Cheap Full Coverage Auto Insurance in 2026

Geico, State Farm, and Auto-Owners offer cheap full coverage auto insurance. Geico’s full coverage car insurance rates start at $114 per month, while drivers in Michigan and Louisiana pay around $200 per month on average. You may be able to reduce your costs by up to 20% with safety feature discounts.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

Geico, State Farm, and Auto-Owners have cheap full coverage auto insurance for $114 per month.

- Geico is the cheapest full coverage car insurance company

- State Farm has cheap full coverage for bad credit scores

- Auto-Owners has the best full coverage claims satisfaction

Geico has the best cheap car insurance for drivers who want full coverage, while State Farm helps you save even more with safe driver and vehicle safety discounts.

Auto-Owners offers reliable claims handling and consistent service, making full coverage straightforward and affordable.

10 Best Companies: Cheapest Full Coverage Auto Insurance| Company | Rank | Monthly Rates | Claims Satisfaction | Best for |

|---|---|---|---|---|

| #1 | $114 | 692 / 1,000 | Affordable Rates | |

| #2 | $123 | 710 / 1,000 | Safe Drivers | |

| #3 | $124 | 692 / 1,000 | Reliable Service | |

| #4 | $141 | 684 / 1,000 | Frequent Travelers | |

| #5 | $150 | 672 / 1,000 | Usage-Based Savings | |

| #6 | $164 | 728 / 1,000 | Bundling Discounts | |

| #7 | $166 | 692 / 1,000 | Family Coverage |

| #8 | $198 | 706 / 1,000 | Accident Forgiveness | |

| #9 | $228 | 691 / 1,000 | Claims Assistance | |

| #10 | $248 | 717 / 1,000 | Flexible Policies |

Each company makes it easy to manage your policy and claims online at any time, but some have higher claims satisfaction scores than others.

Compare personalized rates to find the best deal for your budget and service needs by entering your ZIP code.

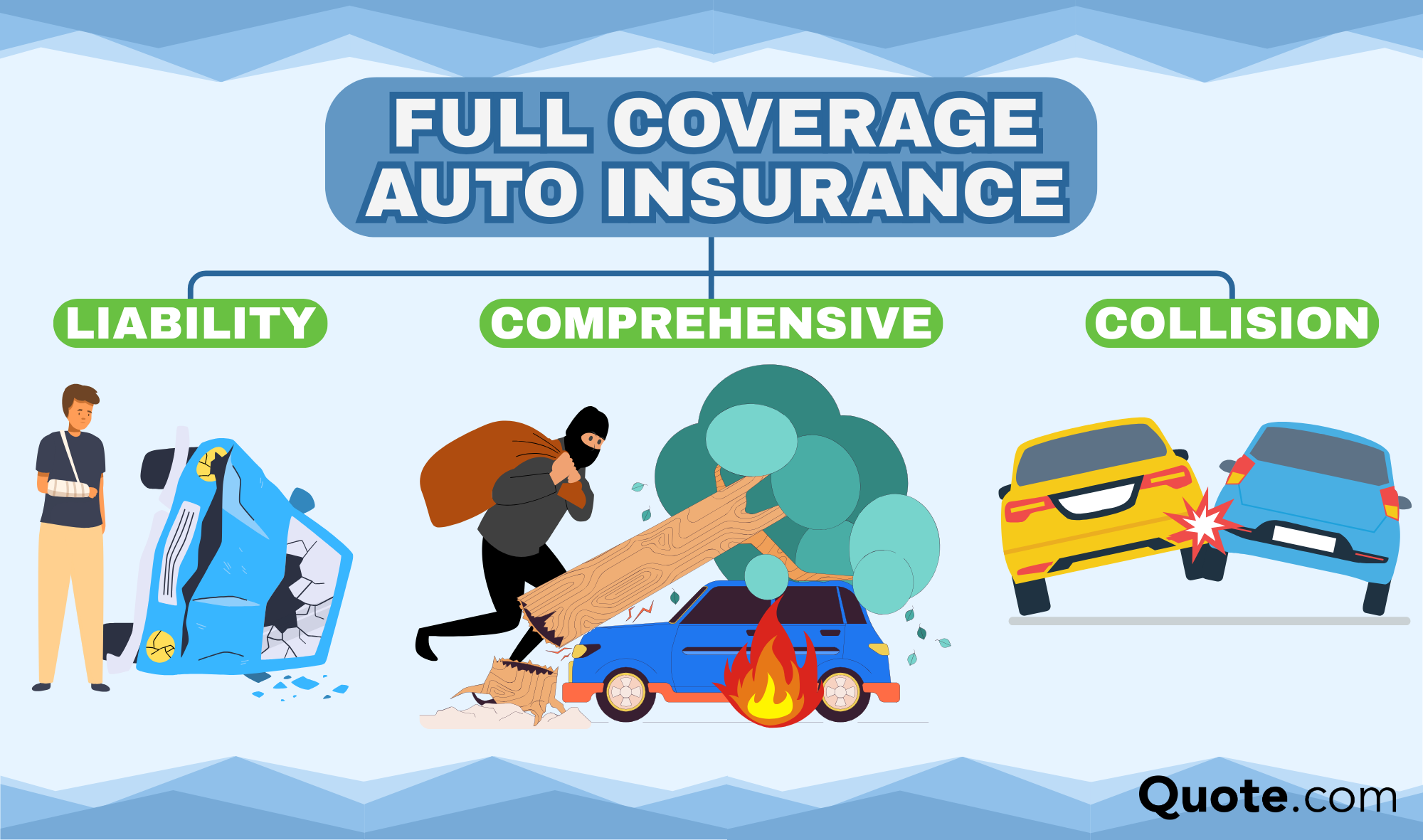

Full Coverage Auto Insurance Explained

Full coverage auto insurance is not just one type of protection but a combination of coverages that work together to keep you and your vehicle secure in different situations.

The first part is liability coverage, which helps pay if you’re involved in a crash that injures someone or damages their property.

Collision coverage helps cover the cost to fix or replace your car after a crash, even if the accident was your fault. Comprehensive coverage steps in for things like theft, vandalism, or weather-related damage.

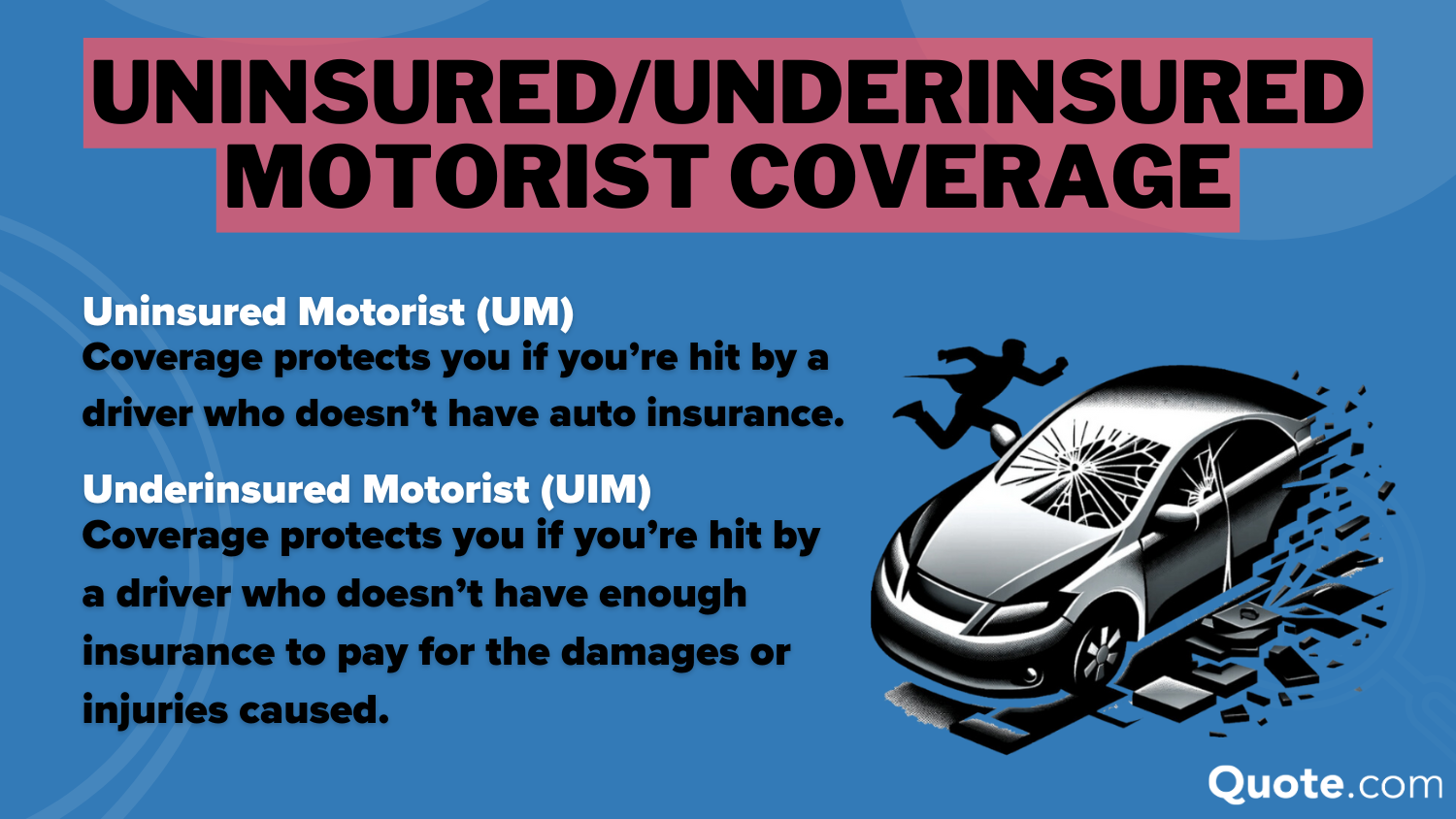

You can also add extras, such as uninsured motorist coverage, rental car reimbursement, or roadside assistance, to full coverage car insurance for additional protection.

When you know what each part covers, it’s easier to find cheap full coverage auto insurance that gives you the right balance of cost and security.

Full coverage insurance policies also qualify for additional perks, like vanishing deductibles and accident forgiveness with some companies, that reward drivers for responsible driving and coverage choices.

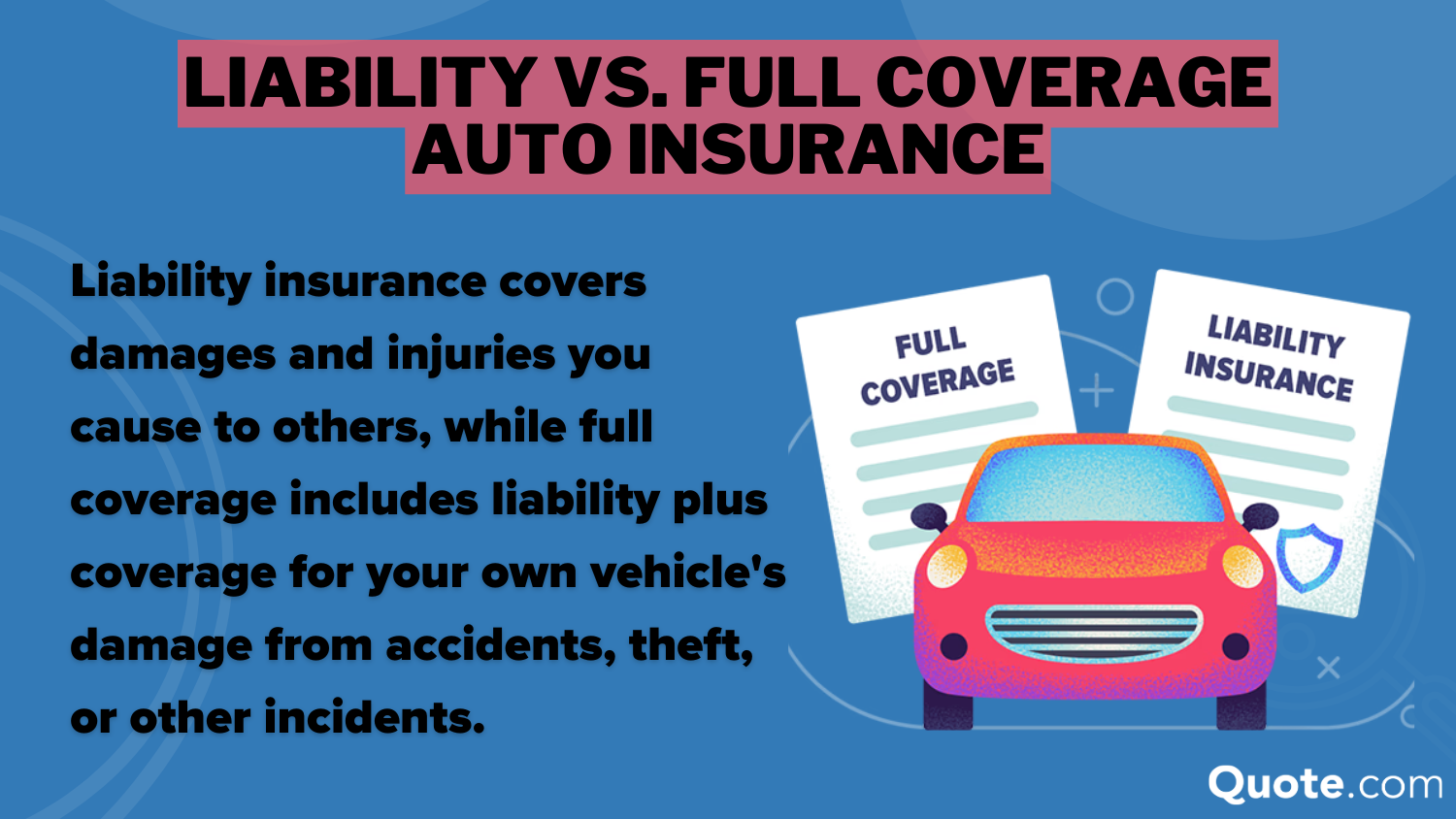

Learn More: Liability vs. Full Coverage Auto Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Full Coverage Car Insurance Cost

Minimum coverage keeps costs low but often leaves gaps that can become expensive after an accident, while full coverage gives drivers extra security when things go wrong.

However, the cost of auto insurance increases significantly when you choose a full coverage policy. Some companies’ monthly rates jump $100 or more for the additional coverages.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $48 | $124 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

Geico has cheap full coverage car insurance for $114 a month, followed by State Farm at $123 a month.

This is nearly half of what pricier providers like Allstate and Liberty Mutual typically charge for many drivers.

Full coverage costs more because it includes extra protection, but safer cars can bring those monthly rates down. In particular, midsize sedans usually rate lower.

Jeff Root Licensed Insurance Agent

When you compare the best full coverage auto insurance, you’ll notice how each company balances value, protection, and affordability.

Sometimes paying a bit more each month gives you better customer service, faster claims, or more flexibility.

Read More: Cheap Auto Insurance for Low-Income Drivers

How Age Influences Full Coverage Rates

The cost of full coverage auto insurance changes a lot with age since insurers look at how much experience you have on the road.

Younger drivers usually pay more because they’re still building a track record and are seen as higher risk. Geico has the cheapest full coverage insurance overall, but its rates are still twice as high for teens at $362 monthly compared to just $133 for a 25-year-old.

Full Coverage Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $740 | $271 | $248 | $228 | |

| $591 | $210 | $182 | $166 |

| $519 | $158 | $139 | $124 | |

| $897 | $256 | $217 | $198 | |

| $362 | $133 | $121 | $114 | |

| $893 | $306 | $274 | $248 |

| $552 | $213 | $187 | $164 | |

| $944 | $209 | $174 | $150 | |

| $405 | $158 | $138 | $123 | |

| $1,056 | $165 | $151 | $141 |

As you get older and keep your record clean, your rates usually go down because insurers see you as a safer bet. Finding the cheapest car insurance for teens often depends on your driving record and how long you’ve been insured.

New drivers may start out paying more, but safe driving habits over time can lead to real savings. Teens and young drivers under 25 can compare full coverage auto insurance quotes online to find cheaper rates as they gain experience.

How Full Coverage Costs Vary by Location

When you compare auto insurance companies, you’ll notice that where you live can significantly affect the cost of full coverage auto insurance.

For example, finding cheap full coverage auto insurance in California is more difficult than in less-populated states like Idaho or Iowa, usually because of heavy traffic, higher repair bills, and more frequent claims.

Similarly, cheap full coverage auto insurance in Texas may also be hard to come by due to the high posted speed limits on state highways and the number of fatal car accidents.

Gender can also influence the amount drivers pay. In many states, male drivers, particularly younger ones, tend to have higher premiums because they’re statistically involved in more accidents.

Read More: Auto Insurance Rates by State

How Your Driving History Affects Full Coverage Rates

Your driving record plays a big part in what you pay for full coverage auto insurance, and keeping it clean really pays off.

Drivers with clean records usually have an easier time scoring cheap full coverage auto insurance with no down payment, which makes getting covered right away a whole lot simpler.

Full Coverage Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $228 | $321 | $385 | $268 | |

| $166 | $251 | $276 | $194 |

| $124 | $182 | $185 | $150 | |

| $198 | $282 | $275 | $247 | |

| $114 | $189 | $309 | $151 | |

| $248 | $335 | $447 | $302 |

| $164 | $230 | $338 | $196 | |

| $150 | $265 | $200 | $199 | |

| $123 | $146 | $160 | $137 | |

| $141 | $199 | $294 | $192 |

But if you’ve had an accident, ticket, or DUI, your rate can jump because insurers see you as a higher risk.

If you’re trying to get coverage with a not-so-perfect record, exploring your options as you buy auto insurance and checking out State Farm and Auto-Owners is a smart move.

Being accident-free really pays off because insurers love consistent safe driving and sometimes offer big savings in some cases over time.

Daniel S. Young Managing Editor

They often offer lower rates than even Geico for drivers dealing with recent serious accidents or DUIs (Read More: Cheap Auto Insurance for High-Risk Drivers).

While a few mistakes may result in your premium increasing, keeping your record clean after a citation can qualify you for discounts and lower rates over time.

How Credit History Impacts the Price of Full Coverage

Your credit score actually affects your full coverage auto insurance rate more than you think. The best car insurance companies see it as a sign of how responsible you are with payments and how likely you are to file a claim.

If your credit’s in good shape, you’ll probably get better rates. Geico, State Farm, and Auto-Owners are the cheapest full coverage auto insurance companies.

Full Coverage Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $228 | $252 | $298 | $372 | |

| $166 | $184 | $217 | $276 |

| $124 | $136 | $158 | $204 | |

| $198 | $214 | $246 | $318 | |

| $114 | $126 | $149 | $196 | |

| $248 | $274 | $316 | $392 |

| $164 | $178 | $202 | $254 | |

| $150 | $162 | $186 | $232 | |

| $123 | $134 | $156 | $188 | |

| $141 | $156 | $182 | $228 |

State Farm has cheap full coverage auto insurance for bad credit at $188 a month, offering solid coverage without breaking the bank. Compare it to the cheapest car insurance companies to see who has the best rates for you.

If you stay on top of bills, keep your debt low, and slowly improve your credit score, you’ll likely start seeing better insurance rates before long.

Tips for Cheaper Full Coverage Car Insurance

There are several practical ways to cut your premium if you pay attention to how your policy works and make smart choices.

A few simple adjustments can help you save without losing important coverage. Here are five practical ways to save:

- Adjust Coverage Over Time: As your car’s value drops, reducing certain coverage limits can help you avoid overpaying.

- Drive Less: If you work remotely or frequently use public transportation, consider asking your insurer about low-mileage plans for additional savings.

- Pick a Car with Safety Features: Vehicles equipped with automatic braking or lane assist often qualify for cheaper full coverage.

- Complete a Defensive Driving Course: Many insurers reward drivers who take approved safety classes with reduced premiums.

- Pay in Full: Paying your policy upfront rather than monthly can help you avoid installment fees and save money overall.

These small steps can help you pay less for car insurance while maintaining solid protection. Discounts help too, whether they reward safe driving, policy bundling, or how often you’re behind the wheel.

These savings help you cut costs while encouraging better driving habits that can lower your rates over time.

Top Full Coverage Auto Insurance Discounts| Company | Multi- Policy | Safe Driver | Usage- Based | Vehicle Safety |

|---|---|---|---|---|

| 25% | 18% | 40% | 20% | |

| 25% | 18% | 20% | 18% |

| 16% | 8% | 30% | 15% | |

| 20% | 20% | 30% | 15% | |

| 25% | 15% | 25% | 15% | |

| 25% | 20% | 30% | 12% |

| 20% | 12% | 40% | 18% | |

| 10% | 10% | $231/yr | 10% | |

| 17% | 20% | 30% | 20% | |

| 13% | 15% | 30% | 17% |

The trick is finding discounts that actually work for you. Bundling your policies or using a usage-based auto insurance app can help you save even more.

Saving on cheap full coverage auto insurance goes beyond just snagging discounts. Always compare companies online to find the provider with the right discounts and the lowest rates.

10 Cheapest Full Coverage Providers

The biggest full coverage auto insurance companies play a major role in how drivers experience pricing and plan options.

State Farm holds a bigger share of the market, so it usually sets the pace for how other insurers price their plans and design coverage options.

At the same time, Geico and Progressive keep the competition lively with discounts and programs that reward safe and smart driving habits.

Auto-Owners and Travelers are cheaper for full coverage than some of the largest companies, particularly Allstate, so it’s best to compare providers that best fit your lifestyle, whether you’re looking to save money, use digital tools, or add extra coverage features.

Read More: State Farm vs. Farmers, Geico, Progressive, and Allstate Insurance Review

#1 – Geico: Top Pick Overall

Pros

- Affordable Rates: Geico keeps costs budget-friendly, with full coverage starting at just $114 per month, making it one of the most affordable options nationwide.

- High Financial Strength: Backed by an A++ A.M. Best rating, Geico gives drivers confidence with dependable full coverage protection and quick, reliable claims payouts.

- Discount Flexibility: Our Geico insurance review highlights that you can save up to 25% on full coverage through Geico’s safe driver, multi-vehicle, and anti-theft discounts.

Cons

- Limited Local Support: Since Geico mainly operates online, drivers who like face-to-face help with full coverage claims or questions might find fewer in-person options.

- Limited Add-Ons: Some extras, such as breakdown or new-car coverage, aren’t available everywhere.

#2 – State Farm: Best for Safe Drivers

Pros

- Safe Driving Discounts: State Farm’s Drive Safe & Save program gives safe drivers who track their habits with a telematics app up to 30% off.

- Broad Agent Network: With over 19,000 local agents, getting help with your full coverage claims, renewals, or policy questions is quick and easy.

- Strong Claims Record: A 710/1,000 claims satisfaction rating reflects better full coverage service than most competitors.

Cons

- Inconsistent Rates: Discounts and pricing for full coverage can vary by state and driver profile, making savings unpredictable.

- Limited Digital Access: Our State Farm insurance review notes that some full coverage policy updates and discount applications require in-person handling.

#3 – Auto-Owners: Best for Reliable Service

Pros

- Reliable Service: Auto-Owners has built a reputation for dependable support, earning a solid 692/1,000 score for full coverage claims satisfaction.

- Strong Financial Stability: With an A++ A.M. Best rating, Auto-Owners gives you confidence that your full coverage claims are well protected.

- Bundling Savings: When you bundle your auto and home policies, you can save up to 20% on your full coverage costs.

Cons

- Limited Availability: Our Auto-Owners insurance review notes that full coverage is only available in 26 states, so not everyone can sign up.

- Outdated Technology: The app for managing full coverage policies and claims feels a bit dated compared to other providers.

#4 – Travelers: Best for Frequent Travelers

Pros

- Frequent Traveler Perks: Travelers offers full coverage add-ons like Premier Roadside Assistance and Trip Interruption benefits for drivers often on the road.

- IntelliDrive Savings: Drivers can earn up to 20% off full coverage premiums by tracking their safe driving through the IntelliDrive app.

- Strong Financial Health: Our Travelers insurance review highlights that Travelers’ A++ A.M. Best rating ensures stability and reliability for policyholders with full coverage.

Cons

- Above-Average Rates: Full coverage costs approximately $141 per month, which is higher than competitors’ rates.

- Claims Delays: A 684/1,000 satisfaction rating points to slower response times for full coverage claims.

#5 – Progressive: Best for Usage-Based Savings

Pros

- Usage-Based Discounts: Progressive’s Snapshot program monitors your driving and can knock up to 25% off your full coverage if you’re a safe driver.

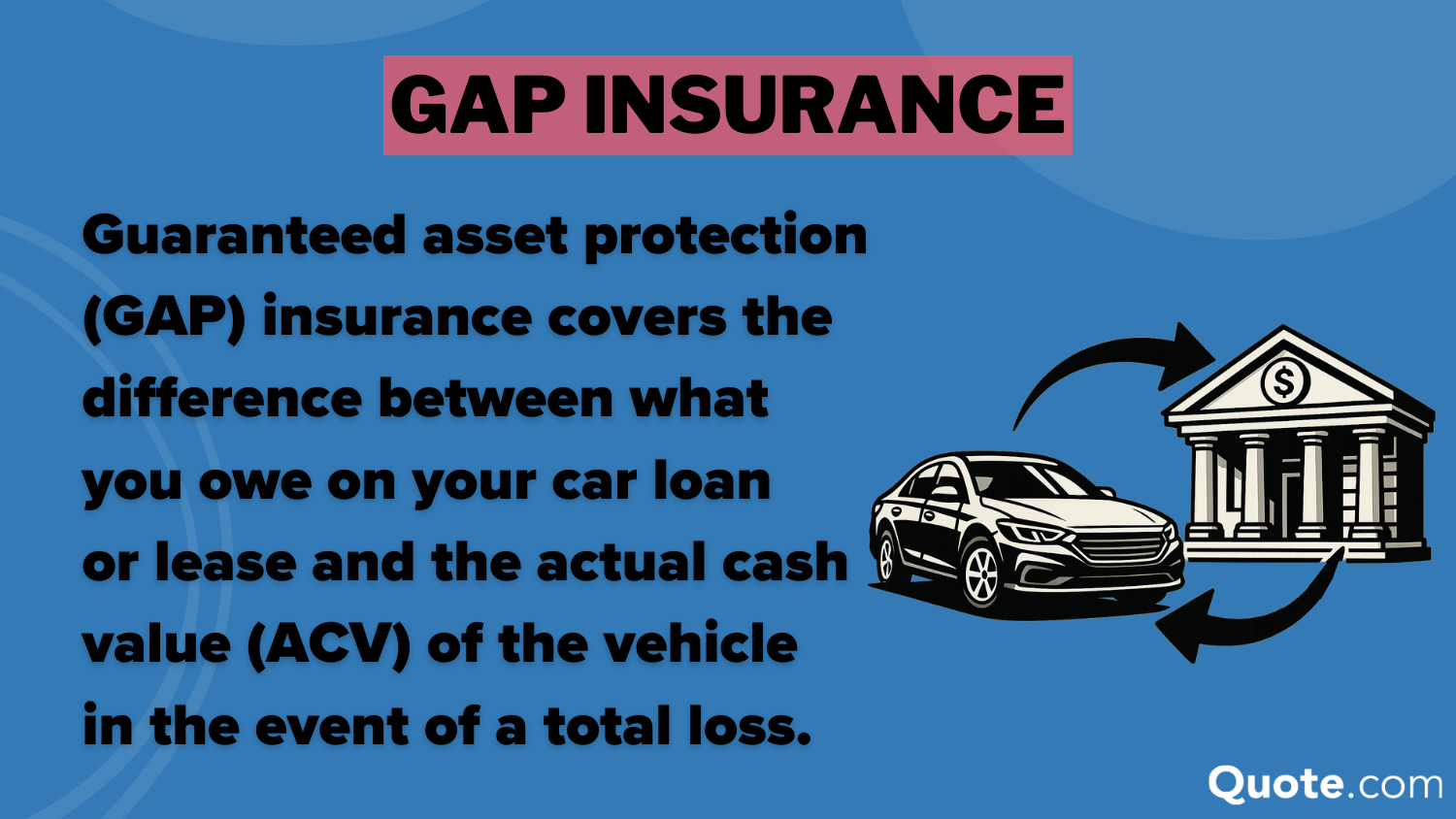

- Custom Add-Ons: You can personalize your full coverage with extras like gap insurance or custom parts protection.

- Budget Transparency: The “Name Your Price” tool makes it easy to find coverage that fits your budget.

Cons

- Low Satisfaction Scores: A 672/1,000 claims rating indicates inconsistent handling of full coverage claims.

- Rate Volatility: Our Progressive insurance review notes that poor driving, as tracked by Snapshot, can cause full coverage premiums to rise quickly.

#6 – Nationwide: Best for Bundling Discounts

Pros

- Bundling Discounts: Drivers can save up to 20% on full coverage when combining home, renters, or life insurance policies.

- Vanishing Deductible: Safe drivers can cut full coverage deductibles by $100 each year of accident-free driving.

- High Claims Performance: A 728/1,000 satisfaction score highlights strong responsiveness for full coverage customers.

Cons

- Moderate Monthly Rate: At $164 per month, Nationwide’s full coverage pricing is slightly above average.

- Fewer Agents: Our Nationwide insurance review points out that drivers in smaller towns may struggle to access in-person full coverage support.

#7 – American Family: Best for Family Coverage

Pros

- Family-Oriented Savings: If your family has two cars, you can save up to 23% on full coverage with American Family’s multi-car discount.

- Teen Driver Program: Their program helps teens become safer drivers and can lower full coverage rates as they get more time and experience on the road.

- Solid Claims Support: With a 692/1,000 satisfaction score, American Family delivers steady and reliable full coverage claims service.

Cons

- Regional Limitations: The American Family Insurance review notes that full coverage is mostly offered in the Midwest and Western states, creating limited availability.

- Slightly Higher Rates: The average full coverage rate is approximately $166 per month, slightly higher than some mid-tier competitors.

#8 – Farmers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Farmers keeps your full coverage rates from going up after your first at-fault accident, giving you a little peace of mind.

- Comprehensive Coverage Options: You can build your full coverage plan with extras like new car replacement or rental reimbursement to fit your needs.

- Local Service: With more than 48,000 agents, it’s easy to get in-person help managing your full coverage policy when you need it.

Cons

- Premium Cost: Our Farmers insurance review notes that full coverage starts at $198 per month, making it one of the most expensive options on the list.

- Limited Savings: Farmers offers fewer discount options for full coverage compared to other providers.

#9 – Allstate: Best for Claims Assistance

Pros

- Claims Assistance Guarantee: Allstate’s unique satisfaction guarantee gives a six-month full coverage credit if claims service falls short.

- Wide Discount Range: Drivers can save up to 25% on full coverage with Drivewise and early signing programs.

- Comprehensive Add-Ons: New car replacement and deductible rewards enhance the flexibility of full coverage.

Cons

- High Monthly Price: Our Allstate insurance review notes that full coverage averages $228 per month, which is significantly higher than the average of many other providers.

- Claims Satisfaction: A 691/1,000 rating shows room to improve consistency in full coverage claim outcomes.

#10 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexible Coverage Options: Liberty Mutual lets you tailor your full coverage to fit your needs with perks like better car replacement and accident forgiveness.

- Digital Management: The app makes it super easy to manage full coverage payments, file claims, or get roadside help right from your phone.

- Above-Average Service: A 717/1,000 satisfaction score reflects steady full coverage reliability across markets.

Cons

- High Premiums: Our Liberty Mutual insurance review notes that full coverage costs $248 per month, making it the steepest among all major insurers.

- Restricted Discounts: Some full coverage savings, such as low-mileage or affinity discounts, are subject to state regulations.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Full Coverage Auto Insurance

To find a car insurance company for full coverage auto insurance, start by identifying what matters most to you in a policy.

Not all insurers offer the same level of flexibility or benefits, so knowing what to look for helps narrow your choices.

- Compare Multiple Quotes: Check rates from at least three insurers to find one that offers the right balance of cost and protection.

- Check Claims Satisfaction: Companies such as Geico, State Farm, and Auto-Owners often score highly for reliable and efficient claims handling.

- Look for Flexible Coverage Options: Select a provider that lets you customize your deductibles or add options like roadside assistance and gap coverage.

- Review Financial Strength: Pick insurers with solid A.M. Best ratings of A or higher to ensure long-term reliability.

- Ask About Full Coverage Discounts: Safe driving, bundling multiple policies, and enrolling in usage-based auto insurance programs can help reduce your premium.

The best full coverage auto insurance company should give you the right mix of affordability, reliability, and flexibility.

Geico offers affordable full coverage insurance for $114 a month, State Farm helps drivers save with safe-driving rewards, and Auto-Owners provides dependable claims service and competitive rates.

Full coverage combines liability, collision, and comprehensive auto insurance protection. The right company should make it easy to get dependable coverage, fair pricing, and great service.

You can lower your rate by bundling policies, raising your deductible, or choosing a car with strong safety features that qualify for discounts.

If you shop around and compare a few quotes, you’ll have a much easier time finding cheap full coverage auto insurance in Florida, Texas, California, or anywhere known for notoriously high prices. Enter your ZIP code to start comparing prices now.

Frequently Asked Questions

Who has the cheapest full coverage car insurance?

Geico offers the cheapest full coverage at $114 a month, with State Farm and Auto-Owners close behind, combining low prices with reliable protection.

Should I have full coverage on a paid-off car?

If your car is worth more than $4,000 or is costly to repair, keeping full coverage is a smart decision. However, for older or lower-value cars, switching to liability-only coverage can help reduce your monthly payment.

Why is full coverage insurance expensive?

Full coverage costs a bit more because it includes liability auto insurance, as well as collision and comprehensive coverage. It protects your car, covers damage to someone else’s property, and helps with things like theft or storm damage, giving you more protection than a basic plan.

What does full coverage car insurance actually include?

Full coverage combines liability, collision, and comprehensive protection. It covers damage you cause, accidents involving your car, and non-crash incidents, such as theft or hail damage.

How often should I shop for full coverage car insurance?

It’s best to get multiple auto insurance quotes every 6-12 months. A cleaner record, improved credit score, or vehicle change can help you qualify for cheaper full coverage rates.

What is a good price for full coverage insurance?

A good price for full coverage insurance ranges between $114 and $150 per month. Geico, State Farm, and Auto-Owners fall within this range, offering affordable protection without cutting coverage.

Is $200 a month high for full coverage car insurance?

Yes. $200 per month is higher than average. Most drivers pay between $114 and $150 per monthly, so consider raising your deductible or bundling policies to lower that cost.

Does a credit score affect full coverage car insurance rates?

Yes. According to many auto insurance guides, insurers often factor credit history into their rate-setting process. Drivers with good credit typically pay up to 25% less for full coverage than those with poor credit.

At what car value should you drop full coverage?

When your car’s market value drops below $4,000, it may not be worth keeping full coverage. The cost of repairs might exceed what your insurer would pay after a claim.

Why is my full coverage car insurance so high with a clean record?

Even if you haven’t had any accidents, your rates can still go up depending on things like where you live, what kind of car you drive, or how pricey repairs are. Premiums usually run higher in big cities or if you’re driving a luxury vehicle.

What state has the cheapest full coverage car insurance?

What car insurance companies do not check credit score for full coverage?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.