Does auto insurance cover hitting a deer?

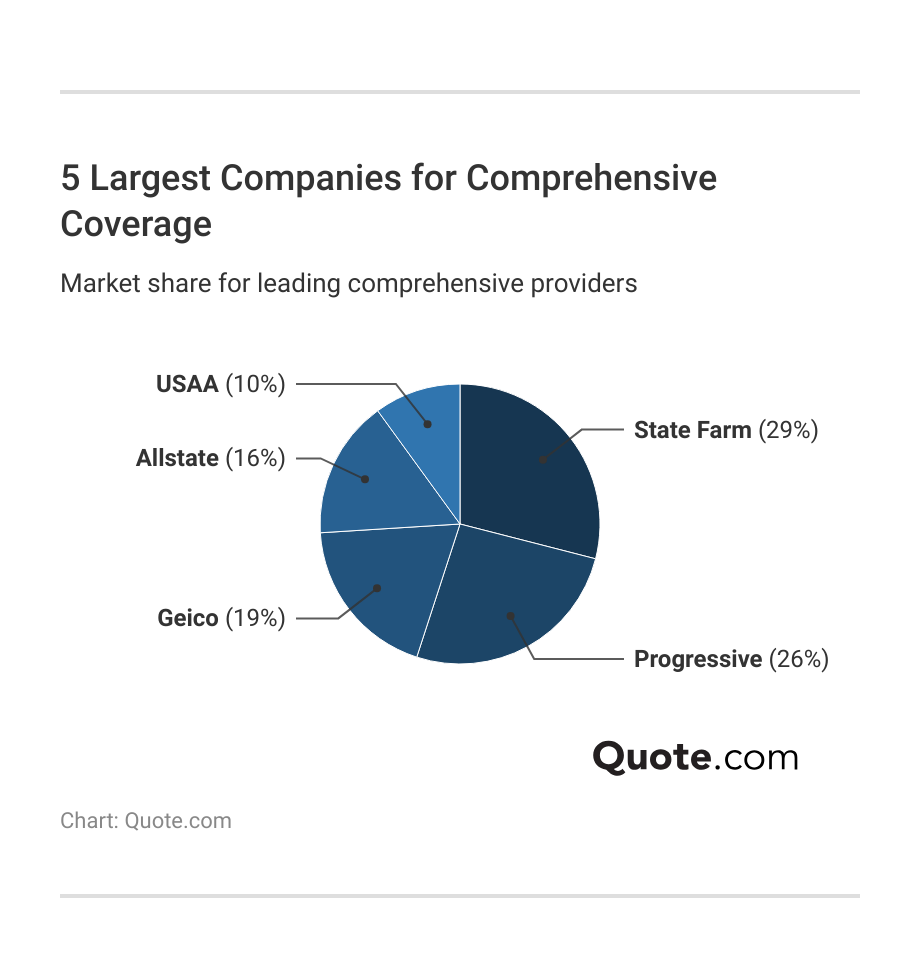

Your auto insurance does cover hitting a deer if you buy the right coverage. You’ll need comprehensive auto insurance, which starts at $20 a month, if you want your policy to cover damage from a collision with a deer. Luckily, comprehensive car insurance is cheap from companies like Geico, State Farm, and USAA.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insurance...

Leslie Kasperowicz

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as ...

Justin Wright

Updated January 2026

Does auto insurance cover hitting a deer? Your insurance does cover hitting a deer, as long as you have comprehensive coverage included in your policy.

- Only comprehensive insurance pays for car repairs after a deer collision

- MedPay or PIP insurance can pay for injuries after you hit a deer

- You should always report a deer collision to your insurance company

Hitting a deer is one of the most common types of animal-related accidents in the U.S., but many drivers are unsure whether to file a comprehensive or collision auto insurance claim.

The good news is that filing a claim after getting deer damage to your car is simple, as basic comprehensive insurance covers it. Read on to learn more about how your car insurance handles deer collisions.

Enter your ZIP code into our free comparison tool to see comprehensive insurance prices in your area.

Comprehensive Insurance Covers Hitting a Deer

Hitting a deer is more common than many drivers realize, especially in rural or heavily wooded areas where wildlife frequently crosses the road.

What happens if you hit a deer? These accidents can cause significant damage to your vehicle, from broken headlights and dented panels to major structural issues.

The good news is that car insurance does cover deer damage, so long as you have the correct type of coverage in place before the accident occurs.

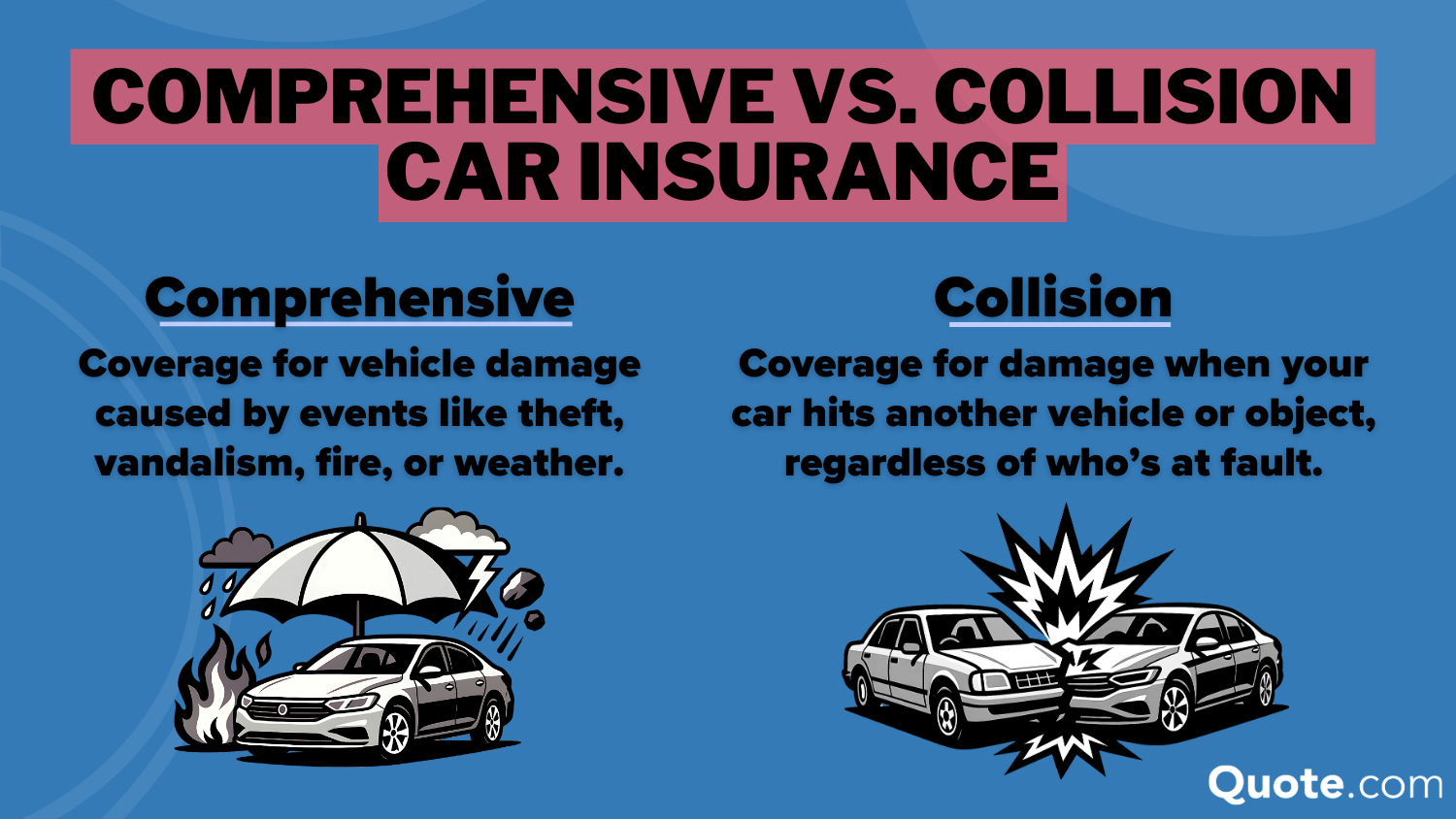

Deer-related accidents fall under comprehensive auto insurance, not collision insurance. Comprehensive coverage protects your car from damage caused by events beyond your control.

Comprehensive insurance also covers damage from floods, falling trees, fire, vandalism, and severe weather.

Dani Best Licensed Insurance Agent

If you hit a deer, you can file a claim under your comprehensive policy to help pay for repairs, minus your deductible. Without comprehensive coverage, you would be responsible for covering the full cost of the damage out of pocket.

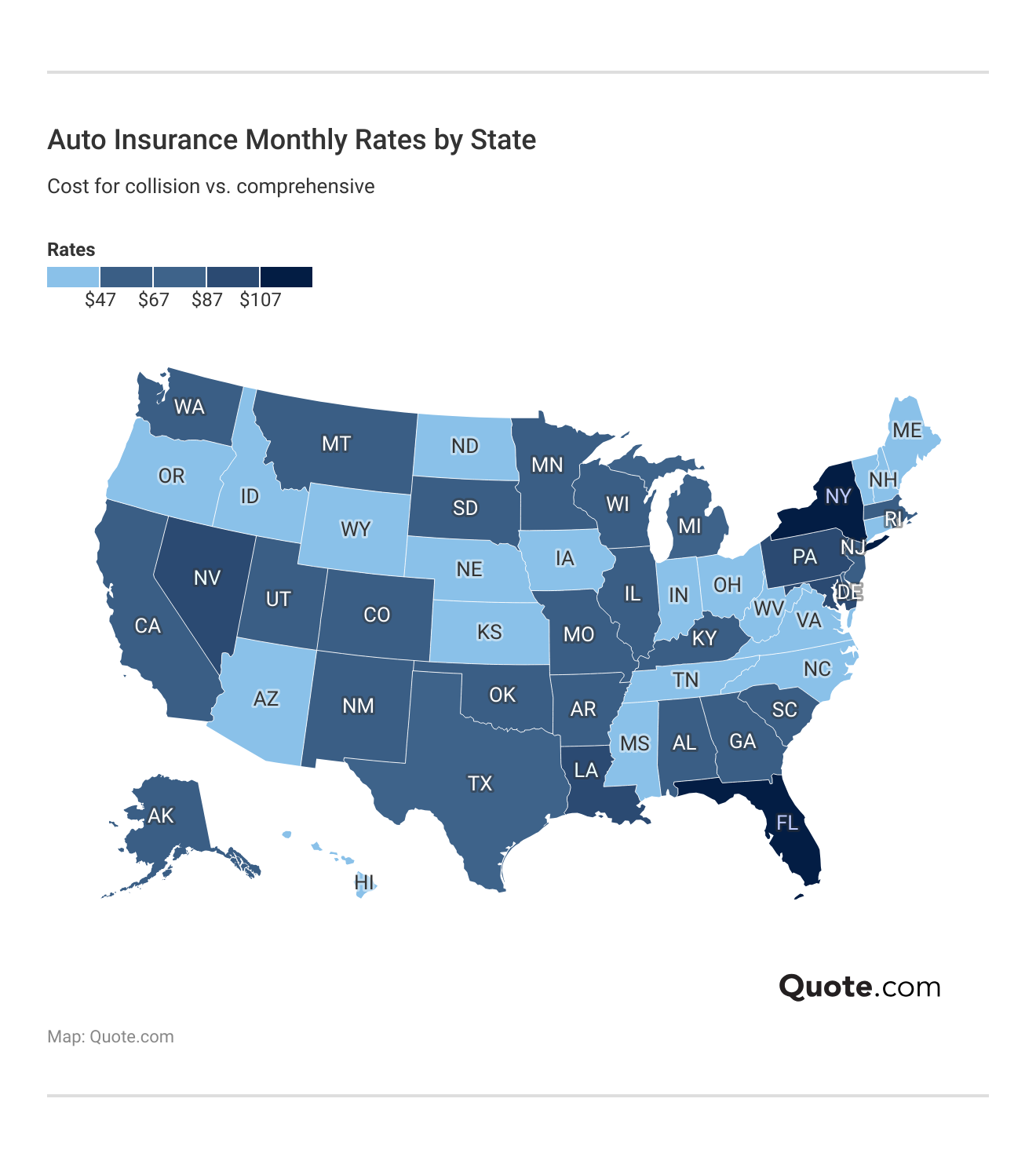

Fortunately, comprehensive insurance is usually an affordable addition to your policy. Compare collision and comprehensive insurance rates by the largest providers to find the best deal.

Auto Insurance Monthly Rates by Coverage Type| Company | Collision | Comprehensive |

|---|---|---|

| $88 | $32 | |

| $68 | $25 |

| $84 | $30 | |

| $62 | $22 | |

| $96 | $34 |

| $70 | $26 | |

| $72 | $28 | |

| $58 | $24 | |

| $78 | $27 | |

| $52 | $20 |

Comprehensive insurance is typically cheaper than collision insurance. Depending on your situation, you may or may not need comprehensive coverage.

For example, drivers with a new vehicle will likely need comprehensive insurance if they have a loan on their car. Alternatively, drivers with older cars sometimes skip the extra costs.

After hitting a deer, you’ll typically want to document the scene, take photos of your vehicle, and contact your insurance company to start the claims process.

In many cases, insurers do not raise rates for a single animal-related claim, since it’s generally considered an unavoidable accident.

Other Types of Insurance That Cover Deer Collisions

There are a variety of coverage types that help keep drivers and their vehicles protected on the road.

Each coverage option is designed to address specific risks, including accidents and injuries, theft, and weather damage. Knowing the significant types of auto insurance can help you choose the right combination of coverages for your budget and driving needs.

Types of Auto Insurance Coverage| Policy Type | What it Covers | Scenario |

|---|---|---|

| Collision | Damage to your vehicle | You hit a pole |

| Comprehensive | Theft or non-crash damage | Storm damages your car |

| Gap Insurance | Loan balance after total loss | Car totaled, loan remains |

| Liability | Damage or injuries you cause | You hit another car |

| Medical Payments | Medical costs for passengers | Passenger needs ER care |

| Personal Injury Protection | Medical bills and lost income | You’re injured in a crash |

| Rental Reimbursement | Rental car while repairing | You need a rental car |

| Rideshare Coverage | Accidents during rideshare use | Waiting for a ride request |

| Roadside Assistance | Towing or roadside help | Car won’t start on roadside |

| Underinsured Motorist | Costs beyond other limits | Other policy limits too low |

| Uninsured Motorist | Injuries from uninsured drivers | Uninsured driver hits you |

While there are a ton of car insurance options to choose from, most won’t help you if you hit a deer.

For example, collision insurance is crucial to protect you from car accidents. It ensures your vehicle repairs are covered when you hit another driver or even a stationary object, like a tree. However, it won’t pay for repairs after a deer collision.

Insurance Coverage Details for Deer-Related Accidents| Insurance Type | Covers Deer? | How it Works |

|---|---|---|

| Collision | No | Covers crashes from avoiding a deer |

| Comprehensive | Yes | Pays for damage from hitting a deer |

| Liability | No | Handles injury or damage to others |

| MedPay | Optional | Covers medical costs for you & riders |

| PIP | Sometimes | Pays medical bills after accidents |

| UM / UIM | No | Protects in uninsured-driver crashes |

Most insurance types won’t help you after a deer collision. However, you can file a claim with your PIP or MedPay insurance if hitting an animal caused you or your passengers injuries.

Regardless of what types of insurance you have, there are certain steps you should take after hitting a deer to make sure you and your passengers are safe.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Steps to Take After Hitting a Deer

Besides asking, “Does insurance cover hitting a deer?” there are a few steps you should take after a collision with an animal. Hitting a deer can be frightening and disorienting, but taking the right steps immediately afterward can help keep you safe.

Your top priority is ensuring everyone in the vehicle is unharmed and preventing any further danger on the road. Once you’re safe, you can focus on gathering information and reporting the incident properly. Here’s what to do after hitting a deer:

- Pull Over and Check for Injuries: Make sure to pull over in a safe location, turn on your hazard lights, and check yourself and passengers for injuries.

- Stay Away from the Deer: An injured animal may panic or kick, which could injure you.

- Call the Police: If the deer is blocking the road, you can’t drive your vehicle, or the animal is alive and suffering, call the local police department.

- Document the Scene: Take photos of your vehicle, the road, and any visible damage.

- Contact your Insurance Company: As soon as you’re safe, contact your provider by phone or online to start a comprehensive coverage claim.

After taking these steps, wait for help or guidance from authorities or roadside assistance. Your insurance company will walk you through the claims process and advise you on the next steps for repairs.

Following a clear plan not only keeps you safe but also ensures you have everything you need for a smooth and accurate insurance claim.

Read More: When Animals or Natural Disasters Damage Your Vehicle

Filing an Insurance Claim After Hitting a Deer

Learning how to file an auto insurance claim and win after hitting a deer is typically straightforward, especially since these incidents fall under your comprehensive coverage rather than collision.

Once you’ve made sure everyone is safe and documented the accident scene, you can begin the claims process with your insurer. Most companies allow you to file by phone, online, or through a mobile app, giving you flexibility to report the damage quickly.

Your insurance company may ask whether the vehicle is drivable and help arrange a tow if needed. An adjuster will then evaluate the damage and estimate the repair cost before approving the claim.

When filing your claim, you’ll usually need to provide photos of the damage, the location of the accident, and a brief explanation of what happened.

Comprehensive claims are the third most common in America, so your insurance company should handle it quickly and efficiently.

Most Common Auto Insurance Claims in the U.S.| Coverage Type | Share | Cost Per Claim | Description |

|---|---|---|---|

| Collision | 30% | $4.5K | Vehicle impact |

| Property Damage | 25% | $4.2K | Others’ property |

| Comprehensive | 15% | $2.5K | Theft, weather, fire |

| Bodily Injury | 12% | $20K | Injuries to others |

| Personal Injury | 8% | $8K | Medical, passengers |

| Uninsured Motorist | 6% | $15K | Uninsured driver hit |

| Medical Payments | 3% | $2.5K | Medical, any fault |

| Other Types | 1% | $1K | Rental, roadside |

After your claim is approved, you can take your vehicle to a repair shop — either one recommended by your insurer or your preferred location, depending on your policy.

You’ll pay your comprehensive deductible, and the insurer will cover the remaining repair costs up to your coverage limits. Overall, filing a claim for a deer collision is a routine process designed to help you get back on the road with minimal stress.

How to Prevent Deer Collisions

While deer collisions aren’t always avoidable, taking preventive measures can significantly reduce your risk, especially at dawn, dusk, and peak migration seasons.

While everyone should be mindful of animal collisions, it’s especially important if you live in an area with a large deer population.

Deer tend to travel in groups and move unpredictably, so staying alert and adjusting your driving habits can make a big difference.

Tracey L. Wells Licensed Insurance Agent

Hitting a deer isn’t always avoidable, and you should never swerve to avoid a collision, but you can better protect yourself, your passengers, and your vehicle by adopting a few practices.

Follow these simple tips to minimize your risk for deer collisions. Being proactive and cautious can make a major difference in preventing these types of accidents.

- Stay extra alert at dawn and dusk.

- Slow down in areas marked with deer crossing signs.

- Use your high beams when appropriate.

- Avoid swerving if a deer crosses your path.

- Limit distractions like phones or loud music.

Even with good habits, wildlife encounters can still happen, so maintaining comprehensive coverage ensures you’re financially protected.

Pairing smart driving practices with the right insurance coverage gives you the best defense against unexpected deer collisions.

Read More: Best Auto Insurance for Good Drivers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Perfect Coverage Against Deer Collisions

Deer collisions can happen in an instant, even to the safest drivers, which is why having the right insurance coverage in place is essential. You’ll need more than collision auto insurance to cover a deer collision.

Comprehensive insurance is the key protection you need. It covers damage from hitting a deer or any other animal.

Choosing comprehensive coverage today means you won’t face costly repair bills alone after a wildlife-related accident.

Now that you know how comprehensive car insurance covers collision with large animals, enter your ZIP code into our free comparison to see rates in your area.

Frequently Asked Questions

Does car insurance cover hitting a deer?

Yes, car insurance covers hitting a deer if you have comprehensive coverage. Without comprehensive insurance, you would have to pay for the damage out of pocket. If you have full coverage auto insurance, you’ll be covered for deer collisions.

Is hitting a deer comprehensive or collision insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.