United Auto Insurance Review for 2026

United Auto Insurance is a strong choice for high-risk drivers, with rates stating at $24 per month. United has multilingual service and also offers motorcycle, home, and renters insurance. Policyholders can bundle home or renters insurance with their United car insurance to save 20%.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

Our United Auto Insurance review found it offers plenty of great auto insurance options to Illinois and Indiana residents, especially those with poor driving records.

- Auto insurance rates start at just $24 per month with UAI

- Policyholders can bundle UAI home or renters insurance with auto

- United Auto Insurance has SR-22 insurance for high-risk drivers

United Auto Insurance (UAI), not to be confused with the United Automobile Insurance Company (UAIC), also has multilingual services and offers motorcycle insurance, home insurance, and more.

United Auto Insurance Rating| Rating Criteria |  |

|---|---|

| Overall Score | 2.8 |

| Business Reviews | 3.0 |

| Claims Processing | 1.8 |

| Company Reputation | 2.5 |

| Coverage Availability | 2.5 |

| Coverage Value | 2.8 |

| Customer Satisfaction | 1.2 |

| Digital Experience | 2.5 |

| Discounts Available | 3.3 |

| Insurance Cost | 3.4 |

| Plan Personalization | 2.5 |

| Policy Options | 3.1 |

| Savings Potential | 3.4 |

Our in-depth review of everything from rates to how to buy auto insurance from UAI will help you decide whether United Auto Insurance might be a good choice for you.

Want to shop for insurance today and find the best rate? Our free quote tool will help you find the lowest rate in your area.

United Auto Insurance Cost

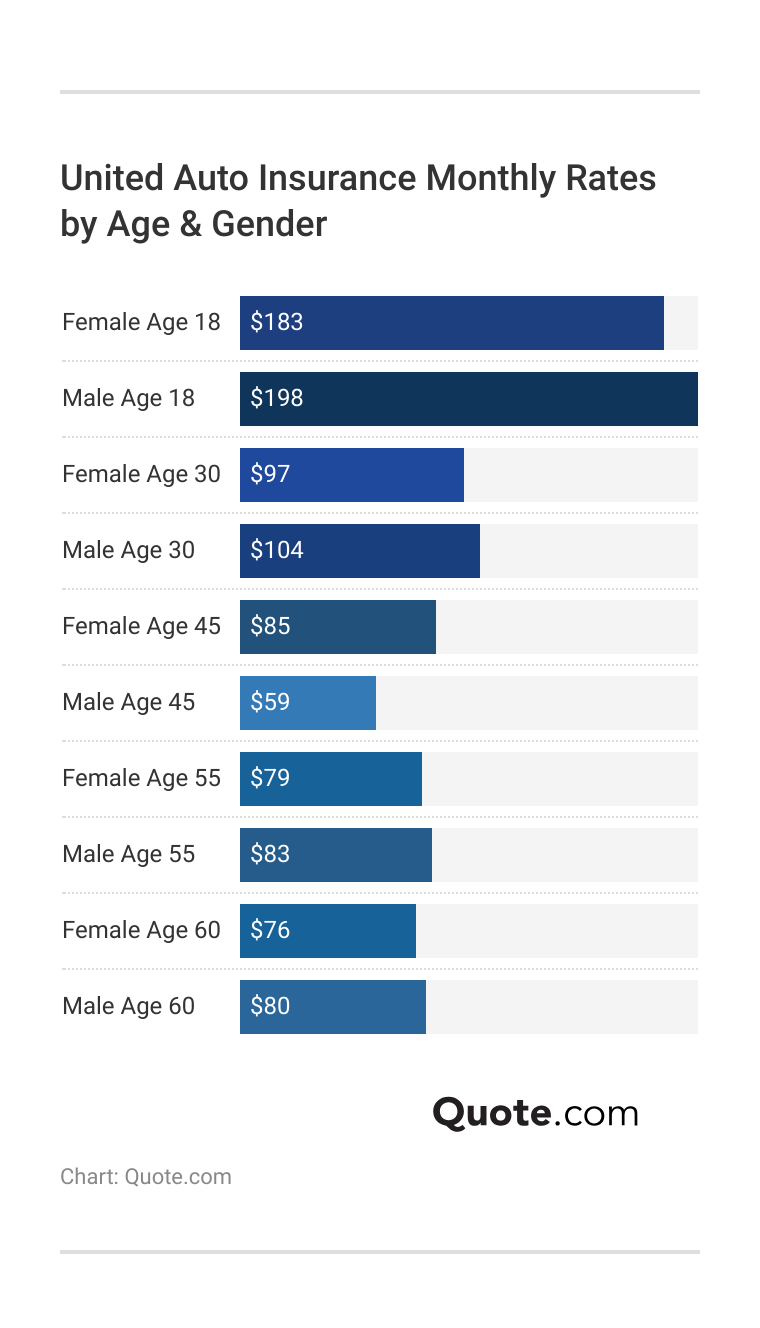

The cost of vehicle insurance at United Auto Insurance will depend on several factors, including the driver’s age. Younger drivers will be charged more than older drivers because they are more likely to file a claim.

A driving record is another factor that United Auto Insurance uses to calculate rates for its customers. United Auto car insurance rates by driving record are on the lower end when compared to competitors.

Other companies, like Allstate or Liberty Mutual, will be more expensive than UAI (Read More: Allstate Insurance Review).

UAI vs. Competitors: Car Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $59 | $89 | $119 | $77 |

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

At UAI, an accident will actually raise rates slightly more than a DUI offense will. A traffic ticket will raise rates the least at United Auto Insurance.

Now that we’ve examined UAI rates, we want to compare its vehicle rates to those of other companies on the market based on coverage level.

UAI vs. Competitors: Car Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $59 | $158 |

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

UAI is not the most expensive on the market for vehicle insurance, but it is not the cheapest either. Other companies like USAA, Geico, State Farm, and Travelers offer lower rates on average for drivers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on United Car Insurance Rates

United Auto Insurance offers several ways customers can save on their auto insurance coverage. For example, if you insure two vehicles or more on one insurance policy, you’ll get a discount. Learn about the best auto and home insurance bundles to get the most savings.

Read More: Car Insurance Discounts You Can’t Miss

The amount of your discount will vary based on your particular situation. So, you can save on United car insurance coverage by bundling its other insurance products, like home or renters, under the same policy.

You can also get a discount if you’re a student with a 3.0 GPA or higher, and if you go accident free for a certain period.

Other auto insurance discounts available at United Auto Insurance include renewal discounts and usage-based discounts.

If you maintain your coverage for a specified period of time without any lapses, you’ll earn a discount as well.

United Auto Insurance Discounts| Discount |  |

|---|---|

| Anti-Theft | 2% |

| Bundling | 20% |

| Good Student | 15% |

| Low Mileage | 5% |

| Military | 15% |

| Multi-Car | 10% |

| Paid-in-Full | 9% |

| Paperless Billing | 4% |

| Renewal | 11% |

| Safe Driver | 10% |

| Senior | 5% |

| Transfer | 5% |

United Auto Insurance automatically begins applying your discount once you qualify.

Some other ways to save include:

- Compare Quotes: Shopping around at different companies every year helps you find the best rate.

- Dropping Add-Ons: Carry only the coverages that are strictly necessary on your car to lower insurance costs.

- Keep a Clean Driving Record: If you have kept a clean driving record for a specific period of time, you’re entitled to a discount.

- Raising Deductibles: If you can afford to pay more out of pocket, raising your deductible will lower rates.

The type of discounts and savings you can get will vary depending on a number of factors. You can call UAI today for more specific information.

United Auto Insurance Reviews & Complaints

Whether it’s for your home or your vehicle, you’re always going to need some form of insurance. You need to make sure that your belongings are safe and that you’re also protected from liability.

A history of poor reviews and ratings is a warning sign that an insurance company has poor business practices.

Daniel Walker Licensed Insurance Agent

Rather than choosing a company based on United Auto Insurance commercials or the United Auto Insurance jingle, look into United Auto reviews from customers and businesses. Unfortunately, UAI has some poor customer UAI insurance reviews on sites like Yelp.

Read Erica T.‘s review of United Auto Insurance on Yelp

Some insurance companies make it difficult with poor customer service and long waits on the phone before you can actually speak to a person, so make sure to pay attention to multiple negative United car insurance reviews.

Some providers are also only quick to answer the phone when you need a quote, and you’ll notice they’ll do everything to help you sign up. However, once you’ve signed up and paid them, you’ll start to experience being put on hold forever to get an answer, whether you’re trying to file a claim or just need some information about your account.

Learn More: Worst States for Filing Auto Insurance Claims

That’s the last thing you need to deal with when you just want to get some insurance. The good news is that while United Auto Insurance company reviews from customers are less than great, United Auto Insurance ratings from businesses show a stellar record.

United Auto Insurance Business Ratings & Consumer Reviews| Agency |  |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 73/100 Avg. Customer Satisfaction |

|

| Score: 825 / 1,000 Above Avg. Satisfaction |

|

| Score: 1.25 Avg. Complaints |

UAI has more customer complaints than average on the NAIC. However, it has a higher-than-average satisfaction rating for claims at J.D. Power and a BBB rating of A+. So while there may be multiple complaints filed, it seems that UAI works to resolve issues.

United Auto Insurance Coverage Options

If you have a car, United Auto Insurance can get you the insurance coverage you need. Even if you don’t own a car but frequently drive someone else’s, you can get United Auto Insurance non-owner insurance for protection.

UAI offers all of the common types of auto insurance, such as collision auto insurance. Whether you have a vehicle for personal or business use, it’s got you covered.

United Auto Insurance Coverage Types| Coverage | What it Covers |

|---|---|

| Accidental Death & Dismemberment | Benefits for death or severe injury |

| Collision Coverage | Damage to your car from collision |

| Comprehensive Coverage | Non-collision damage like theft or weather |

| Liability Coverage | Injuries or damage to others in wreck |

| Medical Payments (MedPay) | Medical costs for you and passengers |

| Personal Injury Protection (PIP) | Medical costs plus lost wages |

| Rental Reimbursement | Rental cost during covered repairs |

| Roadside Assistance | Towing, jump-start, or fuel delivery |

| SR-22 Insurance | State-required proof of liability insurance |

| Uninsured/Underinsured Motorist | Injuries or damage from uninsured driver |

UAI covers leased vehicles and even tow trucks. Plus, it offers the option for increased liability limits. However, keep in mind that the more add-ons you add to your United Auto Insurance policy, the more you will pay for insurance.

Make sure to consider your personal needs for insurance when buying a policy, such as your budget, local risk factors, and more.

SR-22 Insurance

What is SR-22 auto insurance, and why would you need it? You are required to have SR-22 insurance if you’re a driver who’s had your license suspended.

An SR-22 is a certificate of financial responsibility that gets filed with the Secretary of State’s office.

It notifies the state that you have a minimum of liability insurance and have met the State’s insurance requirements. You might need an SR-22 for a number of reasons. Some of them include:

- A high amount of points on your driving record.

- Driving without insurance.

- DUI/DWI convictions.

- Expired license plates.

- Multiple traffic offenses.

Do any of these apply to you? Your driver’s license can get suspended if you don’t file for an SR-22 by a specific date. United Auto Insurance can provide instant SR-22 coverage and proof of insurance.

United can also electronically file your SR-22 paperwork with your state’s Secretary of State office. However, it can take up to 30 days for the state to process it.

The SR-22 filing process can be confusing, but United Auto Insurance is known to be helpful in answering any questions you might have. United Auto Insurance doesn’t charge any additional cost for filing an SR-22 either. You just need to purchase liability or full coverage insurance, and UAI’s staff will handle the rest.

The cost will depend on your age, type of vehicle, driving record, and other insurance factors. The State of Illinois generally requires SR-22s for at least three years. After this period, your SR-22 status will be removed. It’s then essential to review your insurance policy and ensure you remain adequately covered.

United Auto Insurance can help keep your driver status intact and in good standing during and after your SR-22 period. The important thing to note is to be sure you keep both your SR-22 certificate and your insurance policy together with you at all times while driving.

Commercial Vehicle Insurance

Don’t put your livelihood and business at risk because you lack the right insurance. Commercial insurance is necessary if you use your car for business purposes.

That could be service, sales, or delivery calls, or even running work-related errands like trips to the post office or bank.

Normally, commuting to and from work isn’t considered business use, but pretty much anything else you use your car for during work is.

Commercial auto insurance is essential to protect your business vehicles from a number of liability risks.

Dani Best Licensed Insurance Producer

United Auto Insurance can help no matter what type of vehicle you drive for business. Pickups, trailers, box trucks, and regular cars are all covered.

So whether you’re driving a box truck or a Chevrolet pickup, you’ll be covered (Read More: Best Auto Insurance for Chevrolets). United Auto Insurance covers many types of business vehicles, such as taxis, limousines, and vans.

Roadside Assistance

United Auto Insurance’s motor club provides 24/7 roadside assistance, similar to AAA. United Auto Insurance has thousands of garages and service stations under contract to help protect you.

With United Auto Insurance’s 24-hour roadside assistance, you don’t need to worry about getting left stranded anywhere in the continental United States. United Auto offers roadside assistance to help with unexpected vehicle issues, providing these services:

- Battery jumpstart

- Flat tire change

- Fuel delivery if you run out of gas

- Lockout services

- Towing

When you’re having a bad day on the road, it doesn’t need to be any worse. That’s why roadside assistance is nice to quickly get help with just a simple phone call.

United Auto Insurance’s roadside assistance includes the following:

- Emergency Lockout Service: If you accidentally lock your keys inside your vehicle, you can call United Auto Insurance’s 24-hour hotline to get a locksmith to help.

- Emergency Road Services: Members of the roadside assistance plan can get jump starts, tire changes, delivery of gasoline, and mechanical assistance.

- Emergency Towing Service: If your car won’t start or you are in an accident, you can get your car towed to the garage of your choice. 24 hours a day, 7 days a week. There are some limits on towing coverage, though, so make sure to read your service agreement.

UAI has toll-free emergency service lines. United Auto Insurance’s motor club has a toll-free 24-hour emergency road service number. It’s always there for you to call if something happens to your vehicle while you’re on the road.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get a United Auto Insurance Policy

Signing up with United Auto Insurance is pretty straightforward. The website is designed to be the fastest way to obtain a free quote (Learn More: How to Get Multiple Auto Insurance Quotes). The steps to follow include:

- Visit Website or Call: You can call United Auto Insurance or use its online form to get a quote.

- Fill Out Information: You will be asked questions about your driving record, vehicle, address, and more.

- Receive Quote: Once you have your quote, you can choose whether to move forward with purchasing a policy.

Overall, it’s a minimum amount of information. Just enough to ensure your quote will be accurate. This includes things like your address, the make and model of your car, and other essential details.

You’re not under any obligation to buy from United Auto Insurance when you request a quote.

But if you decide that United Auto Insurance is your best choice, you’ll be just a couple of minutes away from having coverage. You can print yourself a copy of your policy immediately after getting an United Auto Insurance quote and purchasing your insurance.

If you are interested in comparing quotes from multiple companies, you can find the best deal with our free quote tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

United Auto Insurance: Pros & Cons

Pros

- BBB Rating: On the Better Business Bureau website, UAI has a BBB rating of A+, and 100% of customer complaints have been resolved or closed.

- Discount Options: Discounts include the basics like multi-car, renewal, and good student discounts.

- Multilingual Services: UAI also offers different language options and services in both English and Spanish.

Cons

- Availability: UAI only provides insurance within two states, Indiana and Illinois. Its roadside assistance will cover you in case of a breakdown in any state.

- Website Lacks Detail: It doesn’t provide specific information on what the insurance options cover. This makes it difficult to compare rates and offerings with the competition.

Other Insurance Products Offered by United

United Auto Insurance offers the following types of insurance:

- Auto: Get top-quality auto insurance at the lowest possible prices.

- Commercial: If you have business vehicles on the road, then you need commercial auto insurance.

- Homeowners & Renters: Make sure your property and the belongings in it are safe (Learn More: Best Renters Insurance Companies).

- Motorcycle: Get full coverage, liability, and guest passenger insurance. All motorcycles can be covered, including high-performance bikes and Harley-Davidsons.

- SR-22: Get your SR-22 certificate the same day you apply.

It can customize a monthly payment plan to fit your budget, whatever that may be. You can pay by check, debit card, or credit card right over the phone, and you have an option to speak to someone in English, Spanish, or Polish.

UAI Homeowners & Renter Insurance

United Auto Insurance provides homeowners and renters insurance. It doesn’t matter if you live in a small apartment downtown or a two-story home in the suburbs, it can help keep your contents safe (Read More: How much homeowners insurance do you need?).

Home insurance costs at UAI are also on the more affordable side, even when compared to other competitors.

UAI vs. Competitors: Home Insurance Monthly Rates by Policy Amount| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $57 | $79 | $118 | $185 |

| $60 | $85 | $125 | $190 | |

| $59 | $82 | $123 | $188 |

| $62 | $88 | $130 | $200 | |

| $58 | $82 | $122 | $195 | |

| $65 | $92 | $135 | $210 |

| $60 | $86 | $128 | $200 | |

| $65 | $89 | $130 | $200 | |

| $61 | $87 | $128 | $198 | |

| $56 | $78 | $118 | $185 |

Renters’ insurance works to protect your personal items. Even if you don’t own the place you live in, your stuff is still important. Make sure you have insurance for all of that stuff you’ve accumulated over the years.

Homeowner insurance protects your house and belongings, and offers protection from lawsuits if accidents happen on your property.

Brandon Frady Licensed Insurance Producer

United Auto Insurance company can ensure everything from your jewelry to your flat screen TV. All it takes is completing the quote form on United Auto Insurance’s website to get a policy customized to fit your needs.

Motorcycle Insurance

United Auto Insurance understands that if you ride a motorcycle, it’s probably your pride and joy. Whether you’re a long-time motorcycle enthusiast or just buying your first bike, United Auto Insurance can make sure you have protection.

What that is depends on your individual needs. But it may include protection against theft or fire, covering your accessories, or providing optional roadside assistance. UAI lets you get out on the open road with peace of mind that your bike has coverage.

You can choose the motorcycle insurance that’s right for you:

- Excursion Diversion: If you crash your bike more than 100 miles from home, this type of insurance helps pay for food, lodging, transportation, and towing.

- Full Coverage: This includes everything liability covers, plus comprehensive and collision. Compare liability vs. full coverage auto insurance here.

- Liability: This includes bodily injury, property damage, and uninsured/underinsured motorist coverage (UM/UIM).

- Optional: You can also get optional rental insurance and roadside assistance through United Auto Insurance.

United Auto Insurance covers all makes and models of motorcycles, including Harley-Davidson, Kawasaki, Honda, Suzuki, and more. It can also cover scooters and mopeds on this type of policy.

Learn more about this Chicago-based auto insurance company. United Auto Insurance has been providing customers top-quality insurance at the lowest possible prices for more than 50 years. The company primarily serves clients living in the Chicago, Illinois, and Indiana areas.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why UAI Auto Insurance May Be Right for You

Our United Auto Insurance review found it has excellent customer service, but it isn’t available nationwide. The website also doesn’t say how much coverage the plans include. So you’re really left in the dark until you’ve requested a quote.

You don’t want to deal with bad customer service when trying to get an insurance quote. You just want to get your vehicle or home insured so that you know you have coverage if anything untoward happens.

United Auto Insurance has online quoting available and claims to offer the lowest possible prices. UAI can provide you with an SR-22 certificate to get you back on the road if you have a suspended driver’s license.

United Auto Insurance’s specialty is last-minute coverage. Its computerized rating system allows its agents to offer you the lowest possible rates, plus instant coverage right over the phone.

Having no prior insurance isn’t a problem. United Auto Insurance will help you find the lowest rate, even if you’ve had tickets in the past. The company provides coverage for all types of drivers, including young adults seeking cheap auto insurance for teens.

In terms of discounts, UAI only offers the bare minimum. But for some people, customer service is a significant factor in deciding which insurance company to go with. Want to find the best rate on insurance coverage today? Enter your ZIP in our free quote tool.

Frequently Asked Questions

Is United Auto Insurance a good company?

Yes, United Auto Insurance is a good company, with an A+ from the BBB for business practices.

Who is the owner of United Auto Insurance?

Richard Parrillo is the owner and CEO of UAI.

How much is United Auto Insurance’s full coverage car insurance?

UAI auto insurance rates for full coverage that includes collision and comprehensive auto insurance average $158 per month.

Is United Auto Insurance legit?

Yes, UAI is a legitimate insurance company that operates in Illinois and Indiana. Find other legitimate insurance companies by entering your ZIP in our free quote tool.

What is the United Auto Insurance claims phone number?

The UAI call center can be reached at 773-202-5000. You can also use your United Auto Insurance login to contact a representative for help with claims. United Auto does not have a 24-hour United Insurance customer service phone number.

What types of payment does United Auto Insurance accept?

It accepts all types of payment. Visa, Mastercard, American Express, Discover, personal check, and Western Union Quick Collect. You can pay for your insurance online or over the phone (Learn More: What to Do If You Can’t Afford Your Auto Insurance).

When do I get my proof of insurance from UAI?

You’ll be provided with proof of insurance immediately. You can print it for yourself as soon as you sign up.

What is the A.M. Best rating of United Auto Insurance?

In 2016, A.M. Best rated United Auto Insurance a C for financial strength, but later withdrew the rating at the company’s request, leaving UAI unrated today.

Is United Auto Insurance in Illinois?

Yes, UAI provides insurance in Illinois and Indiana.

What’s an exclusion form, and why sign it?

An exclusion form is a statement that specific people in your household won’t be driving your vehicle. Most likely, it would be your spouse. They might not be a licensed driver, but you can still use them to qualify for the discounted married rate (Read More: The Ultimate Insurance Cheat Sheet).

Why do I need to list the owner of the car on my policy?

What is a non-business form?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.