10 Best Auto Insurance Companies in Vermont 2026

Amica, Allstate, and Geico are the best auto insurance companies in Vermont, with rates starting at $35 a month. Travelers offers flexible coverage with accident forgiveness, while State Farm’s Drive Safe & Save helps cut costs by 30%. Vermont drivers must carry at least 25/50/10 in liability insurance.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated November 2025

Amica, Allstate, and Geico lead as the best auto insurance companies in Vermont. Geico offers the lowest Vermont car insurance rates at $35 per month.

- Amica leads Vermont’s market with reliable claims and service

- Vermont’s liability minimum is 25/50/10, ensuring driver coverage

- Safe drivers in Vermont can save up to 30% off annual premiums

Amica wins for its strong claims service and financial stability, both of which are excellent for Vermont’s harsh winters.

Allstate helps drivers save with bundling and safe-driving discounts, perfect for families and commuters.

Top 10 Companies: Best Auto Insurance in Vermont| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 735 / 1,000 | A+ | Customer Loyalty | |

| #2 | 641 / 1,000 | A+ | Safe Drivers | |

| #3 | 639 / 1,000 | A++ | Budget Savers | |

| #4 | 634 / 1,000 | A++ | Claims-Free | |

| #5 | 626 / 1,000 | A | Custom Plans |

| #6 | 622 / 1,000 | A++ | Hybrid Vehicles | |

| #7 | 597 / 1,000 | A | New Drivers |

| #8 | 594 / 1,000 | A+ | Family Coverage | |

| #9 | 587 / 1,000 | A | Discount Options | |

| #10 | 582 / 1,000 | A+ | Usage-Based |

Geico makes managing insurance easy with simple online tools and steady savings, keeping Vermont drivers covered and stress-free.

Compare trusted Vermont car insurance companies with our easy auto insurance guide and start saving by entering your ZIP code.

Comparing Vermont Auto Insurance Rates

Drivers have numerous options when it comes to balancing cost and protection with the best car insurance companies in Vermont.

Some companies focus on rewarding safe drivers, while others consider the amount of time spent on the road or the age of the vehicle.

Vermont Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $41 | $92 | |

| $42 | $95 | |

| $45 | $99 | |

| $35 | $77 | |

| $46 | $101 |

| $44 | $98 |

| $39 | $85 | |

| $38 | $84 | |

| $43 | $96 | |

| $47 | $105 |

Geico has the best rates on Vermont auto insurance for both minimum and full coverage.

Amica and Allstate are more expensive but offer more policy add-ons and better customer service than cheaper Vermont insurance companies.

Full coverage is great if your car’s newer or financed, but if it’s older, minimum coverage can help you save each month.

Jeff Root Licensed Insurance Agent

Someone with an older car might prefer basic protection to keep costs low, while drivers with new vehicles or those who have long commutes often choose more comprehensive coverage.

The best thing to do is compare Vermont car insurance companies to find one that provides consistent value, dependable claims handling, and coverage that fits your actual driving habits.

How Age Impacts Vermont Car Insurance Costs

The cost of auto insurance in Vermont changes noticeably as drivers gain more experience behind the wheel. Teen drivers usually pay the most.

By the mid-30s and beyond, Vermont drivers often see some of the lowest premiums, reflecting years of stable driving and established insurance history.

Vermont Auto Insurance Monthly Rates by Age| Company | Age: 18 | Age: 25 | Age: 35 | Age: 45 |

|---|---|---|---|---|

| $131 | $74 | $57 | $41 | |

| $115 | $63 | $50 | $42 | |

| $117 | $68 | $53 | $45 | |

| $92 | $48 | $40 | $35 | |

| $120 | $69 | $55 | $46 |

| $116 | $67 | $51 | $44 |

| $114 | $50 | $44 | $39 | |

| $98 | $54 | $45 | $38 | |

| $118 | $66 | $52 | $43 | |

| $120 | $65 | $48 | $47 |

Drivers of all ages can find the best deals by practicing safe driving and comparing VT auto insurance quotes to see who offers the best match for their situation.

Younger Vermont drivers can keep their costs down by staying on a family policy or using telematics that give rewards for safe driving. Older drivers with clean records often receive loyalty perks and claim-free discounts, making their insurance a bit more affordable.

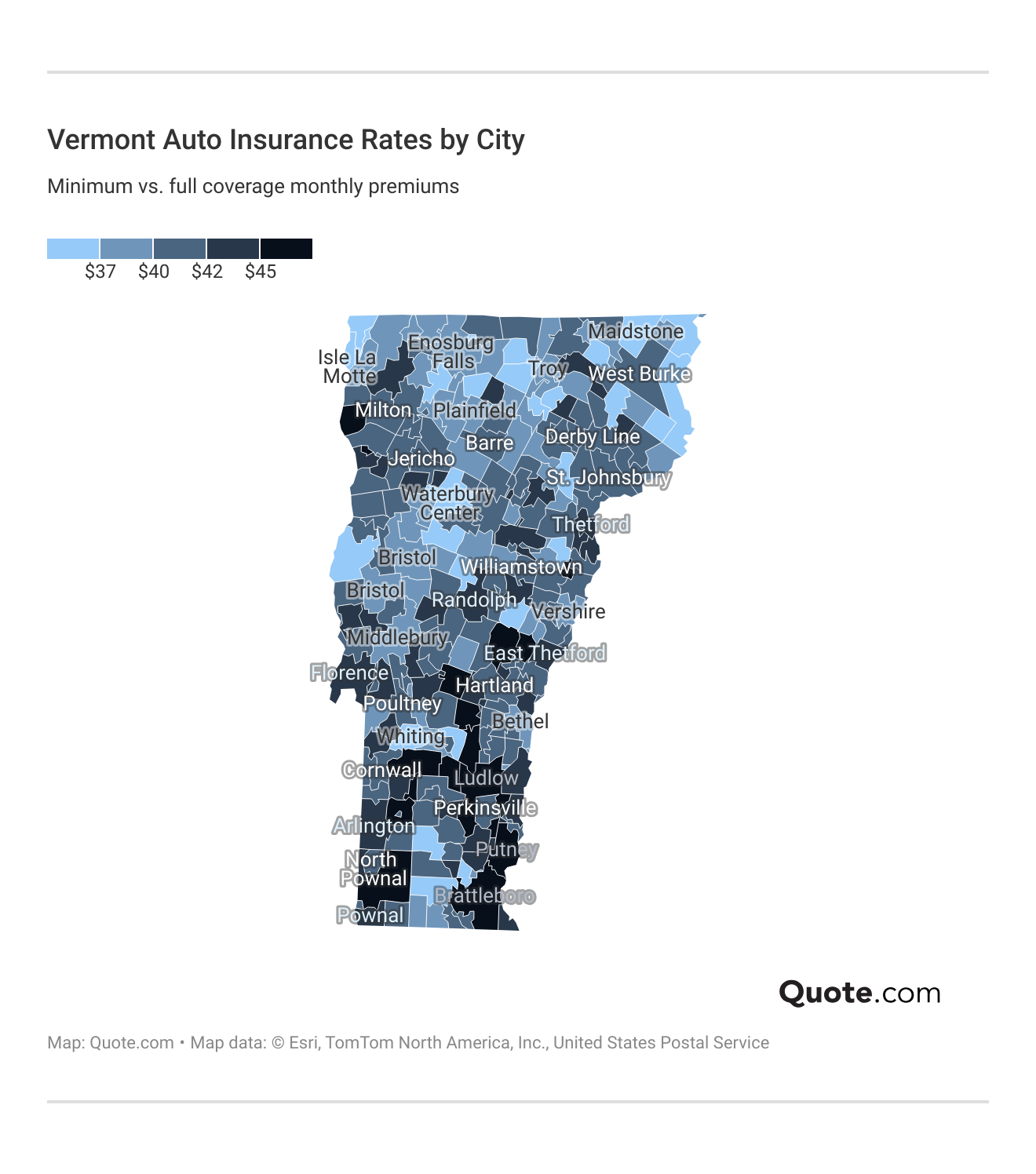

Vermont ZIP Code & Auto Insurance Rates

Auto insurance prices in Vermont can change quite a bit depending on where you live. If you’re in a smaller town, you’ll probably pay less since there’s less traffic and fewer accidents.

Car insurance in big cities usually costs more because there’s more traffic and a higher chance of accidents, but Vermont is cheaper compared to other car insurance rates by state.

For Vermont drivers, it really depends on location. Rural areas often come with lower costs, while city living can make insurance a little pricier.

The best way to find the cheapest car insurance in Vermont is to compare quotes and check your Vermont auto insurance quote, since your ZIP code can change your rate more than you’d expect.

How Driving History Affects Vermont Insurance Rates

If you’ve managed to stay ticket-free, you’re probably getting a solid deal because Vermont insurance companies see you as someone less likely to take risks on the road.

But once a ticket, fender bender, or DUI is filed, your rates can climb quickly because insurance companies start viewing you as more of a risk.

Vermont Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $41 | $66 | $107 | $49 | |

| $42 | $69 | $104 | $52 | |

| $45 | $79 | $110 | $55 | |

| $35 | $53 | $52 | $38 | |

| $46 | $82 | $116 | $58 |

| $44 | $73 | $112 | $56 |

| $39 | $60 | $104 | $47 | |

| $38 | $55 | $76 | $46 | |

| $43 | $71 | $108 | $54 | |

| $47 | $83 | $135 | $60 |

That’s why Vermont drivers should check insurance comparison sites to see how their record affects what they pay. These tools make it easier to find who’s offering the best deal based on your driving history.

Keeping your record clean can unlock lower rates and exclusive discounts, while accident forgiveness or safe-driver tracking programs can help you recover and save after an incident.

Credit Score Can Raise Insurance Premiums in Vermont

When you’re getting car insurance in Vermont, your credit score matters since good credit often means better rates.

Individuals with lower credit scores may pay more, as insurers usually view them as a higher risk when it comes to handling claims or payments.

Vermont Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (< 580) |

|---|---|---|---|---|

| $41 | $47 | $59 | $74 | |

| $42 | $48 | $61 | $76 | |

| $45 | $52 | $66 | $82 | |

| $35 | $39 | $49 | $63 | |

| $46 | $54 | $68 | $85 |

| $44 | $50 | $64 | $80 |

| $39 | $44 | $55 | $70 | |

| $38 | $42 | $50 | $64 | |

| $43 | $49 | $63 | $78 | |

| $47 | $53 | $67 | $83 |

Vermont drivers can save on insurance by maintaining good credit, which often results in lower monthly rates and additional discounts.

And if your credit could use a boost, getting a Vermont car insurance quote online, using safe-driver or multi-policy discounts, and taking time to compare auto insurance companies can make it easier to find a plan that fits your budget.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Vermont Car Insurance Requirements

If you’re driving in Vermont, you need to have the state’s minimum required insurance. It helps cover costs if you cause an accident that injures someone or damages property.

These 25/50/10 limits meet Vermont’s legal minimum, but many drivers opt for higher coverage for added peace of mind. It costs a bit more, but it can save you from big expenses after an accident.

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $10,000 per accident

- Uninsured Motorist Bodily Injury: $25,000 per person / $50,000 per accident

- Uninsured Motorist Property Damage: $10,000 per accident

Liability coverage helps pay for another driver’s injuries or property damage if you’re found at fault in a crash. Uninsured motorist protection steps in when the other driver doesn’t have enough coverage, saving you from paying expenses out of pocket.

Vermont drivers must maintain at least these limits to stay legal on the road. Meeting Vermont auto insurance requirements helps avoid penalties, ensures you’re protected after an accident, and gives you peace of mind behind the wheel.

Optional Vermont Car Insurance Coverages

The best auto insurance companies in Vermont offer drivers numerous ways to stay protected, and most people appreciate having options that match their actual driving habits.

Many insurers offer collision coverage plus protection for snow damage, falling branches, and wildlife hits, which are pretty common in Vermont. These options help drivers feel more prepared during long winters and backroad trips.

Top providers, such as Amica, State Farm, and Geico, also offer medical coverage that helps cover the expenses of injuries after an accident. Additionally, drivers can opt for extras such as rental car reimbursement, roadside assistance, or gap coverage if they own a newer car.

Some companies even offer accident forgiveness or apps that reward safe driving with lower monthly payments. Altogether, these coverage options provide Vermonters with the flexibility to create a policy that feels reliable and meets their everyday needs.

How to Save on Vermont Auto Insurance

Vermont drivers can find numerous ways to save on their auto insurance simply by making informed choices. Most savings come from safe driving habits, owning vehicles with good safety features, and keeping multiple policies with the same insurer.

These discounts let insurers reward low-risk drivers, helping them lower their monthly costs without giving up important coverage.

Top Auto Insurance Discounts in Vermont| Company | Anti-Theft | Bundling | Good Driver | Usage-Based |

|---|---|---|---|---|

| 10% | 25% | 25% | 40% | |

| 18% | 30% | 25% | 20% | |

| 10% | 20% | 30% | 30% | |

| 25% | 25% | 26% | 25% | |

| 35% | 25% | 20% | 30% |

| 15% | 25% | 20% | 20% |

| 25% | 10% | 30% | $231/yr | |

| 15% | 17% | 25% | 30% | |

| 10% | 20% | 15% | 15% | |

| 15% | 13% | 10% | 30% |

What’s nice is that these discounts can stack up fast. Using an app that tracks your driving habits or installing anti-theft gear can earn you better rates because insurers see you as a safer bet.

If you’ve kept a clean record or bundled your home and car insurance, you’ll probably save even more. Vermont drivers who know how these deals work can find cheaper coverage fast.

If you’ve been claim-free for a few years, your insurer might drop your rate automatically. Vermont companies love rewarding consistent, safe drivers.

Melanie Musson Published Insurance Expert

Beyond discounts, there are several smart ways for Vermont drivers to reduce their insurance costs.

It mostly comes down to making the right choices for how and when you use your car, especially with the state’s mix of rural roads and winter conditions.

- Try Seasonal Coverage: If your car stays parked during Vermont’s snowy months, a lay-up policy can save you money by pausing certain coverages while keeping it protected.

- Update Your Address: Living outside busier cities like Burlington could mean cheaper rates, so make sure your insurer has your correct ZIP code.

- Take a Defensive Driving Course: Vermont-approved classes can score you discounts and help you handle icy roads better.

- Check Your Older Car: If it’s lost value, you might skip full coverage auto insurance to save some cash.

- Track Your Miles: If you don’t drive much or work from home, low-mileage plans can help you cut costs.

Small steps like these really add up. When you tweak your policy to match how you actually drive in Vermont, you can keep good coverage without paying more than you need each month.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Car Insurance Companies in Vermont

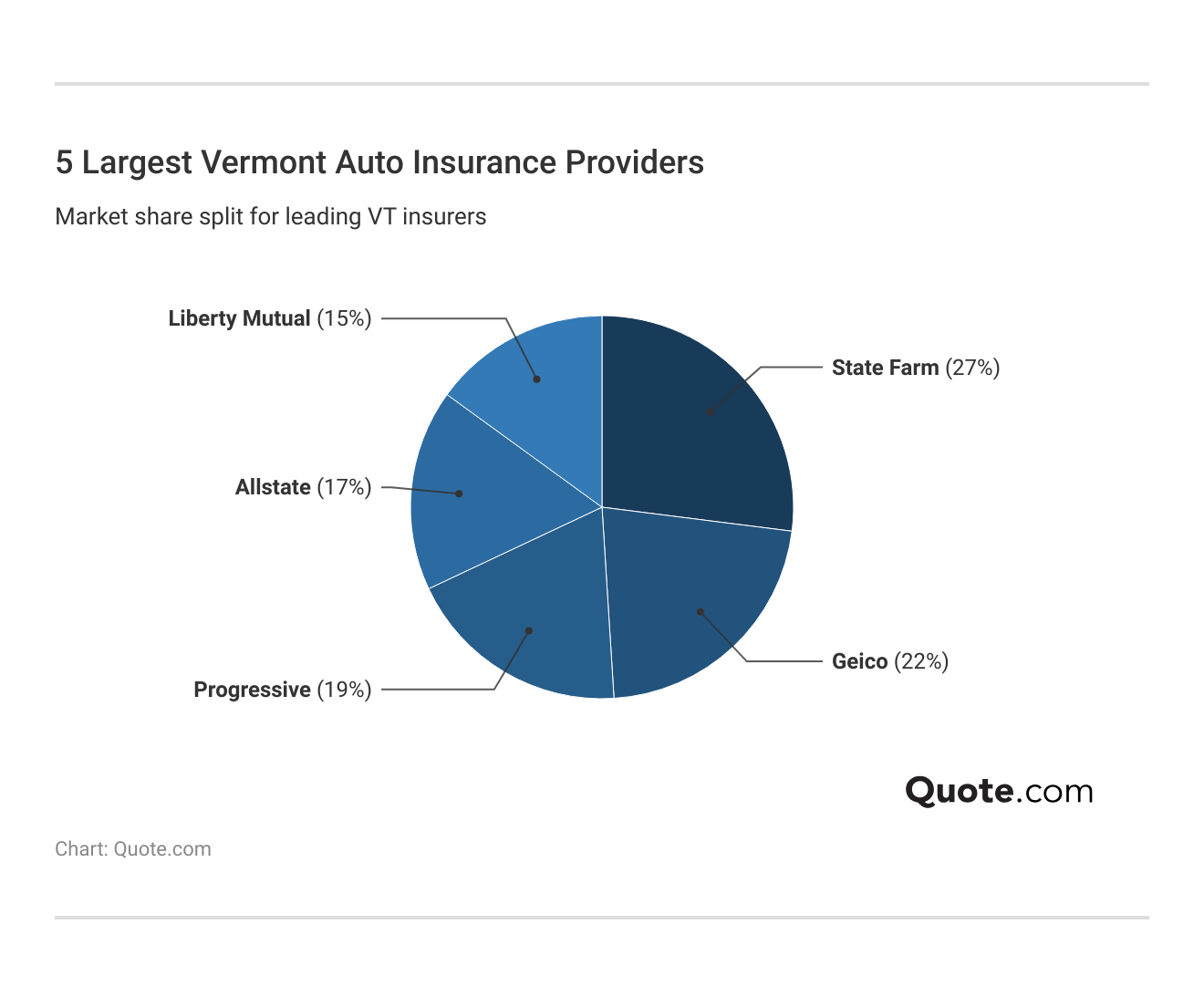

State Farm, Geico, and Progressive lead the best auto insurance companies in Vermont, standing out for affordable rates, dependable coverage, and strong customer service.

Progressive gives safe drivers extra savings through its Snapshot program, Geico keeps things budget-friendly for those who want to save more, and State Farm stays a Vermont favorite with its strong local network and reliable help across the state.

Allstate and Liberty Mutual round out the top five, offering solid benefits such as safe-driver rewards and customizable coverage.

Together, these companies help shape Vermont’s auto insurance scene with solid prices and easy-to-get coverage that works for all kinds of drivers.

#1 – Amica: Best for Customer Loyalty

Pros

- Customer Loyalty Strength: Amica keeps Vermont drivers coming back, earning a 735/1,000 J.D. Power score and an impressive 89% renewal rate.

- Dividend Policy Returns: Drivers in Vermont can get back up to 20% of their premium each year through Amica’s dividend program.

- Financial Stability: With an A+ rating from A.M. Best, Amica gives Vermont drivers peace of mind that their claims will be paid. See more ratings in our Amica review.

Cons

- Limited Discounts: Amica keeps things pretty simple in Vermont, offering loyalty and claims-free perks but not many extra savings programs.

- Limited Local Access: Only two Vermont offices handle in-person claims, so most drivers use online or phone support.

#2 – Allstate: Best for Safe Drivers

Pros

- Safe Driving Rewards: Vermont drivers using Allstate’s Drivewise app can save up to 25% just by keeping their driving clean and safe.

- Accident Forgiveness: After five claim-free years, Vermont drivers can have their first accident forgiven without a rate hike.

- Local Agent Support: With agents across Vermont, drivers can easily get personal help picking coverage and finding discounts.

Cons

- Rate Penalties: Even small tickets can bump Vermont premiums by about 18%, which adds up fast. Compare rates in our Allstate insurance review.

- App Connectivity Limits: Drivewise sometimes runs slowly in rural Vermont, especially where cell coverage is spotty.

#3 – Geico: Best for Budget Savers

Pros

- Lowest Rates: If you’re in Vermont, Geico makes saving easy with coverage starting around $35 a month, one of the lowest rates you’ll find.

- Bundling Advantage: Our Geico insurance review highlights that combining auto and renters insurance can help Vermont households save up to 17% on their total costs.

- Excellent Financial Backing: With an A++ A.M. Best rating, Geico gives Vermont drivers confidence that their claims will be handled quickly and hassle-free.

Cons

- Minimal Agent Presence: Geico doesn’t have local offices in Vermont, so most drivers manage their policies online or by phone.

- Strict Qualification: Accident forgiveness is only available to Vermont drivers who’ve kept a clean record for five straight years, so staying ticket-free really pays off.

#4 – State Farm: Best for Claims-Free Drivers

Pros

- Claims-Free Discounts: Vermont drivers earn up to 20% off renewals through State Farm’s clean record rewards. See more discounts in our State Farm review.

- Drive Safe & Save UBI: Low-mileage Vermont drivers can save up to 30% on costs with the app’s telematics program.

- Strong Financial Backing: Vermont drivers can rely on quick, stress-free claim handling. A.M. Best rating A++ for financial strength.

Cons

- Teen Driver Costs: State Farm Insurance in Vermont families with teen drivers often pay premiums about 40% above the state average.

- Signal Limitations: Vermont users may notice slower app performance in more remote mountain areas where connectivity can be limited.

#5 – Liberty Mutual: Best for Custom Plans

Pros

- Flexible Coverage Choices: Liberty Mutual’s Vermont plans let drivers customize coverage with add-ons like new or better car replacement.

- Weather Protections: Vermont drivers can add collision and comprehensive coverage for wildlife and snow damage.

- Convenient Online Tools: Liberty Mutual’s easy-to-use mobile app helps Vermont policyholders manage payments, file claims, and access roadside assistance anytime.

Cons

- Above-Average Rates: The average Liberty Mutual premium in Vermont is around $46 per month, which is higher than that of many other insurers.

- Discount Restrictions: Our Liberty Mutual insurance review notes that to qualify for bundling savings in Vermont, policies must share the same renewal date and term length.

#6 – Travelers: Best for Hybrid Vehicles

Pros

- Hybrid Vehicle Discounts: Vermont drivers with hybrid or electric cars can save up to 10% with Travelers’ green vehicle discount and keep more money in their pocket.

- Glass Repair Coverage: Comprehensive coverage in Vermont includes glass repair and windshield replacement with no deductible, making those winter chips and cracks less of a hassle.

- Reliable Claims Support: Travelers holds an A++ rating from A.M. Best, giving Vermont drivers confidence that their claims will be handled fast and fairly.

Cons

- High Collision Deductibles: Hybrid owners in Vermont often face average collision deductibles of around $750. Learn more in our Travelers insurance review.

- Limited Reward Programs: Vermont drivers with standard vehicles have fewer loyalty or mileage-based discount options than hybrid owners.

#7 – Mapfre: Best for New Drivers

Pros

- New Driver Support: Vermont teens can get starter coverage built just for them, plus up to 15% off with the good student discount.

- Telematics Training: The MotionSmart app helps new Vermont drivers earn rewards for safe habits like smooth braking and steady speeds.

- Reliable Claims Handling: Mapfre’s A rating from A.M. Best gives Vermont families confidence that their claims will be handled quickly and fairly.

Cons

- Limited Network: Mapfre works with only a few independent agents in Vermont, so local availability can be limited.

- Large Upfront Costs: New Vermont drivers often prepay two months of premiums, so it’s best to get multiple auto insurance quotes first to compare options.

#8 – The Hanover: Best for Family Coverage

Pros

- Family-Focused Savings: Vermont families with multiple cars save up to 20% with Hanover’s multi-vehicle discount.

- Teen Smart Driver Program: Vermont parents save more by enrolling their teens in safe-driving programs.

- Flexible Policy Options: Hanover gives Vermont families the ability to bundle cars, homes, and add-ons under one policy for easier management and extra savings.

Cons

- Higher Deductibles: The Hanover insurance review notes that family plans in Vermont usually start around $750, which can feel steep for some households.

- App Limitations: The mobile app doesn’t yet include live roadside tracking for Vermont customers.

#9 – Farmers: Best for Discount Options

Pros

- Extensive Discount Variety: Vermont drivers can qualify for Signal, good student, and multi-policy discounts that could save them up to 20% on their premiums.

- Strong Local Agents: Farmers has plenty of Vermont-based agents who make it easy to handle renewals, update coverage, or find a plan that fits your needs in person.

- Easy Online Management: Farmers’ online tools make it simple for Vermont drivers to check policies, track claims, and adjust coverage anytime.

Cons

- Uneven County Rates: Vermont premiums differ up to 22% between urban and rural regions.

- Renewal Hikes: Even small Vermont claims can lead to around a 10% increase when policies renew. See how rates compare in our Farmers insurance review.

#10 – Progressive: Best for Usage-Based Coverage

Pros

- Usage-Based Savings: Progressive Insurance in Vermont offers Snapshot, which allows safe drivers to save up to 30% based on their actual driving habits.

- Gap Coverage Add-On: Progressive’s Vermont plans offer optional loan or lease payoff protection, which is great for anyone financing their car.

- Strong Financial Security: Progressive holds an A+ rating from A.M. Best, so that Vermont drivers can count on reliable, timely claim payments.

Cons

- Accident Surcharges: Our Progressive insurance review notes that Vermont drivers often see their premiums rise by about 25% after an at-fault accident.

- Telematics Misreads: Snapshot sometimes mistakes Vermont’s winding rural roads for aggressive driving, which can affect discounts.

How to Find the Best Car Insurance in VT

Picking the best car insurance company in Vermont isn’t just about grabbing the cheapest quote. You want a provider that fits how and where you drive.

With Vermont’s snowy winters, country roads, and small towns, it helps to go with a company that’s dependable and easy to reach when something unexpected happens.

- Compare Vermont-Based Rates: Prices can change depending on where you live, so it’s smart to look at a few quotes before picking a policy.

- Check Local Claim Response Times: Vermont winters can be harsh, so choose a company that handles claims efficiently and treats customers fairly.

- Look for Weather-Related Coverage Options: It’s worth choosing a plan that covers snow, ice, and wildlife damage since those issues are pretty common around here.

- Consider Customer Service Access: Having a local agent or dependable 24/7 support makes things a lot easier when you need help or have questions.

- Review Financial Stability: Stick with companies that have an A or higher rating from A.M. Best to ensure they can handle claims properly.

Amica, Allstate, and Geico are among the best auto insurance companies in Vermont, offering drivers solid discounts, flexible options, and reliable coverage.

Each company makes it easier for Vermonters to manage costs by rewarding safe driving, bundling home and auto, or offering accident forgiveness to keep premiums in check.

When you’re ready to buy auto insurance, it really helps to understand how your coverage choices affect what you pay, since even small changes can make a big difference.

To find the best deal near you, just enter your ZIP code and compare Vermont’s top insurance companies to see which one fits your budget and coverage needs.

Frequently Asked Questions

What is the best car insurance company in Vermont?

Amica, Allstate, and Geico offer some of the best auto insurance for good drivers in Vermont, combining solid savings, rewards, and easy-to-manage coverage.

How much is car insurance in Vermont?

Car insurance in Vermont averages about $35 to $47 per month, depending on your coverage level and driving history. Full coverage typically falls within the $90 range. Vermont’s lower traffic and safer roads help keep rates below the national average.

Who has the cheapest car insurance in Vermont?

Geico offers the most affordable auto insurance in Vermont, starting at around $35 per month for minimum coverage. Drivers who qualify for safe-driver or multi-policy discounts can save even more. Enter your ZIP code to find the cheapest auto insurance near you.

What car insurance company has the best customer satisfaction in Vermont?

Complaint trends can vary by year, but larger national insurers, such as Liberty Mutual and Progressive, tend to experience higher complaint volumes because they manage a larger number of policies. Vermont drivers can check the state’s Department of Financial Regulation for recent complaint data before choosing a provider.

Who is cheaper in Vermont: Geico or Progressive?

In Vermont, Geico is generally cheaper than Progressive, with average rates starting at about $35 monthly, compared to Progressive’s typical range of $39 to $47. However, Progressive’s Snapshot program can help safe drivers save up to 30%. Compare State Farm vs. Farmers, Geico, Progressive, and Allstate auto insurance for more quotes.

Which insurance provider has the highest customer satisfaction in Vermont?

Amica ranks highest in Vermont for customer satisfaction thanks to its smooth claims process and reliable customer service. Many Vermonters also like that Amica’s policies are straightforward and backed by an A+ A.M. Best rating.

What information do you need to get car insurance in Vermont?

You’ll need your driver’s license, vehicle details (including VIN, make, model, and year), your driving record, and your current address. Vermont insurers also use your ZIP code, annual mileage, and preferred coverage level to provide accurate quotes.

Can I register my car in Vermont with an out-of-state license?

You can, but once you move or start working in Vermont, you’ll need to switch to a Vermont license and register your car within 60 days. This keeps your insurance valid and compliant with state laws.

Do you need car insurance in Vermont?

You’re required to have Vermont’s minimum coverage, which includes $25,000 for injuries to one person, $50,000 per accident, and $10,000 for property damage. You’ll also need uninsured motorist coverage, just like what most auto insurance requirements by state call for.

How can I lower my car insurance rates in Vermont?

If you want to save on car insurance, try bundling your policies, keeping your driving record clean, or joining programs like Drivewise or Snapshot. Vermont drivers can also cut costs by adding anti-theft devices or comparing quotes by ZIP code to find the best local rate.

What Vermont insurance company denies the most claims?

What happens if you get pulled over without insurance in Vermont?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.