Cigna Health Insurance Review for 2026

Our Cigna health insurance review shows plans starting at $275 per month, with preventive visits often covered in full when you stay in-network. Members can save up to 15% through Cigna’s wellness rewards program, and lump-sum cancer insurance adds extra financial support when it’s needed most.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated September 2025

Our Cigna health insurance review shows plans starting at $275 per month, although coverage is currently available in only 12 states.

Cigna Health Insurance Rating| Rating Criteria |  |

|---|---|

| Overall Score | 3.7 |

| Business Reviews | 3.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.5 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 4.5 |

| Discounts Available | 3.1 |

| Insurance Cost | 3.3 |

| Plan Personalization | 4.5 |

| Policy Options | 4.0 |

| Savings Potential | 3.2 |

Cigna Healthcare assists members abroad with international plans that provide coverage for medical needs overseas. Seniors can also choose Medicare Advantage options.

Families facing severe conditions like cancer or heart disease can rely on supplemental insurance for added financial support.

- Cigna health insurance review shows strong supplemental insurance options

- Cigna Healthcare wellness rewards can lower premiums up to 15%

- Cigna health insurance review highlights international coverage for members

If you’re interested in lowering monthly costs or seeing how Cigna compares with other providers, simply use our free comparison tool now.

Cigna Health Insurance Review

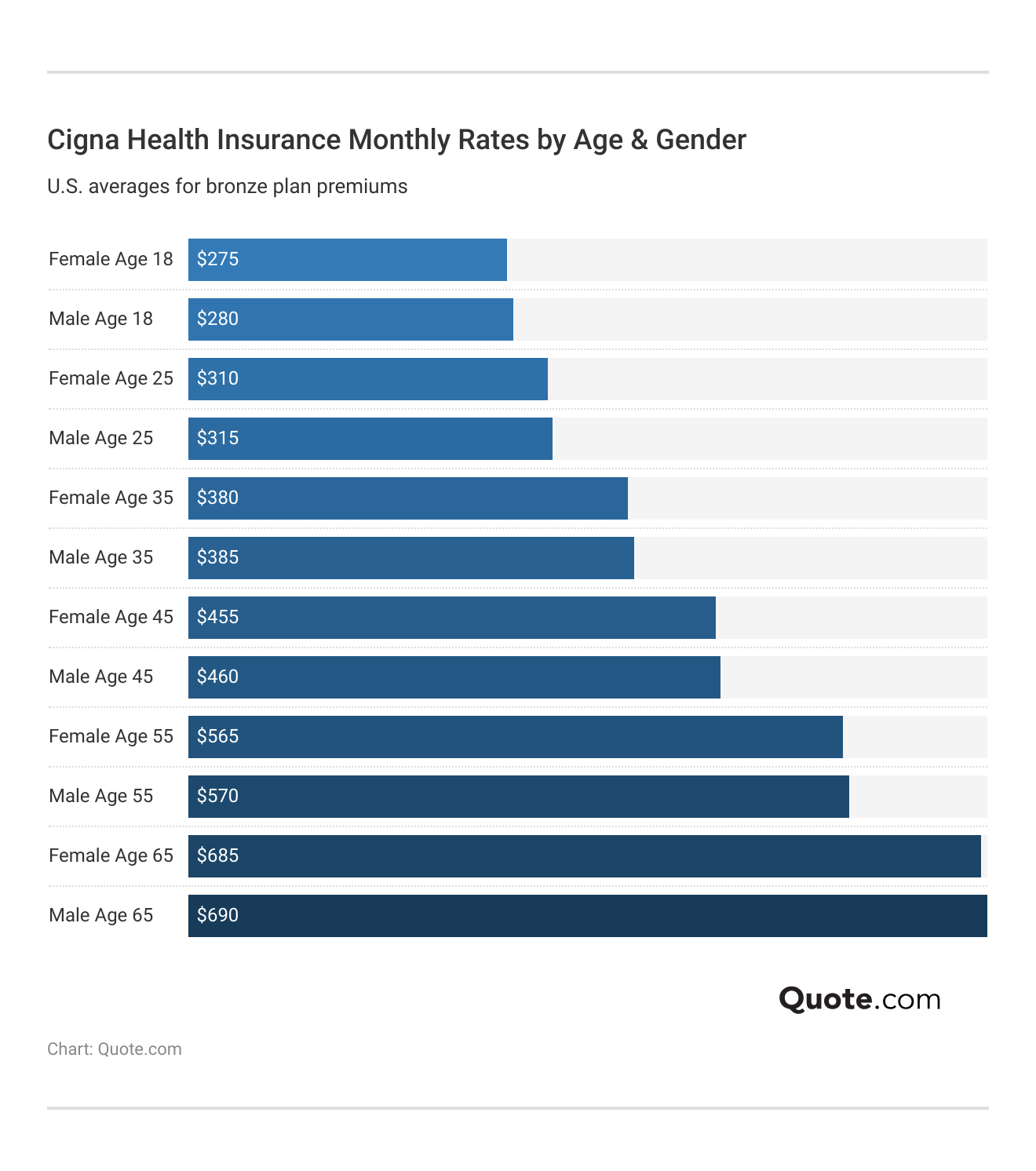

Cigna has over 200 years of history, making it a trusted name in health coverage, with plans designed to fit every stage of life—from early careers to Medicare. Since premiums rise as you age, choosing the right tier helps keep things manageable, and many seniors appreciate that Cigna includes gastroenterologists who accept Medicare for added peace of mind.

Cigna Health Insurance Cost

With Cigna, your costs usually come from three areas: copays, deductibles, and premiums. Each one plays a different role in how much you spend over the year.

At $275 a month, coverage for young adults remains relatively affordable, which is particularly important for students and those early in their careers. By the mid-30s, costs push closer to $380, often adding to the weight of mortgages, childcare, or family expenses.

Premiums over $565 in the 50s remind households that health risks start carrying a bigger price tag. Rates approaching $690, near 65, show why many older adults turn to Medicare Advantage or supplemental plans to help manage costs, often guided by Cigna supplemental insurance reviews that highlight which add-ons provide the most value.

Once premiums rise past $380 in your 30s, families should look at Silver plans for predictable coverage on checkups and prescriptions.

Michelle Robbins Licensed Insurance Agent

While age shifts the cost of coverage, plan choice can make just as big a difference. Our Cigna insurance review highlights how the bronze, silver, and gold tiers each serve a distinct purpose, and understanding these differences helps buyers match coverage with their life stage.

Cigna vs. Top Competitors: Health Insurance Monthly Rates by Tier| Insurance Company | Bronze Plan | Silver Plan | Gold Plan |

|---|---|---|---|

| $445 | $530 | $610 | |

| $470 | $555 | $635 | |

| $430 | $505 | $585 | |

| $460 | $540 | $620 |

| $455 | $525 | $600 |

| $465 | $550 | $640 | |

| $475 | $560 | $645 |

| $440 | $510 | $595 |

| $450 | $520 | $605 | |

| $480 | $570 | $655 |

Bronze plans tend to be suitable for younger adults who want to keep premiums low and don’t visit the doctor frequently. Silver plans strike a balance, providing families with more predictable coverage when regular care or check-ups are part of their routine.

Gold plans come with higher monthly payments, but they help people who manage prescriptions or chronic conditions avoid the stress of enormous out-of-pocket costs.

Cigna health insurance review data also shows how lifestyle choices shape what members pay, with smoking creating one of the most significant cost gaps. These added costs don’t just appear on monthly statements — they affect how families plan, budget, and even decide which benefits they can keep.

Cigna Health Insurance Monthly Rates: Smoker vs. Non-Smoker| Coverage Type | Smoker | Non-Smoker |

|---|---|---|

| ACA Individual Health | $492 | $410 |

| Short‑Term Health | $216 | $180 |

| Employer Group Plan | $192 | $160 |

| Critical Illness Coverage | $36 | $30 |

For ACA individual coverage, smokers face nearly $1,000 more in yearly costs compared to non-smokers, an increase that can quickly overwhelm households already balancing tight budgets.

Short-term plans also carry higher rates for smokers, limiting their usefulness as an affordable safety net. Even employer and critical illness coverage reflect this gap, showing why a complete guide to health insurance should consider both lifestyle choices and long-term costs.

Cigna Copay, Deductible, & Premium Breakdown| Category | Copay | Deductible | Premium |

|---|---|---|---|

| Definition | A fixed dollar amount you pay for a covered service or prescription | The amount you pay out-of-pocket before your insurance kicks in | A monthly amount you pay to maintain coverage |

| When Charged | At the time of service or prescription refill | Paid before most benefits begin; resets annually | Monthly, regardless of whether you use services |

| Medicare Parts | Part C (Medicare Advantage), Part D (Prescription Drug Plans) | Part A, B, C, and D, depending on the plan | Part A (if applicable), B, C, and D |

| Typical Cost | $10–$50 per visit or prescription | $0–$2,000 annually | $0 Part A for most to several hundred dollars per month for others |

| Cost Predictability | More predictable; set amount regardless of service price | Less predictable; depends on total yearly usage | Predictable monthly expense |

| Varies by Plan | Yes, based on provider and service | Yes, higher-deductible plans typically have lower premiums | Yes, based on coverage level, region, and age |

A copay—usually $10 to $50 for a doctor visit or prescription—is one of the easiest costs to plan for. If you’re filling a $25 prescription every month, including those covered under Medicare Part D, you already know what it’s going to cost you. Deductibles work differently.

They can run anywhere from $0 to $2,000 a year and kick in when bigger bills come up. So if you need a $5,000 surgery, you’d have to pay the first $2,000 before your insurance steps in.

Then there’s the premium, which ranges from $0 for Part A with work credits to several hundred dollars per month, keeping your plan active. Lower premiums work well if you rarely need care, while higher premiums often save money for those managing ongoing conditions.

While premiums keep your plan active, it’s copays and deductibles that really decide what you’ll pay when you use care. Cigna’s numbers vary depending on the service, and these differences can have a significant impact. A primary care visit costs $25, with the deductible waived, making routine checkups more affordable.

Cigna Health Insurance Copays and Deductibles| Service | Copay | Deductible |

|---|---|---|

| Primary Care Visit | $25 | Waived after deductible |

| Specialist Visit | $45 | Applies before copay |

| Urgent Care | $60 | Applies before copay |

| Emergency Room | $300 | Deductible applies |

| Generic Prescription | $15 | No deductible |

| Brand-Name Prescription | $35 | Applies depending on tier |

| Hospital Stay | $500 | Deductible + coinsurance |

| Outpatient Surgery | $120 | Deductible applies |

| Mental Health Visit | $40 | Post-deductible |

| Annual Physical | $0 | No deductible (preventive care) |

A specialist visit is $45, but this fee applies after you’ve met your deductible—something that matters if you need regular appointments. Urgent care visits cost $60 and also count toward the deductible, so even minor issues can add up if you haven’t met the deductible yet. The emergency room runs $300 plus the deductible, making it one of the steepest bills for families.

Prescriptions show the clearest gap: generics stay at $15 with no deductible, while brand-name drugs start at $35. Preventive care, such as annual physicals at $0, is covered in full, providing you with at least one predictable, cost-free benefit each year.

Cigna Health Insurance Coverage

Cigna offers health insurance that can fit into just about any stage of life. You might be buying your own plan, getting coverage through work, enrolling in Medicare, or even living abroad — and there’s an option for all of it. Each plan covers the everyday basics and provides backup for larger health needs when they arise.

- ACA Marketplace Plans: These plans encompass the 10 essential health benefits, including checkups, hospital care, prescription drugs, maternity care, and mental health services. If you qualify, subsidies can help bring down your monthly costs.

- Employer-Sponsored Plans: Coverage through work typically bundles medical, pharmacy, and behavioral health benefits. Many plans also offer telehealth visits, wellness programs, and lower rates through your employer’s group pricing.

- Medicare Advantage (Part C): A one-stop option for seniors that covers hospital, medical, and prescription. Most plans also include dental, vision, hearing, and sometimes fitness benefits.

- Medicare Supplement (Medigap): These plans help cover what Medicare skips, like deductibles, coinsurance, and copays. Plan G and Plan N are solid picks, and in some states you can even get household discounts.

- International Health Plans: Ideal for expats or frequent travelers, these plans provide coverage for routine care, hospital stays, and emergency evacuations abroad, with access to Cigna’s global network in over 200 countries.

Cigna’s coverage goes beyond just doctor visits. From ACA plans and employer coverage to Medicare and global protection, plus add-ons like dental and supplemental insurance, it gives you the flexibility to put together a plan that actually fits your life with help from an expert guide to Medicare.

When it comes to Medicare, Cigna gives members more than just the basics. You can choose from HMO, PPO, MAPD, PDP, Medigap, or SNP plans, depending on whether you want extra flexibility, bundled drug coverage, or help filling gaps left by Original Medicare. Many Cigna Medicare plan reviews point to this variety as a big plus, since it lets seniors tailor their coverage to what they really need.

Cigna Medicare Plans: Full Breakdown & Benefits| Feature | Details |

|---|---|

| Plan Types | HMO, PPO, MAPD, PDP, Medigap, SNPs |

| Coverage | Hospital, medical, prescription drug coverage |

| Dental/Vision/Hearing | Included in most Advantage plans |

| Preventive Services | Routine checkups often fully covered |

| Out-of-Pocket Limit | Annual maximum on member spending |

| Worldwide Emergency Care | Offers emergency coverage abroad |

| Fitness & Wellness | Includes SilverSneakers® gym access |

| Telehealth | Virtual care via phone and video |

| DME Support | Durable medical equipment covered |

| OTC Benefits | Over-the-counter allowances provided |

Core benefits cover hospital stays through Medicare Part A, along with doctor visits and prescriptions, and a lot of Advantage plans go further by adding dental, vision, and hearing—things Original Medicare doesn’t usually cover. Preventive care like yearly checkups and screenings is often free, and every plan has an out-of-pocket cap so your costs don’t get out of hand.

For frequent travelers, worldwide emergency coverage adds peace of mind. On top of that, perks like SilverSneakers® gym memberships, telehealth visits, durable medical equipment, and OTC allowances help make daily care more affordable and convenient.

Cigna Health Insurance Discounts

Cigna helps members save money on everyday wellness needs through its Healthy Rewards® program and partner perks. These deals aren’t just nice extras—they’re things people actually use, like gyms, meal plans, and vision care, which often come up in positive mentions across Cigna insurance reviews.

- Healthy Rewards Savings: Get up to 25% off acupuncture, chiropractic visits, massage therapy, hearing aids, and even certain weight management programs.

- Active&Fit Direct™: For around $25 a month plus a small enrollment fee, you can use more than 10,000 gyms nationwide, from big chains to local studios.

- Meal Delivery Discounts: Members save on home-delivered meals designed for heart health, diabetes management, or weight loss, and some services even throw in free shipping.

- Wearables & Online Workouts: Discounts are available on Fitbit and Garmin devices, along with reduced rates for online fitness programs, such as Daily Burn.

- Vision & Hearing Discounts: Members can cut costs on eye exams, glasses, LASIK, and hearing aids, with some services offering up to 20% off regular prices.

These perks make it easier to stay healthy without incurring excessive costs. From staying active to eating better or saving on glasses and hearing care, Cigna provides members with practical ways to make their healthcare dollars go further and finance what their health insurance doesn’t cover.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cigna Dental Insurance Review

Cigna offers options that range from simple preventive coverage to more complete protection for major work, so you can pick what actually fits your needs and budget. It’s kind of like shopping around for life insurance quotes — finding the right match upfront saves you money and gives you peace of mind down the road.

Cigna Dental Insurance Cost

Cigna’s dental plans show how even a slight difference in your monthly payment can change the coverage you get and the protection you have against bigger dental costs. Moving from Bronze to Gold is less about spending more and more and more about the peace of mind that comes with higher limits and added services.

Cigna Dental Insurance Monthly Rates by Coverage Tier| Plan | Premium | What's Covered | Annual Limit |

|---|---|---|---|

| Bronze | $19 | Preventive Only (Cleanings, Exams) | $1,000 |

| Silver | $29 | Preventive + Basic (Fillings, X-rays) | $1,500 |

| Gold | $39 | Preventive + Basic + Major (Crowns, Root Canals) | $2,000 |

The Bronze plan is $19 a month with a $1,000 yearly limit. It works well if you only need routine cleanings and exams, but it leaves little room for unexpected dental work. The Silver plan costs $29 a month and raises the yearly limit to $1,500, while also covering fillings and X-rays.

Dental costs rise as you age, so moving from Bronze to Gold coverage can protect against the financial hit of big-ticket procedures.

Jeff Root Licensed Insurance Agent

That extra coverage really comes in handy if you ever need more than basic checkups. The Gold plan is $39 a month with a $2,000 yearly cap, and it covers big-ticket procedures like crowns and root canals—protection that can easily save you hundreds when major dental work pops up, much like what you’d see highlighted in a review of ObamaCare when comparing plan tiers and coverage trade-offs.

Cigna Dental Insurance Coverage

Cigna offers a range of dental plans, enabling you to select one that best suits your needs and budget. Some focus solely on routine checkups, while others provide additional protection in case major dental work is required.

- Preventive-Only (Bronze): About $20 a month, this one covers cleanings, exams, and routine X-rays with a $1,000 yearly cap. A good pick if you mostly just need the basics.

- High Benefit 1000–3000: Covers preventive care and basic services like fillings, with a $100 deductible and annual limits between $1,000 and $3,000. It works well if you expect a little more than just checkups.

- Gold Plan (Major Services): For around $39 a month, this plan provides coverage for major services, including crowns and root canals, with a yearly cap of $2,000. A safer bet if you want protection against bigger bills.

- Dental + Vision + Hearing Bundle: For about $32 a month, you get dental coverage up to $2,500, plus vision up to $300 and hearing up to $700. Handy if you’d rather have everything in one package.

- Cigna Dental Care DHMO: A network-based plan with no deductibles or annual maximums. You’ll need to stick with in-network dentists and get referrals for specialists, but most preventive visits don’t cost you anything.

All in all, Cigna’s plans give you choices—from basic coverage to more complete options—so you can find one that makes sense for your lifestyle and budget.

Cigna offers you the choice between DPPO, DHMO, and Indemnity plans, allowing you to select the option that best suits your needs, whether you prefer flexibility with dentists or lower, more predictable costs. Across all plans, preventive care, including cleanings, exams, and X-rays, is covered at 100% in-network, so you can handle the basics without worrying about unexpected bills.

Cigna Dental Insurance: Full Breakdown & Benefits| Feature | Details |

|---|---|

| Plan Type | DPPO, DHMO, Indemnity options available |

| Coverage Areas | Nationwide network, varies by plan |

| Preventive Services | 100% in-network (cleanings, exams, X-rays) |

| Basic Services | Fillings, extractions, root canals, emergencies |

| Major Services | Crowns, bridges, dentures, implants covered |

| Orthodontics | Select plans, lifetime limits apply |

| Annual Maximum | $1,000–$3,000 per member yearly |

| Deductible | $50–$100 individual, varies by plan |

| Waiting Period | None preventive, 6–12 months others |

| Network Size | 89,000+ dentists, 300,000+ locations |

| Extras | App tools, 24/7 support, discounts |

For basic care like fillings, extractions, or root canals, coverage starts after a $50–$100 deductible. If you need major work such as crowns, bridges, dentures, or implants, those are included too, but many plans require a 6–12 month waiting period before benefits apply. Some even add orthodontic coverage with lifetime limits, which is a big plus for families and for those preparing to sign up for Medicare.

With annual maximums between $1,000 and $3,000 and a network of more than 89,000 dentists nationwide, Cigna makes it simple to find care when you need it, plus you get handy extras like 24/7 support, mobile tools, and built-in discounts.

Cigna Dental Insurance Discounts

Cigna offers several smart ways to help you save on dental care, whether you’re maintaining regular checkups or planning for a more significant procedure. These discounts aren’t insurance, but they can take a lot of pressure off your budget.

- Cigna Dental Savings® Program: Save up to 40% on cleanings, exams, and fillings, with no waiting period or yearly limits. You get the discount as soon as you sign up.

- CIGNAPlus Savings: Around $135 a year for individuals or $180 for families. It connects you to over 110,000 dentists nationwide, offering average savings of 15–40% per visit.

- Healthy Rewards®: Gives up to 25% off extras like vision, hearing aids, fitness, nutrition programs, and chiropractic care. It’s automatically included with most Cigna plans.In-Network

- In-Network Discounts: Choosing from Cigna’s 89,000+ in-network dentists usually saves you 15–30% on services, even before deductibles apply.

These options make dental care more affordable without cutting corners, whether you want simple savings on routine visits or extra help with bigger treatments once you’re eligible for Medicare.

Cigna Vision Insurance Review

Taking care of your eyes goes beyond just getting a new pair of glasses—it’s about keeping care affordable as your needs change. Cigna’s vision plans help cut costs on exams, contacts, and even LASIK, while giving you options that fit different lifestyles.

Much like choosing a life insurance beneficiary offers peace of mind for the future, picking the right vision plan gives you the same kind of reassurance when it comes to your eye health.

Cigna Vision Insurance Coverage

Cigna’s vision insurance is built to make eye care more affordable, from routine exams to the bigger costs that come with glasses, contacts, or even LASIK. It’s all about giving you coverage where it really counts and keeping your eyes healthy, since knowing how the human eye works is only part of the picture—regular care makes the difference.

Cigna Vision Insurance: Full Breakdown & Benefits| Feature | Details |

|---|---|

| Plan Types | Vision PPO, Indemnity, Discount options |

| Coverage Areas | Exams, frames, lenses, contacts included |

| Preventive Services | Comprehensive eye exams with copay |

| Eyewear Allowance | Frames, lenses, contacts via allowance |

| Network Type | Private practices and retail chains |

| Out-of-Network | Pay full, submit claim for reimbursement |

| Additional Perks | LASIK discounts, wellness vision add-ons |

You can choose from Vision PPO, Indemnity, or discount plans, depending on the level of flexibility you prefer. Eye exams typically come with a small copay, making it easy and affordable to keep up with regular checkups. Most plans also include an allowance for frames, lenses, or contacts, often reducing your costs by $150 or more.

You can use your benefits at private practices or retail chains, and if you go out-of-network, you can still submit a claim to receive some reimbursement. On top of that, extras like LASIK discounts can take hundreds off corrective surgery, giving members another way to save long term.

Cigna Vision Insurance Discounts

Eye care isn’t cheap, but Cigna helps alleviate some of the costs with built-in savings. Whether you need a routine exam, a new pair of glasses, or even LASIK, there are ways to spend less.

- In-Network Material Savings: When you go to a Cigna Vision Network provider, you’ll save at least 20% on frames and lenses after your allowance.

- Low Copays for Exams: Eye exams usually only require a small copay, so you can keep up with checkups without worrying about a surprise bill.

- Plan Options That Fit: With PPO, Indemnity, and Discount plans, you can choose the level of flexibility that suits you while keeping costs down.

- Healthy Rewards Discounts: Members receive up to 25% off eyewear, eye exams, and even LASIK through this program, making extras more affordable.

- Quick Out-of-Network Reimbursements: If you go out of network, Cigna usually processes claims within 10 business days, so you’re not waiting forever to get paid back.

These perks make it easier to manage vision care without stretching your budget. By sticking with in-network providers, using Healthy Rewards, and knowing when Medicaid benefits may apply, you can maintain your eye health while keeping costs under control.

How to Save on Cigna Healthcare Insurance

You don’t have to rely on discounts to save with Cigna. The way you use the plan can make just as much of a difference in how much you ultimately pay. Comparing plans and selecting an insurance plan that works for you is also key, as choosing the right coverage upfront helps you avoid unnecessary costs later. Reading Cigna reviews can also give you a better idea of how other members manage their costs.

- Stick With In-Network Providers: Visiting doctors, specialists, and hospitals in Cigna’s network usually means lower bills thanks to pre-negotiated rates.

- Utilize Preventive Care Benefits: Annual checkups, screenings, and vaccines are fully covered, helping you avoid more significant medical expenses later on.

- Try Virtual Care: MDLIVE telehealth visits often cost less than urgent care or the ER, making it an easy way to handle everyday health issues.

- Choose 90-Day Refills: Using Cigna’s home delivery pharmacy can help reduce copays and save you from making extra trips to the pharmacy.

- Look for Value-Based Care: Providers who focus on long-term health management can help reduce the need for costly hospital visits.

The bottom line is that saving with Cigna comes down to making smart choices with the coverage you already have. By utilizing the network, taking advantage of preventive care, and managing prescriptions effectively, you can keep your healthcare costs under control.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to File an Insurance Claim With Cigna

If you’re seeing an in-network provider, chances are you won’t need to file a claim at all—Cigna usually handles it directly with your doctor or hospital. That covers most HMO, PPO, and EPO plans. The only time you might need to step in is if you’re on an indemnity plan.

For health insurance claims you need to handle yourself, the process is straightforward. Just download the claim form, follow the instructions, and send it in with your original bill to the Cigna Healthcare Claims office.

Disability claims take one extra step. You’ll first decide if it’s short-term or long-term, then complete the proper claim form plus a Physician’s Statement. Once that’s done, you can either mail or fax everything to Cigna Disability Management Solutions at 800.642.8553. Many people also look at Cigna disability insurance reviews to get a better sense of how the process works in real situations and what to expect with approval times.

Life insurance claims start online, where you’ll find Cigna’s fraud guidelines for your state. From there, you can file life, accidental death, or waiver claims online, by fax, or through the mail. And suppose you’re already looking at Cigna life insurance quotes. Checking Cigna life insurance reviews can show how others experienced the claims process, and the Life Department is available at 1-800-238-2125 to help with questions.

How to Cancel Your Cigna Insurance Policy

There are plenty of reasons you might decide to cancel your Cigna plan—maybe the cost no longer works for your budget, or you’re moving onto coverage through work or Medicare. Whatever the case, it’s best to cancel the right way instead of just stopping payments, since missed premiums can affect your credit.

- Write a Cancellation Notice: Send Cigna a signed letter by mail or fax, or call the department that manages your policy to request cancellation.

- Understand When It Takes Effect: Cigna processes cancellations on the first of the month after receiving your request, so line it up with your next coverage start date.

- Have Backup Coverage: Dropping a plan without something like employer coverage, Medicare Part B, or another qualifying option could leave you with penalties and big out-of-pocket costs.

- Check Enrollment Rules: Unless you qualify for a life event, such as marriage or job loss, you may need to wait for the next Open Enrollment period to enroll in a new plan.

- Review State Regulations: Benefits are similar everywhere, but payout amounts can vary depending on your state’s rules.

Canceling a Cigna plan isn’t complicated—it’s just about timing it right and making sure you have new coverage lined up. That way, you can avoid gaps in protection and keep your finances on track.

Cigna Health Insurance Customer Reviews & Ratings

Our Cigna health insurance review shows that outside ratings highlight both financial strength and customer experience. These scores help people see not only if Cigna can pay claims but also what it’s like to be a customer. For anyone comparing options, insights like these are invaluable when building a millennial’s guide to health insurance, since ratings often reveal how an insurer performs beyond the marketing.

Cigna Insurance Business Ratings and Consumer Reviews| Agency |  |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A Good Business Practices |

|

| Score: 75/100 Good Customer Feedback |

|

| Score: 982 / 1,000 Excellent Satisfaction |

|

| Score: 1.2 Avg. Complaints |

A.M. Best gives Cigna an “A,” showing the company has the financial strength to pay claims even in tough times. Cigna health insurance reviews on Consumer Reports also show a 75 out of 100 score, suggesting that most customers are satisfied, though some see room for improvement.

J.D. Power’s 982 out of 1,000 rating is excellent, reflecting very high satisfaction among members when interacting with Cigna. The NAIC complaint index stands at 1.2, which is close to average. While most experiences are steady, occasional issues do arise.

That balance is also echoed in Cigna health insurance reviews on BBB, where many customers appreciate the coverage options but note that service experiences can vary.

In addition to those ratings, hearing from real customers adds another layer of perspective. For example, Cigna health insurance reviews on Reddit often share personal experiences in real time. This is a real review from Reddit where a user described their experience using Cigna during a hospital visit. After handing over their Cigna card, the hospital confirmed a few hours later that a “Guarantee of Payment” had been received.

Comment

byu/Frankieplus1 from discussion

inThailand

The only cost the user had to cover was the deductible, which they paid directly at the hospital. This is a genuine review, highlighting how Cigna can simplify the billing process, even though deductibles still fall to the member.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cigna: Pros and Cons

Cigna Healthcare offers more than the usual health insurance, which makes it a solid pick for families who want options, professionals who like plans they can adjust, and people who spend time abroad but still need reliable coverage.

- Global Reach: With international plans, Cigna makes it simple for members living or working overseas to get medical care without worrying about losing coverage.

- Dental and Vision Options: The ability to add dental and vision benefits lets members create a package that better matches their personal or family needs.

- Critical Illness Coverage: Families facing major health conditions, such as cancer or heart disease, can rely on Cigna’s critical illness insurance for additional financial support.

Of course, no insurer is without its downsides, and Cigna is no exception. While its strengths are clear, there are also limitations that buyers should consider before choosing a plan.

- State Availability: With core health plans limited to just 12 states, many people won’t be able to access Cigna’s primary coverage.

- Complaint Ratio: An NAIC index of 1.2 puts Cigna near the national average for complaints, suggesting customer service experiences can be uneven.

Taken together, Cigna Healthcare offers strong supplemental and international benefits, but may leave some buyers frustrated by limited availability and average complaint levels. Still, its mix of global coverage and medical supplemental insurance makes it an appealing choice for those who want added financial protection.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Find Affordable Coverage With Cigna Healthcare

Cigna Healthcare, part of The Cigna Group, is a dependable option for those seeking flexible coverage backed by financial strength. One thing that really sets it apart is access to over 89,000 dentists and 300,000 locations, providing members with numerous options for care.

Seniors, families, and frequent travelers gain the most from Cigna’s Medicare and international plans, especially when paired with a Medicare savings program that can reduce overall costs. To lower costs, members can use myCigna.com to check claims, compare prescription costs, and find in-network providers. Choosing 90-day prescription refills and scheduling telehealth visits are also simple ways to cut expenses.

Preventive services, often covered in full, help avoid bigger bills later. For the best deal, always compare multiple insurers online and use our free quote tool to see which policies are most affordable in your area.

Frequently Asked Questions

What is the average monthly cost for Cigna?

On the ACA marketplace, the average monthly cost for Cigna health insurance is around $275 for a 30-year-old on a Silver plan. Rates increase with age, often reaching $565 or more by the time one reaches the 50s.

Does Cigna require a copay?

Yes, most Cigna plans require copays. Primary care visits typically cost around $25, specialists’ visits average $45, urgent care visits are $60, and generic prescriptions usually cost $15.

What are the main differences between Aetna vs. Cigna?

Aetna and Cigna differ mainly in coverage reach. Cigna has firm international plans, while Aetna focuses more on large U.S. networks and employer-sponsored coverage, as noted in many Aetna insurance review comparisons.

Why are doctors dropping Cigna insurance?

Doctors may drop Cigna insurance when reimbursement rates fall below regional averages or contract negotiations fail. In 2023, several hospitals in Texas and North Carolina reported disputes tied to low payment schedules.

What Cigna plan should I choose?

Bronze plans are a good choice for younger adults who don’t visit the doctor much, Silver plans fit families that need steady checkups, and Gold plans are better if you take prescriptions or manage chronic conditions.

What is the problem with Cigna insurance?

The biggest problem with Cigna insurance is availability, as core medical plans are only offered in 12 states. Common complaints also include difficulty finding in-network doctors and delays in claim updates; however, some of the best states for employer-provided health insurance help offset these gaps by offering broader employer coverage options.

What does Cigna not cover?

Cigna does not cover elective cosmetic surgery, experimental procedures, fertility treatments unless mandated, or over-the-counter medications. Dental and vision are excluded unless added as separate policies.

Is Cigna PPO or HMO better?

Cigna PPO plans are better suited for individuals who prefer nationwide flexibility without referrals. In contrast, HMO plans are more cost-effective and work best when members are comfortable staying within the network for most of their care.

Is Cigna a good insurance option?

Yes, Cigna is a good insurance option. It offers ACA marketplace, Medicare Advantage, and Original Medicare, as well as supplemental plans with preventive care included, although availability can be limited in some states.

Does Cigna cover Ozempic?

Yes, Cigna covers Ozempic for the treatment of Type 2 diabetes, but many plans require prior authorization and proof of medical necessity. Coverage for weight-loss use is usually excluded.

Compare Cigna Healthcare insurance options using our free quote comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.