Good2Go Auto Insurance Review for 2026

Good2Go offers affordable coverage for high-risk drivers starting at just $43 per month. Our Good2Go auto insurance review offers discounts of up to 35% for good drivers, and features like the LifeSaver App, no-down-payment options, and instant SR-22 filing, making it a good fit for high-risk drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insurance...

Leslie Kasperowicz

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated January 2026

Our Good2Go auto insurance review explains how the company offers coverage starting at $43 per month, with rates based on age, driving history, and coverage type.

Good2Go Auto Insurance Rating| Rating Criteria |  |

|---|---|

| Overall Score | 2.8 |

| Business Reviews | 2.0 |

| Claim Processing | 2.0 |

| Company Reputation | 2.0 |

| Coverage Availability | 2.5 |

| Coverage Value | 2.5 |

| Customer Satisfaction | 3.0 |

| Digital Experience | 2.5 |

| Discounts Available | 3.7 |

| Insurance Cost | 3.7 |

| Plan Personalization | 2.0 |

| Policy Options | 2.5 |

| Savings Potential | 3.7 |

Good2Go sells some policies through affiliates like American Independent and Omni. It supports high-risk drivers and offers up to 35% off through its best auto insurance for good drivers program.

Good2Go also partners with top high-risk insurers such as Progressive, Kemper/Infinity, Dairyland, and Bristol West to provide fast, online quotes.

- Good2Go offers basic auto insurance starting at just $43 per month

- Tailored for high-risk drivers with SR-22 filing and flexible payment plans

- Save up to 35% with good driver discounts and 25% for multi-vehicle policies

Stop overpaying for auto insurance. Enter your ZIP code to see if Good2Go can offer you a better deal on affordable coverage.

Good2Go Auto Insurance Rates

Good2Go provides policies through a mix of its own affiliated insurers such as American Independent and Omni, and through partners like Dairyland, Kemper and Progressive. These partnerships make it possible to offer more flexible, competitive coverage to drivers who have difficulty finding such coverage elsewhere.

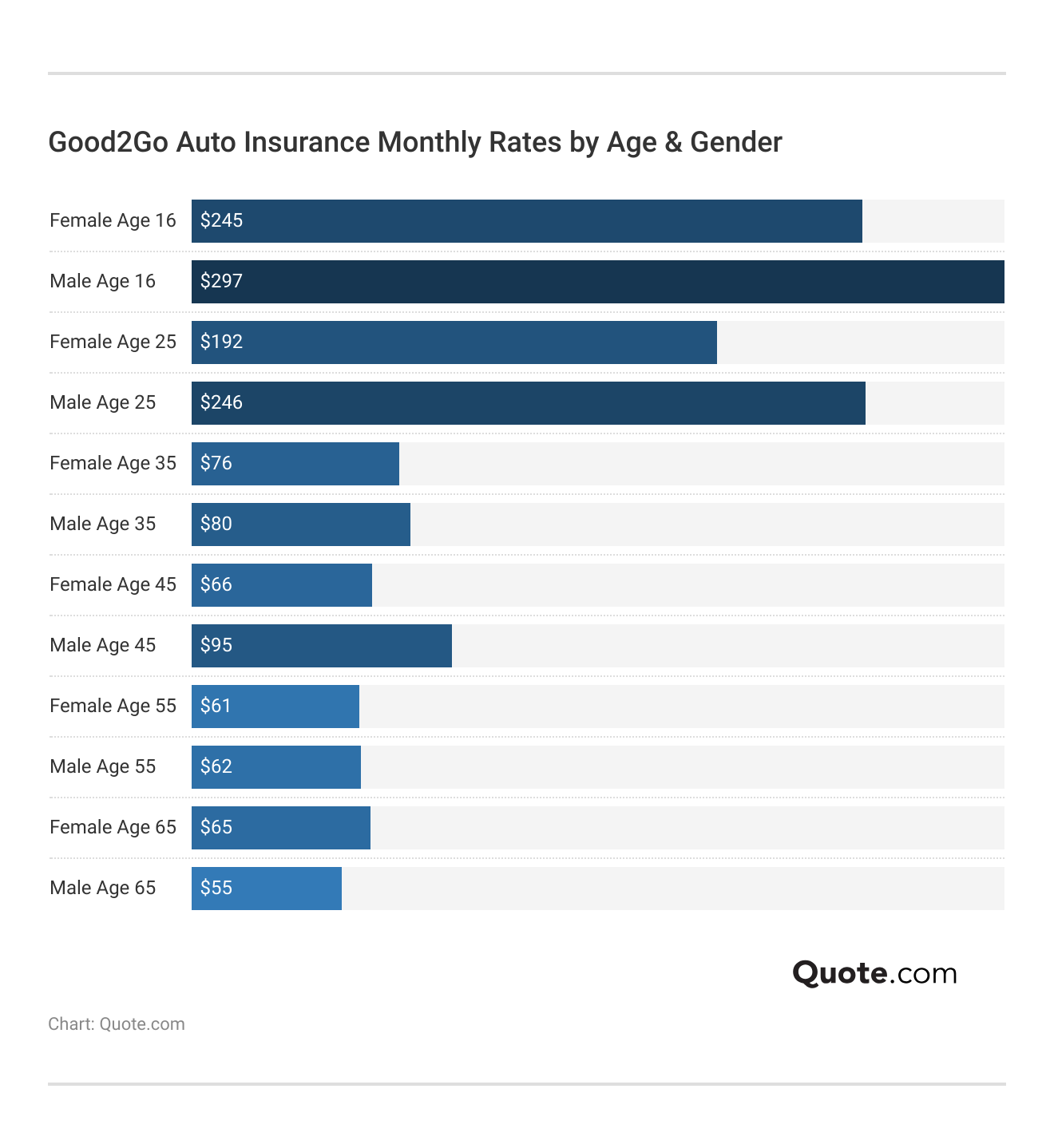

Good2Go insurance rates vary by age and gender, with the highest costs at age 16 and the lowest for older drivers. At 35, women pay $76 and men pay $80. By 65, rates drop to $55 for men and $65 for women, reflecting lower risk and more driving experience.

Good2Go vs. Top Competitors: Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $125 | $178 | $210 | $160 |

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 |

Good2Go Insurance, Inc.’s monthly rates vary based on driving record and the type of coverage selected. For drivers with a clean record, rates are the lowest, averaging $95 for minimum coverage and $225 for full coverage. A single accident increases rates to $145 for minimum and $305 for full coverage.

Your driving record impacts your rate—accidents and violations increase costs. For example, using a telematics app can lower premiums by rewarding safe habits.

Jeff Root Licensed Insurance Agent

Drivers with a DUI pay the highest premium of nearly $185 for minimum coverage and $345 for full coverage. Meanwhile, one traffic ticket results in moderate increases, with rates of $120 for minimum and $275 for full coverage. These figures highlight how driving violations can significantly impact insurance costs.

Good2Go vs. Top Competitors: Auto Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $125 | $247 |

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

Good2Go Auto Insurance rates average $95 for minimum and $225 for full coverage. As noted in everything you need to know about Geico, Geico offers lower rates at $43 and $114.

Progressive, American Family, and Nationwide also provide more affordable options. On the higher end, Liberty Mutual and Allstate have full coverage rates exceeding $225. Overall, Good2Go is less competitive on price, especially for minimum coverage.

Good2Go vs. Top Competitors: Auto Insurance Monthly Rates by Credit Score| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $71 | $122 | $142 | |

| $44 | $52 | $61 |

| $76 | $91 | $106 | |

| $46 | $55 | $66 | |

| $60 | $70 | $90 |

| $91 | $110 | $130 |

| $54 | $64 | $74 | |

| $35 | $42 | $55 | |

| $50 | $60 | $70 | |

| $60 | $72 | $85 |

Good2Go rates by credit score are generally higher than many top competitors. While insurers like Progressive and Geico offer rates as low as $35–$46 for good credit, Good2Go averages around $60 for good credit, $70 for fair, and $90 for bad credit, making it a pricier option, especially for those with lower scores.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Good2Go Auto Insurance Coverage Options

When it comes to selecting the best auto insurance, you have to know what’s available. Good2Go Direct is a fast, affordable one-stop shop, offering basic to full coverage with low down payments and discounts, ideal for high-risk drivers.

- Liability Coverage (Bodily Injury & Property Damage): This coverage pays for injuries and damages to other people when you are at fault, including legal defense if you’re sued.

- Collision Coverage: Collision auto insurance pays for repairs to your vehicle after a crash, no matter who is at fault, and is typically required for leased or financed cars.

- Comprehensive Coverage: Covers non-collision damage like theft, fire, floods, or animal impact. Optional, but recommended for broader vehicle protection.

- Uninsured/Underinsured Motorist Coverage: Covers you when a driver with no, or not enough, insurance hits you, for medical bills, vehicle damage or both, as it says in your policy.

- Rental Reimbursement and Towing & Labor: Optional extras that pay for a rental while your car is out of commission and tow or provide roadside assistance if your vehicle’s disabled.

The Good2Go LifeSaver App further simplifies the process, helping drivers stay legal for less by providing quick access to coverage and policy management.

Whether you need minimum coverage or added protection, Good2Go offers flexible options tailored to your vehicle, lifestyle, and risk level.

Ways to Save on Good2Go Auto Insurance

Good2Go provides several discounts that help reduce the cost of policies for different kinds of drivers.

Good2Go Auto Insurance Discounts| Discount |  |

|---|---|

| Multi-Vehicle | 25% |

| Good Driver | 20% |

| Paid in Full | 15% |

| Anti-Theft | 10% |

| Defensive Driving | 10% |

| Homeownership | 10% |

| Renewal | 10% |

| Electronic Payment | 5% |

| Good Student | 15% |

| Prior Insurance | 10% |

| Driver’s Education | 10% |

Below is a list of common discounts you may qualify for, along with a few additional smart practices to help you maximize your savings.

- Increase Your Deductible: Increasing your deductible can give you a smaller monthly rate, but have enough saved up in case you do have an accident to cover the higher out-of-pocket cost.

- Bundle Your Insurance Policies: Although Good2Go only offers auto insurance, you can still save by bundling with renters or home insurance through another provider that offers multi-policy discounts.

- Drive Less or Join a Usage-Based Program: If you drive rarely, a usage-based plan can cut costs. See the definitive guide to usage-based auto insurance for how tracking low mileage helps.

- Maintain a Clean Credit Score: Many insurers use your credit score to set rates, so maintaining good credit by paying on time and reducing debt can help you save.

- Shop Around Annually: Auto insurance rates change over time, so compare quotes annually to ensure you’re getting the best deal for your needs.

You can cut your car insurance rates by capitalizing on discounts and using these strategies to help reduce your auto insurance premiums.

Review your options regularly and adjust your plan as needed to keep your coverage both affordable and effective.

Good2Go Auto Insurance Reviews

Good2Go car insurance reviews show mixed ratings across major review agencies. It holds an A+ from the Better Business Bureau for strong business practices, but scores below average in customer satisfaction according to J.D. Power with a score of 780 out of 1,000 and Consumer Reports with a rating of 65 out of 100.

Good2Go Insurance Business Ratings & Consumer Reviews| Agency |  |

|---|---|

| Score: 780 / 1,000 Below Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 65/100 Below Avg. Satisfaction |

|

| Score: 4.50 More Complaints Than Avg. |

|

| Score: B Fair Financial Strength |

The NAIC reports more complaints than average with a score of 4.50, and A.M. Best rates its financial strength as fair with a B grade.

A Yelp reviewer gave Good2Go Insurance 5 stars, noting it’s a legitimate company with an A BBB rating and ties to Omni Auto Insurance. A customer from Trenton, NJ shared a positive experience after adding a vehicle to their policy. They praised the representative for being professional, knowledgeable, and making the process quick and easy.

Bundling renters or roadside coverage with Good2Go can save more than buying them separately. Review add-ons regularly to avoid paying for duplicate services.

Michelle Robbins Licensed Insurance Agent

While some complaints involve cancellation fees, the reviewer found these clearly outlined in the paperwork and noted the importance of understanding what happens if you cancel auto insurance. After paying a year upfront and saving about $700, they were satisfied overall despite the initial hiccup.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Good2Go Auto Insurance

Good2Go offers fast quotes, flexible payments, and affordable minimum coverage, making it a solid choice for high-risk drivers seeking the cheapest car insurance.

- Fast and Simple Quote Process: Good2Go delivers quotes in under a minute, making it ideal for drivers seeking fast, no-obligation estimates without the hassle of a lengthy application.

- Affordable Minimum Coverage for High-Risk Drivers: Good2Go is one of the best options for high-risk drivers seeking cheap coverage, as the company focuses on minimum-limit car insurance.

- Flexible Payment Options: Customers can choose monthly, quarterly, or annual payments, offering flexibility to fit their budget and better manage insurance costs.

Good2Go services aren’t available in all states, and its practice of sharing user information with partner insurers can lead to unsolicited marketing, which may be a drawback for privacy-conscious customers.

- Not Available Nationwide: Good2Go isn’t licensed in every state, specifically Alaska, Hawaii, Kansas, Massachusetts, Montana, and Rhode Island. This restricts access for drivers in those regions.

- Aggressive Marketing and Data Sharing: Requesting a quote may result in unwanted calls, emails, or texts, as Good2Go shares your info with partner insurers, frustrating for users expecting just one quote.

Overall, Good2Go suits drivers seeking fast, affordable minimum coverage, particularly those with past violations or limited options.

However, its limited availability and data sharing may not appeal to those valuing privacy. Knowing its upsides and downsides can help you decide whether it’s right for you.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get Affordable Good2Go Auto Insurance Today

This Good2Go auto insurance review highlights $43 monthly rates for high-risk drivers, with fast quotes, SR-22 support, and tips on how to get multiple auto insurance quotes.

However, Good2Go’s drawbacks include limited state availability, higher full coverage rates, and data sharing that may result in marketing calls. Still, it’s a smart pick for drivers needing quick, legal, and affordable auto insurance.

If you want to reduce the costs of your car insurance, enter your ZIP code into our free quote comparison tool to see if Good2Go can offer you a better rate.

Frequently Asked Questions

Who owns Good2Go Insurance?

Good2Go Insurance is a subsidiary of American Independent Companies, Inc., a holding company operating multiple non-standard auto insurance brands. As part of this network, Good2Go functions as a managing general agency (MGA), offering coverage through partner insurers rather than underwriting policies directly.

Is Good2Go insurance good for high-risk drivers?

Yes, Good2Go insurance is a great choice for high-risk drivers. It provides some of the cheapest minimum coverage insurance at just $43/month and is backed with such features as those that support SR-22 filling and flexible payment, making it perfect if you have violations, suspended licenses or your insurance options are limited.

Don’t let expensive insurance rates hold you back. Enter your ZIP code to see if Good2Go can help you find affordable premiums from top providers.

Does Good2Go car insurance include optional add-on coverages?

Good2Go car insurance offers several optional add-ons, including comprehensive auto insurance, collision coverage, rental reimbursement, roadside assistance, and towing. These options can be customized based on your budget and level of protection that goes above the state minimum.

Can I set up automatic payments with Good2Go?

Yes, Good2Go online payment is also available with AutoPay feature where you can pay your bills on a particular date every month automatically. This helps ensure that your coverage remains active without the need for manual transactions.

Does Good2Go sell coverage in all states?

Good2Go does not offer coverage in every U.S. state. Full coverage availability depends on your location, and the company is currently not licensed in Alaska, Hawaii, Kansas, Massachusetts, Montana, and Rhode Island.

Is Good2Go Insurance be a good fit for budget-conscious drivers?

Yes, the Good2Go insurance review highlights that it caters to budget-focused drivers, especially those seeking cheap auto insurance for multiple vehicles with low down payments. Discounts up to 35% for good drivers and 25% for multi-vehicle policies help keep premiums affordable.

Is Good2Go auto insurance legit for customer support and claims service?

Good2Go is an insurance agency that partners with quality companies, but customer ratings for the claims process and support are mixed. Some members say there are wait times, and limited customer service hours that if you need a quick fix, can affect your overall experience there.

How can I contact Good2Go customer service?

You can contact Good2Go customer service by calling the Good2Go insurance phone number at 1-888-303-3430. Representatives are available during standard business hours to assist with billing, policy updates, claims, and general inquiries.

Will requesting a Good2Go insurance quote affect my credit score?

Requesting a Good2Go insurance quote does not affect your credit score. It uses a soft inquiry to estimate rates, helping you shop and learn how to get multiple auto insurance quotes without credit impact.

Is the Good2Go roadside assistance telephone number available 24/7?

Yes, the hotline 1-888-925-6547 is open 24/7 for any roadside emergency. Whether you have a breakdown in the middle of the night or a weekend incident, Good2Go has you covered and keeps you from being stuck.

Can Good2Go Insurance Company help with getting back on the road after a license suspension?

How fast is the response time from Good2Go insurance customer service?

Can I customize my Good2Go travel insurance quote?

How quickly is a payment processed through Good2Go pay online?

Can Good2Go personal service insurance help with SR-22 filings?

Can billing questions be addressed through the Good2Go customer service number 24/7?

How do I file a Good2Go claim after an accident?

How long do Good2Go insurance claims typically take to process?

Does Good2Go comprehensive travel insurance include emergency medical coverage overseas?

Are there any fees for using the Good2Go payment app to pay my bill?

Does Good2Go offer full coverage?

What factors affect Good2Go insurance rates?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.