10 Cheapest Life Insurance Companies in 2026

Liberty Mutual, AAA, and Nationwide are the cheapest life insurance companies, with term life insurance starting at $24 a month. Member discounts cut premiums by 10% and flexible riders keep costs low. Quit smoking and compare insurance providers by state to find the cheapest life insurance rates near you.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2026

If you’re looking for the cheapest life insurance companies, Liberty Mutual, AAA, and Nationwide stand out with rates starting around $24 per month.

- Liberty Mutual is the top pick with accelerated death benefits

- The cheapest life insurance companies offer fast online quote comparisons

- Save $300 a year for bundling Allstate life insurance with other policies

Liberty Mutual keeps $250,000 term coverage affordable for families and offers easy online policy tools to change or update coverage.

AAA helps members save with 10% premium discounts and offers roadside assistance perks.

10 Best Companies: Cheapest Life Insurance| Company | Rank | Monthly Rates | Annual Savings | Best for |

|---|---|---|---|---|

| #1 | $39 | $280 | Affordable Premiums |

| #2 | $40 | $180 | Customized Policies |

| #3 | $41 | $260 | Vanishing Deductible | |

| #4 | $42 | $160 | Customer Service |

| #5 | $43 | $220 | Financial Strength |

| #6 | $44 | $300 | Bundled Savings | |

| #7 | $45 | $250 | Easy Application | |

| #8 | $46 | $210 | Accident Forgiveness | |

| #9 | $47 | $140 | High-Risk Applicants |

| #10 | $48 | $190 | Online Convenience |

Nationwide provides families with more control over costs and coverage through customizable riders.

Discover affordable plans from the cheapest life insurance companies and get life insurance quotes by using our free quote comparison tool.

Compare Cheap Life Insurance Premiums

Term life insurance usually costs less since it only covers you for a set period, but rates will go up as you get older.

Whole life insurance is more expensive because it lasts a lifetime and also builds cash value along the way.

Life Insurance Monthly Rates by Policy Type| Company | 20-Year Term | Whole Life |

|---|---|---|

| $40 | $305 |

| $47 | $340 |

| $44 | $330 | |

| $42 | $315 |

| $43 | $310 |

| $39 | $300 |

| $41 | $320 | |

| $48 | $350 |

| $45 | $295 | |

| $46 | $325 |

For example, a $250,000 term policy from Liberty Mutual averages around $39 a month, while the same company’s whole life option climbs to $300 per month.

A whole life policy will almost always cost several times more than a term policy for the same coverage amount, which is why many shoppers start with term policies when affordability is the priority.

The best term life insurance companies prove that value depends on what you need most.

Understanding how each type works makes it easier to find affordable coverage that still provides your family with the protection they need while giving you a clear picture of the average cost of life insurance.

Finding affordable life insurance is all about selecting the right policy and understanding what each option actually gives you.

Here are five common choices and how they can impact your costs and coverage:

- Term Life: A healthy 30-year-old can often obtain a $250,000, 20-year plan for under $20 per month, making it the most budget-friendly option.

- Whole Life: Costs more, but the policy never expires and builds 2–4% cash value yearly that you can borrow against if needed.

- Universal Life: Allows you to adjust premiums and coverage over time, making it convenient if your income or expenses change.

- Final Expense: Provides between $5,000–$25,000 in coverage designed to handle funeral or medical bills (Read More: Best Final Expense Life Insurance).

- Group Life: Frequently free through work, typically covering one to two times your salary, though it usually ends if you leave your job.

Most people choose a $250,000 policy because it can cover a mortgage and significant debts without making premiums too hard to handle.

When you jump to bigger amounts like $500,000 or even $1 million, term policies are the clear favorite.

Term life policies provide families with sufficient coverage for expenses such as college costs or replacing lost income, all without the high cost of whole life insurance.

Whole life still makes sense for smaller amounts, though, especially for people who like the idea of lifelong coverage and building cash value but don’t want to overspend each month.

Read More: Best Instant Life Insurance

Cheapest Life Insurance Companies by Age

Life insurance rates climb as you get older, which is why locking in coverage early can make such a big difference.

Our life insurance guide highlights how choosing the right company at the right age can save you money in the long run and points to options like the cheapest life insurance for over 60s if you’re buying later in life.

20-Year Term Life Insurance Monthly Rates by Age| Insurance Company | Age: 20 | Age: 30 | Age: 40 | Age: 50 | Age: 60 | Age: 70 |

|---|---|---|---|---|---|---|

| $31 | $36 | $40 | $57 | $79 | $146 |

| $20 | $25 | $47 | $45 | $66 | $120 |

| $34 | $39 | $44 | $60 | $82 | $150 | |

| $26 | $31 | $42 | $50 | $71 | $130 |

| $23 | $28 | $43 | $47 | $68 | $126 |

| $32 | $37 | $39 | $58 | $80 | $148 |

| $24 | $29 | $41 | $48 | $67 | $124 | |

| $27 | $32 | $48 | $51 | $72 | $128 |

| $28 | $33 | $45 | $52 | $73 | $129 | |

| $29 | $34 | $46 | $53 | $74 | $130 |

Nationwide remains one of the cheapest life insurance companies for seniors, costing only $67 per month for applicants in their 60s and $124 per month for those in their 70s.

It also offsets higher costs with bundling discounts when you combine life coverage with home or auto insurance.

Cheapest Life Insurance Companies by Gender

Whole life insurance costs vary by gender, and those differences show how insurers weigh long-term risk. Women usually see lower premiums because they tend to live longer, which makes coverage easier to manage over time.

Men often face higher rates since shorter life expectancy raises insurer risk, and that can make monthly costs add up faster. It’s a clear reminder that gender plays a significant role in how premiums are set.

Whole Life Insurance Monthly Rates by Gender| Insurance Company | Female | Male |

|---|---|---|

| $540 | $590 |

| $525 | $575 |

| $550 | $600 | |

| $520 | $570 |

| $535 | $585 |

| $545 | $595 |

| $530 | $580 | |

| $538 | $588 |

| $555 | $605 | |

| $542 | $592 |

But price isn’t the only factor that matters. AAA helps members save with loyalty discounts, while Liberty Mutual, Nationwide, and Allstate help families cut costs with multi-policy discounts.

Prudential and State Farm earn trust through solid underwriting and excellent customer satisfaction, while Travelers provides people with an easy way to save through affordable group coverage at work.

Cheapest Whole Life Insurance by Death Benefit

Whole life insurance rates naturally go up as coverage amounts get bigger, so it’s essential to budget long-term and figure out how much life insurance you need before you buy a policy.

Even jumping from $100,000 to $250,000 can raise your monthly premium by over $100, which is why setting the right amount up front can save stress later.

Whole Life Insurance Monthly Rates by Policy Amount| Insurance Company | $50K | $100K | $250K | $500K |

|---|---|---|---|---|

| $55 | $105 | $260 | $510 |

| $50 | $95 | $235 | $460 |

| $58 | $110 | $270 | $525 | |

| $48 | $92 | $230 | $455 |

| $52 | $100 | $245 | $480 |

| $56 | $108 | $265 | $515 |

| $51 | $98 | $240 | $470 | |

| $53 | $102 | $250 | $490 |

| $59 | $112 | $275 | $530 | |

| $57 | $106 | $255 | $500 |

Nationwide and AIG are the most affordable life insurance companies for coverage of $500,000 or more, costing less than $500 per month.

AAA costs $515 monthly but takes some of the pressure off with loyalty rewards for long-time members. That $40 to $60 difference in premiums might not seem huge at first, but it adds up to nearly $700 a year in savings for families.

Read More: Cheapest Million-Dollar Life Insurance

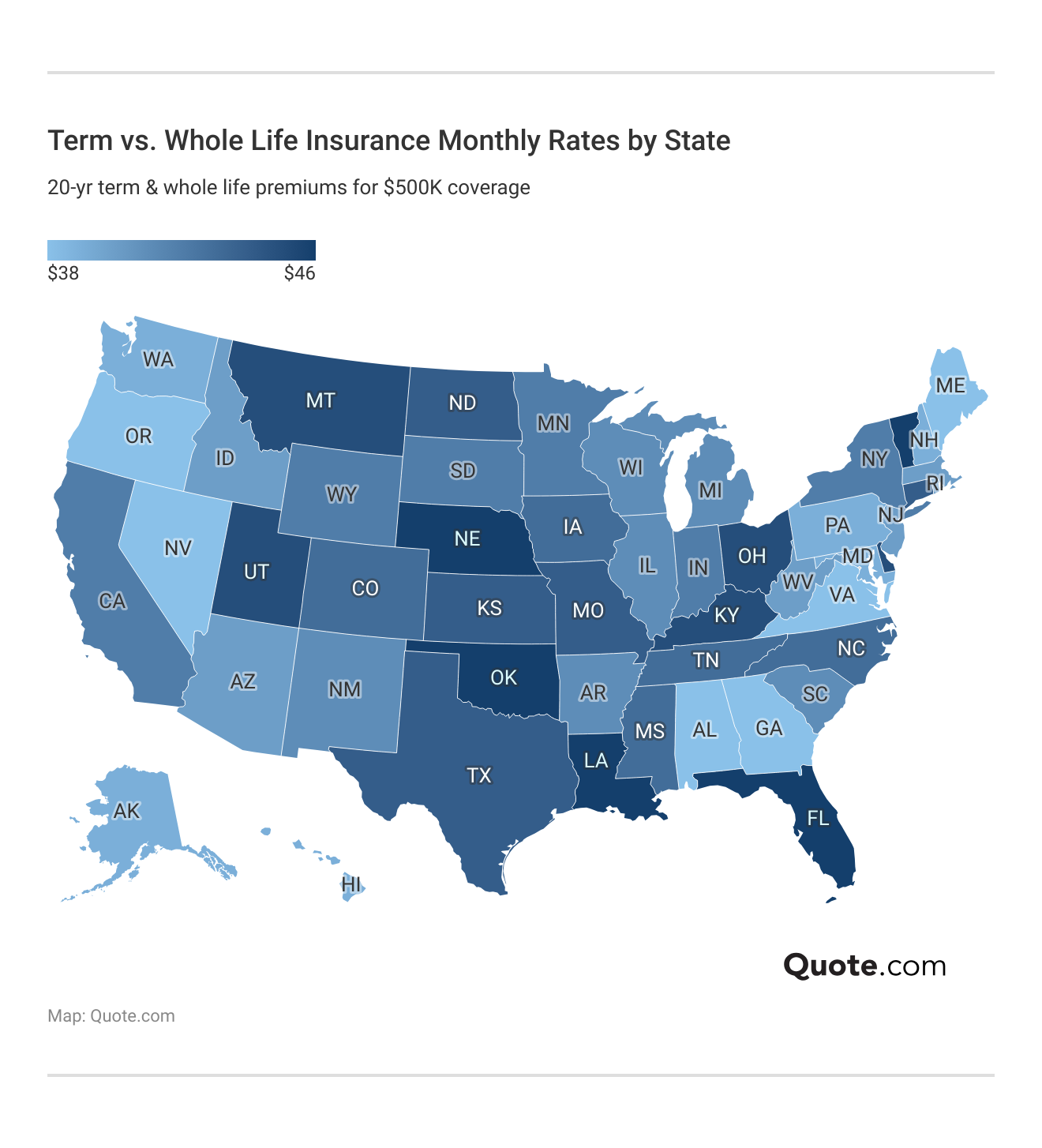

Cheapest Life Insurance Companies by State

Life insurance costs can vary a lot depending on where you live, since every state has its own rules, risks, and pricing trends that shape what companies charge.

For example, people searching for the cheapest life insurance companies near Texas might find lower average term costs than those in other regions. In contrast, whole life rates can still increase rapidly.

Your state’s rules can raise the cost of term life insurance quickly. Specifically, strict regulations in California push prices higher.

Michelle Robbins Licensed Insurance Agent

In some places, term life insurance coverage might save you close to $100 a year compared to other states, while whole life premiums can be over $200 higher each month just because of location.

Those comparing the cheapest life insurance near California will see how location alone can significantly impact premiums.

And in Michigan, a 20-year term averages about $41 per month, but whole life insurance jumps to $617 per monthly.

That’s over $6,800 more every year, which shows just how much your state and policy type matter when you’re shopping for life insurance.

Cheapest Life Insurance Companies for Smokers

Life insurance rates can look very different depending on whether you smoke or not, and it really shows how much your lifestyle impacts what you pay.

If you’re a non-smoker, premiums usually stay lower and easier to manage, which makes planning for the future a lot less stressful. With some companies offering non-smoker rates under $40 a month, the savings really start to add up over time.

Life Insurance Monthly Rates by Tobacco Use| Insurance Company | Non-Smoker | Smoker |

|---|---|---|

| $40 | $150 |

| $38 | $145 |

| $42 | $155 | |

| $37 | $140 |

| $39 | $148 |

| $41 | $152 |

| $38 | $147 | |

| $40 | $150 |

| $43 | $158 | |

| $41 | $151 |

For smokers, the costs climb fast and can add up to thousands more over the years. That’s why quitting or avoiding tobacco altogether is not just good for your health but also your wallet.

Insurers clearly reward healthier habits, and those savings can give families more breathing room when it comes to long-term financial security. Check out our complete guide to health insurance to learn more.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Impact Your Life Insurance Rates

Life insurance rates don’t just depend on how much coverage you buy. They are also shaped by your risk category, which can significantly impact what you ultimately pay.

Even going from Preferred to Standard can increase your bill by $15 or $20, which doesn’t sound huge at first, but really adds up over the years.

Life Insurance Monthly Rates by Risk Factor| Company | Preferred + | Preferred | Standard + | Standard | High Risk |

|---|---|---|---|---|---|

| $38 | $45 | $60 | $80 | $120 |

| $35 | $42 | $55 | $75 | $110 |

| $40 | $48 | $65 | $85 | $130 | |

| $34 | $41 | $57 | $77 | $115 |

| $37 | $44 | $62 | $82 | $125 |

| $39 | $47 | $63 | $83 | $128 |

| $36 | $43 | $59 | $78 | $118 | |

| $38 | $46 | $62 | $81 | $122 |

| $41 | $49 | $68 | $88 | $135 | |

| $39 | $46 | $61 | $80 | $125 |

For many families, one of the primary reasons to buy life insurance is the opportunity to secure lower premiums while health and age are still in their favor.

The most affordable life insurance for seniors focuses on keeping rates reasonable, even as age becomes a more significant factor in determining premiums.

Tips to Lower the Cost of Life Insurance

Life insurance discounts can make a bigger difference than most people think. Allstate, for example, offers a 10% bundling break, which translates to approximately $120 in yearly savings if your premium is $100 per month.

Prudential goes even further, giving non-smokers and healthy applicants up to 20% off. That adds up to a few hundred dollars back in your pocket each year.

Top Life Insurance Discounts by Provider & Savings| Company | Bundling | Good Health | Healthy Lifestyle | Non- Smoker |

|---|---|---|---|---|

| 4% | 10% | 6% | 8% |

| 5% | 10% | 5% | 10% |

| 10% | 15% | 7% | 10% | |

| 6% | 12% | 6% | 10% |

| 7% | 12% | 6% | 8% |

| 5% | 12% | 6% | 10% |

| 8% | 14% | 7% | 12% | |

| 7% | 14% | 7% | 20% |

| 6% | 12% | 10% | 8% | |

| 8% | 13% | 8% | 11% |

What’s interesting is how each company rewards different habits. Nationwide gives a 14% discount for healthier lifestyles, while AIG takes 5% off if you bundle insurance policies.

The cheapest life insurance companies go beyond discounts, giving you other ways to keep costs down if you plan carefully. Many of the most significant savings come from the choices you make when selecting and managing your policy.

- Go With Term Life: A $500,000 term policy can cost less than half of what you’d pay for whole life, saving families thousands over time.

- Pay Once a Year: Monthly billing often incurs small fees, but paying annually can save you 5–10% on your premium.

- Work Toward a Better Health Class: Quitting tobacco or lowering your cholesterol can bump you from “Standard” to “Preferred,” which can result in rate reductions of 20% or more.

- Match Coverage Length to Your Needs: Choosing a 20-year term instead of 30 years can save hundreds if you mainly want protection while raising kids or paying off a mortgage.

- Shop Around Every Few Years: Rates change, and comparing quotes again could save you $15 or more a month on the same $250,000 policy.

Discounts are great, but the real savings usually come from smart moves, such as choosing term coverage or knowing when cash value life insurance makes sense.

Taking the time to shop around and compare companies is one of the simplest and most effective ways to cut costs consistently.

Adding extras like accidental death benefits only when they fit your situation can also help you avoid paying for coverage you don’t really need.

Keep reading to compare cheap life insurance quotes from the largest providers and our top ten picks for the cheapest life insurance companies.

Life Insurance Coverage Options

Most top life insurance providers offer a range of coverage options and riders to help you fulfill long-term financial goals:

- Term Life Insurance: Low-cost, temporary coverage that usually lasts between 10 and 30 years.

- Whole Life Insurance: Offers lifelong protection with guaranteed premiums and cash value (Learn More: Whole Life Insurance Guide).

- Universal Life Insurance: Allows you to change payments and benefits over time for greater long-term flexibility (Read More: Universal Life Insurance Guide).

- Variable Life Insurance: Combines a permanent life insurance policy with an investment option.

- Burial or Final Expense Insurance: Small, permanent payout to help pay for funeral and end-of-life expenses.

No-exam life insurance is also available for faster approval, though it usually comes with higher premiums.

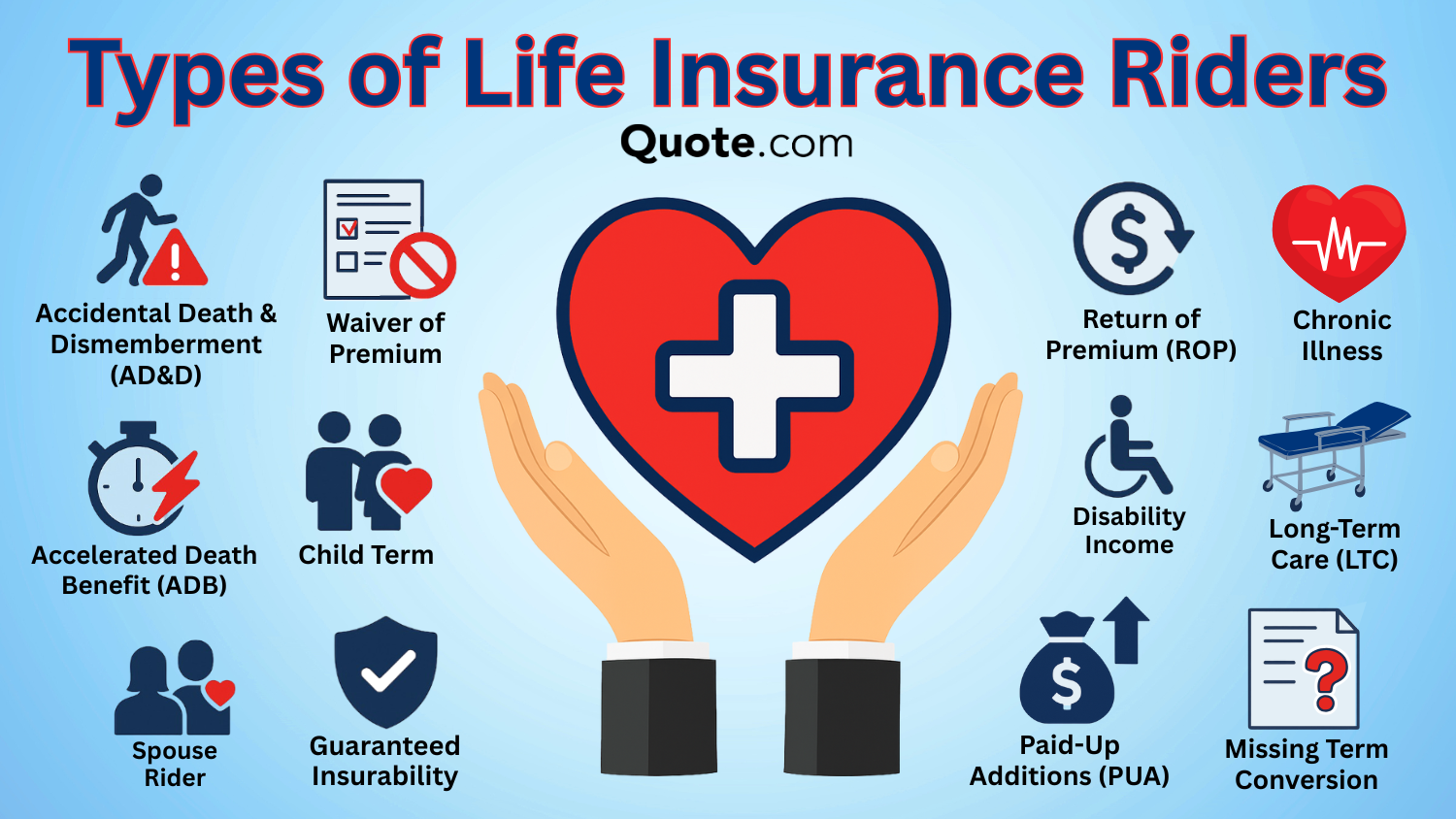

If you want more coverage than what’s listed, common policy riders can expand your coverage with added protection.

For example, an accidental death rider increases your payout if death occurs due to a covered accident, while a critical illness rider lets you access a portion of your benefit if you’re diagnosed with a qualifying serious condition.

In addition, a waiver-of-premium rider can keep your policy active if you’re unable to work.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top 10 Cheapest Life Insurance Companies

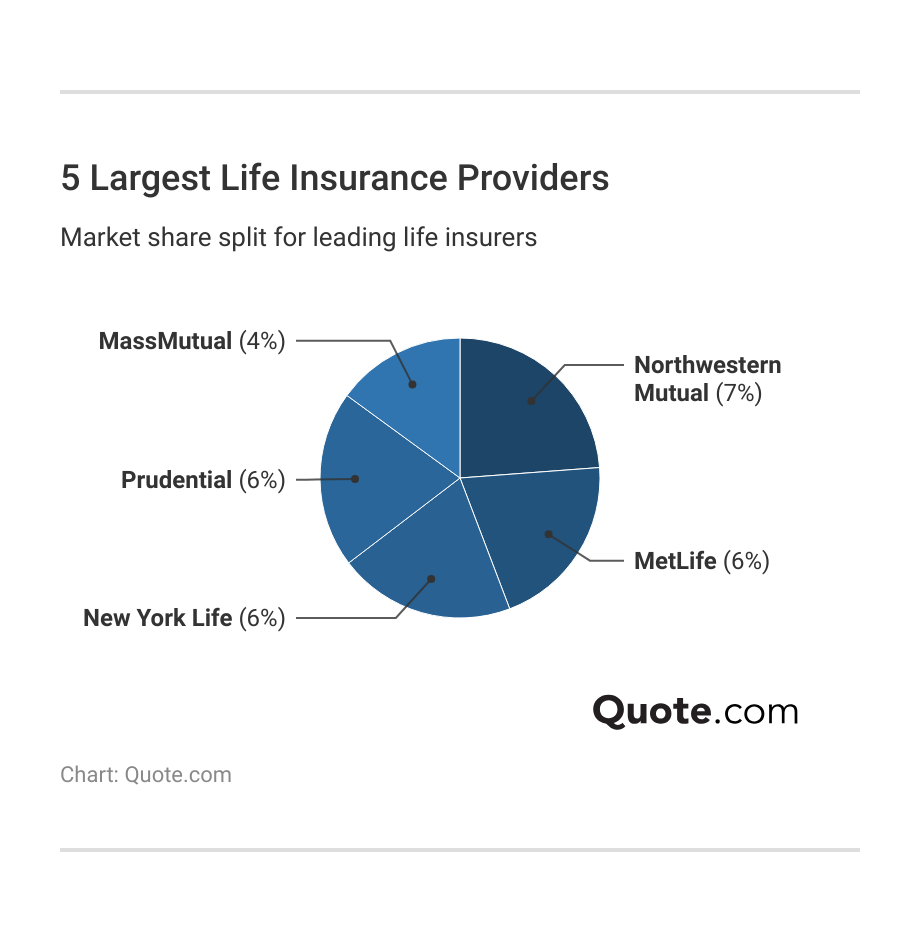

Some of the largest and most established names in life insurance set the standard for families seeking reliable, long-term coverage they can count on.

People trust Northwestern Mutual because it’s known for financial stability, while Prudential and New York Life offer dependable options that people trust for the long term.

Our top companies are better recognized for auto insurance, but they still rank among the best life insurance companies that deliver absolute stability, choice, and lasting value.

And if you have auto insurance with one of the top three, you can combine it with your life policy for additional bundled discounts today.

#1 – Liberty Mutual: Best for Affordable Premiums

Pros

- Affordable Premiums: At $39 monthly with $280 annual savings, Liberty Mutual is the lowest-priced of all listed life insurance companies.

- Financial Strength: Backed by an A.M. Best “A” rating, it offers stronger security than many budget life insurance companies.

- Bundling Discounts: Multi-policy bundling can save up to 10%, a perk not offered by all life insurance companies. Learn how savings stack up in our Liberty Mutual review.

Cons

- Rider Options: Fewer riders, such as accidental death benefit, compared to other life insurance companies.

- Renewal Costs: Premiums increase faster at renewal than those of some competing life insurance companies.

#2 – AAA: Best for Customized Policies

Pros

- Customized Policies: AAA offers flexible term and whole life options, something you won’t often find with most life insurance companies.

- Membership Discounts: At $40 monthly, policyholders save $180 annually and gain 5% member discounts not found at most life insurance companies.

- Financial Stability: Rated “A” by A.M. Best, it outperforms several smaller life insurance companies in reliability. Read our detailed AAA insurance review for more ratings.

Cons

- Service Ratings: Scores below the industry average in J.D. Power surveys for life insurance companies.

- Regional Riders: Some coverage options are only available in specific states, unlike nationwide life insurance companies.

#3 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide reduces deductibles with loyalty, a cost-cutting option not offered by many life insurance companies.

- Competitive Pricing: Premiums start at $41 monthly with $260 annual savings, making it one of the most affordable life insurance companies.

- Flexible Riders: Nationwide offers more flexibility than many other life insurance companies, allowing you to add options like accidental death or waiver of premium.

Cons

- Minimum Coverage: Requires higher entry coverage, limiting affordability compared to smaller life insurance companies (Learn More: Nationwide Insurance Review).

- Conditional Discounts: Loyalty rewards only apply after multiple years, unlike other life insurance companies that offer upfront benefits.

#4 – Columbus: Best for Customer Service

Pros

- Customer Service: Columbus holds 4.5/5 Trustpilot ratings, outperforming larger life insurance companies in policyholder satisfaction.

- Competitive Premiums: With $42 monthly rates and $160 annual savings, it remains one of the more affordable life insurance companies.

- Personalized Support: Each customer receives a dedicated agent, something most life insurance companies don’t provide.

Cons

- Limited Reach: Availability is restricted to certain states, unlike national life insurance companies.

- Discount Gaps: Lacks multi-policy or lifestyle discounts offered by other life insurance companies. See why instant life insurance is a smart choice for quick and reliable protection.

#5 – Erie: Best for Financial Strength

Pros

- Strong Financial Strength: Erie holds an A.M. Best “A” rating, stronger than most regional life insurance companies. See more ratings in our Erie insurance review.

- Solid Pricing: Term life premiums starting at $43 per month with $220 annual savings keep Erie competitive among cheap life insurance companies.

- Dividend Policies: Offers dividend-paying whole life coverage, a benefit few life insurance companies provide.

Cons

- Limited Policy Variety: Erie has fewer universal and variable life policy choices than what you’ll find with bigger life insurance companies.

- Online Limitations: Digital tools trail behind leading life insurance companies, reducing online accessibility.

#6 – Allstate: Best for Bundled Savings

Pros

- Bundled Savings: When policies are combined, Allstate delivers $300 annual savings with $44 monthly premiums, the highest of all life insurance companies.

- Financial Strength: A.M. Best “A+” rating places it ahead of many cheaper life insurance companies.

- Service Reputation: Allstate scores above the industry average in J.D. Power surveys for customer satisfaction with life insurance companies.

Cons

- Limited Discount Variety: Allstate lacks wellness or safe lifestyle discounts that some competing life insurance companies provide.

- Policy Complexity: Numerous rider options may overwhelm compared to simpler life insurance companies. Explore coverage options in our Allstate insurance review.

#7 – State Farm: Best for Easy Application

Pros

- Easy Application: State Farm life insurance offers same-day approvals online, making it faster than most life insurance companies.

- Strong Agent Network: With more than 19,000 licensed agents across the country, State Farm gives easier in-person support than most life insurance companies.

- Top Rankings: Consistently in J.D. Power’s top three for customer satisfaction among life insurance companies.

Cons

- Limited Digital Services: Applications often require agents, unlike fully online life insurance companies.

- Discount Options: Provides fewer loyalty discounts compared to other leading life insurance companies. Explore policies in our State Farm review to see if it fits your needs.

#8 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Offers forgiveness riders, a benefit not widely seen in other life insurance companies. Explore flexible policy options in our Travelers insurance review.

- Strong Customer Service: Travelers ranks above the industry average in J.D. Power surveys, giving it an edge over many life insurance companies.

- Financial Backing: Travelers has an A.M. Best “A++,” a stability rating stronger than nearly all other life insurance companies.

Cons

- Higher Entry Cost: Monthly premiums start at $46, higher than cheaper life insurance companies like Erie.

- Fewer Bundles: Offers fewer bundles compared to larger life insurance companies.

#9 – AIG: Best for High-Risk Applicants

Pros

- High-Risk Applicants: Covers individuals with pre-existing conditions rejected by many life insurance companies.

- Broad Coverage Options: AIG offers term lengths up to 35 years, longer than many competing life insurance companies.

- Guaranteed Issue: Provides no-exam policies, a rarity among standard life insurance companies. Learn about types of life insurance in our review and how they work.

Cons

- Lower Savings: $140 in annual savings is below other cheap life insurance companies like Allstate.

- Claim Delays: Longer payout processing compared to top life insurance companies.

#10 – Prudential: Best for Online Convenience

Pros

- Digital Strength: Prudential is ahead of other life insurance companies with its easy online account management tools.

- Broad Policy Choices: Prudential gives you the choice of term or permanent coverage, making it more flexible than most life insurance companies.

- Strong Reputation: Known for underwriting accuracy, outperforming several national life insurance companies.

Cons

- Higher Premiums: $48 monthly is above the cheaper life insurance companies like Liberty Mutual.

- Limited Dividend Plans: Fewer dividend-paying policies compared to other life insurance companies, like Erie (Read More: Prudential Insurance Review).

Choose the Cheapest Life Insurance Company

The cheapest life insurance companies get even more affordable when you know how to work your policy. Many insurers price policies differently by age band, so applying even a few months earlier can lock in significantly lower life insurance rates for the entire term.

Whether you’re looking at whole or term life insurance, or exploring options like cheap life insurance without a medical exam, the way you structure coverage makes a big difference in long-term costs.

Choosing a shorter term, trimming coverage to what you really need, or re-shopping rates every few years can put real money back in your pocket. Lifestyle changes help too.

Quitting tobacco alone can significantly lower your insurance rates. Also, switching to annual payments can save 5% to 10%, which can mean more than $150 a year for many families.

You may save even more by bundling life insurance with auto insurance or home insurance. Many providers offer multi-policy discounts, which can help reduce your total insurance costs.

The easiest way to keep costs low is to compare multiple life insurance quotes online. Liberty Mutual, AAA, and Nationwide might be our top picks, but use our free quote tool to see which companies give you the best balance of savings and protection.

Frequently Asked Questions

What is the cheapest life insurance company?

Liberty Mutual, AAA, and Nationwide are often considered the most affordable life insurance companies, with Liberty Mutual offering term coverage starting at around $20 per month for $250,000 in protection.

Can I stop paying for my life insurance?

Yes, but the outcome depends on policy type. A $250,000 term plan ends with no payout if premiums are stopped, while a whole life plan may maintain $5,000–$10,000 in reduced paid-up coverage if sufficient cash value has accumulated.

What is the age limit for life insurance?

Most companies stop new term coverage at 75, but guaranteed issue life insurance is available up to 85, though monthly rates can reach $150 or more for just $25,000 in coverage. For those wanting coverage later in life without ongoing payments, single-premium life insurance can be an option, since it only requires one upfront payment instead of monthly premiums.

What is the best age to get life insurance?

The best time is the 20s or 30s, when a healthy applicant can lock in a $500,000, 20-year term for less than $25 monthly, compared to $80–$100 at age 50.

Can I borrow money from my life insurance?

Yes, but only from permanent policies. For example, a whole life policy with a $20,000 cash value might allow borrowing $10,000 at an interest rate of 5–8%, reducing the death benefit until the loan is repaid.

Do I get money back if I cancel my life insurance?

Term life has no refund, but whole life may return part of the built-up cash value. A policy with $12,000 in accumulated value may pay out $10,000 after deducting surrender fees, which is one reason many people consider permanent life insurance when seeking long-term financial protection.

At what age should you cancel life insurance?

Many people cancel around retirement, once mortgages are paid and children are financially independent. At age 65, canceling can result in a savings of $150–$200 per month in premiums.

Can a 70-year-old have life insurance?

Yes, though options are limited. A 70-year-old nonsmoker might pay $200 per month for $50,000 in final expense coverage, while smokers could pay double.

How much life insurance do I need at age 40?

At 40, most advisors suggest 10–15 times income. For someone earning $70,000, this means $700,000 to $1 million in coverage to cover mortgages, childcare, and retirement savings gaps, ensuring a life insurance beneficiary has sufficient financial support in the event of an unexpected loss.

How many years should I get life insurance for?

Pick a term that matches obligations. A 20-year term works well if you want protection until children finish college, while a 30-year term is common for covering a 30-year mortgage.

Which company has the lowest cost for life insurance?

How much is a $500,000 life insurance policy for a 60-year-old man?

Can you cash out life insurance before death?

What is term life insurance, and how does it work?

Why is comparing term life insurance important?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.