Esurance Auto Insurance Review for 2026

In this Esurance auto insurance review, we break down how you could score $60 monthly rates with pay-per-mile if you drive under 10,000 miles a year. Esurance's tool CoverageMyWay helps match you with smart coverage. Owned by Allstate, Esurance no longer sells new policies but supports existing ones.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated September 2025

This Esurance auto insurance review explores flexible options for drivers who like to save based on their habits, though Esurance, an Allstate company, stopped selling new policies in 2023. With pay per mile, rates started around $60 a month for drivers logging under 10,000 miles a year.

Esurance Auto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 4.2 |

| Business Reviews | 4.0 |

| Claims Processing | 4.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.9 |

| Coverage Value | 4.1 |

| Customer Satisfaction | 2.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.2 |

| Plan Personalization | 4.5 |

| Policy Options | 3.8 |

| Savings Potential | 4.5 |

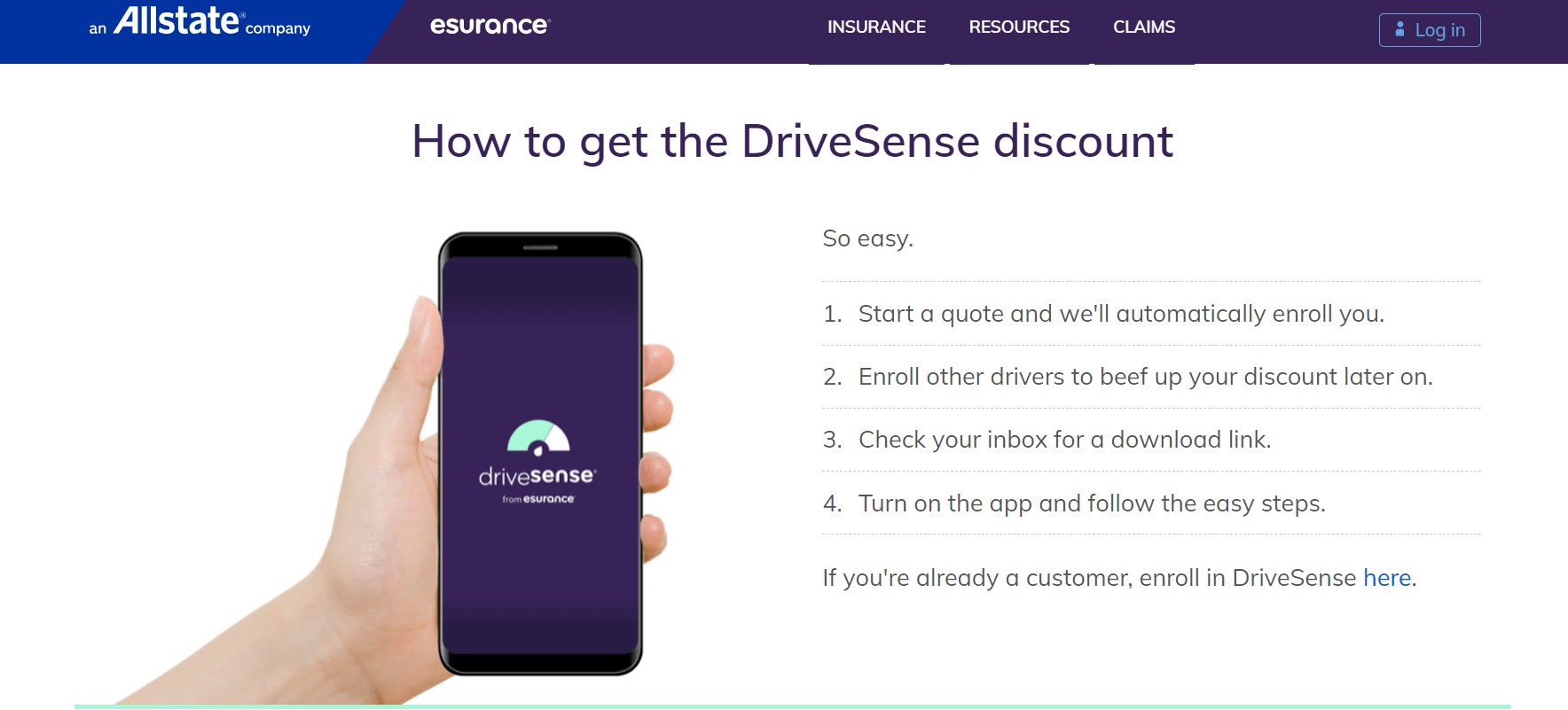

DriveSense rewards smoother habits—like gentle braking and daytime driving—with up to 30% off.

You can even get a 5% Fast 5® discount just to start your quote online, and the What If Calculator helps you see how things like moving or adding a car could change your rate before you commit.

- Save more with fewer-than-average claim filings over 12 months

- Premiums reflect behavior trends like weekday-only commuting patterns

- Lower mileage zones may trigger automatic pricing adjustments at renewal

Find out how people get auto insurance right by matching policies to their needs and budgets using our free comparison tool for side-by-side comparisons.

Comparing Esurance Insurance Monthly Rates

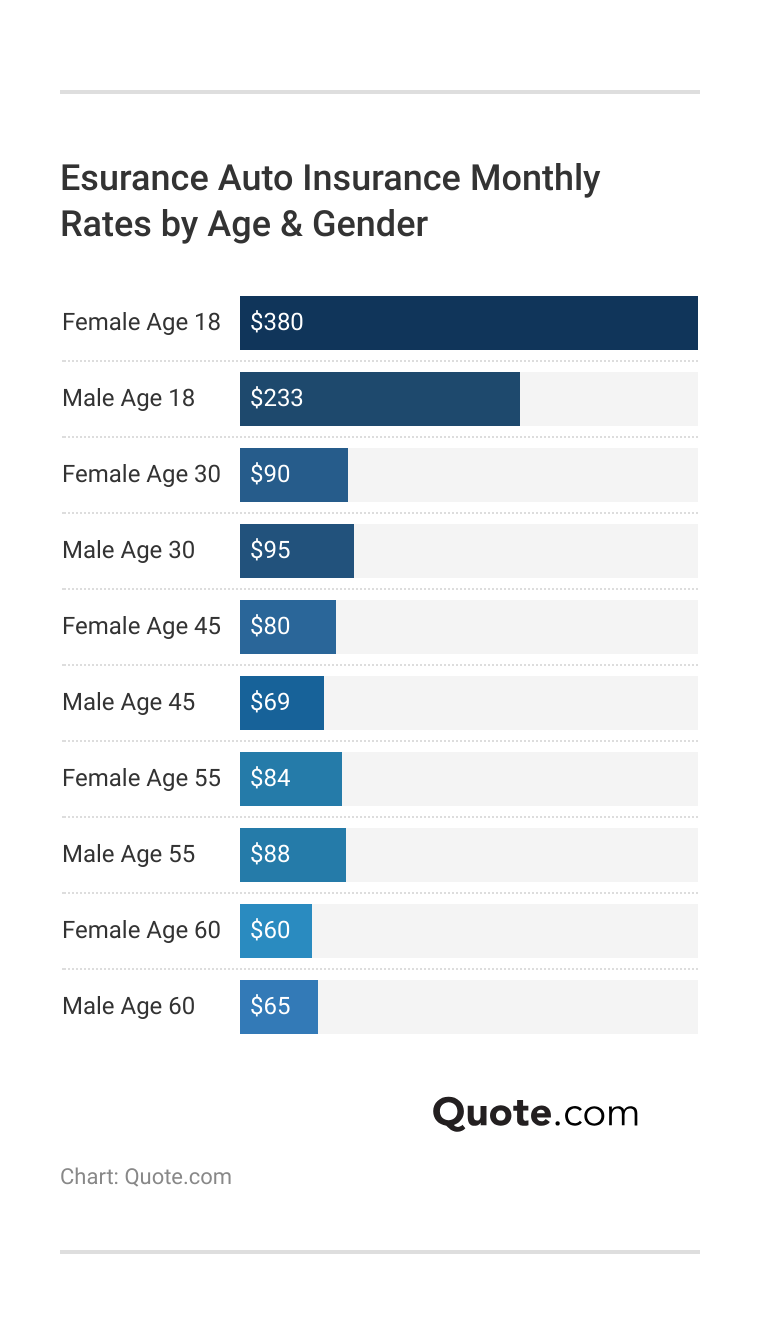

Esurance, a subsidiary of Allstate, clearly explains how your age and gender can impact your monthly payment. This table provides a clear view of how your premium changes as you age and gain more driving experience.

If you’re 18, you’re looking at the highest rates, especially for young women, who average $380 a month. Young men pay less at $233, but it’s still pricey compared to older drivers. Things start to calm down by your 30s, when women drop to about $90 and men sit around $95.

By your 60s, you’re seeing the lowest rates of all—just $60 for women and $65 for men—proving that years of safe driving pay off over time.

But age and gender aren’t the only things that shape your monthly premium—your driving record can wipe out years of savings in one bad moment. The next table illustrates the exact cost of a single mistake.

Esurance Auto Insurance Monthly Rates by Driving Record| Driving Record | Minimum Coverage | Full Coverage |

|---|---|---|

| Clean Record | $90 | $163 |

| One Accident | $200 | $257 |

| One DUI | $280 | $298 |

| One Ticket | $170 | $208 |

If you’ve got a clean record, you’re looking at some of the lowest rates—about $90 for minimum coverage and $163 for full. But one accident can almost double your bill to $200 a month, and a DUI can push it up to $280. Even a single ticket can cost you nearly $1,000 more a year, which shows how much it pays to drive safely.

Even a single ticket can raise your annual premium by nearly $1,000, so it pays to stay cautious on the road.

Jeff Root Licensed Insurance Agent

After seeing how your driving profile affects your rate, it’s also helpful to compare Esurance with other major insurers. This table gives you a clear look at what you’d pay and how those prices stack up if you’re shopping around.

Esurance vs. Top Competitors: Auto Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $90 | $163 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

For minimum coverage, Esurance costs $90 a month—more than Geico’s $43, but $6 less than Liberty Mutual and $10 less than Travelers. On full coverage, it’s $85 cheaper than Liberty Mutual and $35 less than Farmers. It strikes a nice middle ground with good value, easy-to-use digital tools, and the backing of Allstate—something to keep in mind if you’re also reading an ultimate guide to buy a new car and planning your budget.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Esurance Insurance Discounts

Esurance offers discounts that can noticeably lower your premium—sometimes by hundreds—if you take advantage of what you already qualify for.

Esurance Auto Insurance Discounts| Discount | |

|---|---|

| Safe Driver | 40% |

| Anti-Theft | 25% |

| Claims-Free | 25% |

| Multi-Car | 25% |

| Bundling | 10% |

| Defensive Driving | 10% |

| Good Student | 10% |

| Homeowners | 10% |

| Pay-in-Full | 10% |

| Switch & Save® | 10% |

| Fast 5® | 5% |

Safe drivers can see up to 40% off, which could shave over $70 off a $180 monthly bill. Cars equipped with security devices qualify for anti-theft auto insurance discounts, offering up to 25% in savings. A clean claims record can earn another 25% off. When you bundle your auto policy with renters or homeowners insurance, it keeps things simple and knocks 10% off both premiums.

And beyond these standard savings, Esurance offers additional programs that reward low-mileage habits, tech-savvy shoppers, and smart coverage choices.

- Fast 5® Discount: Start your quote on Esurance.com and instantly receive 5% off your first-term premium—no extra steps, just an automatic reward for getting started.

- Multi-Policy Discount: Bundle your auto policy with renters or homeowners insurance and get up to 10% off each. Manage everything from one convenient dashboard.

- Renters Plus® Discount: Bundle your auto policy with Esurance renters insurance or homeowners insurance and get up to 10% off each. Manage everything from one convenient dashboard.

- DriveSense™ Discount: Plug in the device, drive smoothly, and you could earn up to 30% off, based on your braking, speed, and other real-time driving behaviors.

- Pay Per Mile Program: Oregon drivers logging under 10,000 miles a year can pay based on usage, with anything over 150 miles per day completely free.

These Esurance discounts don’t just reduce your premium—they reflect how you drive, live, and manage your insurance. Esurance ensures that your smart habits translate directly into savings.

Coverage Options From Esurance Insurance

Esurance Insurance Company has a bunch of coverage options that do more than just check the minimum boxes—they’re built to help you handle the stuff you didn’t see coming. Whether it’s a little bump in traffic, a stolen car, or unexpected medical bills, each type of coverage has its job.

Esurance Auto Insurance Coverage Options| Coverage | What It Covers |

|---|---|

| Liability | Injuries or damage you cause |

| Collision | Repairs from collision-related damage |

| Comprehensive | Non-collision events like theft, fire |

| Medical Payments | Medical costs for you, passengers |

| Personal Injury Protection | Medical and wage loss coverage |

| Uninsured Motorist (UM) | Injuries from uninsured at-fault driver |

| Underinsured Motorist (UIM) | Covers shortfall from underinsured drivers |

| Roadside Assistance | Towing, lockouts, flat tire help |

| Alternate Transportation | Rideshare or rental reimbursement coverage |

| Digital Claims Filing | Mobile app-based claim processing |

Liability coverage steps in to pay for the other driver’s injuries or car damage if you’re at fault, and most states require you to have it. If your car gets damaged in a crash—regardless of who caused it—collision coverage helps pay for repairs. Comprehensive coverage includes non-collision events like theft, fire, falling branches, or hail damage.

Medical payments and personal injury protection can cover doctor visits, hospital stays, and even lost wages for you and your passengers. And if the other driver isn’t insured or doesn’t carry enough coverage, Esurance’s UM and UIM options help cover the gap.

If you ever need help with a claim or have questions about your policy, you can call the Esurance phone number for quick assistance. Extras like roadside assistance, rental car reimbursement under Alternate Transportation, and digital claims filing from your phone add even more support when needed.

Other Insurance Products Esurance Offers

Esurance makes it easy to find coverage that fits your driving style. You can insure just about anything on wheels—cars, motorcycles, boats, RVs, ATVs, scooters, classic cars, and even commercial vehicles. Their policies are divided into medical, vehicle-based, and liability options, allowing you to select the coverage that matters most to you.

Their CoverageMyWay tool asks a few simple questions and suggests coverage that fits, like adding collision for a newer car or bundling renters and auto to save up to 10%. If you drive less, it may be recommended to lower your liability. With your Esurance login, managing updates and changes is quick and easy.

Esurance Insurance Company makes it easy to protect where you live with flexible homeowners insurance coverage, plus options for condo owners and renters. Homeowners’ insurance covers your house, personal belongings, liability, and even hotel stays if you’re displaced.

Condo policies fill in what your HOA doesn’t, like upgrades and belongings. Renters’ insurance protects around $30,000 worth of your stuff, covers guest injuries, and helps with temporary housing if you can’t stay in your place.

Esurance Insurance Services, Inc. keeps it simple by focusing on what you need. Whether you’re bundling policies, protecting a classic car, or just covering your apartment, they give you clear, personalized suggestions that save you money without overpaying.

Customer Reviews and Ratings of Esurance Insurance

Ratings aren’t just numbers—they offer a glimpse into how an insurance company treats its customers and handles real-life problems. Here’s what Esurance’s recent performance scores say about the expected experience.

Esurance Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: 810 / 1,000 Avg. Satisfaction |

|

| Score: A Good Business Practices |

|

| Score: 72/100 Mixed Customer Feedback |

|

| Score: 1.20 Avg. Complaints |

|

| Score: A- Excellent Financial Strength |

With a J.D. Power score of 810 out of 1,000, Esurance holds its own in digital tools and policy features, though it may not deliver the same consistency as higher-ranked providers. A 72 out of 100 from Consumer Reports points to solid service overall, but some customers have reported frustration with how claims were resolved.

The 1.20 complaint ratio means Esurance Insurance Company receives more negative feedback than average, especially regarding follow-up and communication. Still, A.M. Best’s A- rating confirms that Esurance is financially strong and can pay out claims when needed.

You can check out Esurance reviews on Reddit, where people chat about their real experiences with claims, service, and pricing. One Reddit user even walked through the whole claims process, pointing out what Esurance does well and where it falls short.

This kind of feedback shows up often—Esurance nails the digital side of things, especially for tech-savvy users who like doing everything online. But if you prefer to talk to a real person, getting through by phone might test your patience. Still, for those looking for features like auto insurance for multiple vehicles and a fully online experience, Esurance remains a solid option.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save on Esurance Auto Insurance

Saving with Esurance Insurance Services, Inc. doesn’t have to be complicated—you just need to know where to look. Adjusting your deductible is one of the easiest ways to bring your monthly rate down. If you’re comfortable with a little more risk upfront, bumping it from $500 to $1,000 can seriously cut your monthly pay.

Driving less than usual? Update your mileage in your profile. Esurance looks at how often you’re on the road, so if your commute shrank or you’re just not driving much, it could lower your premium. You can save by going paperless and setting up auto-pay—small changes that add up over time. However, Esurance reviews complaints sometimes mention delays with billing adjustments, so it’s worth double-checking your account.

Review your mileage regularly with Esurance if your driving habits change, as driving less could lower your premium significantly.

Michelle Robbins Licensed Insurance Agent

Take a quick look at your optional coverages, too. If there’s something you’re not using, like roadside assistance, it might be worth trimming to save a little extra. And here’s a tip: if you’re looking for the cheapest car insurance, checking Esurance auto quotes about a week before your renewal date can sometimes lock in a better deal—and help you find a rate that fits your budget.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Pros and Cons of Esurance Insurance

If you’re the type who’d rather do it all online—get a quote, file a claim, buy auto insurance, and manage everything in one place—Esurance receives it. Their setup keeps things quick and easy; the tools aren’t just for show. They help you stay on top of everything without the usual hassle.

- RepairView Photo Updates: When your car’s in the shop, you can track the repairs with daily photo updates through Esurance’s E-Star® network. No calling the body shop or guessing what’s going on—they keep you in the loop every step of the way.

- Claim Turnaround in 10 Days: Most drivers who file through the mobile app get their claims settled in 10 days or less. Upload some photos, answer a few questions, and you could have an estimate—or even a payout—before your next grocery run.

- What If Calculator: Thinking about moving or trading in your car? This tool lets you preview how those changes would impact your premium, without changing your actual policy until you’re ready.

But as helpful as Esurance’s digital tools are, they don’t cover everything. If you’re a low-mileage driver outside Oregon or plan to drive across the border, there are a couple of limitations worth knowing.

- No Mexico or Overseas Coverage: Esurance policies don’t extend outside the U.S. (except Canada), so if you’re driving into Mexico—even just for a weekend—you’ll need separate insurance.

- Pay Per Mile Only in Oregon: Their Pay Per Mile program, which is great for folks who don’t drive much, is only available in Oregon. If you’re in another state, even with low mileage, you won’t have access to this pricing option.

Overall, Esurance Insurance Company is a strong choice if you like handling things yourself online and don’t need hand-holding. It’s fast, intuitive, and backed by solid tools that make day-to-day insurance management less hassle.

How Esurance Changed the Way People Shop for Insurance

Getting a quote used to mean calling random agents, sitting on hold, or booking an awkward in-person meeting just to get a number. Esurance saw how frustrating that was and built something smarter—one of the first companies to let people get an Esurance car insurance quote entirely online, in just a few clicks.

Getting multiple auto insurance quotes without the back-and-forth or pressure from sales reps became easier than ever. Instead of spending on office space and a huge sales staff, Esurance Insurance Services, Inc. focused on developing its technology to deliver fast, accurate pricing that put users in control while still offering solid Esurance customer service for questions and claims. That approach worked.

By the time Allstate stepped in and acquired it, Esurance had already written over $1.5 billion in premiums and was covering more than 970,000 policies. Now with the strength of Allstate’s $130 billion in assets behind them, Esurance keeps doing what made them different—making insurance easier and faster for everyone.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find Affordable Coverage With Esurance

Esurance Insurance Company is a great fit if you like handling things online and don’t need much back-and-forth with customer service. It’s super convenient, but it might not be ideal if you prefer talking to someone on the phone.

One thing that stands out is the What If Calculator—it helps you see how small changes can impact your rate before you commit. When you request an Esurance auto quote, you can spot potential hacks to save money on auto insurance, like raising your deductible or trimming any extra coverage you’re not using.

Driving less than usual? Updating your mileage can help, too. To get the best deal, use our free comparison tool to explore other side-by-side quotes.

Frequently Asked Questions

What is Esurance, and how does it work?

Esurance is an Allstate-owned insurer that focuses on digital convenience, though it no longer sells new policies as of 2023. Existing customers can still manage coverage, file claims through the app with photo uploads, and track repairs in real time using the RepairView tool.

Why is Esurance so cheap compared to others?

Esurance keeps premiums low by cutting agent commissions and operating primarily online, passing those savings to you. They also tailor rates to your exact driving habits using tools like DriveSense, rewarding safe and low-mileage drivers with up to 30% off.

How does Esurance vs. Geico compare on monthly rates?

Esurance often charges lower monthly rates for drivers with clean records who prefer managing everything online. But suppose you’re looking for everything you need to know about Geico. They may offer better rates if you qualify for niche discounts like military or federal employee programs.

What is the Esurance car insurance cancellation fee?

You could pay up to a $50 flat fee when you cancel your Esurance policy before renewal. However, some states prorate the unused premium, so always check your state’s specific rules before canceling to avoid unexpected charges.

Does Esurance offer boat insurance?

Esurance offers boat insurance through its partners, covering liability for accidents, damage repair, theft, and even fuel spill cleanup. Policies also include optional uninsured boater coverage, which protects you if another boater has no insurance.

Does Esurance cover windshield replacement?

Yes, Esurance covers full windshield replacement if you have comprehensive auto insurance and your state mandates no-deductible glass claims, such as Florida or Kentucky. Otherwise, you’ll pay your chosen deductible amount, ranging from $100 to $500.

Does Esurance homeowners insurance cover all types of homes?

Esurance homeowners insurance protects single-family homes, condos, and mobile homes and includes coverage for dwelling damage, personal property, and liability. You can also add identity theft protection or increase limits for valuables like jewelry.

Is Esurance good at paying claims?

Yes, Esurance is reliable when paying claims. Most auto claims, including photo uploads and digital estimates, are processed and settled within 10 business days when submitted through their mobile app.

Should you choose Progressive vs. Esurance for lower premiums?

If you drive less than 10,000 miles a year and value fast claims through an app, Esurance may save you more. But if you’re looking for a broader range of specialty discounts, like rideshare or continuous coverage, you might want to check a Progressive auto insurance review for more tailored options.

Why did my insurance go up with Esurance?

Your Esurance monthly premium likely increased because of a specific change, such as a newly reported speeding ticket, an at-fault accident, higher repair costs in your ZIP code, or updated vehicle risk data affecting your policy.

Why is Esurance not writing new policies?

Are Allstate and Esurance the same?

Is Esurance cheaper than State Farm?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.