Amica Insurance Review for 2026

Amica Insurance costs just $60 per month for low-risk drivers. The company also offers a 25% discount for multiple vehicles and a $0 glass repair deductible. Amica returns up to 20% of premiums through dividends and fully covers replacement value if your car is totaled within the first year.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated November 2025

Explore our Amica auto insurance review to see how low-risk drivers can lock in $60 monthly rates, earn yearly dividends, and skip deductibles on glass repairs.

- Amica offers identity theft protection and credit card fraud coverage

- Amica auto insurance review shows fast claims paid within 24 hours

- Multi-policyholders gain loyalty perks and paperless billing discounts

Amica’s Advantage Points waive up to $500 for safe drivers. Bundling auto and home earns a 25% discount, and totaled vehicles qualify for full replacement within the first year.

Amica Auto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 4.5 |

| Claims Processing | 4.8 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 2.1 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.5 |

| Policy Options | 4.1 |

| Savings Potential | 4.4 |

Unlike many competitors, Amica Mutual confidently allows you to choose your own repair shop or use its vetted contractor network of over 2,000 licensed professionals.

Save more instantly on your next plan when you use our free comparison tool to buy auto insurance from trusted providers like Amica Mutual and compare real-time personalized rates.

Cost of Amica Auto Insurance

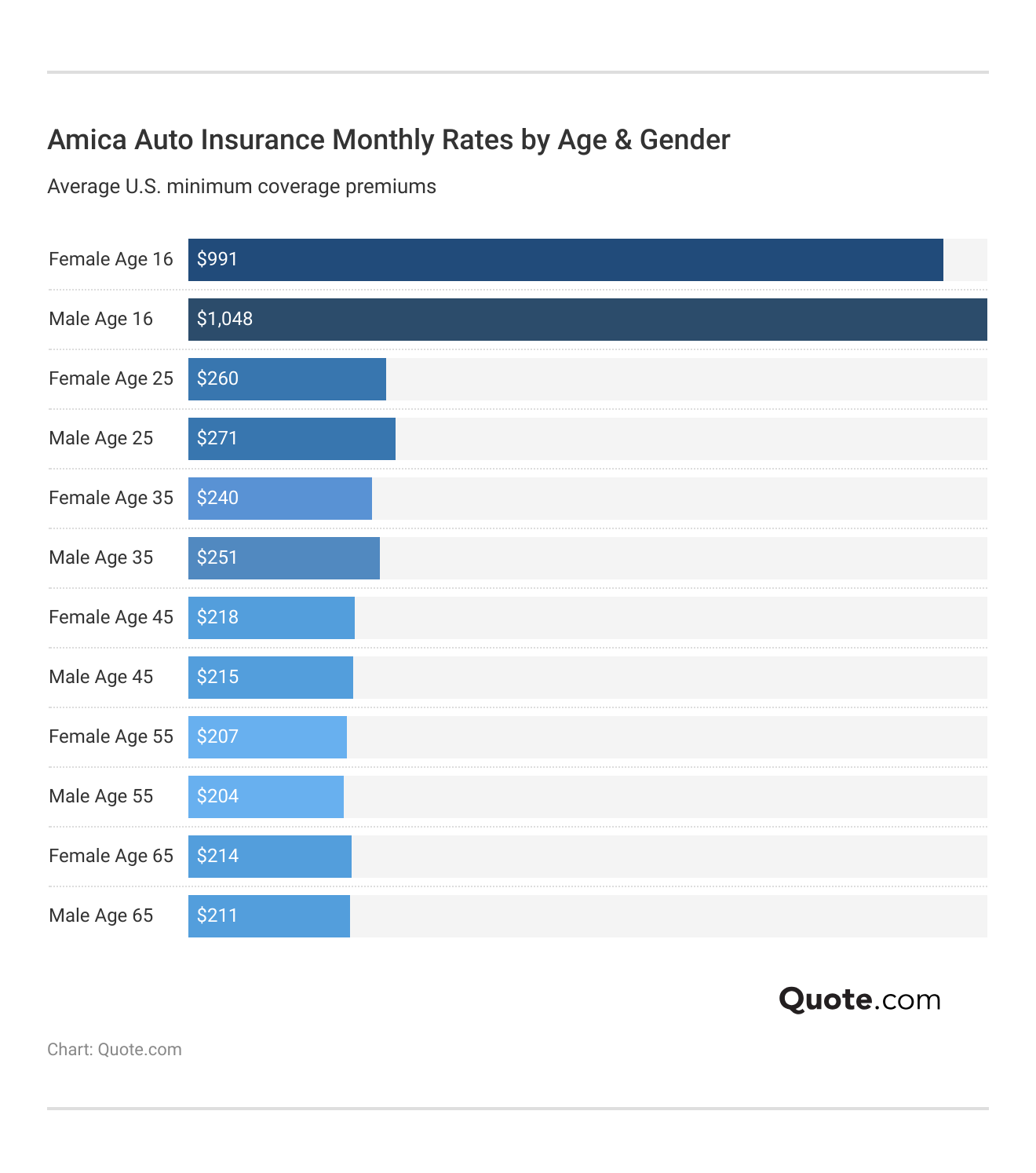

Amica auto insurance rates shift quite a bit depending on your age, gender, and how much coverage you choose.

This table gives a clear picture of what those numbers really mean for drivers.

Teen drivers see the highest rates by far—$1,048 a month for a 16-year-old male with full coverage—highlighting how expensive it can be to insure young, inexperienced drivers. But by the time you hit 30, that cost drops dramatically, making insurance much more manageable.

A 60-year-old female pays just $60 for minimum coverage, while a 25-year-old male can save $190 monthly by switching from full to minimum. These shifts highlight how age, coverage, and driving history affect rates.

Always check if your insurer offers dividend policies—they can refund a portion of your premium at the end of the term.

Michelle Robbins Licensed Insurance Agent

It’s wise to request an Amica car insurance quote to see what you’ll pay based on your profile and explore where you can cut costs or upgrade your coverage as your needs evolve.

Amica’s rates change a lot depending on your driving history, and this chart shows just how much your monthly premium can go up after a violation. Whether it’s a speeding ticket or something more serious, what’s on your record can really impact what you pay.

Amica vs. Competitors: Car Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $65 | $81 | $99 | $123 | |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 |

Amica’s DUI rates show a steep increase—full coverage jumps to $404 per month, while minimum coverage rises to $123. That’s nearly $160 more each month compared to a clean record. One accident can raise your rate by over $100, and even a single speeding ticket may hike your premium by 25%.

Staying ticket-free isn’t just safer—it’s one of the best ways to avoid premium spikes.

Amica’s auto insurance rates may not be the lowest on the list, but when you look at what’s included, the value starts to add up. This table compares monthly costs for both minimum and full coverage across top insurance providers.

Amica vs. Competitors: Car Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $65 | $215 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

At $65 a month for minimum coverage, Amica is a bit more than Geico’s $43 but well below Liberty Mutual’s $96. With a 30% bundling discount, that $65 could drop to around $45—putting it right in line with budget options.

Full coverage runs $215 monthly, which is less than Allstate’s $248 and just a touch above Farmers at $198. What really makes the difference? Amica includes perks like $0 glass repair and a dividend refund that can return up to 20% of what you’ve paid—features that can save you hundreds by year’s end.

Read More: How to Compare Auto Insurance Companies

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Amica Insurance

Amica’s discounts aren’t just percentages on paper, they can make a real difference in how much you pay each month. The table breaks down which car insurance discounts you can’t miss and how they translate into actual savings.

Amica Auto Insurance Discounts| Discount | Savings |

|---|---|

| Bundling | 30% |

| Good Student | 20% |

| Anti-Theft | 18% |

| Safe Driver | 15% |

| Defensive Driving | 12% |

| New Car | 10% |

| Paid-in-Full | 10% |

| Hybrid/Electric Vehicle | 5% |

Bundling your home and auto coverage could knock 30% off your premium, turning a $200 bill into $140 and freeing up serious room in your budget. If you’re insuring a teen with a solid GPA, the 20% good student discount can bring a $300 monthly rate down to $240, which adds up fast.

Installing an anti-theft device could cut 18% of your premium, helping cover the cost of the tech within a few months. Defensive driving courses not only save you 12% but may also reduce points on your license.

Even the 5% break for driving a hybrid means lower costs for eco-conscious drivers—$10 off a $200 plan isn’t anything when you’re stacking multiple savings.

Many Amica insurance reviews highlight how these savings add up, especially when combined with strong customer service, low complaints, and perks like $0 glass repair. If you want to see your savings, compare Amica car insurance rates to other top providers.

Amica Auto Insurance Coverage Options

Amica covers all the basics like liability, collision, and comprehensive auto insurance, but what really makes them stand out are the extra perks built right into their policies.

- $0 Deductible Glass Repair: You won’t pay a dime for windshield or window repairs.

- Full Replacement Value for New Cars: If your car’s totaled in its first year, Amica pays the full retail value—not the depreciated one.

- Free Lock and Airbag Replacement: If your locks are damaged or your airbags deploy, they’re replaced at no cost.

- Dividend-Paying Policies: In select states, you can get up to 20% of your premium back at the end of your term.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages regardless of fault.

Many Amica car insurance reviews point out how rare it is to get this level of coverage without paying extra. Reviewers love that perks like full new car replacement and $0 glass repair come standard, not as expensive add-ons.

Beyond auto insurance, Amica insurance review summaries often highlight the strength of their home and life coverage, too. Their home policies cover everything from fire and theft to smoke damage and even credit card fraud, with flexible add-ons for flood, earthquake, or identity theft.

Whether you need a car, home, life, or umbrella coverage, Amica makes it easy to bundle and protect what matters most.

Amica Auto Insurance Reviews & Ratings

Amica Insurance scores high across the board, and those numbers actually mean something for drivers. This table helps break down what each rating says about the experience you can expect in this Amica car insurance review.

Amica Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A+ Superior Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 85/100 Excellent Customer Feedback |

|

| Score: 746 / 1,000 Above Avg. Satisfaction |

|

| Score: 0.73 Fewer Complaints Than Avg. |

A.M. Best’s A+ rating shows Amica has the financial strength to pay claims quickly, even in big disasters. The BBB’s A+ highlights how well they handle complaints and keep things transparent. An 85/100 from Consumer Reports reflects how easy Amica makes it to file claims and understand your bill.

J.D. Power’s 746 rating comes with top rankings in New England, where customers appreciate the service. A low NAIC score of 0.73 means fewer complaints, and Amica complaints are rare compared to other insurers—an indicator of consistent satisfaction and support.

Amica is often mentioned among the cheapest car insurance options for low-risk drivers who still want dependable, high-touch support.

A Reddit user shared that after being rear-ended twice, Amica handled everything with just a few calls, quickly setting up repairs and a rental—highlighting how smooth and stress-free their claims process really is.

Comment

byu/hermit06 from discussion

inmassachusetts

They also mentioned needing a window replaced, and Amica set up a three-way call with the repair company that had everything scheduled in about 10 minutes. It’s clear from their story that Amica doesn’t just promise smooth service—they actually follow through when you need it most.

If you have questions about discounts or coverage options, you can always call the Amica insurance phone number at 800-242-6422 to speak with a licensed representative.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Amica Auto Insurance Pros and Cons

Pros

- Fewer Complaints Filed: Amica’s 0.73 NAIC score reflects strong satisfaction, fewer issues than average, and offers hacks to save money on car insurance.

- High Financial Stability: Amica holds an A+ rating from A.M. Best, proving its ability to handle large-scale claim payouts without delay—even during widespread loss events.

- Exceptional Regional Performance: Amica ranks #1 in New England for customer satisfaction and service. Get an Amica insurance quote to see if it fits your needs.

Cons

- No Ride-Share Coverage: Amica does not offer insurance options for Uber or Lyft drivers, making it a poor fit for customers needing commercial or hybrid personal-use policies.

- Age-Based Rate Gaps: A 16-year-old male driver pays $1,048 monthly for full coverage, a sharp contrast to the $200 paid by a 60-year-old male, limiting affordability for younger applicants.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get Coverage With Amica Mutual Insurance

Amica Mutual delivers reliable auto insurance backed by decades of top-rated service. The Amica Mobile App makes it easy to manage your policy, file claims, or request roadside help—anytime, anywhere. With a 0.73 NAIC complaint index and high J.D. Power scores in New England, Amica consistently ranks as one of the most dependable insurers.

Low complaint indexes mean fewer surprises during claims—use them as a trust signal when comparing insurers.

Jeff Root Licensed Insurance Agent

Policyholders can save in several ways. Bundling auto and home insurance cuts up to 30% while insuring multiple vehicles saves 25%. Good students qualify for a 20% discount, clean driving records earn 15%, and installing anti-theft devices knocks off 18%.

Completing a defensive driving course can shave off another 12%. Optional dividend policies return up to 20% of your premium, giving you back real dollars at the end of the term.

Coverage includes personal injury protection, $0 glass and lock replacement, and full car replacement within the first year of total loss. Safe drivers can also earn Advantage Points to reduce out-of-pocket costs. Amica’s home insurance includes fire, theft, and credit card fraud protection, with up to 30% liability coverage increases.

Before committing, request a personalized Amica auto insurance quote to see how much you can save based on your driving profile and location. Use our free comparison tool to see how Amica stacks up against other companies and find a policy that fits your needs and budget.

Frequently Asked Questions

Is Amica a reliable company?

Yes, Amica ranks high in J.D. Power surveys for claims satisfaction, especially in New England, and its low NAIC complaint index means fewer service issues compared to competitors.

Is the Amica dividend policy worth it if you want returns on your premiums?

Amica’s dividend policy may be worth it if you’re comfortable paying slightly more each month to potentially get back up to 20% of your premium at the end of your term, essentially lowering your net cost.

What benefits does Amica’s whole life insurance offer beyond standard death coverage?

Amica whole life insurance offers level monthly premiums, lifetime protection, and cash value you can borrow from—ideal if you want both a guaranteed death benefit and long-term financial flexibility. It’s one reason Amica is often mentioned among the best life insurance companies for stability and policy value.

What do Amica’s life insurance reviews say about policy value and support?

Amica life insurance reviews often note the $10 per month starting rate for term coverage, high satisfaction with customer service, and clear communication on policy features like cash value growth and flexible benefit options.

What insights can you get from an Amica car insurance review?

An Amica car insurance review highlights perks like $0 glass repair, full vehicle replacement in the first year, and a clean NAIC complaint index, with full coverage averaging around $215 per month for a 30-year-old male.

Is Amica better than Progressive?

Amica may be a better choice if you value customer service and low complaint rates. Progressive might be more affordable for high-risk drivers or those needing usage-based insurance. For a broader comparison, it helps to look at everything you need to know about Progressive insurance before deciding.

Is Amica good about paying claims?

Yes, Amica is known for fast and hassle-free claims service. It consistently ranks highly in J.D. Power satisfaction surveys and has a low NAIC complaint index.

Is Amica better than Geico?

If you’re looking for dividend policies and personalized service, Amica often beats Geico. However, Geico typically offers cheaper monthly rates and more online quote tools for fast policy access.

Is Amica better than State Farm?

Amica may outperform State Farm in customer satisfaction, especially in the Northeast. However, State Farm provides more agents nationwide and more bundling options. If you’re comparing both, reading a detailed State Farm auto insurance review can help you decide which fits your needs best.

What kind of insurance company is Amica?

Amica is a mutual insurer owned by policyholders. It offers auto, home, life, and umbrella coverage, with a focus on quality service and dividend-paying policies.

How much does Amica insurance cost?

Is Amica better than Allstate?

Why is Amica homeowners insurance so expensive?

How do you file a claim with Amica?

Does Amica have a corporate sustainability program?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.