Liability vs. Full Coverage Auto Insurance in 2026

Comparing liability vs. full coverage auto insurance can help you find the right policy for your needs without overspending. Drivers looking to spend the least can find liability insurance starting at $65 per month. If you want better protection, full coverage auto insurance starts at $120 per month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insurance...

Leslie Kasperowicz

Updated December 2025

Comparing liability vs. full coverage auto insurance is a critical step in determining your coverage needs.

- Liability insurance covers financial responsibility after an accident

- Full coverage pays for your car repairs after a variety of damage

- Liability rates start at $65 a month, while full coverage costs $120

At $65 per month, liability insurance is the cheaper option. Average full auto insurance coverage costs more at $120 per month, but it fully protects your vehicle.

The cheapest car insurance companies can help you find affordable liability vs. full coverage auto insurance rates.

Explore the difference between liability vs. full coverage car insurance and see which one is right for you. When you’re ready, enter your ZIP code into our free comparison tool to see liability and full coverage rates in your area.

Liability vs. Full Coverage Car Insurance

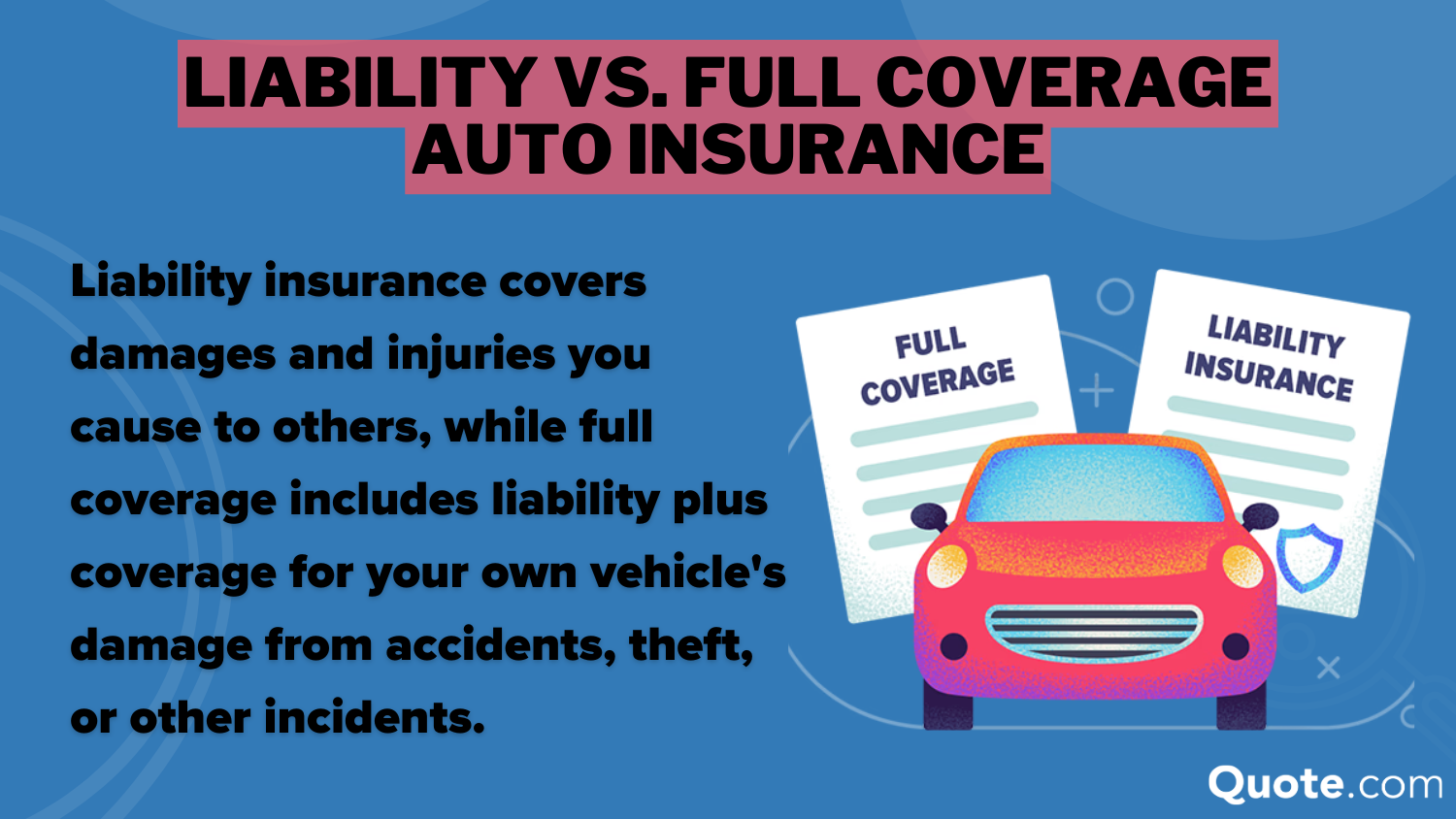

If you need liability vs. full coverage auto insurance explained to you, you’re not alone. Most drivers are at least somewhat confused by these terms, especially those purchasing their first policies. Fortunately, the difference between liability and full coverage is quite simple.

Liability auto insurance pays for injuries and property damage you cause in an at-fault accident. Full coverage is a type of policy that combines multiple types of insurance into a single bundle.

If you want your insurance to cover your vehicle, you’ll need full coverage. Liability insurance never covers your car repair bills.

Jeff Root Licensed Insurance Agent

Most states require at least a liability-only auto insurance policy before you can legally drive. It not only ensures you can pay for medical expenses and property damage you cause, but it also protects you from being saddled with expensive bills. If you’re worried about what to do if you can’t afford auto insurance, a liability-only policy is your most affordable option.

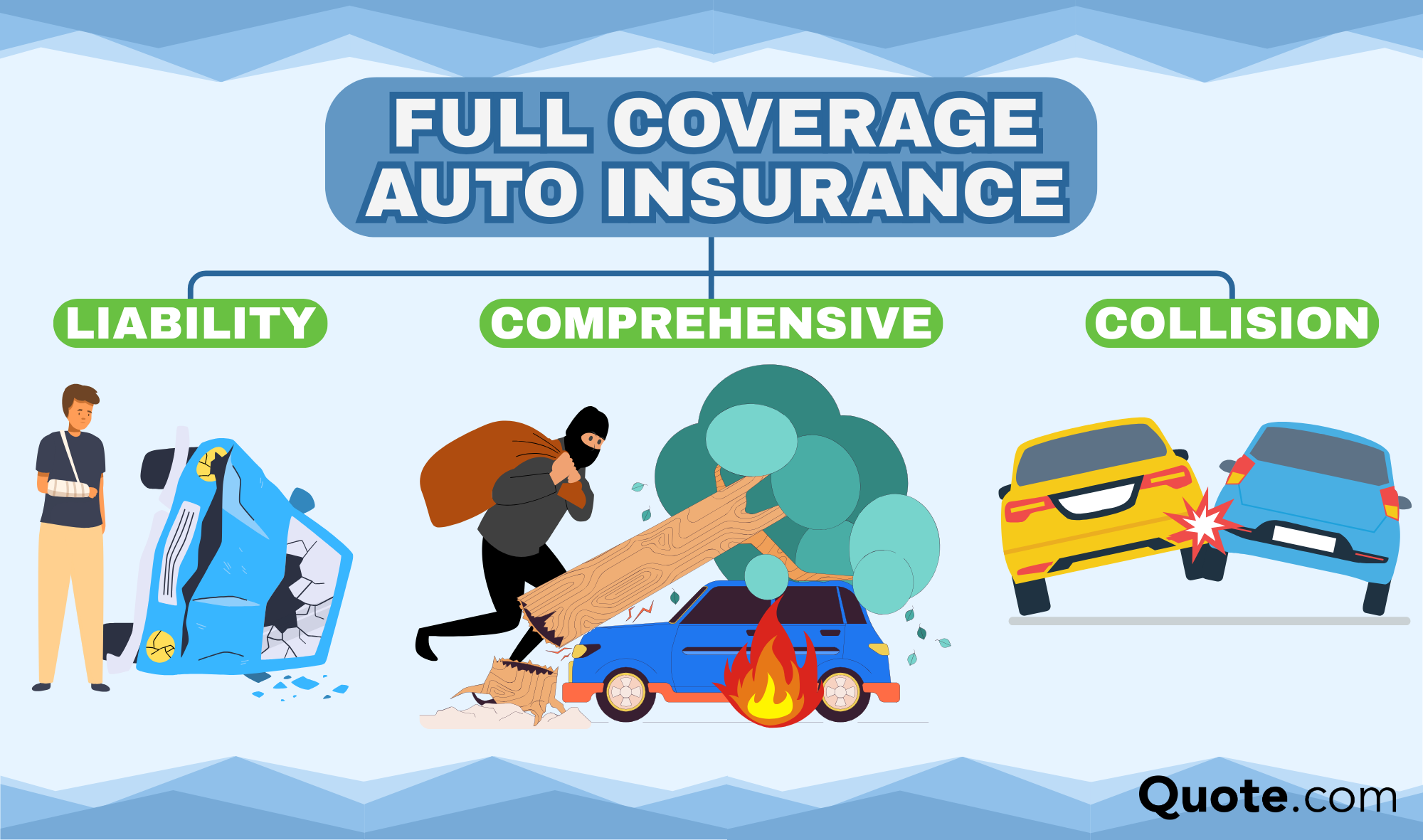

No state requires full coverage insurance, but you may need it if you have a car loan or lease. It consists of three types of coverage bundled into one policy — liability, collision, and comprehensive insurance. Full coverage covers some of the most common ways your car might be damaged.

What Liability Auto Insurance Covers

Understanding liability auto insurance is easy — it covers damage you cause to property and injuries you cause to other drivers, their passengers, and bystanders.

Liability insurance is split into two categories:

- Bodily Injury Liability (BIL): Bodily injury liability insurance covers healthcare bills, legal fees, and lost wages for other people involved in an accident you cause.

- Property Damage Liability (PDL): Property damage liability insurance pays for damage you cause to other vehicles, objects, or buildings.

Liability insurance is meant to cover your financial responsibilities after an at-fault accident. It never covers your own vehicle repairs or medical expenses. So, it’s often best for older, low-value cars where the cost of full coverage may outweigh the benefits.

It’s also a great option for those seeking the most affordable coverage available. Depending on where you live, you may only need a liability-only insurance policy. Purchasing only liability insurance is the best way to get the cheapest car insurance possible.

What Full Coverage Auto Insurance Covers

Full coverage is never required by state law, but you’ll probably need it if you have a car loan or lease. Regardless of the ownership status of your vehicle, full coverage is a great choice if you can’t afford to replace your car outright.

It includes liability insurance plus additional protections for your own vehicle:

- Collision: Collision auto insurance covers your car repairs after an accident, no matter who was at fault. It also covers you if you hit a stationary object.

- Comprehensive: Comprehensive auto insurance covers damages outside of accidents, including animal contact, falling objects, natural disasters, and theft.

Unlike liability, full coverage requires you to pay a deductible before your insurance kicks in to repair or replace your car. An insurance deductible is the set amount you agree to cover out of pocket, such as $500 or $1,000, whenever you file a claim for your own damages.

Even a full coverage auto insurance policy has gaps. Choosing a higher deductible, for example, can lower your monthly premium, but it also means more upfront costs if you file a claim. You’ll also need extra coverage if you want custom parts covered. Fortunately, most providers offer a variety of add-ons that allow you to customize your policy.

Learn More: Does auto insurance cover theft?

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liability vs. Full Coverage Auto Insurance Rates

Insurance premiums change due to various factors, but full coverage is generally more expensive than liability insurance. To get an idea of this price difference, check the rates below.

Auto Insurance Monthly Rates by Age, Gender & Coverage Level| Driver | Liability | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $180 | $410 |

| 16-Year-Old Male | $210 | $450 |

| 25-Year-Old Female | $105 | $190 |

| 25-Year-Old Male | $115 | $205 |

| 35-Year-Old Female | $85 | $150 |

| 35-Year-Old Male | $90 | $155 |

| 55-Year-Old Female | $70 | $125 |

| 55-Year-Old Male | $75 | $130 |

If you’re looking to save money on liability vs. full coverage auto insurance costs, the general rule is that older, less valuable vehicles are probably fine with liability-only insurance. If you can’t afford to replace your car, however, full coverage might be the better option.

Read More: 7 Ways You’re Wasting Money on Your Car

Minimum vs. Full Coverage Auto Insurance by Driving History

Liability is usually cheaper than full coverage, but why is there such a big price difference? The answer depends on several factors, including the type of car you drive, your location, and your age. One of the most significant factors affecting your car insurance rates is your driving record. Incidents such as at-fault accidents, speeding tickets, and DUIs can increase the cost of your auto insurance.

One of the easiest ways to keep your insurance rates low is to keep a clean driving record. Finding cheap auto insurance for high-risk drivers can be significantly harder, so it’s always best to avoid traffic violations.

Aside from your driving record, choosing the right provider for your needs is also crucial. There are many things to consider when you look at different providers, but comparing full coverage vs. liability auto insurance rates at each is a good start. Take a look below for the average cost of liability and full coverage policies from the top providers.

Auto Insurance Monthly Rates From Top Companies| Insurance Company | Liability | Full Coverage |

|---|---|---|

| $85 | $160 | |

| $78 | $145 |

| $88 | $165 | |

| $72 | $135 | |

| $95 | $175 |

| $80 | $150 | |

| $76 | $140 | |

| $70 | $130 | |

| $82 | $155 | |

| $65 | $120 |

USAA is the cheapest company, but only military members are eligible for coverage. Geico, Progressive, and State Farm have the lowest rates for minimum coverage, but only State Farm keeps its rates affordable for full coverage. The significant price variations between companies are why it’s so important to get multiple auto insurance quotes.

Insurance companies use unique formulas to determine how much to charge you, making it practically impossible to guess which provider will have the lowest rates. These different factors are why insurance experts recommend comparing quotes to find the most affordable coverage possible.

While comparing multiple quotes can help you save, it can also take a lot of time. If you want help comparing liability vs. full coverage car insurance rates quickly, enter your ZIP code into our free comparison tool today.

How to Choose the Right Amount of Insurance

Now that you know the difference between liability and full coverage, it’s time to choose how much you need. As you weigh the pros and cons of liability vs. full coverage auto insurance, keep the following in mind:

- State Requirements: No states require full coverage, but you’ll need to know local laws to ensure coverage.

- Lender Requirements: Drivers with a loan or lease on their vehicles will probably need full coverage.

- Your Vehicle’s Value: Drivers with less valuable cars are often comfortable with buying just liability insurance.

- Your Financial Situation: If you can’t afford to replace your vehicle, full coverage is probably your best insurance option.

It’s also important to periodically review your coverage to ensure you don’t need to make any changes, such as adding a driver or another vehicle

Learn More: Cheap Auto Insurance for Multiple Vehicles

You may need full coverage now, but there may come a time when you can switch to a cheaper policy.

Other Types of Auto Insurance

Getting either state minimum liability insurance or full coverage is enough auto insurance for most drivers, but you may want to customize your policy. Most providers offer a variety of add-ons. Some of the most popular include:

- Gap Insurance: If you total a vehicle with a loan or lease on it, you may owe more than the car is worth. In this case, gap insurance, or loan/lease payoff, will pay the difference between your insurance payout and how much you still owe.

- Roadside Assistance: If you ever find yourself stranded due to common emergencies like a flat tire, a dead battery, or an empty gas tank, a roadside assistance plan will come to the rescue.

- Rental Car Reimbursement: If a covered incident leaves your vehicle at the mechanic’s, your insurance will cover the cost of a temporary replacement, provided you have rental car reimbursement coverage.

- Custom Parts and Equipment Coverage: Are you the type of driver who likes to customize your ride? Custom parts and equipment coverage ensure that your insurance covers all your upgrades.

Adding more coverage to your policy can be incredibly helpful, but only purchase what you actually need. Add-ons are usually affordable, but they can quickly increase your rates.

Read More: A Visual Guide to Auto Insurance

Compare Liability vs. Full Coverage Insurance

Once you have a solid understanding of the difference between liability vs. full coverage auto insurance, you’ll be ready to purchase the perfect policy for you. Full coverage protects your vehicle from many of life’s unexpected events, but a liability-only policy is likely much cheaper.

Wondering when to drop full coverage auto insurance? A general rule is to change your policy when you pay off a loan, or your vehicle doesn't cost too much to replace.

Michelle Robbins Licensed Insurance Agent

Read our ultimate guide on the best time to buy a new car to determine when you need full coverage vs. liability insurance. To start comparing liability and full coverage rates for free, enter your ZIP code into our comparison tool today.

Frequently Asked Questions

What does full coverage auto insurance cover?

Full coverage auto insurance policies are a combination of several types of coverage, including liability, collision, and comprehensive insurance. Does full coverage include liability insurance? Yes, a full coverage policy typically covers your financial responsibility after an at-fault accident as well as repairs to your vehicle after a number of covered events.

What does liability auto insurance cover?

Liability insurance ensures that you can pay for any damages and injuries you cause after an at-fault accident. When you compare basic coverage types like liability insurance vs. comprehensive coverage or collision insurance, liability is the only one that doesn’t directly cover your vehicle.

Who has the cheapest full coverage auto insurance?

While you’ll need to shop around for personalized quotes, USAA, State Farm, and Geico typically offer the most affordable full coverage. Drivers can find full coverage rates starting as low as $120 per month from these companies. Enter your ZIP code to find the cheapest full coverage in your city.

Who has the cheapest liability auto insurance?

Depending on your unique circumstances, you can find liability auto insurance rates for as low as $65 per month from the cheapest liability companies, including USAA, State Farm, and Geico.

Read More: 17 Tips to Pay Less for Auto Insurance

Is it better to have liability or full coverage auto insurance?

Deciding between full coverage vs. liability car insurance requires looking at several factors. Take some time to learn how to buy the best auto insurance for your needs. Generally, full coverage is more beneficial for individuals who don’t own their cars outright or who can’t afford to replace them. If you have a less valuable vehicle, liability auto insurance is probably the best choice.

Is full coverage the same as comprehensive auto insurance?

While you can compare full coverage vs. comprehensive car insurance, it doesn’t make much sense to do so. Comprehensive insurance covers unexpected events, like fires, floods, theft, and vandalism. Full coverage policies typically include comprehensive insurance, as well as liability and collision coverage. Full coverage is a complete auto insurance policy, while you often can’t buy comprehensive insurance without also purchasing collision coverage.

Is full coverage auto insurance required?

No state requires full coverage before you can legally drive, but you’ll probably be required to maintain a full coverage policy during the life of a car loan or lease.

Is liability auto insurance the same as minimum insurance coverage?

It depends on where you live. Some states only require liability insurance before you can legally drive. In those states, minimum insurance and liability coverage are the same. However, some states require additional coverage, such as uninsured/underinsured motorist or personal injury protection insurance.

When should you switch from full coverage to liability insurance?

The easiest way to decide if it’s time to switch from full coverage to liability insurance is to look at the value of your car. If your car’s value is worth less than your deductible plus the annual cost of full coverage, it’s probably time to switch to a liability-only plan. If you’re ready to switch plans, you can enter your ZIP code into our free comparison tool to find the cheapest rates in your area.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.