Cheapest Car Insurance in 2026

USAA has the cheapest car insurance rates at $22 a month for military families. For other drivers, Geico offers the lowest rates, and State Farm is highly rated for customer service. Progressive helps you save $231 per year with Snapshot, its usage-based program.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Principal Broker

William Lemmon has been a licensed insurance agent for over 12 years. He is the principal broker and owner of Broadway Insurance Services in Los Angeles, CA. He works one-on-one with clients to create personalized plans that minimize risk and maximize savings. Being one of the foremost authorities on Airbnb and home-sharing property insurance, Lemmon offers his clients first-hand guidance on how t...

William Lemmon

Updated January 2026

USAA, Geico, and State Farm are the cheapest car insurance companies, with monthly rates as low as $22 per month for liability coverage.

- USAA is cheapest for military members at just $22 a month

- Geico and State Farm have the cheapest coverage in all 50 states

- Compare car insurance quotes online to find the cheapest policy

Before you decide to cancel car insurance, consider these top-rated providers to save money on coverage while still having the robust protection you need.

10 Best Companies: Cheapest Car Insurance| Company | Rank | Monthly Rates | UBI Discount | Best for |

|---|---|---|---|---|

| #1 | $22 | 30% | Military Personnel | |

| #2 | $30 | 25% | Safe Drivers | |

| #3 | $33 | 20% | Local Agents | |

| #4 | $37 | 30% | Industry Experience | |

| #5 | $39 | $231/yr | Budget Shoppers | |

| #6 | $43 | 15% | Loyalty Rewards |

| #8 | $44 | 25% | Vanishing Deductible | |

| #7 | $53 | 30% | Insurance Discounts | |

| #9 | $61 | 30% | Comprehensive Coverage | |

| #10 | $68 | 30% | Multiple Policies |

The top three providers distinguish themselves with competitive pricing, and many offer very cheap car insurance with no deposit. Minimum coverage rates start at $22 per month at USAA.

Only military members can buy USAA insurance, but Geico and State Farm have cheap auto insurance starting at $30 monthly in most states.

Enter your ZIP code to compare cheap auto insurance quotes from the top insurers to get the right car insurance at the best price in your city.

Cheapest Car Insurance in the U.S.

USAA stands out with the lowest monthly rates, charging $22 for minimum and $110 for full coverage. However, since coverage is only available to military personnel, Geico and State Farm are the next affordable options.

At the other end, Liberty Mutual lists the highest monthly rates at $68 for minimum coverage and $142 for full coverage, as it provides a broader spectrum of options for potential policyholders.

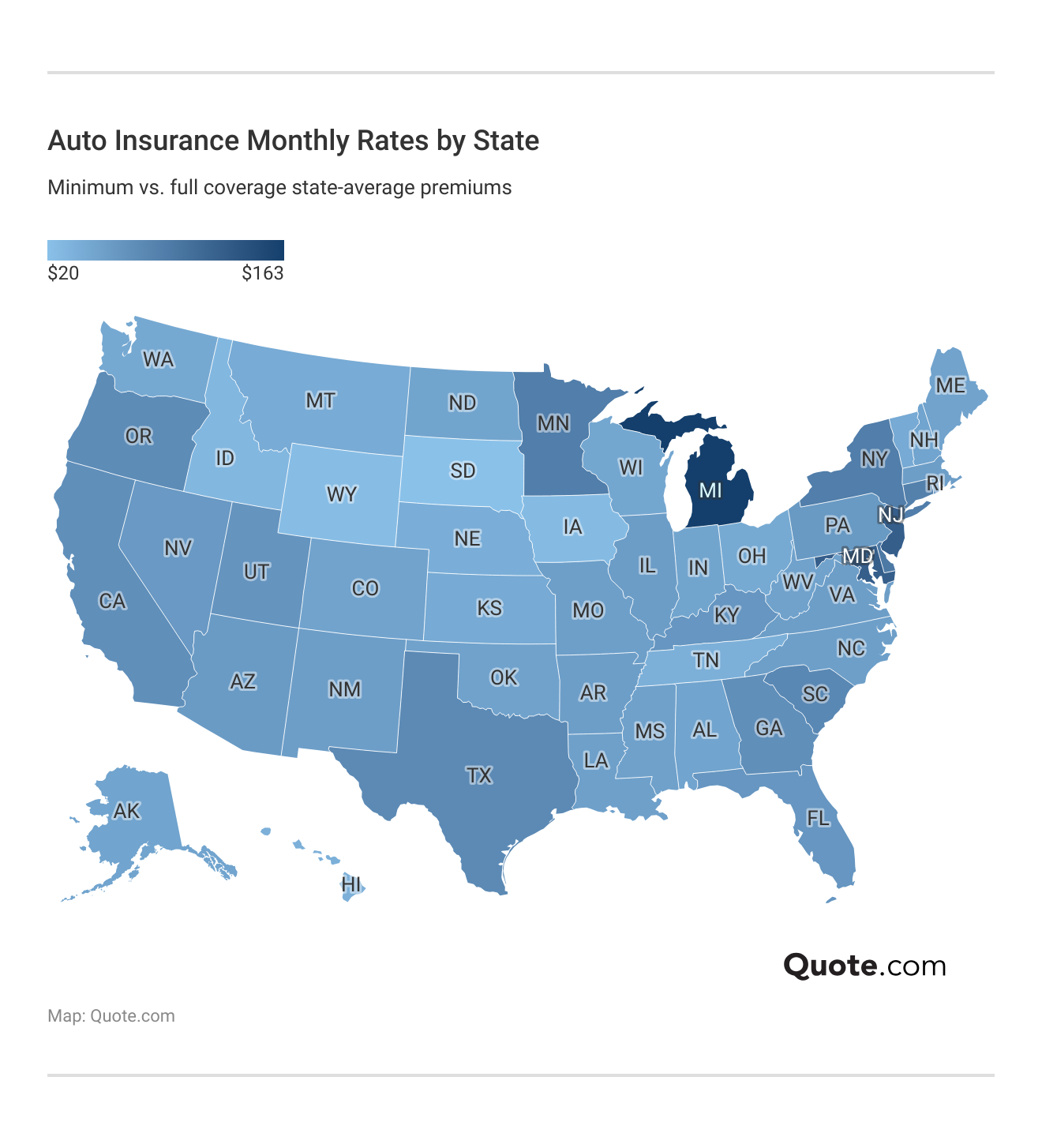

You might see higher or lower insurance rates depending on where you live. Use our auto insurance visual guide to determine how much coverage you need.

State laws set policy limits and additional coverage requirements, impacting monthly premiums across different regions.

Daniel Walker Licensed Insurance Agent

Minimum coverage costs less, but it won’t protect your vehicle if you’re in an accident. It only satisfies your state’s auto insurance requirements, which means you’ll have to pay for repairs out of pocket.

That’s why comparing liability vs. full coverage auto insurance is essential to find the right policy for your budget and needs.

When comparing liability vs. full coverage auto insurance, USAA, Geico, and State Farm are still the cheapest car insurance companies in most states for full coverage.

Use our free quote comparison tool to compare quotes in as little as 2 minutes and find the cheapest provider in your area.

Cheapest Car Insurance for New Drivers

Finding affordable car insurance for new drivers can be difficult because insurers consider young and inexperienced drivers high-risk to insure.

Teens under 21 see the highest rates, but USAA and Geico are the most affordable for young drivers, with premiums starting at $137 and $163 per month, respectively.

Car Insurance Monthly Rates for Young Drivers by Age| Company | Age: 16 | Age: 17 | Age: 18 | Age: 19 |

|---|---|---|---|---|

| $338 | $371 | $275 | $318 | |

| $230 | $296 | $187 | $253 |

| $452 | $452 | $368 | $387 | |

| $163 | $178 | $132 | $153 | |

| $404 | $464 | $329 | $398 |

| $230 | $279 | $187 | $239 | |

| $440 | $467 | $358 | $400 | |

| $177 | $208 | $144 | $178 | |

| $392 | $517 | $319 | $443 | |

| $137 | $146 | $111 | $125 |

State Farm is the next most affordable option, charging around $177 per month for 17-year-olds and around $140 per month for 18-year-olds. Compare State Farm vs. Progressive auto insurance for more quotes.

By age 21, rates at most companies start to even out, but USAA, Geico, and State Farm remain the cheapest options for young drivers.

Cheapest Car Insurance for Older Drivers

As drivers age, monthly rates decrease significantly, since insurance companies reward lower rates to more experienced drivers.

Some seniors pay less than $50 a month for car insurance with companies like USAA, State Farm, Geico, and Travelers.

Car Insurance Monthly Rates for Seniors by Age| Company | Age: 60 | Age: 65 | Age: 70 | Age: 75 |

|---|---|---|---|---|

| $86 | $86 | $119 | $152 | |

| $58 | $75 | $105 | $134 |

| $72 | $75 | $119 | $162 | |

| $41 | $42 | $79 | $118 | |

| $91 | $95 | $121 | $144 |

| $59 | $62 | $94 | $131 | |

| $52 | $55 | $97 | $138 | |

| $43 | $47 | $84 | $121 | |

| $50 | $53 | $101 | $153 | |

| $29 | $31 | $73 | $107 |

However, older drivers over 70 may experience rate hikes due to age, since slower reaction times can increase the risk of an accident.

Always compare companies every year to find cheap auto insurance for seniors as you get older. Get free quotes in just 2 minutes by entering your ZIP code.

Cheapest Car Insurance Based on Your Driving History

State Farm and USAA are the cheapest auto insurance companies for high-risk drivers, especially those with accidents or DUIs on their records. Geico costs more than the other top companies but is still cheaper than most providers on this list.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $61 | $172 | $215 | $145 | |

| $43 | $160 | $198 | $130 |

| $53 | $168 | $210 | $148 | |

| $30 | $158 | $192 | $125 | |

| $68 | $180 | $225 | $150 |

| $44 | $165 | $200 | $135 | |

| $39 | $170 | $205 | $140 | |

| $33 | $155 | $190 | $120 | |

| $37 | $167 | $203 | $132 | |

| $22 | $145 | $178 | $110 |

Any of these infractions is likely to raise rates, but each company assesses risk differently, charging vastly different rates. It’s important to compare quotes from multiple companies to avoid rate spikes, especially if you were recently in an accident or received a citation.

Filing a car insurance claim will raise your rates, but a collision claim for an accident raises premiums more than a comprehensive claim for theft or weather-related damage.

If you need to file an auto insurance claim, pay attention to customer reviews as much as price. USAA and State Farm have the highest claims satisfaction in most states.

These are the 10 worst states to file an auto insurance claim, and rates are significantly higher for drivers who live there.

Cheapest Car Insurance Based on Your Credit Report

Although it has nothing to do with your driving experience, your credit score does impact how much you pay for insurance. Providers consider drivers with bad credit to be more likely to file claims and will charge them slightly higher rates. Find out what to do if you’re denied insurance coverage for poor credit.

Auto Insurance Monthly Rates by Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (<580) |

|---|---|---|---|---|

| $65 | $72 | $94 | $98 | |

| $61 | $68 | $86 | $95 |

| $68 | $75 | $103 | $101 | |

| $56 | $62 | $78 | $88 | |

| $59 | $65 | $92 | $91 |

| $60 | $66 | $84 | $92 | |

| $58 | $64 | $90 | $90 | |

| $53 | $59 | $83 | $85 | |

| $66 | $73 | $98 | $99 | |

| $50 | $55 | $72 | $82 |

Companies charge between $130 and $140 a month for drivers with average or fair credit, but those with good credit and clean records can pay less than $100 per month for full coverage. Using credit score to set rates isn’t allowed in every state, so always check your local insurance laws before comparing quotes online.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Lower Your Car Insurance Rates

If you’re looking for the cheapest car insurance quotes, start comparing discounts.

For example, bundling, usage-based, and low-mileage discounts can lower your car insurance bill by up to 40%.

Top Auto Insurance Discounts by Provider & Savings| Company | Bundling | Claims-Free | Loyalty | Usage-Based |

|---|---|---|---|---|

| 25% | 10% | 15% | 30% | |

| 25% | 15% | 18% | 30% |

| 20% | 9% | 12% | 30% | |

| 25% | 12% | 10% | 25% | |

| 25% | 8% | 10% | 30% |

| 20% | 14% | 13% | 40% | |

| 10% | 10% | 13% | $231/yr | |

| 17% | 11% | 7% | 30% | |

| 13% | 13% | 9% | 30% | |

| 10% | 20% | 11% | 30% |

Discover 17 car insurance discounts you can’t miss and start saving more on your policy today. State Farm, Travelers, and USAA cater to different types of drivers with diverse discounts for good students, accident-free records, and military service.

Other top providers, such as Allstate, American Family, and Farmers, offer a mix of discounts, including multi-policy, safe driving, and early signing.

Liberty Mutual, Nationwide, and Progressive can be more expensive but offer savings to safe drivers through usage-based car insurance programs like RightTrack and SmartRide.

Some insurers also offer pay-per-mile coverage, which only charges you for the miles you drive.

Learn More: Best Pay-as-You-Go Auto Insurance

The good news is that even if you’re a high-risk driver or don’t qualify for certain discounts, you can still get a cheap car insurance quote if you follow these tips:

- Increase Deductibles: If you don’t want to reduce or drop coverage, increasing full coverage deductibles to $1,000 or more can significantly lower your monthly premiums.

- Drive Safely: Insurers reward safe drivers with lower rates. Usage-based programs also lower your rates if you exhibit safe driving after enrolling.

- Compare Quotes: Getting quotes from multiple companies online and comparing discounts and usage-based rewards can help you find the cheapest car insurance.

In addition, if you drive an older car or have paid off your auto loan, the fastest way to lower your rates is to drop full coverage and carry just minimum liability.

However, be sure you can afford to pay for repairs out of pocket before dropping full coverage.

Some providers, including Allstate, offer comprehensive-only coverage if you plan to store a car for 30 days or longer.

This Reddit thread discusses how comparing car insurance companies online and getting quotes every six months helps drivers maintain long-term, affordable coverage.

Comment

byu/IndependentSlip7113 from discussion

inInsurance_Companies

As one Reddit user points out, insurers reconsider your risk profile and adjust premiums every six months. So, it’s a good idea to start comparing quotes once your car insurance policy renews.

If you want the cheapest car insurance, Reddit is a good resource for advice from local forums, but you can only get free quotes on comparison sites like this one.

Car Insurance Coverage You Should Consider

If you’re looking for the most affordable car insurance rates, it’s important to balance cost with choosing the coverages you need. For example, carrying only the state minimum can save you money, but it may leave you with hefty out-of-pocket costs after an accident.

Auto Insurance Coverage Options: Complete Breakdown| Coverage Type | What it Covers |

|---|---|

| Liability | Pays for damage/injuries you cause |

| Collision | Repairs/replaces your car after crash |

| Comprehensive | Covers theft, weather, or animal loss |

| Uninsured/Underinsured Motorist | Pays for injuries from uninsured drivers |

| Medical Payments (MedPay) | Covers med bills for you & passengers |

| Personal Injury Protection (PIP) | Covers medical bills and lost wages |

| Accident Forgiveness | Prevents rate hike after first accident |

| Custom Equipment | Covers custom or added car parts |

| Gap Insurance | Pays loan balance if car is totaled |

| New Car Replacement | Covers new car after total loss |

| Rental Car Reimbursement | Pays for rental while car’s repaired |

| Rideshare Coverage | Protects during rideshare driving |

| Roadside Assistance | Covers towing, jumps, or lockouts |

If your vehicle is paid off and older than 10 years, it may be worth considering whether full coverage is worth the cost compared to the car’s actual value.

Meanwhile, for drivers financing their vehicle, lenders usually require full coverage to protect their investment until the loan is paid off.

Auto Insurance Monthly Rates by Coverage Type| Company | Collision | Comprehensive | Full Coverage |

|---|---|---|---|

| $140 | $74 | $210 | |

| $130 | $68 | $195 |

| $135 | $71 | $203 | |

| $120 | $63 | $180 | |

| $145 | $76 | $217 |

| $125 | $66 | $188 | |

| $128 | $67 | $190 | |

| $118 | $62 | $176 | |

| $132 | $69 | $198 | |

| $110 | $58 | $165 |

Comparing the different types of auto insurance coverage side by side can help you see what risks you want to cover and which you’re comfortable without.

Need the cheapest car insurance possible? Enter your ZIP code into our free comparison tool to find the most affordable rates for your vehicle.

Learn More: Auto Insurance Guide

10 Cheapest Car Insurance Companies

USAA has the cheapest auto insurance at $22 per month. Military members exclusively enjoy its low rates and excellent customer service.

Meanwhile, Geico is the next-cheapest option for drivers who don’t qualify for USAA coverage.

If you aren’t in the military, compare quotes from Geico and State Farm to find lower rates.

By comparing the top ten cheapest car insurance companies in the country, you can save more money on car insurance with a plan that fits your budget.

#1 – USAA: Top Pick Overall

Pros

- Lowest National Rates: Offers some of the cheapest car insurance for military families, starting at $22 a month. Compare quotes in our USAA insurance review.

- Dedicated Military Support: Provides significant discounts that can lower the cost of premiums while drivers are deployed.

- Exceptional Service: Known for exceptional customer service that helps military families access the cheapest car insurance options.

Cons

- Limited to Military Families: Only available to military personnel and their families, which limits accessibility to the cheapest car insurance for others.

- Limited Local Support: Operates primarily online with very few local agents for drivers who prefer to shop for cheap car insurance in person.

#2 – Geico: Cheapest for Safe Drivers

Pros

- Cheapest Monthly Rates: Drivers with clean records and no claims can buy full coverage starting at $80 per month.

- Wide Range of Discounts: Offers a variety of discounts, including federal employee and low mileage discounts, that lead to cheaper car insurance rates.

- Cost-Saving Technology: Streamlined mobile app and website provide cheaper car insurance through tools like online quote comparisons.

Cons

- Variable Customer Service: Even if Geico’s rates are cheap, the quality of its customer service varies. Find out everything you need to know about Geico before you buy.

- Basic Coverage Options: Geico lacks add-ons that many drivers need, like gap insurance.

#3 – State Farm: Cheapest With Local Agents

Pros

- Local Agent Deal Support: Provides personalized service to help drivers find the cheapest car insurance rates through local agents.

- User-Friendly Mobile App: Facilitates management of policies and claims, supporting the ongoing affordability of car insurance.

- Usage-Based Savings: Drive Safe & Save tracks good driving habits for discounts and won’t raise your rates if you speed or brake too hard. See how it works in our State Farm review.

Cons

- Variable Regional Availability: State Farm agents may not write new car insurance policies in Massachusetts, Rhode Island, Florida, or California.

- Reliance on Discounts: Without qualifying for discounts, customers might not get the cheapest car insurance rates available.

#4 – Travelers: Cheapest With Industry Experience

Pros

- Reliable Market Experience: Over 100 years in the insurance industry gives Travelers agents an edge over the competition when it comes to finding the cheapest car insurance.

- Financially-Driven Stability: Its A++ financial rating supports cheap car insurance with reliable claims payments. See more company ratings in our Travelers auto insurance review.

- Flexible Discount Options: Offers multiple discounts that help customers secure cheaper car insurance rates, including for electric vehicles and teen drivers.

Cons

- Comprehensive Rate Increases: Adding more comprehensive options may come at a higher price than with other cheap auto insurance companies.

- Poor Claims Handling: Travelers ranks in the bottom five for claims satisfaction in annual J.D. Power customer surveys.

#5 – Progressive: Cheapest for Budget Shoppers

Pros

- Flexible Rate Structures: Online features like the Name Your Price tool make it easy for drivers to find the cheapest car insurance.

- Wide Driver Eligibility: Progressive offers cheap car insurance to drivers with less-than-perfect records. Read everything you need to know about Progressive insurance to learn how to qualify.

- National Coverage: Progressive sells cheap auto insurance in all 50 states. Minimum coverage starts for $39 a month.

Cons

- Negative Claims Reviews: Progressive has the worst claims handling out of the top ten cheapest car insurance companies on this list.

- Renewal Cost Fluctuations: Some customers report unexpected rate increases at renewal, losing their cheap car insurance savings.

#6 – American Family: Cheapest for Loyal Customers

Pros

- Loyalty-Driven Rewards: Long-term customers can benefit from loyalty discounts, and teen drivers get cheaper car insurance rates if their parents have an AmFam policy.

- Broad Acceptance: Welcomes a wide range of drivers, including high-risk drivers who need SR-22 insurance and young drivers under 21.

- High Customer Satisfaction: AmFam customer service and claims handling are well-reviewed in most regions, supporting its affordable coverage.

Cons

- Regional Availability: American Family car insurance coverage is not available in every state. Find out if it’s near you in our American Family Insurance review.

- Complex Policy Management: Managing highly customizable policies can be complex, potentially leading to difficulties in maintaining the cheapest rates.

#7 – Nationwide: Cheapest With a Vanishing Deductible

Pros

- Shrinking Deductibles: Nationwide reduces deductibles by $50 every six months if drivers go without a claim to help reduce out-of-pocket insurance costs.

- Reliable Financial Stability: View our Nationwide insurance review to see how Nationwide’s financial strength ensures reliable and consistently affordable pricing.

- Usage-Based Discount: Save up to 40% with safe driving habits using Nationwide SmartRide to track things like speeding, braking, and mileage.

Cons

- Regional Availability: Despite its name, Nationwide car insurance is only sold in 46 states.

- Expensive Monthly Rates: Features like vanishing deductibles might come with initially higher costs, potentially making it less affordable compared to other cheap automobile insurance options.

#8 – Farmers: Cheapest With Insurance Discounts

Pros

- Cheap With Discounts: Farmers has more discounts than other cheap car insurance companies, and drivers who bundle various types of policies can achieve significant savings.

- Personalized Support: Local agents are available to help customers navigate options and secure the cheapest car insurance deals.

- Uncommon Coverages: Farmers provides affordable automobile insurance add-ons for rideshare insurance, glass replacement, and custom parts coverage.

Cons

- Complex Customization Costs: Customizing coverage can sometimes result in higher costs. Here’s everything you need to know about Farmers Insurance to see if its policies are right for you.

- Regional Rate Fluctuations: Premiums can vary widely depending on the location, which may impact the affordability of the cheapest car insurance in certain areas.

#9 – Allstate: Cheapest Comprehensive Coverage

Pros

- Comprehensive Policies: Our Allstate insurance review covers how policy options can be adjusted to fit your budget while securing comprehensive protection.

- Long List of Discounts: Various discounts are available to help reduce premiums, making it easier to find the cheapest car insurance.

- Robust Agent Network: A Widespread local agent network can negotiate the best, cheapest car insurance deals for new policyholders.

Cons

- Increased Coverage Costs: Comprehensive options can come at a higher cost of $61 per month, more than double the average rates from the top three companies.

- Variable Customer Service: Allstate ranks lower in claims satisfaction, and drivers in different regions have mixed reviews regarding local agent service.

#10 – Liberty Mutual: Cheapest for Multiple Policies

Pros

- Substantial Multi-Policy Savings: Drivers who bundle auto with home or renters insurance get some of the cheapest car insurance rates.

- Flexible Add-on Coverage: Use our Liberty Mutual insurance review to find flexible coverage add-ons, like new car replacement and classic car insurance.

- Educator Perks: Teachers qualify for additional coverage up to $2,500 for school-related items damaged in a covered event.

Cons

- Higher Base Rates: Initial rates with Liberty Mutual are usually higher than those of other cheap auto insurance companies on this list.

- High Number of Complaints: Liberty Mutual auto insurance receives twice as many complaints as other cheap car insurance companies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Cheapest Car Insurance in Your Area

USAA, Geico, and State Farm are the cheapest car insurance companies. USAA and State Farm receive high marks for their robust local agent networks and extensive discount options, while Geico is the cheapest auto insurance for good drivers at $30 a month.

USAA consistently receives 95% customer satisfaction ratings for its unbeatable rates and superior coverage.

Michelle Robbins Licensed Insurance Agent

Affordable auto insurance starts at $22 per month, but your rates could go up at renewal, even with the cheapest providers. Start shopping for the best liability-only car insurance with our free quote comparison tool.

Frequently Asked Questions

Where can I find cheap car insurance?

Military drivers can find affordable auto insurance with USAA, starting at $22 per month. If you aren’t from a military family, compare quotes from Geico and State Farm to see which is cheaper in your state.

How do I get cheap car insurance online?

Is it possible to get cheap online car insurance quickly? Yes, many insurers provide affordable auto insurance online, with free quotes available on their websites. Enter your ZIP code to find cheap auto insurance online.

How does a credit score affect car insurance?

Insurance companies generally run your credit report when you apply for coverage and assign higher car insurance rates to drivers with low credit.

What are the benefits of affordable car insurance?

Affordable car insurance offers comprehensive coverage at lower costs, ensuring you get affordable comprehensive car insurance without sacrificing protection. Find out what to do if you cannot afford auto insurance.

How do I get cheap car insurance?

Maintaining a safe driving record is the easiest way to get cheap auto insurance. If you have a less-than-perfect record, start comparing quotes online to find an affordable high-risk insurance provider.

What cars are cheaper to insure?

Older vehicles from 2013 or earlier have more affordable rates due to their cheap replacement parts and low-cost repairs. Newer cars with advanced navigation systems, backup cameras, and other expensive technology often have higher repair costs and more expensive premiums.

Who typically has the cheapest car insurance?

Companies like USAA, Geico, and State Farm are known for providing affordable car insurance plans and affordable car insurance quotes. Compare State Farm vs. Farmers, Geico, Progressive, and Allstate auto insurance to find the best company for you.

Is State Farm cheaper than Geico?

No, Geico is usually cheaper than State Farm. However, State Farm is highly rated for claims satisfaction, and often has lower rates for certain demographics.

Is Allstate cheaper than Geico?

No, Allstate is often more expensive than Geico, although it offers more comprehensive coverage options. Compare Geico vs. Allstate auto insurance to find cheap auto insurance quotes.

Is Progressive cheaper than Geico?

Geico is typically cheaper than Progressive, but rates often only vary by a few dollars a month. Always compare quotes to see how much car insurance costs in your city and be able to buy cheap auto insurance online.

How much is car insurance for a new driver?

At what age does auto insurance get cheaper?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.