Best Auto Insurance for Teslas in 2026

The best auto insurance for Teslas is with Erie, Liberty Mutual, and Nationwide. The cheapest Tesla insurance starts at $52 a month, but drivers with accidents, DUIs, or teens on a policy will pay more. Use EV discounts to save up to 10%, and compare rates online to find the best insurance company for Tesla.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated February 2026

The best auto insurance for Teslas is with Erie, Liberty Mutual, and Nationwide. Nationwide is the cheapest car insurance for Teslas, starting at $106 a month.

- Tesla insurance requires higher coverage levels for expensive repairs

- Nationwide has the cheapest full coverage car insurance for Teslas

- Liberty Mutual has specialized roadside help for Tesla batteries

Liberty Mutual stands out with its competitive discounts and easy-to-use online tools, while Erie comes with solid rates and excellent customer service.

The best insurance companies for Teslas reward drivers with special policy features such as battery protection, autonomous driving coverage, and reduced rates for utilizing advanced safety features.

Top 10 Companies: Best Auto Insurance for Teslas| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A+ | Repair Access |

| #2 | 730 / 1,000 | A | Roadside Help |

| #3 | 729 / 1,000 | A+ | Tesla Discounts | |

| #4 | 716 / 1,000 | A+ | Affordable Rates | |

| #5 | 702 / 1,000 | A | Safe Driving |

| #6 | 697 / 1,000 | A++ | Low Mileage | |

| #7 | 693 / 1,000 | A+ | High-Tech Features | |

| #8 | 691 / 1,000 | A++ | EV Coverage | |

| #9 | 690 / 1,000 | A | Custom Equipment | |

| #10 | 673 / 1,000 | A+ | Online Tools |

Tesla car insurance costs more than average, but you can still find affordable coverage when you know where to shop.

Read this guide to compare the top Tesla auto insurance companies, and use our free online comparison tool to get quotes from local providers.

Tesla Car Insurance Cost Comparison

Tesla insurance premiums differ by carrier. Nationwide and State Farm Tesla insurance are the cheapest, and Liberty Mutual and Allstate are more expensive. Compare Liberty Mutual vs. Nationwide auto insurance for free quotes.

Our Tesla auto insurance review found that many drivers struggle to find Tesla insurers that offer full coverage for less than $200 per month.

Teslas are notoriously expensive to fix, and many insurers will total these vehicles rather than pay for repairs.

Ensure that your policy limits cover the increased cost of replacement, and maintain gap coverage on new or leased Teslas, as many providers total electric vehicles due to their high repair costs.

Tesla Insurance Rates for Minimum vs. Full Coverage

When you insure Tesla models, expect to pay higher rates. Fortunately, these providers offer repair guarantees and higher policy limits that extend to cover computer systems and cameras.

At $207 monthly for full coverage policies, Nationwide is the best Tesla insurance company for low rates and competitive discounts.

Tesla Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $118 | $231 | |

| $122 | $238 | |

| $113 | $221 |

| $136 | $267 | |

| $117 | $229 | |

| $123 | $242 |

| $106 | $207 | |

| $139 | $273 | |

| $111 | $218 | |

| $135 | $265 |

Minimum coverage is so cheap because Teslas have high safety ratings and cause less property damage in collisions, but full coverage rates skyrocket due to the vehicle’s expensive, high-tech components.

Premiums increase even more if you need additional coverage, so consider new car replacement or custom parts coverage from top companies, such as Liberty Mutual and Erie.

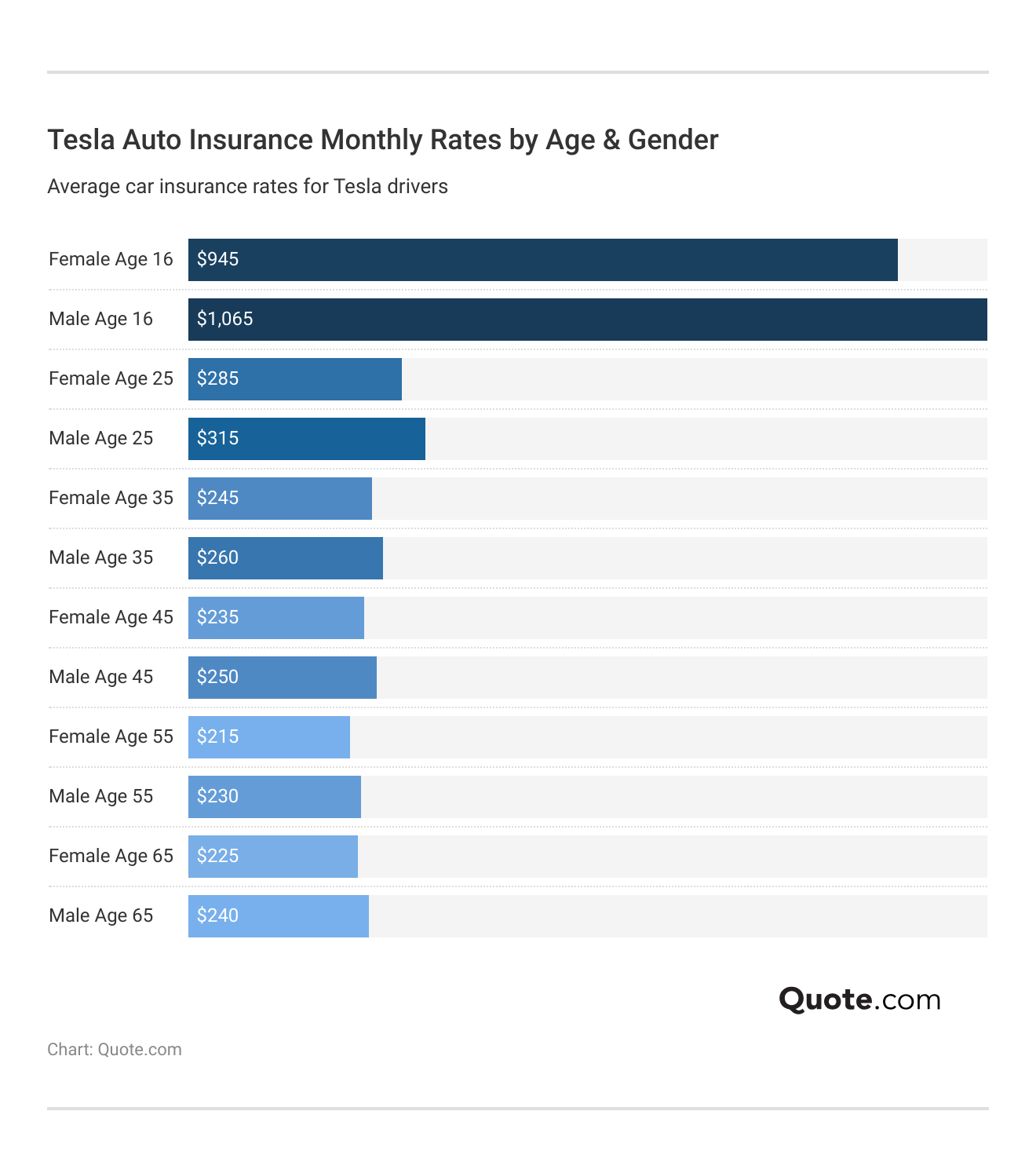

Comparing Car Insurance for a Tesla by Age

Your age and driving record will have the biggest impact on your insurance for a Tesla. Teens have the highest rates, with minimum coverage costing around $1,000 a month.

Your Tesla car insurance quote will drop as you get older, but minimum rates are still higher than average at $200 a month.

It can be hard to find cheap auto insurance for teens if you drive a Tesla, so shop around with multiple providers before you buy.

The best car insurance for a Tesla will always cost less for drivers with clean records. If you avoid speeding tickets and collisions, the top companies offer rates that are lower than average.

Auto Insurance Rate Trends Across Tesla Models

Insurance premiums on Teslas vary depending on the tech in each model. The best insurance for Tesla Model 3 drivers costs around $170 per month, with less to repair.

If you’re looking for the best insurance company for the Tesla Model Y, look for one with monthly quotes around $190. Car insurance for Tesla Model S drivers is much higher.

Tesla Auto Insurance Monthly Rates by Model| Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Tesla Model 3 | $52 | $215 |

| Tesla Model Y | $60 | $245 |

| Tesla Model S | $59 | $243 |

| Tesla Model X | $65 | $270 |

| Tesla Cybertruck | $58 | $230 |

| Tesla Roadster | $70 | $300 |

Full coverage is also highly important with these pricier models, raising monthly rates by almost $200 for some drivers. If you need the best insurance for Tesla Model X drivers, look for full coverage quotes under $250 a month.

The Cybertruck costs around $210 a month, and the Tesla Roadster, a sports car, starts around $290 a month. Owners will want to have the best auto insurance for luxury and exotic vehicles to cover these expensive models.

Car Insurance for Tesla Model S vs. Other Sports Cars

The Model S, Tesla’s luxury model, is comparable to car insurance for a Tesla Model Y, but more expensive to insure than a VW or BMW.

Tesla Model S insurance costs are closer to the luxury rates of the Lucid Air and Mercedes EQS. Read our guide to auto insurance rates by vehicle to see how prices compare.

Tesla Model S vs. Similar Sports Cars: Auto Insurance Monthly Rates| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Tesla Model S | $59 | $243 |

| BMW i4 | $67 | $233 |

| Ford Mustang Mach-E | $65 | $200 |

| Hyundai Ioniq | $45 | $150 |

| Kia EV6 | $48 | $155 |

| Lucid Air | $70 | $260 |

| Mercedes Eqs | $72 | $270 |

| Polestar 2 | $55 | $185 |

| Porsche Taycan | $61 | $245 |

| Volkswagen ID.4 | $50 | $160 |

Insurance on a Tesla is often more expensive because of the vehicle’s expensive repair costs. With an MSRP over $100,000, Model S insurance costs are often the highest.

Car insurance companies that specialize in electric vehicles offer better premium packages and discount incentives that can lower rates. Get the details in our review: Best Auto Insurance for Hybrid and Electric Cars

Tesla Insurance Prices for Different Driving Records

Nationwide has the cheapest auto insurance for Tesla drivers at $106 monthly. However, Tesla auto insurance rates double after an accident or DUI.

Tesla Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| $118 | $177 | $159 | $238 | |

| $122 | $182 | $164 | $244 |

| $113 | $170 | $153 | $230 |

| $136 | $205 | $184 | $276 | |

| $117 | $175 | $157 | $234 | |

| $123 | $184 | $165 | $247 |

| $106 | $159 | $143 | $214 | |

| $139 | $209 | $188 | $281 | |

| $111 | $167 | $150 | $224 | |

| $135 | $203 | $182 | $273 |

Nationwide and State Farm have cheap Tesla car insurance for high-risk drivers, starting at $143 monthly after a citation.

Cheap car insurance for Teslas will also vary based on where you live. The best insurance for Tesla in California will not be the same as Tesla insurance in New York or Florida. Always compare rates by ZIP code to get the best price based on your driving history.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Buying the Right Tesla Insurance Policy

Which insurance is best for Tesla drivers? Full coverage is recommended since all models are expensive to repair. For example, the best insurance for Tesla Model Y drivers will include collision and comprehensive coverage.

You might want to add additional policies based on your state insurance laws and local traffic risks:

- Medical Payments: MedPay covers medical bills for drivers and all passengers in your Tesla after an accident or collision, no matter who is at fault

- Personal Injury: Personal injury protection (PIP) covers medical bills and lost wages for Tesla drivers and their passengers, and is required in no-fault insurance states

- Uninsured/Underinsured Motorist: Covers Tesla repairs if you’re hit by an uninsured or underinsured driver and often covers hit-and-run accidents in some states

- Umbrella Insurance: Extends the limits of your liability or full coverage policy to cover medical bills or repairs to your Tesla after a covered collision

The best auto insurance companies for Teslas will offer coverage unique to how you use your Tesla, including rideshare insurance for drivers working for Uber and Lyft.

Gap insurance is also an important policy to have on new or leased Teslas. Since insurers are more likely to total a Tesla after a claim, gap coverage will pay off your vehicle for you.

Tesla Auto Insurance Coverage Options by Provider| Company | Claim Forgiveness | Gap Plans | Rideshare Coverage | Roadside Assistance |

|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ❌ | ✅ | ❌ | |

| ❌ | ❌ | ✅ | ✅ | |

| ✅ | ❌ | ❌ | ✅ |

| ❌ | ❌ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

Beyond these standard types of car insurance, Tesla drivers should also consider specialty add-ons for battery coverage and computer system repairs.

Liberty Mutual is one of the few providers that offer specialized roadside assistance for EV breakdowns and extra coverage for self-driving technology.

How to Get Cheap Insurance for Tesla

Average monthly rates will be higher for Teslas, but you can still find affordable car insurance by comparing rates and looking for discounts.

To help you make an informed decision, follow these five steps to secure the best Tesla car insurance for your electric vehicle:

- Adjust Deductibles and Coverage Limits: Choose a higher deductible and make sure coverage limits are high enough to cover your Tesla in the event of a claim.

- Assess Customer Service and Claims Experience: Look for excellent customer service and streamlined claims handling, especially about Tesla repair requirements.

- Compare Auto Insurance Providers: Take time to compare car insurance companies, as Tesla rates can differ. Compare quotes and EV-specialized discounts.

- Take Discounts and Deals: Ask about safe driving, multi-policy, and EV discounts. More than one carrier provides special discounts for Tesla owners.

When insuring a Tesla, it’s worth knowing which companies offer great deals for electric cars. Even if you’re a high-risk driver or adding a teen to your policy, don’t think you can’t find the right EV auto insurance.

There are 17 car insurance discounts you shouldn’t miss that reduce premiums while making it easy to manage Tesla insurance coverage.

Safe driving, bundling, and EV-specific discounts can reduce premiums by 5% or more.

Eric Stauffer Licensed Insurance Agent

These four popular Tesla insurance discounts reward drivers for choosing an electric vehicle and practicing safe driving habits.

Nationwide has the biggest good driving discount of 40%, followed by Farmers and Progressive at 30% off.

Top Auto Insurance Discounts for Tesla Drivers by Provider| Company | Multi-Vehicle | Bundling | Good Driver | Green/EV |

|---|---|---|---|---|

| 10% | 25% | 25% | 7% | |

| 23% | 25% | 25% | 5% | |

| 10% | 25% | 23% | 5% |

| 12% | 20% | 30% | 8% | |

| 25% | 25% | 26% | 5% | |

| 25% | 25% | 20% | 8% |

| 15% | 20% | 40% | 10% | |

| 12% | 10% | 30% | 5% | |

| 15% | 17% | 25% | 5% | |

| 8% | 13% | 10% | 10% |

Nationwide and Travelers Insurance have the best electric vehicle (EV) insurance discounts at 10%.

Driving a Tesla electric vehicle with advanced safety features can yield extra savings, and bundling multiple policies can help you save with all ten companies.

A big discount is the multi-vehicle discount, which is available when you have insured more than one vehicle with the same provider.

Geico and Liberty Mutual have the best insurance for Tesla owners who insure other cars, with the biggest multi-vehicle discounts of 25%.

Top Insurance Companies for Tesla Drivers

State Farm, Geico, and Progressive are the largest providers, but that doesn’t mean it’s the right company for you. Compare State Farm vs. Progressive auto insurance to learn more.

Progressive Insurance for Tesla drivers comes with convenient digital tools and usage-based discounts, but it has the lowest claims satisfaction rating, and many drivers report rate increases at renewal.

On the other hand, Erie, Liberty Mutual, and Nationwide offer the best insurance for Tesla drivers, with a balance of cost, customer service, and tailored policies for EVs.

Scroll down for Tesla auto insurance reviews of each company. Get fast and cheap Tesla auto insurance coverage today with our free quote comparison tool.

#1 – Erie Insurance: Top Pick Overall

Pros

- Tesla Repair Access: With Erie Insurance, Tesla drivers are guaranteed access to repairs from Tesla-certified facilities, ensuring quality service.

- New Car Replacement: Erie replaces totaled Teslas with a new model under qualifying policies.

- Top Claims Satisfaction: Tesla drivers give Erie high marks for responsive claims handling. Read our Erie Insurance review for full ratings.

Cons

- Limited Geographic Reach: Erie Tesla insurance is only available in 12 states.

- Fewer Online Tools: While bundling savings are substantial, Erie lacks advanced quote customization.

#2 – Liberty Mutual: Best for Roadside Help

Pros

- Tesla Roadside Coverage: Liberty Mutual provides specialized roadside help for Tesla breakdowns and battery issues.

- Top Bundling Discount: Tesla insurance customers can save up to 25% by combining policies.

- Parts & Tech Protection: Covers Tesla-specific features like glass panels and driver-assist sensors.

Cons

- Higher Urban Costs: Our Liberty Mutual insurance review points out that Tesla insurance premiums may be higher in urban areas than in other areas.

- App Limitations: Tesla drivers may find Liberty Mutual’s app lacks the advanced features of its competitors.

#3 – Nationwide: Best for Tesla Discounts

Pros

- Exclusive Tesla Savings: Nationwide offers discounts for Teslas with advanced driver-assist features, making it the best auto insurance for Tesla Model Y.

- Solid Bundling Value: Tesla insurance costs drop with up to 20% savings on multi-policy bundles.

- Safe Driving Incentives: Tesla owners using Nationwide’s SmartRide UBI program may receive personalized discounts based on good driving habits.

Cons

- Repair Access Limitations: Tesla repairs under Nationwide will be more difficult to locate in rural areas.

- Not All Drivers Qualify: Some Tesla drivers may not earn the full SmartRide benefits due to driving patterns. Learn what impacts rates in our Nationwide auto insurance review.

#4 – State Farm: Best for Affordable Rates

Pros

- Cheap Full Coverage: State Farm has the best auto insurance rates for Teslas that need full coverage, starting at just $218 per month.

- Agent Network Support: Personalized service from local agents helps manage Tesla insurance needs.

- Strong Financial Rating: Its superior A++ financial rating means dependable coverage for Tesla auto insurance claims.

Cons

- State Limitations: State Farm does not write new policies in RI or MA, and drivers in FL and CA may experience rate hikes. Learn more in our State Farm auto insurance review.

- Fewer Online Tools: State Farm doesn’t have some Tesla-friendly online options compared to more tech-oriented insurers.

#5 – American Family: Best for Safe Driving Programs

Pros

- Safe Driver Incentives: Tesla drivers enrolled in the KnowYourDrive UBI program can qualify for premium discounts.

- Generous Bundling Offer: Tesla drivers receive up to 25% off when they bundle with other policies.

- Coverage for EV Systems: Optional protection extends to Tesla’s software and in-cabin tech systems.

Cons

- Shop Availability Issues: Some areas lack approved repair centers for Tesla insurance claims. Find out more in our American Family Insurance review.

- Less Transparent Claims: Tesla policyholders sometimes experience vague updates during claims.

#6 – Geico: Best for Low Mileage Plans

Pros

- Low-Mileage Perks: Tesla drivers who drive less can earn discounts through Geico’s low-mileage discounts.

- Strong Discount Packages: Up to 25% in bundling savings make Geico cost-effective for Tesla insurance.

- EV Roadside Support: Offers Tesla-specific roadside services, including battery assistance and flat tire assistance.

Cons

- Few Tesla-Focused Add-Ons: Geico insurance reviews indicate that extras such as wall chargers may not be covered for Teslas.

- Minimal Agent Interaction: Tesla owners may miss personalized service due to Geico’s digital-first approach.

#7 – Allstate: Best for High-Tech Features

Pros

- Tech-Focused Solutions: Our Allstate auto insurance review highlights this insurer as a strong option for tech-forward coverage with a convenient app and mobile tools.

- Smart Driving Rewards: Teslas with Allstate Drivewise can qualify for lower rates by tracking safe driving behavior.

- Top-Tier Bundling: Allstate car insurance for Teslas is eligible for bundling discounts up to 25%, which can translate to huge savings.

Cons

- Expensive for New Drivers: New Tesla drivers might pay more than with other companies.

- Slower Claim Processing: Some Tesla owners complain of delays in Allstate’s claim approval process.

#8 – Travelers: Best for EV- Specific Policies

Pros

- EV-Specific Protections: Travelers offers specialized Tesla auto insurance that includes home charger and battery coverage.

- Bundling Savings: Tesla drivers can save up to 13% on insurance by bundling with Travelers car insurance with home policies.

- Reliable Insurer: Travelers’ A++ rating reflects solid financial backing for Tesla insurance claims. Explore more ratings in our Travelers auto insurance review.

Cons

- Higher Urban Premiums: Tesla insurance rates through Travelers may rise significantly in big cities.

- Limited Tech Features: App and digital tools for managing insurance policies are basic compared to other Tesla car insurance companies.

#9 – Farmers: Best for Custom Equipment Coverage

Pros

- Add-Ons for Custom Parts: Our Farmers auto insurance review lists the added coverage for Tesla technology or modifications, providing specialized equipment protection.

- OEM Repair Assurance: Farmers repairs on Teslas include original manufacturer parts for better quality.

- Bundling Opportunities: You may save up to 20% by combining your Tesla insurance with a home or renters policy.

Cons

- Higher Rates in Some Areas: Farmers’ Tesla insurance prices can be elevated in certain states.

- Basic App Functionality: Limited tech integration for Tesla users wanting advanced digital tools.

#10 – Progressive: Best for Online Tools

Pros

- Strong Digital Experience: Progressive makes managing Tesla car insurance easy with user-friendly online tools that let drivers choose coverage based on their budget.

- Usage-Based Discounts: Tesla owners using Progressive Snapshot UBI can earn discounts for safe driving. Read More: Progressive Car Insurance Review

- Optional Upgrade Coverage: Add-ons like gap coverage and EV upgrades make Progressive the best auto insurance for Tesla Model 3 drivers.

Cons

- Lower Bundling Incentive: Progressive only offers a 10% discount for bundling Tesla auto insurance with other policies.

- Below-Average Claims Ratings: Other Tesla insurance companies have higher satisfaction ratings, including State Farm.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pick Out the Right Tesla Auto Insurance

Finding the best insurance for Tesla cars is key, as these EVs require specialized coverage due to their advanced technology and higher value.

Drivers find the best auto insurance for Teslas with Erie, Nationwide, and Liberty Mutual. Nationwide has the cheapest insurance for Tesla drivers, starting at $106 a month.

Compare quotes, look for discounts, and select a provider with good claims support to find Tesla insurance that meets your budget.

Kristine Lee Licensed Insurance Agent

Liberty Mutual stands out with solid roadside assistance and parts protection for Tesla-specific components.

Numerous insurers also offer savings under safe driver plans, EV rewards, and discounts for bundling.

The easiest way to find the best car insurance for Teslas is to compare quotes online from multiple companies.

Start saving on your Tesla auto insurance by entering your ZIP code and comparing free quotes from local providers.

Frequently Asked Questions

What is the best insurance company for Tesla?

Erie, Nationwide, and Liberty Mutual have the best car insurance for Teslas, with high claims satisfaction ratings and coverage options that extend to protect Tesla batteries and computer components. Compare Now: Erie vs. Metlife Insurance

Who offers the best car insurance for Tesla Model Y drivers?

Geico and State Farm offer the best insurance rates for compact SUVs like the Tesla Model Y, but providers like Travelers and Liberty Mutual have more customizable coverage for EVs.

Is Tesla auto insurance cheaper?

Tesla car insurance is more expensive than average due to repair prices and Tesla’s sophisticated tech and safety features. Enter your ZIP code into our free quote tool to find the best Tesla auto insurance rates near you.

How do Tesla insurance rates vary by state?

Auto insurance rates by state vary based on localized weather risks, commute times, and theft rates. Coastal states and densely populated cities have the highest insurance costs. When it comes to the best insurance for Tesla, California drivers will have the highest rates compared to drivers in more inland states like Arizona or Kentucky.

How do insurance rates for Teslas compare to other electric vehicles?

Tesla insurance rates are higher due to repair costs and advanced features, but EV discounts can help reduce premiums.

What makes Tesla auto insurance different from regular car insurance?

Tesla insurance covers unique features, like high repair costs, Autopilot, and battery replacement, unlike regular car insurance companies.

Can I get roadside assistance coverage for my Tesla?

Yes, insurers like Liberty Mutual offer roadside assistance for Teslas, covering flat tire changes, boosts, and towing.

How do Tesla’s advanced safety features affect my insurance?

Tesla’s safety features, like automatic emergency braking and self-driving technology, can lower premiums by reducing accident risk. Compare anti-theft auto insurance discounts to learn more.

Are there any insurance companies offering discounts for Teslas?

Providers like Travelers and Nationwide offer discounts for safety features and Tesla-specific coverage options. Use our free comparison tool to compare rates and discounts from local companies.

Does Tesla offer its own insurance?

Tesla offers a usage-based insurance policy that uses the vehicle’s technology to track real-time driving habits. The Tesla insurance A.M. Best rating is an “A,” reflecting strong financial backing to pay claims, but customers report difficulties with claims agents. Drivers in big cities also report steep rate increases at renewal in Tesla insurance reviews on Reddit.

How do I make my Tesla insurance cheaper?

Is Tesla battery replacement covered under my insurance policy?

What types of repair coverage do I need for my Tesla?

Are Teslas becoming uninsurable?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.