Cheap Auto Insurance for Disabled Veterans in 2026

USAA has the cheapest auto insurance for disabled veterans, starting at $29 per month. Geico offers veteran and federal employee discounts, while State Farm stands out for its low-mileage savings. These providers provide military-exclusive benefits to help disabled veterans lower their rates.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated October 2025

USAA has cheap disabled veterans auto insurance for $29 a month. State Farm and Geico also offer some of the most affordable and comprehensive auto insurance options.

- USAA is the cheapest for disabled veterans at $29 per month

- Military discounts help lower insurance rates for disabled veterans

- Veterans can save with bundling and safe driver programs

State Farm rewards veterans with benefits such as accident forgiveness and low-mileage discounts, and Geico is unique among our picks for its veteran-specific programs and usage-based insurance.

10 Best Companies: Cheapest Auto Insurance for Disabled Veterans| Company | Rank | Monthly Rates | Military Discount | Best for |

|---|---|---|---|---|

| #1 | $29 | 30% | Military Members | |

| #2 | $35 | 25% | Reliable Coverage | |

| #3 | $39 | 15% | Military Discounts | |

| #4 | $47 | 25% | Veterans Benefits | |

| #5 | $48 | 10% | Discount Options | |

| #6 | $50 | 15% | Flexible Plans | |

| #7 | $53 | 12% | Personalized Service |

| #8 | $65 | 25% | Safe Drivers | |

| #9 | $68 | 20% | Bundling Deals | |

| #10 | $86 | 10% | Custom Policies |

If you’re a disabled veteran seeking affordable coverage and great service, these three insurers are your top picks.

Enter your ZIP code in our free tool to compare 100% disabled veteran car insurance quotes today.

How Much Disabled Vets Pay for Car Insurance

Many insurers provide lower rates, flexible policies, and additional benefits on auto insurance for disabled veterans to ensure affordability. The table below compares cheap auto insurance for disabled veterans and highlights the cheapest full coverage car insurance for veterans alongside other top providers.

Disabled Veteran Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $163 | |

| $53 | $123 |

| $68 | $145 | |

| $39 | $129 | |

| $86 | $176 |

| $47 | $118 | |

| $50 | $152 | |

| $35 | $113 | |

| $48 | $142 | |

| $29 | $92 |

Disabled veterans can access a range of affordable car insurance for veterans, with rates varying by provider and coverage level.

For minimum coverage, USAA offers the lowest monthly rate at $29, followed by State Farm at $35 and Geico at $39.

Higher rates include Liberty Mutual at $86 and Farmers at $68.

For full coverage, USAA auto insurance for veterans again leads at $92, with State Farm and Nationwide offering competitive rates at $113 and $118, respectively.

Disabled veterans should ask about unlisted military discounts and perks like accident forgiveness or waived fees.

Michelle Robbins Licensed Insurance Agent

On the higher end, Liberty Mutual charges $176, and Allstate follows at $163. Comparing rates across insurers helps veterans find the best value for their coverage needs.

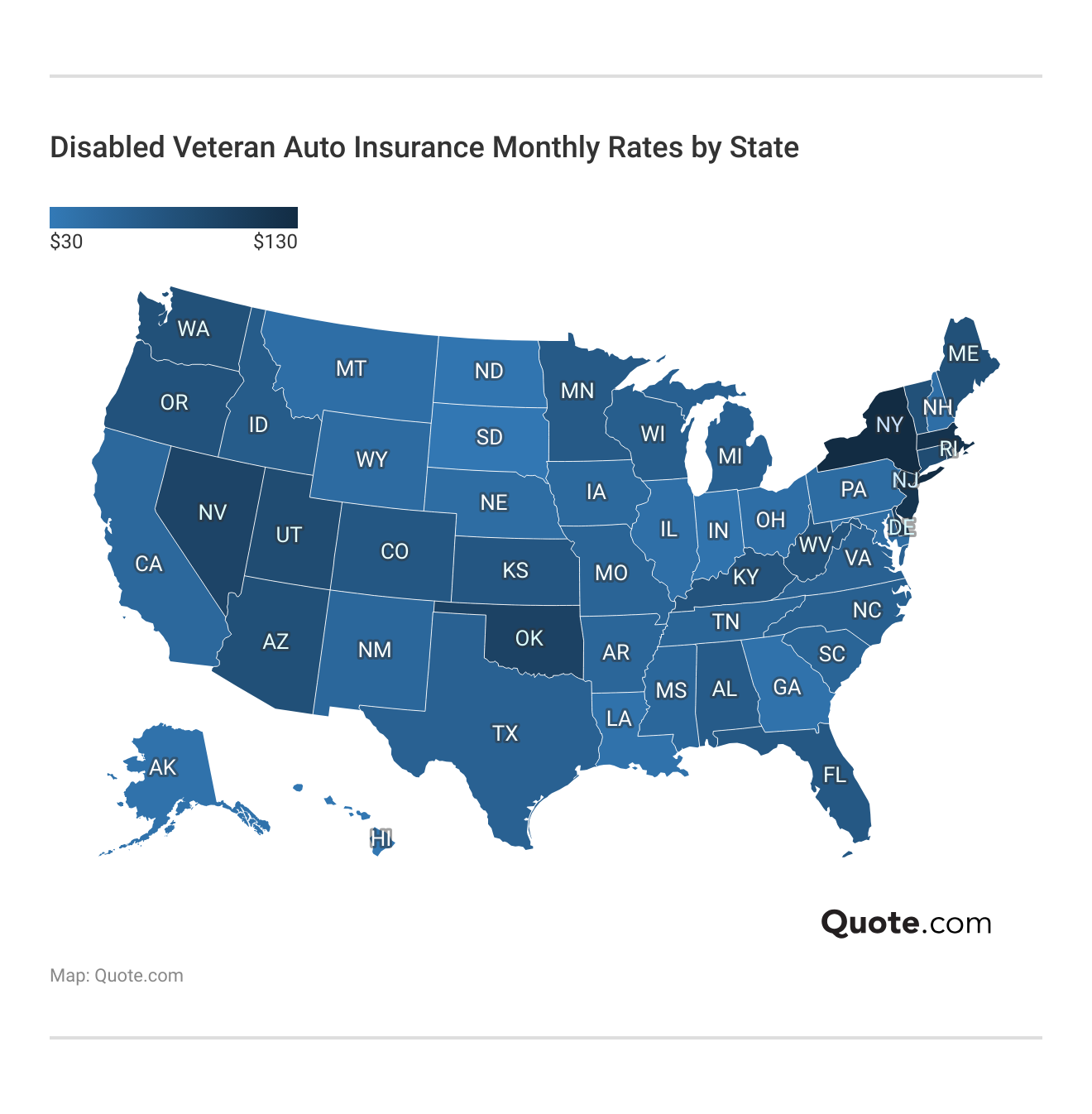

Compare Disabled Veteran Auto Insurance Rates Across the U.S.

The best car insurance for disabled veterans varies significantly across the U.S. due to state regulations, risks, and carrier offerings, making it essential to compare quotes by location.

Using a ZIP code-based quote tool allows veterans to find the best local deals from top providers like Nationwide, Progressive, and American Family, while also comparing options that may align with Michigan disabled veteran benefits for additional savings.

Minimum coverage can start as low as $29 per month with companies like USAA, State Farm, and Geico, while full coverage averages between $90 and $130.

Many insurers also provide additional savings through military discounts, bundling, safe driver programs, and cheap auto insurance for multiple vehicles, aligning with the benefits for 100 disabled veterans in Florida to help secure affordable, tailored coverage.

How Age & Gender Impact Disabled Veteran Auto Insurance Rates

Car insurance for disabled veterans can fluctuate significantly by age, where it will gradually decrease with experience and start to increase again once you reach a certain age.

For all age groups, USAA has the lowest rates, priced from $103 for age 30 to $26 for 55-year-olds.

Disabled Veteran Auto Insurance Monthly Rates by Age| Company | Age: 35 | Age: 45 | Age: 55 | Age: 65 |

|---|---|---|---|---|

| $78 | $65 | $59 | $72 | |

| $64 | $53 | $48 | $58 |

| $82 | $68 | $61 | $75 | |

| $47 | $39 | $35 | $43 | |

| $103 | $86 | $77 | $95 |

| $56 | $47 | $42 | $52 | |

| $60 | $50 | $45 | $55 | |

| $42 | $35 | $32 | $39 | |

| $58 | $48 | $43 | $53 | |

| $35 | $29 | $26 | $32 |

For families seeking cheap auto insurance for teens, comparing multiple providers is essential, as rates can drop significantly with experience, reaching $95 by age 65.

Rates change with age—young veterans pay more, mid-age drivers less. For example, picking insurers with loyalty perks can secure lasting savings.

Jeff Root Licensed Insurance Agent

Most insurers offer their best rates between ages 35 and 55, making age a key factor in finding affordable veteran auto insurance.

How Driving History Affects Auto Insurance Cost for Disabled Vets

Driving history plays a major role in determining how much disabled veterans pay for coverage, and even the best auto insurance for 100 disabled veterans can become more expensive after accidents, DUIs, or tickets.

USAA stands out as the cheapest across the board — $29 per month for a clean record, $39 per month with one accident, $55 per month with a DUI, and $35 with one ticket. State Farm and Geico also have good rates, especially for drivers with few violations.

Disabled Veteran Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $65 | $88 | $124 | $78 | |

| $53 | $72 | $101 | $64 |

| $68 | $92 | $129 | $82 | |

| $39 | $53 | $74 | $47 | |

| $86 | $116 | $163 | $103 |

| $47 | $64 | $89 | $56 | |

| $50 | $68 | $95 | $60 | |

| $35 | $47 | $67 | $42 | |

| $48 | $65 | $91 | $58 | |

| $29 | $39 | $55 | $35 |

In contrast, providers like Liberty Mutual and Farmers impose some of the highest penalties for poor driving history, with DUI-related premiums rising as high as $163 and $129, respectively.

Even a single ticket can lead to noticeable rate hikes across most insurers. This auto insurance guide emphasizes the importance of maintaining a clean driving record to secure lower premiums and keep long-term insurance costs manageable.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Disabled Vets Can Save on Car Insurance

Disabled veterans can save significantly on auto insurance with discounts related to bundling, low mileage, military service, and safe driving.

USAA offers the greatest military discount, at 30%, but Geico, Liberty Mutual, and State Farm each give as much as 30% off for low-mileage drivers.

Top Auto Insurance Discounts for Disabled Veterans| Company | Bundling | Low Mileage | Military | Safe Driver |

|---|---|---|---|---|

| 12% | 30% | 25% | 18% | |

| 25% | 20% | 12% | 18% |

| 20% | 10% | 20% | 20% | |

| 25% | 30% | 15% | 15% | |

| 25% | 30% | 10% | 20% |

| 20% | 20% | 25% | 12% | |

| 10% | 30% | 15% | 10% | |

| 17% | 30% | 25% | 20% | |

| 13% | 20% | 10% | 17% | |

| 10% | 20% | 30% | 10% |

American Family and Geico provide top bundling savings at 25% (Read More: Best Home Insurance for Veterans). Safe driver discounts from Farmers and the State Farm disabled veteran discount are among the best.

Veterans can stretch their budget even further and receive custom coverage at an affordable price by building a bundle including several different deals.

Car Insurance Monthly Rates Before & After Military Discount| Insurance Company | Before Discount | After Discount |

|---|---|---|

| $65 | $49 | |

| $53 | $47 |

| $68 | $54 | |

| $39 | $33 | |

| $86 | $77 |

| $47 | $35 | |

| $50 | $43 | |

| $35 | $26 | |

| $48 | $43 | |

| $29 | $20 |

Military discounts, highlighted in the 17 car insurance discounts you can’t miss, can greatly reduce costs for disabled veterans.

For example, USAA lowers rates from $29 to $20, State Farm from $35 to $26, and Nationwide from $47 to $35.

Even higher-priced providers like Allstate and Farmers show meaningful reductions, with premiums dropping to $49 and $54, respectively.

The Allstate insurance military discount highlights how military-specific savings can help veterans secure more affordable coverage.

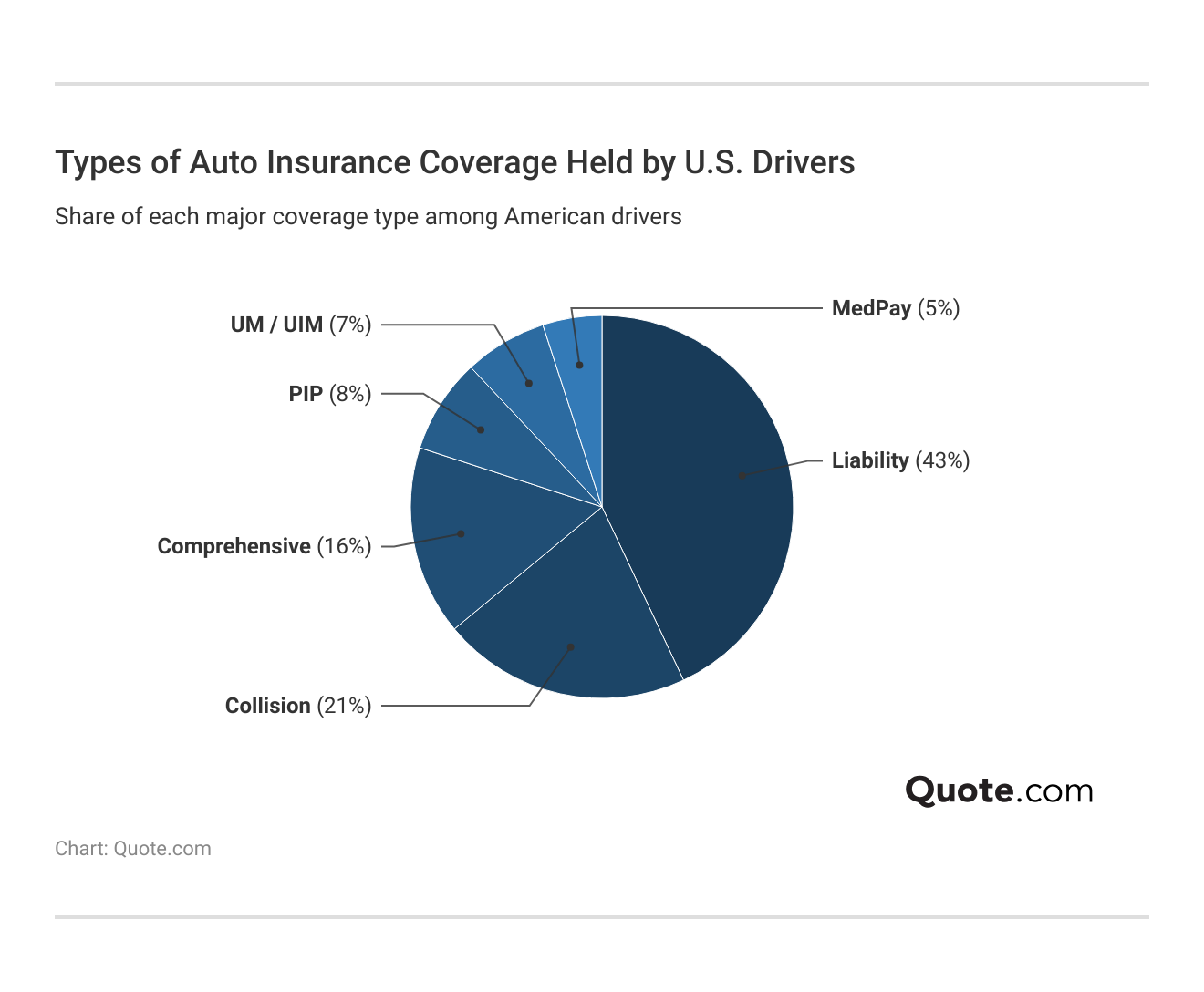

Car Insurance Coverage Disabled Vets Need

For disabled veterans, the right auto insurance provides peace of mind and financial protection. Knowing each coverage type helps match the policy to their needs, from liability to theft and accident protection.

- Liability Coverage: This covers bodily injury and property damage expenses if the policyholder is responsible for an accident.

- Comprehensive Coverage: Protects against non-collision events such as theft, vandalism, fire, and weather-related damage.

- Collision Coverage: Pays for repairs or replacement of vehicles for disabled veterans after an accident, regardless of fault.

- Personal Injury Protection (PIP): Personal injury protection helps cover medical expenses, lost wages, and other costs for the policyholder and passengers after an accident.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection if the policyholder is hit by a driver with little or no insurance coverage.

Choosing the right coverage ensures disabled veterans are well protected on the road—whether it’s for medical costs, vehicle repairs, or uninsured drivers.

By tailoring their policy to include the most relevant protections, disabled veterans can drive with greater confidence knowing they have reliable coverage when it matters most.

USAA is widely recognized as the most affordable and veteran-focused auto insurance provider, offering rates as low as $29 per month for minimum coverage and $92 for full coverage.

USAA offers auto insurance for veterans and their families with perks like waived insurance deductibles, accident forgiveness, and up to 30% in discounts, making it a top choice for affordable, veteran-focused coverage.

Cheapest Car Insurers for Disabled Veterans

Disabled veterans can often access exclusive discounts and special coverage options that make car insurance more affordable.

These providers rank among the best auto insurance companies, offering low rates and perks like accident forgiveness, bundling savings, and military benefits. Comparing them helps veterans secure reliable coverage at the best price.

#1 – USAA: Top Overall Pick

Pros

- Lowest Starting Rates: USAA offers veteran auto insurance for $29 a month, making it a top affordable choice for disabled veterans and families. See our USAA insurance review for details.

- Exclusive Military Discounts: Disabled veterans can save up to 30% with the USAA auto insurance military discount by combining it with safe driving programs and vehicle storage options.

- Exceptional Claims Satisfaction: USAA earns top ratings for service and claims handling, with USAA disabled veteran benefits offering tailored support for military members and veterans.

Cons

- Eligibility Limitations: USAA is only available to active-duty military, veterans, disabled veterans, and their families—civilians without military ties aren’t eligible.

- Limited Physical Locations: USAA mainly serves its members online or by phone, which may be less convenient for disabled veterans who prefer in-person assistance or the familiarity of local agents.

#2 – State Farm: Best for Reliable Coverage

Pros

- Competitive Minimum Coverage Rates: State Farm offers a minimum coverage from just $35 per month, which makes it a very affordable option available to disabled veterans.

- Strong Safe Driver Discount: Disabled veterans can save up to 20% through State Farm’s program, which rewards safe and responsible driving. Read our State Farm auto insurance review for more.

- Usage-Based Insurance Savings: State Farm’s Drive Safe & Save Program lets disabled veterans save up to 30%, making it ideal for low-mileage drivers and those seeking retired military auto insurance.

Cons

- No Nationwide Military Discount: Unlike USAA and Geico, State Farm doesn’t offer a nationwide military discount. Savings for disabled veterans are determined by local agents or state laws.

- Limited Customization for Veterans: State Farm offers reliable coverage but lacks features specifically designed for the unique needs of disabled veterans, like mobility-related support.

#3 – Geico: Best for Military Discounts

Pros

- Competitive Monthly Rates: Disabled veterans can pay as little as $39 for monthly premiums, with no more than $129 for full coverage. Check out our Geico insurance review for insights.

- Military Discount Savings: Eligible veterans can receive up to 15% off their total premium through Geico’s military discount program, helping reduce already competitive rates even further.

- Strong Discounts: Disabled veterans may be able to qualify for low-mileage discounts to save 30%, great for those who don’t drive frequently or have limited access to a vehicle.

Cons

- Veteran Rate Structure by Age: At $148 per month for a 16-year-old driver, Geico’s premiums for younger or newly licensed disabled veterans are significantly higher compared to other age groups.

- No Specialized Coverage: Unlike USAA or Nationwide, Geico does not offer tailored programs specifically for service-connected disabled veterans or VA compensation recipients.

#4 – Nationwide: Best for Veterans Benefits

Pros

- Affordable Rates for Disabled Veterans: Nationwide offers low premiums, $47 for minimum coverage and $118 for full coverage—making it a smart pick for budget-conscious disabled veterans.

- Veteran-Specific Discounts: Disabled veterans with VA benefits or proof of service may qualify for additional savings through local Nationwide agents. Learn more in our Nationwide insurance review.

- Multi-Policy Bundling Perks: Disabled veterans can save up to 20% by bundling auto with homeowners or renters insurance—ideal for those seeking consolidated, cost-effective coverage.

Cons

- Limited Online Customization: Customizing discounts or military status often requires working with an agent, which may be less convenient for tech-savvy or mobility-limited disabled veterans.

- Not Exclusively Military-Focused: Unlike USAA, Nationwide doesn’t specialize in military or veteran clients, so some services and perks may not be tailored to the unique needs of disabled veterans.

#5 – Travelers: Best for Discount Options

Pros

- Wide Range of Discounts: With savings for bundling, safe driving, and hybrid/electric vehicles, disabled veterans will have several options to discount their premiums.

- Loyalty and Multi-Policy Savings: Disabled veterans can save more by insuring multiple vehicles or combining auto with home or renters insurance, maximizing their discount potential.

- National Availability: Travelers is available nationwide, making it a convenient choice for disabled veterans who move or serve in different states. Find the full list in our Travelers auto insurance review.

Cons

- Discounts May Vary by State: Some safe driver or bundling savings are not universally applied, meaning disabled veterans may see inconsistent benefits depending on location.

- Higher Rates for Younger Veterans: Monthly costs are steeper for younger disabled veterans, with rates averaging $182 at age 16, compared to $48 at age 45.

#6 – Progressive: Best for Flexible Plans

Pros

- Affordable Starting Rates: For disabled veterans, Progressive has a low-ball rate of $50 a month for minimum coverage, making this a great option for frugal drivers.

- Strong Accessibility: Through strong app and online functionality, Progressive allows disabled veterans to manage and file claims or make changes to their coverage from anywhere.

- Customizable Policies: Usage-based Snapshot plans let disabled veterans who drive less often save more on premiums. Read our review of Progressive for full details.

Cons

- Customer Service Rating: Progressive receives mixed reviews for claims handling, which could be a drawback for disabled veterans seeking reliable, stress-free support.

- Limited Military-Specific Discounts: Unlike USAA, the Progressive disabled veteran discount is limited since it lacks dedicated military-only savings, making it less appealing for disabled veterans.

#7 – American Family: Best for Personalized Service

Pros

- Personalized Local Service: Known for attentive, agent-driven support, American Family is helpful for disabled veterans seeking tailored guidance. Explore our American Family insurance review.

- Moderate DUI Impact: Rates after a DUI average $101, which is lower than some competitors like Liberty Mutual ($163), offering more affordable recovery options for veterans with violations.

- Attractive Bundling Savings: American Family offers one of the highest bundling discounts at 25%, benefiting disabled veterans who combine auto and home policies.

Cons

- Less Competitive DUI Rates: Disabled veterans with a DUI face higher premiums, with monthly rates averaging $101, compared to $55 with USAA or $67 with State Farm.

- Limited Military-Specific Benefits: American Family does not offer an exclusive veteran auto insurance program, potentially limiting savings for disabled veterans.

#8 – Allstate: Best for Safe Drivers

Pros

- Safe Driver Discounts: Allstate rewards safe drivers with up to 18% in discounts, helping disabled veterans lower already competitive premiums. Discover more details in our Allstate insurance review.

- Accident Forgiveness Options: Disabled veterans with a good driving history may qualify for accident forgiveness, preventing significant rate increases after their first at-fault accident.

- Strong Customer Support Network: Allstate offers personalized service through a large agent network, giving disabled veterans easier access to tailored coverage and claims assistance.

Cons

- Less Tailored Support: Unlike USAA, Allstate does not specialize in veteran-specific customer service or claims assistance, which may matter to disabled veterans needing more personalized care.

- Limited Military Perks: Allstate military discount offers savings, but it lacks USAA’s exclusive benefits like waived deductibles or deployment flexibility.

#9 – Farmers: Best for Bundling Deals

Pros

- Multi-Policy Savings: Farmers gives disabled veterans up to 20% off when bundling auto with home or renters insurance, which can bring a $68 minimum coverage premium closer to $54 per month.

- Family-Centered Coverage Benefits: Disabled veterans who bundle vehicles or use auto insurance for military family members under one plan often get better rates than separate policies.

- Consistent Claims Support: Farmers is valued by disabled veterans for strong customer service and a responsive claims process. Find more in our Farmers insurance review.

Cons

- Expensive for High-Risk Drivers: Disabled veterans with a DUI could see premiums rise to $129 a month, which bundling discounts may not offset enough.

- Savings Vary by State: Some discounts, including bundling percentages, are inconsistent across regions, meaning disabled veterans in certain states may not receive the full advertised reductions.

#10 – Liberty Mutual: Best for Custom Policies

Pros

- Customizable Coverage Options: Liberty Mutual lets disabled veterans personalize policies with add-ons like accident forgiveness, roadside assistance, and new car replacement.

- Safe Driver Incentives: Liberty Mutual offers up to 20% off for disabled veterans with a clean driving record. See our Liberty Mutual insurance review for more.

- Wide Availability: Liberty Mutual has coverage in the majority of U.S. states, so wherever you may be living in the U.S., you should be able to find a policy to suit your needs as a disabled veteran.

Cons

- Less Competitive Military Discount: The military discount of 10% appears less competitive compared to USAA’s 30% discount, meaning disabled veterans may not save as much.

- Not the Best for Budget-Conscious Veterans: Liberty Mutual might not be the right fit for disabled veterans for whom cost was a priority over customization.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get Low-Cost Coverage for Disabled Vets Now

Getting cheap auto insurance for disabled veterans is possible through top providers offering low rates and valuable perks.

USAA is the best among the options below, with premiums beginning at $29 monthly, but State Farm and Nationwide offer solid choices too, with accident forgiveness and veteran discounts.

Rates vary by age, driving record, and location, but veterans can save with bundling, low-mileage, and safe driver discounts. By comparing quotes from the best car insurance companies for veterans and tailoring coverage, disabled veterans can secure affordable protection and peace of mind.

Ready to save? Start comparing cheap auto insurance for disabled veterans by entering your ZIP code into our free quote tool today.

Frequently Asked Questions

What are the most trusted insurance options for veterans?

The most trusted insurance options for veterans are USAA, State Farm, and Geico. USAA offers the lowest rates at $29 per month, while State Farm adds accident forgiveness, and Geico provides veteran-specific programs.

What are the top-rated military auto insurance providers?

The top-rated military auto insurance providers are USAA, State Farm, and Geico. USAA leads with the lowest rates from $29 per month and exclusive military perks. State Farm has accident forgiveness; Geico has programs for veterans; and Geico gives those who serve in the military up to 15% off.

Enter your ZIP code into our free quote comparison tool to compare your rates against local insurers.

Does State Farm offer a military discount?

State Farm doesn’t offer a nationwide military discount, but in Louisiana, veterans and active-duty members get up to 25% off, making it one of the best auto insurance companies in Louisiana. Elsewhere, savings come from bundling, safe driver rewards, and Drive Safe & Save.

Does USAA give discounts to disabled veterans?

Yes, the USAA disabled veteran discount provides valuable savings. USAA offers lower base rates for all military members, plus up to 15% off for garaging on base and as much as 60% off for vehicle storage during deployment.

Can the United States Department of Veterans Affairs help veterans lower their car insurance rates?

Yes, the United States Department of Veterans Affairs can verify service-connected disabilities and veteran disability pay, which many insurers use to determine eligibility for discounted rates for veterans.

Do all companies offer 100% disabled veteran car insurance discounts?

Not all companies provide specific discounts for 100% disabled veteran car insurance, but top providers like USAA, Geico, and State Farm often extend military-related savings to qualified veterans, and guides such as 17 tips to pay less for car insurance can help maximize those savings even further.

Does Allstate offer veteran discounts?

Yes, Allstate offers veteran and military discounts, but availability depends on the state. In Louisiana, active-duty members get a 25% auto insurance discount. In other states, discounts may be lower and vary, so it’s best to confirm with a local Allstate agent.

Are there healthcare advantages under Alabama’s disabled veterans benefits?

Alabama disabled veterans’ benefits include access to VA healthcare facilities across the state, covering medical care, rehabilitation, and specialized veteran support.

Can I combine a disabled veteran car insurance discount with other savings?

Yes, most insurers allow you to combine a disabled veteran car insurance discount with other savings—like bundling, safe driver programs, or the best low-mileage auto insurance discounts—to secure the cheapest car insurance for veterans.

Do A-rated insurers with veteran discounts also offer bundling options?

Yes, many A-rated insurers with veteran discounts provide bundling options, allowing veterans to combine auto, home, or renters insurance for additional savings.

How much can I save by choosing auto and home insurance with a disabled veteran discount?

What are the most affordable insurance plans for veterans in Arizona?

Do disabled veterans get cheaper car insurance?

Does Geico offer a disabled veteran discount?

Are there education-related Colorado benefits for disabled veterans?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.