Fred Loya Insurance Review for 2026

Affordable Fred Loya car insurance quotes start at $155 per month. This Fred Loya insurance review highlights that the company focuses on high-risk drivers and also offers Mexican auto coverage for those who often drive between the U.S. and Mexico.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

Our Fred Loya insurance review finds that the company keeps no-credit-check car insurance affordable, but coverage is only available in 12 states.

- The Fred Loya overall insurance rating is 2.6

- Fred Loya auto insurance includes roadside assistance

- Drivers can get coverage with Fred Loya without a credit check

Fred Loya Insurance focuses on serving drivers who need same-day coverage, with monthly rates around $155 for basic protection.

Flexible policies include liability, collision, and comprehensive coverage, as well as medical payments, rental reimbursement, and roadside assistance.

Fred Loya Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 2.6 |

| Business Reviews | 2.0 |

| Claims Processing | 2.0 |

| Company Reputation | 2.0 |

| Coverage Availability | 2.1 |

| Coverage Value | 2.5 |

| Customer Satisfaction | 3.4 |

| Digital Experience | 2.0 |

| Discounts Available | 2.3 |

| Insurance Cost | 3.5 |

| Plan Personalization | 2.0 |

| Policy Options | 2.5 |

| Savings Potential | 3.1 |

Fred Loya Insurance Company delivers personalized service through local agents in more than 800 offices. Drivers get quick claims help and real-time updates through programs like Direct Repair Facility and Fred Loya Mobile Alerts.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today and see how Fred Loya car insurance reviews compare to other top providers in affordability and coverage.

Fred Loya Auto Insurance Cost

Our Fred Loya auto insurance review shows that while the company offers competitive rates for clean records, it’s also known for offering the best car insurance for bad credit, helping drivers with poor credit or past issues get insured easily.

A low credit score can make car insurance more expensive because insurers often view poor credit as a sign of higher financial risk and consider drivers with lower scores as more likely to file claims than pay out of pocket.

No-credit-check car insurance from Fred Loya offers a solution for drivers with bad credit by focusing on driving record, insurance history, and coverage needs instead of financial background.

Fred Loya Insurance also provides discounts to help lower rates even more. Use this Fred Loya review to compare quotes and find affordable no-credit-check auto insurance near you.

Read More: Expert Guide to Different Loans

Fred Loya Rates by Coverage Level

Some of the most affordable auto insurance options come from State Farm, Progressive, and Travelers, all offering minimum coverage under $60 per month and full coverage under $250.

If you’re comparing broader protection, Allstate and Liberty Mutual cost more, at $228 and $248 for full coverage, but may come with stronger service or policy extras.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $155 | $325 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Fred Loya stands out with the highest rates—$155 for minimum and $325 for full coverage—making it one of the least budget-friendly picks here.

For a balanced cost-to-coverage ratio, American Family and Nationwide insurance land somewhere in the middle, keeping full coverage rates between $160 and $170. These numbers help break down the price difference depending on how much protection you want.

Fred Loya Rates by Credit Score

USAA clearly offers the lowest rates across all credit levels, with prices starting at $65 for excellent credit and $125 if your score is below 580.

State Farm and Fred Loya also keep costs relatively low for drivers with strong credit, charging $70 and $75, while still staying under $140 for poor credit.

Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $90 | $110 | $130 | $150 | |

| $85 | $105 | $125 | $145 |

| $95 | $115 | $135 | $155 | |

| $75 | $95 | $115 | $135 | |

| $80 | $100 | $120 | $140 |

| $82 | $102 | $122 | $142 | |

| $78 | $98 | $118 | $138 | |

| $70 | $90 | $110 | $130 | |

| $92 | $112 | $132 | $152 | |

| $65 | $85 | $105 | $125 |

Farmers and Travelers are the most expensive for low scores, with rates reaching $155 and $152. Including American Family, Liberty Mutual, and Nationwide—show a steady rate increase as credit scores drop, with about a $50 spread from the best to worst credit tiers.

If your score isn’t great, those differences can add up quickly, making it worth the effort to shop around.

Fred Loya Rates by Driving Record

When it comes to high-risk drivers with bad credit or multiple accidents, Fred Loya remains a competitive choice.

It does cost more than USAA or Progressive insurance, but these companies are unlikely to insure drivers with multiple citations or bad credit.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $178 | $95 | |

| $155 | $245 | $310 | $195 | |

| $96 | $129 | $65 | $116 |

| $63 | $88 | $112 | $75 | |

| $56 | $98 | $58 | $74 | |

| $47 | $57 | $38 | $53 | |

| $53 | $76 | $123 | $72 | |

| $32 | $42 | $93 | $36 |

According to average Fred Loya insurance costs, drivers with a clean record typically pay about $155 per month, while those with a DUI can see rates rise to around $310 per month.

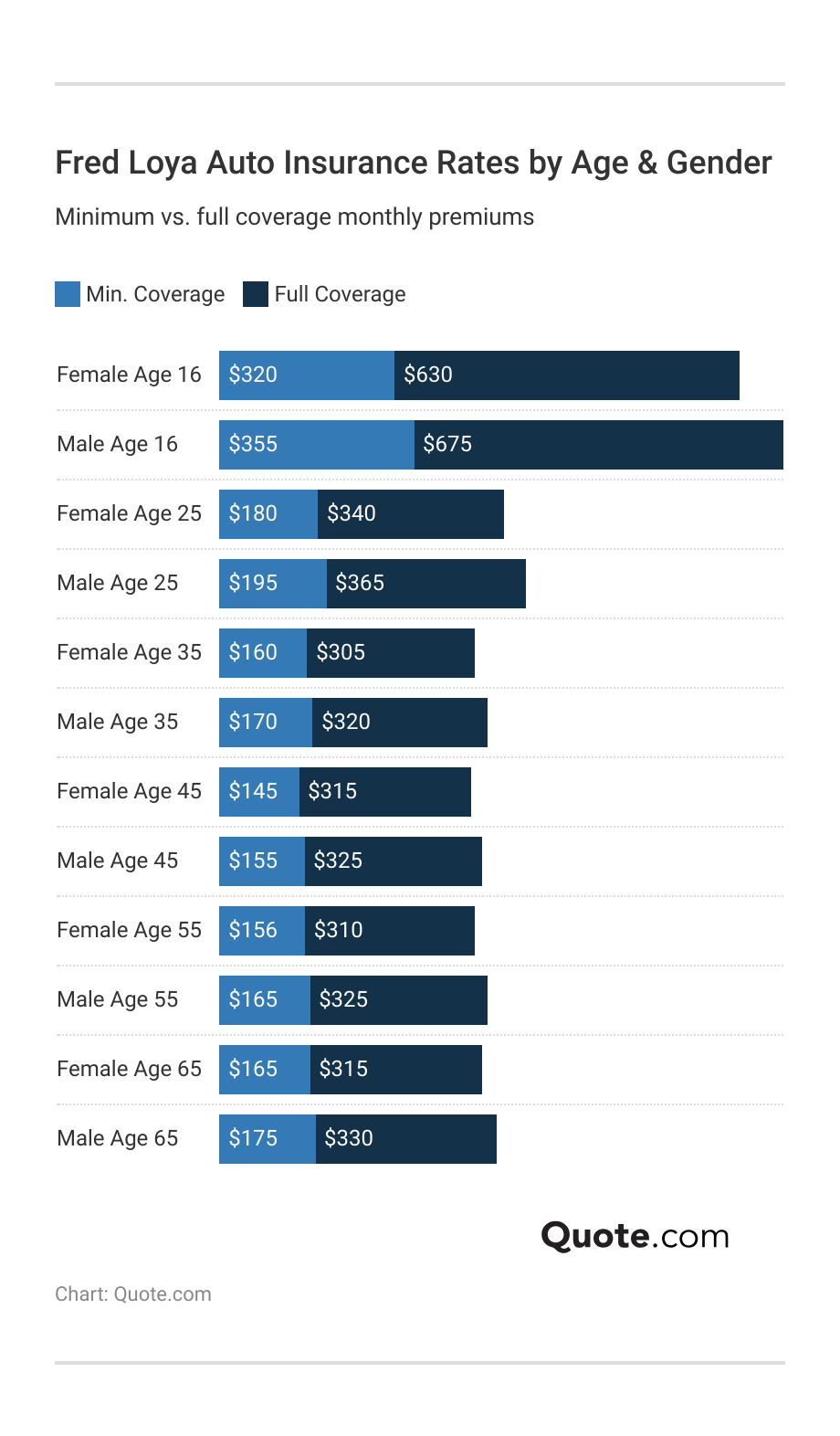

Fred Loya Rates by Age & Gender

Teenagers are also considered high-risk and pay the highest monthly rates, averaging between $320 and $355 for minimum coverage and $630 and $675 for full coverage.

When compared to other insurers, Fred Loya’s minimum coverage average of $155 per month is much higher than Progressive or State Farm at $56 and $47 monthly, respectively (Read More: State Farm vs. Progressive Auto Insurance).

For drivers seeking cheap full coverage auto insurance for bad credit, Fred Loya Insurance offers straightforward policies and in-person support through local agents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fred Loya Insurance Coverage Options

Fred Loya Insurance gives drivers flexible car insurance coverage that can grow with their needs.

It’s a practical choice if you want to balance dependable coverage with manageable monthly rates and explore different types of auto insurance that fit your needs, including cross-border protection.

Auto Insurance Coverage Options Offered by Fred Loya| Coverage | What It Covers |

|---|---|

| Liability | Injuries/damage you cause others |

| Collision | Damage to your car from a crash |

| Comprehensive | Theft or weather-related damage |

| Personal Injury Protection | Medical bills and lost wages |

| Medical Payments | Medical costs after an accident |

| Uninsured Motorist | Injuries from uninsured drivers |

| Underinsured Motorist | Costs not covered by other driver |

| Rental Reimbursement | Rental car while yours is repaired |

| Towing and Labor | Towing or roadside help |

| SR-22 Insurance | Proof of financial responsibility |

By customizing your limits, Fred Loya Insurance helps you find the right balance between affordable monthly rates and the protection you need to avoid large out-of-pocket expenses.

Before buying a Fred Loya insurance policy, review your state’s minimum coverage requirements and choose limits that protect both your car’s value and your savings if an accident happens.Jeff Root Licensed Insurance Agent

Fred Loya partners with select Mexican insurance companies to make sure policyholders are fully protected when driving across the U.S.–Mexico border.

This partnership ensures that Fred Loya insurance coverage extends seamlessly across the U.S. and Mexico, allowing drivers who frequently travel between the two countries to maintain continuous, legally recognized protection.

Fred Loya Insurance Discounts

Fred Loya Insurance provides several ways to lower monthly premiums through straightforward discounts that reward responsible driving and loyalty.

The biggest savings go to safe drivers, who can earn up to 15% off, while multi-policy, good student discounts, and homeowner discounts each offer 10% savings.

Auto Insurance Discounts Offered by Fred Loya| Discount | |

|---|---|

| Safe Driver | 15% |

| Multi-Policy | 10% |

| Good Student | 10% |

| Homeowner | 10% |

| Paid-in-Full | 8% |

| Anti-Theft Device | 7% |

| Continuous Coverage | 5% |

| Military | 5% |

| Renewal | 5% |

| Automatic Payment | 3% |

Drivers who pay their policy in full can save 8%, and those with anti-theft devices can save 7%.

Smaller but consistent savings come from continuous coverage, military, and renewal discounts, each at 5%, while enrolling in automatic payments adds another 3% off the monthly cost.

These discounts can make a noticeable difference, especially for budget-focused drivers who want to keep their overall Fred Loya Insurance car insurance cost manageable.

Fred Loya Insurance Ratings & Reviews

Loya Insurance Group ratings show a mix of strengths and weaknesses that matter when comparing insurers beyond monthly rates. A.M. Best assigns the company a C rating, indicating weaker financial strength than larger carriers.

According to Fred Loya Insurance reviews on BBB, the company holds a B- rating, reflecting fair business practices and some customer service concerns.

Fred Loya Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: C Weak Financial Strength |

| Score: B- Fair Business Practices |

|

| Score: 74/100 Low Customer Feedback |

|

| Score: 780 / 1,000 Avg. Satisfaction |

|

| Score: 4.50 More Complaints Than Avg. |

Meanwhile, Fred Loya Insurance reviews from Consumer Reports give it a score of 74 out of 100, suggesting limited customer feedback but fair satisfaction among policyholders.

Drivers who visit a Fred Loya local office often find better savings because agents can customize monthly rates and coverage on the spot to match their budget.Melanie Musson Published Insurance Expert

J.D. Power scores Fred Loya at 780 out of 1,000, indicating average satisfaction, while Fred Loya insurance complaints, with an NAIC score of 4.50, indicate more issues than the national average.

Pay close attention to the Fred Loya insurance rating and customer service reviews in your area, as local agents provide a different experience depending on where you live.

Read Prankish R.‘s review of Fred Loya Insurance on Yelp

Some local customers share positive feedback. Fred Loya Insurance reviews on Yelp highlight local agents who are courteous, helpful, and provide affordable service.

Fred Loya Insurance offers premiums and personalized local service, but so does the less-rated Allstate. When drivers weigh those savings against their poor financial and customer service scores, they consider other drivers’ success stories for claims experiences.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fred Loya Insurance Pros & Cons

Before deciding if Fred Loya Insurance fits your needs, it helps to look at what the company does well and where it may fall short. Here’s a quick breakdown based on what drivers experience with their coverage, pricing, and service.

- No-Credit-Check Policies: As one of the best no-credit-check car insurance options, Fred Loya makes it easy for drivers with low or no credit to qualify without higher rates.

- High-Risk Driver Coverage: The company accepts drivers with DUIs, accidents, or lapses in coverage, offering options that many standard insurers deny.

- Local Offices & Walk-In Access: With hundreds of offices across multiple states, Fred Loya makes it easy to talk to an agent in person when you prefer face-to-face help.

While Fred Loya Insurance can be a good fit for cost-focused or high-risk drivers, it’s not without a few drawbacks.

Knowing these ahead of time can help you avoid surprises later and decide if the trade-offs are worth the savings.

- Higher Volume of Complaints & Weaker Service Ratings: Fred Loya receives more complaints than average, and its limited digital tools may slow major claim support.

- Limited Availability & Basic Policy Options: Fred Loya operates in about a dozen states and offers simple policies, with fewer bundling options than larger insurers.

If your priority is keeping your monthly rate low and you either have a non-ideal record or simply want basic auto coverage with local service, Fred Loya could be a solid fit.

But if customer service, digital convenience, or broader insurance product options matter more to you, you may want to compare this against carriers with stronger service reputations.

Read More: Best Auto and Home Insurance Bundles

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Fred Loya Insurance Programs & Tools

Fred Loya Insurance focuses on simple, accessible programs that make managing coverage easy, especially for drivers who prefer personal service over tech-heavy platforms. Here’s what makes their tools stand out from other insurers:

- Fred Loya Mobile Alerts: Sends quick text updates on payments, renewals, and claims—no app required. Ideal for policyholders who want instant updates without logging in.

- Direct Repair Facility Network: Offers quick, reliable repairs through approved shops—saving drivers time by skipping multiple estimates, a benefit many insurers don’t provide.

- Other-Than-Collision Program: Extends protection to cover theft, vandalism, and weather-related damage, ensuring drivers are covered beyond typical accident claims.

- Local Agent Support: With 800+ community-based offices, policyholders can walk in for help with claims or policy updates—something most online insurers don’t offer.

Fred Loya’s tools make no-credit-check car insurance online simple and affordable, giving drivers flexible ways to stay covered and manage their policies with personal, reliable support.

Learn More: Traffic Collision Reconstruction

How to File Fred Loya Insurance Claims

Filing a claim with Fred Loya Insurance is a simple, hands-on process designed for quick resolutions and personal assistance. The company aims to contact policyholders within 24 hours of filing to confirm details and guide them through the next steps.

To start, call 1-800-880-0472 right after the accident. Have your policy number, location, and a short incident summary ready. A claims adjuster will confirm your coverage and may ask for photos, repair estimates, or police reports to review your claim.

Once your claim is reviewed, a vehicle inspection may be arranged. Fred Loya often directs customers to a Direct Repair Facility for faster estimates and repairs. After all evidence is evaluated, your adjuster will finalize the settlement based on your coverage limits.

This personal, local approach helps speed up the process and reduces confusion. Many Fred Loya insurance claims reviews note the quick response from in-person agents and the convenience of working directly with local offices instead of relying solely on digital tools.

Read More: How to File an Auto Insurance Claim & Win

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Fred Loya Insurance Plans Today

Fred Loya Insurance is a good option if you’re not comfortable with digital tools and prefer to deal with an agent in person. Starting at around $155 a month, it’s also a good option for cheap auto insurance for high-risk drivers or those who want a more flexible payment structure.

While its customer service and financial strength ratings are lower than larger insurers, its 800 local offices across 12 states make it easy to get personal help when you need it.

If you prefer handling your coverage in person and want straightforward protection without extra frills, Fred Loya Insurance could be a solid fit.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Frequently Asked Questions

Who owns Fred Loya?

Fred Loya Insurance is owned by the Loya Insurance Group, a family-operated company founded by Fred Loya Sr. in 1974. It remains privately held and manages several subsidiaries, including Loya Insurance Company and Young America Insurance, focusing on affordable coverage across 12 states.

What types of auto insurance coverage does Fred Loya offer?

Fred Loya provides all standard coverages, including liability auto insurance, collision and comprehensive coverage, and medical payments coverage. Optional add-ons include rental reimbursement and roadside assistance. These plans let drivers start with basic protection and build up coverage that fits their car and monthly budget.

How much does Fred Loya car insurance cost?

Fred Loya’s average rates are about $155 per month for minimum coverage and $325 per month for full coverage. Clean driving records typically qualify for lower prices, while drivers with DUIs, tickets, or accidents may pay between $245 and $310 monthly. Enter your ZIP code to compare car insurance prices near you.

What discounts does Fred Loya Insurance provide?

Fred Loya offers discounts such as 15% for safe drivers, 10% for bundling, for homeowners, and for students with good grades. It has smaller savings for continuous coverage, military members, renewals, and auto-pay. Together, these can reduce your monthly rate by up to 20%, depending on eligibility.

Does Fred Loya check credit?

Fred Loya Insurance is more flexible about credit history than most major insurers. While some states may still allow credit-based pricing, the company focuses more on your driving record and risk profile. In many cases, you can qualify for coverage even with low or limited credit.

What is Fred Loya’s claims process?

You can file a claim by calling 1-800-880-0472. Within 24 hours, a claims adjuster will review your policy, gather details, inspect your car, and guide you through repair or settlement, often using a Direct Repair Facility.

How do Fred Loya Insurance reviews compare to other insurers?

Fred Loya Insurance focuses on affordability and accessibility, with minimum coverage averaging around $155 per month. That’s higher than Progressive at $56 or State Farm at $47, but Fred Loya helps high-risk drivers who may not qualify elsewhere and provides personal, walk-in service through more than 800 local offices.

How is Fred Loya different from other insurance companies?

Fred Loya Insurance is noteworthy for its no-credit-check car insurance and flexible Mexico car insurance policies that allow drivers to travel back and forth between Mexico and the U.S.

How does Fred Loya Insurance compare to Geico?

Fred Loya Insurance offers local, in-person help for drivers who prefer working with agents face-to-face. Geico Insurance is fully digital, offering fast quotes and app-based claims. Geico’s minimum coverage averages $56 per month, while Loya averages $155 but accepts more high-risk drivers.

How does Fred Loya Insurance compare to The General?

The General and Fred Loya both cater to high-risk drivers, but our The General Insurance review shows the company offers online quotes and faster approvals, while Fred Loya emphasizes local, walk-in offices where customers can talk directly with agents.

How does Fred Loya Insurance compare to Progressive?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.