GoAuto Insurance Review for 2026

GoAuto Insurance offers basic auto coverage starting at $95 per month, aimed at high-risk drivers who want low-cost, no-frills protection. Drivers with GoAuto can save 20% for safe driving, with flexible payment plans to help budget-conscious customers manage their premiums more easily.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated January 2026

GoAuto Insurance provides affordable car insurance designed for high-risk drivers, with minimum rates as low as $95 monthly.

- GoAuto remains accessible after accidents, tickets, or a DUI

- Premiums drop with age, hitting their lowest after 35

- GoAuto Insurance offers up to 15% for bundling policies

It offers key coverages and services for high-risk drivers. Drivers can also take advantage of flexible payment options and a variety of discounts on GoAuto insurance full coverage.

GoAuto offers additional savings for safe driving, bundling, and paying annual premiums in full.

GoAuto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.0 |

| Business Reviews | 3.0 |

| Claims Processing | 2.2 |

| Company Reputation | 3.0 |

| Coverage Availability | 1.9 |

| Coverage Value | 2.9 |

| Customer Satisfaction | 1.7 |

| Digital Experience | 3.0 |

| Discounts Available | 4.3 |

| Insurance Cost | 3.8 |

| Plan Personalization | 3.0 |

| Policy Options | 2.5 |

| Savings Potential | 4.0 |

This GoAuto Insurance review explains how age, credit, and driving history affect pricing and compares it to the average cost of auto insurance from standard insurers.

GoAuto’s rates may be higher than other companies, but it remains a competitive option for high-risk drivers who can’t find coverage elsewhere. Find car insurance that is quick and cheap with our quote comparison tool.

GoAuto High-Risk Insurance Review

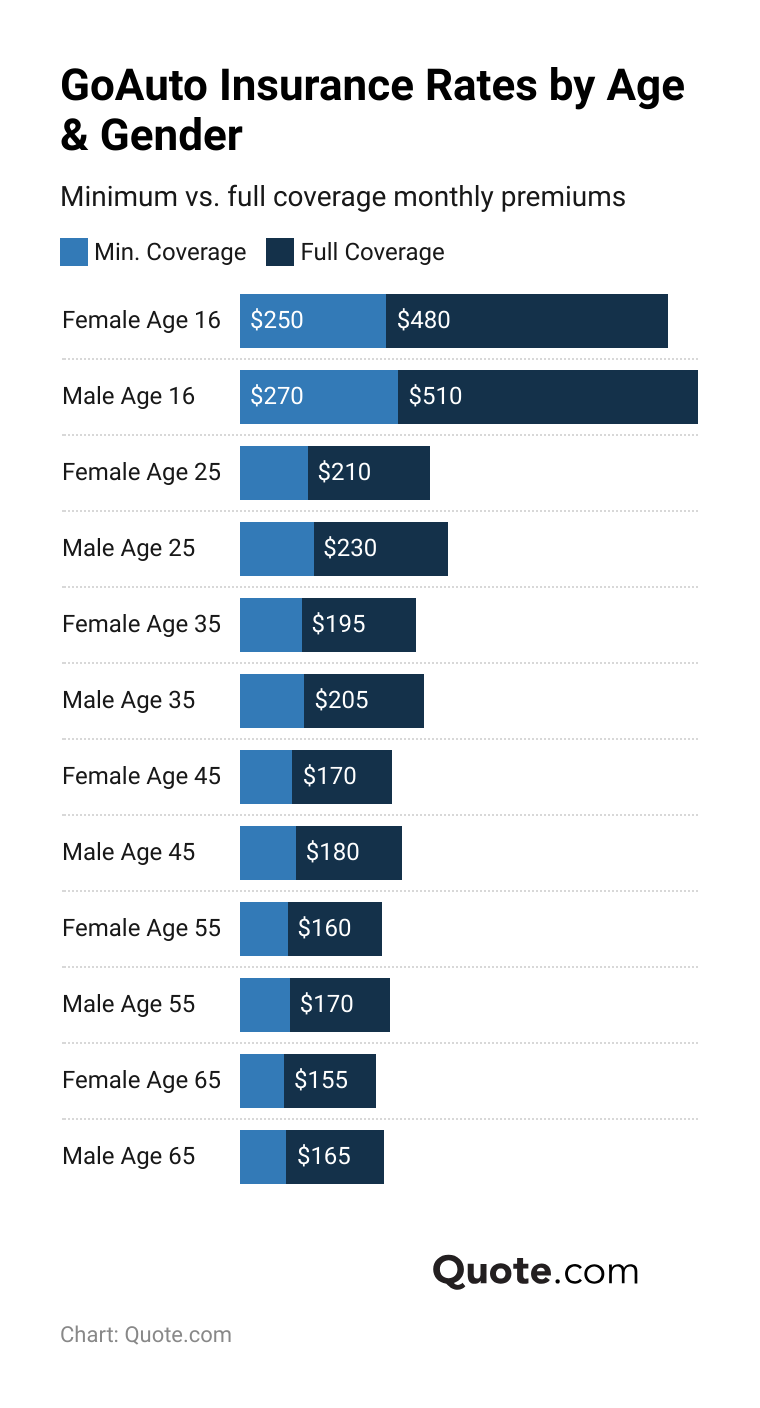

GoAuto Insurance rates start at $95 per month for minimum coverage, but premiums vary by age, gender, driving history, and credit. Teens pay the most, while drivers 35 and older get the best rates.

High-risk coverage costs more due to the higher chance of claims from drivers with violations, accidents, or poor credit. GoAuto sets rates based on these risks but stays competitive with flexible payments and direct pricing.

GoAuto car insurance rates are higher than competitors like Geico or State Farm, but it provides steady coverage after accidents, tickets, or poor credit.

GoAuto’s direct-to-the-consumer approach saves you money on agent commissions, so compare rates to see if it’s a dependable choice for those seeking cheap auto insurance for high-risk drivers.

Breaking Down the Cost of GoAuto Insurance

GoAuto Insurance monthly rates are highest for teen drivers, with 16-year-old males paying up to $510 per month. Compare cheap auto insurance for teens to find better rates.

By age 25, rates start to drop, and from 35 to 65, premiums are the lowest, between $155 and $165 per month for full coverage.

GoAuto’s minimum coverage costs are higher than Geico and State Farm, doubling rates from $43 a month to $95 monthly.

However, its full coverage at $180 per month is more competitive than Allstate and Liberty Mutual (Learn More: Geico vs. Allstate Auto Insurance).

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $95 | $180 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

Full coverage with GoAuto typically costs nearly twice as much as minimum coverage.

Still, GoAuto low-cost car insurance is a practical option, especially for high-risk drivers who often pay higher premiums.

How Driving Record Affects GoAuto Insurance Rates

GoAuto charges $130 a month after an accident, $170 monthly for a DUI, and $115 a month for a ticket, which is cheaper than Liberty Mutual.

While it may not be the absolute cheapest car insurance, it stands out by offering consistent coverage regardless of driving history.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $95 | $130 | $170 | $115 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 |

While many insurers may limit policies or turn up rates following violations, GoAuto is accessible.

It delivers reliable coverage via its direct-to-consumer approach, multiple payment opportunities, and the fact that it caters to non-standard auto insurance.

How Credit Score Impacts GoAuto Insurance Rates

Auto insurance rates frequently differ by credit score, and low scores tend to be associated with higher risk.

Geico and State Farm offer the least expensive rates because of excellent financial ratings and nationwide risk spreading (Read More: State Farm vs. Progressive Auto Insurance).

Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670–799) | Fair (580–669) | Poor (<580) |

|---|---|---|---|---|

| $87 | $98 | $115 | $150 | |

| $62 | $70 | $83 | $110 |

| $76 | $86 | $100 | $135 | |

| $43 | $49 | $59 | $80 | |

| $95 | $108 | $125 | $160 | |

| $96 | $110 | $130 | $170 |

| $63 | $72 | $85 | $115 | |

| $56 | $64 | $76 | $105 | |

| $47 | $53 | $63 | $85 | |

| $53 | $60 | $72 | $100 |

GoAuto Insurance, priced from $95 to $160 monthly, is ideal for high-risk drivers who can’t find coverage with insurers like State Farm.

GoAuto stands apart with a direct-to-consumer approach that cuts out agent commissions for more straightforward rates and easy payment options.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

GoAuto Insurance Coverage Options

GoAuto Insurance offers key coverage to protect drivers. Liability auto insurance covers damage to others.

Collision handles crash damage, and comprehensive covers theft, fire, or weather events.

Auto Insurance Coverage Options Offered by GoAuto| Coverage | What it Covers |

|---|---|

| Liability | Injuries, damages to others |

| Collision | Crash damage to your car |

| Comprehensive | Non-crash damage: theft, fire |

| Uninsured/Underinsured Motorist | If other driver isn’t covered |

| Medical Payments (MedPay) | Your medical bills only |

| Personal Injury Protection (PIP) | Medical bills, lost wages |

| Rental Reimbursement | Rental car during repairs |

| Roadside Assistance | Towing, flat tire, lockout |

Uninsured/underinsured motorist (UM/UIM) coverage can come into play if you’re hit by someone who has little or no insurance or a driver involved in a hit-and-run.

Medical payments cover healthcare for you and your passengers, and PIP also adds protection for lost wages and other post-accident expenses.

Optional add-ons like rental reimbursement ensure transportation during repairs, and roadside assistance provides help with emergencies like towing or lockouts.

Together, these GoAuto insurance coverage options give drivers flexible, reliable protection tailored to real-life needs.

Ways to Save on GoAuto Insurance

The benefits GoAuto Insurance offers reward drivers with cheaper coverage based on personal habits.

GoAuto insurance savings come from choosing a higher insurance deductible, renewing early, driving fewer miles, or comparing rates at renewal.

- Raise Your Deductible: Choosing a higher out-of-pocket cost for GoAuto insurance claims usually helps reduce your premium.

- Loyalty or Renewal Discounts: Remaining with your insurer or renewing early can give you an opportunity to gain a price break or rewards.

- Low Annual Mileage Discount: If you drive significantly fewer miles than average, insurers may offer lower rates.

- Shop Around When Renewing: Compare GoAuto Insurance quotes with other providers as renewal approaches to ensure you’re getting the best rates.

Drivers can also lower their monthly premiums by using available discounts like safe driving, bundling, or auto-pay.

These discounts can be used by policyholders to build cheaper, more customized car insurance coverage.

Top Auto Insurance Discounts Offered by GoAuto| Discounts | |

|---|---|

| Safe Driver | 20% |

| Bundling | 15% |

| Multi-Vehicle | 15% |

| Good Student | 12% |

| Defensive Driving | 10% |

| Pay-in-Full | 10% |

| Anti-Theft | 5% |

| Auto-Pay | 5% |

These include 20% for safe driving, 15% for bundling, 12% for good students, and 10% for defensive driving or paying in full.

Drivers can get 5% off for anti-theft devices or auto-pay, and an additional 10% for paying annual premiums upfront.

Reducing your annual mileage and comparing quotes at renewal can unlock additional savings with GoAuto, especially for drivers whose habits or needs have recently changed.

Melanie Musson Published Insurance Expert

GoAuto Insurance offers a variety of ways to help drivers reduce premiums while keeping quality coverage.

It may offer fewer discounts than some competitors, but GoAuto Insurance discounts still provide valuable savings opportunities for high-risk drivers looking to improve their records and lower their premiums.

GoAuto Insurance Customer Reviews

GoAuto Insurance earns strong industry ratings. It holds an A rating from A.M. Best, a J.D. Power score of 874/1,000, and a Consumer Reports score of 80/100.

However, GoAuto Insurance reviews on BBB are mixed, with some reporting poor customer service. For help, call the GoAuto Insurance phone number at 1-833-700-0000.

GoAuto Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: 874 / 1,000 Above Avg. Satisfaction |

|

| Score: A- Good Business Practices |

|

| Score: 80/100 Good Customer Feedback |

|

| Score: 0.85 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

GoAuto Insurance reviews on Reddit, Yelp, and Google are also mixed, but it’s important to check local reviews where you live.

For instance, one 5-star Yelp review from Adam K., along with similar GoAuto Insurance Google reviews, praises the Covington, Louisiana office for providing quick GoAuto Insurance claim support.

This combination of strong financial backing and mostly positive GoAuto reviews positions it as a dependable choice.

Compare it to the best auto insurance companies for claims handling for a closer review.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of GoAuto Insurance

GoAuto Insurance Company is a strong choice for high-risk drivers, including those with previous violations or minimal credit.

It’s also an excellent choice for high-risk drivers with multiple violations who may struggle to find cheaper rates from big-time insurers.

- Accessible for High-Risk Drivers: GoAuto is a solid choice for high-risk drivers who may have trouble getting affordable coverage from larger insurers.

- Flexible Payment Options: With installment plans, auto-pay, and pay-in-full discounts, policies are easier to fit into the budget of just about anyone.

- Essential Coverage Without the Overhead: GoAuto offers core coverages like liability and collision, ideal for drivers seeking simple, affordable protection.

The company focuses on providing essential auto coverages, including liability, collision, and comprehensive coverage, which will appeal to drivers who are looking for basic protection without having to pay for unnecessary extras.

GoAuto uses a direct-to-consumer model to keep rates low and provides solid service for customers with bad credit or violations.

Brad Larson Licensed Insurance Agent

However, its digital tools are limited, and the GoAuto Insurance login portal offers fewer features than those of larger insurers.

- Basic Digital Tools: GoAuto car insurance quotes are available online, but its app and digital tools are less advanced than those of national carriers.

- Mixed Customer Service Feedback: GoAuto customer reviews, including a 3 out of 5 on Yelp, cite delays in claims and inconsistent service by location.

GoAuto offers flexible payment options like auto-pay, installments, and pay-in-full discounts to help manage costs, all of which can be easily accessed and managed through the GoAuto mobile app.

But customer service varies by location, and some drivers report inconsistent responses when filing claims (Learn More: How to File an Auto Insurance Claim & Win).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Explore GoAuto Insurance Options Now

Our GoAuto Insurance review finds it to be a good option for high-risk drivers who want a straightforward policy and affordable payment options.

With rates from $95 per month, it offers essential coverage, including comprehensive auto insurance, steady claims handling, and discounts for safe driving and bundling.

If you’re a high-risk driver, it’s important to compare multiple auto insurance quotes in order to find the best company based on your specific driving history.

GoAuto is a good fit for many high-risk drivers, but the easiest way to find the lowest car insurance rates in your area is by entering your ZIP code in our free comparison tool.

Frequently Asked Questions

Is GoAuto Insurance good?

GoAuto Insurance is a legit company that provides budget-friendly coverage options, particularly for high-risk drivers. However, compared to larger, national insurers, policyholders may experience more limitations in terms of customer service responsiveness and coverage features.

How much does GoAuto Insurance cost per month?

Minimum coverage starts at $95 per month, but actual premiums depend on factors like age, driving history, credit score, and location. Instantly compare quotes by entering your ZIP code here.

Who is GoAuto Insurance best suited for?

GoAuto Insurance is ideal for high-risk drivers, including those with prior traffic violations, limited credit history, or young drivers, and it can also be a good option for cheap auto insurance for seniors seeking budget-conscious coverage.

Who owns GoAuto Insurance?

GoAuto Insurance is owned by Drive Assurance Holdings LLC, which is backed by the private equity firm Milestone Partners. In 2022, Milestone acquired a majority stake, and GoAuto now operates as a privately held company under Drive Assurance.

Is GoAuto Insurance available nationwide?

No, GoAuto only operates in Georgia, Alabama, Louisiana, Ohio, Texas, and Nevada.

Does GoAuto Insurance have full coverage?

Yes. GoAuto provides full coverage, including liability, collision, comprehensive, uninsured motorist, and medical payments coverage.

Does GoAuto Insurance offer digital tools or a mobile app?

GoAuto’s digital tools are basic compared to major national insurers. Its focus is more on affordability and direct service rather than high-tech features.

Does GoAuto Insurance charge higher rates for poor credit?

Yes. Monthly rates increase with lower credit scores. For poor credit, premiums may reach $160 per month, while excellent credit scores can keep it closer to $95 per month.

How does GoAuto compare to State Farm on service and claims?

GoAuto offers basic service and slower claims support, while State Farm provides more reliable customer service and faster claim resolution. Read our State Farm auto insurance review for more.

Does GoAuto Insurance Company offer roadside assistance?

Yes, roadside assistance is available as an optional add-on and covers emergencies like towing or lockouts.

How does GoAuto Insurance compare to Geico?

Can I get a quote from GoAuto Insurance online?

How does GoAuto handle claims?

What payment options does GoAuto Insurance provide?

Is GoAuto better for drivers with bad credit or violations?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.