10 Best Auto Insurance Companies for Claims Handling in 2026

American Family, Auto-Owners, and State Farm are the best auto insurance companies for claims handling. Geico has the cheapest rates at just $43. When searching for great car insurance claims handling, look for providers with high customer satisfaction ratings, 24-hour access, and fast payouts.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Malory Will has an M.A. in English from Arizona State University. She has over four years of experience in writing for the insurance industry. With a background in health, auto, life, and homeowners insurance, Malory is passionate about making complex insurance topics clear and approachable. Her goal is to help readers make informed decisions with confidence.

Malory Will

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the...

Heidi Mertlich

Updated January 2026

The best auto insurance companies for claims handling are Liberty Mutual, Nationwide, and State Farm for their great service. Geico is the cheapest at just $43 a month.

- Liberty Mutual earns top scores in multi-state claim satisfaction surveys

- State Farm includes rental coverage automatically in most claims cases

- Auto-Owners completes on-site inspections within 48 hours of filing

Liberty Mutual provides 24-hour claims processing, and drivers can file claims right away from the mobile app.

State Farm’s convenient app makes filing and tracking claims simple, right from your phone, while Nationwide SmartRide UBI collects data for more accurate claims handling.

Our Top 10 Picks: Best Auto Insurance Companies for Claims Handling| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 730 / 1,000 | A | Customizable Policies |

| #2 | 729 / 1,000 | A+ | Collision Alerts | |

| #3 | 716 / 1,000 | A++ | Local Agents | |

| #4 | 711 / 1,000 | A++ | Add-Ons | |

| #5 | 702 / 1,000 | A | Fast Service |

| #6 | 697 / 1,000 | A++ | Cost Savings | |

| #7 | 693 / 1,000 | A+ | Deductible Rewards | |

| #8 | 691 / 1,000 | A++ | Discount Options | |

| #9 | 690 / 1,000 | A | Glass Coverage | |

| #10 | 673 / 1,000 | A+ | Roadside Assistance |

Compare multiple companies to find the right provider for you. AmFam stands out with its quick 24-hour claims turnaround, so you’re not left waiting after an accident, and Auto-Owners keeps things personal, connecting you directly with local claims reps.

Need guidance on how to file an auto insurance claim? Use our free quote tool to compare providers that make the process fast and stress-free.

Comparing Auto Insurance Rates After a Claim

Drivers looking for the best company for a car insurance claim often opt for full coverage since it typically includes built-in perks that speed up the process.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $47 | $124 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 |

If your car’s totaled or stuck in repairs, full coverage can fast-track claims and include rental support as an add-on. Companies with the best claims handling often incorporate those perks into their policies.

Minimum coverage works best if your car’s older or paid off, but it usually comes with more out-of-pocket risk. Compare liability-only vs. full coverage auto insurance to learn more.

How Age Impacts Auto Insurance Rates After a Claim

If you’re just getting your license, shopping for coverage early might seem smart, but it can actually lock you into sky-high rates. That’s because insurers are looking at how little time you’ve spent behind the wheel.

Auto Insurance Monthly Rates by Age| Company | Age: 25 | Age: 35 | Age: 45 | Age: 55 |

|---|---|---|---|---|

| $102 | $95 | $87 | $82 | |

| $78 | $70 | $62 | $59 |

| $71 | $59 | $47 | $45 | |

| $98 | $87 | $76 | $72 | |

| $50 | $47 | $43 | $41 | |

| $119 | $108 | $96 | $91 |

| $81 | $72 | $63 | $59 | |

| $77 | $67 | $56 | $52 | |

| $60 | $54 | $47 | $45 | |

| $62 | $58 | $53 | $50 |

Filing a quote at 16-years-old could mean monthly rates over $400. Without a driving history, insurers see you as high risk. Before you commit, get multiple auto insurance quotes to see how different companies treat new drivers. Holding off just a few years can lead to major savings once you’ve built some experience.

How Driving Record Affects Rates After Claims

Getting strong claims support matters, but that doesn’t mean your rates stay low after an accident.

Even the best auto insurance company for paying claims may still raise your premium if your record takes a hit. That’s why it’s smart to weigh both how they handle service and how they price risk.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $47 | $69 | $105 | $57 | |

| $76 | $109 | $178 | $95 | |

| $43 | $71 | $129 | $56 | |

| $96 | $129 | $65 | $116 |

| $63 | $88 | $112 | $75 | |

| $56 | $98 | $58 | $74 | |

| $47 | $57 | $38 | $53 | |

| $53 | $76 | $123 | $72 |

If your record’s clean, you’ll likely get the lowest rates. However, one accident or ticket can quickly escalate things, even with insurers that are generally good with claims.

A DUI hits even harder, especially on collision auto insurance. It’s always a good idea to ask how long a violation or claim will affect your premium before committing to a policy.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Auto Insurance After Claims

Saving money isn’t just about promo codes or loyalty perks. Pay close attention to how your insurer handles your claim and your coverage after filing.

For instance, look for claims adjusters who are focused on working with you to lock in the best value rather than settling for the lowest amount as quickly as possible.

Staying organized, avoiding unnecessary claims, and having a good back-and-forth with your claims adjuster can really pay off when something goes wrong.

Implement a few smart habits like these now can save you money and stress later.

- Choose Actual Cash Value on Older Cars: If your car isn’t worth much, scaling back coverage might make more financial sense.

- Drop Extras You Don’t Need: If you rarely use rental reimbursement or roadside assistance, removing them could trim your bill.

- Pay Your Premium Upfront: Some insurers offer lower rates and prioritize claim processing for customers who pay in full.

- Update Your Policy When Life Changes: Changes like working from home or retiring can lower how much you drive, and that can decrease the likelihood of claims, leading to savings.

- Use Your Insurer’s Repair Network: Companies like Auto-Owners or American Family often process claims faster when you stick with their preferred shops.

These small moves might not seem like much, but they can make a big difference over time. You’ll not only save money, but you’ll likely have a smoother experience with the best car insurance companies for claims when it matters most.

Discounts on Car Insurance After Claims

Insurance discounts aren’t just small perks. They can seriously reduce your monthly bill if you qualify for the right ones.

The type of car you drive, how you use it, and even the number of cars you insure all factor into what you save.

Top Auto Insurance Discounts by Provider| Company | Bundling | Good Driver | Multi-Vehicle | Usage-Based |

|---|---|---|---|---|

| 25% | 25% | 25% | 30% | |

| 25% | 25% | 20% | 30% |

| 16% | 25% | 10% | 30% | |

| 20% | 30% | 20% | 30% | |

| 25% | 26% | 25% | 25% | |

| 25% | 20% | 25% | 30% |

| 20% | 40% | 12% | 40% | |

| 10% | 30% | 12% | $231/yr | |

| 17% | 25% | 20% | 30% | |

| 13% | 10% | 25% | 30% |

If you’ve got a clean record and steer clear of tickets or accidents, some companies will knock up to 40% off your rate. Bundling your auto and home policies could save you 25% on both, which adds up to significant savings over time. Usage-based auto insurance programs track your driving habits and can reward low-mileage drivers with significant savings.

Anti-theft features might only save 5–15%, but they’re still worth it in high-risk areas. And if your household has more than one car, some insurers offer multi-vehicle discounts of up to 25%.

Insurance Coverage Options for Claims Handling

When you file a claim, the kind of coverage you have determines how it’s handled and what gets paid. Liability is what takes care of the other person’s damages if you’re at fault, and it’s usually the first thing insurers look at.

If your car’s damaged in a crash, collision coverage helps move your repair claim forward quickly (Read More: Diminished Value Claims).

Common Auto Insurance Coverages| Coverage | What It Covers |

|---|---|

| Liability | Damage or injuries you cause to others in an accident |

| Collision | Vehicle damage from hitting another car or object |

| Comprehensive | Damage from theft, vandalism, weather, or animals |

| Uninsured/Underinsured Motorist (UM/UIM) | Injuries or damage caused by a driver with little or no coverage |

| Medical Payments (MedPay) | Medical bills for you and passengers after an accident |

| Personal Injury Protection (PIP) | Medical and lost wages for you and your passengers |

| Rental Reimbursement | Cost of rental while your car is being repaired |

| Roadside Assistance | Towing, flat tires, battery jump-starts, and lockouts |

| Accident Forgiveness | Keeps rate from increasing after your first at-fault accident |

Comprehensive comes into play when your car’s hit by something unexpected, like hail, theft, or even a deer. If the other driver can’t cover the costs, uninsured or underinsured motorist coverage makes sure your claim doesn’t get stuck.

Medical bills? Medical payments and personal injury protection help speed up reimbursement for ER visits, ambulance rides, and even time off work.

Comprehensive insurance is only as valuable as the claims service behind it, especially when quick action is needed to repair or replace your vehicle.

Jeff Root Licensed Insurance Agent

And if you need a rental, a tow, or just want to avoid a rate hike after your first accident, extras like rental reimbursement, roadside assistance, and accident forgiveness keep things running smoothly.

Breaking Down Claim Trends Across the U.S.

Some claims are more common than others, and knowing what they are can help you understand what matters in a policy.

It also gives you a better idea of what to expect if you ever have to file an auto insurance claim.

Most Common Auto Insurance Claims in the U.S.| Coverage Type | Share | Cost Per Claim | Description |

|---|---|---|---|

| Collision | 30% | $4.5K | Vehicle impact |

| Property Damage | 25% | $4.2K | Others’ property |

| Comprehensive | 15% | $2.5K | Theft, weather, fire |

| Bodily Injury | 12% | $20K | Injuries to others |

| Personal Injury | 8% | $8K | Medical, passengers |

| Uninsured Motorist | 6% | $15K | Uninsured driver hit |

| Medical Payments | 3% | $2.5K | Medical, any fault |

| Other Types | 1% | $1K | Rental, roadside |

Collision claims are the most common, accounting for approximately 30% of all auto claims. They usually happen when you hit another car or something like a pole, and they tend to come with higher repair costs and longer wait times.

Property damage claims are next at 25%, often involving damage to someone else’s car or property, and things can get a little messy if there’s a dispute about who’s at fault.

Comprehensive auto insurance claims make up 15% and cover things like theft, hail, or a broken window, though you might need extra paperwork to get it processed.

Bodily injury claims make up 12% and tend to move slowly since they involve medical records and questions about who’s at fault. Uninsured motorist claims are just 6%, but they’re some of the most frustrating, especially when the other driver can’t pay for anything.

Auto Insurance Claims by State

Where you live also plays a big role in how claims are handled. Some states have far more accidents and claims than others, which can affect everything from how quickly your claim gets processed to how much you end up paying.

In California, with 3.5 million accidents and 1.9 million claims annually, insurers are dealing with a heavy volume, which can slow down the process.

Annual Accidents & Insurance Claims by State| State | Accidents | Traffic Deaths | Claims | Claim Cost |

|---|---|---|---|---|

| Alabama | 520K | 10,196 | 168K | $53,760 |

| Alaska | 60K | 8,219 | 28K | $13,160 |

| Arizona | 730K | 10,000 | 280K | $106,400 |

| Arkansas | 350K | 11,667 | 125K | $45,000 |

| California | 3.5M | 8,861 | 1.9M | $1,026,000 |

| Colorado | 480K | 8,276 | 360K | $270,000 |

| Connecticut | 290K | 8,056 | 140K | $67,200 |

| Delaware | 150K | 15,152 | 65K | $27,950 |

| Florida | 2.5M | 11,521 | 1.6M | $1,024,000 |

| Georgia | 850K | 7,944 | 790K | $734,700 |

| Hawaii | 120K | 8,571 | 65K | $35,100 |

| Idaho | 230K | 12,105 | 110K | $52,800 |

| Illinois | 950K | 7,540 | 800K | $672,000 |

| Indiana | 690K | 10,147 | 520K | $390,000 |

| Iowa | 300K | 9,375 | 200K | $134,000 |

| Kansas | 310K | 10,690 | 200K | $130,000 |

| Kentucky | 440K | 9,778 | 420K | $403,200 |

| Louisiana | 450K | 9,783 | 420K | $390,600 |

| Maine | 160K | 11,429 | 85K | $45,050 |

| Maryland | 490K | 8,033 | 430K | $378,400 |

| Massachusetts | 680K | 9,855 | 470K | $324,300 |

| Michigan | 830K | 8,300 | 710K | $610,600 |

| Minnesota | 640K | 11,228 | 380K | $224,200 |

| Mississippi | 340K | 11,333 | 230K | $156,400 |

| Missouri | 670K | 10,807 | 540K | $437,400 |

| Montana | 120K | 10,909 | 90K | $67,500 |

| Nebraska | 160K | 8,000 | 130K | $105,300 |

| Nevada | 270K | 8,438 | 260K | $249,600 |

| New Hampshire | 140K | 10,000 | 110K | $86,900 |

| New Jersey | 800K | 8,989 | 720K | $648,000 |

| New Mexico | 200K | 9,524 | 170K | $144,500 |

| New York | 1.1M | 5,641 | 1.1M | $1,100,000 |

| North Carolina | 840K | 7,851 | 850K | $858,500 |

| North Dakota | 90K | 11,539 | 60K | $40,200 |

| Ohio | 900K | 7,692 | 820K | $746,200 |

| Oklahoma | 380K | 9,500 | 350K | $322,000 |

| Oregon | 340K | 7,907 | 330K | $320,100 |

| Pennsylvania | 1.0M | 7,752 | 880K | $774,400 |

| Rhode Island | 120K | 10,909 | 85K | $60,350 |

| South Carolina | 520K | 10,000 | 510K | $499,800 |

| South Dakota | 90K | 10,000 | 70K | $54,600 |

| Tennessee | 700K | 10,000 | 700K | $700,000 |

| Texas | 3.2M | 10,848 | 2.4M | $1,800,000 |

| Utah | 240K | 7,273 | 220K | $202,400 |

| Vermont | 80K | 12,308 | 50K | $31,500 |

| Virginia | 780K | 9,070 | 620K | $496,000 |

| Washington | 750K | 9,615 | 510K | $346,800 |

| West Virginia | 150K | 8,333 | 120K | $96,000 |

| Wisconsin | 650K | 11,017 | 450K | $310,500 |

| Wyoming | 90K | 15,517 | 50K | $28,000 |

North Carolina and New York see nearly one claim per accident, something that can drive up rates. In states like Nevada, where 260,000 of 270,000 accidents result in claims, approvals may occur more quickly.

However, insurers tend to be more vigilant in detecting fraud. Lower-claim states, such as Alaska and Vermont, typically experience fewer delays and may offer more competitive premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Pick the Best Auto Insurance Company

If dealing with claims gives you a headache, picking the right insurance company can really ease the pressure. Some get your payout to you fast, while others are just better at picking up the phone when you need help.

If you’re looking for the best car insurance for paying claims, here’s what really matters when shopping around.

- 24-Hour Filing Access: This feature means you can file anywhere at any time, adding convenience and reassurance, especially in emergencies.

- Complaint Data: Check auto insurance reviews on sites like Reddit or Yelp for real customer experiences with claims, especially delays or denials.

- Loss Ratio vs. Price: Understand that a company’s claims behavior (like how often it pays out) is just as important as what it charges.

- Payout Speed: Ask your provider about timelines, which is vital for those who can’t afford long delays after a loss.

- Preferred Repair Shops: Ensure you can use your preferred shop for repairs, or that you know which local shops your insurer works with.

For instance, most companies will total out a vehicle after a collision if the repairs are considered more expensive than the value of the car. If you don’t have another vehicle or rental reimbursement coverage, look for companies that are less likely to total a car, and consider leasing a car if you can’t afford to buy one.

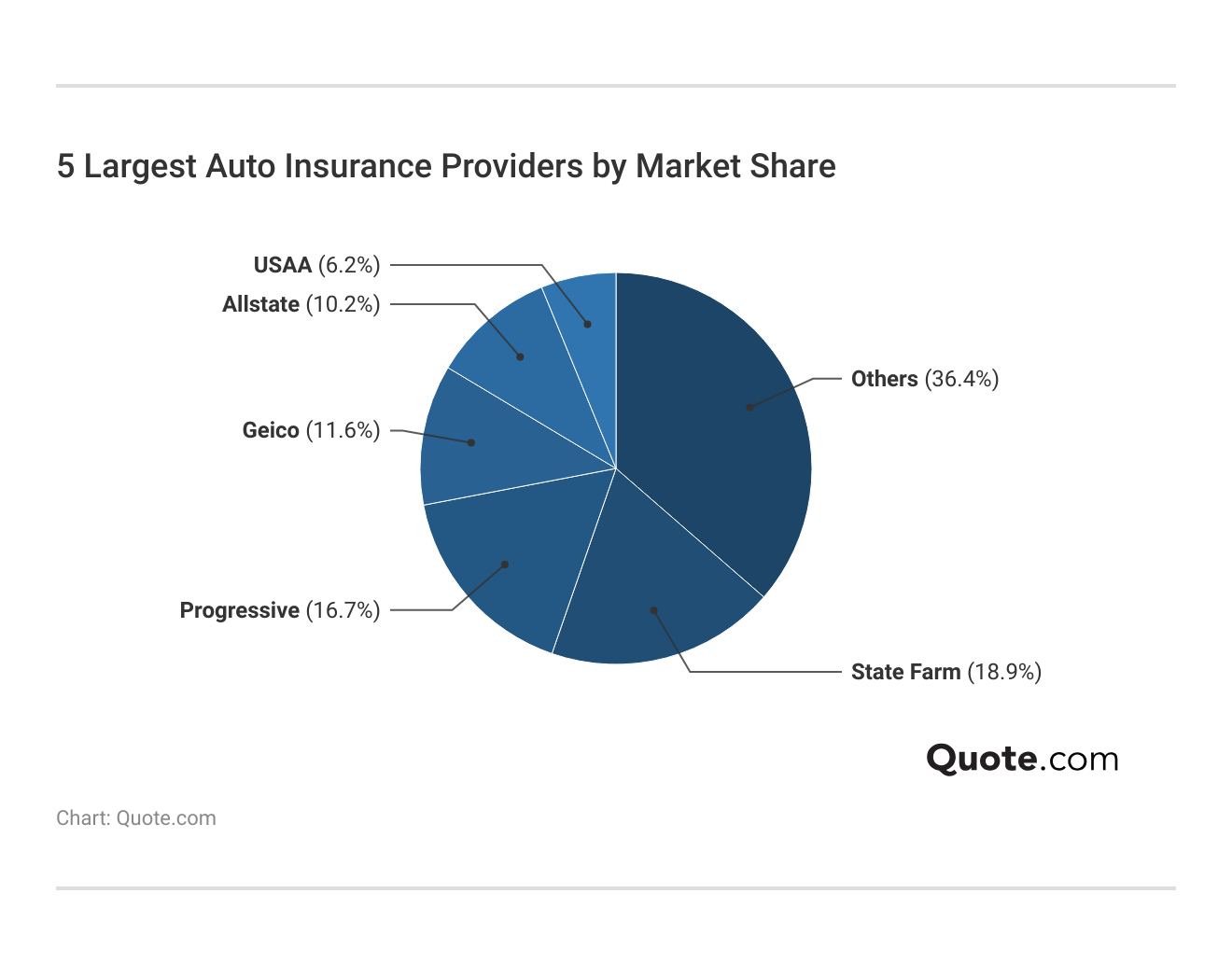

Once you know what to expect from a claims experience, it helps to look at who’s actually handling the most. Premium volume shows how many drivers a company insures, but the loss ratio tells you how much they’re paying out—and how efficiently they’re managing claims.

Top 10 Auto Insurance Companies by Premiums Written| Company | Rank | Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| #1 | $69.7B | 18.9% | 88% | |

| #2 | $46.6B | 16.7% | 88% | |

| #3 | $41.7B | 11.6% | 76% | |

| #4 | $38.6B | 10.2% | 85% | |

| #5 | $36.1B | 3.3% | 97% |

| #6 | $29.8B | 2.0% | 96% | |

| #7 | $18.8B | 3.8% | 95% | |

| #8 | $16.0B | 3.8% | 95% | |

| #9 | $12.7B | 1.7% | 94% |

| #10 | $9.7B | 1.9% | 93% |

State Farm leads the way with $69.7 billion in premiums and an 88% loss ratio, which shows it handles a massive number of policies while keeping claims under control.

But Geico, with the lowest loss ratio at 76%, may be more selective with payouts, especially for minor claims. On the other hand, Liberty Mutual pays out more often (with a 97% loss ratio), but that could lead to higher premiums later on.

That’s why our top picks shine even if they aren’t in every state. American Family speeds things up with same-day rentals and 24-hour claim turnaround, while Auto-Owners has an A++ financial strength rating that gives peace of mind that your claim will be paid, even during a bad storm or major accident.

Top-Rated Auto Insurance Companies for Claims Handling

When you buy auto insurance, you’re not just signing up for coverage, you’re choosing how things go if you ever need to file a claim.

State Farm tops the charts by being one of the largest, but that doesn’t always mean being the best car insurance company for claim settlements.

If a company has a claims satisfaction score under 630, that could mean a longer, more stressful process when you’re already dealing with a tough situation.

Some insurers can spot an accident through your phone and start the claims process immediately, while others may leave you waiting on hold. Compare the best car insurance companies for claims handling before you buy to guarantee a smooth customer service experience.

#1 – Liberty Mutual: Top Pick Overall

Pros

- High Claims Satisfaction: Liberty Mutual improved its already above-average score by 13 points, ranking in the top for claims handling and satisfaction.

- Better Car Replacement: Covers the cost of a newer model in total loss claims, enhancing customer satisfaction in claims handling.

- OEM Parts Guarantee: Utilizes original parts for covered repairs, enhancing the quality of claims handling outcomes. Explore key benefits inside our Liberty Mutual review.

Cons

- Expensive Premiums: Liberty Mutual auto insurance rates are some of the highest when compared to other companies on this list.

- Incomplete Digital Tools: The mobile app lacks in-claim messaging and upload capabilities for claims handling.

#2 – Nationwide: Best for Real-Time Alerts

Pros

- SmartRide Integration: The UBI platform monitors driving behavior, allowing faster claims handling through real-time crash alerts.

- Financial Security: Nationwide’s A+ rating from A.M. Best supports strong claims handling even in disaster seasons.

- Deductible Relief: Nationwide’s Vanishing Deductible program reduces your out-of-pocket costs over time, streamlining claims handling when accidents happen.

Cons

- Manual Filing: Claims handling lacks automated or in-app filing functionality. Get the full details in this expert Nationwide auto insurance review.

- Limited Availability: Despite its name, Nationwide is not available in Alaska, Hawaii, or Louisiana.

#3 – State Farm: Best for Local Agents

Pros

- Personalized Support: State Farm’s 19,000+ agents provide face-to-face claims handling assistance nationwide. Start with our expert-led State Farm insurance review.

- Top Financial Stability: State Farm’s A++ rating from A.M. Best ensures prompt claims handling even under surge demand.

- Drive Safe & Save App: Up to 30% discount through telematics, which improves the accuracy and speed of claims handling.

Cons

- Slower Complex Cases: Claims handling for high-value vehicles may involve longer processing times.

- Basic Medical Add-Ons: MedPay is separate, delaying claims handling in injury-related cases.

#4 – Auto-Owners: Best for Add-Ons

Pros

- Rich Add-On Selection: Auto-Owners supports enhanced claims handling through optional coverages like diminished value, accident forgiveness, and rental car reimbursement.

- Exceptional Financial Strength: Auto-Owners’ A++ rating from A.M. Best secures timely claims handling even during disasters (Read More: Auto-Owners Review).

- Multi-Policy Savings: Up to 25% discount improves affordability while supporting multi-line claims handling coordination.

Cons

- No Digital Filing: Claims handling must begin with a call or agent visit, not digitally.

- Limited Coverage Availability: Drivers can only buy Auto-Owners insurance in 26 states, making out-of-state claims handling difficult.

#5 – American Family: Best for Fast Service

Pros

- FastTrack Program: American Family’s FastTrack system delivers 24-hour claims handling for qualifying auto incidents.

- Rental Reimbursement Add-On: Optional coverage provides same-day rental access in the event of claims handling delays.

- KnowYourDrive Discount: Save up to 20% while driving behavior data improves claims handling precision. See how discounts stack up in our AmFam Insurance review.

Cons

- Limited App Features: Claims handling lacks instant damage estimates and shop scheduling tools.

- Not in Every State: AmFam car insurance is only sold in 19 states, limiting out-of-state claims services if you’re traveling.

#6 – Geico: Best for Cost Savings

Pros

- Low Premium Access: Rates start below $50 per month while maintaining fast digital claims handling via photo tools.

- Multi-Car Discount: Save up to 25% while streamlining claims handling for families with multiple vehicles. Explore savings in our Geico insurance review.

- Superior Financial Rating: Geico’s A++ rating from A.M. Best supports uninterrupted claims handling under pressure.

Cons

- Limited Human Support: Digital claims handling lacks in-person adjusters in most regions.

- Rental Reimbursement Add-On: Not included by default, which may slow claims handling for transportation coverage.

#7 – Allstate: Best for Deductible Rewards

Pros

- Deductible Rewards: Earn $100 per year toward deductible reduction, lowering claims handling costs.

- Reliable Financial Support: Allstate’s A+ rating from A.M. Best ensures timely claims handling funding. See what makes it stand out in this Allstate insurance review.

- Drivewise Telematics: Offers up to 40% off and provides usage data that improves claims handling decision-making.

Cons

- Satisfaction Gaps: Its 693/1000 in J.D. Power’s claims handling ranking is below average, indicating inconsistent service.

- App Falls Short: No integrated adjuster communication or repair scheduling within the claims handling interface.

#8 – Travelers: Best for Discount Options

Pros

- IntelliDrive Discount: Up to 30% off with telematics that helps fast-track minor claims handling decisions. Start comparing plans with the Travelers auto insurance review.

- Decreasing Deductible: Drivers get $50 off every six months with no claims, easing the out-of-pocket burden during claims handling.

- Strongest Rating: Travelers’ A++ rating from A.M. Best ensures consistent and fast claims handling capacity.

Cons

- Weekend Gaps: Claims handling pauses on Saturdays and Sundays, causing brief processing delays.

- Limited Digital Tools: The mobile app lacks photo upload and real-time tracking features for claims handling.

#9 – Farmers: Best for Glass Coverage

Pros

- Glass Buyback Option: Lowers deductible to zero for windshield claims, reducing time in claims handling for repairs. Explore rates and features in our Farmers Insurance review.

- Financial Stability: Farmers’ A rating from A.M. Best supports dependable claims handling for liability and collision incidents.

- Signal Integration: Farmers’ app detects accidents in real time, speeding up claims handling and offering up to 15% off.

Cons

- Below Average Score: A 690/1000 score from J.D. Power reflects customer dissatisfaction with claims handling wait times.

- Limited Tracking: The app lacks step-by-step status updates in claims-handling cases.

#10 – Progressive: Best for Roadside Assistance

Pros

- Emergency Roadside Add-On: Optional 24/7 coverage integrates towing and trip interruption into claims handling. Take a closer look at add-ons in our Progressive review.

- Digital Claims Service: Policyholders can file a car insurance claim from the scene of the collision through the mobile app.

- Solid Financial Foundation: Progressive’s A+ rating from A.M. Best supports stable, long-term claims handling capacity.

Cons

- Mid-Level Satisfaction: Progressive is one of the lowest-ranking companies for claims satisfaction in J.D. Power surveys, falling 17 points below average with a 673/1000.

- High Deductibles: Collision claims handling often requires a deductible of $1,000 or more before repair work can begin.

Find the Most Reliable Provider for Your Claims

Finding a reliable insurer for claims isn’t just about who’s the cheapest. Liberty Mutual is one of the most expensive providers, but it has the highest claims satisfaction and customizable policies for new drivers and new cars.

At the same time, it backs every claim with an A financial rating, which means your payout won’t get stalled if disaster strikes.

You also want to look at how often companies actually pay out. State Farm keeps things steady with an 88% loss ratio despite handling tons of claims, while Liberty Mutual pays out more often at 97%, which could mean higher premiums later.

Other providers offer different perks. American Family, for example, offers same-day rental support and 24-hour turnaround times.

If you’re thinking about switching or just want better support when it’s time to file a claim, try our free quote tool to compare rates and find the best car insurance companies for claims handling that actually fit your needs.

Frequently Asked Questions

What car insurance handles claims the best?

State Farm, Liberty Mutual, and Nationwide are the best car insurance companies for claims handling. They offer fast processing, strong financial backing, and 24-hour services, including same-day rentals and agent support.

Which car insurance company is best in claim settlement?

State Farm stands out with an 88% loss ratio and over 19,000 agents nationwide, offering personal help and reliable claim payouts even during high-demand events.

Which auto insurance company denies the most claims?

While public data on denial rates is limited, companies with lower loss ratios like Geico (76%) may scrutinize claims more closely, especially for minor damage or non-injury incidents. If you’re shopping around or considering the best time to buy a new car, it’s smart to factor in how claim approvals could impact your experience later on.

What insurance company approves the most claims?

Liberty Mutual, with a 97% loss ratio, tends to pay out a high number of claims. However, this may result in higher premiums due to the risk-sharing arrangement.

Is Geico or Progressive better for claims?

Geico handles claims more efficiently with digital tools and a lower loss ratio, while Progressive offers roadside coverage and Snapshot discounts that can expedite the resolution of minor claims.

How do you get the most money from an auto insurance claim?

Document everything thoroughly, get independent repair estimates, and review your coverage closely, especially if you’re in what’s considered the worst state for filing insurance claims, where delays and denials may be more common. Coming prepared with detailed evidence can give you leverage when negotiating with the adjuster and help maximize your payout.

Is Geico auto insurance good at paying claims?

Yes, Geico has a strong A++ financial rating and digital tools that allow for photo uploads, but limited human support may slow down the processing of complex claims.

What are the worst auto insurance companies for paying claims?

Insurers with low J.D. Power satisfaction scores, such as Progressive and Farmers, may exhibit regional inconsistencies or delays in payments.

How many claims before State Farm drops you?

State Farm may take a closer look at your policy after two or more at-fault claims within a short span, though non-fault claims typically won’t have the same impact. If you’re trying to avoid future hikes, one of the best tips to pay less for car insurance is to drive cautiously and keep claims to a minimum.

Can you negotiate with a claims adjuster?

Yes, you can. Provide clear documentation,iand ndependent estimates, and be firm but polite. Adjusters expect negotiations, especially for total loss or medical claims.

How much does my insurance go up when I make a claim?

Is Geico or Allstate better for handling claims?

What is the difference between a claims rep and a claims adjuster?

What makes a car insurance carrier good for claims?

How do you choose a car insurance company that’s good for claims?

How long does the average car insurance claim take to process?

What can I do if I am experiencing trouble with my car insurance claim?

Can I switch car insurance companies while an open claim is pending?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.