Average Cost of Auto Insurance in 2026

The average cost of auto insurance for minimum coverage starts at $32 per month, while full coverage costs as low as $84 per month. Factors like driving record, age, and location all affect your premiums. Still, good drivers get the cheapest auto insurance with discounts of up to 40%.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated January 2026

The average cost of auto insurance starts as low as $32 per month for minimum coverage, though rates vary based on the driver’s insurer, age, location, and driving record.

- Full coverage auto insurance starts at $84 per month

- Michigan has the most expensive auto insurance rates on average

- Being a good driver can save you as much as 40% on auto insurance

Our auto insurance guide on average costs covers all the factors affecting rates, including credit score and vehicle type, to help you determine how much you’ll pay. If the average cost of car insurance seems high to you, there are things you can do to save money, such as applying for auto insurance discounts.

You can also use our free quote tool to find affordable auto insurance for your vehicle from providers near you. Simply enter your ZIP to get started.

Top Factors Affecting Auto Insurance Rates

It is important to pick the right auto insurance coverage for your vehicle, as gaps in auto insurance could leave you financially vulnerable.

Because auto insurance is an important purchase that protects you and your vehicle, we want to give you a thorough look at the average rates you can expect to pay.

To help you find reasonable rates for auto insurance coverage, we’ve broken down the main factors that affect auto insurance rates.

Whether you are shopping for full coverage with a poor credit score or are looking for rates after an at-fault accident, keep reading to find a complete list of car insurance averages.

Comparing Average Costs by Coverage Level

One of the first factors that will affect the average cost of car insurance is the type of coverage you choose for your vehicle. Naturally, buying more coverage will result in a higher rate.

General auto insurance policies can be described as either full coverage or minimum coverage policies, with minimum coverage being the cheapest to buy.

Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 | |

U.S. Average | $61 | $165 |

Minimum coverage policies only include the minimum insurance required by your state to drive legally. This coverage is best for older vehicles that are greatly depreciated in value.

Full coverage auto insurance policies, on the other hand, also include collision and comprehensive auto insurance coverage. Full coverage is best suited for newer cars that require more financial protection.

Collision and comprehensive coverages protect your vehicle in several situations, from collisions with fences to collisions with animals. Without these coverages, you are stuck paying for your own vehicle repairs if you are at fault in an accident.

Most drivers will be fine with just a full coverage policy, but there are some other auto insurance coverage options available for a higher price.

Auto Insurance Coverage Options: Key Details| Coverage | What It Covers | Monthly Rate |

|---|---|---|

| Liability | Others’ injury or property damage | $55 |

| Collision | Repairs after an accident | $65 |

| Comprehensive | Theft, fire, vandalism, & animals | $30 |

| PIP | Medical bills & lost wages | $40 |

| UM/UIM | Costs if other driver uninsured | $25 |

| Gap | Loan/lease vs. car value gap | $20 |

| Rental | Rental car while repaired | $15 |

| Roadside | Towing, jump starts, & lockouts | $10 |

If you are interested in adding on extras like rental reimbursement, gap insurance, or roadside assistance, you can expect the average cost of auto insurance per month to increase by at least $10.

However, if you end up needing to use these coverages, they can pay for themselves. For example, if you have an older vehicle that frequently breaks down, roadside assistance can help cover the cost of expensive tows and quick roadside fixes like jump-starts.

How Age and Driving Record Impact Rates

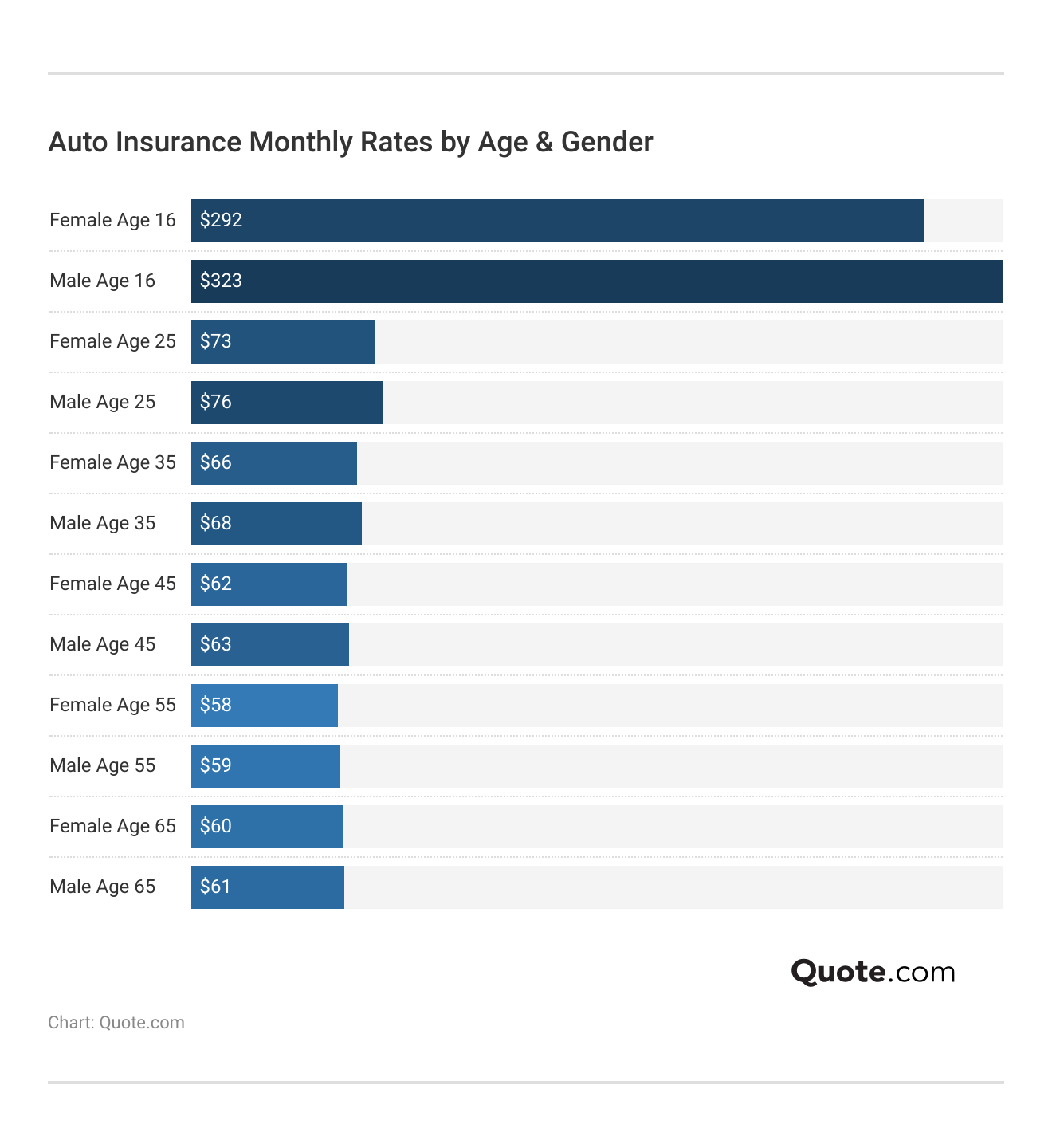

Age and gender are two of the main demographic factors that affect auto insurance rates at companies. Age has a greater impact than gender, as it correlates with driving experience.

When you look at a car insurance rates by age chart, you’ll quickly see that finding cheap auto insurance for teens can be challenging because teens are considered higher-risk drivers.

Young drivers should stay on their parents' policy if possible, as it is significantly more expensive for young drivers to buy their own policy.

Dani Best Licensed Insurance Producer

Male drivers also tend to pay slightly more on average than female drivers, though the cost discrepancy is greatest among young teen drivers.

This is because statistically, insurance companies have found that young male drivers file more claims on average than young female drivers.

As drivers age, the average cost of auto insurance per year will drop as long as drivers have a clean driving record. Rates will start to rise again slightly when drivers hit age 65 and older, due to age-related driving risks like decreasing vision and reaction time.

If drivers do not have a clean driving record, however, their average auto rates will still stay high as they age until their driving record has been clean for at least a few years.

Auto Insurance Monthly Rates by Provider & Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 | |

U.S. Average | $61 | $91 | $112 | $76 |

DUIs are often the cause of the biggest cost increases at auto insurance companies. A DUI charge on a driving record will result in much higher rates than a simple traffic ticket.

If you have a poor driving record, make sure to get quotes from companies that have more affordable rates for your driving violations. Learn More: What to Do If You Can’t Afford Your Auto Insurance

Credit Score and Auto Insurance Costs

The majority of auto insurance companies will check drivers’ credit scores when they apply for an auto insurance policy. Drivers with higher credit scores will often receive better rates than drivers with lower credit scores.

For example, the average rate at Allstate for a driver with a poor credit score is $170 per month, whereas a driver with an excellent credit score pays an average of $87 per month. Read More: Allstate Insurance Review

Auto Insurance Monthly Rates by Provider & Credit Score| Company | Excellent (800+) | Good (670-799) | Fair (580-669) | Poor (<580) |

|---|---|---|---|---|

| $87 | $100 | $115 | $170 | |

| $62 | $72 | $85 | $120 |

| $76 | $88 | $105 | $150 | |

| $43 | $50 | $60 | $85 | |

| $96 | $112 | $135 | $195 |

| $63 | $74 | $90 | $130 | |

| $56 | $66 | $80 | $115 | |

| $47 | $55 | $65 | $95 | |

| $53 | $62 | $75 | $110 | |

| $32 | $38 | $48 | $70 | |

U.S. Average | $61 | $76 | $86 | $124 |

The reason for higher rates for poor credit scores is that insurance companies view these customers as riskier to insure. Poor credit scores could indicate failure to make monthly payments.

This could then lead to other issues, such as insurance companies having to cancel auto insurance coverage for nonpayment, leaving customers driving around illegally without insurance. Drivers who are caught driving uninsured will have much higher rates in the future.

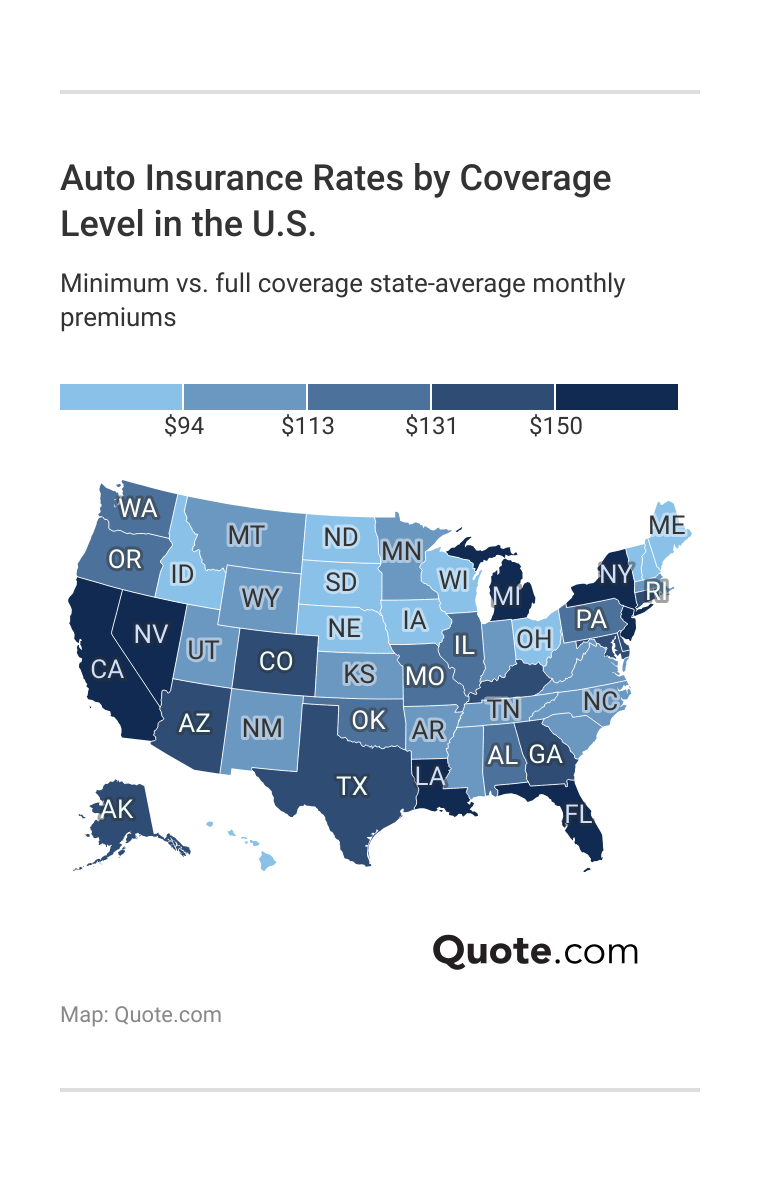

Why Where You Live Impacts Insurance Costs

Where you live also affects the average auto insurance rates you’ll pay. Some states will be significantly more expensive than others, due to living expenses and local risk factors like traffic, weather, and theft.

Basically, if auto insurance claims are high in your state, or even in your town, you can expect to pay a higher auto insurance rate. When you look at the average car insurance cost per month by state, the average cost of auto insurance in Texas will not be the same as the average cost of auto insurance in Arizona.

Local auto insurance laws will also affect what you pay. Michigan will be one of the most expensive states for auto insurance, with full coverage costing an average of $339 per month.

This is partly because of Michigan’s no-fault auto insurance system, which requires drivers to purchase more minimum coverage than in the majority of other states. Michigan also has multiple fraud cases every year, which is one of the reasons it is one of the worst states for filing auto insurance claims.

Average Auto Insurance Rates by Vehicle

Lastly, the type of vehicle you own will affect auto insurance rates. Dependable vehicles with lower purchasing prices will be among the cheaper vehicles to insure.

When comparing auto insurance rates by vehicle type, insurance companies give the lowest rates to sedans and hatchbacks, with rates starting at an average of $46 per month.

Auto Insurance Monthly Rates by Provider & Vehicle Type| Insurance Company | Pickups / Trucks | Sedans / Hatchback | SUVs / Crossovers |

|---|---|---|---|

| $68 | $54 | $63 | |

| $67 | $52 | $62 |

| $69 | $55 | $64 | |

| $62 | $48 | $56 | |

| $71 | $56 | $65 |

| $66 | $51 | $61 | |

| $67 | $52 | $62 | |

| $64 | $50 | $57 | |

| $66 | $51 | $60 | |

| $60 | $46 | $54 | |

U.S. Average | $66 | $52 | $60 |

In addition to the build of your vehicle, insurance companies will also consider factors like the cost of replacement parts and safety ratings when determining prices.

A Toyota RAV4, for example, will be a cheaper vehicle to insure due to its safety ratings and the fact that there are fewer claims on Toyota RAV4s. However, a Tesla Model Y costs an average of $183 per month to insure, as it is a pricier car to replace and repair.

20 Top-Selling Vehicles: Auto Insurance Monthly Rates| Make & Model | Rank | Premium | Cost Factors |

|---|---|---|---|

| Ford F-Series | #1 | $63 | Large pickup; big driver pool lowers costs |

| Chevrolet Silverado | #2 | $66 | Full-size truck; slightly less than Ford |

| Toyota RAV4 | #3 | $55 | Compact SUV; strong safety, low claims |

| Honda CR-V | #4 | $58 | Compact SUV; reliable, affordable repairs |

| Ram 1500 Series | #5 | $65 | Full-size pickup; higher liability exposure |

| Tesla Model Y | #6 | $183 | EV; costly parts and repairs |

| GMC Sierra | #7 | $64 | Full-size truck; expensive parts |

| Toyota Camry | #8 | $60 | Midsize sedan; safe, moderate costs |

| Nissan Rogue | #9 | $59 | Compact SUV; affordable, family-friendly |

| Honda Civic | #10 | $57 | Compact car; cheap repairs, safe profile |

| Toyota Corolla | #11 | $56 | Compact sedan; dependable, modest costs |

| Chevrolet Equinox | #12 | $58 | Compact SUV; low repairs, safe profile |

| Jeep Grand Cherokee | #13 | $66 | Midsize SUV; higher theft/repair costs |

| Hyundai Tucson | #14 | $57 | Compact SUV; affordable, safe choice |

| Chevrolet Trax | #15 | $55 | Subcompact SUV; cheap repairs, safe |

| Ford Explorer | #16 | $68 | Midsize SUV; higher liability/repair costs |

| Toyota Tacoma | #17 | $62 | Midsize pickup; moderate premiums |

| Subaru Crosstrek | #18 | $56 | Subcompact SUV; strong safety, low claims |

| Subaru Forester | #19 | $57 | Compact SUV; safe, reliable, affordable |

| Subaru Outback | #20 | $58 | Wagon/SUV; safe, family-friendly |

Whenever you have a more expensive vehicle like an electric car or sports car, you can expect higher auto insurance rates because the replacement cost will be higher.

If you’re looking for a vehicle with affordable rates, use a car insurance calculator to find the average rates for different models and makes, and choose the most affordable vehicle for your needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Lower Your Auto Insurance Premiums

Auto insurance is a necessity, but it can be expensive. If you are trying to get the cheapest car insurance possible, one of the first things you can do is check with your auto insurance company to see if there are any discounts that can be applied to your policy.

For example, if you recently installed an anti-theft device like a GPS tracking system, see if you can qualify for an anti-theft discount. Read More: Best Anti-Theft Auto Insurance Discounts

Top Auto Insurance Discounts by Provider & Savings| Company | Anti- Theft | Good Driver | Multi- Policy | Multi- Vehicle |

|---|---|---|---|---|

| 10% | 25% | 25% | 10% | |

| 25% | 25% | 25% | 23% |

| 10% | 30% | 20% | 12% | |

| 25% | 26% | 25% | 25% | |

| 35% | 20% | 25% | 25% |

| 5% | 40% | 20% | 15% | |

| 25% | 30% | 10% | 12% | |

| 15% | 25% | 17% | 20% | |

| 15% | 10% | 13% | 8% | |

| 15% | 30% | 10% | 10% |

Other large auto insurance discounts that are offered at the majority of companies include multi-car discounts, bundling discounts, and more.

Combining auto insurance with other coverage, such as home insurance, at the same company can earn you a bundling discount. It is an easy way to save and make multi-policy management easier.

Have you exhausted the discounts at your auto insurance company? Discounts are just one way to reduce car insurance rates.

There are still a few other things you can try to reduce the rates on your auto insurance policy. Some of the top savings tips are:

- Evaluating Coverages: Check your policy to see if there are any coverages, such as roadside assistance, you could drop without putting yourself at financial risk.

- Raising Deductibles: Raise your deductibles to an amount you feel comfortable paying out of pocket to reduce your monthly costs.

- Comparison Shopping: Use online comparison tools to get quotes every year to see if you can score a better deal at another company.

If you have a poor driving record or a poor credit score, improving your driving record with safe driving or raising your credit score will help reduce your auto insurance rates.

Looking to find the cheapest auto insurance rates today? Use our free quote tool to quickly compare rates from companies in your area.

Frequently Asked Questions

How much is car insurance per month?

The cheapest car insurance starts at $32 per month for minimum coverage policies.

How much is full coverage insurance a month?

Full coverage auto insurance starts at $84 per month on average.

Who typically has the cheapest car insurance?

State Farm and Geico often have the cheapest auto insurance rates in most states, but regional companies like Erie and American Family are also competitive.

How much is car insurance for a 16-year-old?

Female drivers pay an average of $292 per month for car insurance, while male drivers pay an average of $323 per month for car insurance. Rates for teens are high because they are considered high-risk drivers. Learn More: Cheap Auto Insurance for High-Risk Drivers

How much is car insurance on average in the U.S.?

Rates start at $32 per month for minimum coverage policies and $84 per month for full coverage.

Is $200 a month a lot for car insurance?

A $200 premium can be a normal amount for a full coverage policy, but it is pricier than normal for a good driver with a lower-cost car. To see if you can score a lower rate, enter your ZIP code in our free quote tool.

Why is car insurance increasing so much?

Car insurance rates increase over time due to factors like inflation, risk factors, and more. Applying discounts can help lower rates (Read More: 17 Car Insurance Discounts You Can’t Miss).

Does auto insurance increase with age?

Auto insurance rates typically decrease with age as drivers gain experience, but may increase slightly again when drivers hit age 65.

Can I lower my monthly car insurance?

Wondering how to get car insurance to go down? Make sure to apply for discounts, improve your credit score, and drive safely. Check out our guide on 26 hacks to save money on auto insurance for more tips.

What car is the cheapest to insure?

One of the cheaper cars to insure is the Toyota RAV4, with average rates of $55 per month.

How does my credit score affect car insurance?

Why is my car insurance so high with a clean record?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.