Metromile Auto Insurance Review for 2026

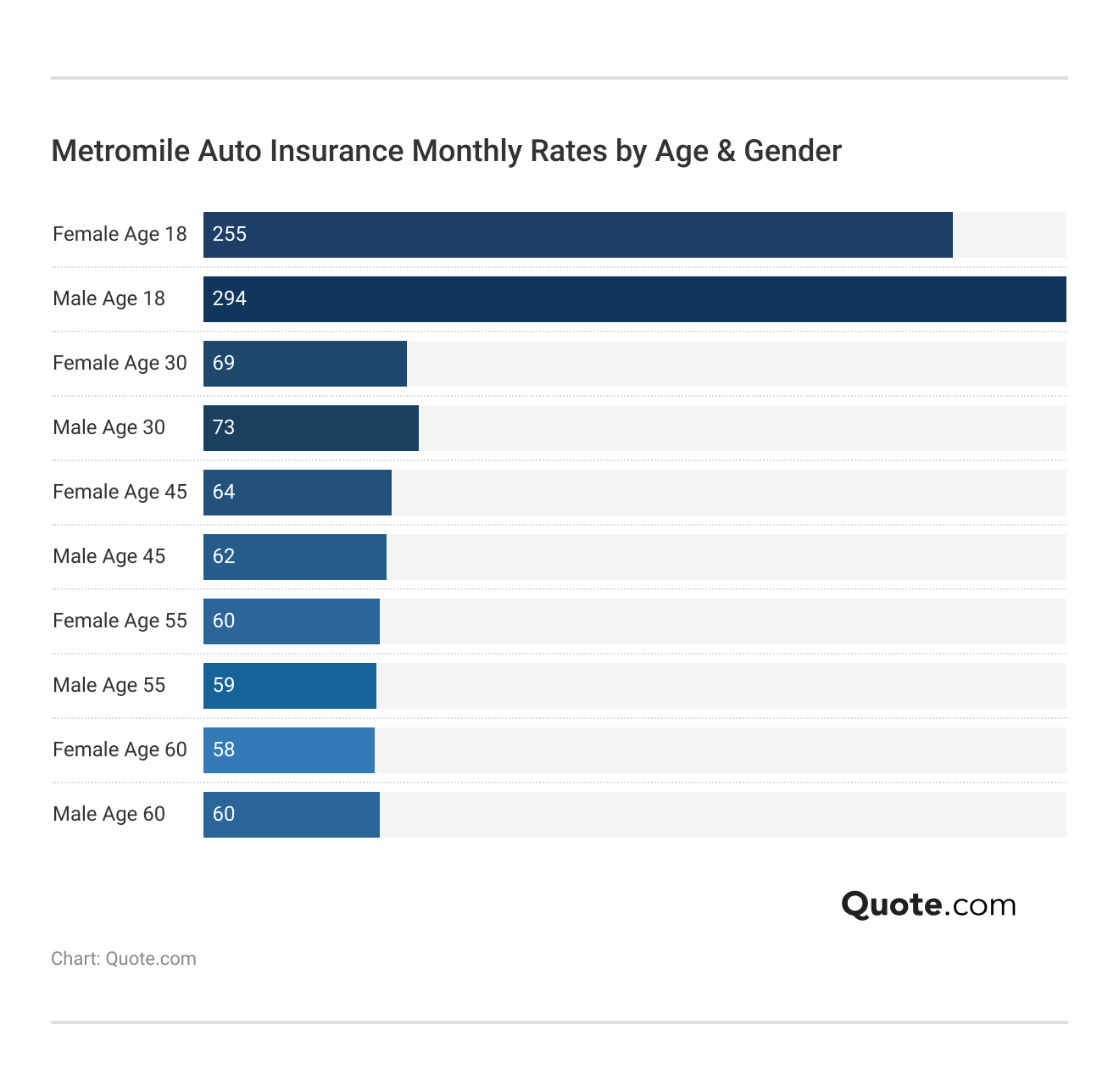

Our Metromile auto insurance review found it best for low-mileage drivers who want to pay by the mile for coverage. Metromile pay-per-mile car insurance starts at $58 per month. Metromile was recently acquired by Lemonade, where drivers can shop for home, renters, life, and pet insurance, along with auto coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

Metromile can be a good choice for drivers who travel under 10,000 miles per year and are looking for cheap pay-per-mile car insurance.

Metromile Auto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.4 |

| Business Reviews | 4.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 1.9 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 2.1 |

| Digital Experience | 4.0 |

| Discounts Available | 3.0 |

| Insurance Cost | 3.9 |

| Plan Personalization | 4.0 |

| Policy Options | 2.8 |

| Savings Potential | 3.6 |

Metromile was acquired by Lemonade in 2022 and no longer offers new policies to customers. If you want to purchase Metromile pay-per-mile auto insurance, you will be directed to Lemonade’s website. Learn about Lemonade in our Lemonade Insurance review.

- Metromile coverage is now sold by Lemonade Insurance

- Rates are paid by the mile, meaning monthly rates will fluctuate

- Lemonade Insurance also offers home and renters insurance

Read on to learn more in this full Metromile auto insurance review. If you are looking for cheap car insurance in your area or a Metromile alternative, enter your ZIP in our free quote tool.

Metromile Auto Insurance Rates

Metromile rates are paid by the mile, also known as pay-as-you-go auto insurance, meaning that you will pay a monthly base fee and then a small per-mile fee. Metromile rates are now based on Lemonade’s rates, as Lemonade now issues Metromile policies.

In addition to age and the coverage level you choose, your driving record will also impact what you pay for auto insurance coverage.

Metromile vs. Top Competitors: Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $62 | $91 | $96 | $76 | |

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $63 | $75 | $129 | $75 | |

| $50 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

A traffic ticket will raise rates the least at Metromile, while a DUI will raise auto insurance rates the most at Metromile Insurance Company.

Metromile Auto Insurance Rates vs. the Competition

Although pay-per-mile insurance is usually cheaper for most drivers, Metromile isn’t necessarily the cheapest on the market.

Metromile vs. Top Competitors: Auto Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $62 | $164 | |

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $63 | $164 | |

| $50 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

If you are looking for the cheapest car insurance, other companies like USAA or Geico may actually end up being cheaper than pay-per-mile coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Metromile Auto Insurance Coverage

Metromile, a Lemonade company, offers basic coverages like liability auto insurance that meets state requirements. There are also some add-on coverages like roadside assistance available through Lemonade.

Metromile Auto Insurance Coverage Options| Coverage Type | What it Covers |

|---|---|

| Liability | Injuries or damage you cause to others |

| Collision | Your car’s damage from crashes |

| Comprehensive | Non-crash damage such as theft, fire, or weather |

| Uninsured/Underinsured Motorist | Injuries or damage from a driver with little or no insurance |

| Medical Payments (MedPay) | Medical bills for you and passengers |

| Personal Injury Protection | Medical costs and lost wages |

| Rental Car Reimbursement | Cost of rental car while yours is repaired |

| Roadside Assistance | Towing, lockouts, flat tires, jump-starts |

| Glass Repair | Broken auto glass replacement |

| Pet Injury | Vet bills if your pet is injured in a crash |

You can choose which extra coverages you carry on your vehicle, unless you have a vehicle lease, in which case you’ll have to carry collision and comprehensive coverage.

Full coverage is recommended even for drivers without leased vehicles, as minimum liability insurance only covers other parties’ damages if you cause an accident, not your own.

Ways to Save on Metromile Auto Insurance

Although Metromile is a pay-per-mile auto insurance company, there are still some auto insurance discounts that customers can apply for to save money (Read More: Car Insurance Discounts You Can’t Miss). These discounts are available through Lemonade.

Metromile Auto Insurance Discounts| Discount | |

|---|---|

| Anti-Theft | 5% |

| Bundling | 10% |

| Defensive Driving | 10% |

| Early Sign-Up | 3% |

| Loyalty | 7% |

| Low Mileage | 10% |

| Multi-Car | 12% |

| Paperless | 3% |

| Pay-in-Full | 15% |

Ensuring more than one car at Metromile can earn you 12% off your auto insurance and offers the convenience of keeping all your cars on one account. Some other ways to save on Metromile insurance, in addition to discounts, include:

- Keeping a Clean Driving Record: Good drivers present less risk to insurers, which will result in lower rates.

- Driving a Safe Car: Choose an economical car with good safety ratings for the lowest auto insurance rates.

- Raising Your Deductible: If you can afford to pay more out of pocket, raising your deductible will result in a lower auto insurance rate.

Following the tips above will almost always result in lower rates on your auto insurance. It is also recommended to periodically compare car insurance quotes every year or so to ensure you’re still getting the best deal.

Other Metromile Insurance Products

Metromile does not offer its own homeowners insurance coverage. It partnered with Hippos to offer a deal on home and auto insurance, but since Lemonade acquired Metromile, home insurance can also now be bought through Lemonade.

Metromile Partners: Home and Auto Insurance Monthly Rates| Company | Home | Auto |

|---|---|---|

| $121 | $30 | |

| $147 | NA |

| NA | $28 plus $0.06 per mile |

If you are interested in other coverages, you will have to purchase them from Lemonade. Lemonade offers the following coverages:

- Home and Renters: Can be bundled with Lemonade auto coverage for a discount.

- Pet: Coverage that helps pay for pet exams, medications, procedures, and more.

- Life: Lemonade only offers term life insurance.

These Lemonade coverages can be purchased directly from their website, and you may get a deal if you buy more than one type of insurance.

If you’re looking for coverage under Metromile’s name alone, you will not find it, as everything is now sold under Lemonade. Any Metromile insurance logins or accounts will have been switched over to Lemonade.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Customer Reviews and Business Ratings of Metromile

Customer reviews can give you insight into Metromile insurance claims, Metromile customer service, and more. Take a look at the Metromile Reddit discussion thread below to see what customers think of the company.

Metromile Car Insurance – anyone else have a stark increase when metromile renewed recently?

byu/waffles93 inInsurance

A common complaint is rate increases at renewal, which could be because Lemonade is now issuing Metromile policies. There are also some complaints about poor claims processing and customer service (Read More: How to File an Auto Insurance Claim & Win It Each Time). However, other customers like their Lemonade Metromile policy because it’s the cheapest rate they could find.

When evaluating a company, it’s also good to check business ratings for financial stability, customer complaints, and more.

Metromile Auto Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: 807 / 1,000 Above Avg. Satisfaction |

|

| Score: B Fair Business Practices |

|

| Score: 70/100 Average Customer Satisfaction |

|

| Score: 2.50 More Complaints Than Avg. |

A.M. Best gave Metromile an A- for financial stability, which is a decent rating. It means that financially, Metromile is able to meet its ongoing financial obligations, such as paying out claims.

Metromile Insurance Pros and Cons

When choosing your auto insurance company, it’s important to consider the pros and cons. We found that Metromile Insurance has the following perks:

- Bundling Deals: Lemonade Insurance Company, which now owns Metromile, offers bundling deals on auto and home/renters insurance.

- Per-Mile-Rates: Because rates are based on how much drivers travel, driving less could result in bigger savings one month (Read More: Best Low-Mileage Auto Insurance Discounts).

- A.M. Best Rating: Mertromile has an A- rating, which is a solid financial stability rating.

Metromile Insurance Company is also well-rated for customer service, as it has fewer customer complaints than average. However, the cons we found about Metromile Insurance Company are the following:

- Limited Availability: Metromile policies, now sold by Lemonade, are only available in 38 states.

- Customer Complaints: There are some poor reviews of Metromile’s customer service and claims online.

Make sure to consider which factors of an insurance company are important to you. A company that is right for one customer may not be the best fit for another.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Choosing Metromile Pay-Per-Mile Auto Insurance

Our Metromile insurance review found it can be affordable car insurance coverage for customers who want to be charged by how much they drive each month.

Mileage-based insurance is ideal for low-mileage drivers who travel under 10,000 miles per year, such as retirees or remote workers.

Dani Best Licensed Insurance Producer

Since Metromile has now been bought out by Lemonade, customers can also purchase Lemonade coverages like home or renters insurance (Read More: Best Renters Insurance Companies).

If Metromile Insurance is not the right fit for you, use our free quote tool to shop around and find affordable insurance in your area.

Frequently Asked Questions

Is Metromile a good insurance company?

Yes, Metromile is a good insurance company with an A.M. Best A- rating, but it is now under Lemonade Insurance.

What happened to Metromile insurance?

Lemonade Insurance Agency acquired Metromile Insurance in 2022.

Who is Metromile owned by?

Metromile is now owned by Lemonade. If you want to buy car coverage from Lemoande, read our guide on how to buy auto insurance.

How much does Metromile insurance charge?

Metromile auto insurance rates start at an average of $58 per month.

How does Metromile insurance work?

Metromile pay-per-mile car insurance tracks a customer’s mileage to see how much they drive. Metromile will charge a monthly fee, and then a per-mile fee, so rates will fluctuate month to month (Learn More: The Definitive Guide to Usage-Based Auto Insurance).

What is pay-per-mile car insurance?

Pay-per-mile car insurance is car insurance that charges based on how many miles a customer drives. You will pay a base monthly fee, and then a small per-mile fee on top of that each month.

What mileage makes insurance cheaper?

It depends on the insurance company, but most companies will charge less for drivers who travel under 10,000 miles annually.

Does Metromile offer home insurance?

Metromile used to partner with Hippo to offer a bundling deal on home and auto insurance, but since Metromile was acquired by Lemonade, all home insurance is through Lemonade. You can compare homeowners insurance quotes to find the best deal.

What states is Metromile insurance in?

Metromile is now sold under Lemonade. Lemonade is available in the following states, although availability depends on what type of insurance you are purchasing: AL, AZ, AR, CA, CO, CT, FL, GA, IL, IN, IA, MD, MA, MI, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA, WA, and WI.

If Metromile isn’t in your state, you can still find cheap auto insurance by entering your ZIP in our free quote tool.

Is Lemonade Insurance a legit company?

Yes, Lemonade Insurance, which now owns Metromile, is a legitimate insurance company. It is publicly traded, and its largest shareholders are BlackRock and The Vanguard Group.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.