How to Get Multiple Auto Insurance Quotes (2026)

The first step to getting multiple auto insurance quotes is understanding your coverage options. Liability insurance starts at just $20 per month, with full coverage offering broader protection. A comparison tool like Quote.com then shows reliable quotes once your information is entered.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Mortgage Loan Originator

Steve Crowell is a New Hampshire based mortgage loan originator with Luminate Home Loans, Inc. After graduating from the University of New Hampshire in 2003 with a BS in Business and Economics and a BA in History, he went on to get his broker license in 2005. In 2021, he was recognized as a Luminate Home Loans “Circle of Excellence” top agent. Steve works as a trusted resource for clients w...

Steve Crowell

Updated January 2026

To get multiple auto insurance quotes, start by researching trusted insurers, choosing a reliable comparison tool, and answering a few questions about yourself and your car.

- Use comparison sites, agents, or go directly to insurers to get quotes

- Check customer reviews and financial ratings to find a trusted provider

- You can save $540 per year by comparing multiple quotes with Quote.com

Comparing quotes side by side is important. This way, you can find the cheapest car insurance that gives you the coverage you need.

Related: What to Do if You Can’t Afford Car Insurance

These easy steps will walk you through how to get multiple auto insurance quotes at the same time so you can compare options and save money. Then, enter your ZIP code to compare free insurance quotes from top companies in your area.

Get Auto Insurance Quotes in 4 Easy Steps

Before getting multiple insurance quotes at one time, take a few minutes to research the insurance companies you’re considering. Price matters, but how an insurer handles claims can make a big difference when you need coverage.

To get the best deal on car insurance, request quotes from multiple companies. Each insurer may offer different prices, discounts, or coverage options.

Comparison tools help show the tradeoffs between price and protection, so you can see what you gain or give up as costs change.

Michelle Robbins Licensed Insurance Agent

Look beyond star ratings. Read customer reviews, and ask people you trust about their experiences.

Following the steps below will help you compare auto insurance quotes, understand what you’re paying for, and choose coverage that fits your needs.

Step #1: Determine Your Coverage Needs

Before comparing auto insurance companies, take time to figure out what coverage makes sense for you.

Start by reviewing your state’s minimum auto insurance requirements, including required liability coverage. State minimums are often low, so choosing higher limits can provide better financial protection if you cause an accident.

Auto Insurance Requirements by State (+Min. Coverage Cost)| State | Liability Limits | Monthly Rate | Coverage Required |

|---|---|---|---|

| Alabama | 25/50/25 | $50 | BI + PD |

| Alaska | 50/100/25 | $50 | BI + PD |

| Arizona | 25/50/15 | $59 | BI + PD |

| Arkansas | 25/50/25 | $56 | BI + PD + PIP |

| California | 30/60/15 | $72 | BI + PD |

| Colorado | 25/50/15 | $51 | BI + PD |

| Connecticut | 25/50/20 | $87 | BI + PD + UM/UIM |

| Delaware | 25/50/10 | $96 | BI + PD + PIP |

| Florida | 10/20/10 | $64 | PIP |

| Georgia | 25/50/25 | $72 | BI + PD |

| Hawaii | 20/40/10 | $37 | BI + PD + PIP |

| Idaho | 25/50/15 | $30 | BI + PD |

| Illinois | 25/50/20 | $57 | BI + PD + UM/UIM |

| Indiana | 25/50/25 | $49 | BI + PD |

| Iowa | 20/40/15 | $26 | BI + PD |

| Kansas | 25/50/25 | $43 | BI + PD + PIP |

| Kentucky | 25/50/25 | $64 | BI + PD + PIP + UM/UIM |

| Louisiana | 15/30/25 | $54 | BI + PD |

| Maine | 50/100/25 | $51 | BI/PD + UM + MedPay |

| Maryland | 30/60/15 | $126 | BI + PD + PIP + UM/UIM |

| Massachusetts | 20/40/5 | $56 | BI + PD + PIP |

| Michigan | 50/100/10 | $163 | BI + PD + PIP |

| Minnesota | 30/60/10 | $90 | BI + PD + PIP + UM/UIM |

| Mississippi | 25/50/25 | $53 | BI + PD |

| Missouri | 25/50/25 | $55 | BI + PD + UM |

| Montana | 25/50/20 | $42 | BI + PD |

| Nebraska | 25/50/25 | $39 | BI + PD + UM/UIM |

| Nevada | 25/50/20 | $61 | BI + PD |

| New Hampshire | 25/50/25 | $50 | Can opt out for free |

| New Jersey | 25/50/25 | $126 | BI + PD + PIP + UM/UIM |

| New Mexico | 25/50/10 | $56 | BI + PD |

| New York | 25/50/10 | $90 | BI + PD + PIP + UM/UIM |

| North Carolina | 50/100/50 | $55 | BI + PD + UM/UIM |

| North Dakota | 25/50/25 | $49 | BI + PD + PIP + UM/UIM |

| Ohio | 25/50/25 | $44 | BI + PD |

| Oklahoma | 25/50/25 | $52 | BI + PD |

| Oregon | 25/50/20 | $75 | BI + PD + PIP + UM/UIM |

| Pennsylvania | 15/30/5 | $60 | BI + PD + PIP |

| Rhode Island | 25/50/25 | $61 | BI + PD |

| South Carolina | 25/50/25 | $79 | BI + PD + UM/UIM |

| South Dakota | 25/50/25 | $20 | BI + PD + UM/UIM |

| Tennessee | 25/50/15 | $37 | BI + PD |

| Texas | 30/60/25 | $77 | BI + PD + PIP |

| Utah | 25/65/15 | $66 | BI + PD + PIP |

| Vermont | 25/50/10 | $43 | BI + PD + UM/UIM |

| Virginia | 50/100/25 | $56 | Pay $500 to opt out |

| Washington | 25/50/10 | $45 | BI + PD |

| West Virginia | 25/50/25 | $52 | BI + PD + UM/UIM |

| Wisconsin | 25/50/10 | $47 | BI/PD + UM + MedPay |

| Wyoming | 25/50/20 | $24 | BI + PD |

Your personal driving habits and finances also matter. How often you drive, the length of your commute, and your budget should all factor into your decision.

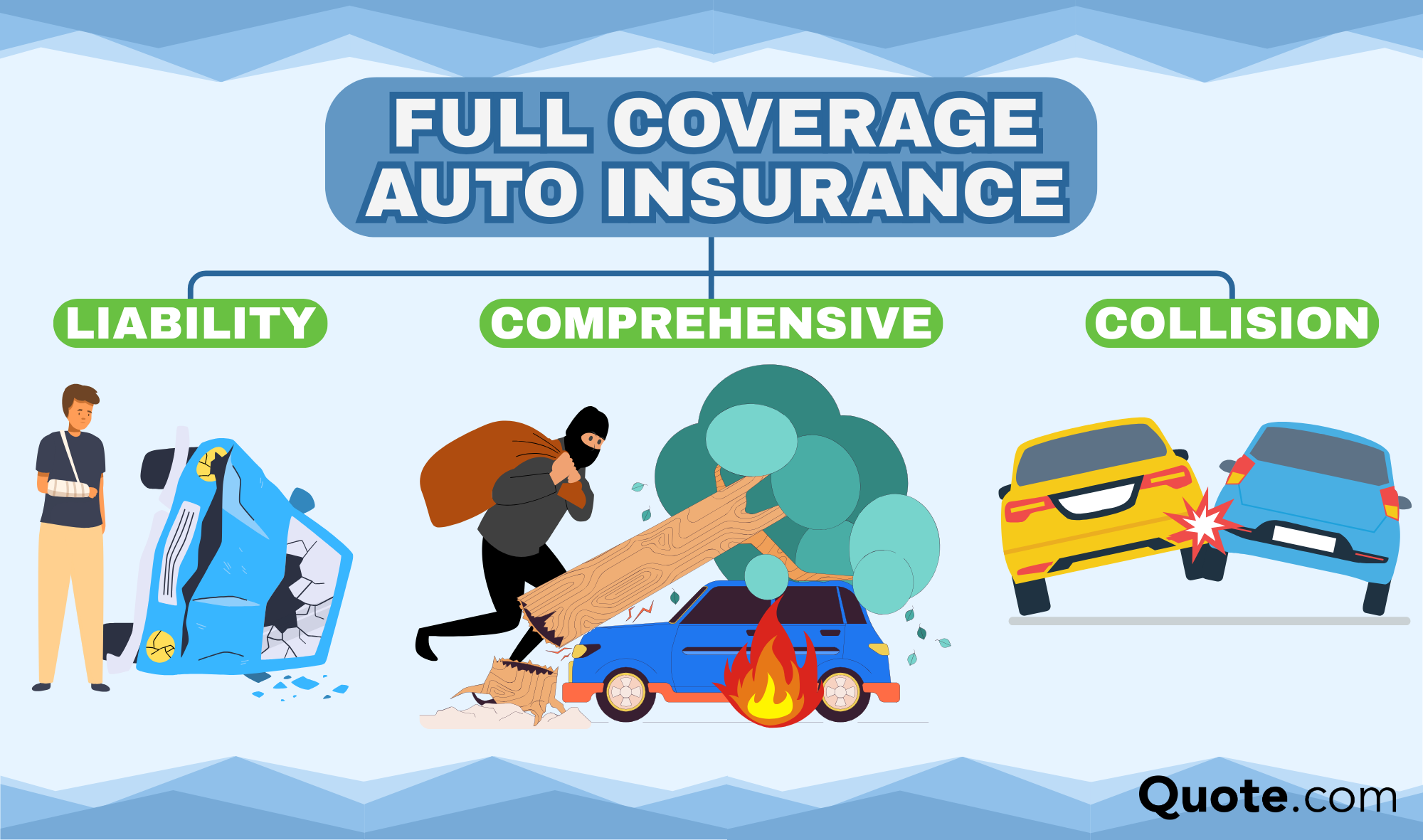

If your car is financed or leased, your lender will usually require full coverage car insurance, including collision and comprehensive coverage.

Auto Insurance Coverage Types: Details on What’s Covered| Coverage | What it Covers |

|---|---|

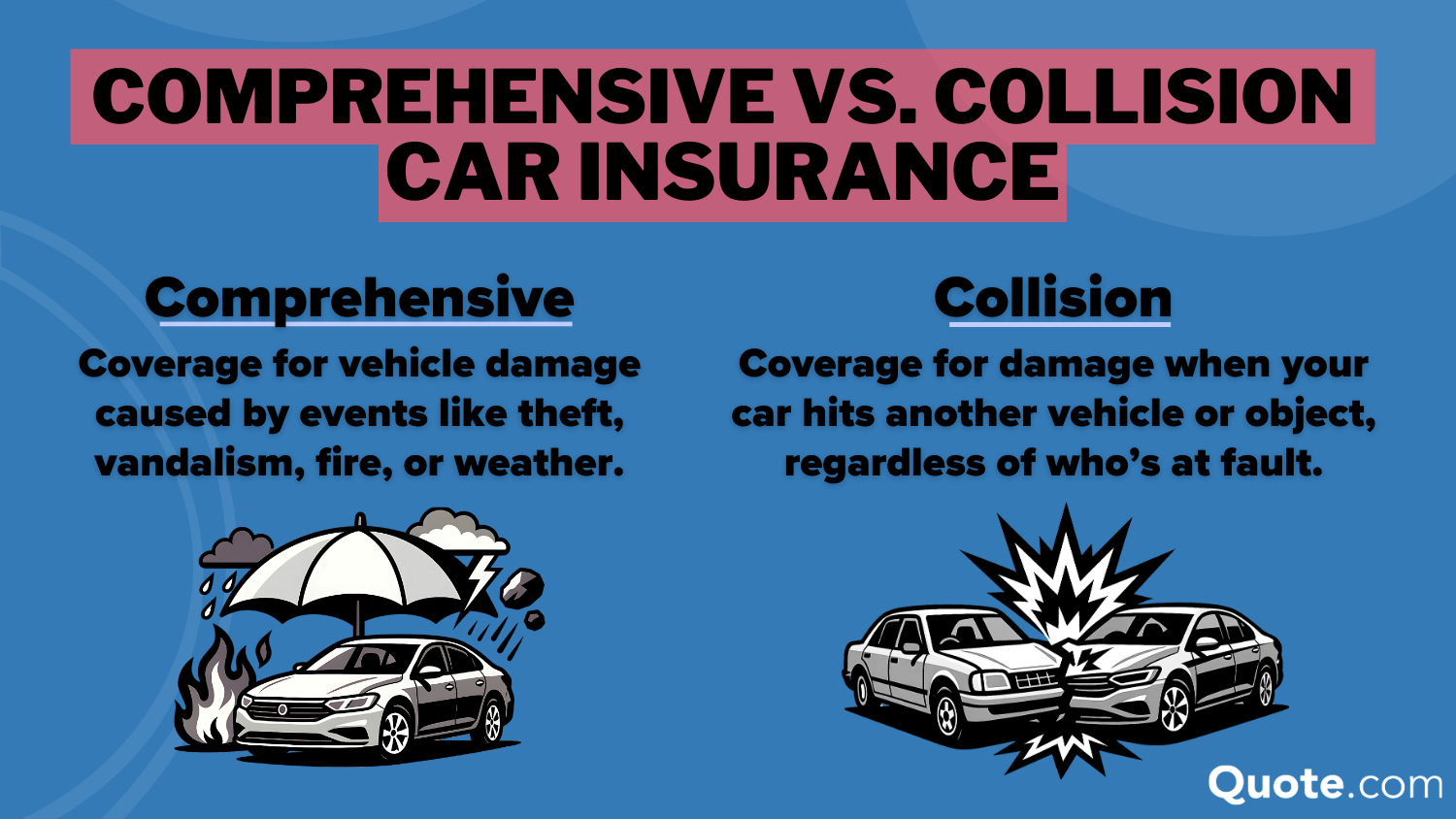

| Collision | Crash damage to your car |

| Comprehensive | Non-crash damage: theft, fire |

| Custom Parts & Equipment | Aftermarket parts damage/loss |

| Gap Insurance | Loan vs. car value difference |

| Liability | Injuries, damages to others |

| Medical Payments (MedPay) | Your medical bills only |

| Personal Injury Protection (PIP) | Medical bills, lost wages |

| Rental Reimbursement | Rental car during repairs |

| Roadside Assistance | Towing, flat tire, lockout |

| Uninsured/Underinsured Motorist | If other driver isn't covered |

Your car’s value also affects how much coverage makes sense. Newer or higher-value vehicles usually cost more to repair or replace, which makes full coverage car insurance a practical option.

For older, lower-value cars, paying for additional coverage may not be worth the cost if it exceeds the vehicle’s actual value. That’s why it helps to include full coverage insurance quotes in your comparison, so you can see how prices stack up.

You’ll also want to think about your deductible. Choosing a higher deductible can lower your monthly premium, but it increases how much you’ll pay out of pocket if you file a claim.

You may also want to consider optional coverages, such as gap insurance or uninsured/underinsured motorist protection.

Step #2: Find a Trustworthy Comparison Tool

A reliable comparison tool can make it easy to get car insurance quotes from multiple companies. Instead of visiting multiple websites or making endless calls, you can view several quotes in one place and focus on choosing the best fit.

The best insurance comparison sites, like Quote.com, let you enter your ZIP code and get auto insurance quotes from multiple companies instantly. It’s often the fastest and easiest way to compare prices side by side and find a policy that works for you.

Some shoppers prefer working with agents or getting quotes directly from insurers, especially if they need guidance or help understanding how to buy auto insurance.

However, those methods usually take more time, while a comparison tool lets you get multiple quotes quickly in one place.

Never Provide Your Social Security Number

You don’t need to provide your Social Security number to get a car insurance quote. Insurers and comparison tools can generate accurate estimates using basic details like your ZIP code, vehicle information, and driving history.

If a website asks for your SSN upfront, that’s a clear red flag and should be avoided.

Never Pay for an Insurance Quote

Car insurance quotes are always free. Legitimate comparison tools will never ask for credit card details just to show rates, and paying for a quote won’t unlock better pricing.

Using Quote.com to compare insurance quotes is completely free, with no strings attached. You won’t be asked for credit card information, and you won’t receive spam emails or unwanted phone calls.

Step #3: Answer Questions Accurately

Getting an accurate car insurance quote starts with being honest. If you lie or leave out details, such as how many miles you drive, past accidents, or your car’s make and model, it can change your quote. It’s also one of the most common reasons insurers deny insurance coverage.

For many drivers, it can be tempting to say you drive less than you actually do to save a few dollars on your premium. But if an insurer finds out you weren’t truthful, they could cancel your policy or refuse to pay a claim. It’s simply not worth the risk.

Learn More: Documents Needed to Buy Auto Insurance

Step #4: Compare Options and Policy Details

Once you have your quotes, don’t focus on price alone. Two policies may cost about the same but provide very different levels of protection.

Review the liability limits, deductibles, and any optional coverage, such as roadside assistance, rental reimbursement, or gap coverage.

Some auto insurance policies include these extras automatically, while others charge more or don’t offer them at all. If you’re not sure which add-ons are worth paying for, our ultimate insurance cheat sheet can help you figure out what actually makes sense for your situation.

Pay attention to deductibles, too. A lower premium often comes with higher out-of-pocket costs when you file a claim. If that amount would be hard to afford, the policy likely isn’t the right fit.

Make sure you’re comparing the same type of coverage across the board when viewing quotes. One policy may include higher liability limits than another, even if the price difference is small.

If you’re thinking about switching coverage, timing and details matter. Make sure your new policy starts before your old one ends to avoid a lapse, which can raise your rates later.

If you want to save money, car insurance discounts are usually a better option than cutting coverage. Many insurers offer lower rates if you pay annually instead of monthly, have safety features on your car, or keep a clean driving record.

Comparing quotes side by side makes it easier to spot real value. You can use our free quote tool to compare coverage options from multiple insurers in minutes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What You’ll Need to Get Auto Insurance Quotes

Before you start comparing auto insurance quotes, it helps to have a few basic details ready. Having this information on hand can make the process faster and more accurate:

- Your vehicle details, including make, model, year, and VIN

- Basic driver information, such as age and driving history

- How the car is used, like commuting or personal driving

- Current coverage limits and deductible preferences

- Any discounts you may qualify for, such as bundling or safe driving

Providing accurate details is important, because even small differences, like mileage or coverage limits, can noticeably affect the quotes you receive. Since rates and coverage options vary by state, insurers also use your location to apply state-specific pricing rules, minimum coverage requirements, and available discounts.

Once you provide this information, you’ll quickly get auto insurance quotes from multiple companies and see how they stack up side by side.

Enter your ZIP code to get started on finding the best car insurance rates for you by comparing several providers at once.

Car Insurance Rates vs. Quotes

When shopping for car insurance, it’s easy to mix up rates and quotes. A quote is simply an estimate based on the details you provide, like your vehicle, driving history, and coverage preferences.

Many insurers also allow you to get anonymous or no-obligation quotes, so you can compare estimated prices without immediately providing sensitive personal information.

What you see in a quote isn’t your final rate. Your actual auto insurance premium may end up higher or lower once the insurer reviews all your information, including your driving record, coverage level, and location.

Rates can also change after a full application, once details such as mileage, prior claims, and eligible discounts are verified. Quotes are still helpful because they give you a general price range, but your final rate may change once everything is fully reviewed.

Read More: The 17 Best Tips to Pay Less for Car Insurance

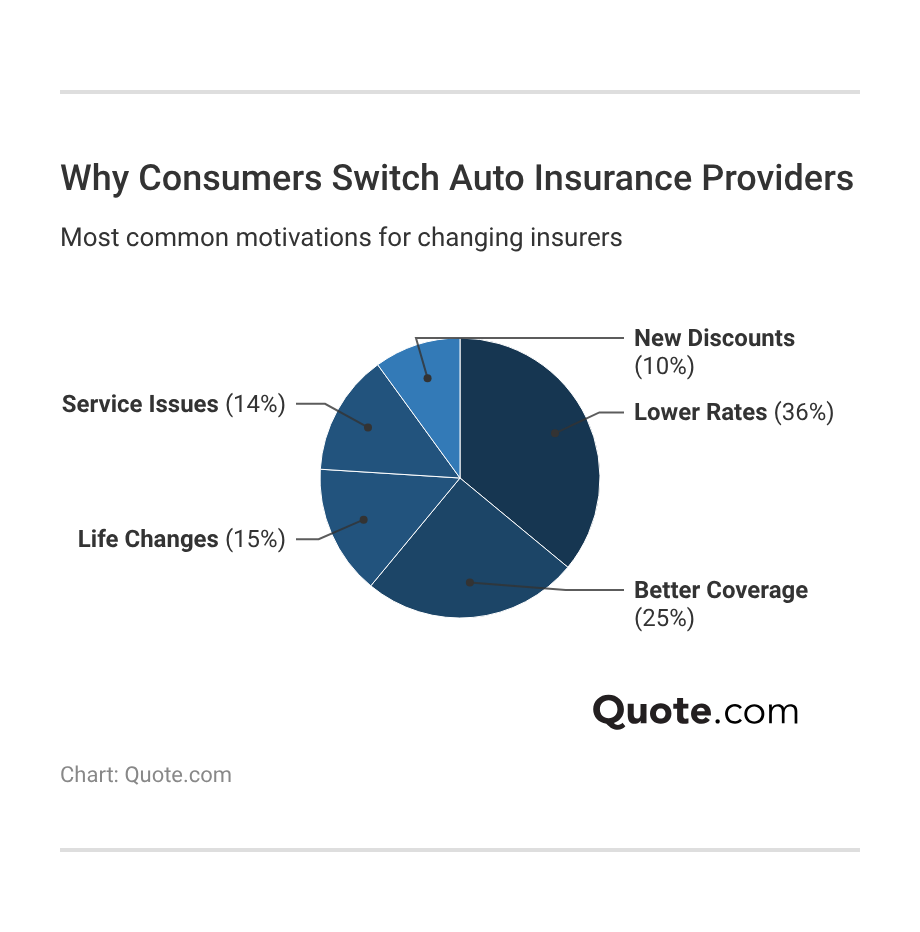

Why Drivers Switch Car Insurance Companies

Drivers switch auto insurance providers for a variety of reasons, but the most common motivation is cost. As premiums go up or coverage no longer fits their needs, switching to a different provider can be an effective way to find better value and pricing.

Common reasons people switch auto insurance companies include:

- Higher premiums at renewal, even with no accidents or tickets

- Life changes like buying a new car, moving, or adding a driver

- Better discounts from another insurer

- Poor claims handling or weak customer service

- Options for bundling auto and home insurance

Many insurance companies offer their lowest rates to new customers, so loyalty doesn’t always lead to savings.

Comparing auto insurance quotes before each renewal can help you avoid paying more for the same coverage.

Switching providers doesn’t cancel your current auto insurance policy automatically. Always make sure your new coverage starts before ending your old policy to prevent a lapse in coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Different Types of Insurance Affect Quotes

Most people don’t realize how huge an impact the coverage they choose has on their quote. If you only look at the price without checking what it covers, you could end up underinsured or overpaying for coverage you don’t need.

Before you start comparing, make sure you know what kind of coverage you’re comfortable with.

Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Say one quote includes just liability, and another has full coverage with comprehensive and collision.

Those are two very different levels of protection, so of course, the prices will be miles apart.

Even when you compare multiple auto insurance quotes by company, rates can vary by $50 or more per month for the same level of coverage.

Brandon Frady Licensed Insurance Agent

One mistake that throws off a lot of drivers when getting multiple car insurance quotes is jumping into the quote process without having a clear idea of the coverage they need.

Collision and comprehensive auto insurance make a big difference in price, so mismatched coverage will give you a false sense of what’s cheaper

If you’re not sure whether you want just liability or full coverage, it’s going to be hard to compare quotes.

Before you start filling out any forms, take a moment to think about what level of protection you’re looking for.

Learn More: Is it bad to cancel car insurance?

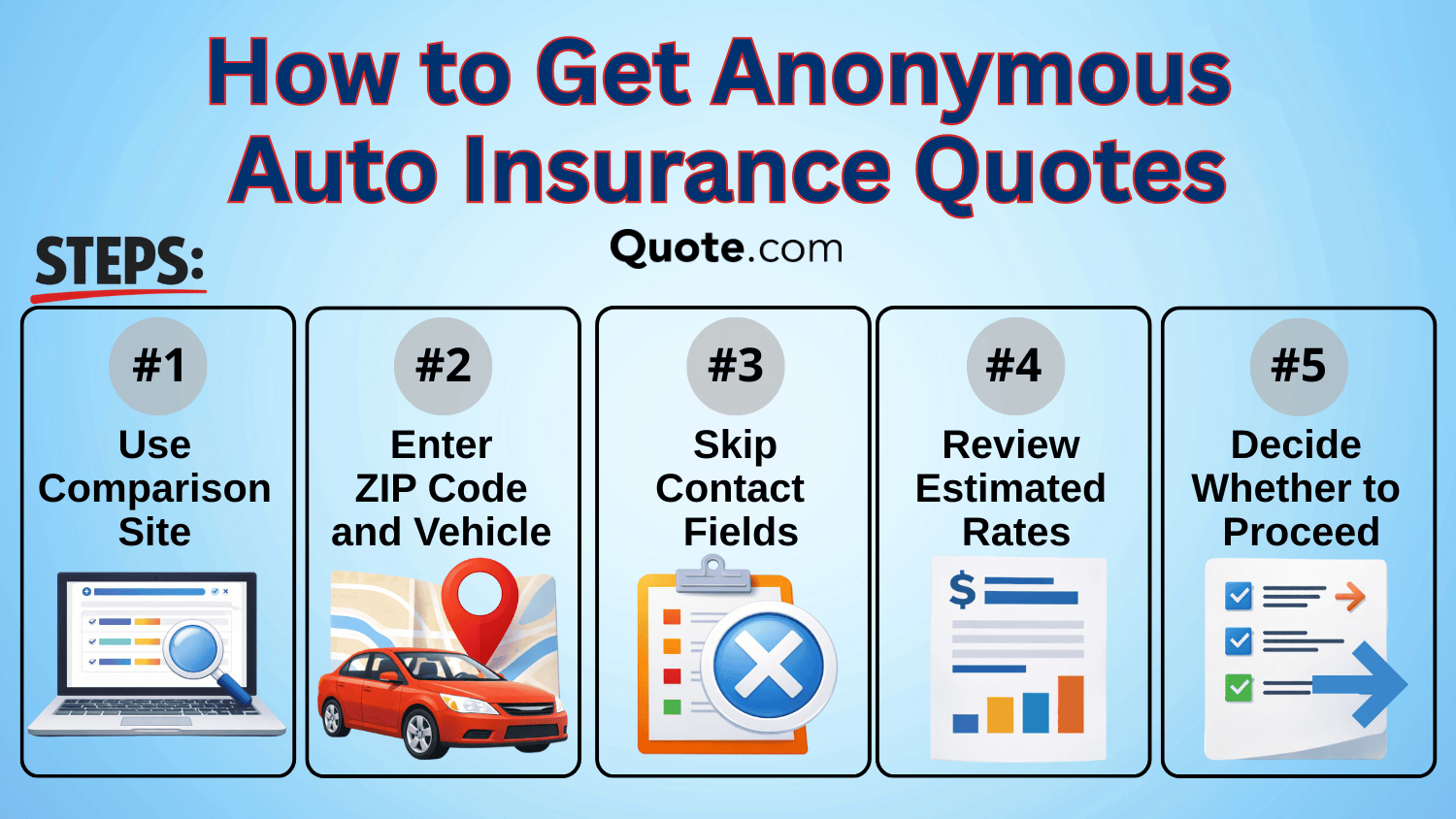

Getting Anonymous Car Insurance Quotes

Many of the best insurance comparison sites let you get auto insurance quotes without giving out personal information.

To get started, use a no-signup comparison tool to enter basic driving details, review multiple quotes at once, and adjust coverage options until you find the right fit.

Using this approach helps you stay in control of your information while still finding competitive car insurance rates. Once you’re ready to buy a policy, you can provide additional details directly to the insurer you choose.

Get Multiple Car Insurance Quotes With Ease

If you’re still wondering how to get multiple car insurance quotes at once, do some research, use comparison tools, and answer a few questions to see your quotes.

USAA and Geico often have the cheapest insurance rates, but the more quotes you get, the better your chances of finding a good deal that suits you. You could also save even more by bundling if you compare car and home insurance quotes.

Read More: An Insured Story: These 3,000 People Got Auto Insurance Right

A common issue is providing inaccurate information during the quote process. It might seem harmless to leave out a recent claim or adjust your annual mileage to get a cheaper quote, but insurance companies verify the details you provide.

If there’s a mismatch, your rate could go up later, or you could lose coverage. Before you get multiple quotes for auto insurance, ensure your application reflects accurate information.

Ensure that the coverage meets your specific needs, and carefully review each quote. It all comes down to striking the right balance between cost and coverage.

Heidi Mertlich Licensed Insurance Agent

Because each driver’s situation is unique, finding the right policy is essential. Enter your ZIP code into our free quote tool to compare car insurance rates side-by-side and see what different companies have to offer.

Frequently Asked Questions

How do I get multiple quotes for auto insurance?

Wondering how to get car insurance quotes from multiple companies? You can get multiple auto insurance quotes online by using a trusted comparison tool that shows prices from several insurers at once. This is often the quickest way to compare options without checking multiple websites or calling companies individually.

Can I get multiple car insurance quotes at once?

Yes, you can shop multiple car insurance providers at once using online comparison tools. Websites like this one let you fill out one form and then provide quotes from several insurers at once. Enter your ZIP code to get started.

Does getting multiple insurance quotes hurt your credit?

Can quotes affect a credit score? No, getting multiple auto insurance quotes does not typically affect your credit score. Insurance companies conduct a soft inquiry when they check your credit to provide a quote. Unlike a hard inquiry, which happens when you apply for a loan, a soft inquiry doesn’t impact your credit score.

How do I get the cheapest auto insurance quotes?

If you’re like most drivers, you’re probably wondering how to get the cheapest car insurance quotes without cutting corners on coverage. The trick is to shop around. Companies like Geico, State Farm, Progressive, Nationwide, and USAA (if you qualify) usually have some of the lowest rates. Find out if you qualify for USAA in our USAA insurance review.

What is the best way to get car insurance quotes?

The easiest way to get multiple car insurance quotes is by using an online comparison tool. This saves time and gives you a broad view of available options. If you prefer, you can also contact insurance agents directly or visit insurers’ websites to request quotes individually.

Can you get an auto insurance quote before buying?

Yes, you can get a car insurance quote before you buy a car. In fact, it’s a good idea to get quotes in advance to know what to expect in terms of pricing and coverage.

Learn More: Ultimate Guide to The Best Time to Buy a Car

What are the best insurance comparison sites?

The best car insurance quotes comparison sites include Quote.com, AutoInsurance.org, and financial websites like NerdWallet and ValuePenguin. With these sites, you can quickly compare car insurance quotes and find the best deals.

Is it bad to get multiple insurance quotes at once?

Getting multiple car insurance quotes is actually a good strategy for finding the best deal on car insurance. Start comparing free auto insurance quotes today to see how much you could save.

Can bundling insurance policies save you money?

Yes, comparing home and auto insurance quotes can help you save money because many insurers offer discounts when you combine coverage. For example, the best auto and home insurance bundles can save you up to 25%.

By comparing bundle insurance quotes, you can see how much you might save by keeping multiple policies with the same provider. Enter your ZIP code to get a home and auto insurance quote now.

Does your credit score affect your auto insurance quote?

Yes, your credit score can impact your car insurance quote. Many insurers use credit-based insurance scores to help determine your rates. However, it’s not the case everywhere. Some states, like California, Massachusetts, and Michigan, don’t allow insurers to use credit scores when setting rates.

What’s the best way to insure multiple vehicles?

Is it better to get an insurance quote online or in person?

How can I get multiple car insurance quotes near Atlanta, GA?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.