Auto Insurance Guide for 2026

Auto insurance offers protection through liability, collision, and comprehensive coverage. The cheapest car insurance starts at just $43 a month for minimum coverage. Drivers can save up to 40% through usage-based insurance (UBI) programs, which use telematics to track habits like braking, speed, and mileage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated February 2026

Auto insurance helps cover the cost of accidents, vehicle damage, and medical bills through essential protections like liability, collision, and comprehensive coverage. Most states require minimum liability car insurance.

- Auto insurance covers liability, collision, comprehensive, and medical costs

- Geico offers the lowest minimum coverage rates starting at just $43 a month

- Save up to 40% with discounts for usage-based insurance (UBI) programs

Auto insurance rates start as low as $43 per month, depending on your age, location, driving record, and vehicle. Many drivers save up to 40% through discounts for safe driving, bundling, low mileage, and usage-based insurance (UBI) programs. Top-rated companies include American Family, Geico, and Nationwide, known for affordable pricing and strong customer satisfaction.

Whether you’re a new driver or renewing your policy, understanding what auto insurance covers can help you choose the best protection at the lowest price. Use our free comparison tool to find the best auto insurance rates today.

Auto Insurance Explained

Auto insurance helps pay for damage or injuries if you’re in a car accident, if your car is stolen, or if it’s damaged by something like weather or fire.

Auto Insurance Coverage in the U.S.| Feature | Description |

|---|---|

| Purpose | Covers costs from accidents, theft, or damage |

| Required By | Mandatory in most states with minimum liability |

| Common Coverages | Liability, collision, comprehensive, uninsured, injury |

| Optional Add-ons | Roadside, rental, gap, custom parts coverage |

| Premium Factors | Based on age, location, record, vehicle, and limits |

| Policy Types | Liability, full, non-owner, usage-based |

| Claims Process | File online, via app, or with an agent |

| Discounts Available | Safe driver, bundle, student, multi-car, paperless |

| Major Providers | Progressive, State Farm, Geico, Liberty Mutual, etc. |

| Who Needs It? | Anyone who drives, leases, or owns a vehicle |

Most states require you to have at least basic coverage, called liability auto insurance. You can also add more protection, like coverage for your own car, help with rental cars, or roadside assistance if your car breaks down.

- Auto Insurance Basics

- Diminished Value Claims (2026)

- Driving Without Auto Insurance in 2026

- High-Risk Auto Insurance (2026 Guide)

- Full Coverage Auto Insurance 2026 Guide

- How to Cancel an Auto Insurance Policy in 2026

- At-Fault Accidents & Insurance Rates in 2026

- What does the Insurance Institute for Highway Safety do?

- What Happens If You Cancel Auto Insurance in 2026

- What to Do If You Can’t Afford Your Auto Insurance in 2026 (Follow These 5 Steps)

- When Animals or Natural Disasters Damage Your Vehicle in 2026 (Advice + Coverage Guide)

- What to Do When You’re Denied Insurance Coverage in 2026

- How to File an Auto Insurance Claim & Win in 2026

- Seat Belt Use in the U.S. (2026 Report)

Bodily injury liability pays for medical expenses if you injure someone in an accident. Meanwhile, property damage liability helps pay to replace or repair any vehicles or buildings you damage in the crash.

Liability insurance doesn’t pay for your own medical bills or vehicle repairs, meaning you’ll need to get full coverage to protect your own vehicle.

What you pay each month depends on your age, where you live, your driving record, and the type of car.

Some companies give discounts if you drive safely, bundle auto and home insurance, or use automatic payments.

10 Best Auto Insurance Companies

The best car insurance companies give good service, fair prices, and strong coverage. American Family is one of the top choices for great customer support and trust. Geico is another top choice because it offers low prices and easy online tools. See what drivers say in our Geico insurance review.

Best Auto Insurance Companies for Customer Satisfaction| Company | Rank | BBB | J.D. Power | NAIC |

|---|---|---|---|---|

| #1 | A+ | 692 / 1,000 | 0.26 |

| #2 | A+ | 692 / 1,000 | 0.52 | |

| #3 | A+ | 728 / 1,000 | 0.9 | |

| #4 | A+ | 692 / 1,000 | 0.75 | |

| #5 | A+ | 672 / 1,000 | 1.11 | |

| #6 | A+ | 706 / 1,000 | 1.32 | |

| #7 | A+ | 691 / 1,000 | 1.02 | |

| #8 | A+ | 684 / 1,000 | 3.96 | |

| #9 | F | 710 / 1,000 | 0.84 | |

| #10 | A- | 717 / 1,000 | 4.28 |

Nationwide also gets high scores for keeping customers happy. Auto-Owners and Farmers are known for helping drivers quickly after accidents. Progressive, Allstate, and Travelers offer many coverage choices and useful discounts. Many driver also trust State Farm and Liberty Mutual for their wide coverage and support.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Coverage Rates

Monthly rates for auto insurance depend on whether you choose minimum or full coverage. Geico has the lowest prices, starting at just $43 a month for basic coverage and $114 monthly for full.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $47 | $124 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

Auto-Owners and State Farm also offer great deals, both starting at $47 per month and staying affordable for full coverage. American Family and Nationwide give good value with full coverage for under $170 monthly. However, the rate you’ll pay depends on several factors, like age, gender, driving record, and more.

Get an auto insurance quote online to see how much coverage costs near you.

Read More: State Farm vs. Farmers, Geico, Progressive, Allstate: The Best?

How Driving Record Affects Your Insurance Rates

Your driving record can change how much you pay each month for insurance. Geico stays the most affordable even if you’ve had an accident, ticket, or DUI, with prices starting at $43. State Farm and Auto-Owners also offer low rates for drivers with clean or imperfect records.

Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $88 | $103 | |

| $62 | $94 | $62 | $73 |

| $47 | $69 | $72 | $57 | |

| $76 | $109 | $76 | $95 | |

| $43 | $71 | $43 | $56 | |

| $96 | $129 | $95 | $116 |

| $63 | $88 | $62 | $75 | |

| $56 | $98 | $59 | $74 | |

| $47 | $57 | $47 | $53 | |

| $53 | $76 | $53 | $72 |

American Family and Nationwide are also helpful for keeping costs down after a driving mistake. These providers are good options for safe drivers and those trying to save after past issues. Learn full details in our American Family Insurance review.

Age and Auto Insurance Rates

Age has a big impact on what you pay for auto insurance. Geico offers the lowest monthly rates for most drivers, with prices as low as $41 for older adults and $50 for younger drivers.

Auto Insurance Monthly Rates by Age| Company | Age 16 | Age 25 | Age 35 | Age 45 | Age 55 | Age 65 |

|---|---|---|---|---|---|---|

| $371 | $102 | $95 | $87 | $82 | $86 | |

| $296 | $78 | $73 | $62 | $59 | $61 |

| $260 | $60 | $55 | $47 | $45 | $46 | |

| $452 | $98 | $91 | $76 | $72 | $75 | |

| $178 | $50 | $46 | $43 | $41 | $42 | |

| $464 | $119 | $110 | $96 | $91 | $95 |

| $279 | $81 | $76 | $63 | $59 | $62 | |

| $467 | $77 | $72 | $56 | $52 | $55 | |

| $208 | $60 | $56 | $47 | $45 | $47 | |

| $517 | $62 | $58 | $53 | $50 | $53 |

Auto-Owners and State Farm are also affordable, especially for drivers over 25. American Family is a good choice for teens and young drivers looking for better rates.

Read More: Cheap Auto Insurance for Teens

Cost of Auto Insurance by State

Auto insurance costs can vary widely depending on where you live. Several factors affect these rates, including local accident rates, repair costs, traffic laws, and the level of required coverage in each state. States with lower average claims and fewer accidents tend to offer cheaper premiums.

On the other hand, states like Michigan often have higher rates due to stricter coverage requirements and higher accident-related costs. Knowing your state’s average can help you decide how much coverage you need. Learn how to buy auto insurance and get a good deal.

Ways to Save on Auto Insurance

Car insurance can get expensive, especially if you have a new car or are adding a teen driver. Follow these strategies to make your monthly premiums more manageable.

- Park in a Garage: Companies may offer discounts for parking your vehicle in a garage or covered lot, saving drivers up to 10% with some providers.

- Increase Your Deductibles: Choosing an insurance deductible of $1,000 or more will help lower your monthly rates.

- Qualify for Discounts: Providers apply discounts if you drive less than average, are in the military, or are a full-time student with good grades.

Some of the biggest savings come from safe driver discounts, bundling your auto insurance with your home or renters policy, or insuring more than one car.

Top Auto Insurance Discounts & Average Savings| Discount Type | Savings | Requirements |

|---|---|---|

| Safe Driver | 25% | No violations or accidents in the past 3–5 years |

| Good Student | 15% | Full-time student with at least a B average |

| Bundling | 20% | Combine auto and home or renters insurance |

| Multi-Vehicle | 25% | Insure two or more cars under the same policy |

| Low Mileage | 15% | Drive less than 7,500–12,000 miles per year |

| Defensive Driving | 10% | Complete a state-approved safety course |

| Military | 15% | Must be active duty, veteran, or military family |

| Senior Citizen | 10% | Age 55+ or 65+ depending on the insurer |

| Anti-Theft Device | 10% | Car must have alarm, GPS, or immobilizer |

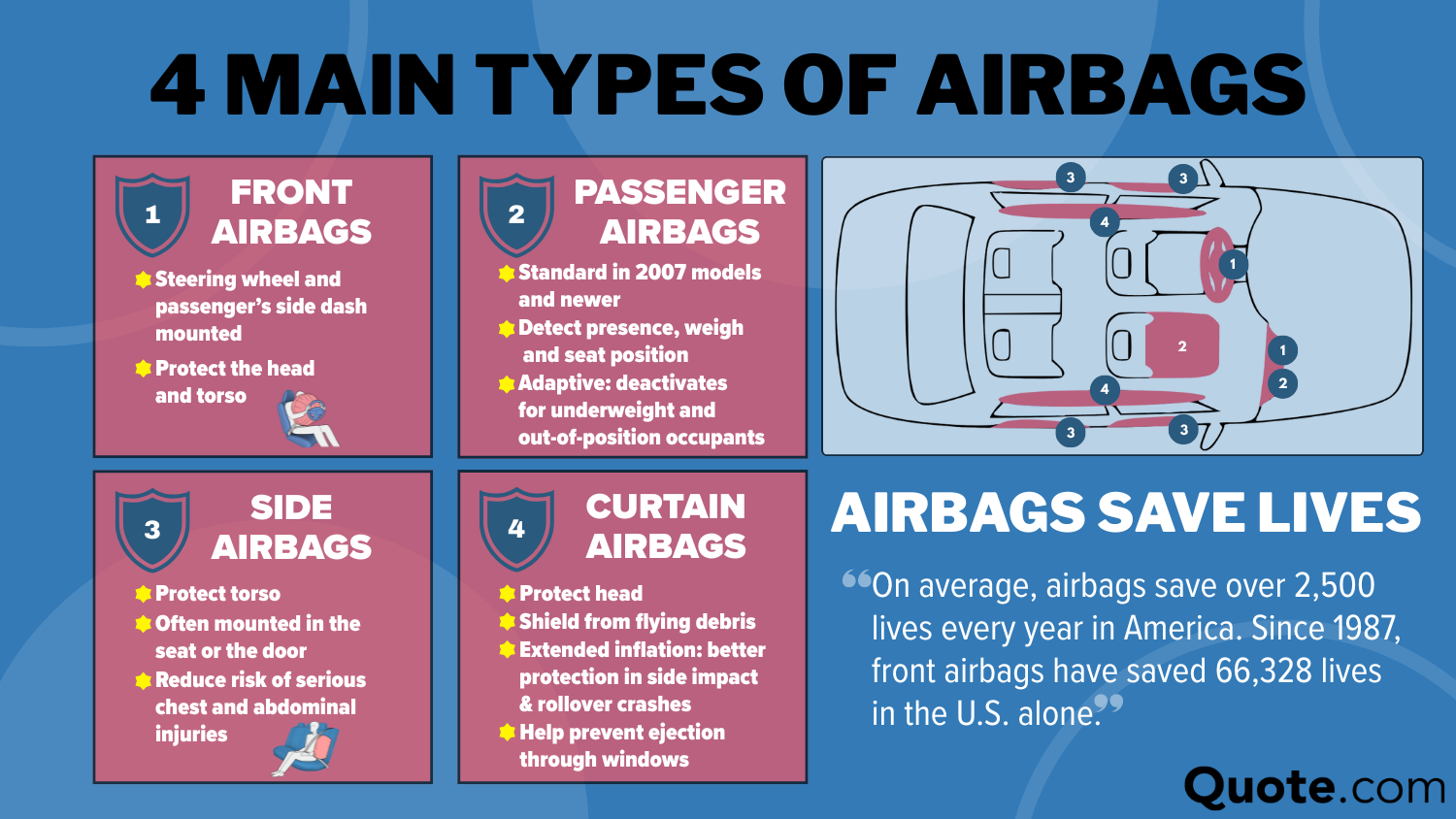

| Safety Features | 15% | Vehicle must have airbags, ABS, or lane assist |

Drivers who stay claim-free, take a defensive driving course, or have good credit can save money.

You can also get discounts for your car’s safety features like anti-lock brakes, alarms, automatic braking, or airbags.

Personal details like being a student with good grades, being married, or owning a home may also lead to extra savings. The more of these discounts you qualify for, the more you can cut your monthly bill.

Learn More: Top Ways Drivers are Wasting Money on Their Cars

Usage-Based Auto Insurance

Usage-based insurance (UBI) programs reward safe driving by tracking how you drive using a mobile app or a device in your car. Top programs include Drivewise from Allstate and SmartRide from Nationwide, both offering savings up to 40%.

Top Usage-Based Auto Insurance (UBI) Programs| Company | Program | Savings | System |

|---|---|---|---|

| Drivewise | 40% | Mobile App | |

| DriveMyWay | 20% | Mobile App |

| TrueRide | 30% | Mobile App | |

| YourTurn | 30% | Mobile App |

| RightTrack | 30% | Plug-in Device |

| SmartRide | 40% | Mobile App or Plug-in | |

| Snapshot | 30% | Mobile App | |

| Drive Safe & Save | 30% | Mobile App or Plug-in | |

| TrueLane | 25% | Mobile App |

| IntelliDrive | 30% | Mobile App |

Other good programs like Snapshot by Progressive and Drive Safe & Save by State Farm can save you up to 30%. These programs look at things like how hard you brake, how far you drive, and what time you drive. If you’re a safe driver, UBI can be a smart way to pay less.

Read More: Car Insurance Discounts You Can’t Miss

Filing an Auto Insurance Claim

Securing auto insurance is important because it protects you from paying large costs out of pocket when accidents or unexpected events happen. The most common auto insurance claim in the U.S. is for a collision, which isn’t covered by minimum liability insurance.

Most Common Auto Insurance Claims in the U.S.| Coverage Type | Share | Cost Per Claim | Description |

|---|---|---|---|

| Collision | 30% | $4.5K | Vehicle impact |

| Property Damage | 25% | $4.2K | Others’ property |

| Comprehensive | 15% | $2.5K | Theft, weather, fire |

| Bodily Injury | 12% | $20K | Injuries to others |

| Personal Injury | 8% | $8K | Medical, passengers |

| Uninsured Motorist | 6% | $15K | Uninsured driver hit |

| Medical Payments | 3% | $2.5K | Medical, any fault |

| Other Types | 1% | $1K | Rental, roadside |

Property damage claims come next at 25%, covering damage you cause to someone else’s car or belongings. Comprehensive claims, at 15%, cover things like theft, weather damage, vandalism, or fire. These are all common situations where drivers need more than minimum liability insurance to help cover big repair or replacement costs.

From fixing your car to paying for someone else’s damage or covering losses from a storm, having the right coverage can save you thousands of dollars. Without auto insurance, even one accident could lead to serious money problems. Browse more details on how to file an auto insurance claim and win each time.

Auto Insurance Claims by State

Every year, states like California and Florida have millions of car accidents and insurance claims, meaning drivers there have a higher chance of getting into a crash. Even in smaller places like Alaska or Delaware, thousands of people still file claims each year.

Annual Accidents & Insurance Claims by State| State | Accidents | Traffic Deaths | Claims | Claim Cost |

|---|---|---|---|---|

| Alabama | 520K | 10,196 | 168K | $53,760 |

| Alaska | 60K | 8,219 | 28K | $13,160 |

| Arizona | 730K | 10,000 | 280K | $106,400 |

| Arkansas | 350K | 11,667 | 125K | $45,000 |

| California | 3.5M | 8,861 | 1.9M | $1,026,000 |

| Colorado | 480K | 8,276 | 360K | $270,000 |

| Connecticut | 290K | 8,056 | 140K | $67,200 |

| Delaware | 150K | 15,152 | 65K | $27,950 |

| Florida | 2.5M | 11,521 | 1.6M | $1,024,000 |

| Georgia | 850K | 7,944 | 790K | $734,700 |

| Hawaii | 120K | 8,571 | 65K | $35,100 |

| Idaho | 230K | 12,105 | 110K | $52,800 |

| Illinois | 950K | 7,540 | 800K | $672,000 |

| Indiana | 690K | 10,147 | 520K | $390,000 |

| Iowa | 300K | 9,375 | 200K | $134,000 |

| Kansas | 310K | 10,690 | 200K | $130,000 |

| Kentucky | 440K | 9,778 | 420K | $403,200 |

| Louisiana | 450K | 9,783 | 420K | $390,600 |

| Maine | 160K | 11,429 | 85K | $45,050 |

| Maryland | 490K | 8,033 | 430K | $378,400 |

| Massachusetts | 680K | 9,855 | 470K | $324,300 |

| Michigan | 830K | 8,300 | 710K | $610,600 |

| Minnesota | 640K | 11,228 | 380K | $224,200 |

| Mississippi | 340K | 11,333 | 230K | $156,400 |

| Missouri | 670K | 10,807 | 540K | $437,400 |

| Montana | 120K | 10,909 | 90K | $67,500 |

| Nebraska | 160K | 8,000 | 130K | $105,300 |

| Nevada | 270K | 8,438 | 260K | $249,600 |

| New Hampshire | 140K | 10,000 | 110K | $86,900 |

| New Jersey | 800K | 8,989 | 720K | $648,000 |

| New Mexico | 200K | 9,524 | 170K | $144,500 |

| New York | 1.1M | 5,641 | 1.1M | $1,100,000 |

| North Carolina | 840K | 7,851 | 850K | $858,500 |

| North Dakota | 90K | 11,539 | 60K | $40,200 |

| Ohio | 900K | 7,692 | 820K | $746,200 |

| Oklahoma | 380K | 9,500 | 350K | $322,000 |

| Oregon | 340K | 7,907 | 330K | $320,100 |

| Pennsylvania | 1.0M | 7,752 | 880K | $774,400 |

| Rhode Island | 120K | 10,909 | 85K | $60,350 |

| South Carolina | 520K | 10,000 | 510K | $499,800 |

| South Dakota | 90K | 10,000 | 70K | $54,600 |

| Tennessee | 700K | 10,000 | 700K | $700,000 |

| Texas | 3.2M | 10,848 | 2.4M | $1,800,000 |

| Utah | 240K | 7,273 | 220K | $202,400 |

| Vermont | 80K | 12,308 | 50K | $31,500 |

| Virginia | 780K | 9,070 | 620K | $496,000 |

| Washington | 750K | 9,615 | 510K | $346,800 |

| West Virginia | 150K | 8,333 | 120K | $96,000 |

| Wisconsin | 650K | 11,017 | 450K | $310,500 |

| Wyoming | 90K | 15,517 | 50K | $28,000 |

The annual accident numbers show how many car crashes happen in each state every year, while the annual claims numbers show how many times drivers file insurance claims to cover those accidents or other damage. No matter where you live, accidents can happen at any time.

Read More: Worst States for Filing Auto Insurance Claims

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Where to Get the Best Auto Insurance Coverage

The most popular auto insurance companies in the U.S. are the ones that cover the most drivers. Progressive is the largest, holding 39% of the market. Find out why so many drivers trust and choose it in our Progressive auto insurance review.

Many drivers choose these companies for their strong customer support, digital tools, and large network of agents or service centers. Bigger providers also tend to offer more discounts, better claims handling, and flexible policy choices, making them popular with drivers in all states.

Choose auto insurance that meets your state’s minimums, covers what you can't afford to fix or replace, and balances a deductible that fits your monthly budget.

Jeff Root Licensed Insurance Agent

Choosing a well-known provider can give peace of mind, especially when dealing with claims or needing fast help on the road. Explore auto insurance quotes from companies near you by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

How do I find the best auto insurance?

Start by comparing quotes from multiple companies online. Look for providers that offer the coverage you need, have strong customer reviews, and provide discounts for safe driving, bundling, or usage-based programs. Make sure the company has good claims service and financial strength.

What is the main purpose of auto insurance?

The main purpose of auto insurance is to protect you financially after an accident. It helps cover the cost of damage to your car, other people’s property, and medical bills so you’re not stuck paying out of pocket. Explore how medical payments coverage works.

What factors affect auto insurance rates?

Your auto insurance quotes will vary depending on your location, age, and driving record. Credit score and marital status may also impact rates in some states.

Who has the cheapest car insurance?

Geico often offers the lowest minimum coverage rates, starting as low as $43 a month. Other affordable companies include Auto-Owners, State Farm, and American Family. Enter your ZIP code to find out when you can get a the best auto insurance.

How do I choose the best auto insurance company?

First determine how much coverage you need and a budget you can afford, then start comparing providers on auto insurance marketplaces and comparison sites like this one to get quotes. When you find an affordable company, research its customer satisfaction rates and discount list to see if it works for you.

How much liability insurance should you carry on your car?

What is a good amount of car insurance coverage? It depends on your state’s minimum requirements, but many experts recommend carrying higher limits, such as $100,000 per person/$300,000 per accident for bodily injury and at least $50,000 for property damage. Compare liability vs. full coverage auto insurance to better protect your assets.

What does PD mean in auto insurance?

PD stands for Property Damage. It’s part of liability insurance that pays for damage you cause to someone else’s car, building, fence, or other property in an accident.

What is the 15/30/5 rule in auto insurance?

This is a type of liability coverage limit. It means your policy covers up to $15,000 for one person’s injuries, $30,000 total for all injuries in an accident, and $5,000 for property damage. This is the minimum requirement in some states like California.

What does $100k/$300k/$100k mean in car insurance?

This means your liability limits are $100,000 for injuries to one person, $300,000 total for all injuries in one accident, and $100,000 for damage to property. These higher limits give more protection if you’re at fault in a major accident.

Is it better to have collision or comprehensive insurance?

It depends on your needs and budget. Collision covers damage from crashes (like hitting another car), while comprehensive covers non-crash events like theft, fire, or weather. Many drivers choose full coverage because it comes with collision vs. comprehensive auto insurance plus minimum liability requirements.

Can you have car insurance in a different state than your registration?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.