Does auto insurance cover windshield replacement?

Auto insurance covers windshield replacement when damage qualifies under comprehensive or collision coverage. Farmers have the lowest monthly rates at $55 for comprehensive and $68 for collision. If windshield replacement or repairs are cheaper than your deductible, your insurance won't cover glass damage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

Does auto insurance cover windshield replacement? It can if you have collision or comprehensive coverage, but each type of insurance covers glass damage differently.

- Affordable windshield coverage starts at $55 per month

- Some states waive deductibles for windshield replacement

- Repair versus replacement costs affect policy premiums

Collision auto insurance applies if your windshield was damaged in a crash with another vehicle or a stationary object, like a pole. Comprehensive coverage applies if the glass is damaged by vandals, animals, or weather.

This guide explains how comprehensive and collision insurance apply to glass damage, how insurance deductibles affect costs, and when minor chips versus spreading cracks justify a claim.

Farmers offers the lowest rates at $55 a month for comprehensive and $68 a monthly for collision. Find the cheapest auto glass insurance by entering your ZIP code into our free comparison tool.

How Windshield Replacement Works

Windshield replacement depends on the type of auto insurance you have and what caused the damage.

Certain coverages don’t help with windshield repairs because they are made for different needs, such as paying medical bills or helping with a loan after a total loss.

Windshield Replacement Coverage by Policy Type| Policy | Glass Benefit? | What Is Covered |

|---|---|---|

| Comprehensive | Repair / replacement | Theft, hail, animal, damage |

| Collision | Repair / replacement | Hitting vehicle / object |

| Liability | None | Others’ damage only |

| Full Glass | Full, no deductible | Add-on to comprehensive |

| Rental / Loan Payoff | Not applicable | Loan / lease after total loss |

| Personal Injury Protection | Not applicable | Medical only |

Comprehensive insurance helps when the windshield is damaged by things like weather, theft, or animals, while collision coverage helps when the damage happens in a crash or when you hit something.

These two coverages decide whether your windshield can be repaired or replaced and which deductible you must pay.

Some add-ons, such as full glass coverage auto insurance, remove the deductible so you pay nothing for a replacement.

Knowing what each policy does makes it easier to tell when insurance will cover your windshield. Compare comprehensive vs. collision auto insurance to learn more.

Understanding Different Types of Auto Insurance Coverage

Different types of car insurance protect you in different situations, and only some of them help with windshield damage.

Collision and comprehensive cover damage to your own car, and may pay for windshield repair or replacement, depending on how the damage occurred.

Types of Auto Insurance Coverage| Policy Type | What it Covers | Scenario |

|---|---|---|

| Collision | Damage to your vehicle | You hit a pole |

| Comprehensive | Theft or non-crash damage | Storm damages your car |

| Gap Insurance | Loan balance after total loss | Car totaled, loan remains |

| Liability | Damage or injuries you cause | You hit another car |

| Medical Payments | Medical costs for passengers | Passenger needs ER care |

| Personal Injury Protection | Medical bills and lost income | You’re injured in a crash |

| Rental Reimbursement | Rental car while repairing | You need a rental car |

| Rideshare Coverage | Accidents during rideshare use | Waiting for a ride request |

| Roadside Assistance | Towing or roadside help | Car won’t start on roadside |

| Underinsured Motorist | Costs beyond other limits | Other policy limits too low |

| Uninsured Motorist | Injuries from uninsured drivers | Uninsured driver hits you |

Liability auto insurance only pays for other people’s damage, so it never helps with your windshield, but it may cover the windshield of the vehicle you hit.

Other coverages focus on medical bills, rental cars, towing, or accidents involving uninsured drivers. These types don’t repair your windshield, but they can help with the extra costs that come with car damage or an accident.

UM/UIM insurance may include windshield replacement coverage if the at-fault driver can’t cover it, but this varies by state and company.

Altogether, these coverages support you in different ways while your car is being fixed, making it easier to manage repair costs. Understanding this clarifies whether you need windshield insurance and which type of coverage applies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Determining Windshield Replacement Costs

The cost of windshield replacement changes a lot between companies, and the biggest difference comes from the cost of comprehensive and collision insurance.

Comprehensive is the part that usually pays for windshield damage, so comparing company prices matters.

Monthly Cost for Auto Insurance With Windshield Coverage| Company | Comprehensive | Collision |

|---|---|---|

| $65 | $74 | |

| $70 | $72 |

| $60 | $69 | |

| $90 | $109 |

| $55 | $68 | |

| $65 | $78 | |

| $60 | $69 | |

| $65 | $72 | |

| $115 | $128 |

| $60 | $74 |

Farmers has the cheapest rates at $55 per month for comprehensive and $68 a month for collision. Learn more about coverage costs in our Farmers auto insurance review. Auto-Owners, Nationwide, and Travelers are also low-cost choices.

Other companies charge more for the same coverage, so researching whether windshield replacement increases insurance on Reddit can help you find affordable providers locally.

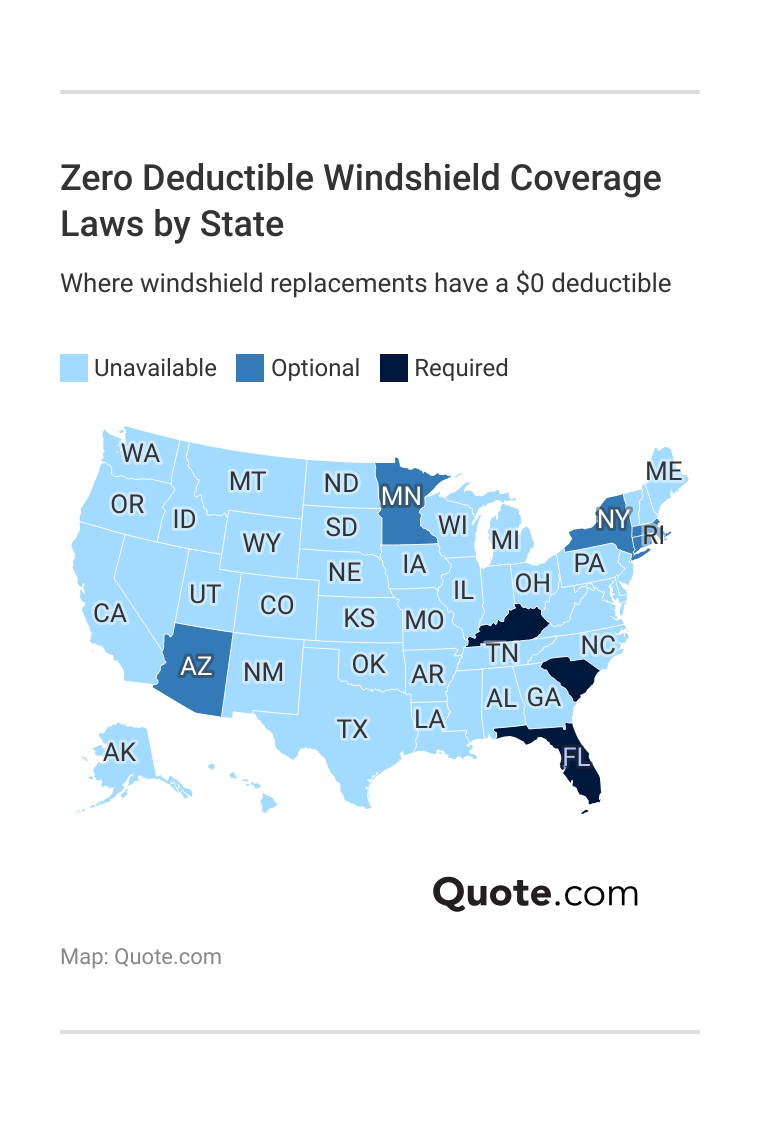

Always compare local windshield insurance companies online because certain states require providers to waive the windshield replacement deductible when you carry comprehensive coverage.

Here, drivers can replace a damaged windshield without paying out of pocket because companies waive the insurance windshield replacement deductible automatically.

However, drivers in other states only have the windshield replacement deductible waived with an optional add-on. Many states do not offer it at all. Drivers in those areas must pay their normal deductible unless they buy extra glass coverage.

Because windshield damage is common, knowing whether your state waives the deductible for windshield replacement can help you choose the right company and avoid surprise costs.

Windshield Replacement vs. Repair Prices

Windshield repair usually costs much less than a full replacement, which is why fixing small chips early can help you avoid bigger bills later.

Repairs often range from $60 to $150, while a full replacement can cost $200 to over $800, especially if your car has safety features that need extra work.

Windshield Repair vs. Replacement Cost| Service | Expense |

|---|---|

| Windshield Repair | $60–$150 |

| Windshield Replacement | $200–$800+ |

| ADAS Recalibration (add-on) | +$300–$600 |

ADAS recalibration alone can add another $300 to $600 to the total price. If the repair or replacement costs less than your insurance deductible, your insurance won’t pay anything, and you must cover the full amount yourself.

Knowing these costs can help you decide the best time to file a claim and whether it makes more sense to use insurance or simply pay for the repair yourself.

Factors That Raise Windshield Insurance Premiums

Windshield insurance costs change based on your coverage and how your policy works. If you have comprehensive auto insurance or special auto glass coverage, your out-of-pocket cost can be much lower.

Your deductible also plays a big part because a high deductible means you pay more before insurance helps, while a low deductible raises your monthly premium.

Windshield Replacement Cost Factors| Factor | Details |

|---|---|

| Comprehensive Coverage | Windshield replacement is usually covered |

| Deductible | Upfront cost; lower deductible = higher premium |

| Full Glass Coverage | Separate, often lower, glass-only deductible |

| Claim History | Frequent claims can increase future premiums |

| Insurer Rules | Coverage and premium impact vary by insurer |

| Make / Model | Luxury or rare vehicles cost more to replace |

| Features | ADAS, HUD, and sensors increase replacement cost |

| Glass Type | OEM glass costs more than aftermarket |

| Labor | Costs vary by location and job complexity |

| Severity | Chips are cheaper; cracks need full replacement |

Your past claims matter too, since filing many glass claims can cause your insurance rate to go up later.

The type of car you drive and the kind of glass needed also affect the price. Cars with advanced safety features may need extra work, raising the total cost.

Choose windshield coverage based on road debris risk, your budget, and whether a $0 glass deductible makes sense.

Ted Patestos Licensed Insurance Adjuster

Luxury cars and models with rare parts are usually more expensive to fix. Labor costs also change by location and how hard the job is. Small chips are cheaper to fix, while long cracks usually mean the whole windshield must be replaced.

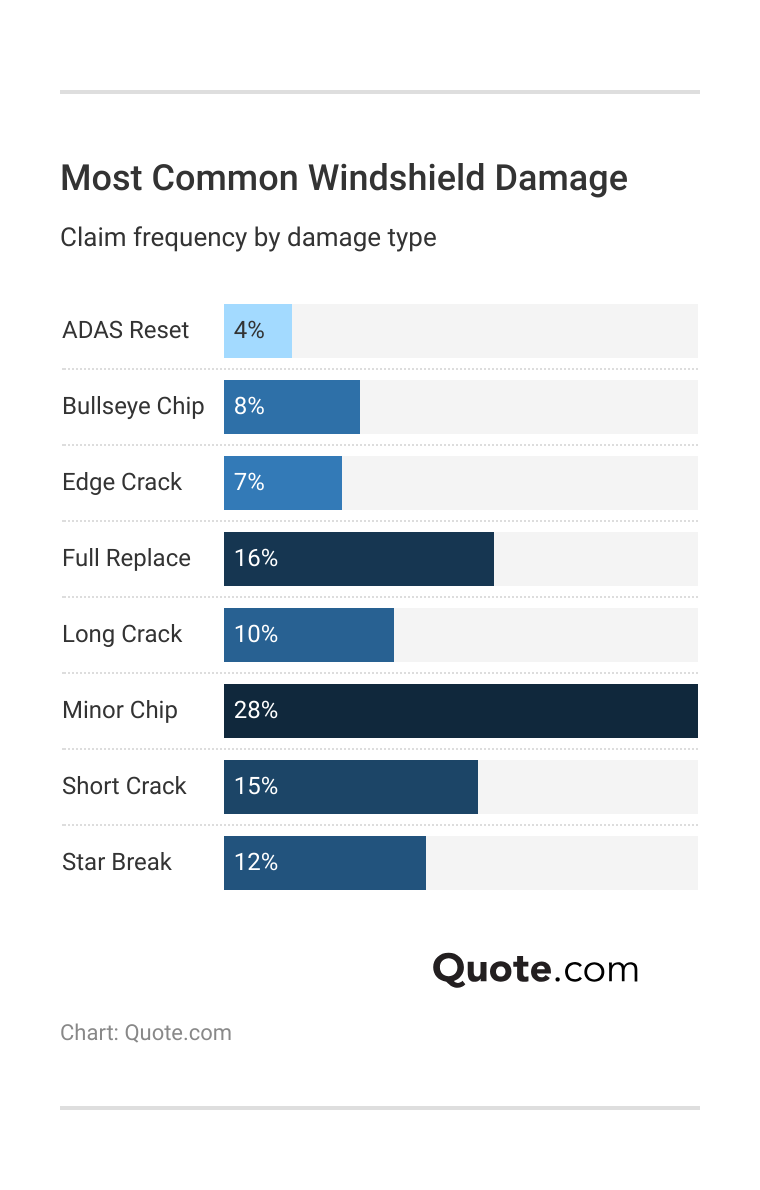

This matters because minor chips make up the largest share of windshield damage, so most drivers are more likely to face quick, low-cost repairs rather than major replacements.

More serious issues like full replacements or long cracks still happen, but less frequently, which helps explain why many insurance claims involve small, manageable damage.

ADAS resets remain the least common type of damage, yet they can add a noticeable cost when modern safety features need recalibration during repair.

Understanding Windshield Replacement Claims

Windshield damage is usually handled under comprehensive insurance. It’s one of the more common claim types because things like rocks, storms, and falling objects often hit the glass without damaging the rest of the car.

While collision and property damage claims happen more often and cost more, windshield claims are still very common and tend to be smaller and easier to fix.

Most Common Auto Insurance Claims in the U.S.| Coverage Type | Share | Cost Per Claim | Description |

|---|---|---|---|

| Collision | 30% | $4.5K | Vehicle impact |

| Property Damage | 25% | $4.2K | Others’ property |

| Comprehensive | 15% | $2.5K | Theft, weather, fire |

| Bodily Injury | 12% | $20K | Injuries to others |

| Personal Injury | 8% | $8K | Medical, passengers |

| Uninsured Motorist | 6% | $15K | Uninsured driver hit |

| Medical Payments | 3% | $2.5K | Medical, any fault |

| Other Types | 1% | $1K | Rental, roadside |

Many drivers file at least one glass claim in their lifetime because even a tiny rock can leave a chip or crack that needs attention.

With the right coverage in place, you can handle windshield damage quickly, safely, and with confidence (Read More: Best Auto Insurance Companies for Claims Handling).

File a windshield claim right away, keep photos of the damage, and confirm your deductible so you know exactly what you’ll pay.

Michelle Robbins Licensed Insurance Agent

What you pay out of pocket depends mostly on your deductible. If you don’t have insurance, you must pay the full cost of the repair or replacement.

Out-of-Pocket Costs for Windshield Claims| Scenario | No Insurance | $500 Deductible | $0 Deductible |

|---|---|---|---|

| Repair | $120 | $120 | $0 |

| Replacement | $450 | $450 | $0 |

| Replacement + ADAS | $900 | $400 | $0 |

If repair or replacement costs are less than your deductible, you won’t receive an insurance payout. For instance, with a $500 deductible, you pay the full repair cost because your policy won’t cover anything less than $500.

A $0 deductible makes repairs and replacements much cheaper since insurance pays the full bill, even when ADAS recalibration adds more to the price.

Buying Car Insurance for Windshield Damage

Does auto insurance cover windshield replacement? Having comprehensive insurance helps protect you from high costs caused by chips, cracks, and full auto glass replacements.

A $0 glass deductible or separate windshield insurance, when available, can also remove out-of-pocket expenses, which is especially helpful for drivers in areas with frequent road debris or inclement weather.

Comparing auto insurance companies and rates is one of the best ways to find a plan that fits your budget, especially since prices for auto glass insurance coverage can vary widely.

Providers like Farmers offer some of the lowest rates, making them a strong option for drivers who want affordable protection. Get fast and cheap auto insurance coverage today with our quote comparison tool.

Frequently Asked Questions

Does auto insurance cover windshield replacement?

Yes, car insurance covers windshield replacement if you have comprehensive coverage or separate windshield insurance. These cover non-crash damage, like chips and cracks caused by debris.

Can I claim on my insurance for a cracked windscreen?

Yes, you can usually file a claim for a cracked windscreen if the damage falls under your comprehensive coverage. Some states also require a $0 deductible for glass claims.

How do I know if my insurance covers windshield replacement?

Check your policy for comprehensive coverage or separate windshield insurance. You can also call your insurer and ask if your plan pays for repairs, full replacement, or both.

Does full coverage insurance cover windshield replacement?

Full coverage insurance includes comprehensive and collision, so it usually covers windshield replacement. Comprehensive covers most glass damage, while collision helps if the glass breaks during a crash.

Does car insurance cover a cracked windshield from a rock?

Yes, a rock hitting your windshield is normally covered under comprehensive insurance because it is a non-crash event caused by road debris.

Will filing a windshield claim increase my insurance rates?

It depends on the insurer. Many companies do not raise rates for a single small glass claim, but frequent claims might lead to higher premiums. Compare rates from the cheapest car insurance companies to see what premiums you can get.

When should I file a claim or pay out of pocket for a windshield replacement?

If the repair is cheaper than your deductible, there is no point in filing a claim. You may also want to pay out of pocket if you recently made a comprehensive claim, as your insurer might see you as a risk and raise your rates at renewal.

Read More: How to File an Auto Insurance Claim & Win

What happens if the repair or replacement costs less than my deductible?

If the cost is below your deductible, insurance does not pay anything, and you must cover the full amount yourself. A $0 glass deductible removes this problem.

What does a $500 deductible with full glass mean?

Full glass means that the deductible doesn’t apply to auto glass insurance. Your provider will cover the total cost of windshield replacement or repairs.

Is it better to repair or replace a damaged windshield?

Small chips and short cracks can often be repaired, which is cheaper. Large cracks or damage in the driver’s view usually require a full replacement.

Does insurance cover ADAS recalibration after windshield replacement?

Is separate windshield insurance worth it?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.