Best Commercial Auto Insurance in 2026

The best commercial auto insurance comes from Erie Nationwide and Liberty Mutual, with rates starting at $60 per month. Businesses benefit from liability coverage, flexible vehicle protection, dependable claims support designed for everyday small business driving needs without overpaying for fleet vehicles today.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

The best commercial auto insurance comes from Erie, Nationwide, and Liberty Mutual, with rates starting at $60 per month based on coverage needs, vehicle use, and business risk.

- Erie leads with the best commercial auto insurance claims service

- Nationwide and Liberty Mutual offer customizable commercial policies

- Commercial auto insurance rates can start as low as $60 per month

Erie is a solid choice if you’re looking for stable pricing and consistently low rates. On the other hand, Nationwide is a great fit for businesses that want to bundle several types of coverage.

Liberty Mutual works well for companies needing more flexible coverage options, especially those with varying vehicle uses or different risk levels.

Top 10 Companies: Best Commercial Auto Insurance| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A+ | Customer Service |

| #2 | 730/ 1,000 | A | Flexible Policies |

| #3 | 729 / 1,000 | A+ | Bundling Discounts | |

| #4 | 716 / 1,000 | A++ | Safe Drivers | |

| #5 | 702 / 1,000 | A | Loyalty Rewards |

| #6 | 697 / 1,000 | A++ | Affordable Rates | |

| #7 | 693 / 1,000 | A+ | Local Agents | |

| #8 | 691 / 1,000 | A++ | Discount Options | |

| #9 | 690 / 1,000 | A | Accident Forgiveness | |

| #10 | 672 / 1,000 | A | Online Tools |

This guide walks you through how the cost of commercial auto insurance can vary depending on things like the driver’s age, driving history, credit score, and location. These providers are based on factors like liability limits and the type of vehicles you’re insuring.

Stop overpaying for commercial car insurance. Enter your ZIP code to see if you qualify for lower rates and better coverage options for your business.

Comparing Commercial Car Insurance Costs

Monthly commercial car insurance online costs vary based on the coverage you choose. Erie, Safeco, and Geico often deliver some of the best commercial auto insurance rates, especially when requesting a commercial auto insurance quote for basic coverage.

Comparing minimum and full commercial auto insurance coverage is the quickest way to run a proper commercial auto insurance comparison and understand the real cost of commercial car insurance based on risk and budget.

Commercial Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $165 | $395 | |

| $128 | $298 |

| $92 | $214 |

| $154 | $368 | |

| $112 | $269 | |

| $178 | $422 |

| $131 | $305 | |

| $105 | $249 | |

| $118 | $284 | |

| $124 | $296 |

Minimum coverage can help reduce monthly expenses and may qualify as cheap commercial auto insurance if your business operates older vehicles or carries low liability risk.

Full coverage might cost more upfront, but it gives your commercial auto policy a serious boost — adding collision, comprehensive protection, and higher liability limits to better cover your business vehicles.

Commercial auto insurance should reflect how your business uses its vehicles, so consider who drives, what you carry, and how often you’re on the road to avoid coverage gaps.

Jeff Root Licensed Insurance Agent

Liberty Mutual and Allstate tend to price higher for full coverage, but they remain solid options for businesses that need broader commercial auto insurance coverage and dependable claims handling.

Commercial insurance rates can vary depending on state-level trends, so the smartest way to get an accurate price is by comparing a local instant commercial auto insurance quote.

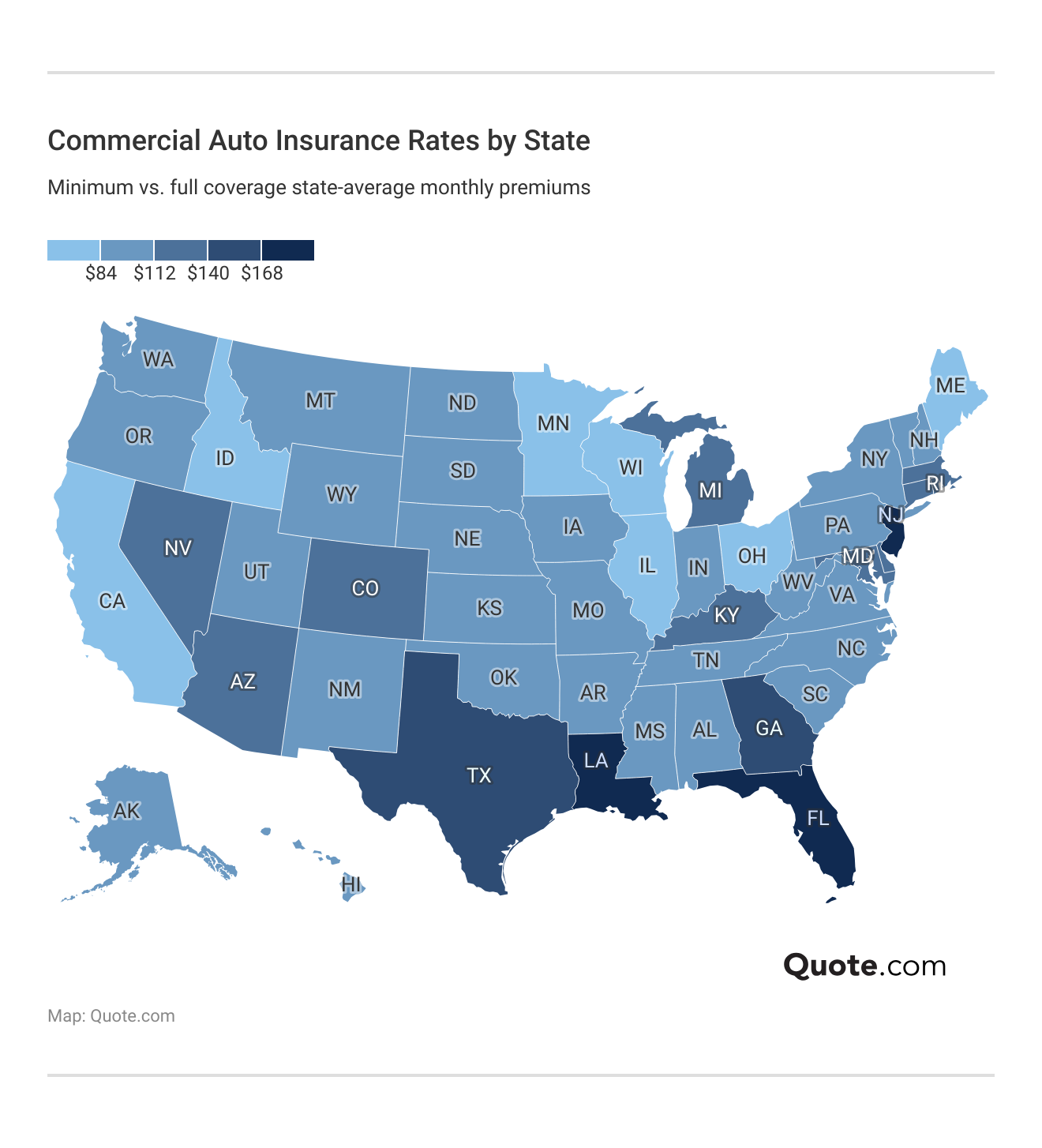

Commercial Auto Insurance Rates by State

Commercial auto insurance pricing varies widely by location, which is why a commercial auto insurance quote can change significantly depending on where your business operates.

States with dense traffic, higher claim frequency, or stricter regulations often see higher commercial car insurance online premiums, especially for full coverage (Read More: Auto Insurance Rates by State).

Florida, Texas, and parts of the Northeast usually rank higher for the cost of commercial car insurance, while the Midwest and Mountain states tend to offer lower-priced commercial vehicle insurance.

There are regional weather risks and factored-in repair costs and accident rates, which is why two businesses with the same types of vehicles and drivers can pay very different amounts just based on location (Learn More: Auto Insurance Requirements by State).

Cost of Commercial Auto Liability Coverage

Liability limits directly affect what businesses pay for commercial auto liability insurance each month.

Lower limits may suit low-risk operations, while higher limits protect small businesses from costly lawsuits—especially those searching for the best commercial auto insurance for small businesses.

Commercial Auto Insurance Monthly Rates by Liability Limit| Coverage | Premium | Best for | Details |

|---|---|---|---|

| $300K | $150 | Low risk | Basic liability |

| $500K | $210 | Moderate risk | Increased protection |

| $1M | $300 | Small businesses | Standard limit |

| $2M | $450 | High risk | Higher claim buffer |

| $5M | $850 | Large fleets | Maximum protection |

Many small businesses settle around the $1 million mark to balance cost and protection while keeping commercial insurance quotes predictable.

For larger fleets or businesses with greater risk exposure, whether that comes from larger vehicles or heavier traffic, higher limits can protect against expensive lawsuits after an accident (Read More: Cheap Auto Insurance for Multiple Vehicles)

Commercial Insurance Rates Vary by Vehicle Type

The commercial auto insurance average cost is going to look different for every business because it depends on the type of vehicle you use.

Lighter vehicles, such as cargo vans and pickup trucks, generally have smaller premiums because they are often used for local jobs and cause minimal damage in a collision.

Commercial Auto Insurance Monthly Rates by Vehicle Type| Vehicle Type | Premium | Details |

|---|---|---|

| Box Truck | $350 | Medium commercial freight |

| Cargo Van | $150 | Local delivery and service use |

| Food Truck | $280 | Food service and equipment |

| Passenger Van | $250 | Business passenger transport |

| Pickup Truck | $180 | Business hauling and tools |

| Semi / Heavy Truck | $800 | Long-haul commercial freight |

| Service Utility Truck | $300 | Utility body and equipment |

As vehicles get larger or become more specialized, costs will increase to cover pricer repairs, expensive cargo, and increased liability, especially for box trucks, service utility trucks, and food trucks with equipment.

Semi and heavy trucks sit at the upper end of types of auto insurance costs due to long-haul routes, higher mileage, and the greater severity of accidents.

Commercial Auto Insurance Rates by Driving History

Driving history plays a major role in the cost of commercial car insurance, and the difference becomes apparent as soon as a violation comes into play.

Clean records receive the lowest commercial auto insurance quotes, while violations quickly raise premiums.

Commercial Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $165 | $223 | $289 | $190 | |

| $128 | $173 | $224 | $147 |

| $92 | $124 | $161 | $106 |

| $154 | $208 | $270 | $177 | |

| $112 | $151 | $196 | $129 | |

| $178 | $240 | $312 | $205 |

| $131 | $177 | $229 | $151 | |

| $105 | $142 | $184 | $121 | |

| $118 | $159 | $207 | $136 | |

| $124 | $167 | $217 | $143 |

Erie, Safeco, and Geico consistently offer cheap commercial auto insurance options even after minor violations.

A DUI is by far the worst and leads to monthly premium spikes across any company. This reinforces how important driver screening and ongoing safety habits are.

Businesses with older, more experienced drivers who have clean records usually see far more predictable and affordable rates.

However, the cheapest companies, including Erie, Safeco, and Geico, consistently offer lower rates across most age groups.

Commercial Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $429 | $231 | $190 | $165 | |

| $333 | $179 | $147 | $128 |

| $239 | $129 | $106 | $92 |

| $400 | $216 | $177 | $154 | |

| $291 | $157 | $129 | $112 | |

| $463 | $249 | $205 | $178 |

| $341 | $183 | $151 | $131 | |

| $273 | $147 | $121 | $105 | |

| $307 | $165 | $136 | $118 | |

| $322 | $174 | $143 | $124 |

At age 25, prices start to fall noticeably, and they continue to drop at ages 35 and 45, as insurers reward consistency and safer driving habits.

Liberty Mutual and Allstate cost more, especially when it comes to younger drivers (Read More: Cheap Auto Insurance for Teens).

How Credit Score Impacts Commercial Car Insurance

Credit also affects commercial insurance quotes, with stronger credit producing lower monthly premiums.

Commercial auto insurance rates can also fluctuate with the business or business owner’s line of credit. Having good credit can make a noticeable difference in long-term operating costs.

Commercial Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $165 | $182 | $215 | $281 | |

| $128 | $141 | $166 | $218 |

| $92 | $101 | $120 | $156 |

| $154 | $169 | $200 | $262 | |

| $112 | $123 | $146 | $190 | |

| $178 | $196 | $231 | $303 |

| $131 | $144 | $170 | $223 | |

| $105 | $116 | $137 | $179 | |

| $118 | $130 | $153 | $201 | |

| $124 | $136 | $161 | $211 |

Having poor credit can really drive up the cost of commercial car insurance online, especially with companies that take a more aggressive approach to pricing risk.

Erie, Safeco, and Geico tend to stay more affordable even if your credit score changes, while companies like Liberty Mutual and Allstate often show higher price jumps between different credit tiers.

Erie, Safeco, and Geico usually keep their rates more stable when your credit score changes, while Liberty Mutual and Allstate often have bigger jumps in pricing between credit levels, as outlined in our expert guide to different loans and credit risk factors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Commercial Auto Insurance Covers

Commercial auto insurance coverage fills the gaps left by personal policies when vehicles are used for work.

It works just like personal auto plans, with things like collision, comprehensive, and medical payments coverage, which helps cover injury costs.

Commercial Auto Insurance Coverage Overview| Coverage Type | What’s Covered | What’s Not Covered |

|---|---|---|

| Cargo / Equipment Coverage | Tools and cargo | Excluded items |

| Collision | Crash damage | Wear, breakdowns |

| Comprehensive | Theft, weather | Collisions |

| Hired & Non-Owned Auto | Rented or employee vehicles | Vehicle damage |

| Liability | Damage to others | Your vehicle |

| Medical Payments / PIP | Medical costs | Employee injuries |

| Non-Owned Liability | Employee vehicle liability | Personal damage |

| Rental Reimbursement | Temporary vehicle or income | Fuel, delays |

| Roadside Assistance | Towing, lockout | Repairs, upkeep |

| Uninsured Motorist | Injuries by uninsured drivers | Over limits |

This flexibility is essential for businesses relying on commercial auto liability insurance for employee-driven or rented vehicles.

Business owners are often amazed by how specific the exclusions tend to be. There’s generally no allowance for wear and tear on your property, maintenance, or many types of personal losses.

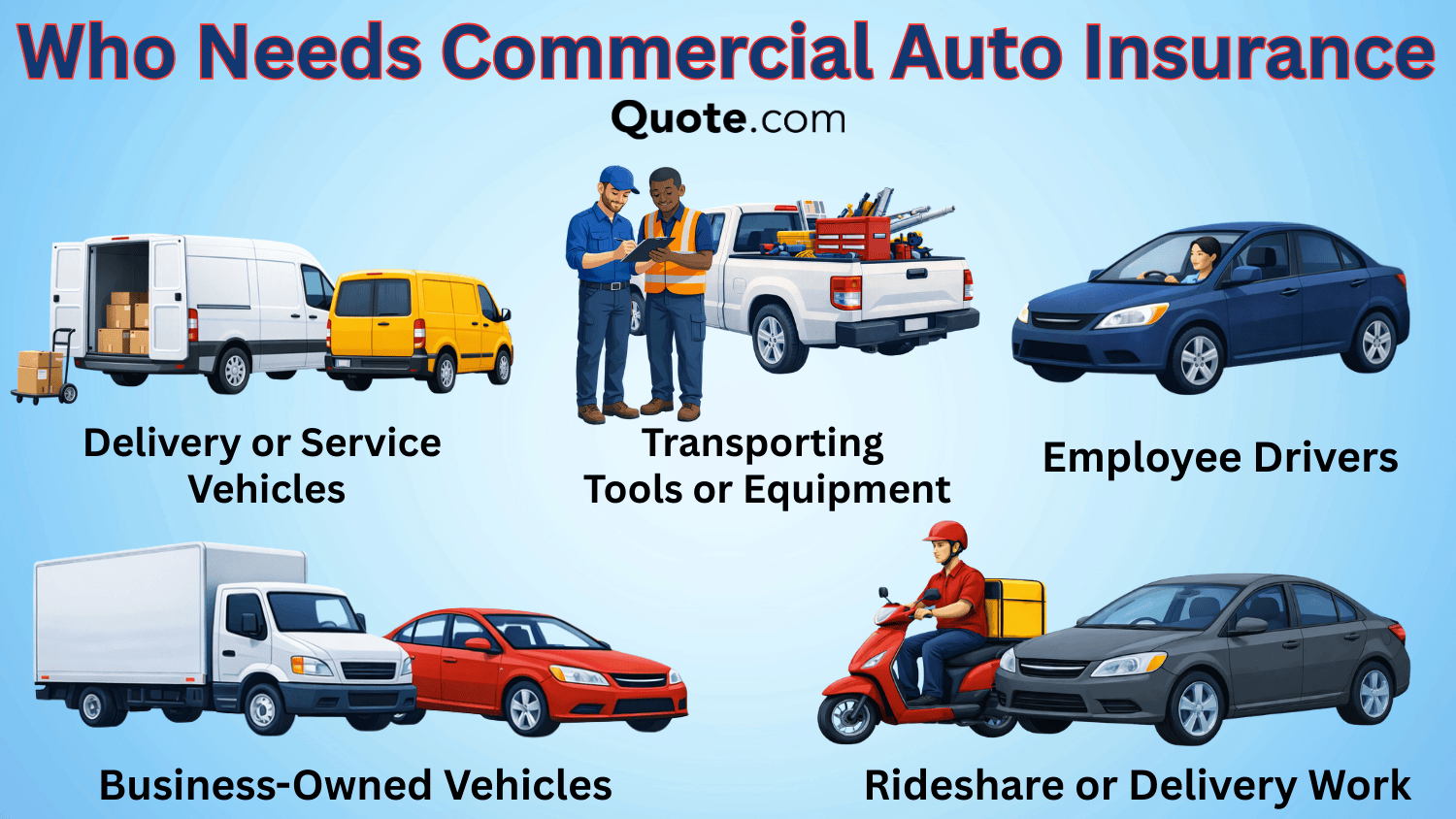

When to Buy Commercial Car Insurance

If a vehicle is used for work, deliveries, or service calls, you’ll likely need commercial vehicle insurance, even if the car is personally owned.

Even if you aren’t a business owner or driving a corporate vehicle, you may still need to buy commercial auto insurance when using a personal vehicle for work.

Company-owned cars, service calls, employee-driven vehicles, and delivery drivers typically need commercial car insurance policies.

This is because the personal auto policies often limit or do not cover such uses, especially if they involve frequent driving or are within the scope of work.

Who Needs Commercial Auto Insurance| Use Case | Why Required |

|---|---|

| Business-Owned Vehicles | Personal coverage may not apply |

| Delivery or Service Use | Frequent driving and stops |

| Employee Driving | Employer liability exposure |

| Rideshare or Delivery Work | For-hire use often excluded |

| Tools or Equipment Transport | Personal policies may exclude hauling |

Running a commercial auto insurance quote early helps avoid denied claims later. Your insurer will still require a commercial policy, or at least an add-on for rideshare or delivery driving (Read More: Best Auto Insurance for DoorDash Drivers).

All of the best commercial auto insurance companies on this list write both personal and commercial policies, so you likely won’t need to switch insurers or buy a separate policy if you use your personal vehicle for work.

Difference Between Commercial vs. Personal Car Insurance

The main difference between commercial and personal auto insurance really comes down to how the vehicle’s being used and who’s driving it.

Commercial auto policies are built for work-related driving — they cover multiple drivers, business-owned or leased vehicles, and offer higher liability limits to handle the unique risks that come with the job.

Commercial vs. Personal Auto Insurance| Feature | Commercial | Personal |

|---|---|---|

| Business use | Covered | Limited or excluded |

| Claims eligibility | Work-related claims covered | Business use may be denied |

| Driver coverage | Multiple drivers | Named drivers only |

| Liability limits | Higher limits available | Lower standard limits |

| Vehicle ownership | Business-owned or leased | Personally owned only |

Personal auto insurance is meant for personal use, and coverage may be limited or denied once you’re on the clock, driving a branded vehicle, or transporting company products.

That gap can come as a surprise to people who file claims, particularly if they only use their vehicle for delivery or rideshare work part-time.

Don’t assume your personal policy covers you while you’re working. Selecting the right kind of commercial car insurance ensures that your coverage actually kicks in when you need it (Read More: How to Lease a Car When You Can’t Afford to Buy One).

Using Hired & Non-Owned Policies for Commercial Coverage

Hired and non-owned auto insurance fills an important gap for businesses that don’t have company-owned vehicles. It steps in when employees use their own cars for work or when the business rents a vehicle temporarily.

This type of coverage protects your business from liability if someone gets hurt or property is damaged during work-related driving.

Hired & Non-Owned Auto Insurance Explained| Situation | What it Covers | What it Doesn’t |

|---|---|---|

| Business Liability Policy | Company exposure | Personal use |

| Employee-Owned Vehicles | Business liability | Vehicle damage |

| Personal Auto Policies | Personal driving | Business liability |

| Rental Vehicles | Liability while rented | Physical damage |

What it doesn’t do is cover damage to the employee’s car or to the rental itself. That kind of protection typically comes from personal auto policies or a standalone rental policy (Learn More: Collision vs. Comprehensive Auto Insurance).

This coverage is an extra layer of protection that standard auto policies don’t provide for many businesses, particularly those with intermittent or permissive driving.

Ways to Save on Commercial Car Insurance

Bundling policies, improving driver safety, and tracking mileage can lower commercial insurance quotes quickly.

While not every company offers the same discounts or percentages, the more proactive a business is about safety and policy structure, the more room there is to reduce monthly premiums.

Top Auto Insurance Discounts for Commercial Drivers| Company | Bundling | Fleet | Safe Driver | Telematics |

|---|---|---|---|---|

| 25% | 20% | 18% | 25% | |

| 25% | 20% | 18% | 25% |

| 25% | 20% | 15% | 20% |

| 20% | 25% | 20% | 30% | |

| 25% | 20% | 15% | 25% | |

| 25% | 25% | 20% | 30% |

| 20% | 20% | 12% | 25% | |

| 15% | 20% | 10% | 20% | |

| 17% | 25% | 20% | 30% | |

| 13% | 25% | 15% | 30% |

Bundling commercial auto with other types of business coverage is the easiest way to save. Covering more than one vehicle under a fleet policy and avoiding claims and traffic citations are also common ways business owners lower rates.

Telematics programs often unlock some of the best commercial auto insurance rates for businesses willing to monitor driving behavior (Learn More: The Definitive Guide to Usage-Based Auto Insurance).

Beyond discounts, there are several practical steps businesses can take to keep costs under control.

- Choose Vehicles With Lower Risk Profiles: Insurers typically offer lower rates for vehicles with less expensive repair costs or good safety records.

- Improve Driver Training & Oversight: Continuous safety training and driving policies keep claims low and help you maintain lower rates over time.

- Limit Vehicle Use to Business Needs: Monitoring miles driven and minimizing driving for nonessential purposes can reduce exposure and favorable risk to insurers.

- Review Coverage Limits Regularly: Liability limits and add-ons that are up to date with your business needs can help prevent you from paying for services you don’t need.

- Shop & Re-Quote Periodically: Rates change, and comparing options at renewal gives you leverage to negotiate or move to a more cost-effective provider.

Reviewing commercial liability coverage limits and getting quotes based on new limits can help you save money on car insurance over time.

Picking liability limits that match your business model can help keep your commercial auto insurance costs in check. It’s smart to choose limits based on how often your vehicles are on the road, where they’re going, and what a potential claim might actually cost you.

Commercial Auto Insurance Recommended Liability Limits| Business Type | Suggested Limit |

|---|---|

| Fleets | $1–$2 million |

| High-Risk Industries | $2 million+ |

| Small Businesses | $500,000–$1 million |

| Sole Proprietors | $300,000–$500,000 |

Smaller businesses and single-vehicle owners usually go with lower coverage limits since they have fewer vehicles and less risk. But as a business grows, so does the need for higher limits to give more cushion for potential issues.

For fleets and high-hazard industries, larger losses are more likely, so higher limits help keep commercial auto insurance costs predictable and reduce the risk of costly lawsuits—one of the most effective tips to pay less for car insurance long term.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Commercial Auto Insurance Companies

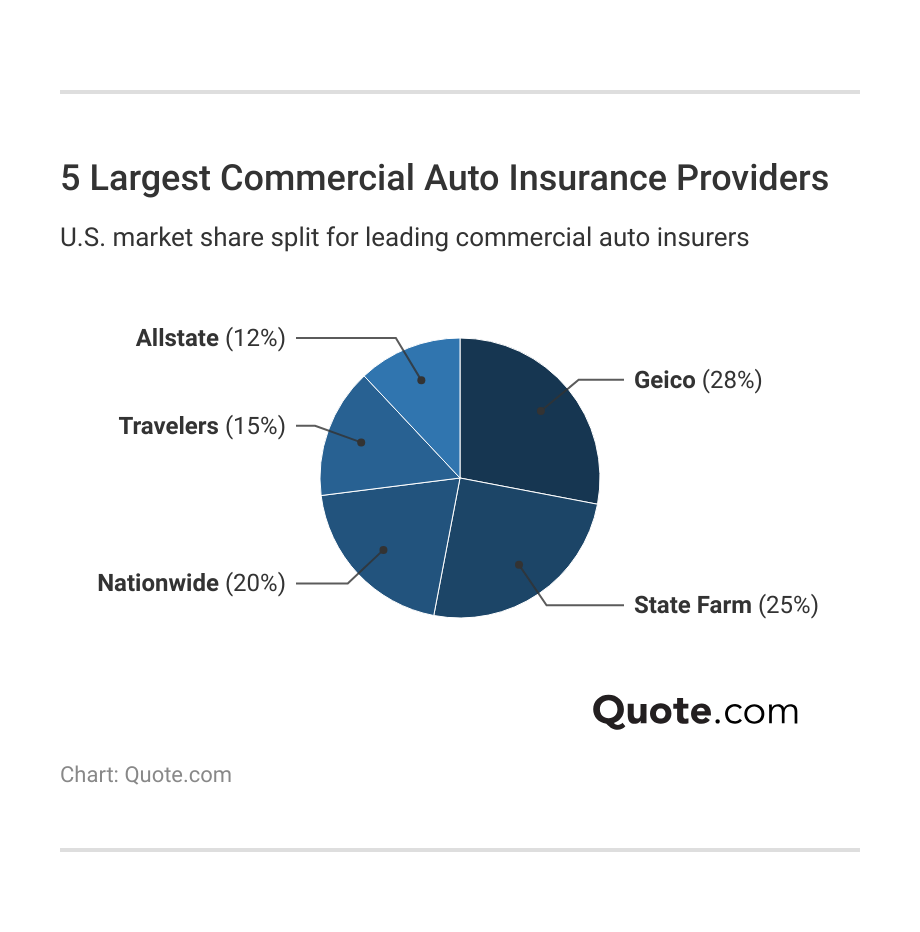

Geico, State Farm, Nationwide, Travelers, and Allstate are the largest providers on this list of commercial auto insurance companies.

Geico and State Farm are popular for their competitive rates, especially for small or low-risk businesses. Travelers and Allstate focus on higher-risk operations and larger, heavier fleets.

Nationwide ranks at the top for its competitive multi-policy discounts for those bundling multiple commercial policies.

Liberty Mutual and Erie may not be the biggest companies, but they have better customer service and more flexible coverage options than their competitors. Compare providers on our list of top 10 commercial auto insurance companies to find the right one for you.

#1 – Erie: Top Overall Pick

Pros

- Dedicated Local Agents: Erie commercial auto insurance gives businesses a single local agent for policy changes, vehicle updates, and coverage reviews.

- Hands-On Claims Handling: Erie assigns fewer adjusters per claim, so business owners wait less and don’t have to repeat themselves.

- Rate Stability for Clean Records: Businesses with safe drivers usually get more consistent renewals without sudden price hikes just because of small changes.

Cons

- Limited Availability: Erie’s commercial auto policies are only available in certain states, making it a poor fit for multi-state fleets.

- No Online Self-Service: Most policy changes and certificates still require agent assistance, according to our Erie insurance review.

#2 – Liberty Mutual: Best for Flexible Policies

Pros

- Built for Commercial Risk: Liberty Mutual commercial auto insurance includes hired and non-owned coverage and higher liability limits as built-in features.

- Excellent Financial Strength: Its strong A.M. Best rating means it can handle big losses, like multi-vehicle accidents with serious injuries.

- Multi-State Fleet Support: Policies cover vehicles operating in multiple states without separate filings, based on our Liberty Mutual auto insurance review.

Cons

- Higher Base Rates: Smaller fleets or businesses with just one vehicle often face higher costs upfront, at least until discounts kick in.

- Policy Complexity: Some custom options still require an agent and can’t be done online, which may slow changes or updates.

#3 – Nationwide: Best for Bundling Discounts

Pros

- Commercial Bundling Savings: Nationwide commercial auto insurance offers up to 20% savings when you bundle auto with general liability, property, or workers’ comp.

- Fleet Expansion Friendly: Adding vehicles and drivers is straightforward as operations grow. Our Nationwide auto insurance review explains how to update policies.

- Strong Claims Capacity: Its strong A.M. Best rating means it can handle big commercial losses, especially ones involving multiple vehicles or serious injuries.

Cons

- Higher Entry Pricing: Single-vehicle businesses often see higher starting rates before bundling discounts apply.

- Limited Online Quoting: Most commercial auto quotes and policy changes still require working through an agent rather than full online self-service.

#4 – State Farm: Best for Safe Drivers

Pros

- Stable Pricing for Safe Fleets: Businesses using commercial auto insurance with State Farm often see steady renewal rates and savings for clean driving records.

- Consistent Claims Handling: Claims follow a structured, predictable process. See how to file a claim in our State Farm auto insurance review.

- Agent-Led Policy Changes: Local agents can easily update your driver list, vehicles, or coverage limits as your business evolves.

Cons

- Limited High-Risk Options: Industries that use heavy trucks or involve hazardous work usually have fewer coverage options.

- Basic Online Tools: Digital account features lag behind more tech-savvy commercial car insurance companies with self-service platforms.

#5 – American Family: Best for Loyalty Rewards

Pros

- Loyalty-Based Discounts: Commercial auto insurance with American Family rewards long claim-free periods with premium credits that help control costs.

- Predictable Mid-Range Pricing: Rates tend to remain more consistent at renewal, which can make budgeting much easier for small and mid-sized businesses.

- Clear Policy Structure: Coverage options are laid out plainly, reducing confusion around liability limits and add-ons, and local agents are available to tailor business policies.

Cons

- Limited State Availability: Commercial auto coverage is not offered nationwide. Use our American Family Insurance review to see if it’s available in your state.

- Fewer Fleet Tools: AmFam lacks advanced telematics or usage-based programs for large or specialized fleets.

#6 – Geico: Best for Affordable Rates

Pros

- Low Starting Rates: Geico commercial auto insurance is one of the most affordable choices for single-vehicle businesses that just need basic liability coverage.

- Fully Online Policy Setup: Quotes and policy changes are handled digitally. Our Geico insurance review shows how easy it is to manage coverage online.

- Strong Claims Capacity: Geico’s superior A++ A.M. Best rating is a good sign that the company can handle and pay out large commercial claims.

Cons

- Sharp Rate Increases After Claims: Premiums can jump pretty fast after accidents, violations, or even changes to your business or drivers’ credit scores.

- Limited Hands-On Support: Minimal access to local agents may be a drawback for complex fleets or custom coverage needs.

#7 – Allstate: Best for Local Agents

Pros

- Dedicated Local Agents: Businesses using commercial auto insurance with Allstate get one-on-one support for policy changes, certificates, and claim follow-ups.

- Multi-Policy Support: You can bundle commercial auto with general liability, property, and umbrella policies to save 25%, within our Allstate Insurance Review.

- Established Claims Network: A large national claims team helps keep repairs on track and coordinates smoothly with third parties after an accident.

Cons

- Higher Base Pricing: Commercial auto premiums often come in above market averages, starting at $165 per month for minimum coverage.

- Regional Complaints: Allstate usually receives twice as many complaints as other national providers, but customer service experiences vary by state.

#8 – Travelers: Best for Discount Options

Pros

- Built-In Discounts: Travelers commercial auto insurance offers savings for fleet size, prior coverage, safe driving, and bundling to offset higher base rates.

- Handles Large Claims Well: Strong financial support allows Travelers to cover major losses and complex accidents. Read our Travelers auto insurance review for details.

- Good Fit for Fleets and High-Risk Use: It’s a solid choice for businesses with heavy vehicles, lots of time on the road, or higher risk out there.

Cons

- Higher Starting Costs: Travelers has higher-than-average quotes when compared with other commercial car insurance companies.

- Less Competitive for Solo Drivers: If you only have one vehicle, you’ll usually get better rates from insurers that offer more flexibility.

#9 – Farmers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Option: A first at-fault accident may avoid a rate increase for eligible businesses, with our Farmers insurance review.

- Agent-Guided Policy Setup: Local agents in all 50 states help businesses set up commercial policies that align with their actual driving risks.

- High Liability Limit Options: Businesses with a lot of driving or higher risk can access higher liability limits to stay better protected.

Cons

- Higher Base Premiums: Monthly costs can start out a bit higher than average, but qualifying for discounts can bring them down.

- Limited Value for One-Vehicle Businesses: Commercial auto insurance with Farmers can cost more for single-vehicle businesses than more price-focused carriers.

#10 – Safeco: Best for Online Tools

Pros

- Strong Online Policy Management: Safeco’s portal lets small business owners pay bills, access ID cards, and update policies without calling an agent.

- Solid Pricing for Low-Risk Use: Commercial auto insurance with Safeco works well for single-vehicle businesses with steady mileage.

- Simple Coverage Structure: Fewer add-ons and clearer limits make policies easier to manage. Explore policy options in our Safeco auto insurance review.

Cons

- Limited Agent Support: If you’re looking for hands-on help, you might find there aren’t as many chances to meet with someone face-to-face.

- Not Built for Fleets: Coverage and pricing are less competitive once multiple vehicles or higher-risk operations are involved.

Choosing the Best Commercial Auto Insurance

The best commercial auto insurance comes from Erie, Nationwide, and Liberty Mutual, with rates starting as low as $60 per month for businesses that need minimum coverage.

Each of these providers is best for their reliable claims handling, flexible policies for growing businesses, and coverage options that cater to many types of vehicles and risk levels.

Commercial car insurance is designed for business-use driving. It typically covers fleets, delivery vehicles, and other corporate cars. However, you might need it if you use your personal vehicle for work.

Personal auto insurance does not cover accidents or damages that happen while you’re working, so compare commercial auto insurance policies to ensure you’re covered at all times.

Businesses can avoid claim denials by choosing commercial auto coverage that matches how their vehicles are actually used and stays within the policy’s driving and liability limits.

Michelle Robbins Licensed Insurance Agent

Look beyond the average cost of car insurance and choose coverage that goes with how your company really uses its vehicles. That way, you’re not paying for coverage you don’t need.

Enter your ZIP code to request an instant commercial auto insurance quote based on your location, vehicle type, and coverage needs.

Frequently Asked Questions

What is the best commercial auto insurance company?

Erie is typically ranked the top company for commercial auto insurance due to its rate stability and solid claims service. To put that in perspective, Erie’s minimum policy is around $92 per month in most states, but some states (such as Idaho) could charge as low as $60 a month for the same coverage if they have less risk and need for coverage.

Why is commercial auto insurance so expensive?

Commercial auto insurance costs more because it covers higher risk, including frequent driving, multiple drivers, heavier vehicles, and greater liability exposure, compared to personal auto policies.

Explore your commercial auto insurance options by entering your ZIP code into our free comparison tool today.

Is commercial auto insurance available for high-risk drivers?

Yes, many insurers offer commercial auto insurance for high-risk drivers, though rates increase significantly after DUIs, multiple accidents, or severe violations due to higher claim likelihood, and options similar to cheap auto insurance for high-risk drivers are much harder to secure in commercial markets.

What is commercial auto insurance?

Commercial auto insurance covers business-use vehicles and helps pay for accidents, injuries, or property damage if you or an employee is found responsible. It’s designed for work-related driving and protects your business from costly claims involving employees, customers, or other drivers.

Who is insured on a commercial auto policy?

A commercial auto policy generally covers the business the car is being driven for, the vehicle’s owner, and any employee or anyone else who operates the vehicle as part of their work-related duties. This may include full-time employees, part-time employees, and occasionally temporary or permissive drivers, as determined by the policy terms.

What does commercial auto insurance usually include?

Common types of commercial auto insurance include liability, collision and comprehensive coverage, medical payments, uninsured or underinsured motorist coverage, and hired or non-owned auto coverage. Businesses that haul goods may also add cargo or equipment coverage based on how their vehicles are used.

What is not covered by a commercial auto policy?

A commercial auto package policy does not cover routine wear and tear, mechanical failures, personal items inside the vehicle, or intentional damage caused by a driver. It also excludes accidents that happen during personal use unless that usage is specifically added to the policy.

What is another name for commercial auto insurance?

Another name for commercial auto insurance is “business auto insurance,” which is the term many insurers use when referring to coverage for vehicles used in day-to-day business operations.

Why do I need commercial auto insurance instead of personal auto insurance?

Personal auto policies often exclude business use, meaning claims can be denied if a vehicle is used for deliveries, service calls, or employee driving, which can leave you unsure of what to do if you get denied insurance coverage.

What is the difference between commercial auto insurance and liability auto insurance?

Commercial auto insurance covers business vehicles with protections like liability, collision, comprehensive, medical payments, and hired or non-owned coverage for work driving. Liability auto insurance is just one part of that package and only pays for damage or injuries you cause to others.

What is Coverage C in commercial auto insurance?

What are the parts of a commercial auto policy?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.