Best Auto Insurance Companies in Alaska for 2026

State Farm, American Family, and Allstate are the best auto insurance companies in Alaska, offering coverage starting around $35 a month. Geico helps Alaskans save with military and multi-policy discounts, while Progressive rewards safe driving with up to 25% off to keep drivers protected on Alaska roads.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

State Farm, American Family, and Allstate top the list of the best auto insurance companies in Alaska for flexible coverage that fits local needs.

- State Farm offers personalized reviews and mobile claims tracking

- The best auto insurance companies in Alaska cover salt damage

- Alaska drivers meet the 50/100/25 liability limit with flexible coverage

Starting from $35 a month, State Farm helps drivers handle icy roads with winter emergency towing and rental reimbursement.

American Family rewards safe driving with shrinking deductibles and teen-driver savings, while Allstate stands out with claim satisfaction guarantees and coverage for snow and wildlife collisions.

Top 10 Companies: Best Auto Insurance in Alaska| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 664 / 1,000 | A++ | Safe Drivers | |

| #2 | 660 / 1,000 | A | Local Support |

| #3 | 644 / 1,000 | A+ | Bundling Policy | |

| #4 | 641 / 1,000 | A++ | Cost Savings | |

| #5 | 641 / 1,000 | A | Customer Service | |

| #6 | 640 / 1,000 | A | Flexible Coverage |

| #7 | 637 / 1,000 | A+ | High-Risk Drivers | |

| #8 | 632 / 1,000 | A+ | Broad Protection | |

| #9 | 628 / 1,000 | A | Senior Drivers |

| #10 | 585 / 1,000 | A++ | Reliable Service |

Discover top savings with the best car insurance companies in Alaska using our free quote tool. Compare coverage options designed for both city and rural drivers.

What Drivers Pay for Auto Insurance in Alaska

Auto insurance prices in Alaska really show how much your coverage level, driving record, and insurance company can affect what you pay each month.

State Farm, Progressive, and Geico Insurance in Alaska tend to offer better deals to drivers with clean records and consistent driving habits.

Alaska Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $70 | $148 |

| $73 | $163 | |

| $63 | $139 |

| $64 | $140 | |

| $54 | $120 | |

| $65 | $144 |

| $59 | $131 | |

| $57 | $127 | |

| $56 | $125 | |

| $60 | $134 |

Higher-priced options usually include extra perks or stronger protection, which can be worth it for Alaskans who drive in rural areas or face harsh weather.

You can also see how each company approaches value differently. Providers with mid-range prices, such as AmFam and Farmers, often focus on better customer support and flexible coverage options that appeal to people who want dependable service.

Sticking with minimum coverage keeps things legal, but not always safe. For example, full coverage can save you big after a serious crash.

Daniel Walker Licensed Insurance Agent

Companies like Liberty Mutual and Travelers build policies that adjust to Alaska’s changing seasons, giving drivers peace of mind all year.

Understanding these trends in this auto insurance guide can help you strike the right balance of price, protection, and reliability for your needs and choose the best car insurance in Alaska for your situation.

Driver Age & Alaska Car Insurance Rates

In Alaska, car insurance costs mostly depend on your age, experience, and driving record. Younger drivers usually pay more since they’re considered riskier.

Auto insurance for teens in Alaska is the most expensive, while experienced drivers get better rates for keeping a clean record. Drivers in their 30s and 40s see the lowest prices since they’ve proven to be dependable on the road.

Alaska Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $175 | $80 | $63 | $70 |

| $180 | $101 | $74 | $73 | |

| $132 | $76 | $56 | $63 |

| $162 | $93 | $70 | $64 | |

| $128 | $69 | $40 | $54 | |

| $163 | $94 | $88 | $65 |

| $143 | $83 | $60 | $59 | |

| $158 | $72 | $56 | $57 | |

| $135 | $77 | $35 | $56 | |

| $165 | $95 | $49 | $60 |

Insurance companies also tend to reward consistent, safe driving habits. The average cost of car insurance in Alaska can drop as low as $35 a month with State Farm if you keep a clean driving record.

Staying safe on the road can make a big difference in how much you pay and help build trust with your insurer over time. Comparing Alaska car insurance rates from multiple providers can also help you find better coverage and save more each month.

How Driving History Impacts Alaska Insurance Costs

Your driving record has a big influence on what you pay for car insurance in Alaska. One infraction, especially a DUI, can raise your rates fast, so picking the best Alaska insurance company helps you save long-term.

Alaska auto insurance companies evaluate reliability and driving habits when setting prices, and each weighs these infractions differently.

Alaska Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $70 | $125 | $190 | $88 |

| $73 | $126 | $195 | $84 | |

| $63 | $110 | $174 | $77 |

| $64 | $118 | $175 | $78 | |

| $54 | $77 | $124 | $62 | |

| $65 | $119 | $176 | $79 |

| $59 | $107 | $158 | $71 | |

| $57 | $100 | $152 | $70 | |

| $56 | $95 | $151 | $68 | |

| $60 | $108 | $160 | $76 |

Drivers with clean records often enjoy steady premiums and safe-driving discounts. However, Geico and State Farm consistently have cheap auto insurance for high-risk drivers in Alaska.

If you’re trying to rebuild your record, both Progressive and Nationwide make it easier with programs that reward steady progress and safe driving. Finding the best Alaska auto insurance isn’t just about the price—it’s about picking a company that helps you grow as a driver while keeping your coverage affordable.

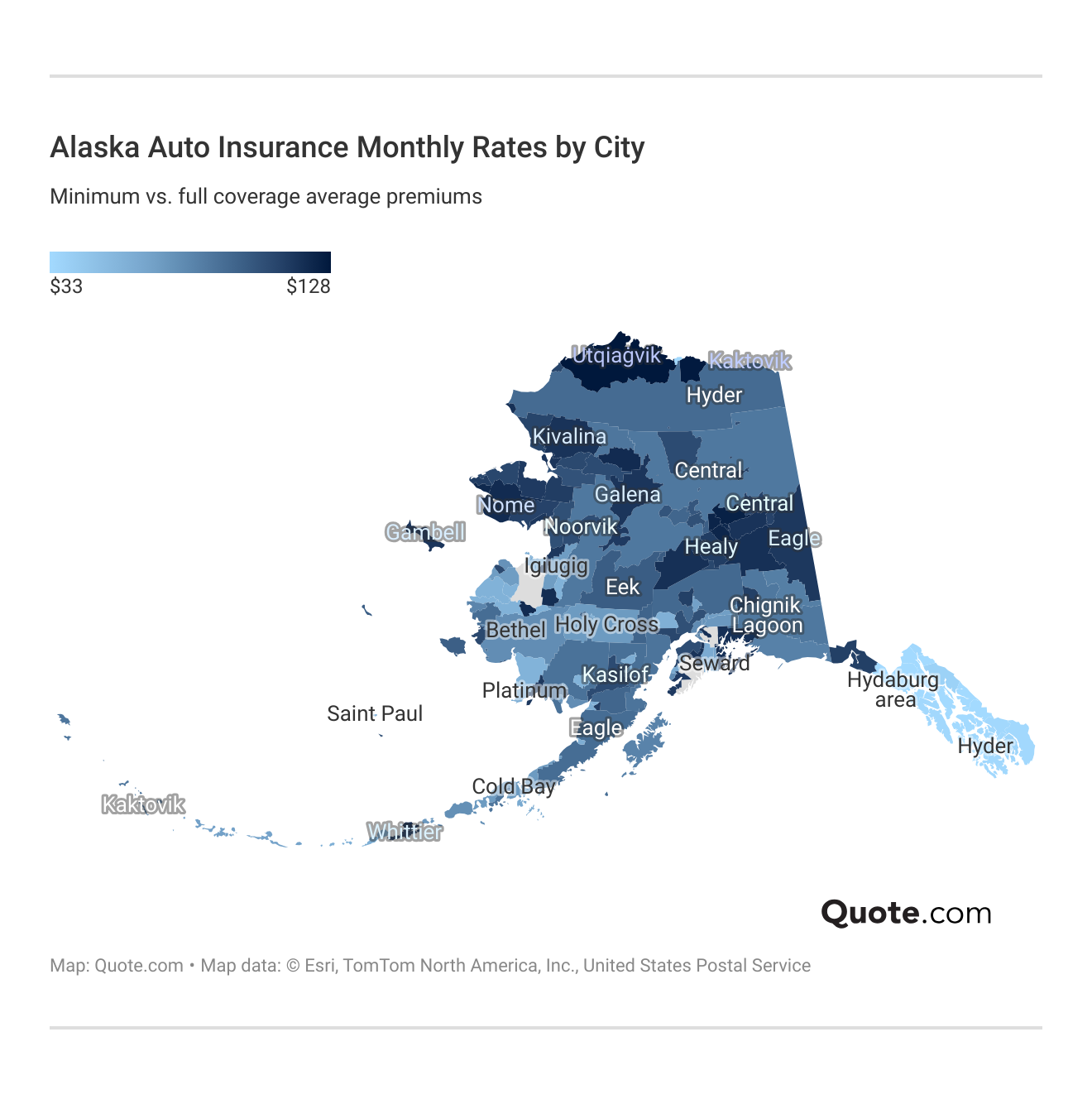

Auto Insurance Rates Based on Where You Live in Alaska

Car insurance prices can change a lot depending on where you live in Alaska. Smaller towns with fewer drivers usually have lower rates, but this can depend on factors such as local road conditions or how often accidents occur nearby.

If you’re in a busy city with more traffic and unpredictable weather, you’ll probably pay a bit more for coverage, even with the best car insurance in Alaska.

Every part of Alaska has its own story when it comes to insurance costs. Knowing what factors impact your area makes it easier to find the cheapest car insurance that actually fits your lifestyle and budget.

If you live in a big city — for example, if you’re comparing quotes for the best car insurance in Anchorage, Alaska, be sure to include your mileage and whether you garage the vehicle to see if you can’t reduce your monthly premium.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Alaska Car Insurance Requirements Explained

To find the right Alaska car insurance policy, choose coverage that fits how and where you drive. The best insurers offer a mix of options that help protect you in almost any situation.

You’ll need to know the Alaska car insurance requirements to stay legal, and you’re required to keep proof of coverage in your vehicle and show it during traffic stops or after an accident.

- Bodily Injury Liability per Person: You’ll need at least $50,000 to cover medical bills if one person gets hurt in a crash you cause.

- Bodily Injury Liability per Accident: The minimum is $100,000 to help pay for injuries to more than one person in the same crash.

- Property Damage Liability: You must carry at least $25,000 to pay for repairs or replacements if you damage someone else’s vehicle or property.

- Uninsured/Underinsured Motorist: You need to carry at least $50,000/$100,000 in uninsured/underinsured motorist (UM/UIM) insurance to protect against hit-and-runs and uninsured drivers.

Alaska car insurance requirements are unique since UM/UIM coverage isn’t required in every state. However, around 12% of Alaskan drivers are uninsured, which is nearly double the number in states like Utah and Wyoming.

This requirement protects responsible drivers who are insured from paying out of pocket or facing rising premiums if they’re in a hit-and-run accident or collide with an uninsured driver.

While these minimums keep you legal, they might not be enough after a serious accident. Many Alaska drivers add extras like collision and comprehensive insurance to stay protected from weather, theft, or wildlife damage.

Liability coverage pays for the damage or injuries you cause, while collision coverage helps repair your car after a crash. Comprehensive coverage protects against non-crash events like theft, hail, or hitting an animal.

Drivers can also add medical payments coverage (MedPay) or personal injury protection (PIP) to cover medical bills, even if you’re at fault. Extras like gap insurance, rental reimbursement, and roadside assistance give more peace of mind but raise monthly rates.

When reviewing your options, always consider how much car insurance coverage you need based on your driving habits, vehicle type, and budget.

Tips to Lower Alaska Auto Insurance Premiums

With unpredictable weather, long drives, and miles of open road, tweaking how you manage your policy can really help you cut down your auto insurance costs in Alaska.

Focusing on car insurance discounts in Alaska and simple policy tweaks can help you get cheap car insurance in Alaska and cut your monthly bill easily.

- Take a Defensive Driving Course: If you’re 55 or older in Alaska, you can earn a nice discount by taking a simple state-approved course that stays valid for three years.

- Add Safety Features: Vehicles with airbags, anti-lock brakes, or anti-theft systems often qualify for lower premiums, as they help reduce accidents and theft.

- Ask About Low-Mileage Pricing: If you drive fewer miles in places like Anchorage or Fairbanks, your insurer might offer reduced rates for fewer miles driven each year.

- Try Telematics if Offered: Some insurers in Alaska offer programs that track safe driving behaviors, such as smooth braking and steady speeds, to help lower your rates.

- Review Your Coverage Regularly: Taking time once a year to review your policy helps ensure your coverage and costs still match your current driving habits.

You’ll save the most on Alaska auto insurance by asking about discounts. Understanding how auto insurance discounts in Alaska actually work can help you make the most of them.

Safe drivers in Alaska who use telematics programs usually see steady savings, and those who bundle home and auto or add anti-theft devices can save even more.

Top Auto Insurance Discounts in Alaska| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 8% | 15% | 30% | 30% |

| 10% | 25% | 25% | 40% | |

| 25% | 25% | 25% | 20% |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 35% | 25% | 20% | 30% |

| 5% | 20% | 40% | 40% | |

| 25% | 10% | 30% | $231/yr | |

| 15% | 17% | 25% | 30% | |

| 15% | 13% | 10% | 30% |

The best auto insurance companies in Alaska reward safe driving, consistent habits, and smart coverage decisions that reduce risks on Alaska’s unpredictable roads.

Finding the right good driver auto insurance discounts can make a big difference, with Nationwide, AAA, and Progressive giving the biggest savings.

Using winter tires and avoiding driving during storms when possible are smart moves that can help lower your premiums over time.

Kristen Gryglik Licensed Insurance Agent

Being proactive with your driving habits based on where you live in Alaska can help you lower rates with discounts.

Turn safe habits into long-term savings that keep your Alaska car insurance coverage affordable year after year.

Choosing the Best Car Insurance in Alaska

Picking the right car insurance company in Alaska isn’t just about finding the cheapest rate. It’s about finding a provider that actually fits how and where you drive.

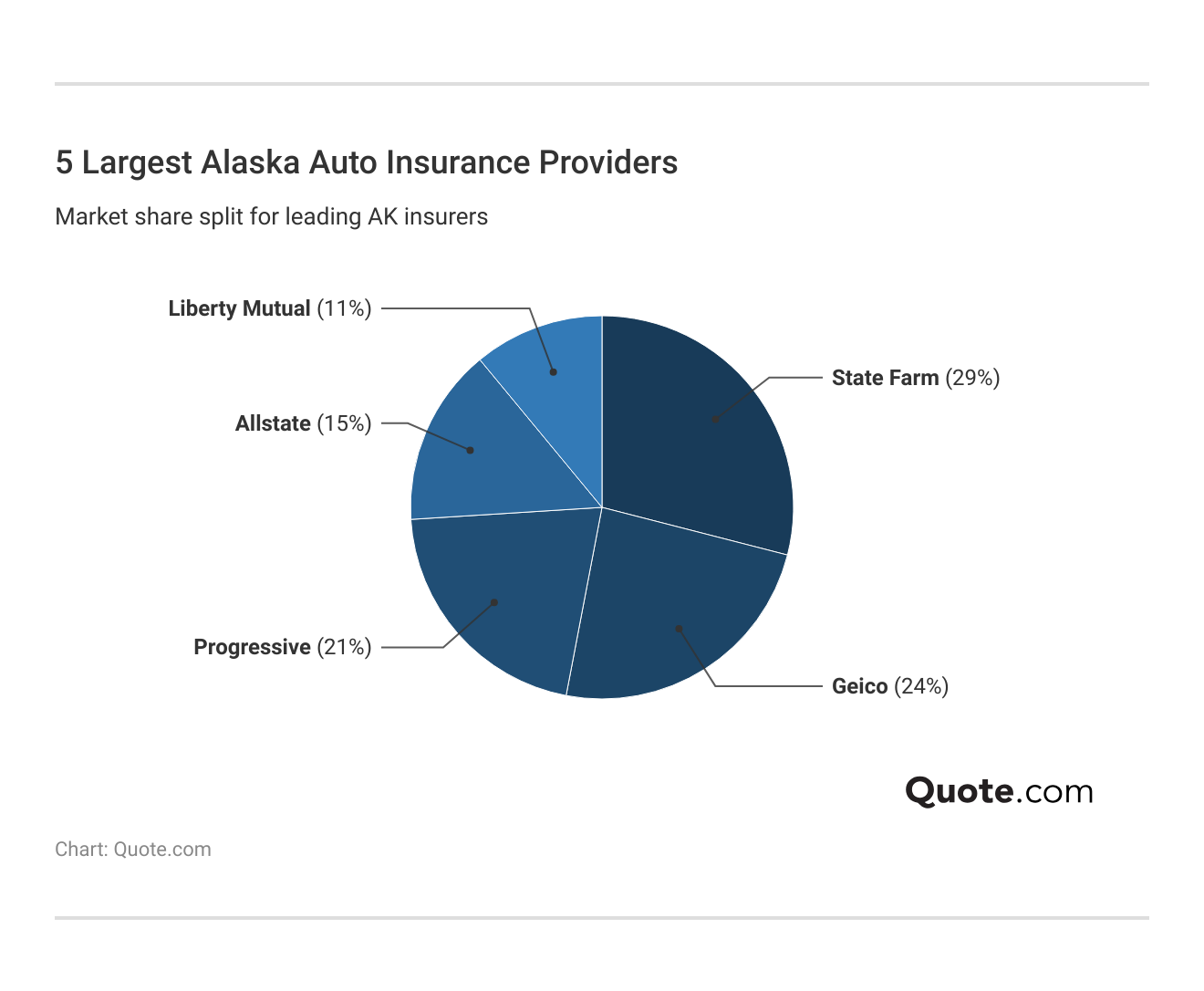

The biggest names in Alaska auto insurance continue to raise the bar for reliable coverage and strong financial protection across the state. State Farm leads the pack with a reputation for dependable service, trusted local agents, and quick claims support.

Geico appeals to cost-conscious drivers with low base rates and military discounts, while Progressive stands out for flexible coverage and SR-22 auto insurance options.

With icy roads, long stretches of highway, and unpredictable weather, you’ll want a company that’s easy to work with and there when you need them. Take a little time to compare auto insurance companies and find the one that truly fits your needs.

In the end, the best car insurance company for you is the one that fits your budget, gives great service, and keeps you covered wherever you drive in Alaska.

#1 – State Farm: Top Pick Overall

Pros

- Safe Driver Program: Alaska drivers can get up to 30% off with State Farm’s Drive Safe & Save program, which rewards steady, safe driving on the state’s icy winter roads.

- Roadside Coverage: Includes towing, jump-start, and lockout services that are essential for Alaska drivers traveling long, isolated routes.

- Financial Strength: With an A++ A.M. Best rating, the State Farm insurance review highlights dependable claims support and long-term stability for Alaska policyholders.

Cons

- Higher Deductibles: Many Alaska drivers choose $1,000 deductibles for collision coverage to keep payments lower, but that can mean higher out-of-pocket costs after an accident.

- Limited Add-On Options: Unlike competitors, State Farm offers fewer add-ons in Alaska, like new car replacement or gap coverage, limiting customization for customers.

#2 – American Family: Best for Local Support

Pros

- Local Agent Network: Alaska drivers get friendly, hands-on help from local agents in Anchorage, Fairbanks, and Juneau who really understand the state’s driving conditions.

- KnowYourDrive Savings: The KnowYourDrive program can save Alaska drivers up to 20% by tracking safe driving habits through easy-to-use telematics.

- Comprehensive Add-Ons: Drivers can add gap coverage, rental reimbursement, and roadside assistance for extra peace of mind on those long Alaska road trips.

Cons

- Slow Claims Processing: Some Alaska drivers say it can take a few extra days for American Family to approve claims, especially during the busy winter months.

- Limited Rural Access: Smaller Alaska towns have fewer offices, and the American Family Insurance review notes that this can reduce face-to-face support options for local drivers.

#3 – Allstate: Best for Bundling Policy

Pros

- Bundling Advantage: Alaska households can save up to 25% by combining home, renters, and auto insurance under Allstate’s Multi-Policy Discount.

- Drivewise Rewards: Alaska drivers can earn up to 30% off through Drivewise for safe speeds and smooth braking on snow-covered roads.

- Financial Stability: Backed by an A+ A.M. Best rating, Allstate maintains firm reserves to handle major Alaska weather-related claims.

Cons

- Limited Local Agents: Allstate has fewer in-person agents across Alaska, which can make getting one-on-one help harder for some drivers.

- Rate Increases: The Allstate insurance review shows that renewal premiums in Alaska can rise by up to 8% after minor at-fault accidents.

#4 – Geico: Best for Cost Savings

Pros

- Affordable Premiums: Geico helps Alaska drivers save with some of the lowest prices, making it a great option for anyone who wants reliable coverage.

- Military Discounts: Active-duty service members in Alaska can grab up to 15% off their policies thanks to Geico’s easy-to-use military discount.

- Top Financial Rating: Holding an A++ A.M. Best rating, Geico delivers reliable claims payment during large-scale winter damage events in Alaska.

Cons

- Limited Office Access: Only three Alaska branches in Anchorage, Fairbanks, and Wasilla are noted in the Geico insurance review, showing reduced in-person availability.

- Service Delays: Drivers in remote Alaska areas often experience delays in roadside assistance during severe winter conditions.

#5 – Farmers: Best for Customer Service

Pros

- Customer Service Reputation: With a 641/1,000 claims satisfaction rating, Farmers ranks among Alaska’s most responsive insurers.

- Signal App Rewards: Alaska drivers can earn up to 15% off smooth acceleration and safe braking through the Signal telematics program.

- OEM Parts Guarantee: Farmers uses original manufacturer parts for repairs, which is a big help for Alaska drivers who sometimes run into wildlife on the roads.

Cons

- Limited Discount Options: Farmers doesn’t have many Alaska-specific discounts, so some drivers might find it tougher to save on their premiums.

- App Connectivity Issues: Some Alaska drivers report data-syncing issues with the Signal app in rural areas, according to the Farmers insurance review.

#6 – Liberty Mutual: Best for Flexible Coverage

Pros

- Policy Customization: Liberty Mutual lets Alaska drivers adjust their deductibles, limits, and add-ons to match their seasonal driving needs.

- RightTrack Program: According to the Liberty Mutual insurance review, drivers in Alaska can save up to 30% by tracking habits with Liberty Mutual’s telematics app.

- Strong Financial Rating: Backed by an A rating from A.M. Best, Liberty Mutual provides reliable claim support for drivers across Alaska.

Cons

- Complicated Discounts: Alaska drivers say it can be a bit tricky to qualify for Liberty Mutual’s multi-car and advanced safety discounts, as there are a few extra requirements.

- Processing Delays: Rural Alaska residents report longer claim processing times during winter peaks, sometimes exceeding 10 business days.

#7 – Progressive: Best for High-Risk Drivers

Pros

- SR-22 Expertise: Progressive helps Alaska drivers who need an SR-22 filing get back on the road after a DUI or serious violation, making the process much less stressful.

- Snapshot Program: Alaska drivers can save up to 25% by driving safely with Progressive’s Snapshot app, which tracks habits like braking and speed.

- Strong Financial Rating: The Progressive insurance review highlights its A+ A.M. Best rating, supporting prompt claims payouts for Alaska’s high-risk drivers.

Cons

- Premium Fluctuations: High-risk drivers in Alaska might notice their rates go up 10% to 15% after filing a claim.

- Limited Local Offices: Progressive doesn’t have as many in-person locations in Alaska, so getting local help can take a little more effort.

#8 – Nationwide: Best for Broad Protection

Pros

- Comprehensive Package: Alaska customers benefit from accident forgiveness, roadside assistance, and total-loss deductible waivers in a single policy.

- Vanishing Deductible: Alaska drivers can reduce their deductible by $100 each year, up to $500, for maintaining a clean driving record.

- Financial Strength: According to the Nationwide Insurance review, the company’s A+ A.M. Best rating ensures timely and reliable claim payments across Alaska.

Cons

- Higher Liability Costs: Alaska drivers may pay more because of higher minimum liability coverage limits.

- Limited Regional Discounts: Alaska policies do not include some specialty savings available in other states.

#9 – AAA: Best for Senior Drivers

Pros

- Senior Safe Driver Discount: Alaska drivers 55 and older can save up to 10% by completing a defensive driving course, making it a great perk for experienced drivers.

- Comprehensive Roadside Assistance: AAA covers up to 200 miles of towing, which really comes in handy for those long Alaska road trips.

- Financial Reliability: With an A rating from A.M. Best, AAA gives Alaska’s older drivers peace of mind knowing their coverage is dependable.

Cons

- Membership Fees: Alaska customers must pay between $60 and $120 per year to maintain policy eligibility.

- Limited App Features: The AAA insurance review notes that its app lacks full claim-tracking and submission features, which can make claim management less convenient.

#10 – Travelers: Best for Reliable Service

Pros

- Strong Claims Handling: Travelers maintains quick response times and an A++ A.M. Best rating, giving Alaska drivers confidence in emergencies.

- Responsible Driver Discount: Provides 23% savings for Alaska drivers with three or more accident-free years.

- Premier New Car Replacement: Travelers covers the full value of new cars under 5 years old, a huge help for Alaska drivers navigating rough roads and tough terrain.

Cons

- Small Agent Network: The Travelers insurance review notes the company doesn’t have many offices in Alaska, making in-person help a little tricky for drivers.

- Youth Premiums: Alaska drivers under 25 often pay about 20% more for coverage, reflecting the higher risk associated with limited driving experience.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get Affordable Alaska Car Insurance Coverage

The best auto insurance companies in Alaska make it easy to stay covered without paying too much. State Farm’s great for its accident forgiveness and quick roadside help.

American Family keeps loyal drivers happy with renewal discounts, and Allstate gives peace of mind with its claim satisfaction guarantee.

When you’re shopping for coverage, comparing car insurance quotes in Alaska can help you see how rates differ by city, driver profile, and coverage needs. You can cut costs by bundling your policies, driving safely, or joining a usage-based program.

Look for companies with solid financial strength, good local claims support, and flexible plans that match your lifestyle. Follow these tips to pick out the best car insurance companies in Alaska

- Meet Alaska’s Minimum Requirements: Make sure your policy has at least 50/100/25 coverage so you’re legal and protected while driving in Alaska.

- Look for Strong Claims Support: Choose a company with good customer service and roadside assistance that works well in rural areas, where getting help can take longer.

- Check Financial Strength: Stick with companies that have high A.M. Best ratings so you can count on them to handle claims smoothly.

- Compare Coverage Options: Go for a company that lets you personalize your plan with options like collision and uninsured coverage to fit Alaska’s conditions.

- Read Local Reviews: See what other Alaskans are saying about their experiences with service, response times, and overall satisfaction.

To get the best deal, get multiple auto insurance quotes, compare plans online, and enter your ZIP code to find affordable coverage near you.

Frequently Asked Questions

Who has the best car insurance in Alaska?

State Farm ranks highest in Alaska for customer satisfaction due to fast claims processing, reliable local agents, and 24/7 roadside assistance. Its strong financial backing (A++ A.M. Best rating) gives drivers extra confidence after an accident.

Who has the cheapest car insurance in Alaska?

Geico, State Farm, and Progressive offer the lowest rates in Alaska. Geico starts at around $54 per month for minimum coverage, while State Farm and Progressive average about $56 to $60 per month, depending on your driving history. Compare the best auto insurance companies in Alaska with our free quote comparison tool.

How does car insurance work in Alaska?

Alaska car insurance helps cover injuries, repairs, and property damage if you end up causing an accident. Drivers must carry at least 50/100/25 in liability and UM/UIM coverage. Many add comprehensive or collision auto insurance coverage to protect against wildlife collisions and snow-related damage.

How much is car insurance in Alaska?

The average car insurance cost in Alaska is about $105 per month for full coverage and $60 per month for minimum coverage. Rates vary based on driving record, ZIP code, and coverage level. Rural areas like Fairbanks often cost less than places like Anchorage.

Is car insurance more expensive in Alaska?

Auto insurance in Alaska is slightly cheaper when you compare insurance rates by state, but costs can climb in icy regions or remote towns. Limited repair facilities, wildlife collisions, and extreme weather often make coverage more expensive for some drivers.

What is a good deductible for Alaska car insurance?

A $500 deductible is common in Alaska, balancing affordability and protection. However, if you want lower monthly payments, a $1,000 deductible could help reduce premiums. Just be sure you can cover that amount after an accident.

Does Geico cover Alaska?

Yes, Geico provides coverage across Alaska, including roadside assistance, rental reimbursement, and military discounts. It’s one of the most affordable insurers in Anchorage and Fairbanks for safe drivers, service members, and those seeking auto insurance for disabled veterans.

Does Progressive cover Alaska?

Yes, Progressive covers all of Alaska, including SR-22 insurance for high-risk drivers. Its Snapshot telematics program tracks safe driving habits, helping drivers save up to 25% over time.

What is the penalty for driving without insurance in Alaska?

Driving uninsured in Alaska can result in a $500 fine, 90-day license suspension, and a requirement to file SR-22 proof of insurance before getting your license reinstated. Repeat offenders face longer suspensions.

Is Alaska a no-fault state?

No, Alaska follows a fault-based insurance system, meaning the at-fault driver pays for injuries and damages. Having sufficient liability auto insurance coverage ensures you’re not stuck paying large out-of-pocket costs after an accident.

How do snowbirds get car insurance in Alaska?

What happens if you don’t have car insurance in Alaska?

What auto insurance is required in Alaska?

Do you need proof of insurance to register a car in Alaska?

Are older or newer cars cheaper to insure in Alaska?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.