims drop by $100 annually for safe driving, with a cap of $500. See how it works in our Nationwide insurance review.

- SmartRide UBI Program: Real-time driver behavior monitoring through usage-based insurance delivers personalized savings of up to 40% on Chevy car insurance.

- Accident Forgiveness: Keeps your Chevrolet auto insurance costs from going up after your first accident if you qualify.

Cons

- Coverage Add-On Costs: Important features like towing or rental for Chevrolets are not included by default, and premiums go up if you add this coverage.

- Fewer Chevrolet Loyalty Rewards: Long-term Chevrolet policyholders receive fewer perks compared to American Family or Allstate.

#3 – State Farm: Best for Low Mileage

Pros

- Low-Mileage Discounts: You can save 30% on rates if you drive your Chevy less than 7,500 miles annually.

- Drive Safe & Save UBI: Chevrolet drivers tracked with this usage-based app can earn up to 30% off for consistent safe habits.

- Multi-Vehicle Savings: Drivers insuring two or more vehicles with State Farm can receive additional savings of up to 20% off Chevy auto insurance rates.

Cons

- High Teen Driver Surcharge: Adding a young driver to a Chevrolet car insurance policy significantly raises monthly premiums. Compare costs in our State Farm insurance review.

- Regional Renewal Issues: Chevy drivers in high-risk states like California, Florida, and Rhode Island may not be able to renew their policies or buy new coverage.

#4 – The Hartford: Best for Senior Drivers

Pros

- AARP Auto Insurance: Senior Chevrolet owners receive guaranteed renewals, first-accident forgiveness, and exclusive discounts of 10% or more.

- RecoverCare Coverage: The Hartford pays for home services like cleaning or lawn care if a Chevrolet driver is injured in a covered crash.

- Lifetime Renewability: Qualified drivers with Chevrolets won’t lose coverage due to age or minor traffic violations. See More: The Hartford Insurance Review

Cons

- Minimal Tech Integration: The Hartford lacks an app-based telematics program to monitor Chevrolet driving habits.

- Restrictive Eligibility: Only Chevy drivers over 50 are eligible for coverage. Find out who offers better value in our The Hartford vs. Auto Club insurance review.

#5 – American Family: Best for Customer Satisfaction

Pros

- Excellent Claim Response: High J.D. Power ratings for Chevrolet claims handling, particularly for physical damage and total loss cases.

- DreamKeep Rewards: Chevrolet policyholders earn perks for milestone achievements like consecutive claim-free years.

- KnowYourDrive App: Tracks driver habits and offers up to 20% off based on braking, acceleration, and time of day. Find out how to qualify in our AmFam Insurance review.

Cons

- Higher Rates in Urban Areas: Chevrolet premiums in metro regions like Phoenix or Miami exceed national averages despite discounts.

- Limited Availability: AmFam auto insurance for Chevrolets is only available in 26 states.

#6 – Geico: Best for Cheap Rates

Pros

- Cheapest Chevrolet Auto Insurance: Chevy car insurance rates start at $50 per month for minimum coverage and $98 monthly for full coverage.

- Military and Federal Employee Discounts: Eligible Chevrolet drivers receive up to 15% off with Geico’s affiliation savings.

- Highest Financial Strength: Our Geico car insurance review shows it holds an A++ A.M. Best Rating for reliable Chevrolet claim payments.

Cons

- No Gap Coverage: Leased Chevrolets and drivers with auto loans will not find gap policies with Geico.

- Varied Customer Reviews: Customer experience varies by state, with drivers in the Central and Southwest U.S. rating customer service below average.

#7 – Allstate: Best for New Chevys

Pros

- New Car Replacement Coverage: Replaces totaled Chevrolets less than two years old with the same model, minus depreciation.

- Deductible Rewards: Get up to $100 deducted from your Chevy collision deductible for every claim-free year, up to $500. See how it works: Allstate Insurance Review

- Comprehensive Insurance Options: Allstate offers add-ons, including rideshare coverage and Mexico auto insurance, for Chevy drivers who need more than standard policies.

Cons

- Mobile App Limitations: In-app policy servicing for Chevrolet coverage lacks certain endorsement options available on the desktop.

- High Monthly Rates: Allstate is the second-most expensive insurance company for Chevrolets after State Farm.

#8 – Travelers: Best for Hybrid/Electric Chevys

Pros

- EV Insurance Discounts: Electric and hybrid models, like the Silverado EV, get an extra 10% off rates. It’s the best company for cheap Chevrolet Volt car insurance.

- EV Claim Expertise: The specialized support team handles Chevrolet EV battery, charging port, and towing claims.

- IntelliDrive Savings: Chevrolet EV drivers can save up to 20% after 90 days of monitored driving. Our Travelers insurance review provides the full scoop on UBI coverage.

Cons

- Limited Risk Flexibility: Drivers with multiple Chevrolet claims or high-mileage EVs may be denied coverage.

- Expensive Full Coverage: Travelers is one of the most expensive Chevrolet auto insurance companies for full coverage, with policies starting at $118 a month.

#9 – Farmers: Best for OEM Coverage

Pros

- OEM Coverage Endorsement: Ensures all Chevrolet repairs use factory-original parts after a covered claim.

- Signal App Telematics: Chevy drivers can earn up to 15% off by maintaining high scores with good driving. See how to sign up in our Farmers Insurance review.

- Customized Deductibles: Farmers allows Chevrolet owners to select diminishing or fixed deductibles based on budget and risk tolerance.

Cons

- No Online Quote Adjustments: Chevrolet coverage updates, like adding rental or towing, require an agent.

- Limited Availability of Specialty Discounts: Teachers, first responders, and affinity group members receive fewer exclusive incentives than with other Chevrolet insurers.

#10 – Progressive: Best for UBI Coverage

Pros

- Snapshot UBI Savings: Safe Chevrolet drivers using the Snapshot usage-based app can lower their annual rates by $231.

- Loan/Lease Payoff Option: Progressive includes gap insurance add-ons to cover depreciation for financed or leased Chevrolets.

- Name Your Price Tool: Chevrolet owners can customize policies to match their budget. Check Out: Progressive Insurance Review

Cons

- Steep First-Year Hikes: Chevrolet policyholders may face higher premiums at their first renewal, even without a claim.

- Low Claims Satisfaction: Progressive has the lowest claims satisfaction rating compared to every other Chevrolet insurance company on this list.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choose the Best Chevrolet Insurance Company

Liberty Mutual, Nationwide, and State Farm have the best auto insurance for Chevrolets. Geico has the cheapest Chevrolet car insurance for $58 a month, but the top three companies have higher customer satisfaction ratings.

Liberty Mutual stands out with new and better car replacement that will replace your new Chevy if it’s totaled in a covered claim.

Adding anti-theft features also unlocks 35% discounts with Liberty Mutual, while defensive driving discounts can help Camaro owners trim nearly $80 off full coverage.

But remember to look beyond just discounts and rates. Look for these qualities to find the best Chevrolet auto insurance for you:

- Claims Service and Customer Reviews: Chevy drivers should only work with providers who offer 24/7 claims service with high BBB and J.D. Power consumer ratings.

- Multiple Coverage Options: If you drive a Corvette or Camaro, look for insurers that specialize in sports car coverage, which may include agreed-value and higher limits.

- Reliable OEM Repair Network: Look for providers that allow you to choose your own repair shop or offer specialized repair networks for OEM or custom Chevy parts.

If you’re comparing the insurance cost for the Chevy Silverado 1500, expect full coverage rates to vary depending on the model year and safety features.

To find your best Chevrolet insurance rate, enter your ZIP code and get multiple quotes from top providers in minutes.

Frequently Asked Questions

Who has the best auto insurance for Chevrolets?

Liberty Mutual, Nationwide, and State Farm have the best car insurance for your Chevrolet, with high claims satisfaction ratings and competitive discounts available to all Chevy models.

Which company has the cheapest car insurance for Chevrolets?

Geico typically offers the lowest rates for Chevrolet drivers, especially those with clean records, low mileage, or who enroll in usage-based programs like DriveEasy. Enter your ZIP code to find the cheapest Chevy car insurance company near you.

Is Allstate a good Chevrolet insurance company?

Yes, Allstate is a solid pick for Chevrolet drivers wanting perks like OEM parts coverage, accident forgiveness, and bundling discounts of up to 25%. Compare Allstate vs. Geico auto insurance to learn more.

Are Chevrolets expensive to insure?

Some can get pricey to insure, like Chevrolet Camaro car insurance at $180 monthly or Corvette premiums at $195 per month, mainly because they’re built for speed and cost more to fix. On the other hand, Chevrolet Malibu car insurance is much cheaper at $152 per month since it’s a safer vehicle.

How much is Chevrolet Sonic car insurance?

Auto insurance rates for the Chevrolet Sonic are very affordable, starting at $59 monthly for minimum coverage and offering full coverage at $148 a month. The Chevy Sonic was discontinued in 2020, so drivers can get lower rates on this older, reliable model.

What is the cheapest insurance for a Chevy Silverado?

The cheapest insurance for a Chevy Silverado is usually through Geico, with minimum coverage starting at $50 per month if you qualify for bundling or anti-theft discounts. If you’re not checking for these savings, it’s one of the easiest ways you’re wasting money on car insurance without even realizing it.

How much does insurance cost for a Chevy Silverado 1500?

Chevrolet Silverado 1500 car insurance costs around $241 per month for full coverage and $149 monthly for minimum. Rates are higher mostly due to its repair costs and advanced features like driver-assist tech.

Which insurance is best for older Chevrolet models?

For a Chevrolet over ten years old, companies like Progressive and Farmers offer strong options with flexible coverage and access to OEM parts protection. For instance, you may want to add OEM coverage to your Chevrolet HHR car insurance policy to protect the vehicle’s integrity. Our free quote comparison tool can help you pick out the right policy for an older car.

What mileage is the cheapest for Chevrolet car insurance?

Chevy drivers who drive under 7,500 miles annually often pay less, especially when using tracking programs like Drivewise or SmartRide, which reward low-mileage use. If you don’t qualify for telematics programs, ask about low-mileage auto insurance discounts.

Do Chevy pickup trucks have higher insurance?

Yes, Chevy pickup trucks like the Silverado cost around $241 per month for full coverage, which is $30–$40 more a month than Chevy Spark or Chevrolet Trax car insurance. Higher premiums for pickups are tied to accident severity, higher body repair costs, and greater liability risks.

At what age does Chevrolet auto insurance stop being expensive?

How much is insurance on a Chevy Trax?

Is auto insurance cheaper on a Chevy SUV or pickup truck?

How much will my insurance go up if I get a Chevrolet truck?

Which is better for car insurance, Toyota or Chevy?

How good is General Motors insurance for Chevrolets?

Does credit score affect Chevrolet auto insurance costs?

How much is insurance for a 19-year-old with a Chevrolet truck?

Why is insurance so high on Chevy Cruze?

How can I lower my Chevrolet car insurance costs?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.