Liability Auto Insurance (2026 Guide)

Liability auto insurance offers coverage for damages you cause to others in an accident, including property damage and bodily injuries. Liability insurance quotes start at $50 per month. It’s the best policy type for drivers seeking affordable premiums that meet state requirements.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2026

Liability auto insurance includes bodily injury and property damage coverage for those you injure in an accident or claim.

- Several states require $100K liability for bodily injury

- Liability auto insurance is best for older vehicles or tight budgets

- Full coverage adds more protection for your vehicle

Liability policies are budget-friendly options for many drivers, with Geico offering the lowest rates at just $50 monthly. Learn the crucial differences between liability and full coverage, especially when animals or natural disasters damage your vehicle.

We’ll help you navigate provider options and state laws to ensure you’re properly protected while meeting legal requirements. Enter your ZIP code into our free quote tool to find the best liability auto insurance providers near you.

Liability Auto Insurance Coverage Explained

Liability car insurance coverage is a policy that covers damages or injuries you cause to others in an accident.

Liability insurance helps pay for medical bills, property repairs, and legal fees if you’re at fault. It consists of two parts: bodily injury and property damage liability.

Property damage liability covers the damages you cause to others’ property, such as vehicle repairs (Learn More: Diminished Value Claims).

Bodily injury liability, on the other hand, covers the cost of injuries you cause to others, such as medical bills and lost wages.

If you are sued by another driver, property damage and bodily injury liability insurance will help cover your legal fees.

Dani Best Licensed Insurance Producer

Auto insurance liability coverage is a smart choice for older cars or tight budgets, as it has the lowest car insurance costs.

Many drivers looking for the cheapest car insurance start with basic liability car insurance quotes to meet legal requirements while keeping premiums low.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State-Mandated Liability Limits & Cost

You will see three numbers for state-mandated liability insurance. For instance, liability 20/40/15 insurance means that drivers need $20,000 of bodily injury coverage for one person’s medical costs, $40,000 total bodily injury for an accident, and $15,000 for property damages.

You can choose to carry more than the state-mandated minimum if you want more protection. A policy for auto insurance of 50/100/50 in Ohio would be more than the state-mandated minimum of 25/50/25, for example.

Auto Insurance Requirements by State (+Min. Coverage Cost)| State | Liability Limits | Monthly Rate | Coverage Required |

|---|---|---|---|

| Alabama | 25/50/25 | $50 | BI + PD |

| Alaska | 50/100/25 | $50 | BI + PD |

| Arizona | 25/50/15 | $59 | BI + PD |

| Arkansas | 25/50/25 | $56 | BI + PD + PIP |

| California | 30/60/15 | $72 | BI + PD |

| Colorado | 25/50/15 | $51 | BI + PD |

| Connecticut | 25/50/20 | $87 | BI + PD + UM/UIM |

| Delaware | 25/50/10 | $96 | BI + PD + PIP |

| Florida | 10/20/10 | $64 | PIP |

| Georgia | 25/50/25 | $72 | BI + PD |

| Hawaii | 20/40/10 | $37 | BI + PD + PIP |

| Idaho | 25/50/15 | $30 | BI + PD |

| Illinois | 25/50/20 | $57 | BI + PD + UM/UIM |

| Indiana | 25/50/25 | $49 | BI + PD |

| Iowa | 20/40/15 | $26 | BI + PD |

| Kansas | 25/50/25 | $43 | BI + PD + PIP |

| Kentucky | 25/50/25 | $64 | BI + PD + PIP + UM/UIM |

| Louisiana | 15/30/25 | $54 | BI + PD |

| Maine | 50/100/25 | $51 | BI/PD + UM + MedPay |

| Maryland | 30/60/15 | $126 | BI + PD + PIP + UM/UIM |

| Massachusetts | 20/40/5 | $56 | BI + PD + PIP |

| Michigan | 50/100/10 | $163 | BI + PD + PIP |

| Minnesota | 30/60/10 | $90 | BI + PD + PIP + UM/UIM |

| Mississippi | 25/50/25 | $53 | BI + PD |

| Missouri | 25/50/25 | $55 | BI + PD + UM |

| Montana | 25/50/20 | $42 | BI + PD |

| Nebraska | 25/50/25 | $39 | BI + PD + UM/UIM |

| Nevada | 25/50/20 | $61 | BI + PD |

| New Hampshire | 25/50/25 | $50 | Can opt out for free |

| New Jersey | 25/50/25 | $126 | BI + PD + PIP + UM/UIM |

| New Mexico | 25/50/10 | $56 | BI + PD |

| New York | 25/50/10 | $90 | BI + PD + PIP + UM/UIM |

| North Carolina | 50/100/50 | $55 | BI + PD + UM/UIM |

| North Dakota | 25/50/25 | $49 | BI + PD + PIP + UM/UIM |

| Ohio | 25/50/25 | $44 | BI + PD |

| Oklahoma | 25/50/25 | $52 | BI + PD |

| Oregon | 25/50/20 | $75 | BI + PD + PIP + UM/UIM |

| Pennsylvania | 15/30/5 | $60 | BI + PD + PIP |

| Rhode Island | 25/50/25 | $61 | BI + PD |

| South Carolina | 25/50/25 | $79 | BI + PD + UM/UIM |

| South Dakota | 25/50/25 | $20 | BI + PD + UM/UIM |

| Tennessee | 25/50/15 | $37 | BI + PD |

| Texas | 30/60/25 | $77 | BI + PD + PIP |

| Utah | 25/65/15 | $66 | BI + PD + PIP |

| Vermont | 25/50/10 | $43 | BI + PD + UM/UIM |

| Virginia | 50/100/25 | $56 | Pay $500 to opt out |

| Washington | 25/50/10 | $45 | BI + PD |

| West Virginia | 25/50/25 | $52 | BI + PD + UM/UIM |

| Wisconsin | 25/50/10 | $47 | BI/PD + UM + MedPay |

| Wyoming | 25/50/20 | $24 | BI + PD |

State auto insurance requirements significantly impact the type and amount of liability auto insurance coverage drivers must carry, as well as what additional coverages may be needed.

For example, liability auto insurance in Texas and liability auto insurance in Illinois require minimum bodily injury and property damage limits, but differ in required add-ons, like uninsured motorist protection.

The cost of minimum coverage in both states also differs, with Texas’s average rate starting at $77 per month and Illinois’s average rate starting at $57 per month.

Liability auto insurance in California is also mandatory, and it can be harder to find cheap car insurance in California, but the right provider can help you stay compliant without overpaying (Learn More: Best Auto Insurance Companies in California).

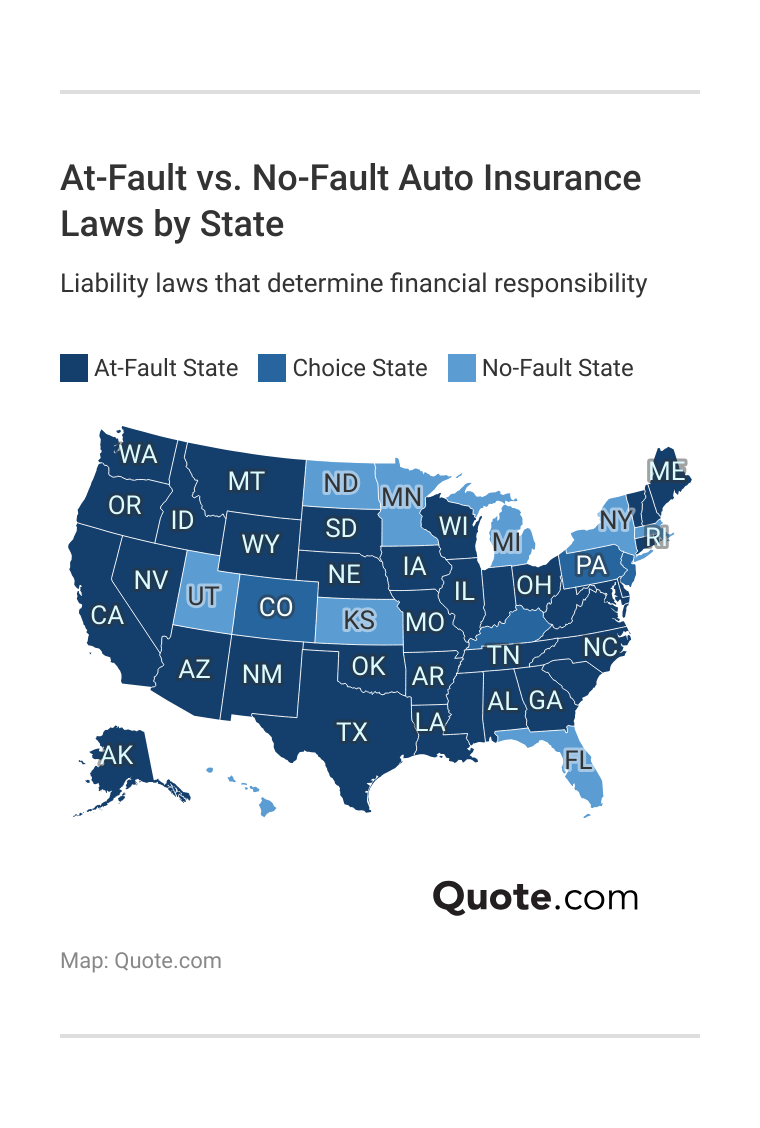

Liability Laws by State

Every state has different liability auto insurance laws that determine drivers’ financial responsibility in an accident. These differences often impact how easily claims are handled, especially in the worst states for filing an auto insurance claim.

In at-fault states, the driver who caused the at-fault accident is responsible for the other parties’ costs (Read More: At-Fault Accidents & Insurance Rates). At-fault liability states are the most common in the U.S.

In no-fault states, each driver’s liability insurance will pay for their own medical costs, regardless of who caused the accident.

Finally, there are a few choice liability insurance states. How does car insurance work in these states? In choice states, drivers can choose between no-fault and at-fault liability insurance policies.

Know Your Car Insurance Options

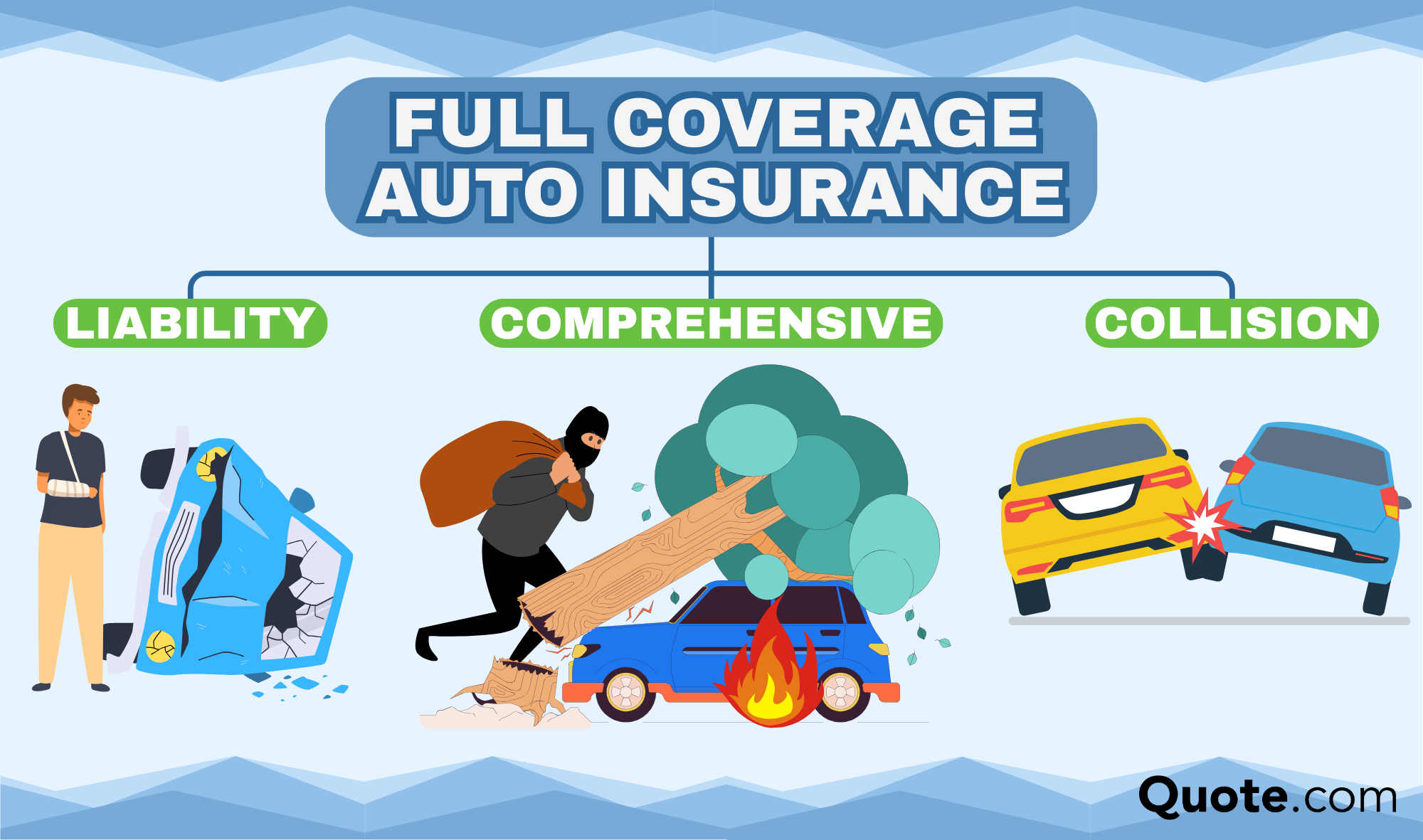

Understanding the differences between liability vs. full coverage auto insurance helps drivers choose the right protection.

It is also important to familiarize yourself with add-on options so you can choose a policy that best protects your assets.

Choosing liability auto insurance only means you’re not covered for your own damages, just others'.

Scott Young MANAGING EDITOR

With multiple add-on options, however, you may be wondering what coverages you should choose besides liability insurance to best protect yourself.

Some other auto insurance coverages commonly available from auto insurance providers include extras such as gap insurance or roadside assistance.

Types of Auto Insurance Coverage| Policy Type | What it Covers | Scenario |

|---|---|---|

| Collision | Damage to your vehicle | You hit a pole |

| Comprehensive | Theft or non-crash damage | Storm damages your car |

| Gap Insurance | Loan balance after total loss | Car totaled, loan remains |

| Liability | Damage or injuries you cause | You hit another car |

| Medical Payments | Medical costs for passengers | Passenger needs ER care |

| Personal Injury Protection | Medical bills and lost income | You’re injured in a crash |

| Rental Reimbursement | Rental car while repairing | You need a rental car |

| Rideshare Coverage | Accidents during rideshare use | Waiting for a ride request |

| Roadside Assistance | Towing or roadside help | Car won’t start on roadside |

| Underinsured Motorist | Costs beyond other limits | Other policy limits too low |

| Uninsured Motorist | Injuries from uninsured drivers | Uninsured driver hits you |

Liability car insurance coverage is legally required and pays for others’ damages and medical costs if you’re at fault, but it doesn’t protect your own vehicle (Learn More: Driving Without Auto Insurance).

Liability-only insurance is often best for drivers with older cars or those seeking state-mandated coverage at a lower cost.

For drivers who want broader protection, a full coverage policy is often the best choice. What is full coverage car insurance? It includes liability, collision, and comprehensive coverage.

Collision insurance will cover your repair costs if you hit another car or a stationary object. Comprehensive insurance covers a wider range of accidents and damages, such as animal collisions, theft, and vandalism (Read More: Collision vs. Comprehensive Auto Insurance).

In serious accidents, especially those requiring traffic collision reconstruction, liability-only may fall short, but full coverage will protect drivers.

Knowing what each coverage includes ensures policyholders aren’t underinsured when it matters most. Always evaluate your needs and risks before committing to an auto insurance policy.

Find the Best Liability Auto Insurance

When comparing liability auto insurance rates, it’s clear that costs vary significantly by provider. How much does liability car insurance cost? Quotes for liability insurance can start as low as $50 per month on average, but may be as high as $100 per month.

The cost differences highlight the importance of shopping around for a competitive liability car insurance quote (Learn More: How to Get Multiple Auto Insurance Quotes).

Liability-Only vs. Full Coverage Auto Insurance Monthly Rates| Insurance Company | Liability Only | Full Coverage |

|---|---|---|

| $80 | $160 | |

| $85 | $150 | |

| $75 | $145 | |

| $50 | $120 | |

| $100 | $180 |

| $95 | $170 |

| $55 | $135 | |

| $60 | $130 | |

| $90 | $160 | |

| $65 | $125 |

The best liability and collision coverage providers like Geico, Progressive, and USAA offer an affordable insurance quote for liability coverage, making them strong contenders. However, remember to get multiple auto insurance quotes from different companies to ensure you get both value and adequate protection.

Drivers seeking budget-friendly coverage should compare liability auto insurance vs. full coverage, especially if they own an older vehicle. While full coverage auto insurance offers broader protection, liability-only plans are often the most cost-effective option for meeting legal requirements.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Save Money on Liability Car Insurance

Liability car insurance forms the foundation of financial protection for drivers. It is the most affordable type of auto insurance, especially with Geico liability coverage rates starting at $50 monthly.

Drivers looking to save on their liability-only car insurance cost should look into auto insurance discounts at their provider. Some common discounts that may reduce a driver’s liability car insurance cost include good driver discounts and bundling discounts.

Most Common Auto Insurance Discounts| Vehicle Discounts | Driver Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-Lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-Smoker/Non-Drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

Some of the hacks to save more money on car insurance are to compare liability car insurance quotes regularly, bundle policies, maintain good credit, and consider usage-based options.

Want to find the cheapest quote for liability car insurance today? Explore liability insurance quotes by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

When should you get liability or full coverage?

Wondering “how much car insurance do I need?” Choose liability-only for older cars worth less than $4,000 or with high mileage. Opt for full coverage with newer vehicles, leased cars, or when your state requires it.

How much is liability-only car insurance?

Liability-only car insurance averages $50-$100 monthly. Geico liability insurance coverage has the lowest rates at $50 per month. Liability quotes vary by location, driving history, and coverage limits.

Avoid expensive auto insurance premiums by entering your ZIP code to see the cheapest rates for you. Our free quote tool will help you find the cheapest car insurance quotes for liability coverage, whether you are shopping for the cheapest car insurance in Utah or Oklahoma.

How long does insurance have to decide liability?

Insurance companies usually determine liability within 30-45 days after an accident claim is filed, though complex cases may take longer. It’s bad to cancel car insurance during this waiting period (Read More: What Happens If You Cancel Auto Insurance).

How much will your insurance go up from liability to full coverage?

According to our data, upgrading from liability to full coverage typically doubles your premium. Geico’s rates increase from $50 to $120 monthly on average.

What is the 50/100/50 rule for liability insurance?

The 50/100/50 rule represents coverage limits: $50,000 bodily injury per person, $100,000 bodily injury per accident, and $50,000 property damage per accident. Enter your ZIP code to explore which companies have the cheapest auto insurance rates for you.

What two things should be considered when choosing an auto insurance deductible?

Consider your emergency savings capacity and vehicle value. Higher deductibles lower premiums, but they require more out-of-pocket expenses during claims, which is one of the many ways you’re wasting money on your car.

Will your insurance go up if you get hit by an uninsured driver?

Your rates typically won’t increase if you’re not at fault, but this depends on your state and insurer. Uninsured motorist coverage helps protect against situations like these.

What is 100k/300k liability auto insurance coverage?

The 100k/300k liability coverage means your policy pays up to $100,000 per injured person and up to $300,000 total per accident for bodily injury.

What if you can’t afford auto insurance?

Check out companies with cheaper rates like Geico liability car insurance coverage, consider liability-only coverage, or ask about discounts. Explore what to do if you can’t afford your auto insurance instead of going without coverage.

What is the liability auto insurance limit in Iowa?

Iowa requires minimum liability limits of 20/40/15, meaning $20,000 per person for bodily injury, $40,000 per accident, and $15,000 for property damage.

What is full coverage car insurance in California?

What is bodily injury liability?

What does the liability BI/PD mean?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.