Documents Needed to Buy Auto Insurance in 2026

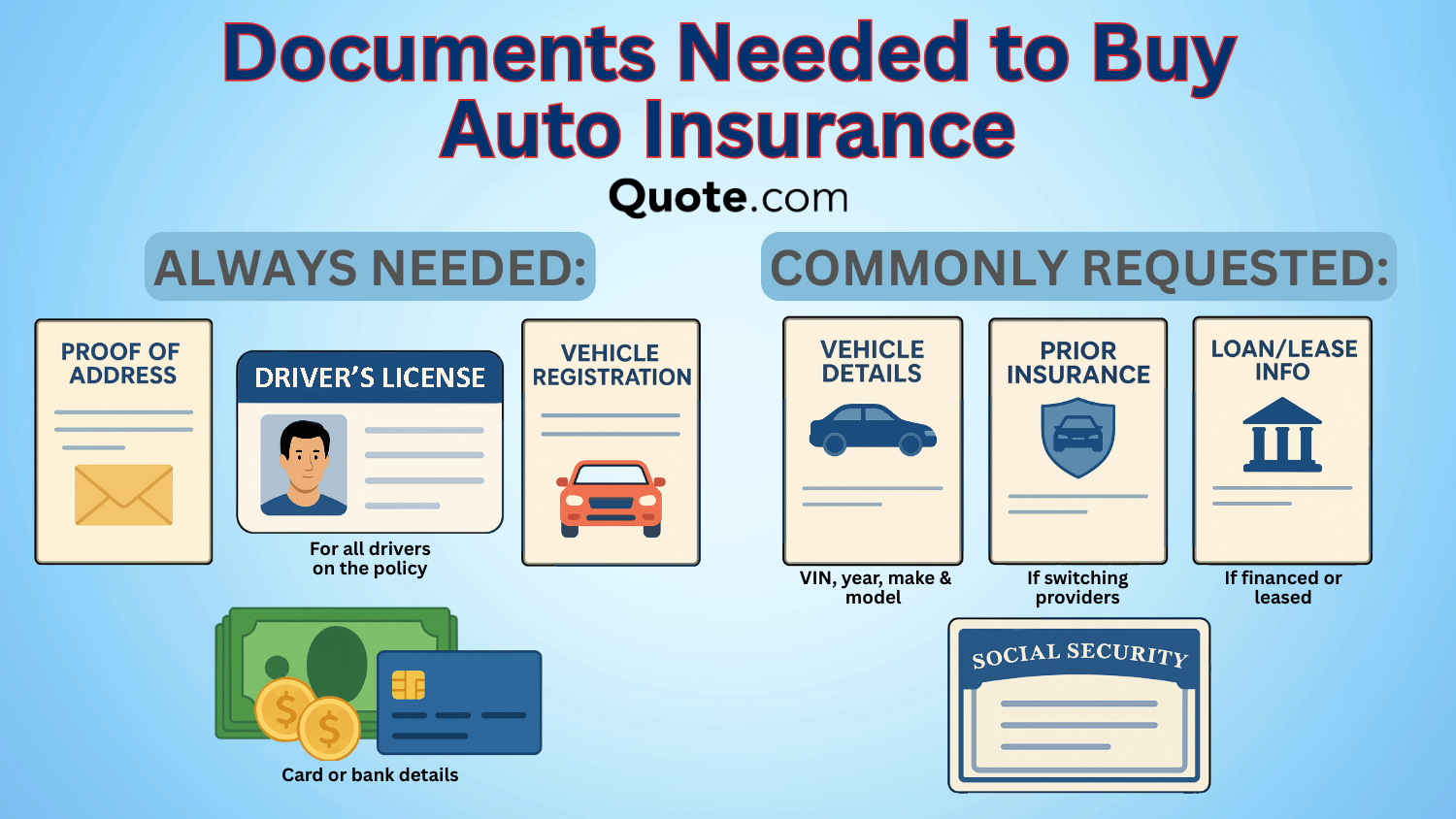

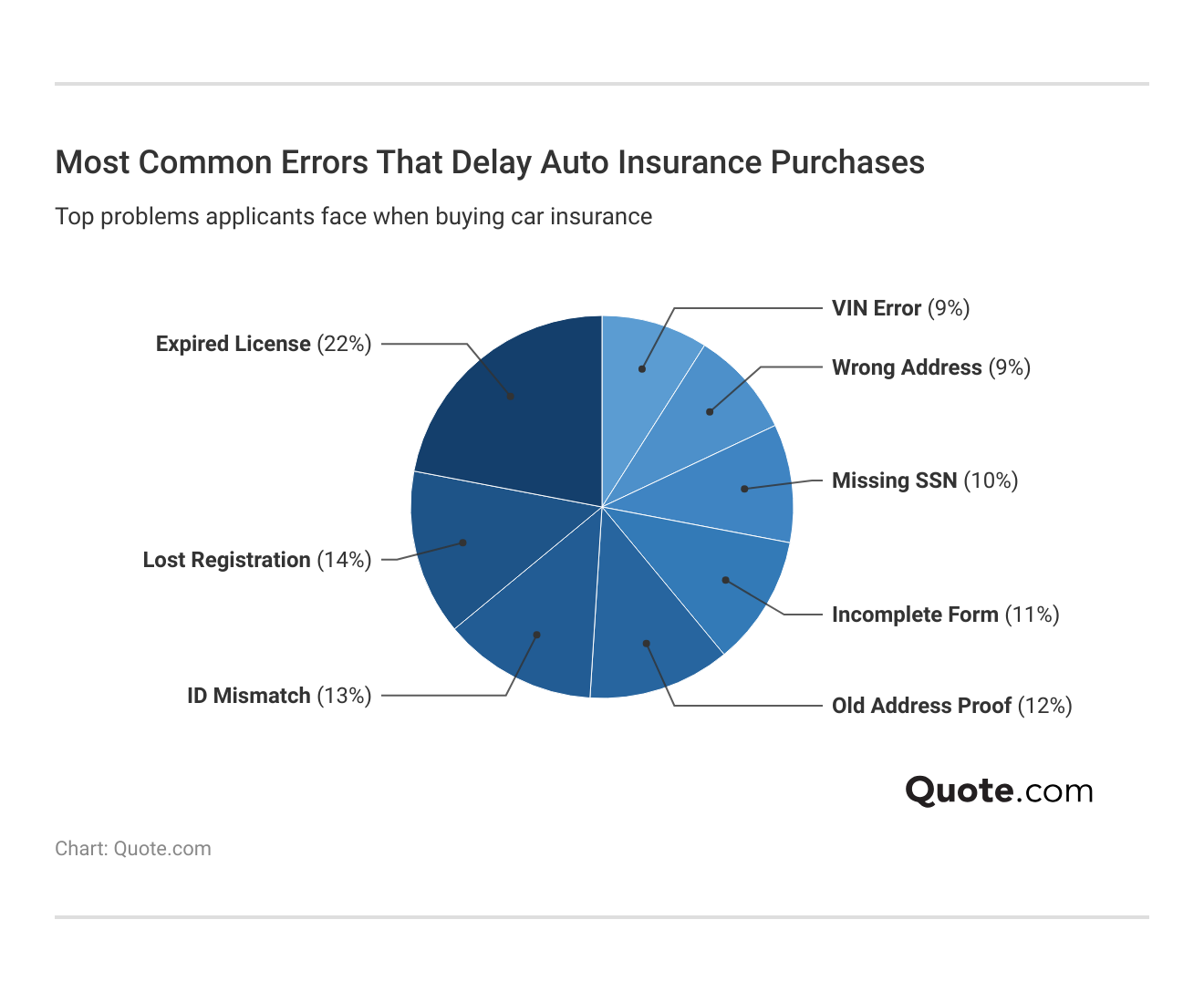

The documents needed to buy auto insurance include your VIN and drivers license. The most common mistake involves licensing, with 22% of people shopping with expired drivers licenses. Other information needed for car insurance is your Social Security number, your vehicle's current mileage, and school transcripts.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

While there are many documents needed to buy auto insurance, some of the most important include your driver’s license and VIN.

- You need personal and vehicle documents to buy auto insurance

- Gather proof for auto insurance discounts, like school transcripts

- Make sure to provide your information correctly for accurate quotes

If you want to know how to buy auto insurance with as little hassle as possible, have your driver’s license, VIN, mileage, and vehicle registration on hand.

Whether you’re a first-time car insurance buyer or want to see if there’s a more affordable option out there, having the documents needed to buy auto insurance speeds up the process.

The fastest way to get car insurance is to have all your personal and vehicle documents ready. Enter your ZIP code into our free online generator to compare rates in your area.

Documents Needed to Buy Car Insurance

Buying car insurance is usually straightforward, but you’ll need a variety of personal and vehicle information before you can get a quote. Having the documents you need ready to go will make the car insurance quote process faster and more accurate.

It will also help you find the cheapest car insurance possible, because you’ll need accurate information to compare multiple quotes.

Insurers use the information listed above to verify who you are, assess your risk level as a driver, and determine which discounts you qualify for.

Whether you’re switching providers or buying coverage for the first time, being prepared can save you time and money.

Required Documents for Buying Auto Insurance: Sources & Formats| Document | Source | Format | Alternatives |

|---|---|---|---|

| Coverage Choices | Insurer | Digital/Paper | Declaration page |

| Declaration Page | Insurer | Digital/Paper | Proof of coverage letter |

| Driver History | DMV | Digital/Paper | Driving record printout |

| Driver’s License | DMV | Physical | Passport, temp license |

| Driving Record | DMV | Digital/Paper | None |

| Email Address | User/Email Provider | Digital | Phone # verification |

| Household Info | Policyholder | Digital/Paper | Lease or tax docs |

| Loan/Lease | Lender/Dealer | Digital/Paper | Loan statement |

| Mileage Check | Owner/Dealer | Physical/Digital | Inspection report |

| Payment Card | Bank/Credit Union | Physical | Bank letter/e-wallet |

| Phone Number | Mobile Carrier | Digital | Phone bill |

| Policy Expiration | Insurance Company | Digital/Paper | Renewal note |

| Prior Insurance | Insurance Company | Digital/Paper | Coverage letter |

| Proof of Address | Utility Co./Bank | Digital/Paper | Financial statements |

| Social Security | SSA | Physical | W-2/1099 |

| Usage Data | Telematics Co. | Digital | OBD device report |

| Vehicle Details | Dealer/Maker | Digital/Paper | Bill of sale |

| Vehicle Photos | Vehicle Owner | Digital | Inspection photos |

| Vehicle Registration | DMV/Dealer | Physical/Digital | Temp registration |

| VIN Number | Maker/DMV | Physical | Door sticker |

In most cases, you won’t need physical paperwork if you’re buying insurance online or over the phone, but you will need the information those documents contain.

Gathering all the documents you need beforehand may seem like a hassle, but it will help you get insurance quotes quickly.

Reason for Required Documents When Buying Auto Insurance| Document | Why Needed | Who Provides | When Used |

|---|---|---|---|

| Coverage Choices | Coverage selection | All drivers | Before issue |

| Declaration Page | Confirm coverage | Owner | At purchase |

| Driver History | Assess risk | Policyholder | During application |

| Driver’s License | Verify Identitiy | All drivers | During application |

| Driving Record | Verify violations | DMV | Underwriting |

| Email Address | Set up account | Policyholder | During application |

| Household Info | Rate drivers | Policyholder | During underwriting |

| Loan/Lease | Verify lienholder | Lender/Dealer | Purchase or renewal |

| Mileage Check | Verify mileage | Vehicle owner | Purchase or renewal |

| Payment Card | Process payments | Policyholder | Purchase or renewal |

| Phone Number | Claims contact | Policyholder | During application |

| Policy Expiration | Confirm coverage | Old insurer | Renewal/switch |

| Prior Insurance | Verify discount | Policyholder | During underwriting |

| Proof of Address | Confirm territory | Policyholder | During application |

| Social Security | ID check | Policyholder | During application |

| Usage Data | Telematics data | Driver (app) | Ongoing |

| Vehicle Details | Identify vehicle | Dealer/Policyholder | During application |

| Vehicle Photos | Vehicle condition | Policyholder | Policy start/claim |

| Vehicle Registration | Verify ownership | DMV/Owner | During application |

| VIN Number | Rate vehicle | Dealer/Maker/Owner | During application |

Having all your documents and information ready before shopping for auto insurance helps streamline the process. Insurers can generate accurate quotes right away, reducing follow-up questions and back-and-forth.

Being prepared also lowers the risk of mistakes on your policy, helping you secure coverage faster and with more confidence.

Personal Information Needed for Car Insurance

Auto insurance companies need information like your name, date of birth, and where you live to determine how much you’ll pay for coverage.

The average cost of auto insurance coverage varies significantly based on your personal details, so it’s important to provide accurate information to get the cheapest car insurance possible. The personal information you’ll need to provide usually includes:

- Your full legal name and date of birth

- Your current address and how long you’ve lived there

- A valid driver’s license number for all drivers on the policy

- Your Social Security number (sometimes optional, but often used for credit-based insurance scoring)

- Your driving history, including accidents, tickets, or claims

Most insurance companies let you save your quote progress and come back later. However, you’ll need information on every driver who will be on the policy, such as a spouse or a teenager, before you can purchase coverage.

Some insurance companies ask if you already have coverage, but you won’t need to provide your policy number. You’ll only need to know your current insurance company’s name and how long you’ve had the policy.

Vehicle Information Needed to Buy Auto Insurance

Aside from personal details like where you live and your age, the type of vehicle you want to insure is one of the most crucial parts of how much you’ll pay for insurance.

Insurers need detailed information about your car to determine the cost to repair or replace it and which coverage options are appropriate.

Average auto insurance rates by vehicle vary significantly, so you’ll need your car’s information for an accurate quote. Be prepared to provide the following information about your vehicle:

- The vehicle identification number (VIN)

- Make, model, and year of the vehicle

- Current mileage or an estimate

- How the vehicle is primarily used (commuting, pleasure, or business)

- Where the car is usually parked (garage, driveway, or street)

If you’re buying a new or used car, the dealership can usually give you this information right away. Alternatively, you can find it in your paperwork they dealership gives you, or by looking in your new car.

You can also find most of this information in your vehicle. For example, your VIN is typically located on the driver’s side dashboard.

Read More: The Best Time to Buy a New Car

Proof Required for Car Insurance Discounts

Most providers offer auto insurance discounts to help drivers save on their premiums. While many discounts are automatic, some require proof, especially for discounts involving a student’s grades.

While you can always apply for a discount later, having the information you need can help you start saving right away. Some of the most common discounts require the following proof:

- Proof of prior insurance to qualify for a continuous coverage discount

- Vehicle safety features, such as anti-lock brakes or anti-theft devices

- Good student documentation, like report cards or transcripts

- Defensive driving or driver’s education completion certificates

- Low-mileage verification, sometimes through odometer readings or apps

Insurance providers have different rules and requirements for their discounts, so it’s always a good idea to check your eligibility.

If you need help with discount information, you can always contact the insurance company. A representative can double-check that you’re getting every discount possible.

Read More: 26 Hacks to Save Money on Auto Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Auto Insurance Quotes

Whether you need first-time car insurance for new drivers or want to switch policies, getting insurance quotes is easier than ever. You can get quotes in person, by phone, or online.

Then, you can use your personalized quotes from different companies to learn how to compare auto insurance companies and find the right fit for you.

Online quotes are the most convenient way to compare prices from multiple companies at once, helping you save money.

Daniel Young Published Insurance Expert

No matter how you choose to get your insurance quotes, the process is usually simple, particularly if you’ve gathered all the documents needed to buy car insurance. Simply follow these steps to get an insurance quote:

- Gather Documents: If you have everything listed above, getting a quote will be much faster.

- Pick Your Coverage: You’ll need to know how much coverage you need for your vehicle before you can purchase a policy.

- Get Quotes: You can get individual quotes from an insurance company or use an online quote generator to see multiple rates.

- Compare Prices: Make sure to compare quotes with at least three companies to find the lowest price possible.

When you get insurance quotes, it’s important to use accurate information. Insurance fraud leads to denied claims and canceled policies, even if you accidentally put the wrong information.

Providing inaccurate information also makes buying insurance take longer. Take a look at some of the most common ways that people accidentally prolong the insurance buying process.

If you do accidentally enter the wrong information, make sure to contact your insurance company as soon as you can to correct it.

Although getting auto insurance quotes is easier than ever, you can always get help if you need it. Most insurance companies use chatbots for simple inquiries. For more complex problems, you can speak with an insurance representative.

Buying the Right Amount of Auto Insurance

Buying coverage is an important part of keeping you safe on the road, but there are many types of insurance to consider.

One of the most important choices is whether you need minimum insurance or a full coverage insurance policy.

Car insurance requirements and laws vary by location, but most states require coverage before you can drive. A minimum insurance policy is the least amount of coverage you can purchase and still legally drive.

A full coverage policy includes your state’s auto insurance requirements, as well as comprehensive and collision coverage.

So, how do you choose between these two policies? The amount of coverage you need depends on your vehicle.

Drivers with a car loan or lease, or with vehicles they can’t afford to replace outright, should consider full coverage.

If you have a car loan or lease, your lender will likely require full coverage until it’s paid off.

Michelle Robbins Licensed Insurance Agent

If your car is less expensive or you can replace it with your own funds after it’s totaled, a minimum insurance policy may be the right choice for you.

Aside from these policies, you can buy a variety of coverages for your car. The basic types of insurance include:

- Liability: Bodily injury and property damage liability auto insurance ensures that you can pay for damage you cause in an accident. It does not overage your vehicle.

- Comprehensive: Comprehensive auto insurance covers non-collision damage to your vehicle, including things like fire, theft, weather, and vandalism.

- Collision: If you want help paying for your car repairs after a collision, you need collision insurance.

- Uninsured/Underinsured Motorist: Uninsured/underinsured motorist insurance pays for your car repairs and medical bills if a driver without coverage strikes you.

- MedPay/Personal Injury Protection: Medical payments (MedPay) and personal injury protection (PIP) cover medical bills for you and your passengers after an accident.

There are also a variety of add-ons you can purchase, though availability depends on your insurance company.

For example, gap insurance, which covers the difference between what you owe on a vehicle and what your insurance will pay, is available from many insurance companies but not from Geico.

Tips for First-Time Car Insurance Buyers

Even if you have all the information needed for an insurance quote, buying coverage for the first time can feel overwhelming or nerve-wracking. However, you can follow our easy tips to find affordable coverage quickly.

Whether you’re a first-time buyer or just want a new policy, use these tips to get affordable car insurance quotes:

- Avoid Fraud: Make sure you provide accurate information when you get an insurance quote, or any future claim you might make will likely be denied.

- Check Your Deductible: Your auto insurance deductible is the amount you pay when you file a claim. Make sure to choose a deductible you can afford.

- Compare Quotes: If you purchase from the first company you get a quote from, you’ll likely overpay for insurance.

- Look for Discounts: Picking the company that offers the most discounts you qualify for can help you save significantly.

Taking the time to understand your options can help you find coverage that fits your needs now and in the future.

Keep in mind that comparing quotes online from multiple companies is the best way to get affordable coverage quickly.

Read More: Auto Insurance Coverage Guide

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get the Information Needed for Auto Insurance

Learning how to get multiple auto insurance quotes doesn’t have to be complicated when you know what to expect. Make sure you have your driver’s license, vehicle registration, mileage, and VIN to get started.

Having the right information and documents needed to buy auto insurance ready can speed up the process, help you get accurate quotes, and ensure you don’t miss out on valuable discounts.

By understanding your coverage options and taking time to compare insurers, you can choose a policy that protects both your vehicle and your finances.

Now that you know the documents needed to buy car insurance online or in person, enter your ZIP code into our free quote generator today to compare rates in your area.

Frequently Asked Questions

What documents do you need for a car insurance quote?

While every company is different, the documents needed to buy auto insurance include personal information like your driver’s license, home address, and Social Security number. You’ll also need to provide information about your vehicle, including its VIN and the make and model. Some insurance companies might ask about your driving history and if you have a current policy with another provider.

Do you need a driver’s license to buy auto insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.