Cheap Auto Insurance for Seniors in 2026

Geico, State Farm, and Travelers have cheap auto insurance for seniors. Geico is the cheapest overall, with rates at just $41 a month. State Farm is best for safe seniors with usage-based savings from its Drive Safe & Save program, while Travelers excels with comprehensive add-ons like accident forgiveness.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated November 2025

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage for Seniors

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsThe top pick overall for cheap auto insurance for seniors is Geico, followed by affordable options from State Farm and Travelers. Geico offers the lowest monthly rate at just $41 for minimum coverage.

Our Top 10 Company Picks: Cheap Auto Insurance for Seniors| Company | Rank | Monthly Rates | Defensive Driving | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $41 | 15% | Low Rates | Geico | |

| #2 | $43 | 15% | Safe Drivers | State Farm | |

| #3 | $50 | 20% | Comprehensive Coverage | Travelers | |

| #4 | $52 | 30% | Defensive Driving | Progressive | |

| #5 | $59 | 10% | Claims-Free Drivers | Nationwide | |

| #6 | $62 | 12% | Dividend Payments | Amica | |

| #7 | $72 | 10% | Usage-Based Coverage | Farmers | |

| #8 | $86 | 10% | Flexible Policies | Allstate | |

| #9 | $91 | 10% | Accident Forgiveness | Liberty Mutual |

| #10 | $124 | 10% | High-Risk Coverage | The General |

State Farm stands out for rewarding safe driving habits, while Travelers is best for comprehensive coverage, offering valuable add-ons like accident forgiveness.

This guide explains how to compare auto insurance companies, rates, coverage levels, and senior-specific discounts to help older drivers find affordable and reliable coverage.

- Get cheap auto insurance for seniors with defensive driving discounts up to 30%

- Geico is the top pick with the lowest rate at just $41 a month for seniors

- State Farm rewards safe drivers, and Travelers offers big defensive driving savings

To find out if you can get cheap senior auto insurance rates, enter your ZIP code into our free quote tool to instantly compare prices from various companies near you.

Cheap Auto Insurance Rates for Seniors

Rates for senior drivers vary widely, but the cheapest car insurance comes from Geico, State Farm, and Travelers. Geico offers the lowest minimum coverage at just $41 per month, followed by State Farm at $43 monthly and Travelers at $50 a month.

Senior Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $86 | $220 | |

| $62 | $200 | |

| $72 | $183 | |

| $41 | $106 | |

| $91 | $227 |

| $59 | $149 | |

| $52 | $136 | |

| $43 | $108 | |

| $124 | $316 | |

| $50 | $129 |

These three providers also keep full coverage affordable, making them top choices for the best full coverage car insurance for seniors, with monthly rates ranging from $106 to $129, making them ideal for seniors seeking low-cost, reliable coverage.

Seniors can save significantly by choosing one of the top three providers, especially when combining low base rates with discounts like safe driver and defensive driving incentives.

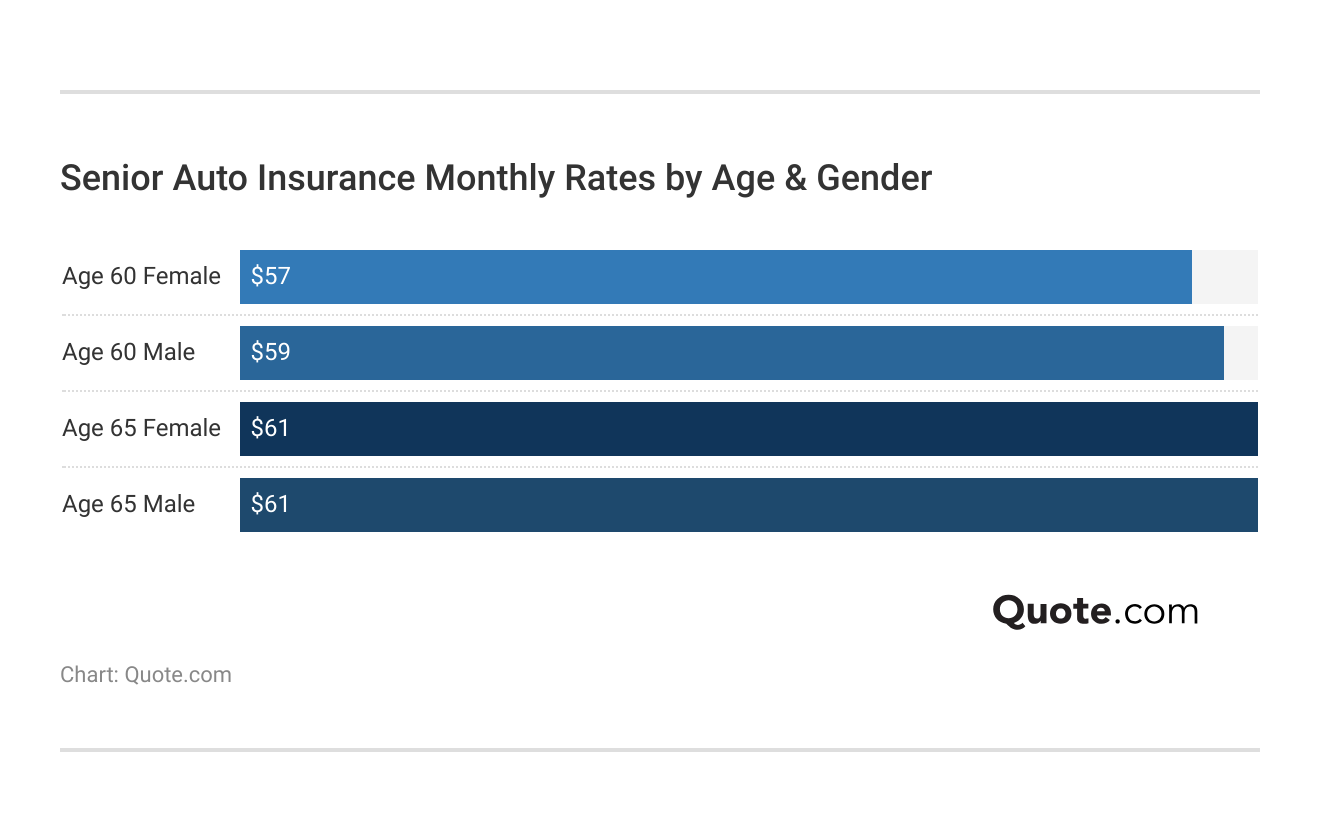

Senior Auto Insurance Rates by Age

Auto insurance rates for seniors tend to decrease in the early retirement years and gradually rise again with age. For example, the average monthly premium for a 55-year-old senior is $48, while a 65-year-old pays about $44—highlighting the availability of the cheapest car insurance for seniors over 60.

However, rates begin to rise after age 70, with 70-year-olds paying $47 and 75-year-olds paying $52 on average. Seniors in this age range should compare quotes to find the cheapest car insurance for seniors over 70, especially if they maintain a clean driving record and drive fewer miles annually.

For older seniors, premiums continue to increase due to perceived risk factors such as slower reaction times and medical concerns. Auto insurance for seniors over 80 can cost around $60 per month at age 80 and jump to $68 per month by age 85. Even so, many providers still offer discounts tailored to senior drivers, such as defensive driving savings and low-mileage pricing.

Read more: How to Get Multiple Auto Insurance Quotes

Senior Auto Insurance Rates by Driving Record

Driving record plays a major role in determining auto insurance rates for seniors. These companies reward accident-free driving with significantly lower premiums.

Senior Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $86 | $95 | $110 | $125 | |

| $64 | $72 | $85 | $98 | |

| $75 | $85 | $95 | $110 | |

| $42 | $48 | $55 | $60 | |

| $95 | $105 | $120 | $130 |

| $62 | $68 | $75 | $85 | |

| $55 | $60 | $65 | $75 | |

| $47 | $52 | $60 | $65 | |

| $121 | $130 | $140 | $150 | |

| $53 | $58 | $65 | $70 |

Seniors with a clean record can get the lowest rates from Geico, Travelers, and State Farm. On the other hand, The General charges $121 per month — even for seniors with no infractions — which is nearly triple Geico’s rate.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Coverage That Seniors Need

As seniors age, their insurance needs often shift based on how frequently they drive, the value of their vehicle, and their financial situation. While maintaining state-required liability coverage is essential, some seniors may choose to adjust or expand their policy to better protect their health and assets.

Retired drivers who rarely drive may opt for basic liability to save money—but others may benefit from more robust coverage. Here are the core coverages that seniors should consider:

- Liability Insurance: Covers injuries and property damage to others if you’re at fault. Seniors should consider higher limits to protect retirement savings from lawsuits.

- Personal Injury Protection (PIP) or Medical Payments (MedPay): Personal injury protection (PIP) or medical payments coverage (MedPay) can cover senior driver medical bills, regardless of who’s at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: Pays for medical bills or car repairs if you’re hit by someone with little or no insurance. Crucial protection for seniors in states with high rates of uninsured drivers.

- Comprehensive Coverage: Covers non-collision incidents like theft, hail, or animal damage—ideal for seniors with newer cars or those in areas prone to severe weather.

- Collision Coverage: Pays for damage to your car from accidents, regardless of fault. Seniors with high-value vehicles or limited emergency funds may want to keep this.

Certain add-ons can provide seniors with extra financial protection and convenience, especially as their driving habits and mobility needs evolve. One of the most useful add-ons for seniors is accident forgiveness, which helps maintain low premiums after a first at-fault accident, which is ideal for seniors with long clean driving histories.

New car replacement ensures full replacement value instead of a depreciated payout, especially useful for those driving newer vehicles. Roadside assistance offers 24/7 help for breakdowns or lockouts, giving peace of mind to seniors who may not want to handle emergencies alone.

Rental reimbursement covers transportation costs while a vehicle is being repaired, keeping seniors mobile for essential tasks like medical appointments or errands. These add-ons can enhance a policy without adding significant cost.

Tips to Save Auto Insurance for Seniors

Seniors can lower their car insurance costs in several simple and effective ways, starting with defensive driving courses. These classes not only refresh safe driving habits but also unlock major savings, and in some states, completing one qualifies for a government-mandated auto insurance discount for seniors.

Top Auto Insurance Discounts for Seniors| Company | Anti-Theft | Claims-Free | Defensive Driving | Safe Driver | Senior |

|---|---|---|---|---|---|

| 10% | 10% | 10% | 18% | 10% | |

| 18% | 10% | 12% | 15% | 12% | |

| 10% | 9% | 10% | 20% | 12% | |

| 25% | 12% | 15% | 15% | 10% | |

| 35% | 8% | 10% | 20% | 15% |

| 5% | 14% | 10% | 12% | 7% | |

| 25% | 10% | 30% | 10% | 12% | |

| 15% | 11% | 15% | 20% | 10% | |

| 15% | 10% | 10% | 12% | 10% | |

| 15% | 13% | 20% | 17% | 10% |

Progressive offers a 30% discount for completing a course, while Travelers gives up to 20%. Safe drivers can also benefit from ongoing rewards. Companies like Farmers and State Farm offer up to 20% off to seniors with clean driving records. And if you haven’t filed any claims recently, you could save even more — Nationwide offers a 14% discount for being claims-free.

Many seniors also qualify for savings just by having the right features in their car. Anti-theft devices can make a big difference, with Liberty Mutual offering up to 35% off and Geico up to 25%. On top of that, several companies provide senior-specific discounts.

Seniors can save the most by combining a defensive driving course and asking about age-based, claims-free, and low-mileage discounts.

Scott W. Johnson Licensed Insurance Agent

Asking your provider about all available discounts and combining them is one of the easiest ways to get cheap auto insurance for seniors. Get more information about the best car insurance discounts you can’t miss.

10 Cheapest Auto Insurance Companies For Seniors

Geico, State Farm, and Travelers are the top three companies with the cheapest car insurance for senior citizens. However, all ten of these providers stand out in different ways. Compare the insurers below to find the best auto insurance for seniors.

Read More: State Farm vs. Farmers, Geico, Progressive, Allstate: The Best?

#1 – Geico: Top Overall Pick

Pros

- Lowest Monthly Rate: Seniors have the most affordable minimum coverage at just $41 per month. Read everything you need to know about Geico to determine your policy options.

- Defensive Driving Discount: Geico car insurance for seniors can reduce their premium by up to 15% by completing a state-approved driving course.

- User-Friendly Tools: Seniors can manage policies, payments, and claims through Geico’s easy-to-use mobile app and online portal.

Cons

- Limited Agent Access: Seniors who like talking to an agent face-to-face may not get the support they want since Geico mostly works online.

- Fewer Optional Add-Ons: Seniors looking for extra features like accident forgiveness may need to look elsewhere for more coverage options.

#2 – State Farm: Cheapest for Safe Drivers

Pros

- Affordable Base Rate: Minimum coverage for seniors starts at a budget-friendly $43 per month. See our State Farm car insurance review for more quotes.

- Safe Driving Rewards: Good drivers can earn up to 20% off rates, and seniors who sign up for Drive Safe & Save usage-based policies can save up to 30%.

- Local Agent Network: Seniors benefit from personalized service through State Farm’s strong in-person support structure.

Cons

- Telematics May Not Fit: Seniors uncomfortable with app-based monitoring may not benefit from the Drive Safe & Save program.

- Limited Discount Stacking: Seniors may find that not all discounts combine to maximize total savings.

#3 – Travelers: Cheapest for Comprehensive Coverage

Pros

- Competitive Monthly Rate: Seniors can access minimum coverage for as little as $50 per month. Read our Travelers auto insurance review to compare rates.

- Comprehensive Policy Options: Seniors with new or luxury vehicles will benefit from Travelers highly comprehensive plans and add-ons.

- Defensive Driving Discount: Seniors who take a safety course can earn a discount of up to 20%.

Cons

- Fewer Local Offices: Seniors may have limited access to face-to-face support due to fewer physical branches.

- Average Bundling Value: While bundling is available, the savings for seniors may be lower than with other companies.

#4 – Progressive: Cheapest for Defensive Driving

Pros

- Affordable Minimum Coverage: Seniors can expect to pay around $52 per month for basic liability coverage.

- Highest Course Discount: Defensive driving courses can reduce premiums by up to 30% for seniors.

- Telematics Savings Option: Seniors with safe driving habits can save more through Progressive Snapshot. Learn everything you need to know about Progressive Insurance.

Cons

- Privacy Concerns: Snapshot uses real-time tracking, which may not appeal to seniors uncomfortable with digital monitoring.

- Customer Experience May Vary: Seniors have reported inconsistent customer service depending on location and representative.

#5 – Nationwide: Cheapest for Claim-Free Drivers

Pros

- Reasonable Rate: Seniors pay about $59 per month for minimum coverage, with additional savings possible.

- Claims-Free Discount: Long-time, claims-free seniors can save up to 14% on their premiums. See more in our Nationwide auto insurance review.

- Reliable Claims Service: Seniors benefit from Nationwide’s A+ financial rating and above-average claims satisfaction score, which reflects its ability to pay claims.

Cons

- Lowest Senior Discounts: The auto insurance discount for seniors caps at 7%, which is lower than any competitor on this list.

- Limited Availability: Despite its name, Nationwide car insurance for seniors is only available in 44 states.

#6 – Amica: Cheapest for Dividend Payments

Pros

- Annual Dividend Payments: Amica pays its policyholders dividends every year based on market performance. Learn how it works in our Amica insurance review.

- Multiple Discount Options: Seniors receive up to 12% off for completing a defensive driving course and another 12% as a senior driver.

- Highly Rated Service: Amica earns top marks in customer satisfaction, ideal for seniors who value helpful, consistent support.

Cons

- Higher Rates: Senior car insurance starts at $62 per month with Amica, over $20 more a month than with Geico and State Farm.

- Limited Tech Features: Amica’s website and app may not be as easy or helpful for seniors who like to manage their policy online.

#7 – Farmers: Cheapest for Usage-Based Coverage

Pros

- UBI Savings: Seniors who sign up for Farmers Signal usage-based insurance plan can save between 15%-30% for safe driving habits and low mileage.

- Good Driver Discount: Safe senior drivers can save up to 20% through accident-free rewards.

- Financially Stable Provider: Seniors benefit from a long-standing company reputation and reliable claims service. Get full reviews in our guide to everything you need to know about Farmers Insurance.

Cons

- Higher Starting Premium: Minimum coverage for seniors costs about $72 per month, which is higher than average.

- Senior Discount Requirements: Senior discounts aren’t automatically applied. Drivers over 55 must complete a defensive driving course to earn Farmers senior discount on car insurance.

#8 – Allstate: Cheapest for Flexible Policies

Pros

- Flexible Coverage Options: Seniors can tailor policies with add-ons like accident forgiveness and new car replacement.

- Safe Driver Discount: Seniors with a clean record can reduce premiums by up to 18%. Learn how to qualify in our Allstate auto insurance review.

- Bundling Available: Seniors can save more by combining their car insurance with home or renters insurance.

Cons

- High Monthly Premium: Minimum coverage for seniors starts at $86 per month, one of the higher base rates.

- Deductible Adjustments: Seniors may need to increase deductibles beyond their comfort level to make premium costs more manageable.

#9 – Liberty Mutual: Cheapest for Accident Forgiveness

Pros

- Accident Forgiveness: Seniors who have gone five years without an accident at any company will automatically avoid a rate increase after filing an at-fault claim with Liberty Mutual.

- Significant Anti-Theft Savings: Seniors can save up to 35% with approved anti-theft devices installed in their vehicles.

- Safe Driving Reward: Seniors can receive up to 20% off for maintaining a clean driving record. Take a look at our Liberty Mutual review to see more options.

Cons

- Expensive Monthly Coverage: Minimum coverage for seniors starts at $91 per month, significantly higher than the cheap senior car insurance companies on this list.

- Poor Customer Service: Liberty Mutual receives low customer service ratings for claims handling.

#10 – The General: Cheapest for High-Risk Coverage

Pros

- Accessible for All Seniors: Seniors with a history of accidents or insurance lapses may still qualify for coverage.

- Quick Online Enrollment: Seniors can get approved and insured the same day with a simple online application.

- Senior Driver Discount: Seniors are eligible for a basic 10% discount based solely on age. See more discounts in our The General auto insurance review.

Cons

- Most Expensive Coverage: Seniors pay $124 per month for minimum coverage, the highest among all providers listed.

- Limited Policy Options: Seniors looking for extras like rental car reimbursement or roadside assistance may find fewer available features.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get the Best Auto Insurance for Seniors

Finding the right car insurance as a senior doesn’t have to be complicated. Start by comparing rates from several top providers. Prices can vary widely for the same coverage, and shopping around is one of the fastest ways to save. We found that Geico, State Farm, and Travelers have cheap auto insurance for seniors.

If you have homeowners or renters insurance, consider bundling it with your auto policy. Companies like State Farm and Farmers offer multi-policy discounts that can lead to big savings. Not all discounts are advertised, so ask insurers directly about age-based savings. Some providers offer extra savings just for being over a certain age. Look at our tips to pay less for car insurance for more ways to save.

Completing a state-approved defensive driving course can lower your rate by up to 30%, depending on the company. Many insurers offer this discount specifically to seniors.

Michelle Robbins Licensed Insurance Agent

By taking these simple steps, seniors can find the best mix of coverage and cost. The key is to be proactive. Ask about every possible discount and compare providers to find the best deal for your needs. Get fast and cheap auto insurance coverage today with our quote comparison tool.

Frequently Asked Questions

How do I get the cheapest senior auto insurance?

To get the cheapest senior car insurance, compare quotes from multiple providers, take a defensive driving course, maintain a clean record, and ask about senior, safe driver, and bundling discounts.

Read More: What to Do If You Can’t Afford Your Auto Insurance

What is the best auto insurance for seniors?

The best car insurance for seniors combines affordability, strong customer service, and senior-specific discounts, with Geico, State Farm, and Travelers leading the pack.

Which insurance company is best for seniors?

Geico is the best overall for seniors due to its low rates and senior citizen discounts for car insurance, while State Farm is great for safe drivers, and Travelers provides comprehensive coverage. Start comparing total coverage auto insurance rates by entering your ZIP code here.

What is the cheapest car insurance for senior citizens?

Who has the absolute cheapest auto insurance for seniors? Geico offers cheap auto insurance for senior citizens, with minimum coverage starting at $41 per month, along with additional savings for defensive driving and vehicle safety features. Compare Geico vs. Allstate auto insurance to learn more.

Does your car insurance get cheaper with age?

Yes, car insurance generally gets cheaper with age until your mid-60s, provided you maintain a clean driving record and low-risk behavior. Check out our guide about the best auto insurance for good drivers.

At what age is car insurance cheapest?

Car insurance is typically cheapest in your 60s, as insurers see seniors with decades of driving experience as low risk, especially those with clean records.

What is the best car and homeowners insurance for seniors?

State Farm and Farmers are strong options for seniors who want to bundle auto and homeowners insurance, offering competitive rates and bundling discounts that maximize savings.

Which type of insurance is most important for retired persons?

Liability coverage remains essential for retirees, and medical payments or personal injury protection (PIP) can help cover out-of-pocket health expenses after an accident.

Read more: Collision vs. Comprehensive Auto Insurance

What type of life insurance is best for over 65?

For individuals over 65, guaranteed issue life insurance or final expense policies are often best, offering smaller coverage amounts with no medical exams. Read our life insurance guide to pick out a policy.

Is insurance more expensive for older or newer cars?

Insurance is typically more expensive for newer cars due to higher replacement and repair costs, while older cars may qualify for cheaper liability-only coverage. Get more details in our guide about how to buy auto insurance.

What is the best car insurance for older cars?

How much should a senior pay for car insurance?

What is the lowest type of car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.