What We Learned Analyzing 815 Insurance Companies

Across the U.S., 25.3 million people lack insurance, average home premiums climb to $2,151, and life insurance ownership drops below 60%. These are precise results from what we learned analyzing 815 insurance companies, showing how costs, risk exposure, and policy trends directly affect households.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated November 2025

Insurers shape protection across auto, home, life, and health, and what we learned analyzing 815 insurance companies highlights the programs that set them apart.

Auto carriers use accident forgiveness to protect drivers from premium increases after their first at-fault accident. Home insurers cut costs for households that add secure roofs or modern plumbing.

- Analyzing 815 insurance companies reveals UBI boosted enrollment by 50%

- Home insurers cut 2–15% with alarms and 6–17% after roof upgrades

- Life insurance carriers include accelerated death benefits during illness to aid

Life and health providers offer living benefits during illness and wellness programs that strengthen long-term stability. Discover results from analyzing 815 insurance companies when you use our free quote tool and enter your ZIP code.

Auto, Life, Home & Health Insurance Findings

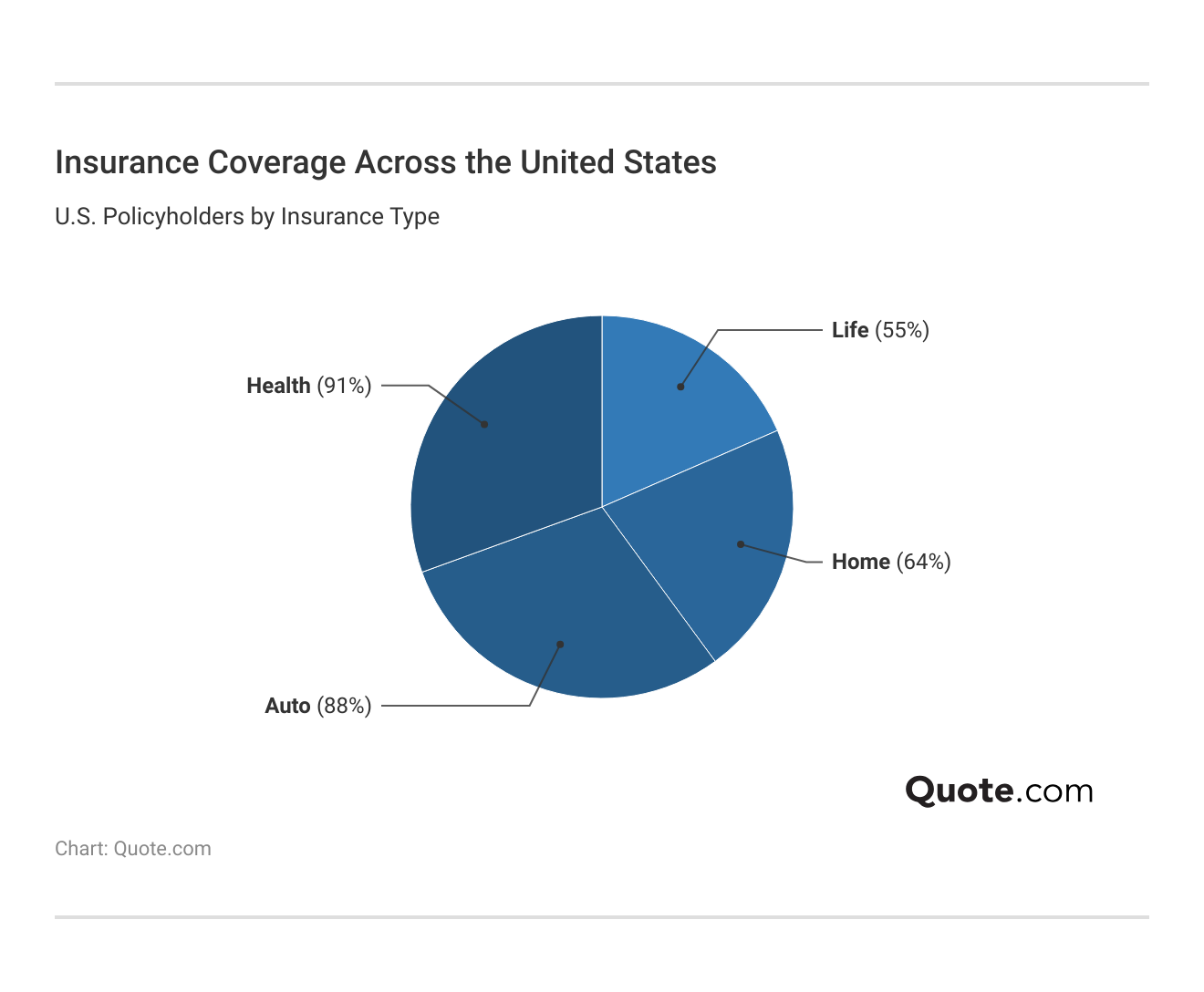

Insurance coverage in the U.S. shows a clear pattern. Our review of 815 insurance companies highlights how households split their policies.

Auto insurance leads at 31%, driven by legal requirements and the daily reliance on cars. Health insurance follows at 30%, reflecting its importance in protecting families from overwhelming medical costs.

Life insurance accounts for 21%, offering support through living benefits and death payouts, while home insurance, at 18%, highlights protection for property and possessions.

These numbers illustrate where families place their priorities, balancing immediate risks with long-term security. Understand how to buy auto insurance with insights on policies that lower costs for multi-vehicle households.

Compare Auto, Life, Home, & Health Insurance Costs by State

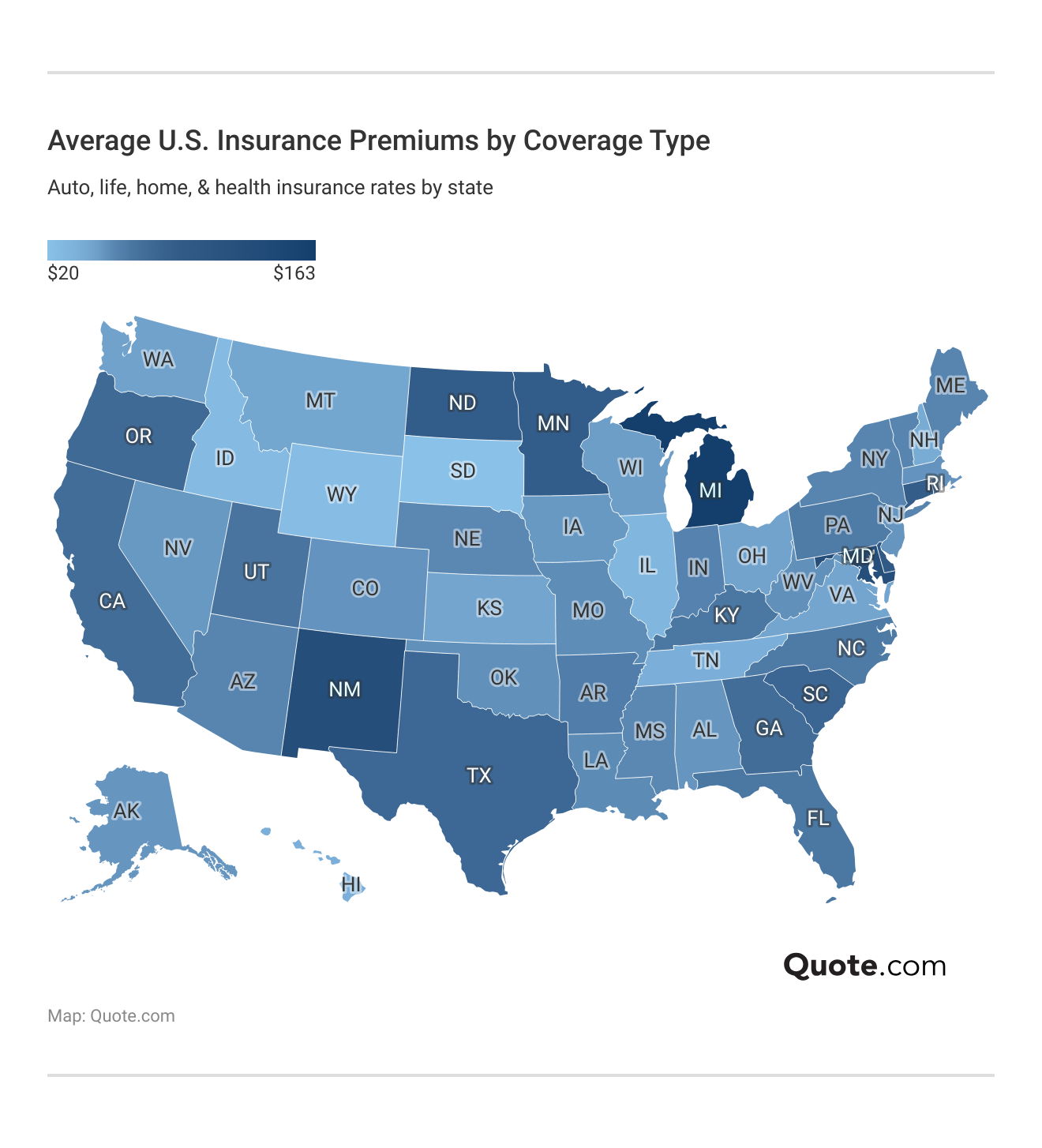

Average insurance premiums shift widely across the country, and what we learned analyzing 815 insurance companies shows how location and coverage type drive the differences.

Auto premiums rise in states like California and Florida, where dense traffic increases accident risk, while health insurance costs run higher in Mississippi and Louisiana due to regional healthcare expenses.

Homeowners in coastal states such as Florida or New Jersey pay more to account for hurricanes and flood exposure, whereas inland states like Nebraska or Kansas hold steadier averages.

Life insurance remains more consistent across states, though factors like age and medical history still influence what policyholders pay.

Read more: Best Car Insurance Companies

Monthly Insurance Premiums by Coverage Type

Average monthly premiums shift across providers, and what we learned analyzing 815 insurance companies shows clear differences by coverage type.

USAA delivers the lowest auto rate at $105, while AIG and Travelers reach $130. Life insurance prices stay tight, from $25 at USAA to $32 at AIG.

Average Monthly Rates by Provider & Insurance Type| Insurance Company | Auto | Life | Health | Home |

|---|---|---|---|---|

| $130 | $32 | $490 | $125 |

| $125 | $30 | $470 | $115 | |

| $110 | $27 | $430 | $100 | |

| $125 | $30 | $470 | $115 |

| $115 | $28 | $440 | $105 | |

| $120 | $28 | $450 | $110 |

| $115 | $28 | $440 | $105 | |

| $120 | $28 | $450 | $110 | |

| $130 | $31 | $480 | $120 | |

| $105 | $25 | $420 | $95 |

Health coverage produces the widest gap, with USAA Insurance at $420 and AIG at $490, reflecting how medical costs create variation.

Home insurance remains steadier, starting at $95 with USAA and climbing to $125 with AIG, showing how property risks still influence pricing.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Report: Rates, Best Companies, & Discounts

Auto insurance costs change noticeably when comparing minimum to full coverage, and what we learned analyzing 815 insurance companies shows how sharply those prices shift.

USAA keeps rates among the lowest, with $32 for minimum and $84 for full coverage, while Liberty Mutual Insurance charges as high as $96 and $248.

Driving history also reshapes premiums, with National General climbing from $86 on a clean record to $234 after a DUI, compared to State Farm’s smaller increase from $47 to $65.

Discounts create another layer of savings, where Liberty Mutual leads with a 35% anti-theft reduction, and Geico matches strong bundling deals at 25%.

Auto Insurance Costs Based on Coverage Amount

Auto insurance monthly premiums vary widely, and what we learned analyzing 815 insurance companies highlights clear gaps between minimum and full coverage.

USAA sets the lowest rates at $32 for minimum and $84 for full, offering significant savings compared to higher-priced carriers.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $43 | $114 | |

| $96 | $248 |

| $86 | $230 | |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

Geico keeps costs affordable with $43 for minimum and $114 for full coverage, while State Farm Insurance stays close at $47 and $123.

Liberty Mutual stands on the high end, charging $96 for minimum and $248 for full, showing how some providers price far above competitors.

Auto Insurance Costs Based on Driving History

Auto insurance rates shift dramatically with driving records, and what we learned analyzing 815 insurance companies makes the differences clear.

USAA posts the lowest costs, with $32 on a clean record and only $58 after a DUI, showing limited penalties compared to others. Our study of 815 companies reveals key findings on cheap auto insurance for high-risk drivers.

Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $86 | $142 | $234 | $112 | |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

State Farm also increases modestly, starting at $47 and rising to $65 after a DUI. National General shows one of the steepest climbs, charging $86 with no violations but spiking to $234 with a DUI, highlighting how high-risk drivers face far higher premiums depending on the insurer.

Top 5 Auto Insurance Providers in the U.S.

The top auto insurers stand apart through customer satisfaction and financial stability, and what we learned analyzing 815 insurance companies makes those differences clear.

USAA takes the lead with a J.D. Power score of 882 out of 1,000 and an A++ financial rating, pairing strength with above-average satisfaction.

5 Best Auto Insurance Companies| Company | ||

|---|---|---|

| Score: 882 / 1,000 Above Avg. Satisfaction | A++ | |

| Score: 710 / 1,000 Avg. Satisfaction | A++ | |

| Score: 692 / 1,000 Below Avg. Satisfaction | A++ | |

| Score: 691 / 1,000 Below Avg. Satisfaction | A+ | |

| Score: 672 / 1,000 Below Avg. Satisfaction | A+ |

State Farm follows with a score of 710 and the same A++ grade, offering solid service and stability. Discover insights about the cheapest car insurance choices from analyzing 815 insurers.

Geico posts 692, Allstate 691, and Progressive 672, all below-average satisfaction scores, yet they maintain strong financial ratings, showing how customer experience and financial strength can diverge across providers.

Save Money With Auto Insurance Discounts

Auto insurance discounts vary widely, and what we learned analyzing 815 insurance companies highlights how providers structure savings around driver behavior and policy choices.

Allstate gives up to 25% for both accident-free records and bundling, making it strong for households with multiple needs.

Top Auto Insurance Discounts by Provider & Savings| Company | Accident- Free | Anti- Theft | Bundling | Defensive Driving | Multi- Vehicle |

|---|---|---|---|---|---|

| 25% | 10% | 25% | 10% | 10% | |

| 25% | 25% | 25% | 5% | 23% |

| 20% | 10% | 20% | 10% | 12 | |

| 22% | 25% | 25% | 15% | 25 | |

| 20% | 35% | 25% | 10% | 25 |

| 20% | 5% | 20% | 10% | 15 |

| 10% | 25% | 10% | 30% | 12 | |

| 17% | 15% | 17% | 15% | 20 | |

| 13% | 15% | 13% | 20% | 8 | |

| 10% | 15% | 10% | 5% | 10 |

Geico also provides 25% bundling savings and 22% for safe drivers, rewarding consistent performance. Liberty Mutual leads in security-focused reductions with a 35% anti-theft insurance discount, while State Farm maintains steady offers such as 17% for accident-free drivers and 20% for multi-vehicle policies.

Travelers and USAA offer smaller percentages, but both still recognize safe habits through defensive driving or vehicle-based discounts.

Home Insurance Report: Rates, Best Companies, & Discounts

Home insurance prices change noticeably with dwelling coverage amounts, and what we learned analyzing 815 insurance companies makes those differences easy to see.

Kemper and Westfield offer some of the lowest monthly options, starting at $72 for $200k in coverage and $111 for $500k, while Union Mutual stays close with $74 and $121.

On the higher side, Cincinnati Insurance rises from $156 to $244, and USAA posts $160 to $234, reflecting the higher costs often tied to larger national carriers. Bundling options from the affordable home insurance companies creates added value by combining auto and home protection under one provider.

Discounts also play a big role, with State Farm giving up to 24% off for claims-free policies and Progressive offering 21% for the same, while USAA adds savings of 23% when paired with home security upgrades.

Home Insurance Costs Based on Coverage Amount

Home insurance premiums shift depending on dwelling coverage, and what we learned analyzing 815 insurance companies highlights how rates climb from $200k to $500k policies.

Kemper and Westfield post the lowest costs at $72 for $200k and $111 for $500k, keeping them highly competitive for budget-conscious homeowners.

Home Insurance Monthly Rates by Dwelling Coverage| Insurance Company | $200k | $300k | $500k |

|---|---|---|---|

| $132 | $167 | $210 |

| $142 | $178 | $223 |

| $156 | $195 | $244 |

| $138 | $171 | $213 |

| $113 | $141 | $177 | |

| $122 | $153 | $191 | |

| $72 | $90 | $111 | |

| $74 | $95 | $121 | |

| $160 | $199 | $234 | |

| $72 | $90 | $111 |

Union Mutual stays close with $74 at $200k and $121 at $500k, while Grange delivers balanced mid-range pricing at $113 and $177 across the same tiers.

At the higher end, Cincinnati Insurance reaches $156 for $200k and $244 for $500k, and USAA posts $160 and $234, showing how larger national providers often carry higher monthly costs at expanded coverage levels.

Learn more: Compare Homeowners Insurance Quotes

Top 5 Home Insurance Providers in the U.S.

Home insurance companies set themselves apart with customer satisfaction scores and savings tied to home security, and what we learned analyzing 815 insurance companies makes those differences clear.

USAA tops the list with a J.D. Power score of 882 out of 1,000 and provides a 20% discount for security upgrades, delivering both reliability and savings to policyholders. Gain clarity by understanding all eight types of homeowners insurance here.

5 Best Home Insurance Companies| Company | Home Security Discount |

|

|---|---|---|

| Score: 882 / 1,000 Above Avg. Satisfaction | 20% | |

| Score: 717 / 1,000 Avg. Satisfaction | 15% |

| Score: 710 / 1,000 Avg. Satisfaction | 15% | |

| Score: 691 / 1,000 Below Avg. Satisfaction | 10% | |

| Score: 684 / 1,000 Below Avg. Satisfaction | 15% |

Liberty Mutual follows with a 717 score and a 15% discount, while State Farm stays close behind at 710 with the same 15% savings, reflecting steady value across larger carriers.

Allstate posts a 691 score and a smaller 10% discount, while Travelers scores 684 but matches Liberty Mutual and State Farm with 15% off, showing how satisfaction and savings do not always align.

Save Money With Home Insurance Discounts

Home insurance discounts reflect how providers reward safe habits and long-term commitments, and what we learned analyzing 815 insurance companies shows which carriers deliver the most value.

State Farm leads with a 24% claims-free discount, 20% for bundling, and 15% for home security savings, giving homeowners several strong incentives.

Top Home Insurance Discounts by Provider & Savings| Company | Bundling | Claims- Free | Green Home | Home Security | Loyalty |

|---|---|---|---|---|---|

| 10% | 22% | 5% | 12% | 10% |

| 20% | 20% | 6% | 10% | 7% | |

| 12% | 18% | 5% | 9% | 7% | |

| 10% | 20% | 7% | 12% | 10% | |

| 10% | 15% | 5% | 8% | 6% | |

| 11% | 18% | 7% | 10% | 9% | |

| 16% | 21% | 6% | 11% | 10% | |

| 20% | 24% | 5% | 15% | 12% | |

| 13% | 16% | 4% | 7% | 8% | |

| 10% | 23% | 6% | 12% | 11% |

USAA follows closely with 23% for claims-free histories and 12% tied to security upgrades, while American Family offers 22% for claims-free policies and 12% for added protection.

Progressive remains competitive with 21% claims-free and 16% bundling discounts, and Chubb distinguishes itself by providing 7% for green home upgrades alongside 20% claims-free savings.

Discover more by reading our guide: Progressive Auto Insurance Review

Life Insurance Report: Rates, Best Companies, & Discounts

Life insurance costs change dramatically between term and whole policies, and what we learned analyzing 815 insurance companies makes those differences clear.

Pacific Life and Protective Life keep 20-year term coverage affordable at $29 a month, while whole life quickly rises, reaching $160 with MassMutual. The best life insurance companies stand out by offering strong health-based discounts and flexible policy options that fit different family needs.

Health status pushes premiums further, with excellent health locking in $29 for term and $135 for whole, but a cancer history increases those numbers to $85 and $340.

Discounts also reshape affordability, as Northwestern Mutual rewards strong family history with 20% savings and good health with 25%, while Guardian Life gives 15% for non-smokers and Protective Life spreads incentives across bundling and lifestyle choices.

Life Insurance Costs Based on Plan Type

Life insurance pricing shifts depending on whether the policy is term or whole, and what we learned analyzing 815 insurance companies shows how much rates can climb between the two.

Bundling life policies with auto or home adds overlooked savings that families miss. Specifically, this increases multi-line protection value.

Michelle Robbins Licensed Insurance Agent

Pacific Life and Protective Life offer the most affordable 20-year term plans at $29 a month, while Mutual of Omaha and Banner Life stay close at $30.

Term vs. Whole Life Insurance Monthly Rates| Insurance Company | 20-Year Term | Whole Life |

|---|---|---|

| $32 | $150 |

| $30 | $140 |

| $35 | $155 | |

| $33 | $145 |

| $38 | $160 | |

| $36 | $155 | |

| $30 | $140 | |

| $29 | $135 | |

| $31 | $140 | |

| $29 | $135 |

AIG lands at $32 and Lincoln Financial at $33, placing them in the mid-range, while Guardian Life and MetLife move higher at $35 and $36.

Whole life premiums sit on a different level, beginning at $135 with Pacific Life and Protective Life, reaching $140 with Banner Life and Mutual of Omaha, and climbing to $160 with MassMutual Insurance, the highest among the group.

Life Insurance Costs Based on Your Health

Life insurance pricing is closely tied to health conditions, and what we learned analyzing 815 insurance companies shows how rates climb with higher risks.

Someone in excellent health pays just $29 a month for a 20-year term policy and $135 for whole life, while moderate health issues increase those figures to $40 and $160.

Life Insurance Monthly Rates by Health Condition| Health Status | 20-Year Term | Whole Life |

|---|---|---|

| Excellent Health | $29 | $135 |

| High Blood Pressure | $42 | $180 |

| Diabetes | $55 | $220 |

| Heart Disease | $70 | $280 |

| Cancer History | $85 | $340 |

| Obesity | $50 | $200 |

| Smoker | $65 | $260 |

| Moderate Health Issues | $40 | $160 |

High blood pressure raises premiums to $42 and $180, and obesity drives them up to $50 and $200. More serious conditions create even steeper costs, with diabetes at $55 and $220, smoking at $65 and $260, heart disease at $70 and $280, and a cancer history leading the chart at $85 for term and $340 for whole life.

Read more: Whole vs. Term Life Insurance

Top 5 Life Insurance Providers in the U.S.

Life insurance carriers rank differently based on satisfaction and medical exam rules, and what we learned analyzing 815 insurance companies highlights where each stands.

MassMutual leads with a J.D. Power score of 741 out of 1,000 and requires a medical exam, while Northwestern Mutual sits close behind at 740 with the same requirement.

5 Best Life Insurance Companies| Company | Medical Exam Required? |

|

|---|---|---|

| Score: 741 / 1,000 Avg. Satisfaction | ✅ | |

| Score: 740 / 1,000 Avg. Satisfaction | ✅ | |

| Score: 710 / 1,000 Avg. Satisfaction | ❌ | |

| Score: 685/ 1,000 Below Avg. Satisfaction | ✅ | |

| Score: 639/ 1,000 Below Avg. Satisfaction | ✅ |

State Farm offers a 710 score and distinguishes itself by not requiring a medical exam, creating a simpler path to coverage. The life insurance guide explores how discounts tied to good health and non-smoker status reduce overall costs.

Guardian Life records a 685 score with exams required, and New York Life falls lower at 639 with the same requirement, showing how consumer satisfaction does not always align with established reputations.

Save Money With Life Insurance Discounts

Life insurance providers structure discounts around health and lifestyle, and what we learned analyzing 815 insurance companies shows how savings can differ widely.

Northwestern Mutual leads the way with 25% off for good health and 20% tied to strong family history, offering the largest combined reductions.

Top Life Insurance Discounts by Provider & Savings| Company | Bundling | Family History | Good Health | Healthy Lifestyle | Non- Smoker |

|---|---|---|---|---|---|

| 5% | 15% | 10% | 5% | 10% |

| 5% | 10% | 12% | 7% | 12% |

| 7% | 10% | 12% | 6% | 8% |

| 5% | 10% | 13% | 7% | 8% | |

| 8% | 10% | 10% | 7% | 12% | |

| 5% | 12% | 15% | 10% | 15% | |

| 5% | 7% | 10% | 10% | 10% | |

| 4% | 20% | 25% | 7% | 10% | |

| 15% | 18% | 14% | 12% | 15% |

| 5% | 10% | 12% | 7% | 10% |

Guardian Life comes in strong with 15% discounts for both good health and being a non-smoker, offering real savings to people who stick with habits that lower long-term risk.

Protective Life spreads its rewards across several areas, offering 15% off for bundling policies and up to 18% for a strong family health history. Geico steps in with a 12% break for non-smokers, while Erie matches that same 12% for good health.

Read more: Average Cost of Life Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Health Insurance Report: Rates, Best Companies, & Discounts

Health insurance costs climb as coverage levels increase, and what we learned analyzing 815 insurance companies shows just how much those differences matter.

Molina offers the lowest entry point at $300 for Bronze and $560 for Platinum, while Oscar rises to $340 and $600 at the upper end.

Tobacco use pushes rates higher across every tier, with Platinum plans moving from $580 for non-smokers to $650 for smokers. The complete guide to health insurance explains how premiums shift across Bronze to Platinum tiers and what that means for affordability.

Provider comparisons also stand out, with BlueCross BlueShield earning the highest satisfaction score at 985 and a $7,500 Bronze deductible, while Humana delivers the lowest deductible at $6,800 but falls behind in satisfaction.

Health Insurance Costs Based on Coverage Tier

Health insurance costs rise with each coverage tier, and what we learned analyzing 815 insurance companies makes the differences clear from Bronze through Platinum.

Molina posts the most affordable entry point at $300 for Bronze and $560 for Platinum, while HealthNet follows closely with $305 and $565.

Health Insurance Monthly Rates by Coverage Tier| Company | Bronze | Silver | Gold | Platinum |

|---|---|---|---|---|

| $320 | $410 | $490 | $580 | |

| $320 | $410 | $490 | $580 | |

| $310 | $400 | $480 | $570 | |

| $330 | $420 | $500 | $590 |

| $305 | $395 | $475 | $565 |

| $325 | $415 | $495 | $585 |

| $315 | $405 | $485 | $575 |

| $300 | $390 | $470 | $560 |

| $340 | $430 | $510 | $600 | |

| $335 | $425 | $505 | $595 |

BlueCross BlueShield stays competitive at $310 and $570, making it one of the steadier options across tiers. Exploring how to finance what your health insurance won’t cover helps households manage unexpected medical expenses with strategies that ease long-term financial strain.

On the higher side, Oscar reaches $340 for Bronze and $600 for Platinum, while UnitedHealthcare charges $335 and $595, showing how top carriers set the highest premiums at the upper tier.

Health Insurance Costs Based on Tobacco Use

Health insurance premiums rise across every tier when tobacco use is factored in, and what we learned analyzing 815 insurance companies makes the differences clear.

Bronze coverage costs $320 for non-smokers but increases to $380 for smokers, while Silver rates move from $410 to $470. Comparing plans and getting an insurance plan that works for you reveals strategies to combine discounts, coverage levels, and provider strengths effectively.

Health Insurance Monthly Rates by Tobacco Use| Coverage Tier | Smoker | Non-Smoker |

|---|---|---|

| Bronze | $380 | $320 |

| Silver | $470 | $410 |

| Gold | $560 | $490 |

| Platinum | $650 | $580 |

Gold plans continue the climb at $490 for non-smokers and $560 for smokers. Platinum reaches the highest levels, with $580 for non-smokers and $650 for smokers, showing how smoking consistently raises monthly costs at every coverage level.

Top 5 Health Insurance Providers in the U.S.

The top 5 health insurance companies in the U.S differ sharply in satisfaction and deductibles, and what we learned analyzing 815 insurance companies shows which carriers excel.

BlueCross BlueShield leads with a J.D. Power score of 985 and a Bronze deductible of $7,500, while Cigna follows closely at 982 with a slightly lower $7,000 deductible.

5 Best Health Insurance Companies| Company | Bronze Deductible |

|

|---|---|---|

| Score: 985 / 1000 Excellent Satisfaction | $7,500 | |

| Score: 982 / 1,000 Excellent Satisfaction | $7,000 |

| Score: 835 / 1,000 Above Avg. Satisfaction | $7,200 | |

| Score: 835 / 1,000 Above Avg. Satisfaction | $7,100 | |

| Score: 643 / 1,000 Below Avg. Satisfaction | $6,800 |

UnitedHealthcare and Aetna Insurance both land at 835, with deductibles of $7,200 and $7,100, placing them in the competitive midrange.

Humana trails with a 643 score, but it posts the lowest Bronze deductible at $6,800, highlighting a trade-off between lower upfront costs and overall customer experience.

Save Money With Health Insurance Discounts

Health insurance discounts differ across providers, and what we learned analyzing 815 insurance companies highlights how bundling, preventive care, and retiree perks shape savings.

Progressive leads with 15% off for bundling, giving households the largest break when combining policies. Nationwide Insurance offers 12% for bundling, alongside 10% for preventive care visits and 7% for retirees, creating strong value across multiple categories.

Top Health Insurance Discounts by Provider & Savings| Insurance Company | Bundling | Healthy Lifestyle | Loyalty | Preventive Care | Retiree |

|---|---|---|---|---|---|

| 10% | 5% | 5% | 10% | 5% | |

| 12% | 8% | 6% | 10% | 7% |

| 10% | 6% | 5% | 9% | 6% |

| 11% | 7% | 6% | 9% | 6% | |

| 10% | 5% | 5% | 8% | 6% |

| 12% | 7% | 6% | 10% | 7% | |

| 15% | 5% | 5% | 8% | 5% | |

| 10% | 6% | 5% | 9% | 6% | |

| 10% | 5% | 5% | 8% | 7% |

| 11% | 6% | 5% | 8% | 5% |

Erie delivers steady savings with 11% bundling and 7% tied to healthy lifestyles, while Allstate balances its incentives with 10% off for bundling and preventive care.

The Hartford and Liberty Mutual remain closer to average with 10% bundling, while Travelers adds 11% bundling but limits retiree discounts to 5%.

Our Recommendations After Analyzing 815 Insurance Companies

The review of 815 insurance companies highlights how insurers structure value differently across auto, home, life, and health coverage.

Auto carriers stand out with features like accident forgiveness and strong multi-vehicle savings, while home providers reward upgrades such as new roofs or security systems. Cheap multi-vehicle auto insurance allows families to cut costs by insuring several cars under one policy with added bunding savings.

Our review confirms loyalty perks apply across auto, home, life, and health. In particular, long-term clients earn the deepest rewards.

Jeff Root Licensed Insurance Agent

Life insurers adjust pricing heavily based on health conditions, with favorable rates for those in excellent health and steep increases tied to smoking or chronic illness.

Health coverage reveals clear differences in satisfaction and deductibles, showing how provider choice directly affects both access and affordability. Understand how analyzing 815 insurance companies highlights top providers and affordable options by using our free comparison tool today.

Frequently Asked Questions

What is the most important measure to understand if an insurance company’s operations are profitable?

The most important measure is the combined ratio, which compares claims and expenses to premium income. A ratio under 100% means the company is operating profitably from underwriting activities. Understand how to file an auto insurance claim with tips that ensure accuracy.

Why is it important to understand that insurance is a financial product?

It is important because insurance involves risk transfer and financial protection, where premiums paid today secure coverage for future losses, making it essential to evaluate policies like any other financial investment.

What are four things that insurance companies evaluate before giving you a price quote?

Insurance companies evaluate age, location, type of coverage requested, and risk factors such as driving history or health status before providing a monthly quote. Compare coverage options by analyzing 815 insurance companies by entering your ZIP code into our free quote comparison tool.

What is a good claims loss ratio?

A good claims loss ratio typically falls between 60 and 70%, showing that most premium income is used for paying claims while leaving enough to cover operating costs.

What does CR mean in insurance?

CR in insurance refers to the combined ratio, which measures underwriting profitability by adding the loss ratio and expense ratio together. A CR below 100% indicates profit. Learn how to compare auto insurance companies by checking the combined ratio for profit.

What is the simplest way to explain insurance?

Insurance is a financial agreement where a person pays monthly premiums to transfer potential risks to an insurer, ensuring financial protection against future losses.

What are the 7 types of insurance?

The seven common types are auto, home, health, life, renters, disability, and liability insurance, each offering protection for specific risks.

What is the best age to get life insurance?

The best age to get life insurance is in the 20s or 30s, when premiums are lower due to better health and reduced risk factors.

What type of insurance is the most important?

Health insurance is considered the most important because it prevents medical expenses from creating unmanageable financial burdens. Learn how much Medicare costs and see how premiums vary by coverage choices and income levels.

What is the most important factor in an insurance company’s decision on the price you pay for homeowners insurance?

The most important factor is the location of the property, as risks such as crime rates, weather hazards, and proximity to fire protection services directly affect monthly premiums.

How much is homeowners insurance on a $500,000 house?

What are the 5Ps of insurance?

How does Esurance vs MetLife compare for insurance coverage?

What do Progressive home insurance reviews commonly mention?

Why is it important to evaluate the insurance company on quotes?

How does Erie vs Liberty Mutual compare for auto and home coverage?

What is included with AARP homeowners insurance?

What does Amica insurance in Utah provide?

What is the Allstate risk avoidance discount?

How does Liberty Mutual vs MetLife compare for insurance coverage?

How does Liberty Mutual vs Erie differ in homeowners insurance?

What does AIG life insurance offer?

What do Amica Mutual Insurance reviews highlight?

Does Esurance do renters insurance?

What does Esurance’s leaving California mean for National General?

What do automobile insurance companies provide?

What is the best home and auto insurance bundle?

What is the best insurance for a 19-year-old female?

Do I need renters insurance for an apartment?

How many auto insurance companies are there?

How many health insurance companies are in the US?

How many insurance companies are there in the US?

What is the best insurance for a 23-year-old female?

What is an independent insurance adjuster?

Is it cheaper to put two cars on one policy?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.