Insurance Deductibles (2026 Guide)

Insurance deductibles are the amount you pay before your policy helps cover a claim. Some plans have a $0 annual insurance deductible, but most are between $100 and $2,000. The most common are auto, health, and homeowners insurance deductibles, but pet insurance also comes with an insurance deductible.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated December 2025

The insurance deductible definition is the fixed dollar amount or percentage you’re responsible for when an accident, theft, or other covered event occurs. Deductibles have a major impact on your monthly premiums.

- Insurance deductibles range from $100 to $2,000 before coverage begins

- Collision and comprehensive coverage have auto insurance deductibles

- Higher deductibles lower premiums, while lower raises monthly costs

Most annual insurance deductibles range from $100 to $2,000, with $500 being the most common. However, your annual deductible will vary by coverage type, including auto, health, pet, renters, and homeowners insurance.

Lower deductibles mean higher monthly costs, while a higher insurance deductible lowers your monthly payments but increases your costs if you ever file a claim. Enter your ZIP code to compare quotes for different deductibles from companies near you.

Insurance Deductible Explained

The insurance deductible meaning refers to the amount you pay out of pocket before your insurance coverage kicks in after a claim.

For example, if you have a $500 deductible and your repair costs are $2,000, your insurer pays $1,500 after you pay the first $500.

Choosing a higher deductible can lower your monthly premium, while a lower deductible results in higher premiums but less out-of-pocket expense after a claim.

Consider the value of your vehicle or home, average repair costs in your area, and what you can realistically afford to fix before changing your insurance deductible.

Learn More: At-Fault Accident: What it Means & How it Affects Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Insurance Deductibles Impact Premiums

The annual deductible you choose has a big effect on your monthly insurance payment. The lower your deductible, the higher your premiums.

Having a $0 deductible costs the most, about $160 per month for full coverage. A $2,000 deductible costs $75 each month, cutting rates more than 50%.

Auto Insurance Monthly Rates by Deductible & Coverage Type| Deductible | Collision | Comprehensive | Full Coverage |

|---|---|---|---|

| $0 | $92 | $68 | $160 |

| $100 | $85 | $61 | $146 |

| $250 | $77 | $55 | $132 |

| $500 | $68 | $47 | $115 |

| $1,000 | $58 | $39 | $97 |

| $2,000 | $47 | $28 | $75 |

Liability auto insurance coverage has no deductible, which is why it’s the cheapest type of coverage. Your liability-only premiums are based on factors like your driving history, location, and coverage limits, not on a deductible amount.

Since only comprehensive and collision auto insurance requires a deductible, your deductible amount impacts full coverage insurance rates or the individual policy cost if you choose to buy only collision coverage.

Exploring Different Insurance Deductibles

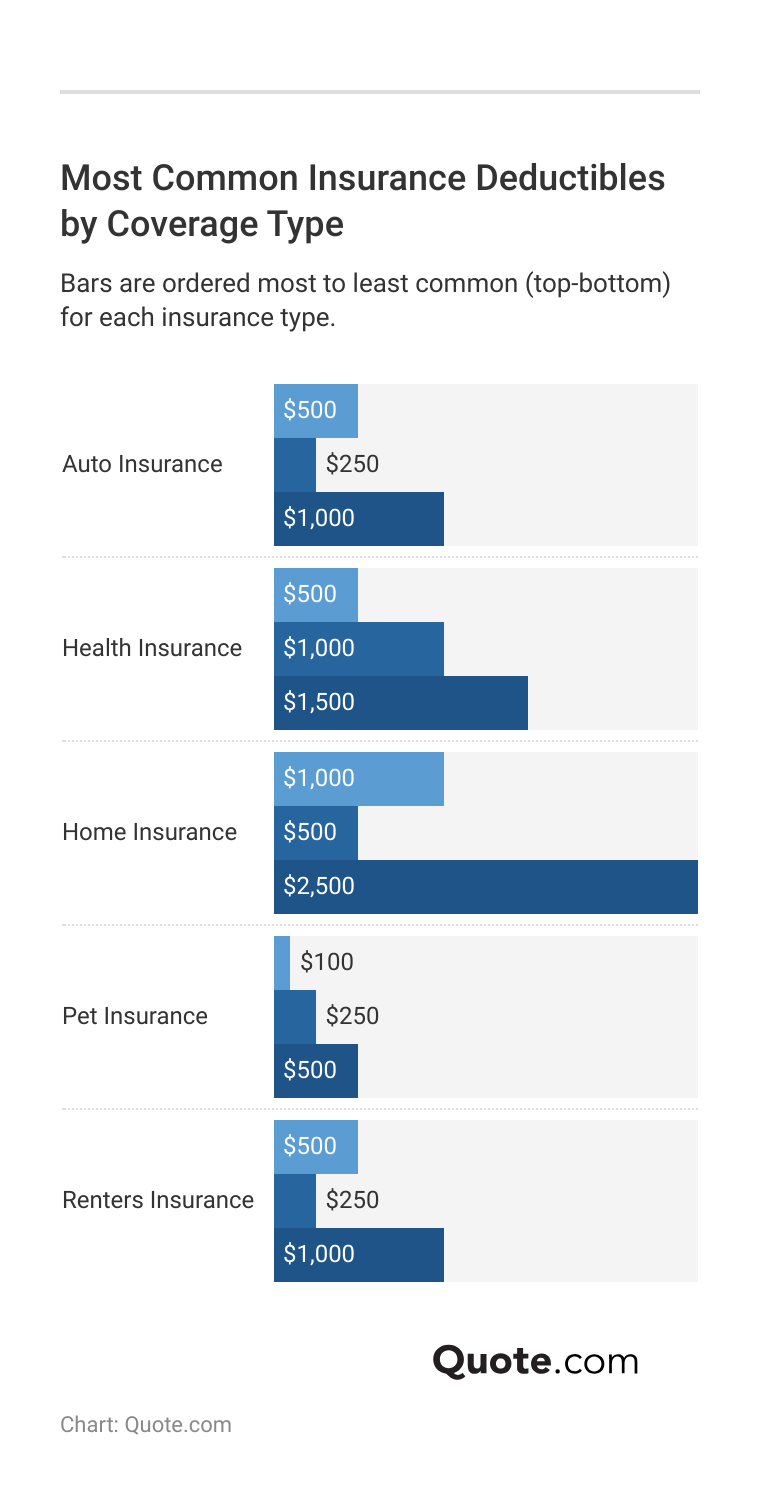

Insurance deductibles vary by coverage type, with each designed to fit the level of risk and protection that coverage provides.

Auto and renters insurance often share similar deductible patterns, while health, home, and pet insurance follow their own ranges based on claim costs and frequency.

These differences help match annual deductible amounts to the typical expenses and risks covered by each policy type. The amounts show the trade-off between what you pay each month and what you pay after an accident or loss.

Lower amounts, like $100 for pet insurance or $500 for health insurance, mean you pay less after a claim but more each month. Higher amounts, like $2,500 for home insurance, lower your monthly cost but mean paying more out of pocket if you file a claim.

Read More: How to File an Auto Insurance Claim

Common Auto Insurance Deductibles

Common auto insurance deductibles vary depending on the type of coverage you have, such as collision, comprehensive, uninsured motorist property damage, and personal injury protection.

These deductible amounts affect how much you pay out of pocket before your insurance covers the rest.

Auto Insurance Deductibles by Policy Type| Policy | Deductible | Details |

|---|---|---|

| Collision Coverage | $500 | Your car is damaged in an at-fault accident |

| Comprehensive Coverage | $100 | Non-collision events like theft, fire, hail, or vandalism |

| Uninsured Motorist Property Damage | $250 | Uninsured driver damages your car |

| Personal Injury Protection | $250 | Medical bills for you/your passengers after a crash |

Collision auto insurance coverage usually has a $500 deductible and pays for damage to your car from accidents you cause.

Comprehensive coverage, with a lower $100 deductible, covers non-collision events like theft or weather damage.

Uninsured/underinsured motorist and personal injury protection both have $250 deductibles, and you may have to pay for both in one claim.

UM/UIM repairs your car if an uninsured driver hits you, while PIP covers medical bills for you and your passengers after a crash.

Picking the Right Homeowners Insurance Deductibles

A home insurance deductible is important because it determines how much you pay yourself before your insurance helps cover a loss.

This can be a set amount, often between $500 and $2,500, or a percentage of your home’s value, usually 1% to 5% for things like hurricane damage.

Home Insurance Deductibles by Coverage Type| Coverage | Deductible | Details |

|---|---|---|

| Flat Dollar | $500 – $2,500 | Fixed amount taken from payout |

| Percentage | 1% – 5% of value | Based on the insured home value |

| Wind/Hail | $500 – $5,000 or % | For wind or hail damage |

| Hurricane | 1% – 5% of value | Used in hurricane‑prone areas |

| Earthquake | 10% – 20% of value | For added earthquake coverage |

Some risks, like wind or hail, can have deductibles of up to $5,000 or more, while earthquake deductibles are much higher, often 10% to 20% of the home’s value.

Using comparison websites like this one is the fastest way to compare homeowners insurance quotes.

Understanding Your Health Insurance Deductible

Health insurance deductibles are the amount you pay before your plan begins covering costs, and they can differ widely depending on your policy.

Most plans also have an out-of-pocket maximum, such as $7,500 for individuals, which limits the total you’ll pay in a year before your insurance covers 100% of eligible expenses.

Health Insurance Deductibles by Plan Type| Plan | Deductible | Details |

|---|---|---|

| Individual | $1,000 – $1,500 | Amount one person pays before coverage |

| Family | $2,000 – $3,000 | Combined amount for all family members |

| High‑Deductible Plan | ≥ $1,500 individual / ≥ $3,000 family | HSA‑eligible, lower premiums, higher costs |

| Out‑of‑Pocket Max | $7,500 individual / $15,000 family | Max paid yearly before full coverage |

High-deductible health plans, starting at around $1,500 for individuals, often have lower monthly premiums but higher care costs.

Individuals may qualify for a health savings account (HSA) to save on taxes and apply the funds to deductibles.

Learn More: The Millennials’ Guide to Health Insurance

Choosing a Deductible for Pet Insurance

Pet insurance deductibles set the amount you must pay before your provider covers vet bills, and they can range from as low as $50 to over $1,000, depending on the plan.

Lower deductibles, such as $100, result in lower payments when making a claim but higher monthly premiums.

Pet Insurance Deductibles by Plan Type| Plan | Deductible | Details |

|---|---|---|

| Annual Deductible | $100 – $1,000 | You pay this amount once per year before reimbursement kicks in |

| Per-Condition Deductible | $50 – $500 | You pay this amount for each new condition your pet is treated for |

| Lifetime Deductible | $250 – $1,000+ | Applies once per condition over the pet’s lifetime. Rare, used by few plans |

| Customizable Deductible | $100 – $1,000+ | Adjust deductible amount to adjust premiums with some providers |

In contrast, higher deductibles, like $1,000, reduce your monthly cost but increase your personal responsibility when your pet requires care.

Most pet insurance plans also require you to pay upfront for all medical care, and your policy will reimburse you, minus the deductible.

Some policies use a yearly deductible, while others charge per condition, and rare lifetime deductibles apply once for the entire duration of a specific illness or injury.

The best pet insurance companies will help you cover costs as you need them, so you aren’t stuck with expensive vet bills.

How to Avoid Paying an Insurance Deductible

Insurance deductibles are the amount you pay out of pocket before your coverage begins.

While annual insurance deductibles are a standard part of most policies, there are situations where you might not have to pay them.

In the event of a claim, having a deductible amount within your budget ensures you can get repairs or medical care without delay.

Justin Wright Licensed Insurance Agent

Knowing when to pay the insurance deductible vs. out of pocket can save you money.

To help you get the most from your coverage, here are some ways to avoid paying your annual insurance deductible:

- Use A Deductible Waiver: Some policies include a waiver if you’re not at fault in an accident.

- Leverage Vanishing Deductible Programs: Certain insurers reduce your deductible each year you drive without a claim.

- File Under Another Driver’s Insurance: If someone else is at fault, their liability coverage may pay your costs.

- Check for Glass Repair Coverage: Some auto policies cover windshield repairs without applying the deductible.

- Look for Special Policy Add-Ons: Endorsements like accident forgiveness may include deductible benefits.

Avoiding a deductible depends on your policy’s terms and the circumstances of the claim. Reviewing your coverage and asking your insurer about available waivers or programs can help you save money when a loss occurs.

If you plan to buy auto insurance, don’t let expensive insurance rates hold you back. Enter your ZIP code and shop for affordable deductibles from the top companies.

Frequently Asked Questions

What are insurance deductibles?

An insurance deductible is the amount you pay out of pocket before your insurance starts covering costs for a claim. If you can’t afford your auto insurance, increasing your annual deductible is an easy way to lower premiums.

What does a $500 annual deductible mean?

This means you pay a total of $500 in deductible costs within a year before your insurance covers eligible expenses for the rest of that year.

Is it better to have a $500 insurance deductible or $1,000?

It depends on your budget and risk tolerance. A $500 deductible means higher monthly premiums but less to pay after a claim. What does it mean when you have a $1,000 insurance deductible? A $1,000 deductible lowers monthly costs but increases what you pay if you file a claim.

What’s a good amount for an insurance deductible?

A good deductible is one you can comfortably afford to pay after a claim, often between $500 and $1,000 for auto insurance, depending on your budget. Enter your ZIP code to compare rates by deductible amount from local companies.

What’s considered a high deductible?

For auto insurance, $1,000 or more is generally considered high. Is $1,500 a high deductible? Yes, for many policies, especially health insurance, $1,500 is considered high.

Is it better to have an insurance deductible or not?

Most policies require a deductible, but a $0 deductible option may be available at a higher monthly cost. Choosing one depends on whether you prefer lower premiums or no out-of-pocket costs after a claim.

What happens if I don’t meet my deductible?

If you do not pay the deductible amount within the timeframe specified in your policy, you will be responsible for all costs associated with your claim.

Do you get money back from an insurance deductible?

No, deductibles are not refunded. They are the portion you agree to pay toward a claim. If you want to save money, check out our 17 tips to pay less for car insurance.

What is a $5,000 deductible?

A $5,000 deductible means you pay $5,000 toward covered costs before insurance pays anything, which can significantly lower monthly premiums but create high out-of-pocket expenses after a loss.

Why is my insurance deductible so high?

High deductibles are often chosen to lower monthly premiums. Your policy, insurer’s options, and your past claims history can also affect the amount.

Is it better to get a higher or lower deductible?

What are the downsides of having a high deductible?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.