Does auto insurance cover vehicle theft?

Auto insurance can cover vehicle theft, but only if you carry comprehensive auto insurance. Comprehensive coverage is usually affordable, with rates starting as low as $12 per month. It helps pay for theft, damage caused by thieves, and the cost to replace your car if it can’t be recovered.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

Auto insurance will cover vehicle theft, but only if you have comprehensive coverage in your policy.

- A comprehensive car insurance policy includes auto theft coverage

- Some add-ons are available to help cover losses, like gap insurance

- Comprehensive car insurance is usually affordable, starting at $12 a month

Many drivers assume their car insurance will automatically cover theft, but that isn’t always the case. Read on to learn why you need comprehensive auto insurance to cover costs if your vehicle is ever stolen.

If you need to add comprehensive insurance to your policy, enter your ZIP code into our free comparison tool to find the lowest rates.

How Auto Theft and Insurance Work

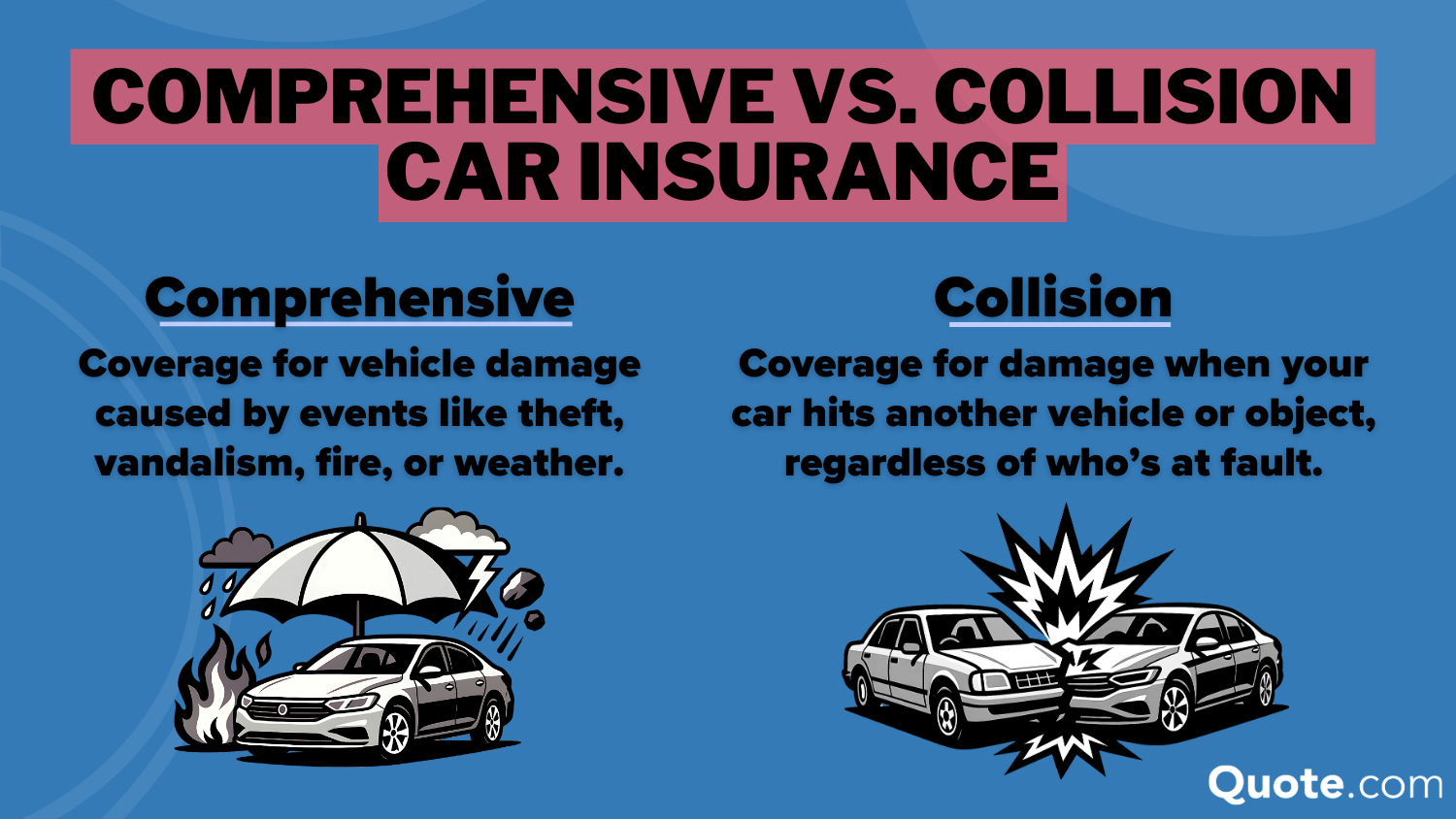

Car theft is covered by comprehensive auto insurance, which is designed to protect your vehicle from non-collision incidents that are largely outside your control.

In addition to theft, comprehensive coverage typically includes protection against vandalism, fire, falling objects, weather-related damage, and animal-related incidents.

Although many drivers confuse comprehensive and collision auto insurance, only comprehensive handles theft. If your car is stolen and not recovered, comprehensive insurance can reimburse you for the vehicle’s actual cash value, minus your deductible.

When this happens, your car will be declared a total loss. Unless you have special coverage, such as new-car replacement insurance, your provider will pay for your car’s actual cash value (ACV).

Comprehensive insurance also covers theft-related damage, such as broken windows, damaged locks, or interior damage.

Dani Best Licensed Insurance Agent

The good news is that comprehensive insurance is generally an affordable addition to an insurance policy.

Comprehensive car insurance tends to be cheaper than collision coverage and sometimes even liability insurance.

Comprehensive Coverage Costs for Auto Theft

Being the victim of a car theft can cost you a lot, emotionally and financially. Thankfully, getting the right car insurance that covers car theft is usually relatively cheap.

You can compare comprehensive insurance rates to full coverage prices to get a better idea of how affordable comprehensive insurance is.

Monthly Rates for Vehicle Theft Coverage| Insurance Company | Comprehensive | Full Coverage |

|---|---|---|

| $22 | $228 | |

| $15 | $166 |

| $20 | $198 | |

| $14 | $114 | |

| $24 | $248 |

| $16 | $164 | |

| $19 | $150 | |

| $17 | $123 | |

| $18 | $141 | |

| $13 | $84 |

It’s important to note that auto insurance generally does not cover personal belongings taken from inside your car. Items like phones, purses, or laptops are covered under renters or homeowners insurance coverage instead.

Like all other types of coverage, comprehensive auto insurance rates vary by many factors. One of the most important is where you live. Compare average comprehensive car insurance rates in your state. Read More: Auto Insurance Rates by State

Comprehensive coverage is never required by law, regardless of which state you live in. However, you’ll likely need comprehensive coverage in your policy if you have a loan or lease on your car.

Even if you don’t need it, adding comprehensive insurance to your policy is often a good idea. Without it, you’ll be responsible for replacing your vehicle after its been stolen by yourself. If you can’t afford to replace your car outright, comprehensive insurance might be a good idea for you.

Full Coverage Insurance Protects Against Theft

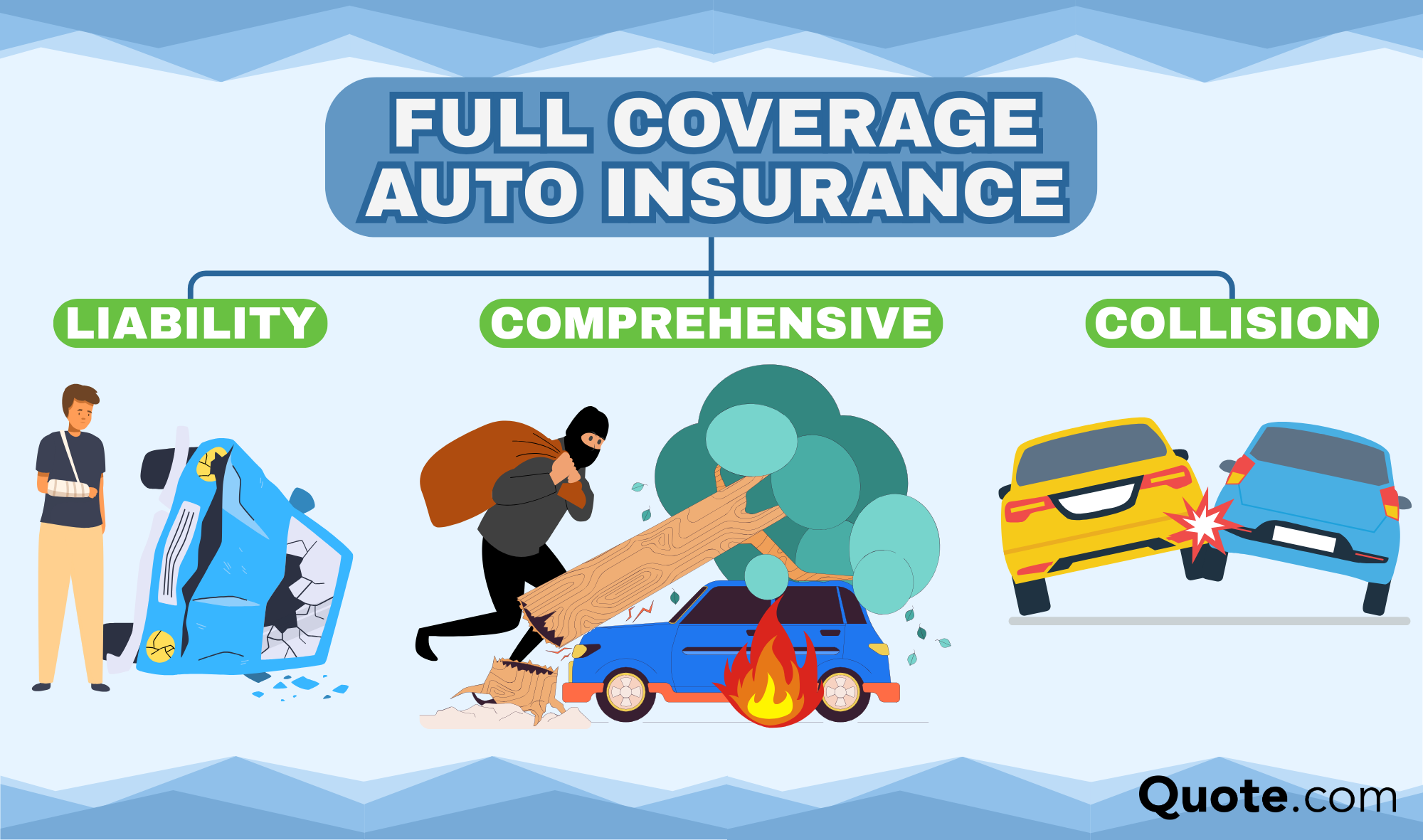

Full coverage auto insurance isn’t a single type of coverage, but a collection of different protections. You might need full coverage insurance if you have a loan or lease on your car, but full coverage is never required by law.

In most cases, full coverage includes liability, collision, and comprehensive insurance, which covers theft.

Because theft is considered a non-collision event, it’s comprehensive coverage, not liability or collision, that protects your vehicle if it’s stolen.

If you carry full coverage and your car is stolen, your comprehensive insurance can help pay for the vehicle’s actual cash value if it isn’t recovered, or for repairs if it is found damaged.

You’ll still need to pay your comprehensive deductible before coverage applies, even if your car is declared a total loss.

Tracey L. Wells Licensed Insurance Agent

Full coverage can also provide peace of mind, as theft often involves related damage, such as broken windows, damaged steering columns, or vandalism.

It’s essential to understand what the other parts of full coverage do and don’t cover. While they play an important role in protecting you financially, they aren’t stolen car insurance policies:

- Collision Insurance: Pays for damage to your car caused by hitting another vehicle or object, regardless of fault.

- Liability Insurance: Covers injuries and property damage you cause to others in an at-fault accident.

Without comprehensive coverage, even a policy described as full coverage would not protect you from car theft. Reviewing your policy details can help ensure you have the right protection in place, especially if vehicle theft is a concern in your area.

However, comprehensive insurance is not required in any state as part of the required coverage to drive. If you buy nothing but your state’s mandatory insurance, you won’t be covered against car theft.

Full Coverage Rates for Stolen Car Insurance

Full coverage costs more than a minimum coverage policy, but many drivers choose it for the protection it offers.

While comprehensive insurance is relatively cheap, most providers only offer it as a full coverage package with collision insurance. Take a look to compare minimum and full coverage rates.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

As you can see, full coverage can cost significantly more than a minimum insurance policy. However, only full coverage policies help pay for damage to your vehicle.

Your age plays an important role in how much you’ll pay for a full coverage policy. See how much you might pay based on how old you are.

Full Coverage Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $740 | $271 | $248 | $228 | |

| $591 | $210 | $182 | $166 |

| $519 | $158 | $139 | $124 | |

| $897 | $256 | $217 | $198 | |

| $362 | $133 | $121 | $114 | |

| $893 | $306 | $274 | $248 |

| $552 | $213 | $187 | $164 | |

| $944 | $209 | $174 | $150 | |

| $405 | $158 | $138 | $123 | |

| $1,056 | $165 | $151 | $141 |

Although full coverage policies offer great protection, they can be expensive. Always shop around to find the best rates. You can also take advantage of discounts, find the best auto insurance for good drivers, and pick the right coverage level for your needs.

Whether you have it in a full coverage policy or add it as a standalone comprehensive insurance policy, it’s the only type of insurance that pays for your vehicle after it’s stolen. However, other types of insurance can help.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Other Types of Insurance That Cover Theft

Beyond liability, collision, and comprehensive insurance, there are several types of auto insurance and policy add-ons designed to provide extra financial protection and convenience.

These coverages can help with medical expenses, vehicle repairs, or unexpected costs after an accident or breakdown.

Types of Auto Insurance Coverage| Policy Type | What it Covers | Scenario |

|---|---|---|

| Collision | Damage to your vehicle | You hit a pole |

| Comprehensive | Theft or non-crash damage | Storm damages your car |

| Gap Insurance | Loan balance after total loss | Car totaled, loan remains |

| Liability | Damage or injuries you cause | You hit another car |

| Medical Payments | Medical costs for passengers | Passenger needs ER care |

| Personal Injury Protection | Medical bills and lost income | You’re injured in a crash |

| Rental Reimbursement | Rental car while repairing | You need a rental car |

| Rideshare Coverage | Accidents during rideshare use | Waiting for a ride request |

| Roadside Assistance | Towing or roadside help | Car won’t start on roadside |

| Underinsured Motorist | Costs beyond other limits | Other policy limits too low |

| Uninsured Motorist | Injuries from uninsured drivers | Uninsured driver hits you |

Auto insurance add-ons increase the protection your policy offers, but they can get expensive quickly. It’s important to only choose the add-ons you need, so your insurance premium doesn’t get too high.

Which of these insurance types helps out when your car is stolen? Here are four auto insurance add-ons that you should consider if you’re worried about theft:

- Custom Parts and Equipment Coverage: This coverage helps pay to replace aftermarket upgrades, such as custom wheels, audio systems, or performance modifications.

- Gap Coverage: If your car is stolen and declared a total loss, gap insurance will pay the difference between what your insurance reimburses and what you still owe on your car.

- Personal Effects Coverage: Personal effects coverage can help reimburse you for personal items stolen from inside your vehicle, such as electronics, clothing, or bags.

- Rental Car Reimbursement: This add-on pays for a rental car if your vehicle is stolen or deemed a total loss and you need to buy a new one.

You should consider your needs before you sign up for these add-ons. For example, someone without a car loan doesn’t need gap insurance. If you frequently transport valuable items, personal effects coverage might be a good investment.

Regardless of which types of insurance you buy, your auto insurance does cover a stolen vehicle so long as you have comprehensive coverage.

How Insurance Companies Pay for a Stolen Car

The car theft insurance claim process ends the same way most claims are resolved: with either a check sent directly to you or a payment made to a mechanic. When a car is stolen, insurance companies typically wait about 30 days to see if the vehicle is recovered before issuing a payout.

During this time, the insurer will investigate the claim, confirm the theft with a police report, and review your policy to make sure comprehensive coverage is in place.

If your vehicle isn’t recovered within a month, it’s usually declared a total loss.

Kristen Gryglik Licensed Insurance Agent

Once a vehicle is declared a total loss, the insurance company pays out the car’s actual cash value (ACV), which reflects its market value at the time of the theft, factoring in depreciation, mileage, condition, and local market prices.

While that’s how insurance companies pay for a stolen car in most cases, you should understand how the different types of coverage work when it comes to theft.

See how some of the more popular car insurance options help after your vehicle has been stolen.

Vehicle-Theft Insurance Coverage Breakdown| Policy Type | Theft Protection? | What it Covers |

|---|---|---|

| Comprehensive Insurance | ✅ | Vehicle theft and attempt damage |

| Collision Insurance | ❌ | No theft; covers crash damage only |

| Liability Insurance | ❌ | No theft; covers injuries or damage you cause |

| Full Coverage | ✅ | Covers theft and attempted-theft damage |

| Personal Effects Coverage | ⚠️ Add-On | Theft of personal items in the vehicle |

| Gap Insurance | ⚠️ Indirect | Pays loan/lease gap if car is totaled |

| Rental Reimbursement | ⚠️ Indirect | Pays rental costs during theft claim |

Your comprehensive deductible is subtracted from this amount. If you have an auto loan or lease, the payment is typically sent to the lender first, unless you have gap insurance, which covers if you owe more than the car is worth. Any remaining balance then goes to you.

What to Do After Your Car is Stolen

Taking the right steps after insurance claims process smoother. Start by documenting what happened and notifying the appropriate authorities and companies as soon as possible. Follow these easy steps to make the process as smooth as possible:

- Contact the Police: File a police report and get a copy or report number for your insurance company. Let police know if your car has a GPS or a tracking app.

- Gather Documentation: Collect your vehicle title, loan or lease information, keys, and photos to support your insurance claim.

- Notify Your Provider: Report the theft promptly and provide details, including the police report, vehicle information, and the last known location.

- Cancel Connected Services: Disable toll tags, parking apps, and vehicle-linked payment services to prevent unauthorized charges.

Once you’ve completed these steps, you’ll likely have to file an insurance claim. Even if you get your vehicle back, thieves often cause at least some damage during the theft.

Luckily, filing an insurance claim after a vehicle theft is easy, especially if you’ve followed the steps listed above. Unfortunately, your insurance rates will likely go up after a comprehensive claim, but you can take steps like comparing quotes and finding auto insurance discounts to help minimize the damage.

How to File a Claim After Your Car is Stolen

Filing an insurance claim after your car is stolen is usually straightforward, especially if you act quickly and have the right information ready.

Most insurers allow you to file a claim online, through a mobile app, or by phone. Having documentation prepared can help speed up the investigation and payout process. If you need to file a claim after your car’s been stolen, follow these steps:

- Cooperate With the Investigation: Respond promptly to follow-up questions from your insurer while they determine whether the car is recovered or declared a total loss.

- Provide Police Report: Submit the police report number and any details about when and where the theft occurred.

- Share Vehicle Information: Be ready to provide your VIN, license plate number, mileage, and a list of any custom parts or recent upgrades.

- Submit Required Documents: This may include photos, spare keys, loan or lease paperwork, and proof of ownership.

Since most insurance companies offer a variety of ways to file a claim, you can pick the one you’re most comfortable with.

Comprehensive claims are the third-most-common type in the U.S. You won’t have to worry too much about how to file an auto insurance claim and win for vehicle theft, because most companies are used to paying out with these sorts of claims.

Most Common Auto Insurance Claims in the U.S.| Coverage Type | Share | Cost Per Claim | Description |

|---|---|---|---|

| Collision | 30% | $4.5K | Vehicle impact |

| Property Damage | 25% | $4.2K | Others’ property |

| Comprehensive | 15% | $2.5K | Theft, weather, fire |

| Bodily Injury | 12% | $20K | Injuries to others |

| Personal Injury | 8% | $8K | Medical, passengers |

| Uninsured Motorist | 6% | $15K | Uninsured driver hit |

| Medical Payments | 3% | $2.5K | Medical, any fault |

| Other Types | 1% | $1K | Rental, roadside |

That means most insurance companies are experienced in working with their customers throughout a comprehensive claim. The only part of the process that often causes issues is the 30-day period before a missing car can be declared a total loss.

While comprehensive claims are usually easy to file, you should always try to minimize the risk that your vehicle falls into the hands of thieves.

Expert Tips to Prevent Auto Theft

While no method can guarantee your car won’t be stolen, taking proactive steps can significantly reduce your risk. Thieves often look for easy targets, so even small deterrents can make a difference and save you money on car insurance.

One of the easiest ways to ensure that your car stays safe is to practice common sense behaviors like locking your doors and not leaving valuables behind.

Melanie Musson Published Insurance Expert

Being mindful of where and how you park your vehicle is one of the simplest and most effective prevention strategies. Parking in well-lit, highly visible areas and avoiding isolated locations can discourage theft, especially overnight.

If possible, you should also park your car in a garage or a locked area overnight. Some insurance companies will reward you with a garaging discount if you can park your car safely every night.

Steering wheel locks, immobilizers, alarms, and GPS tracking systems can all make your car less attractive to thieves or help recover it if it’s stolen. You should also purchase comprehensive insurance if you live in an area with high vehicle theft rates.

You may also qualify for an anti-theft auto insurance discount if your vehicle has certain features or if you upgrade your car yourself. Adding anti-theft devices can provide another layer of protection.

If you can take advantage of an anti-theft discount, you could see significant savings on your car insurance. Anti-theft features such as GPS trackers, engine kill switches, and audible alarms help keep your vehicle safe from falling into the hands of thieves.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting Affordable Auto Theft Coverage

Does auto insurance cover vehicle theft? Comprehensive auto insurance is designed to cover theft and related damage, giving you peace of mind whether your car is recovered or declared a total loss.

Car theft can happen when you least expect it, but comprehensive insurance or full coverage that includes collision and comprehensive policies will help protect you from major financial loss.

With flexible deductibles and optional add-ons, you can tailor comprehensive coverage to your needs and budget by comparing auto insurance companies.

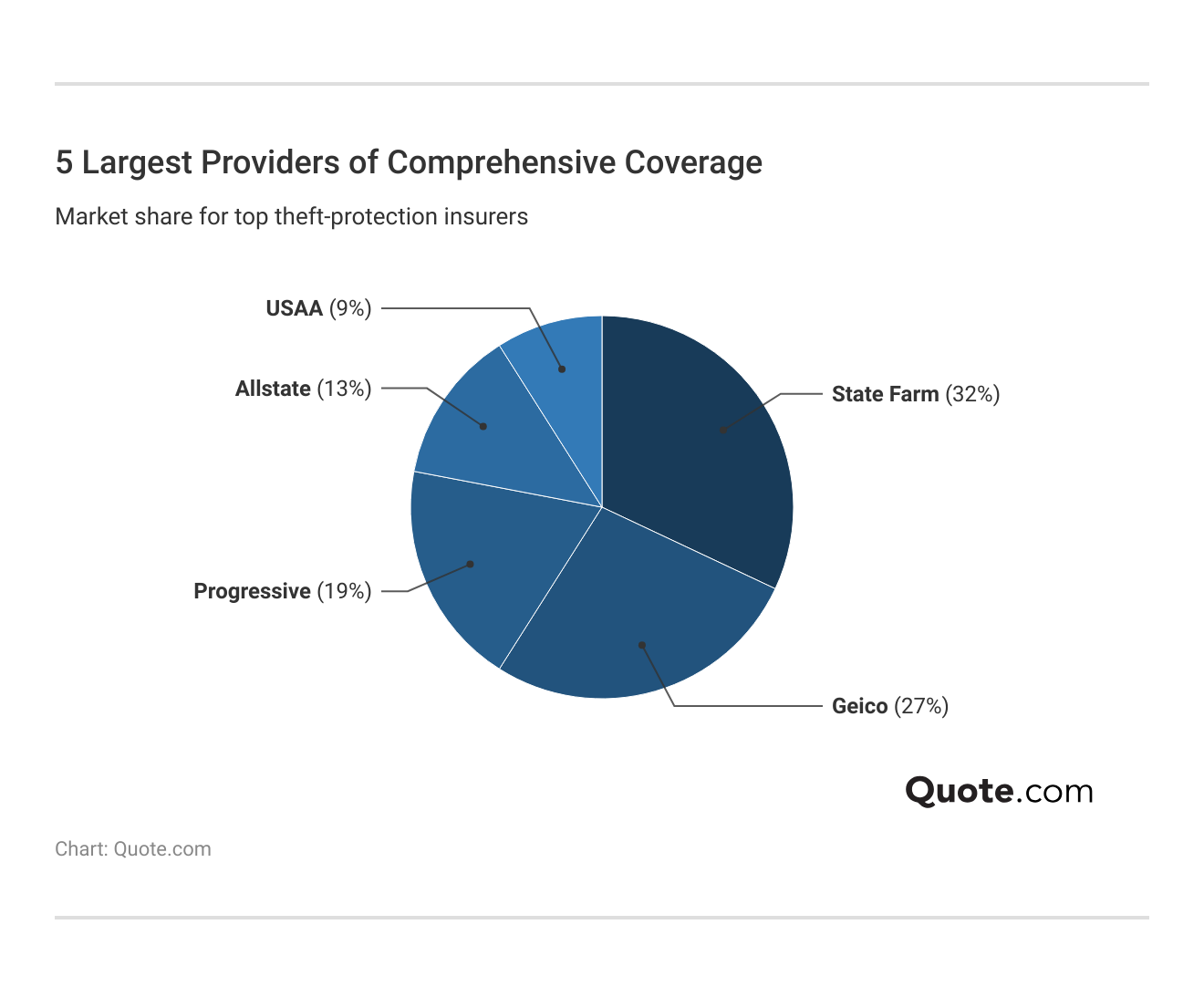

Check out the largest comprehensive insurance providers if you need a place to start looking for affordable coverage.

State Farm and Geico are the most popular providers for their competitive rates and nationwide coverage. Comprehensive insurance starts at $14 a month with Geico.

If you’re ready to find the perfect comprehensive coverage car insurance company near you, enter your ZIP code into our free comparison tool today.

Frequently Asked Questions

Does auto insurance cover theft?

You’ll only have stolen car insurance coverage if you add comprehensive insurance to your policy. Neither liability nor collision will cover theft on its own.

Comprehensive insurance pays up to your car’s actual cash value if it’s stolen and not recovered, minus your deductible. Check out our auto insurance guide for more information on how your policy works.

Does car insurance cover break-ins?

Yes, comprehensive car insurance covers vehicle damage resulting from break-ins, including forced entry. For example, if your window is broken after someone has broken into your car, comprehensive coverage will pay for damages. Comprehensive coverage also pays for repairs if your vehicle is vandalized.

While your insurance covers damage to your car when someone breaks into it, it does not replace stolen personal items.

Should I file a police report after a car theft?

Yes, filing a police report is essential to the potential recovery of your vehicle and to bringing the people who stole your car to justice. Aside from the efforts of law enforcement, filing a police report is usually required to file a stolen car insurance claim.

Will insurance pay for a stolen car if the keys were left inside?

Yes, comprehensive insurance will usually still send a stolen car insurance payout even if the keys were left inside, though some insurers may investigate the claim more closely. Coverage can vary by policy, so exclusions or negligence clauses may apply in rare cases.

Your insurance deductible may go up if you need to file a comprehensive claim, though, so it’s best not to forget your keys when you park.

Can insurance refuse to pay for a stolen car?

An insurance claim can be denied if the policy had lapsed, you don’t have the right coverage, or there is evidence of fraud or misrepresentation. Failure to file a police report or cooperate with the investigation can also lead to denial.

Does insurance go up if a car is stolen?

Your rates may increase after a theft claim, but not always. Because theft is typically considered a non–at-fault claim, some insurers do not raise premiums.

Does full coverage insurance cover auto theft?

Yes, because what people commonly call full coverage usually includes comprehensive insurance, which does cover vehicle theft. However, full coverage won’t cover personal items inside the car.

What’s the difference between comprehensive and full coverage insurance?

Wondering what the difference is between comprehensive vs. full coverage insurance? Comprehensive insurance is a specific type of coverage for non-collision incidents such as theft, vandalism, and weather damage, while full coverage is a general term that typically refers to a policy that combines liability, collision, and comprehensive.

Read More: Liability vs. Full Coverage Auto Insurance

What happens if your car is stolen and you still owe money?

If the car is totaled and you have comprehensive coverage, the insurer pays the car’s actual cash value (ACV), not how much you own on a loan or lease. If your car’s ACV is less than your loan balance, you’re responsible for the difference unless you have gap insurance.

Does car insurance cover theft of personal items?

No, standard auto insurance typically does not cover personal belongings stolen from your vehicle. You’d usually need to file a claim under your renters or homeowners insurance to get reimbursed for theft of personal items from cars. Or, you can add personal belongings coverage to your policy.

Does insurance cover a stolen catalytic converter?

Does car insurance cover a broken window from theft?

How much does comprehensive car insurance cost?

How much does full coverage insurance cost?

Can you buy comprehensive car insurance without full coverage?

How much will insurance pay for a stolen car?

What is a car’s actual cash value?

What is the most commonly stolen vehicle in America?

Does renters insurance cover items stolen from a car?

Does homeowners insurance cover items stolen from a car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.