Medicare Parts A, B, C, & D

Medicare Parts A, B, C, and D cover hospital insurance, medical insurance, and prescription drugs for Medicare recipients. Medicare Part C combines all parts of Medicare into one plan and premium. Monthly premiums vary, but signing up late for Medicare could result in a 1% penalty per month on Medicare Part D.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Creator

Lia Vergin develops both video and written content across all lines of insurance, with a primary focus on auto, home, and life coverage. She is dedicated to helping consumers better understand and navigate their insurance options. Driven by a passion for saving money and finding great deals, she is committed to creating clear, engaging, and practical content that empowers readers to make confident...

Lia Vergin

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated December 2025

Medicare Parts A, B, C, and D provide healthcare to millions of Americans over 65. Each Medicare part covers different aspects of medical care, from hospital stays to prescription drugs.

- Original Medicare Plans include Part A and Part B

- Medicare Part C is also known as Medicare Advantage

- Medicare Part D covers prescription drugs

Medicare Parts A and B are the most common parts and provide hospital and medical insurance, respectively. If you aren’t sure what parts you want on your Medicare plan, our expert guide to Medicare parts is for you.

- Medicare Coverage

- Does Medicare cover prescription drugs in 2026?

- Medicare Coverage & Eligibility in 2026

- Medicare Part B (2026 Guide)

- Medicare Part A (2026 Guide)

- What is Medicare Part D? (Coverage Details for 2026)

- Medicare Supplemental Insurance (Medigap) in 2026

- What is Medicare Advantage?

- Medicare Advantage vs. Original Medicare in 2026

- Best Gastroenterologists That Accept Medicare in 2026

- Best Endocrinologists That Accept Medicare in 2026

We cover what each different part of Medicare covers in detail, as well as exclusions and costs.

To speak with a licensed insurance agent about your Medicare needs, call (855) 634-0435 today. You can also enter your ZIP in our free tool to get quotes.

Medicare Parts A, B, C, & D Explained

What are Medicare Parts A, B, C, and D? Medicare Parts A and B make up Original Medicare plans. These plans will provide you with hospital and medical insurance.

Medicare Advantage plans, also known as Medicare Part C, provide Part A and Part B and may include additional benefits.

Is Medicare Part C better than Parts A and B? Check out our article on Medicare Advantage vs. Original Medicare to see which better fits your needs. For example, Medicare Advantage Plans often also include Medicare Part D, which helps cover the cost of prescription drugs.

Keep reading for a full breakdown of each of the parts of Medicare that make up both the Original and Advantage plans.

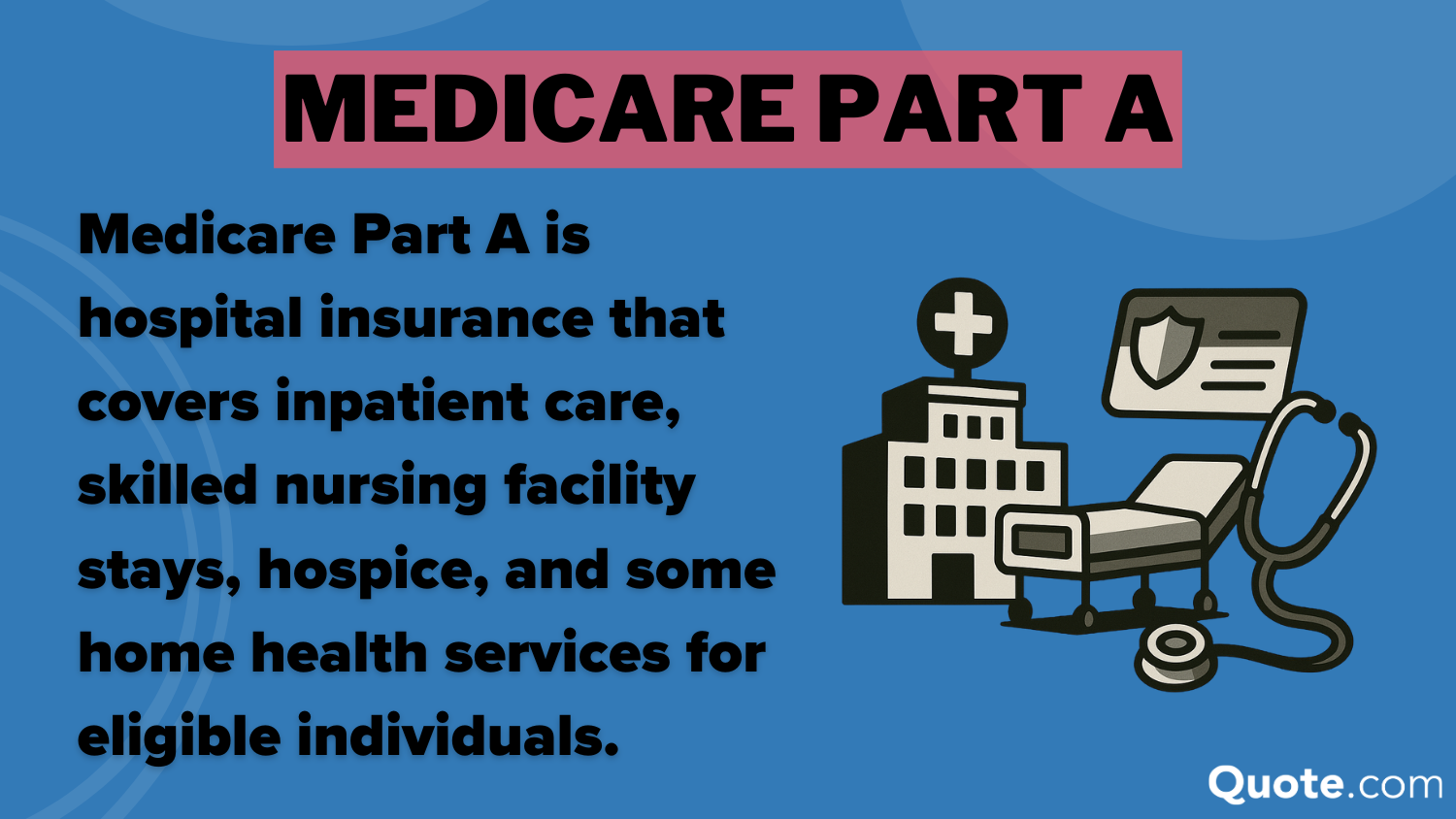

Medicare Part A

Medicare Part A is a crucial coverage component of all Medicare plans. If you need hospital care or other advanced medical care, it will help cover your costs.

For example, Part A helps cover medical care at other facilities besides hospitals, such as helping cover the cost of nursing home stays as well as hospice care for recipients.

Medicare Part A is funded in part through payroll taxes, which is why most people do not pay a monthly premium for this coverage.

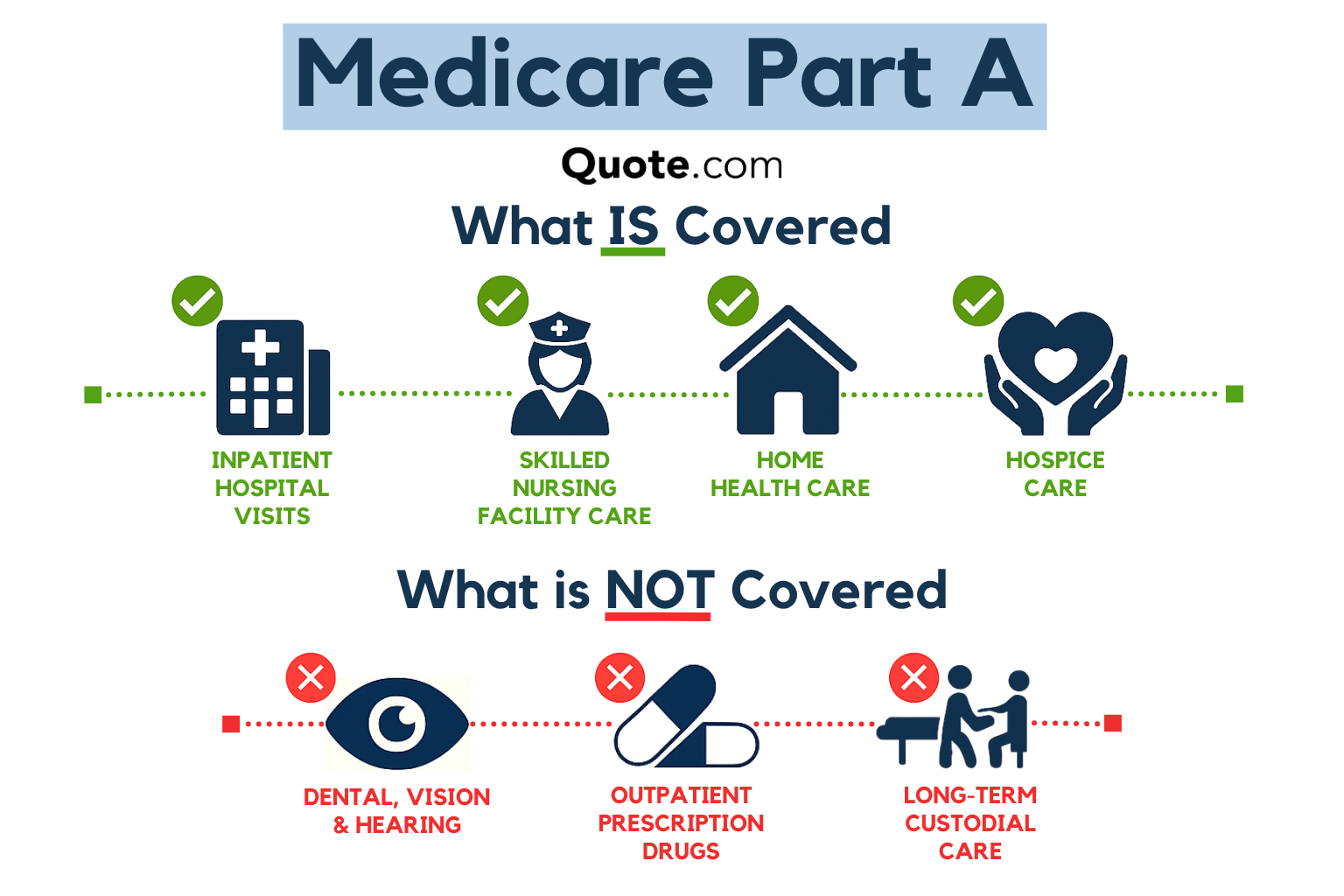

It is important to note that there are some limitations to Medicare Part A’s hospital insurance. Not every aspect of care will be covered.

For example, Medicare Part A only covers short-term rehabilitation in a skilled nursing facility, and you must have a qualifying three-day hospital stay beforehand. It does not cover long-term custodial care in a nursing home when you only need help with daily activities instead of skilled medical services.

In addition, some services must be deemed medically necessary before Part A coverage applies.

Medicare Part A: Hospital Insurance| Coverage | Details | Eligibility |

|---|---|---|

| Inpatient Hospital Care | Room, meals, nursing, meds | Age 65+ or disability |

| Skilled Nursing Facility | Short-term rehab only | 3-day prior hospital stay |

| Hospice Care | End-of-life care | Terminal illness confirmed |

| Home Health Care | Part-time skilled care | Must be homebound |

| Blood Transfusion | Covers after 3 pints | Medically necessary |

| Benefit Period | Resets after 60 days | Limits per period apply |

Hospice care will be covered if a terminal illness is confirmed. It’s important to note that with all the insurance coverages of Part A, the benefits period resets after 60 days.

This means that even if you used Part A’s services, if it has been longer than 60 days, it will reset, and you will have to pay a deductible again if you need to use Medicare Part A again.

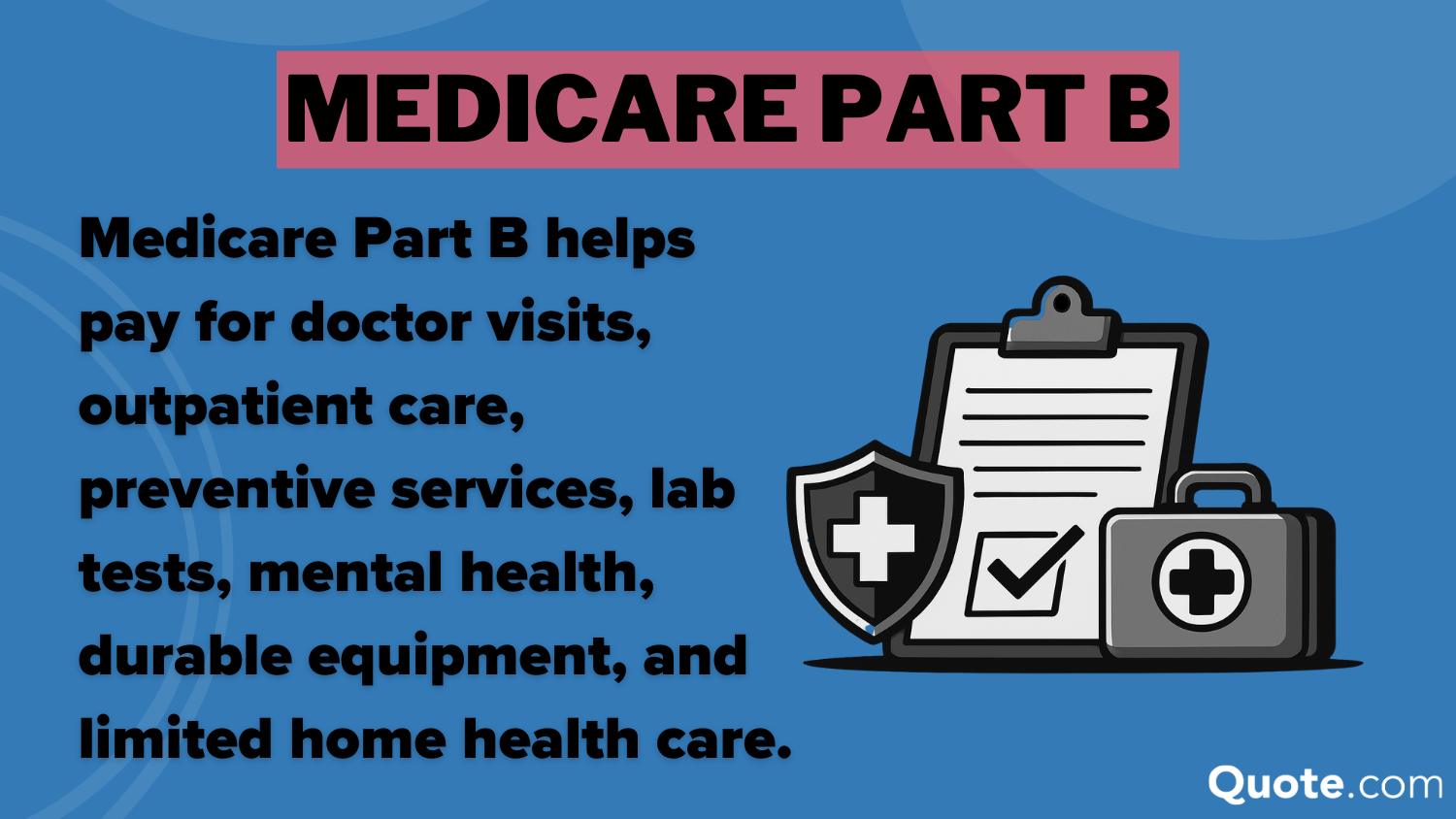

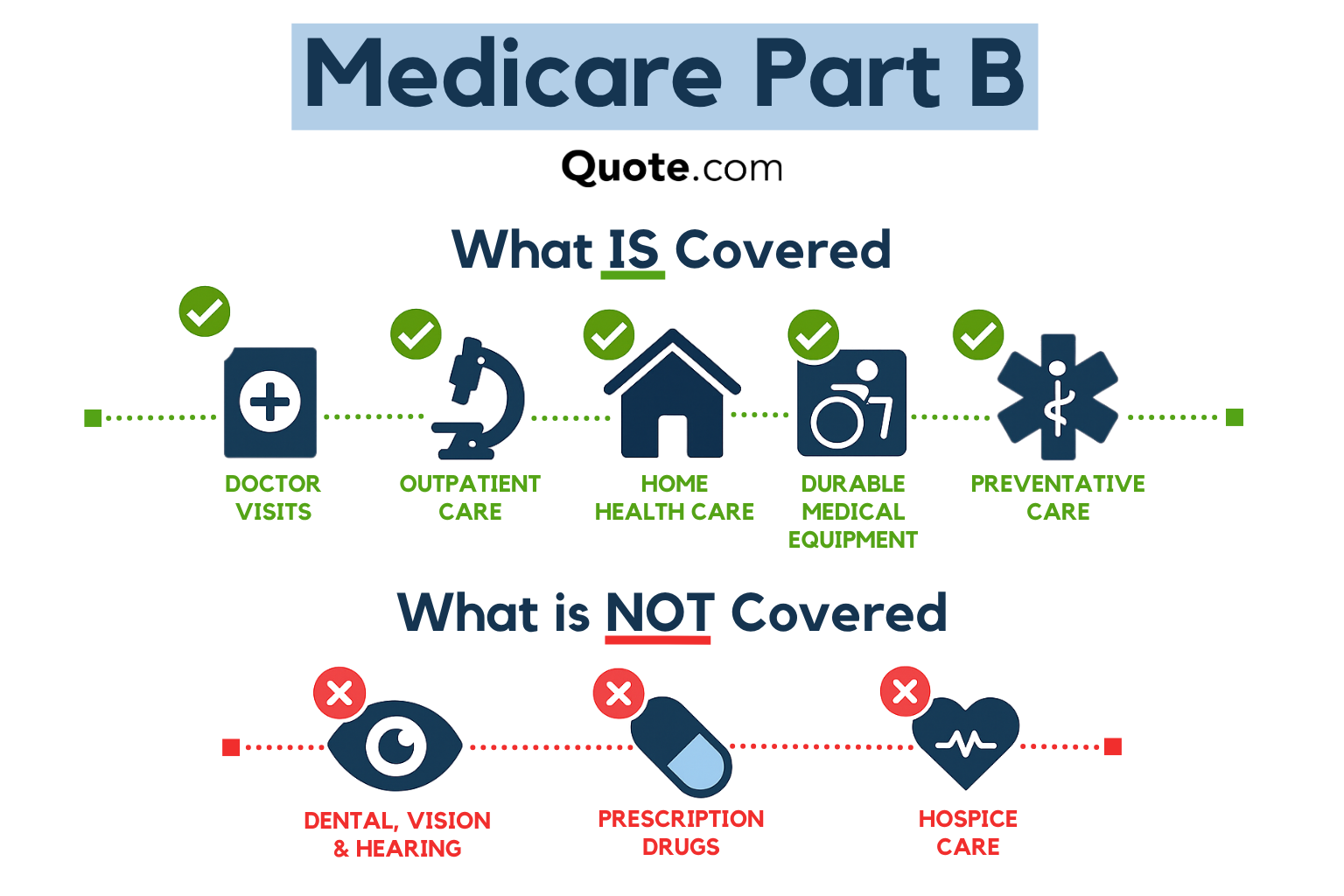

Medicare Part B

Medicare Part B is an important coverage that helps pay for the majority of healthcare needs and complements Medicare Part A by covering healthcare outside of the hospital.

Part B typically covers 80% of approved medical costs after meeting your annual deductible, leaving you responsible for the remaining 20%.

If you’re considering which parts of Medicare to buy, make sure your plan includes Medicare Part B, as it will help with care such as regular doctor appointments and lab tests.

Part B enrollees pay a standard monthly premium, but higher-income individuals may owe an added surcharge called the Income Related Monthly Adjustment Amount.

As with Medicare Part A, policyholders must meet certain criteria to have Medicare Part B help cover some healthcare aspects, which is typical of any health insurance coverage.

For example, you must have a doctor’s prescription to get medical equipment like hospital beds or oxygen covered.

Medicare Part B: Medical Insurance| Coverage | Details | Eligibility |

|---|---|---|

| Doctor Visits | Outpatient primary/specialist care | Must be enrolled in Part B |

| Preventive Care | Checkups, vaccines, screenings | Age or risk-based |

| Diagnostic Services | Lab tests, X-rays, imaging | Must be doctor-ordered |

| Medical Equipment | Walkers, oxygen, hospital beds | Doctor’s prescription |

| Mental Health | Therapy and outpatient services | When medically necessary |

| Ambulance Services | Emergency ground transport | No safe alternative available |

Most customers will make the most use out of coverage from Medicare Part B, as it helps cover preventive care, doctor visits, and testing.

Taking advantage of coverage for screening, vaccinations, and more will also help customers stay on top of their health and catch conditions earlier.

Medicare Part C

Medicare Part C, also known as a Medicare Advantage plan, is slightly different than the Original Medicare plans we talked about earlier.

Like Original Medicare Plans, Medicare Part C also combines Part A and Part B, but it may also include Part D, which helps cover prescription drugs.

The catch is that customers have to sign up to get Medicare Advantage through a private insurance plan, which can be more time-consuming (Read More: How to Sign up for Medicare).

Medicare Advantage may also not be as widely accepted by healthcare providers as Medicare Original plans, so it’s important to check provider coverage beforehand.

Medicare Part C: Medicare Advantage| Coverage | Details | Eligibility |

|---|---|---|

| Part A & B Combined | Private hospital/medical plan | Must have Parts A & B |

| Drug Coverage | Often includes Rx drugs | Must include drug benefit |

| Vision, Dental, Hearing | Routine care & aids | Varies by plan |

| Wellness Programs | Fitness/health perks | Offered by some plans |

| Cost Limits | Annual out-of-pocket max | Advantage plans only |

| Provider Networks | HMO/PPO coordination | In-network, unless emergency |

However, Part C Medicare Advantage plans may include additional benefits. Some plans may also include Part D prescription drug coverage. The disadvantage of Medicare Advantage is that these plans may not be as widely accepted as Original Medicare (Parts A and B). Benefits also vary based on your state laws and the provider you choose.

Always compare Medicare plans online before you buy or call (855) 634-0435 to speak with a local agent about your options.

Medicare Part D

What does Medicare Part D cover? The primary purpose of Medicare Part D is to help cover prescription drug costs, a large expense for many older adults and people managing chronic health issues.

It can be added to your Medicare plan, but is not automatically included in Original Medicare or Medicare Advantage plans.

To get Medicare Part D, you must have at least Medicare Part A coverage. For example, you may still have a deductible or copay you have to meet on your Medicare plan, so prescription drugs may not be 100% covered by Part D.

In some cases, Medicare Part B covers your medications instead of Part D. Part B generally pays for drugs given in a doctor’s office or outpatient clinic, including injections or infusions that require medical supervision.

It can also cover medications directly connected to outpatient treatments. This includes drugs used during dialysis, immunosuppressive medications after a Medicare-covered organ transplant, and certain vaccines like the flu, pneumonia, and COVID-19 shots.

Learn More: Does Medicare cover prescription drugs?

If you’re hospitalized, Medicare Part A may cover the medications you receive during your inpatient stay. These drugs are included in the hospital’s bundled payment, so they’re not billed separately under Part D.

Medicare Part D: Prescription Drug Coverage| Coverage | Details | Eligibility |

|---|---|---|

| Prescription Drugs | Generic & brand-name meds | Must have Part A and/or B |

| Formulary Tiers | Lower-tier drugs cost less | Drug must be plan-approved |

| Pharmacy Access | Use retail or mail-order in-network | Must use plan network |

| Coverage Phases | Includes deductible, gap, & max | Based on drug spending |

| Plan Costs | Premium, deductible, and copays | Varies by plan and income |

| Late Penalty | Fee added for late enrollment | No prior creditable drug plan |

However, Medicare Part D can still be a significant financial help to those on multiple medications, especially those who need very expensive medications.

If you have multiple medications that need to be filled regularly, you should consider looking into Medicare plans that include Medicare Part D.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

How Much Medicare Parts A, B, C, & D Costs

Curious about your Medicare Parts A, B, C, and D cost? Standard copays and deductibles are the same on most plans, and generally increase after certain time limits.

For example, Medicare Part A copays for skilled nursing costs $0 on days one through 20, and then $209 per day on days 21 through 100.

Medicare Premium, Copay, & Coinsurance Breakdown| Part | Premium | Copay | Coinsurance |

|---|---|---|---|

| Part A: Hospital | $0 for most | $0 (day 0-21); $210/day (21-100) | $0; $419/day (61-90); $838/day (91+) |

| Part B: Medical | Varies; late penalty | None | 20% after deductible |

| Part C: Advantage | Set by provider | Plan-specific | Plan-based rates |

| Part D: Prescriptions | Set by provider | Plan-specific | Varies; 1% monthly late penalty |

| Medigap: Supplement | Extra fee by plan | Covered copays | Covers deductibles & coinsurance |

With Medicare Part A, copays and coinsurance are $0 for a certain set amount of time. After the specific time period has passed, there is a per-day copay or coinsurance charge (Learn More: How much does Medicare cost?).

However, premiums will vary by plan if you are getting Medicare insurance through a private insurance company.

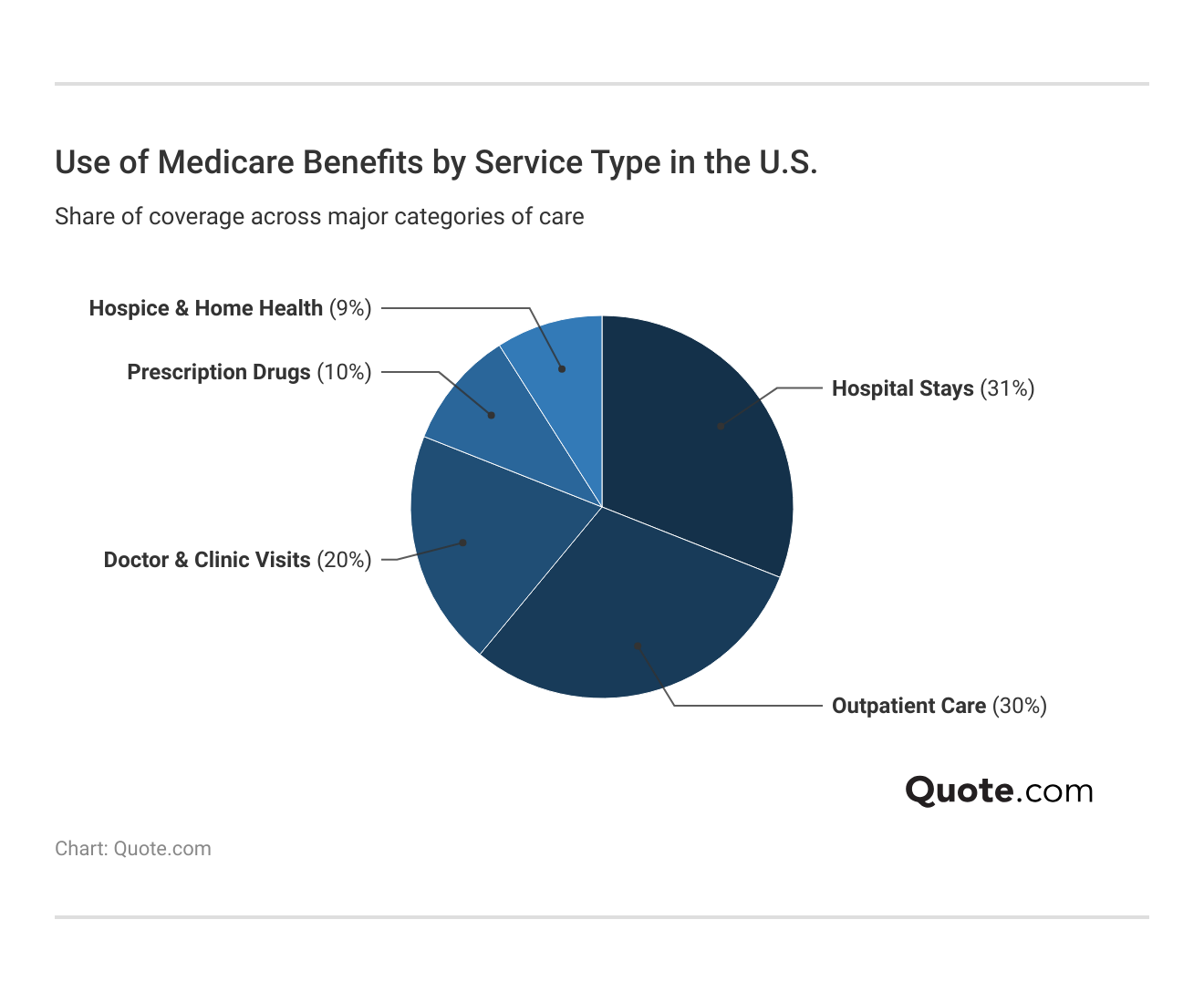

Not sure what Medicare Parts you should pay for? The majority of Medicare holders use their Medicare coverage for hospital stays, outpatient care, and doctor visits.

Because of this, you should at least consider having Medicare Part A and Part B on your Medicare insurance plan.

Coverage is used less for prescription drugs, so Medicare Part D may not be necessary for all customers to purchase.

However, there is a penalty for buying Medicare Part D late, so if you think you’ll need it, it is best to buy it when you first enroll in Medicare coverage.

Medicare Parts A, B, C, & D Exclusions

Medicare helps cover a majority of medical costs, but like all healthcare plans, it doesn’t cover every medical bill that a patient receives.

There are certain exclusions to Medicare insurance coverage that are specific to each Medicare Part’s coverage policies.

It is important to familiarize yourself with exclusions on your Medicare plan so that you don't get taken by surprise by an unexpected bill.

Jeff Root Licensed Insurance Agent

For example, Medicare Part D only covers certain medications that are considered medically necessary. It won’t cover drugs for cosmetic or fertility purposes, for instance.

And if you are in the hospital, Medicare Part A won’t cover private duty nursing or a private room, unless a private room is deemed medically necessary.

Medicare Coverage & Exclusions by Part| Medicare Part | What's Covered | Exclusions |

|---|---|---|

| Part A: Hospital | Hospital, nursing, hospice, home care | Private care, comfort items |

| Part B: Medical | Visits, outpatient, preventive care | Dental, vision, hearing aids |

| Part C: Advantage | Parts A & B under private plan | Out-of-network care, extras |

| Part D: Drugs | Prescription drugs, some vaccines | OTC, lifestyle, cosmetics |

If you want to get extra coverage to help with copays and deductibles on what is covered, you may want to look into Medigap supplemental insurance (Medigap).

However, the restrictions and exclusions don’t mean that Medicare still doesn’t benefit patients. There are still plenty of pros to each Medicare Part that help balance out the cons.

Comparing Medicare Parts A, B, C, & D

Medicare offers seniors and eligible individuals a reliable way to manage healthcare costs, with different parts designed to cover hospital care, medical services, prescription drugs, and bundled benefits.

These separate plans exist to give people flexibility in choosing healthcare coverage that matches their needs and budgets (Learn More: How to Finance What Your Health Insurance Won’t Cover).

Medicare Parts A-D Comparison: Pros & Cons| Option | Pros | Cons |

|---|---|---|

| Part A | Hospital, hospice, & home care | Deductibles; no long-term care |

| Part B | Preventive & outpatient care | Premium, copay; no dental/vision |

| Part C | Combines A & B; may add D | Network limits; costs & benefits vary |

| Part D | Prescription drugs; plan options | Extra fees; limits & gaps |

The main cons of all Medicare Parts are that there are deductibles and copays to be met. For the most part, though, the potential benefits of Medicare outweigh the cons.

For example, Medicare Part A is often premium-free for most customers and covers everything from inpatient hospital care to hospice. While coverage can be limited for long-term care, it still helps reduce costs for customers.

Need more assistance with your Medicare options? Call (855) 634-0435 to speak to a licensed representative or enter your ZIP code to learn more about your Medicare options.

Frequently Asked Questions

What are Medicare Parts A, B, C, and D?

Medicare Part A is hospital insurance while Part B is medical insurance. What are Medicare Part C and D? Medicare Part C is known as Medicare Advantage, and includes Medicare Parts A and B, but may offer additional benefits. Medicare Part D helps cover prescription drugs.

What is not covered by Medicare Part A or B?

Medicare Part A and Part B do not cover vision or dental care or things like long-term hospitalization or cosmetic treatments.

What is the best Medicare plan that covers everything for seniors?

No Medicare plan will cover everything for seniors, but Medicare Part C and Medigap coverage are among the more comprehensive options. Read our guide on Medicare coverage and eligibility for more information.

Which items will Medicare Part D not cover?

Medicare Part D only covers prescription drugs, so it does not cover hospital stays, medical supplies, or dental or vision care. Part D also doesn’t cover prescription drugs given in a hospital setting, which is covered by Part A.

Why do I need Medicare Part C?

You do not need Medicare Part C, but it may offer additional benefits compared to a Medicare Original plan.

Is Medicare Part C free?

No, Medicare Part C is not free, as there are deductibles, copays, and premiums to be paid. Is Medicare Part C based on your income? Yes, having a higher income may mean you have to pay more for Medicare Part C.

Is Medicare Part C deducted from Social Security?

Medicare Part C is not automatically deducted from Social Security, but you can usually request that it be deducted for lower costs. It will likely be deducted from your Social Security if you qualify for Medicaid (Learn More: What is Medicaid?).

Is Medicare Part D really necessary for seniors?

Medicare Part D can be a very useful coverage to help cover the cost of prescription drugs. While it is not mandatory, it can be a great coverage for seniors to have.

Does Medicare Part A cover 100% of hospital bills?

No, Medicare Part A does not cover 100% of hospital bills, as there are still copays and deductibles.

Can I drop my Medicare Advantage plan and go back to Original Medicare?

Yes, you can change back to an original Medicare plan. However, you will have to wait until the enrollment period comes up to do so.

What are the income limits for Medicare?

Do I really need supplemental insurance with Medicare?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.