Amica vs. Auto-Owners 2026

When comparing Amica vs. Auto-Owners, Auto-Owners is typically cheaper for both auto and home insurance. For auto insurance, Auto-Owners averages $52/mo for minimum coverage and $120/mo for full coverage, compared to Amica at $61 and $140. For home insurance, Auto-Owners charges $155/mo vs. $160 at $200K dwelling coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Managing Editor

Aleksandra J. Churlinov holds a Bachelor of Arts in English Language and Literature and a Master of Science in Marketing Management. Over the past six years, Aleks has focused on the insurance sector, working on a range of content, including business, auto, and life insurance. In April 2025, she stepped into the role of Managing Editor, where she now leads a team of talented insurance writers. ...

Aleksandra J. Churlinov

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2026

If you’re trying to decide between Amica vs. Auto-Owners, you’re probably asking: What does each company offer? How much does Amica vs. Auto-Owners cost?

- Amica and Auto-Owners each have an A+ rating from A.M. Best

- Teen drivers pay less with Auto-Owners, about $153 a month

- Auto-Owners has a larger market share than Amica: 1.5% vs. 0.5%

Both Amica and Auto-Owners offer great insurance options, but a few things place Amica ahead of the competition. Amica is better than Auto-Owners because of its availability and digital features. (Read more: 10 Best Car Insurance Companies)

Amica vs. Auto-Owners Insurance Rating| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.4 | 4.2 |

| Business Reviews | 4.5 | 4.5 |

| Claim Processing | 4.8 | 4.8 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 4.4 |

| Coverage Value | 4.3 | 4.3 |

| Customer Satisfaction | 2.1 | 2.1 |

| Digital Experience | 4.5 | 5.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.0 | 4.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 4.1 | 3.8 |

| Savings Potential | 4.4 | 4.3 |

This Amica vs. Auto-Owners review breaks down the major insurance types each company offers and compares costs, as well as the most common discounts that can lower premiums. Start comparing affordable insurance options by entering your ZIP code into our free quote comparison tool today.

Amica vs. Auto-Owners Car Insurance

Amica and Auto-Owners offer different types of car insurance. The core products Amica and Auto-Owners offer don’t differ much.

You can get your standard liability, collision, and comprehensive insurance no matter which company you choose. However, each of them provides different levels of coverage.

Amica vs. Auto-Owners Car Insurance Coverage Options| Coverage | ||

|---|---|---|

| Collision Coverage | ✅ | ✅ |

| Comprehensive Coverage | ✅ | ✅ |

| Gap Insurance | ⚠️ Few States | ⚠️ Many States |

| Liability Coverage | ✅ | ✅ |

| Medical Payments (MedPay) | ⚠️ Many States | ⚠️ Many States |

| New Car Replacement | ⚠️ Few States | ⚠️ Many States |

| Personal Injury Protection (PIP) | ⚠️ Many States | ⚠️ Many States |

| Rental Reimbursement | ✅ | ⚠️ Few States |

| Rideshare Insurance | ⚠️ Few States | ❌ |

| Uninsured / Underinsured Motorist | ✅ | ⚠️ Many States |

Several Amica coverage options are available individually that would normally be bundled into a comprehensive plan. For instance, you can add full glass coverage to any policy. That means you can add it to your liability insurance and not worry about paying out of pocket if your windshield gets cracked.

Amica doesn’t deduct for depreciation when a new vehicle gets totaled within the first year of ownership. It’s basically a year of gap insurance at no charge.

Say you buy a $25,000 car worth $20,000 after three months of ownership. If you get in a wreck, insurers would cover only its current value of $20,000. Amica would pay out what you originally paid for it.

Kalyn Johnson Insurance Claims Support & Senior Adjuster

Both companies offer excellent auto insurance, but Amica throws in a lot of free coverage with its plans. Auto-Owners offers lower car insurance rates than Amica.

Amica is cheaper if you stay for the dividends, while car insurance discounts help ease sticker shock with Auto-Owners insurance.

Choosing the Right Coverage Level

Most drivers are choosing between liability-only (or state-mandated coverage) and full coverage (liability, comprehensive, and collision combined).

Your choice depends on what you’d have to pay out of pocket after an accident, how much your car is worth, and whether you’re required to carry full coverage because of a loan or lease.

Auto Insurance Monthly Rates by Coverage Level| Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $140 | |

| $52 | $120 | |

| $78 | $175 | |

| $69 | $157 |

| $74 | $172 | |

| $55 | $136 | |

| $64 | $151 | |

| $71 | $166 | |

| $59 | $143 | |

| $70 | $160 |

Auto-Owners is the cheapest option at both coverage levels: $52 a month for minimum coverage and $120 a month for full coverage. Amica auto insurance rates are competitive, especially compared with several larger national insurers.

For minimum coverage, Amica’s monthly rate is $61. For full coverage, the monthly rate rises to $140 per month. The most expensive full coverage rates are Allstate at $175 and Farmers at $172.

How Driving History Affects Auto Insurance

Your driving record is also one of the biggest factors in auto insurance pricing. That’s why the same driver can see very different monthly rates depending on whether they have a clean record, a recent accident, a speeding ticket, or a DUI. (Read more: Cheap Auto Insurance After a DUI)

Compared side by side, Auto-Owners is consistently cheaper than Amica, depending on the record type.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| $61 | $83 | $105 | $74 | |

| $52 | $71 | $90 | $63 | |

| $78 | $105 | $133 | $94 | |

| $69 | $93 | $118 | $84 |

| $74 | $100 | $127 | $90 | |

| $55 | $74 | $94 | $66 | |

| $64 | $87 | $110 | $78 | |

| $71 | $96 | $122 | $86 | |

| $59 | $80 | $100 | $71 | |

| $70 | $94 | $119 | $83 |

Looking at Amica, the monthly rate starts at $61 for a clean record. After one accident, it increases to $83, which is a jump of $22 per month. A single ticket raises the cost to $105 per month, $44 above the clean-record rate. With one DUI, Amica’s rate is $74 per month.

Auto-Owners charges $52 per month for a clean record, then $71 after one accident and $90 after one ticket. For one DUI, Auto-Owners charges $63 per month.

Read more: Cheap Auto Insurance for High-Risk Drivers

How Age & Gender Impact Auto Insurance

Even though insurance companies consider a long list of factors when setting rates, age and gender still remain among the most important.

Younger drivers have less experience behind the wheel and tend to file more claims, so insurers usually charge the highest premiums. As they become more experienced, rates typically drop and are often the cheapest in the 50s and 60s.

Amica vs. Auto-Owners Car Insurance Monthly Rates by Age & Gender| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $180 | $153 |

| 16-Year-Old Male | $192 | $164 |

| 25-Year-Old Female | $77 | $66 |

| 25-Year-Old Male | $81 | $69 |

| 35-Year-Old Female | $68 | $58 |

| 35-Year-Old Male | $70 | $60 |

| 45-Year-Old Female | $60 | $51 |

| 45-Year-Old Male | $61 | $52 |

| 55-Year-Old Female | $55 | $47 |

| 55-Year-Old Male | $57 | $48 |

| 65-Year-Old Female | $49 | $42 |

| 65-Year-Old Male | $50 | $43 |

With Amica, a 16-year-old female pays $180 a month, while a 16-year-old male pays $192. Auto-Owners charges $153 for a 16-year-old female and $164 for a 16-year-old male. (Learn more: Cheap Auto Insurance for Teens)

So, regardless of the company, both charge the most when someone is brand new to driving, due to the higher risk.

The more time a driver has behind the wheel and the cleaner their record, the more likely they are to see lower premiums. At 65, Amica has the lowest monthly premiums ($49-$50), while Auto-Owners drops to $42-$43.

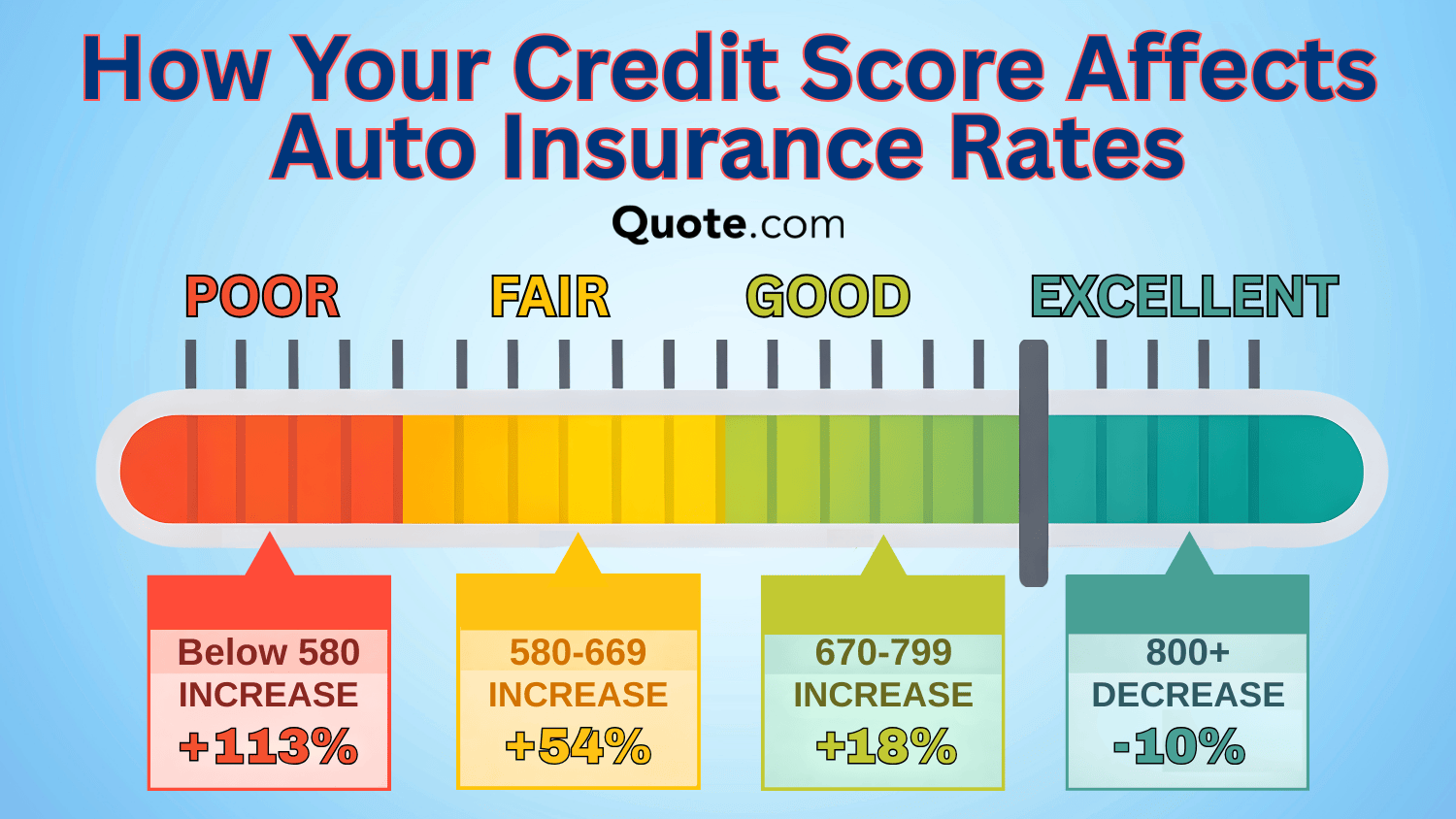

How Good Credit Lowers Car Insurance Rates

Do you have a high credit score? Both Auto-Owners and Amica Insurance use credit-based insurance scores when deciding how much you’ll pay.

Considering that Auto-Owners has lower prices than Amica, though, you’ll want the best chance at the lowest possible premiums.

Any credit score above 700 will help you get better car insurance rates. If your score is around that number, you shouldn’t have any problems with Auto-Owner’s credit-based insurance score pricing.

Price, customer service, and where you live all play important roles in choosing Amica or Auto-Owners.

Auto Insurance Digital Tools & Programs

Amica pulls ahead of Auto-Owners with its website and app. Amica’s website lets you pay your bill, get a quote, file a claim, and check the status of existing claims. Downloading the Amica app from Google Play or the iTunes store lets you access the same features available on the website, as well as the option to call roadside assistance or request emergency repairs.

If you prefer self-service and 24/7 access, prioritize the insurer with stronger online and mobile support.

Laura Kuhl Managing Editor

Auto-Owner’s website lets you pay a bill, locate the nearest agency, and check the status of a claim. There’s no app, online quote feature, or any other digital options for Auto-Owner’s customers.

Amica’s app and website functions won’t impress anyone, while Auto-Owners offers only bare-bones options on its website.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Amica vs. Auto-Owners Home Insurance

Both Amica and Auto-Owners offer the standard home insurance coverage, which typically includes:

- Dwelling Coverage

- Loss of Use

- Other Structures

- Personal Property

- Personal Liability

From there, most homeowners can customize their policy with add-ons, such as higher coverage limits for valuables, water backup coverage, or replacement-cost upgrades for personal property.

Home Insurance Monthly Rates by Dwelling Coverage| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $160 | $215 | $345 | $710 | |

| $155 | $210 | $335 | $695 | |

| $170 | $225 | $360 | $745 | |

| $175 | $230 | $370 | $765 |

| $180 | $235 | $380 | $785 | |

| $150 | $205 | $325 | $675 | |

| $152 | $208 | $330 | $690 | |

| $158 | $212 | $338 | $705 | |

| $155 | $210 | $335 | $695 | |

| $153 | $209 | $332 | $685 |

Auto-Owners offers slightly cheaper home insurance rates than Amica at every dwelling amount, but the gap stays fairly small. At $200K in dwelling coverage, Amica is $160 a month, and Auto-Owners is $155 a month (a $5 difference).

And at $1M, Amica costs $710 a month compared to $695 a month with Auto-Owners ($15 less).

Amica vs. Auto-Owners Life Insurance

Term life insurance is more affordable and lasts for a set period (15, 20, or 30 years), while whole life insurance is permanent coverage that typically costs much more because it can last for life and may build cash value.

For term life coverage, Amica charges $24 per month for a 15-year term, $30 per month for a 20-year term, and $42 per month for a 30-year term. Auto-Owners comes in just under that at $23, $29, and $40.

Life Insurance Monthly Rates by Policy Type| Company | 15-Yr Term | 20-Yr Term | 30-Yr Term | Whole Life |

|---|---|---|---|---|

| $24 | $30 | $42 | $330 | |

| $23 | $29 | $40 | $320 | |

| $26 | $33 | $45 | $350 | |

| $25 | $32 | $44 | $340 |

| $27 | $35 | $47 | $360 | |

| $22 | $28 | $39 | N/A | |

| $24 | $30 | $42 | $330 | |

| $23 | $29 | $41 | N/A | |

| $25 | $32 | $43 | $345 | |

| $24 | $30 | $42 | $335 |

Auto-Owners is slightly cheaper than Amica across every policy type. The differences are small, so the better choice may depend on underwriting, eligibility, and the exact coverage amount rather than price alone.

Amica vs. Auto-Owners Business Insurance

The right business insurance policy depends on what your company does, how many employees you have, and what risks you’re trying to protect against. Amica and Auto-Owners generally offer similar rates across the main business coverage types, but still, Auto-Owners is slightly cheaper.

Business Insurance Monthly Rates by Coverage Type| Company | Business Policy | Commercial Auto | General Liability | Professional Liability |

|---|---|---|---|---|

| $75 | $120 | $40 | $50 | |

| $73 | $115 | $38 | $48 | |

| $85 | $130 | $45 | $55 | |

| $80 | $125 | $43 | $52 |

| $90 | $135 | $47 | $58 | |

| $78 | $120 | $42 | $50 | |

| $82 | $128 | $44 | $54 | |

| $79 | $122 | $41 | $50 | |

| $80 | $125 | $43 | $52 | |

| $84 | $130 | $45 | $55 |

For a business policy, Amica charges $75 per month, while Auto-Owners charges $73 per month. For professional liability, Amica costs $50 a month compared to $48 a month with Auto-Owners.

Auto-Owners is still a bit cheaper here, but only a small monthly difference. So, the better option may come down to what each insurer offers in your state and which gives you the best combination of coverage limits, endorsements, and discounts.

Learn more: Best Commercial Auto Insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros & Cons: Amica vs. Auto-Owners

Curious to find out more about which is better? Amica versus Auto-Owners is a fair match between two good insurance companies, but there are significant differences separating them.

Amica Pros & Cons

Here are Amica’s biggest strengths:

- Available Nationwide: Amica writes policies nationwide, while Auto-Owners offers insurance in certain states.

- Direct-to-Consumer Experience: It writes insurance policies directly, rather than through agents.

- Digital Features: Amica also wins at the digital services game. You can use its website and app to file a claim or pay your bill.

Here are Amica’s drawbacks:

- Worse Customer Service: Amica falls behind Auto-Owners in handling claims and providing positive customer experiences.

- Missing Out on Some Discounts: Amica doesn’t provide a few discounts that most other insurers offer.

Auto-Owners Pros & Cons

Here are Auto-Owners’ main advantages:

- Excellent Customer Service: Auto-Owners agents offer one-on-one consultations, from policy writing to filing a claim.

- Great Claims Handling: The company ranked second for claims satisfaction in a 2024 J.D. Power study.

- Lots of Discounts: Auto-Owners goes “above and beyond” with its discounts.

Here are Auto-Owners’ drawbacks:

- Independent Agent Network: It sells through independent agents, which can be less convenient for online buyers.

- Limited Availability: Auto-Owners is only offered in certain states, so it isn’t an option for everyone.

Read more: What We Learned Analyzing 815 Insurance Companies

Comparing Companies: Amica vs. Auto-Owners

Auto-Owners is better for its lower price, while Amica is better for its wider availability, even though it lacks some basic discounts.

If you live in an area where Auto-Owners offers insurance and are willing to pay less for personalized customer service from an agent, the company deserves your consideration. Read more: Best Insurance Comparison Sites

Here’s a closer look at how Amica and Auto-Owners compare across availability, discounts, policy cancellation, industry position, and overall customer experience.

How Amica & Auto-Owners Can Help You Save

Both Amica and Auto-Owners offer the most common discounts, such as bundling, multi-car, AutoPay (EFT), paperless billing, and pay-in-full. They also reward lower-risk customers with savings for being claims-free, safe drivers, good students, and for having vehicle safety features and anti-theft devices. (Read more: 26 Hacks to Save Money on Auto Insurance)

Amica offers stronger home insurance discounts, such as renovated home and roof upgrades, as well as new build and home loss prevention features. Amica also offers broader availability of driver improvement discounts, such as defensive driver and safety courses.

Amica vs. Auto-Owners Insurance Discounts| Discount | ||

|---|---|---|

| Age of Home | ❌ | ❌ |

| Anti-Theft | ✅ | ✅ |

| AutoPay (EFT) | ✅ | ✅ |

| Bundled Policy | ✅ | ✅ |

| Claims-Free | ✅ | ✅ |

| Defensive Driver | ✅ | ⚠️ Varies by State |

| Gated Community | ❌ | ❌ |

| Generational / Legacy | ❌ | ❌ |

| Green-Home | ❌ | ❌ |

| Good Student | ✅ | ✅ |

| Home Security System | ✅ | ⚠️ Varies by State |

| Loss Prevention | ✅ | ✅ |

| Low Mileage | ❌ | ✅ |

| Loyalty Discount | ✅ | ✅ |

| Multi-Car | ✅ | ✅ |

| New Build | ✅ | ✅ |

| Paperless Billing (eDocs) | ✅ | ✅ |

| Pay-in-Full | ✅ | ✅ |

| Renovated Home | ✅ | ❌ |

| Roof Upgrade | ✅ | ⚠️ Varies by State |

| Safety Course | ✅ | ⚠️ Varies by State |

| Safe Driver | ✅ | ✅ |

| Smart Home | ✅ | ⚠️ Varies by State |

| Vehicle Safety Features | ✅ | ✅ |

Auto-Owners stands out with its low-mileage auto insurance discount, which appears to be available with Auto-Owners but not with Amica. Auto-Owners also offers many of the same home insurance discounts, but several are state-dependent.

Amica offers rewards, but Auto-Owners doesn’t. It’s not unusual for Auto-Owners not to offer rewards to its car insurance customers, but it is out of the ordinary for Amica to do so.

- Good Driving Rewards: Amica offers a supplemental Good Driving Rewards coverage that lets you earn points for completing a year of good driving, buying additional insurance policies, or referring new customers.

- You Pay for Points: Here’s the thing – most people will pay around $150 per year to add Good Driving Rewards to their coverage, and can only use the points when they get in an accident.

That means the drivers who would get the most points for safe driving are the ones least likely to use them, making this rewards program feel like an unnecessary expense. Even though Amica offers a rewards program, you probably don’t need it.

Get a Quote From Amica & Auto-Owners

The best way to obtain a quote from Amica and sign up for a policy is to speak with a representative over the phone. The company can provide a more accurate quote, factor in any possible discounts, and answer your questions. To do that, call 800-242-6422.

You can also get an insurance quote on Amica’s website.

First off, determine whether Auto-Owners offers insurance in your region using the agency locator tool. It will also provide the agency number you should call for policy information.

Then, collect all the necessary information to obtain an accurate Auto-Owners insurance quote. The company will also provide a list of what you need on its website.

Find out: How to Get Multiple Auto Insurance Quotes

How to Cancel Amica or Auto-Owners

The best way to cancel insurance with Amica or Auto-Owners is after you have a new policy.

If you cancel your policy before signing up for a new auto insurance plan, you could face higher premiums.

Ensure your new insurance is in place before canceling your old one.

- Stop Using Amica by Calling Customer Service: To cancel your Amica insurance, call 800-242-6422.

- Quit Auto-Owners by Calling Your Agent: Speak with the agency that signed you up for your insurance to cancel your plan. This number will vary based on your location.

Learn more: How to Cancel an Auto Insurance Policy

Where You Can Find Amica & Auto-Owners

Amica and Auto-Owners overlap in most insurance types. Both companies offer auto, homeowners, renters, condo, motorcycle, RV, boat/watercraft, umbrella, and roadside assistance, which means either insurer can work well if it fits your budget and needs.

The differences are evident in the less common policy types. Auto-Owners offers a slightly broader lineup. It includes classic car insurance, which Amica doesn’t offer. Its business/commercial insurance is generally available (whereas Amica’s commercial options can vary by state).

Amica vs. Auto-Owners: Types of Insurance Available| Type | ||

|---|---|---|

| Auto Insurance | ✅ | ✅ |

| Boat / Watercraft Insurance | ✅ | ✅ |

| Business / Commercial Insurance | ⚠️ Varies by State | ✅ |

| Classic Car Insurance | ❌ | ✅ |

| Condo Insurance | ✅ | ✅ |

| Flood Insurance (NFIP) | ⚠️ Varies by State | ⚠️ Varies by State |

| Health Insurance | ❌ | ❌ |

| Homeowners Insurance | ✅ | ✅ |

| Liability Insurance | ✅ | ✅ |

| Life Insurance | ✅ | ❌ |

| Medicaid Insurance | ❌ | ❌ |

| Medicare Insurance | ❌ | ❌ |

| Motorcycle Insurance | ✅ | ✅ |

| Pet Insurance | ⚠️ Varies by State | ⚠️ Varies by State |

| Renters Insurance | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| RV / Motorhome Insurance | ✅ | ✅ |

| Travel Insurance | ❌ | ❌ |

| Umbrella Insurance | ✅ | ✅ |

Amica has one key advantage: life insurance. Auto-Owners does not offer it, so anyone who wants to keep life insurance with the same company as their home and auto policies may find Amica better suited to their needs.

Pet insurance is also listed as state-dependent for both providers. For those looking for health insurance, Medicare, Medicaid, or travel insurance, neither company offers those products.

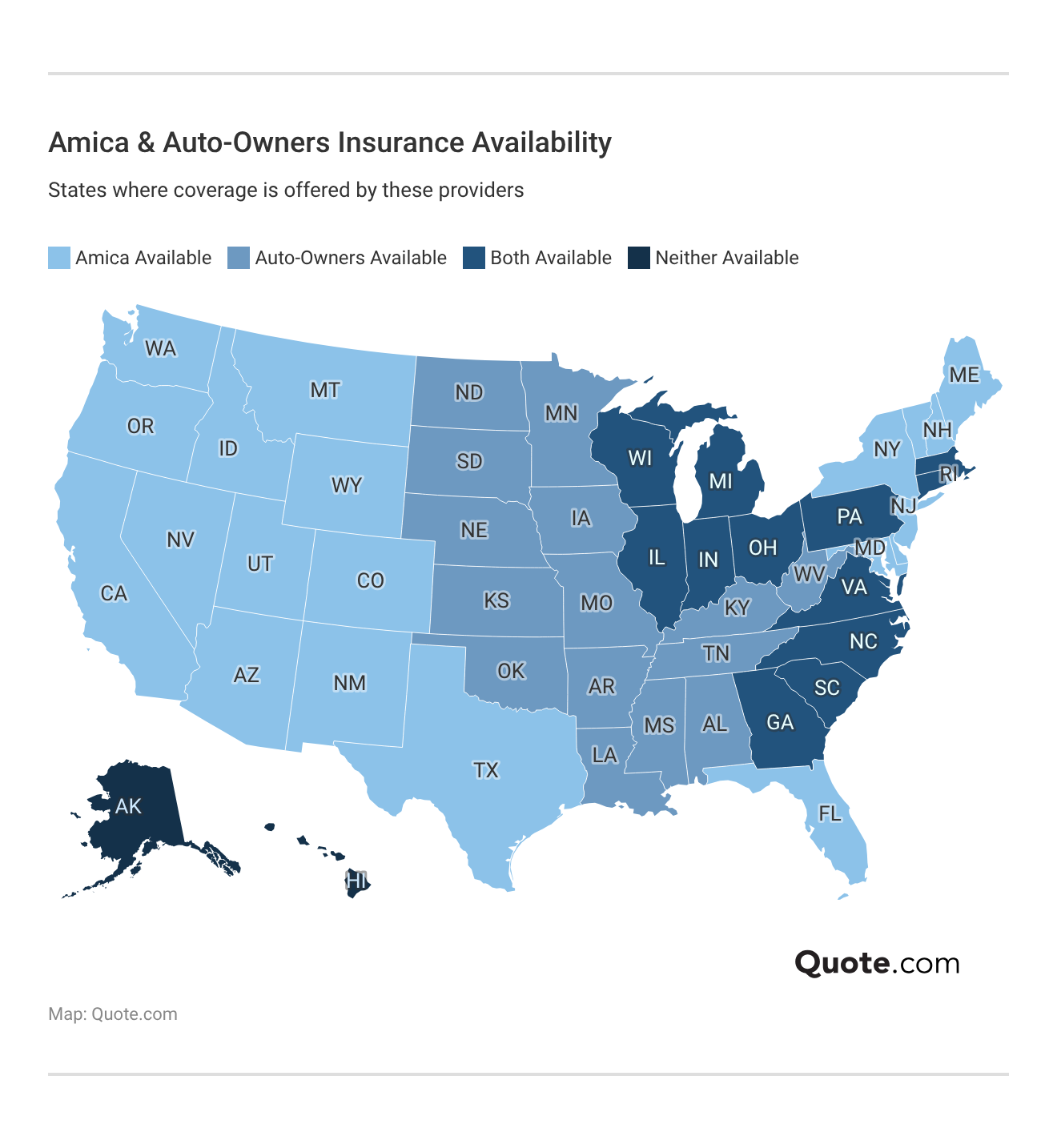

Where you live matters, also, because these companies aren’t equally available everywhere. Amica has a much wider availability overall. That said, availability can still depend on the specific insurance product you’re looking for.

For example, Amica Life Insurance Company is authorized in all states except Hawaii, so life insurance is a clear exception.

Auto-Owners is more regional. The company sells through independent agents. So, it may be a good option only if you’re in one of its operating states and are comfortable buying through an independent agent network.

Business Scores: Amica vs. Auto-Owners

Amica and Auto-Owners customer service records are strong. Even though Amica holds an A+ rating from A.M. Best, a few customers have had issues with their claims. Auto-Owners also holds an A+ rating from A.M. Best, but a few angry customers have spoken out, saying they hate the company’s rate hikes.

Amica vs. Auto-Owners Business Ratings & Consumer Reviews| Agency | ||

|---|---|---|

| Score: A+ Superior Financial Strength | Score: A+ Superior |

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 85/100 Excellent Customer Feedback | Score: 80/100 Positive Customer Feedback |

|

| Score: 718 / 1,000 Avg. Satisfaction | Score: 711 / 1,000 Avg. Satisfaction |

|

| Score: 0.73 Fewer Complaints Than Avg. | Score: 0.75 Fewer Complaints Than Avg. |

The main difference here is the insurance agents. Auto-Owners has them, while Amica doesn’t.

Since Amica doesn’t have any insurance agents, your claims, quotes, and questions get handled by a call center. That may be a drawback for people looking for a more personalized touch. This lack of agents doesn’t seem to significantly impact the company’s customer service.

Auto-Owners insurance agents are your point of contact for almost everything, from updating your policy to filing a claim. That means when you’re dialing your agent after an accident or considering adding a new car to your policy, you’re speaking with someone who knows your needs, wants, and personality.

Those who prefer a familiar face for their insurance needs would do well with Auto-Owners, but Amica's customer service does just fine.

Travis Thompson Licensed Insurance Agent

Agents are only available for contact during normal business hours. If you need to file a claim after 5:00 p.m., you must call an emergency after-hours phone service. Nevertheless, Auto-Owners has received stellar customer satisfaction ratings.

Find out more: How to Compare Auto Insurance Companies

Amica & Auto-Owners Industry Position

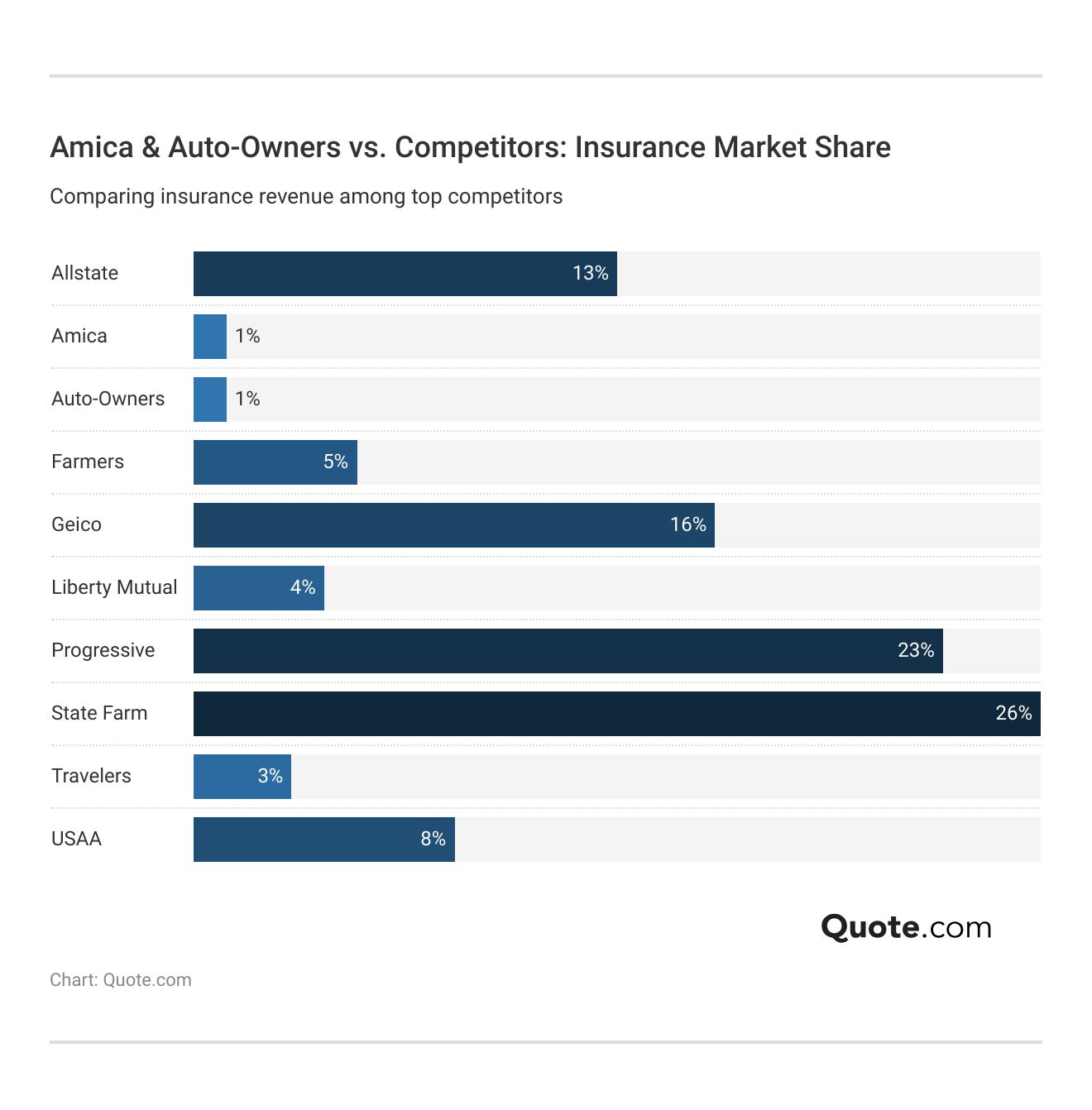

State Farm (19%) and Progressive (17%) take up a big chunk of the market on their own, and companies like Allstate (10%) and Liberty Mutual (5%) aren’t far behind.

By comparison, Amica (0.5%) and Auto-Owners (1.5%) are much smaller insurers, but that doesn’t automatically mean worse.

Auto-Owners is a solid competitor where it’s available, but it isn’t trying to be everywhere. Amica is more widely accessible, but it’s still not chasing market share the way big national insurers do. However, even without a large market share, they offer competitive rates while providing the core coverage most people need.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Amica vs. Auto-Owners Insurance History

Amica and Auto-Owners are mid-sized insurance companies that have been around for over 100 years.

During that time, Auto-Owners Insurance has grown to the 18th largest auto insurer, while Amica ranks 23rd, according to the National Association of Insurance Commissioners.

Amica Mutual has been around since 1907. Currently, it is the oldest mutual automobile insurer. Back when Auto-Owners started its business in 1906, it had a whopping $147.25 in assets. From there, it’s grown into a company with over 37,000 agents across 6,200 agencies.

Do you use Amica or Auto-Owners?

How has it worked out for you? Any great tips to share with the rest of us?

Does another provider have lower rates? Find out by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

Is an Amica dividend a discount or a payment?

Since Amica is a mutual insurance company, it’s owned by its policyholders.

That makes those it insures akin to its stockholders, and much like stockholders, they get a dividend whenever the company has a profitable year (and Amica has been paying them for over 100 years, according to its website).

The dividend is a payment. You can arrange to have it sent via check or direct deposit. You can also have it applied against your annual premiums, though, which makes it function similarly to a discount.

How much does Amica’s dividend usually pay out?

The dividend usually pays out approximately 20% of the cost of your policy. That means if you pay $1,500 per year for car insurance, you’ll receive around $300 in dividends.

How do I make an Auto-Owners insurance claim after hours?

Call the after-hours phone service at 1-888-252-4626. It’s active between 4:30 PM and 8:00 AM Eastern Time, Monday through Friday, and 24 hours a day on weekends and holidays.

Read more: How to File an Auto Insurance Claim & Win

Can I insure vehicles other than cars with Amica and Auto-Owners?

Yes. Both insurers cover a wide range of vehicles.

While both insurers provide motorcycle insurance, only Amica offers boat insurance.

Auto-Owners also covers various vehicles that Amica doesn’t, including:

- All-terrain vehicles

- Classic or antique cars

- Mopeds

- Motor-homes

- Recreational vehicles

- Utility trailers

- Vacation trailers and campers

Does Auto-Owners employ the agents that sell its insurance?

No. Auto-Owners sells its insurance through independent agents who represent multiple insurance companies.

The benefit is that if another insurance company offers coverage that better fits your needs, the agent is free to recommend it over Auto-Owners.

The drawback is that some independent agents may not have the same level of in-depth knowledge of an individual company’s products as agents who represent only one insurer.

Does Amica have a good reputation?

Amica is recognized for strong customer satisfaction and holds an A+ (Superior) financial strength rating from A.M. Best.

Read more: A Visual Guide to Auto Insurance

What is the best rating for Auto-Owners insurance?

Auto-Owners’ current A.M. Best financial strength rating is A+ (Superior). Don’t let expensive insurance rates hold you back. Enter your ZIP code and shop for affordable premiums from the top companies.

Who owns Auto-Owners Insurance?

Who owns Auto-Owners insurance in the US? Auto-Owners is a mutual insurance company, meaning it’s owned by its policyholders.

Who are Auto-Owners competitors?

Competitors include large national insurers like State Farm, Progressive, Geico, Allstate, and USAA.

What country is Amica from?

Amica was founded in Providence, Rhode Island.

Why choose Amica?

Which is better, Progressive or Auto-Owners?

Who is the CEO of Auto-Owners?

Does Amica offer landlord insurance?

Is Amica auto insurance good?

What’s Amica’s car insurance phone number?

Where can I check Amica complaints?

How do Amica and Auto-Owners claims compare?

What’s Amica’s home insurance phone number?

Amica vs. Auto-Owners vs. Progressive: Which company is the best?

How do I get an Amica auto insurance quote?

What do Amica vs. Auto-Owners insurance Reddit reviews say?

How do I get proof of insurance from Auto-Owners?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.