American Family vs. Travelers in 2026

Our American Family vs. Travelers review shows that Travelers is typically cheaper, with monthly car insurance rates starting from $53 and home insurance from $90. American Family’s rates start from $62 for auto and $95 for home insurance. Travelers holds an A++ rating, while AmFam is rated A from A.M. Best.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated December 2025

When it comes to finding the right insurance, it’s about more than just saving money. It’s about finding the best company that offers solid protection and affordable pricing.

- AmFam is rated A, and Travelers is rated A++ by A.M. Best

- Travelers IntelliDrive is available in 42 states + D.C. + Canada

- AmFam’s DriveMyWay program offers a 10% discount for teens

Sounds simple enough on the surface, right?

In this head-to-head review, we’ll take a closer look at two of the best insurance companies: American Family, also known as AmFam, and Travelers Insurance.

American Family vs. Travelers Insurance Rating| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.0 | 4.3 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 4.8 | 4.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 3.9 | 5 |

| Coverage Value | 4.0 | 4.3 |

| Customer Satisfaction | 2.0 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.8 | 4.1 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 4.1 |

| Savings Potential | 4.2 | 4.4 |

Whether you’re comparison shopping or narrowing your choice between these two well-known brands, our review presents everything you need to know about AmFam and Travelers Insurance to help you make a more informed decision.

See how much you could save on coverage by entering your ZIP code into our free quote comparison tool.

Insurance Availability: AmFam vs. Travelers

Both American Family and Travelers Insurance provide a wide range of personal insurance products, including auto, condo, homeowners, motorcycle, and travel insurance. They also offer coverage beyond the basics.

However, their availability for certain insurance types varies significantly from state to state. One insurance type that sets AmFam apart is that it still provides life insurance, whereas Travelers does not.

American Family vs. Travelers: Types of Insurance Available| Type |  | |

|---|---|---|

| Auto Insurance | ✅ | ✅ |

| Boat / Watercraft Insurance | ⚠️ Varies by State | ✅ |

| Business / Commercial Insurance | ⚠️ Varies by State | ✅ |

| Classic Car Insurance | ⚠️ Varies by State | ⚠️ Varies by State |

| Condo Insurance | ✅ | ✅ |

| Flood Insurance (NFIP) | ⚠️ Varies by State | ⚠️ Varies by State |

| Health Insurance | ⚠️ Varies by State | ❌ |

| Homeowners Insurance | ✅ | ✅ |

| Liability Insurance | ✅ | ✅ |

| Life Insurance | ✅ | ❌ |

| Medicaid Insurance | ❌ | ❌ |

| Medicare Insurance | ⚠️ Varies by State | ❌ |

| Motorcycle Insurance | ✅ | ✅ |

| Pet Insurance | ⚠️ Varies by State | ⚠️ Varies by State |

| Renters Insurance | ✅ | ✅ |

| Roadside Assistance | ⚠️ Varies by State | ⚠️ Varies by State |

| RV / Motorhome Insurance | ✅ | ✅ |

| Travel Insurance | ✅ | ✅ |

| Umbrella Insurance | ✅ | ✅ |

Additionally, AmFam offers several products with state-dependent availability, including boat insurance, business insurance, pet insurance, Medicare-related coverage, and roadside assistance.

Travelers has a broader suite of commercial and specialty insurance options, including professional liability, inland marine, and more. It also offers more specialized personal policies, such as boat & yacht coverage. Unlike AmFam, Travelers does not offer health, Medicare, or life insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AmFam vs. Travelers Auto Insurance Coverage

Both American Family and Travelers offer standard car insurance options, including liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage.

In addition to traditional car insurance policies, both insurers offer common add-on options such as gap, rideshare, rental reimbursement, and new car replacement coverage.

Gap insurance protects your car lease or loan if your car is totaled before the lease ends or is paid in full. In this case, gap coverage kicks in and pays off the remainder.

American Family vs. Travelers Auto Insurance Coverage Options| Coverage |  | |

|---|---|---|

| Collision | ✅ | ✅ |

| Comprehensive | ✅ | ✅ |

| Gap Insurance | ✅ | ✅ |

| Liability | ✅ | ✅ |

| Medical Payments | ✅ | ✅ |

| New Car Replacement | ⚠️ Varies by State | ⚠️ Varies by State |

| Personal Injury Protection | ⚠️ Varies by State | ⚠️ Varies by State |

| Rental Reimbursement | ✅ | ✅ |

| Rideshare Insurance | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

Rideshare insurance helps ridesharing companies like Uber and Lyft cover liability in the event of an accident when drivers are en route to pick up or drop off a passenger.

The rates for American Family and Travelers vary significantly based on multiple factors, including the amount of coverage you need, your driving record, age, and gender.

What Drivers Pay Based on Coverage Amount

Auto insurance rates vary widely depending on whether the driver chooses minimum coverage or full coverage. American Family and Travelers both offer competitive rates, but Travelers is cheaper at both coverage levels.

Travelers charges an average of $53 per month for minimum coverage and $141 per month for full coverage, making it the more affordable insurer between the two, especially for drivers seeking more comprehensive protection.

AmFam vs. Travelers Auto Insurance Monthly Rates by Coverage Level| Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $62 | $166 |

| $53 | $141 | |

| $87 | $228 | |

| $65 | $122 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 |

American Family is slightly more expensive, averaging $62 per month for minimum coverage and $166 per month for full coverage. While still competitive, AmFam car insurance rates fall in the middle compared to those of national insurers.

Insurers like Geico and State Farm have the cheapest premiums overall. Geico averages $43 for minimum coverage and $114 for full coverage, while State Farm averages $47 and $123, respectively.

Understanding how these car insurance companies price policies by coverage level can help you get the cheapest car insurance.

How Age & Gender Impact Auto Insurance

When comparing American Family vs. Travelers costs, younger drivers pay substantially more due to the higher risk associated with inexperience. For example, 16-year-old males incur the highest costs.

Travelers is especially expensive for teens, averaging $392 per month for a 16-year-old female and $517 per month for a 16-year-old male, which is substantially higher than American Family’s $230 and $296, respectively.

AmFam vs. Travelers Auto Insurance Monthly Rates by Age & Gender| Age & Gender |  | |

|---|---|---|

| 16-Year-Old Female | $230 | $392 |

| 16-Year-Old Male | $296 | $517 |

| 25-Year-Old Female | $66 | $57 |

| 25-Year-Old Male | $78 | $62 |

| 35-Year-Old Female | $62 | $53 |

| 35-Year-Old Male | $73 | $58 |

| 45-Year-Old Female | $63 | $54 |

| 45-Year-Old Male | $62 | $53 |

| 55-Year-Old Female | $58 | $50 |

| 55-Year-Old Male | $59 | $51 |

Middle-aged and older drivers see much lower premiums. For example, a 35-year-old female pays $53 with Travelers and $62 with AmFam, while a 55-year-old male pays $51 with Travelers versus $59 with AmFam.

Overall, Travelers tends to offer slightly lower rates than American Family across most age groups. Learn how to find cheap auto insurance for teens.

How Driving History Affects Insurance Costs

Even a single accident, speeding ticket, or DUI can raise monthly car insurance rates. For drivers with a clean record, Travelers tends to be the cheaper option, averaging $53 per month, compared to American Family’s $62. Travelers continues to be cheaper for drivers with one accident, charging $76, compared to AmFam at $94.

AmFam vs. Travelers Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $62 | $94 | $104 | $73 |

| $53 | $76 | $112 | $72 | |

| $87 | $124 | $152 | $103 | |

| $65 | $81 | $58 | $71 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 |

Pricing changes when DUI rates are considered. American Family becomes the more affordable option, averaging $104 per month, while Travelers jumps to $112 per month.

For drivers with one speeding ticket, both companies charge nearly identical rates: Travelers averages $72 a month, and American Family averages $73 a month.

Read more: Cheap Auto Insurance After a DUI

Usage-Based Driver Programs & Mobile Apps

In addition to the insurance types noted above, both companies offer a range of other benefits. These perks showcase the insurers’ push to tie driving habits and therefore rates to a specific driver rather than lumping all drivers into a typical “risk pool” based on what they drive, their background, where they live, and so on.

Travelers Intellidrive Program

Although not available in every state, Travelers Intellidrive is a usage-based car insurance program that collects driving metrics, including location, time of day, average speed, acceleration and braking, and miles driven. Intellidrive requires a smartphone and tracks your driving behavior with a discount for safe driving habits.

However, the program may not be the right choice for every driver. Since it records the time of day, drivers who frequently commute late at night may not enjoy the same discounts as daytime drivers.

Currently, the program is available in 42 U.S. states and Washington, D.C., as well as Canada, making it one of the most widely available telematics programs among major insurers.

My AmFam Mobile App

This mobile app is part of a UBI program, DriveMyWay, designed to help teens develop safe driving habits. As long as their smartphone is in the car, it tracks their driving and scores their rides, while also providing feedback.

The app is smart enough to tell who’s at the wheel, but if it does log a trip where someone else is driving, you can delete that log. Once your teen driver completes 1 year or 3,000 hours in the program, parents may receive up to a 10% discount on their car insurance.

Usage-based programs like Travelers IntelliDrive and AmFam’s DriveMyWay can unlock meaningful savings, but only if your driving habits are truly safe.

Travis Thompson Licensed Insurance Agent

Ask your agent whether they offer an app or another way to file a claim or get assistance if needed. You’d be surprised at how this can come in handy when you’re in the midst of an accident and thinking about insurance paperwork is the last thing on your mind.

Home Insurance by AmFam vs. Travelers

Both American Family and Travelers include the standard protections you’d expect in a homeowners policy. So, if you’re mainly focused on getting solid, basic coverage, you really can’t go wrong with either company.

The biggest differences come down to optional add-ons and state-level variations. These add-ons can include identity theft protection, equipment breakdown coverage, and scheduled personal property for valuables.

American Family vs. Travelers Home Insurance Coverage Options| Coverage |  | |

|---|---|---|

| Add-ons / Endorsements | ⚠️ Varies by State | ⚠️ Varies by State |

| Dwelling | ✅ | ✅ |

| Loss of Use | ✅ | ✅ |

| Medical Payments | ✅ | ✅ |

| Other Structures | ✅ | ✅ |

| Personal Liability | ✅ | ✅ |

| Personal Property | ✅ | ✅ |

Since availability varies by location, you may find that one company offers certain specialized coverage in your state that the other does not.

Home insurance costs vary based on how much dwelling coverage you need. Both companies offer competitive home insurance rates across all coverage levels, but Travelers tends to be slightly cheaper.

For homes insured for $200K, Travelers averages $90 per month, while American Family averages $95 per month.

Home Insurance Monthly Rates by Dwelling Coverage| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $95 | $118 | $165 | $260 |

| $90 | $112 | $158 | $250 | |

| $110 | $135 | $185 | $290 | |

| $105 | $128 | $175 | $280 |

| $115 | $140 | $190 | $295 | |

| $100 | $125 | $175 | $285 | |

| $108 | $132 | $180 | $288 | |

| $102 | $128 | $178 | $290 | |

| $88 | $110 | $155 | $245 |

At $300K of coverage, Travelers charges about $112 per month, compared to AmFam’s $118. For homes requiring the highest tier ($1 million), Travelers charges $250, compared with American Family’s $260.

While neither company is significantly more expensive than the other, Travelers outperforms AmFam across all dwelling limits.

AmFam vs. Travelers Renters Coverage

Renters’ policies from AmFam and Travelers include core protections that help renters safeguard their belongings in the event of a loss. Their standard policies include:

- Additional Living Expenses: Helps cover hotel bills, meals, and other costs if your rental becomes uninhabitable after a covered loss.

- Housing Improvements Coverage: Covers upgrades or improvements you’ve made inside your rental unit.

- Personal Liability Coverage: Covers injuries or property damage you’re legally responsible for.

- Personal Property Coverage: Pays to repair or replace your belongings if they’re damaged or stolen.

They also offer optional add-ons, though availability varies by state:

- Equipment Breakdown: Covers accidental breakdown of appliances and electronics.

- Identity Theft Protection: Helps with recovery costs if your identity is stolen.

- Valuable Items: Offers higher coverage limits for jewelry, artwork, and instruments.

Moreover, both providers make it easy to get solid renters coverage at a low monthly rate. Travelers tends to be slightly cheaper across all coverage levels, but the difference is usually only a dollar or two per month.

Renters Insurance Monthly Rates by Coverage Amount| Company | $30K | $50K | $70K |

|---|---|---|---|

| $14 | $17 | $21 |

| $13 | $16 | $20 | |

| $15 | $18 | $23 | |

| $16 | $19 | $24 |

| $17 | $20 | $25 | |

| $12 | $15 | $19 | |

| $14 | $17 | $22 | |

| $13 | $16 | $21 | |

| $12 | $15 | $18 |

At the $30K coverage level, Travelers averages $13 per month, while American Family averages $14. As the coverage amount increases to $50K, Travelers stays slightly ahead at $16, compared to AmFam’s $17.

Even at $70K in coverage, both insurers offer similar monthly rates, with Travelers at $20 and AmFam at $21.

Read more: 9 Best Renters Insurance Companies

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find Savings With AmFam & Travelers

While the two companies share many insurance discounts to help customers save on premiums, each offers a few unique options that may make one a better choice.

For example, both reward safe drivers, students with strong grades, and loyal customers. Other popular discounts include accident-free, claims-free, multi-car, and auto-pay.

American Family vs. Travelers Insurance Discounts| Discount |  | |

|---|---|---|

| Accident-Free | ✅ | ✅ |

| Age of Home | ⚠️ Varies by State | ⚠️ Varies by State |

| Anti-Theft | ✅ | ✅ |

| AutoPay (EFT) | ✅ | ✅ |

| Bundled Policy | ✅ | ✅ |

| Claims-Free | ✅ | ✅ |

| Defensive Driver | ✅ | ✅ |

| Gated Community | ⚠️ Varies by State | ⚠️ Varies by State |

| Generational / Legacy | ⚠️ Varies by State | ⚠️ Varies by State |

| Good Student | ✅ | ✅ |

| Green Home | ❌ | ✅ |

| Home Security System | ✅ | ✅ |

| Loss Prevention | ⚠️ Varies by State | ⚠️ Varies by State |

| Low Mileage | ✅ | ✅ |

| Loyalty Discount | ✅ | ✅ |

| Multi-Car | ✅ | ✅ |

| New Build | ⚠️ Varies by State | ✅ |

| Paperless Billing | ⚠️ Varies by State | ⚠️ Varies by State |

| Pay-in-Full | ✅ | ✅ |

| Renovated Home | ⚠️ Varies by State | ❌ |

| Roof Upgrade | ⚠️ Varies by State | ✅ |

| Safe Driver | ✅ | ✅ |

| Safety Course | ✅ | ⚠️ Varies by State |

| Smart Home | ⚠️ Via Partner | ⚠️ Via Partner |

| Usage-Based | ✅ | ✅ |

| Vehicle Safety Features | ✅ | ✅ |

You’ll also find savings on anti-theft devices, home security systems, and vehicle safety features. These discounts not only reduce your premiums but can also encourage safer habits and better protection for your home and vehicle.

The difference lies in some of their more specialized or property-related discounts. Travelers, for example, offers a green home discount and has broader savings availability for new builds, roof upgrades, and other home improvements.

AmFam, on the other hand, offers state-specific savings, such as discounts for renovated homes or for multigenerational households. Be sure to ask about any additional discounts you may be eligible for when requesting your free quote.

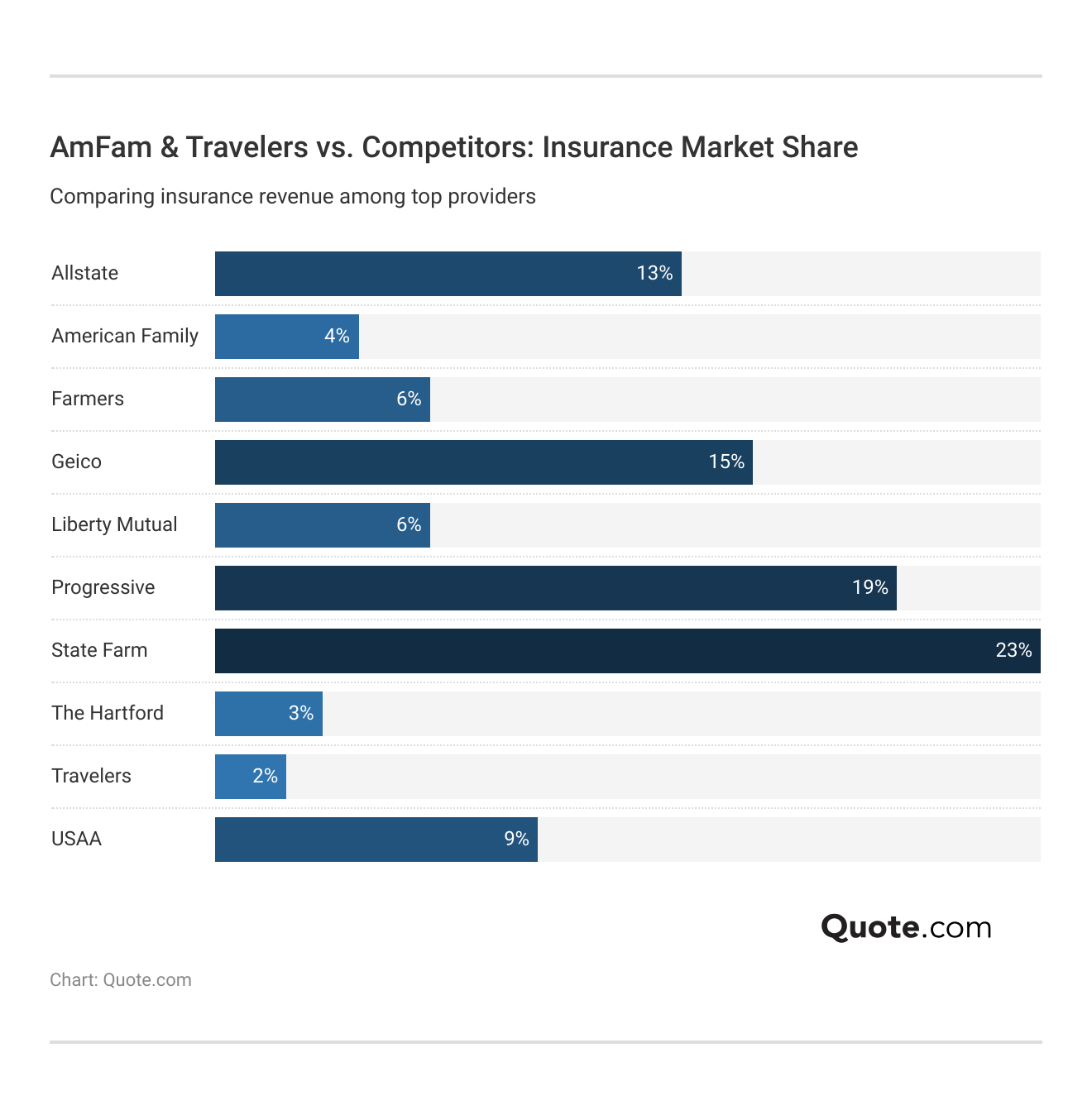

AmFam & Travelers vs. Leading Insurers

When looking at American Family vs. Travelers’ insurance market share alongside big company names like State Farm, Progressive, and Geico, both companies hold a solid place in the market.

State Farm continues to have the largest share at 23%, followed by Progressive (19%) and Geico (15%). By comparison, American Family accounts for about 4% of the market, placing it in the mid-sized range. Compare Progressive vs. State Farm in this review.

AmFam has a strong regional presence, especially in the Midwest, but it doesn’t operate in every state, which limits its overall share. Travelers, with about 2% market share, is slightly smaller in the personal insurance lines, but has a strong reputation in commercial and specialty coverage.

How to Get a Quote From AmFam & Travelers

Getting a quote from either American Family Insurance or Travelers Insurance is easy and hassle-free. You can obtain a quote directly on our website and compare the two providers to determine which is right for your needs.

Don’t assume the cheapest insurer is the best choice. Consider customer satisfaction, digital tools, claims convenience, and optional add-ons.

Laura Kuhl Managing Editor

Getting a customized quote this way is better than searching for generic insurance rates online, as it’s more tailored to your specific needs.

You can also get multiple policies from both companies and are actively encouraged to do so, as it may save you money by bundling your policies under one company, plus give you a central way to manage your account, view claims, and so on.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AmFam & Travelers State Availability

Both companies serve only specific states, and depending on where you live, certain programs may not be available.

The best way to confirm exactly what’s available to you is to request a free quote online. Both AmFam and Travelers tailor their quotes to your ZIP code, making it easier to determine which programs, discounts, and other features are available in your area.

For reference, each company serves the following states:

It’s worth noting that even if the insurer you’re considering isn’t available in your state, both companies are expanding and may offer coverage there soon. It’s always a good idea to check back periodically or ask for a quote if you’re considering switching insurers.

Read more: Best Insurance Comparison Sites

Business Scores: AmFam vs. Travelers

J.D. Power ratings and online complaints should be considered. To gain an accurate understanding of how companies are reviewed, it’s essential to consider factors such as J.D. Power ratings and any complaints filed against them, according to data from the NAIC.

American Family’s customer service ratings are average. The company generally has fewer complaints than similarly sized companies. Travelers’ customer satisfaction ratings are below average, and the company has more complaints than its competitors.

American Family vs. Travelers Business Ratings & Consumer Reviews| Agency |  | |

|---|---|---|

| Score: A+ Excellent Business Practices | Score: A Good Business Practices |

|

| Score: 702 / 1,000 Avg. Satisfaction | Score: 691 / 1,000 Below Avg. Satisfaction |

|

| Score: 78/100 Positive Customer Feedback | Score: 76/100 Good Customer Feedback |

|

| Score: 0.26 Fewer Complaints Than Avg. | Score: 3.96 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A++ Superior Financial Strength |

Overall, the reviews, given the size and breadth of the companies and their representation in each state, are satisfactory.

The best way to gain insight beyond online reviews is to consult your local agent and ask friends, family, or colleagues who are insured with each company about their experiences.

It’s important in this case to fully understand what your insurance covers and what it does not, and what to do if you have been denied coverage.

See Which Provider Offers the Best Coverage

If you live in a state served by both American Family and Travelers and are seriously considering choosing between them, it may be helpful to obtain quotes from both. With just a few basic details, you can get a quote online tailored to your needs.

By obtaining quotes online from both companies, you can easily compare their features and optional extras, as well as any discounts you may be eligible for.

It’s also worth noting that you can save significantly on your policy by bundling your home and car insurance with the same company.

These, in addition to other discounts, can add up quickly in your favor, so it’s a smart idea to get an online quote and determine just how much savings you may be entitled to—it could surprise you!

Frequently Asked Questions

How big is American Family Insurance?

American Family ranks among the top 15-20 largest U.S. property and casualty insurance groups, serving millions of customers across multiple states.

Does American Family Insurance pay claims well?

Is American Family good at paying claims? American Family is generally rated above average for claims satisfaction, according to J.D. Power studies and customer reviews.

Is American Family a good insurance company?

Is American Family any good? American Family is widely recognized as a reliable insurer, offering financial stability and competitive rates. Find out how to compare auto insurance companies.

Why is American Family so expensive?

Is American Family Insurance high? American Family may be more expensive due to broader coverage options, stronger customer service, and policy features that cost more than competitors’.

Does another provider have lower rates? Find out by entering your ZIP code into our free quote comparison tool

Is American Family Insurance worth it?

Yes, for many drivers and homeowners who value customer service, comprehensive coverage, and reliable claims support, even at a slightly higher price.

What is the rating of American Family Insurance?

How is American Family rated? American Family is rated strong financially by A.M. Best (A) and earns above-average customer satisfaction scores from J.D. Power.

What is the best company to use for travel insurance?

Allianz Global Assistance, AIG, and World Nomads are consistently top-rated for coverage options, claims handling, and global support.

Read more: 8 Best Travel Insurance Companies

Which company has the best insurance plan?

It depends on the type of insurance, but companies like State Farm, USAA, Allstate, and American Family Insurance are frequently ranked among the best for strong coverage and customer satisfaction.

Which insurance company has the worst rating?

Companies with low A.M. Best financial strength ratings or poor J.D. Power customer satisfaction scores are generally considered weaker.

What country has the highest insurance rates?

The United States has the highest overall insurance costs, particularly for health insurance, and comparatively high auto insurance premiums compared with most developed countries.

What do American Family vs. Travelers Insurance customer reviews say?

How does American Family vs. Travelers claims handling compare?

What’s the A.M. Best rating for Travelers Insurance Company?

Is American Family car insurance good based on customer reviews?

What do Travelers auto insurance reviews say about customer satisfaction and claims?

How can you get an American Family car insurance quote?

What does American Family auto insurance cover?

Does American Family offer travel insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family renters insurance good?

American Family ranks among the top 15-20 largest U.S. property and casualty insurance groups, serving millions of customers across multiple states.

Is American Family good at paying claims? American Family is generally rated above average for claims satisfaction, according to J.D. Power studies and customer reviews.

Is American Family a good insurance company?

Is American Family any good? American Family is widely recognized as a reliable insurer, offering financial stability and competitive rates. Find out how to compare auto insurance companies.

Why is American Family so expensive?

Is American Family Insurance high? American Family may be more expensive due to broader coverage options, stronger customer service, and policy features that cost more than competitors’.

Does another provider have lower rates? Find out by entering your ZIP code into our free quote comparison tool

Is American Family Insurance worth it?

Yes, for many drivers and homeowners who value customer service, comprehensive coverage, and reliable claims support, even at a slightly higher price.

What is the rating of American Family Insurance?

How is American Family rated? American Family is rated strong financially by A.M. Best (A) and earns above-average customer satisfaction scores from J.D. Power.

What is the best company to use for travel insurance?

Allianz Global Assistance, AIG, and World Nomads are consistently top-rated for coverage options, claims handling, and global support.

Read more: 8 Best Travel Insurance Companies

Which company has the best insurance plan?

It depends on the type of insurance, but companies like State Farm, USAA, Allstate, and American Family Insurance are frequently ranked among the best for strong coverage and customer satisfaction.

Which insurance company has the worst rating?

Companies with low A.M. Best financial strength ratings or poor J.D. Power customer satisfaction scores are generally considered weaker.

What country has the highest insurance rates?

The United States has the highest overall insurance costs, particularly for health insurance, and comparatively high auto insurance premiums compared with most developed countries.

What do American Family vs. Travelers Insurance customer reviews say?

How does American Family vs. Travelers claims handling compare?

What’s the A.M. Best rating for Travelers Insurance Company?

Is American Family car insurance good based on customer reviews?

What do Travelers auto insurance reviews say about customer satisfaction and claims?

How can you get an American Family car insurance quote?

What does American Family auto insurance cover?

Does American Family offer travel insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family renters insurance good?

Is American Family any good? American Family is widely recognized as a reliable insurer, offering financial stability and competitive rates. Find out how to compare auto insurance companies.

Is American Family Insurance high? American Family may be more expensive due to broader coverage options, stronger customer service, and policy features that cost more than competitors’.

Does another provider have lower rates? Find out by entering your ZIP code into our free quote comparison tool

Is American Family Insurance worth it?

Yes, for many drivers and homeowners who value customer service, comprehensive coverage, and reliable claims support, even at a slightly higher price.

What is the rating of American Family Insurance?

How is American Family rated? American Family is rated strong financially by A.M. Best (A) and earns above-average customer satisfaction scores from J.D. Power.

What is the best company to use for travel insurance?

Allianz Global Assistance, AIG, and World Nomads are consistently top-rated for coverage options, claims handling, and global support.

Read more: 8 Best Travel Insurance Companies

Which company has the best insurance plan?

It depends on the type of insurance, but companies like State Farm, USAA, Allstate, and American Family Insurance are frequently ranked among the best for strong coverage and customer satisfaction.

Which insurance company has the worst rating?

Companies with low A.M. Best financial strength ratings or poor J.D. Power customer satisfaction scores are generally considered weaker.

What country has the highest insurance rates?

The United States has the highest overall insurance costs, particularly for health insurance, and comparatively high auto insurance premiums compared with most developed countries.

What do American Family vs. Travelers Insurance customer reviews say?

How does American Family vs. Travelers claims handling compare?

What’s the A.M. Best rating for Travelers Insurance Company?

Is American Family car insurance good based on customer reviews?

What do Travelers auto insurance reviews say about customer satisfaction and claims?

How can you get an American Family car insurance quote?

What does American Family auto insurance cover?

Does American Family offer travel insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family renters insurance good?

Yes, for many drivers and homeowners who value customer service, comprehensive coverage, and reliable claims support, even at a slightly higher price.

How is American Family rated? American Family is rated strong financially by A.M. Best (A) and earns above-average customer satisfaction scores from J.D. Power.

What is the best company to use for travel insurance?

Allianz Global Assistance, AIG, and World Nomads are consistently top-rated for coverage options, claims handling, and global support.

Read more: 8 Best Travel Insurance Companies

Which company has the best insurance plan?

It depends on the type of insurance, but companies like State Farm, USAA, Allstate, and American Family Insurance are frequently ranked among the best for strong coverage and customer satisfaction.

Which insurance company has the worst rating?

Companies with low A.M. Best financial strength ratings or poor J.D. Power customer satisfaction scores are generally considered weaker.

What country has the highest insurance rates?

The United States has the highest overall insurance costs, particularly for health insurance, and comparatively high auto insurance premiums compared with most developed countries.

What do American Family vs. Travelers Insurance customer reviews say?

How does American Family vs. Travelers claims handling compare?

What’s the A.M. Best rating for Travelers Insurance Company?

Is American Family car insurance good based on customer reviews?

What do Travelers auto insurance reviews say about customer satisfaction and claims?

How can you get an American Family car insurance quote?

What does American Family auto insurance cover?

Does American Family offer travel insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family renters insurance good?

Allianz Global Assistance, AIG, and World Nomads are consistently top-rated for coverage options, claims handling, and global support.

Read more: 8 Best Travel Insurance Companies

It depends on the type of insurance, but companies like State Farm, USAA, Allstate, and American Family Insurance are frequently ranked among the best for strong coverage and customer satisfaction.

Which insurance company has the worst rating?

Companies with low A.M. Best financial strength ratings or poor J.D. Power customer satisfaction scores are generally considered weaker.

What country has the highest insurance rates?

The United States has the highest overall insurance costs, particularly for health insurance, and comparatively high auto insurance premiums compared with most developed countries.

What do American Family vs. Travelers Insurance customer reviews say?

How does American Family vs. Travelers claims handling compare?

What’s the A.M. Best rating for Travelers Insurance Company?

Is American Family car insurance good based on customer reviews?

What do Travelers auto insurance reviews say about customer satisfaction and claims?

How can you get an American Family car insurance quote?

What does American Family auto insurance cover?

Does American Family offer travel insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family renters insurance good?

Companies with low A.M. Best financial strength ratings or poor J.D. Power customer satisfaction scores are generally considered weaker.

The United States has the highest overall insurance costs, particularly for health insurance, and comparatively high auto insurance premiums compared with most developed countries.

What do American Family vs. Travelers Insurance customer reviews say?

How does American Family vs. Travelers claims handling compare?

What’s the A.M. Best rating for Travelers Insurance Company?

Is American Family car insurance good based on customer reviews?

What do Travelers auto insurance reviews say about customer satisfaction and claims?

How can you get an American Family car insurance quote?

What does American Family auto insurance cover?

Does American Family offer travel insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family renters insurance good?

What’s the A.M. Best rating for Travelers Insurance Company?

Is American Family car insurance good based on customer reviews?

What do Travelers auto insurance reviews say about customer satisfaction and claims?

How can you get an American Family car insurance quote?

What does American Family auto insurance cover?

Does American Family offer travel insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family renters insurance good?

What do Travelers auto insurance reviews say about customer satisfaction and claims?

How can you get an American Family car insurance quote?

What does American Family auto insurance cover?

Does American Family offer travel insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family renters insurance good?

What does American Family auto insurance cover?

Does American Family offer travel insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family renters insurance good?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family renters insurance good?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.