10 Best Auto Insurance Companies in Louisiana for 2026

The best auto insurance companies in Louisiana are Erie, Farmers, and State Farm, with rates as low as $32 a month. Louisiana drivers must meet auto insurance minimums of 15/30/25, but you can save more by bundling policies, driving safely, or using telematics, especially in cities like Baton Rouge or New Orleans.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated November 2025

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe best auto insurance companies in Louisiana are Erie, Farmers, and State Farm. Erie is the top pick overall, offering the lowest rates starting at $32 per month and exceptional customer service.

Our Top 10 Picks: Best Auto Insurance Companies in Louisiana| Company | Rank | Claims Satisfaction | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 676 / 1,000 | A+ | Customer Service | Erie |

| #2 | 676 / 1,000 | A | Group Discounts | Farmers | |

| #3 | 673 / 1,000 | A++ | Financial Strength | State Farm | |

| #4 | 651 / 1,000 | A++ | Digital Service | Geico | |

| #5 | 650 / 1,000 | A++ | Personalized Service | Auto Owners | |

| #6 | 642 / 1,000 | A++ | Safety Features | Travelers | |

| #7 | 637 / 1,000 | A+ | Usage-Based | Progressive | |

| #8 | 637 / 1,000 | A | Quick Claims | Liberty Mutual |

| #9 | 634 / 1,000 | A+ | Local Agents | Allstate | |

| #10 | 607 / 1,000 | A | Safe Drivers | Safeco |

Farmers ranks second for its wide range of group discounts, making it ideal for drivers affiliated with partner employers, alumni organizations, and professional associations.

State Farm stands out for its A++ financial strength rating, competitive pricing, and consistent performance across age groups and driving records.

- Erie offers the cheapest rates and top-rated customer service at $32 a month

- Farmers and State Farm provide strong discounts and reliable coverage in Louisiana

- Louisiana drivers must carry at least 15/30/25 liability coverage by law

This guide compares monthly rates, discount programs, and satisfaction scores to help you choose the best car insurance in Louisiana for your needs. Start saving on your auto insurance by entering your ZIP code to get multiple auto insurance quotes.

Comparing Auto Insurance Rates in Louisiana

Louisiana drivers can find affordable auto insurance from several top companies, with rates varying by coverage level. Erie has the cheapest car insurance rates at just $32 for minimum coverage and $84 for full.

Louisiana Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $64 | $239 | |

| $47 | $124 | |

| $32 | $84 |

| $66 | $247 | |

| $44 | $163 | |

| $85 | $319 |

| $50 | $187 | |

| $38 | $101 | |

| $39 | $144 | |

| $48 | $181 |

Other top choices include State Farm at $39 for minimum coverage and $144 for full, and Auto-Owners at $47 and $124. Safeco and Geico also provide affordable options, especially for drivers looking to save on basic coverage.

While companies like Farmers and Liberty Mutual have higher rates, they may offer more features or discounts that suit specific needs.

Louisiana Auto Insurance Rates by Age

Age significantly impacts how much drivers in Louisiana pay for auto insurance. Young drivers, especially at age 16, pay the most, while older drivers often get much lower rates.

Louisiana Auto Insurance Monthly Rates by Age| Company | Age 16 | Age 25 | Age 35 | Age 45 | Age 55 | Age 65 |

|---|---|---|---|---|---|---|

| $207 | $79 | $71 | $64 | $60 | $63 | |

| $260 | $60 | $53 | $47 | $45 | $46 | |

| $136 | $38 | $35 | $32 | $30 | $31 |

| $394 | $85 | $75 | $66 | $62 | $65 | |

| $194 | $40 | $44 | $44 | $41 | $43 | |

| $412 | $105 | $75 | $85 | $80 | $84 |

| $466 | $71 | $60 | $50 | $46 | $49 | |

| $208 | $46 | $42 | $38 | $36 | $37 | |

| $172 | $50 | $45 | $39 | $36 | $38 | |

| $476 | $56 | $52 | $48 | $45 | $48 |

Drivers under 25 usually pay the most due to limited driving experience, while those aged 35–55 often receive the most favorable rates. Erie stands out with the lowest prices across all age groups, making it a top choice for affordable coverage at any stage of life.

Read More: Cheap Auto Insurance for Seniors

Louisiana Auto Insurance Rates for High-Risk Drivers

Your driving record plays a major role in how much you pay for auto insurance in Louisiana. One accident or ticket can cause your rates to rise. Erie stands out by offering cheap auto insurance for high-risk drivers with DUIs or at-fault accidents.

Louisiana Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $64 | $99 | $87 | $76 | |

| $47 | $69 | $47 | $57 | |

| $32 | $60 | $32 | $45 |

| $66 | $94 | $92 | $83 | |

| $44 | $72 | $89 | $57 | |

| $85 | $115 | $153 | $103 |

| $50 | $87 | $79 | $67 | |

| $38 | $59 | $38 | $48 | |

| $39 | $45 | $42 | $42 | |

| $48 | $67 | $101 | $65 |

State Farm also keeps rate increases modest after violations, making it a reliable choice for drivers with past incidents. Auto-Owners and Safeco follow closely, maintaining affordable rates even after accidents or tickets.

Louisiana Auto Insurance Rates by City

Auto insurance costs in Louisiana vary widely by city due to factors like traffic density, accident frequency, and local claim rates. Cities with higher population levels and more congested roadways, such as Baton Rouge and New Orleans, often see the highest monthly premiums, reaching up to $110 in New Orleans.

Louisiana Auto Insurance Rates by City| City | Monthly Cost |

|---|---|

| Bossier City | $58 |

| Shreveport | $65 |

| Lafayette | $70 |

| Monroe | $75 |

| Alexandria | $80 |

| Slidell | $85 |

| Lake Charles | $90 |

| Houma | $95 |

| Baton Rouge | $100 |

| New Orleans | $110 |

Smaller cities like Bossier City or Shreveport typically have lower rates, starting around $58–$65 per month, since they experience fewer accidents and lower overall risk levels for insurers. These regional differences mean where you live can significantly impact how much you pay for car insurance in LA.

Comment

byu/Fuzzwars from discussion

inLouisiana

Many drivers on Reddit mention that Louisiana car insurance is expensive statewide due to high accident rates, frequent lawsuits, and severe weather events, all of which lead to more claims and higher premiums.

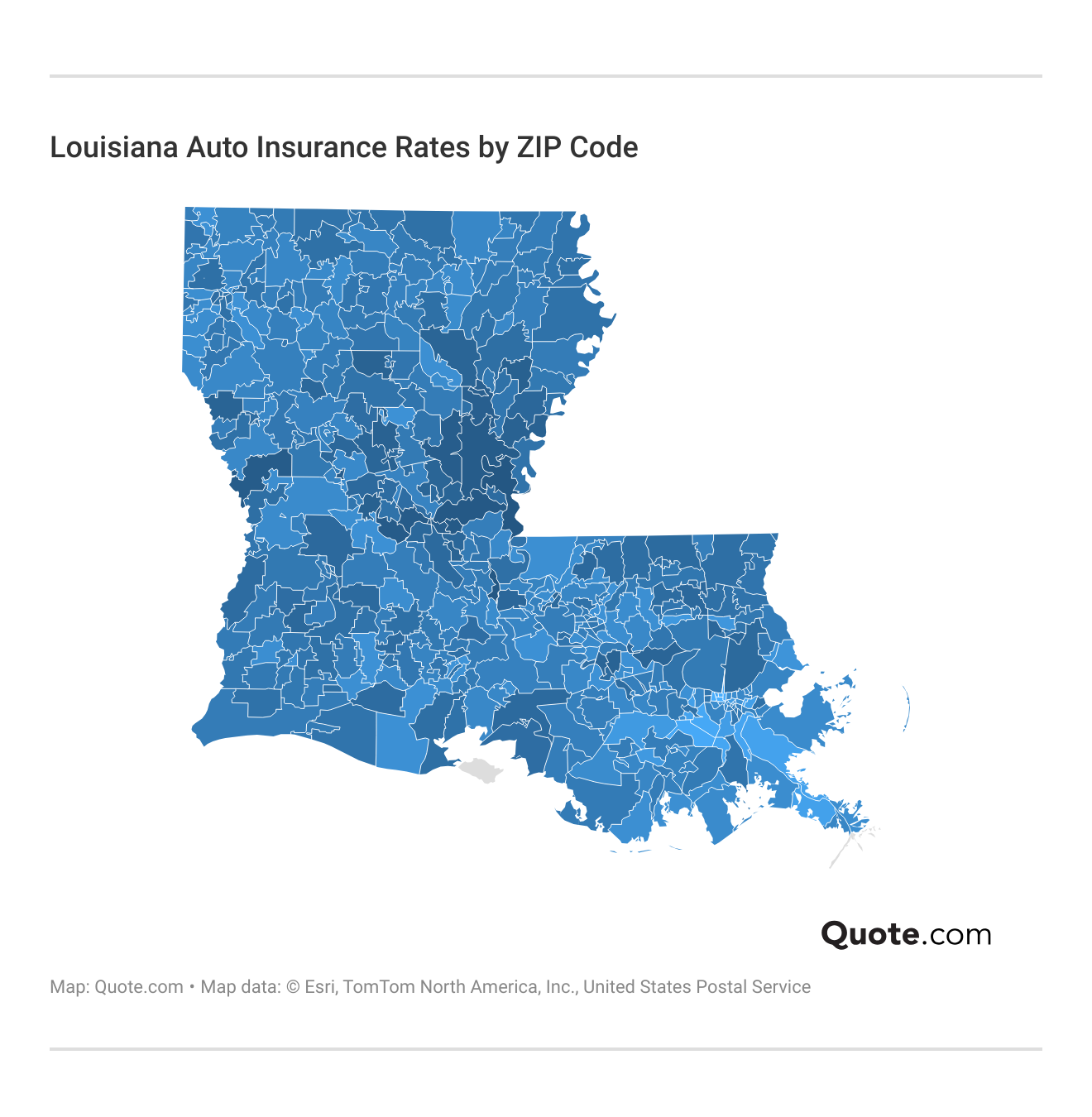

Louisiana Auto Insurance Rates by ZIP Code

Rates for auto insurance in Louisiana vary widely by ZIP code due to factors like traffic patterns, local accident frequency, theft risk, and weather-related claims. Urban ZIP codes, especially in New Orleans and Baton Rouge, tend to have the highest premiums because of heavier traffic and more reported accidents.

Rural areas or lower-risk regions typically see lower monthly rates, giving some Louisiana drivers a big advantage simply based on where they live. This map shows how your specific ZIP code can impact what you pay for coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Louisiana Auto Insurance Coverage Requirements

Louisiana law requires drivers to carry minimum liability coverage of $15,000 for bodily injury per person, $30,000 per accident, and $25,000 for property damage. The law also requires insurers to offer uninsured/underinsured motorist (UM/UIM) coverage, which protects you if you’re hit by an uninsured driver.

Louisiana drivers aren’t required to keep UM/UIM coverage, but you must send a request in writing to the DMV to remove it from your policy. No Pay, No Play laws, which limit compensation for uninsured drivers, are also enforced in Louisiana due to the high number of uninsured drivers in the state.

The state also implemented Tort Reform, which prevents anyone over 51% at fault from collecting damages. It requires proof that injuries were caused by the accident, helping reduce fraudulent claims in an attempt to stabilize increasing insurance costs in Louisiana.

Read More: Worst States for Filing Auto Insurance Claims

Coverage Options in Louisiana

While meeting these minimums keeps you legal, many Louisiana drivers choose to add more protection. Here are some common additional coverage types to consider:

- Collision Coverage: Collision auto insurance covers damage to your vehicle after an at-fault accident in Louisiana.

- Comprehensive Coverage: Comprehensive auto insurance pays for non-collision events common in LA, like flooding, theft, or falling objects.

- Uninsured/Underinsured Motorist: Helps cover costs if you’re hit by a driver with little or no insurance in Louisiana.

- Medical Payments (MedPay): Covers medical expenses for you and your passengers after a crash in LA, regardless of fault.

Choosing extra protection beyond the Louisiana auto insurance minimums can help drivers avoid large expenses and stay better prepared on the road. By investing in more than the minimum insurance requirements in Louisiana, you gain added financial security and peace of mind.

Louisiana drivers should carry more than the state minimum if they commute daily, drive in high-traffic areas, or can’t afford to pay out of pocket for major repairs.

Daniel Walker Licensed Insurance Agent

Optional coverages like rental reimbursement, roadside assistance, and gap insurance can make a big difference when unexpected accidents, severe weather, or uninsured drivers put you at risk, ensuring you won’t have to shoulder the full cost of repairs or medical bills alone.

Ways to Save on Louisiana Auto Insurance

Liberty Mutual, Farmers, and Geico offer the most generous auto insurance discounts in Louisiana. Liberty Mutual leads with a 35% anti-theft discount.

Top Auto Insurance Discounts in Louisiana| Company | Anti- Theft | Good Driver | Multi- Car | Multi- Policy | Usage Based |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 25% | 30% | |

| 12% | 25% | 10% | 16% | 30% | |

| 15% | 23% | 10% | 25% | 30% |

| 10% | 30% | 20% | 20% | 30% | |

| 25% | 26% | 25% | 25% | 25% | |

| 35% | 20% | 25% | 25% | 30% |

| 25% | 30% | 12% | 10% | $231/yr | |

| 20% | 20% | 20% | 15% | 30% | |

| 15% | 25% | 20% | 17% | 30% | |

| 15% | 10% | 8% | 13% | 30% |

Get the biggest savings for safe driving habits, policy bundling, and signing up for usage-based car insurance. Farmers provides a 30% good driver discount and broad savings with car insurance discounts you can’t miss.

Aside from traditional discounts, Louisiana drivers can reduce their auto insurance costs by making strategic policy choices and improving risk factors insurers consider when setting rates.

- Drive a Low-Risk Vehicle: Choosing a car with a strong safety record and low repair costs can lower your premium.

- Improve Your Credit Score: Insurers in Louisiana often use credit-based insurance scores when determining rates.

- Reduce Mileage: Driving fewer miles annually may qualify you for lower premiums, especially if you work from home or carpool.

- Adjust Coverage as Your Car Ages: Dropping collision or comprehensive coverage on older vehicles can save money.

- Pay in Full: Paying your premium upfront instead of monthly can help Louisiana drivers avoid installment fees and get a small rate break.

Louisiana drivers who own older cars or don’t drive frequently can opt for liability-only coverage at the lowest rates possible. If you aren’t interested in carrying less than full coverage, many of the top auto insurance companies in Louisiana offer usage-based car insurance that tracks only mileage, helping those who don’t drive often get cheaper rates.

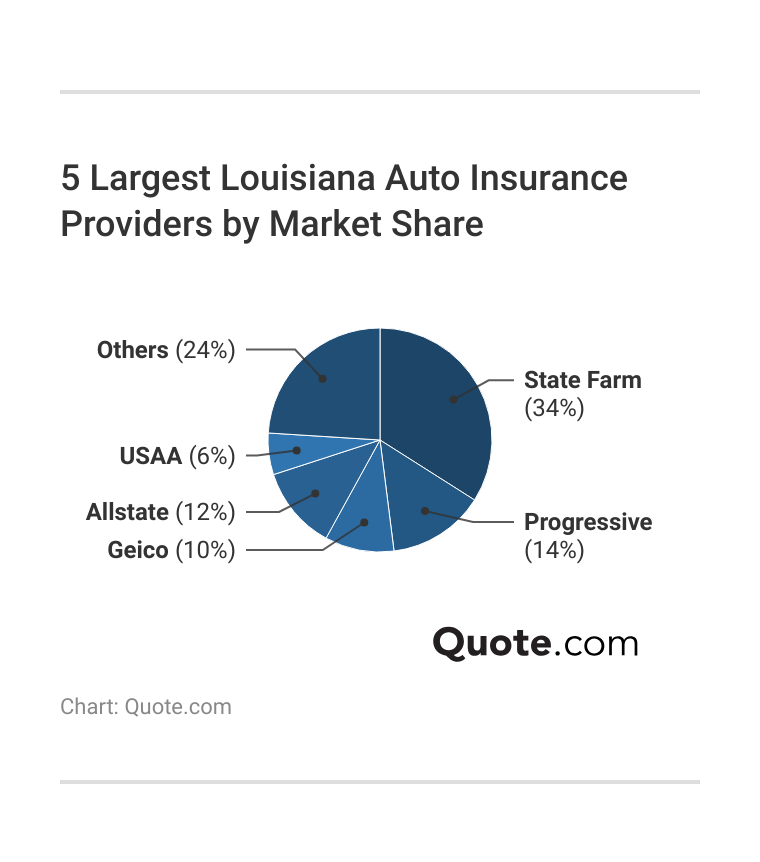

The Most Popular Louisiana Auto Insurance Companies

State Farm is the largest auto insurance provider in Louisiana, with about 34% of the market. Big national companies like State Farm, Progressive, and Geico can usually keep rates steady by spreading risk across more drivers.

Smaller local insurers don’t have the same resources, so their prices may be higher or change more often, especially with Louisiana’s high accident rates and storm-related claims. Some Louisiana car insurance companies, however, focus on high-risk drivers or special coverage needs, which larger insurers might not offer, even if it costs a bit more per month.

Learn More: Hacks to Save More Money on Car Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

10 Best Auto Insurance Companies in Louisiana

Erie, Farmers, and State Farm are the best auto insurance companies in Louisiana, known for affordable rates, reliable coverage, and strong discounts. Compare pros and cons and get personalized quotes to find the right LA auto insurance policy for your needs.

Read More: How to Compare Auto Insurance Companies

#1 – Erie: Top Overall Pick

Pros

- Exceptional Customer Service: Erie is known for top-tier customer service across Louisiana, backed by a high satisfaction score of 676/1,000.

- Lowest Rates in Louisiana: Erie offers the cheapest minimum coverage in Louisiana at just $32 a month,

- Strong Discount Programs: LA drivers can save up to 30% through usage-based discounts and 25% through bundling with Erie. Explore savings and features in this Erie insurance review.

Cons

- Limited Availability: Erie auto insurance isn’t available everywhere, so policies may not follow you if you move out of state.

- Fewer Digital Tools: Louisiana customers may find Erie’s online and mobile tools less robust compared to larger national insurers.

#2 – Farmers: Best for Group Discounts

Pros

- Extensive Group Savings: Farmers offers group discounts for teachers, military members, and corporate partners, helping Louisiana drivers reduce premiums.

- Multiple Discount Layers: Louisiana drivers can combine up to 30% usage-based savings with 20% multi-car and 20% bundling discounts. Find everything you need to know about Farmers Insurance.

- Unique Policy Options: Farmers auto insurance in Louisiana covers rideshare drivers, collector cars, custom parts, and more.

Cons

- Higher Base Rates: Even with discounts, Farmers’ minimum coverage rate in Louisiana is higher than most top competitors.

- Mixed Claims Satisfaction: LA drivers may experience inconsistent claims service, despite Farmers’ 676/1,000 satisfaction score.

#3 – State Farm: Best for Financial Strength

Pros

- Top Financial Security: State Farm holds an A++ A.M. Best rating for reliable claims coverage. See more ratings in our State Farm auto insurance review.

- Affordable Louisiana Pricing: Minimum coverage starts at $39 a month, offering balanced pricing for most LA driver profiles.

- Local Customer Service: Local agents provide hands-on service for policy changes, claims handling, and more, backed by a 673/1,000 J.D. Power satisfaction score.

Cons

- Discount Limitations: State Farm offers 17% bundling in LA, which is lower than Liberty Mutual or Geico’s 25% offerings.

- Limited Tech-Driven Discounts: LA drivers looking for advanced usage-based or app-based savings may find State Farm’s tech programs limited.

#4 – Geico: Best for Digital Service

Pros

- Maximized Digital Experience: Louisiana drivers benefit from easy online quote comparisons, claims filing, and coverage adjustments through Geico’s mobile app.

- Strong Multi-Policy Savings: Geico provides Louisiana residents up to 25% in bundling and 26% for good driver discounts. Get everything you need to know about Geico in our review.

- Consistently Low Rates: Geico car insurance in Louisiana offers affordable minimum coverage starting at $44 a month, with competitive pricing across age groups.

Cons

- Lower Claims Satisfaction: With a score of 651/1,000, Geico’s claims experience in Louisiana may fall short of driver expectations.

- Fewer Local Agents: Geico has limited in-person support options in Louisiana, relying on its digital offerings.

#5 – Auto-Owners: Best for Personalized Service

Pros

- Highly Personalized Service: Auto-Owners earns high marks in Louisiana for personalized support via local agents and responsive customer care.

- Affordable Minimum Coverage Rates: Starting at $47 a month, Auto-Owners offers dependable budget coverage for LA drivers. Get more quotes in our Auto-Owners review.

- Strong Discounts for Safe Drivers: Louisiana drivers can qualify for up to 25% savings with a clean record and 30% with usage-based tracking.

Cons

- Limited Online Tools: LA drivers must rely heavily on agents, as Auto-Owners’ digital tools lag behind competitors like Geico or Progressive.

- Availability Restrictions: Coverage is not available statewide in Louisiana, particularly in rural or underserved ZIP codes.

#6 – Travelers: Best for Safety Features

Pros

- Vehicle Safety Features: LA drivers with modern cars enjoy competitive rates with Travelers, especially those with advanced safety systems.

- Competitive Pricing: Minimum coverage starts at $48 a month, ideal for tech-savvy drivers who also want quality protection. See what stands out in our expert Travelers auto insurance review.

- Discounts for Tech Users: Travelers offers up to 30% off for LA drivers enrolled in usage-based programs and 13% bundling savings.

Cons

- Below-Average Claims Score: With a claims satisfaction rating of 642/1,000, LA drivers may experience slower resolution times.

- Low Multi-Car Discount: Travelers only offers 8% off for multi-car policies in Louisiana, well below the state average.

#7 – Progressive: Best for Usage-Based Options

Pros

- Popular Usage-Based Discount: LA drivers can save up to $231/year with Progressive’s Snapshot program by tracking safe driving behavior.

- Best for Policy Customization: Progressive allows Louisiana drivers to stack add-ons like roadside assistance, gap insurance, and rideshare coverage.

- Decent Minimum Coverage Pricing: Rates start from $50 a month. Browse more quotes in our guide to everything you need to know about Progressive insurance.

Cons

- Moderate Claims Reputation: Progressive holds a 637/1,000 claims satisfaction score, which may reflect some delays for LA drivers.

- Low Bundling Discount: At just 10%, Progressive’s bundling savings for Louisiana drivers are lower than many top competitors.

#8 – Liberty Mutual: Best for Quick Claims

Pros

- Quick Claims in Louisiana: Liberty Mutual stands out for rapid claims processing, earning a 637/1,000 satisfaction rating among LA drivers.

- Generous Anti-Theft Discounts: LA drivers can save up to 35% for anti-theft features, the highest of any provider on this list.

- High Usage-Based Savings: With a 30% telematics discount, Liberty Mutual rewards safe driving behavior in Louisiana. See full details in our Liberty Mutual auto insurance review.

Cons

- Expensive Base Rates: Liberty Mutual’s minimum coverage in LA starts at $85 a month, the highest among top insurers.

- Inconsistent Pricing by Profile: Liberty Mutual premiums in Louisiana vary widely by age and driving history, limiting predictability.

#9 – Allstate: Best for Local Agents

Pros

- Strong Agent Network: Allstate offers broad access to local agents throughout Louisiana, providing face-to-face policy support.

- Solid Coverage Options: Flexible plans in Louisiana include accident forgiveness, rental reimbursement, and new car replacement. Learn about policy benefits in our Allstate auto insurance review.

- Competitive Discounts: Allstate offers Louisiana drivers up to 25% off for bundling and good driving.

Cons

- Higher Starting Rates: Allstate’s LA minimum coverage starts at $64 a month, well above Erie or Geico.

- Usage-Based Limits: While LA drivers can get 30% off, Allstate’s telematics programs can penalize bad driving more harshly than other providers.

#10 – Safeco: Best for Safe Drivers

Pros

- Safe Driver Discounts: LA residents can receive up to 20% off for good driving and 30% with usage-based savings. Delve more details in our Safeco auto insurance review.

- User-Friendly Digital Access: Safeco’s online tools allow Louisiana drivers to easily manage claims, payments, and policy changes.

- Affordable LA Coverage: With minimum coverage from $38 a month, Safeco balances low pricing with solid digital support.

Cons

- Limited Physical Support: Safeco has fewer in-person offices in Louisiana, which may frustrate drivers who prefer agent assistance.

- Average Claims Satisfaction: Safeco’s score of 607/1,000 reflects average service compared to higher-ranked Louisiana competitors.

How to Choose the Best Auto Insurance in Louisiana

Finding the best auto insurance company in Louisiana means looking beyond just the cheapest price. Drivers should consider factors that impact coverage quality, long-term costs, and reliability. Use these tips to help narrow down your options:

- Compare Rates by City or ZIP Code: Prices vary across Louisiana, with cities like New Orleans and Baton Rouge often having higher premiums.

- Check Customer Service Ratings: Look for companies with strong claims satisfaction scores, as fast and fair claims handling is crucial after an accident.

- Review Financial Strength: Choose insurers with high A.M. Best ratings to ensure they can pay claims even after widespread events like hurricanes.

- Look at Discounts That Fit Your Profile: Farmers offers strong group discounts, while Liberty Mutual has large anti-theft savings for Louisiana drivers.

- Consider Local Risk Factors: Companies with good flood and storm coverage options may be better suited for drivers in coastal Louisiana regions.

By comparing these factors, Louisiana drivers can confidently choose an insurer that balances affordability with dependable service and tailored coverage.

Looking beyond just rates, Erie, Farmers, and State Farm have better customer service ratings than many other Louisiana auto insurance companies on this list. Compare State Farm vs Farmers, Geico, Progressive, and Allstate auto insurance to learn more.

It’s also important to think about things like how easy it is to file a claim, what discounts are available, and how simple it is to manage your policy online.

Leslie Kasperowicz Farmers CSR for 4 Years

Be sure to compare quotes from different companies and read customer reviews so you can feel confident you’re picking the right provider for your situation. You can find affordable auto insurance today by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

What is the best auto insurance in Louisiana?

Erie is considered one of the best Louisiana auto insurance companies for its generous discounts and affordable rates starting at just $32 per month. It consistently ranks high in customer satisfaction and provides strong value for both minimum and full coverage (Learn More: How to Buy Auto Insurance).

What is the average car insurance rate in Louisiana?

The average cost of car insurance in Louisiana is around $52 for minimum coverage and $174 for full coverage, though rates vary based on your age, driving record, and provider. Erie, Safeco, and State Farm offer some of the lowest rates in the state.

How much is full coverage car insurance in Louisiana?

On average, most drivers pay $174 per month for full coverage in Louisiana, but your rates will vary based on your ZIP code, the kind of car you drive, and the company you choose. Erie has the cheapest full coverage car insurance in Louisiana, starting at $84 a month (Read More: Liability vs. Full Coverage Auto Insurance).

Why is car insurance so expensive in Louisiana?

Your car insurance in Louisiana is so high due to several factors, including high accident rates, frequent severe weather, and a large number of uninsured drivers. Additionally, state laws and a high volume of litigation contribute to rising insurance costs.

What factors affect car insurance rates in Louisiana?

Car insurance in Louisiana is affected by your age, driving record, credit score, ZIP code, vehicle type, and coverage level. Insurers also consider local risks like hurricane exposure, accident frequency, and legal claim trends. Avoid expensive auto insurance premiums by entering your ZIP code to see the cheapest rates for you.

What auto insurance is required in Louisiana?

Louisiana requires drivers to carry at least $15,000 in bodily injury liability per person, $30,000 per accident, and $25,000 in property damage liability. These are the minimum legal limits to drive in the state, but many drivers choose to add more coverage for better protection (Learn More: Liability Auto Insurance).

Who has the best and cheapest car insurance in Louisiana?

Erie offers both the best and cheapest car insurance in Louisiana, with minimum coverage starting at $32 per month and full coverage at $84 per month. It’s highly rated for both price and customer service, making it a top pick for most drivers.

How much is car insurance in Louisiana per month?

Car insurance in Louisiana costs an average of $52 per month for minimum coverage and around $174 per month for full coverage. Rates can vary based on factors like your city, age, driving record, and chosen provider, with Erie offering the lowest minimum coverage starting at $32 per month.

How much is Progressive car insurance in Louisiana?

Progressive’s average cost of full coverage in Louisiana are about $187 per month and $50 per month for minimum coverage. Drivers can also save through Progressive’s Snapshot program, which tracks safe driving habits and can offer up to $231 per year in savings (Read More: State Farm vs. Progressive Auto Insurance).

How can I save on car insurance in Louisiana?

You can save by driving a safe vehicle, improving your credit score, reducing mileage, adjusting your coverage, and paying your premium in full. Also, comparing quotes from different Louisiana car insurance companies and applying for discounts such as bundling, usage-based programs, or good driver rewards can help lower your monthly costs. (Read More: Best Auto Insurance for Good Drivers).

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.