Best Auto Insurance for Dodges in 2026

Erie, Liberty Mutual, and Nationwide have the best auto insurance for Dodges. Dodge car insurance starts at $48 a month, but drivers with more than one Dodge benefit from multi-vehicle discounts. Progressive and Travelers can customize Dodge insurance coverage with usage-based policies and accident forgiveness.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated February 2026

Find the best auto insurance for Dodges at Erie, Liberty Mutual, and Nationwide. Erie has the best cheap car insurance for Dodges at $48 a month.

- Erie offers reliable coverage and is the top pick for cheap Dodge insurance

- Dodge owners can find rates as low as $576 a year for minimum coverage

- Factors like model year and driving history impact Dodge insurance costs

Nationwide excels with flexible payment plans and competitive rates starting at $54 per month.

Liberty Mutual is more expensive, but policies are backed by high claims satisfaction and financial strength. Read More: Liberty Mutual vs. Nationwide Auto Insurance

Top 10 Companies: Best Auto Insurance for Dodges| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A | Cheapest Rates |

| #2 | 730 / 1,000 | A | Multi-Policies |

| #3 | 729 / 1,000 | A+ | Easy Payments | |

| #4 | 716 / 1,000 | A++ | Reliable Service | |

| #5 | 716 / 1,000 | A+ | AARP Benefits |

| #6 | 711 / 1,000 | A++ | Financial Strength | |

| #7 | 697 / 1,000 | A++ | National Availability | |

| #8 | 693 / 1,000 | A+ | Extensive Discounts | |

| #9 | 691 / 1,000 | A++ | Custom Plans | |

| #10 | 673 / 1,000 | A+ | Usage Based |

Dodge Charger insurance is the most expensive, while Dodge Caliber car insurance rates are often the cheapest, but comparing these top providers will help you find the best value.

Start comparing Dodge auto insurance rates now by entering your ZIP code into our free comparison tool today.

Finding Affordable Insurance for Dodge Drivers

Getting the best Dodge auto insurance means comparing both prices and discounts from top providers. Start with anonymous auto insurance quotes to see the average prices from providers in your area.

Erie, Geico, and State Farm are often the cheapest Dodge insurance companies, but you should compare multiple providers to find the best insurer based on your coverage needs, age, and driving record.

Comparing Dodge Premiums for Minimum vs. Full Coverage

Dodge insurance costs vary based on the coverage you choose. Minimum liability policies are the cheapest, but drivers who own or lease a Dodge model should consider full coverage. Our guide to liability vs. full coverage insurance explains the benefits of each.

Erie offers the lowest rates at $48 per month for minimum coverage and $140 monthly for full coverage, but it’s only available in 12 states.

Dodge Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $62 | $170 | |

| $55 | $150 | |

| $48 | $140 |

| $50 | $145 | |

| $66 | $175 |

| $54 | $148 | |

| $57 | $155 | |

| $52 | $150 | |

| $60 | $165 |

| $56 | $155 |

Companies with competitive rates across the country are State Farm and Geico vs. The Hartford and Liberty Mutual, which are on the higher end but offer additional benefits that justify the price.

For instance, Liberty Mutual costs almost $20 more per month than the cheapest providers, but it has higher claims ratings and flexible policies that Dodge drivers can customize.

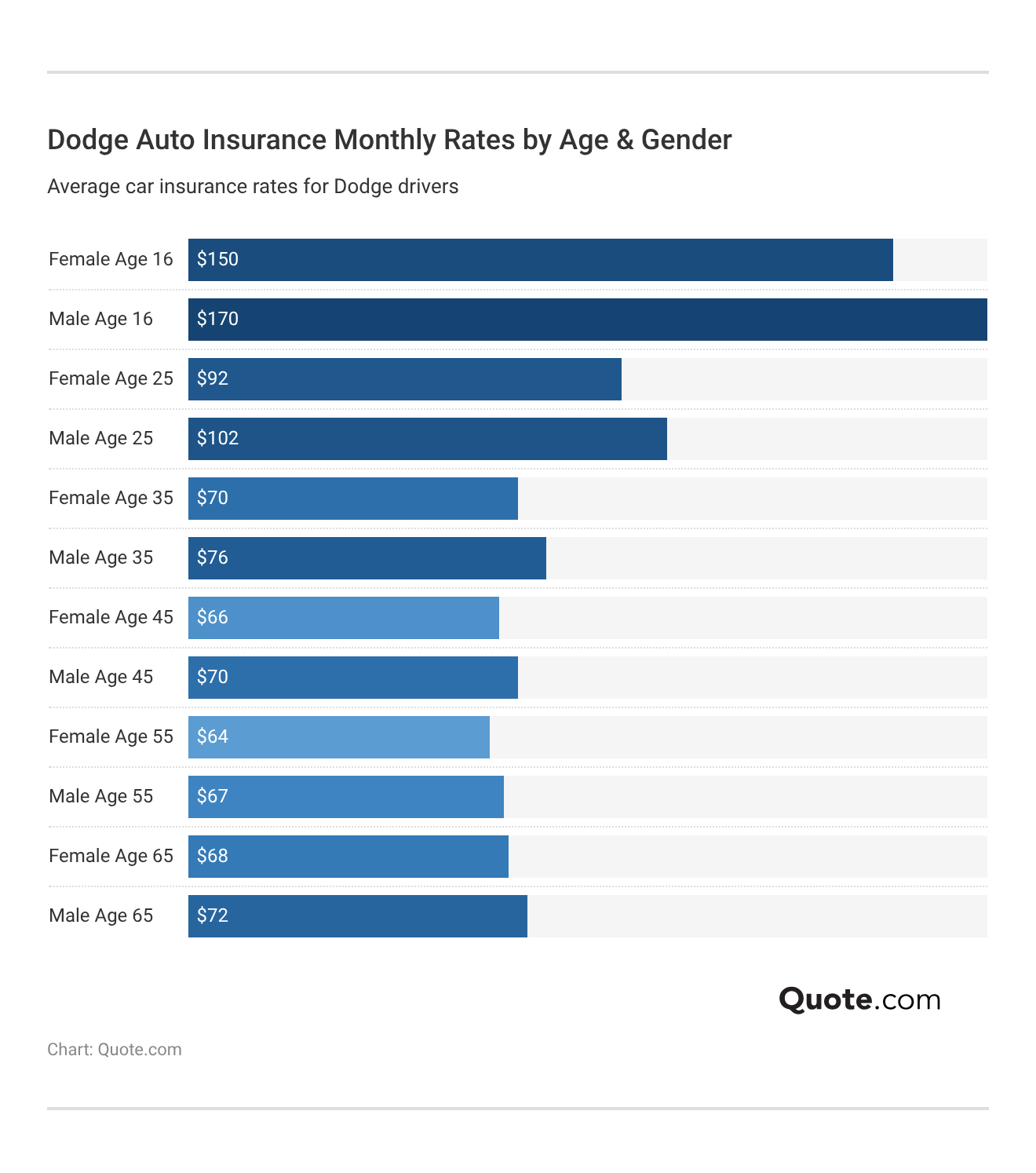

Dodge Car Insurance for Teens vs. Older Drivers

Dodge insurance costs are highest for teens and young drivers under 25. Dodge car insurance for 16-year-olds costs between $150 and $170 a month for minimum coverage.

Rates drop by 50% or more by the time drivers turn 35, averaging $70 per month for safe drivers.

Dodge drivers can get cheap auto insurance for teens with Nationwide, Travelers, and Progressive through usage-based plans that track habits and offer discounts for safe driving.

State Farm also offers online teen driver education programs and applies discounts to Dodge insurance policies once the course is completed.

Driving History & Dodge Insurance Costs

Dodge insurance premiums are largely influenced by driving history. For example, someone with a clean driving record is charged under $70 a month for minimum coverage, compared to a driver with an accident or DUI.

Dodge insurance with a DUI would increase to $145 per month, the highest compared to other Dodge drivers. Shop around to find cheap auto insurance after a DUI.

Dodge Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $62 | $105 | $136 | $87 | |

| $55 | $94 | $121 | $77 | |

| $48 | $82 | $106 | $67 |

| $50 | $85 | $110 | $70 | |

| $66 | $112 | $145 | $92 |

| $54 | $92 | $119 | $76 | |

| $57 | $97 | $125 | $80 | |

| $52 | $88 | $114 | $73 | |

| $60 | $102 | $132 | $84 |

| $56 | $95 | $123 | $78 |

Erie and Geico remain the cheapest Dodge insurance companies for high-risk drivers, keeping monthly rates under $100 after a speeding ticket or accident.

However, driving a sportier model will increase your rates. Dodge Charger and Dodge Challenger insurance rates can skyrocket after a citation due to the vehicles’ high speeds and high-risk classification.

Dodge Car Insurance for Different Models

Dodge auto insurance rates can vary widely depending on the model and the type of coverage you choose. The Dodge Neon is the cheapest to insure at $48 monthly, while Dodge Grand Caravan insurance remains competitive at $60 a month.

Drivers looking for affordable minimum coverage compare auto insurance rates by vehicle and often find the best deals with Dodge Caliber and Dodge Dart insurance.

Dodge Auto Insurance Monthly Rates by Model| Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Dodge Avenger | $54 | $140 |

| Dodge Caliber | $52 | $135 |

| Dodge Challenger | $90 | $200 |

| Dodge Charger | $85 | $190 |

| Dodge Dart | $50 | $130 |

| Dodge Durango | $80 | $180 |

| Dodge Grand Caravan | $60 | $155 |

| Dodge Hornet | $66 | $165 |

| Dodge Journey | $58 | $150 |

| Dodge Neon | $48 | $125 |

| Dodge Nitro | $62 | $160 |

| Dodge Ram | $75 | $175 |

| Dodge Viper | $95 | $215 |

If you’re insuring a Dodge truck or SUV, expect costs to be higher than insuring a sedan. Dodge Durango insurance rates average $80 a month, and Rams cost $75 a month for minimum and $175 monthly for full coverage.

However, Ram Trucks is now its own brand and no longer affiliated with Dodge Motor Company, which could impact premiums in your area.

Performance vehicles also come with higher full coverage costs, such as Dodge Charger insurance rates at $190 a month.

The Dodge Charger insurance classification as high-risk will increase your premiums, just like Dodge Avenger car insurance, because these vehicles are more likely to be involved in high-speed accidents or have expensive claims.

Dodge continues to specialize in muscle cars and SUVs, but Dodge Viper insurance and Dodge Durango car insurance will have higher rates due to their size and risk classification.

Zach Fagiano Licensed Insurance Broker

Maintaining a safe driving record and avoiding claims can keep insurance for Dodge Charger drivers affordable, and parking in a garage will reduce the risk of theft and lower full coverage rates.

The Dodge Challenger insurance cost is also high at $200 monthly due to its classification as a sports car, but safe drivers can earn discounts and qualify for usage-based policies that track driving habits rather than the brand’s reputation.

Learn More: Ultimate Guide on the Best Time to Buy a New Car

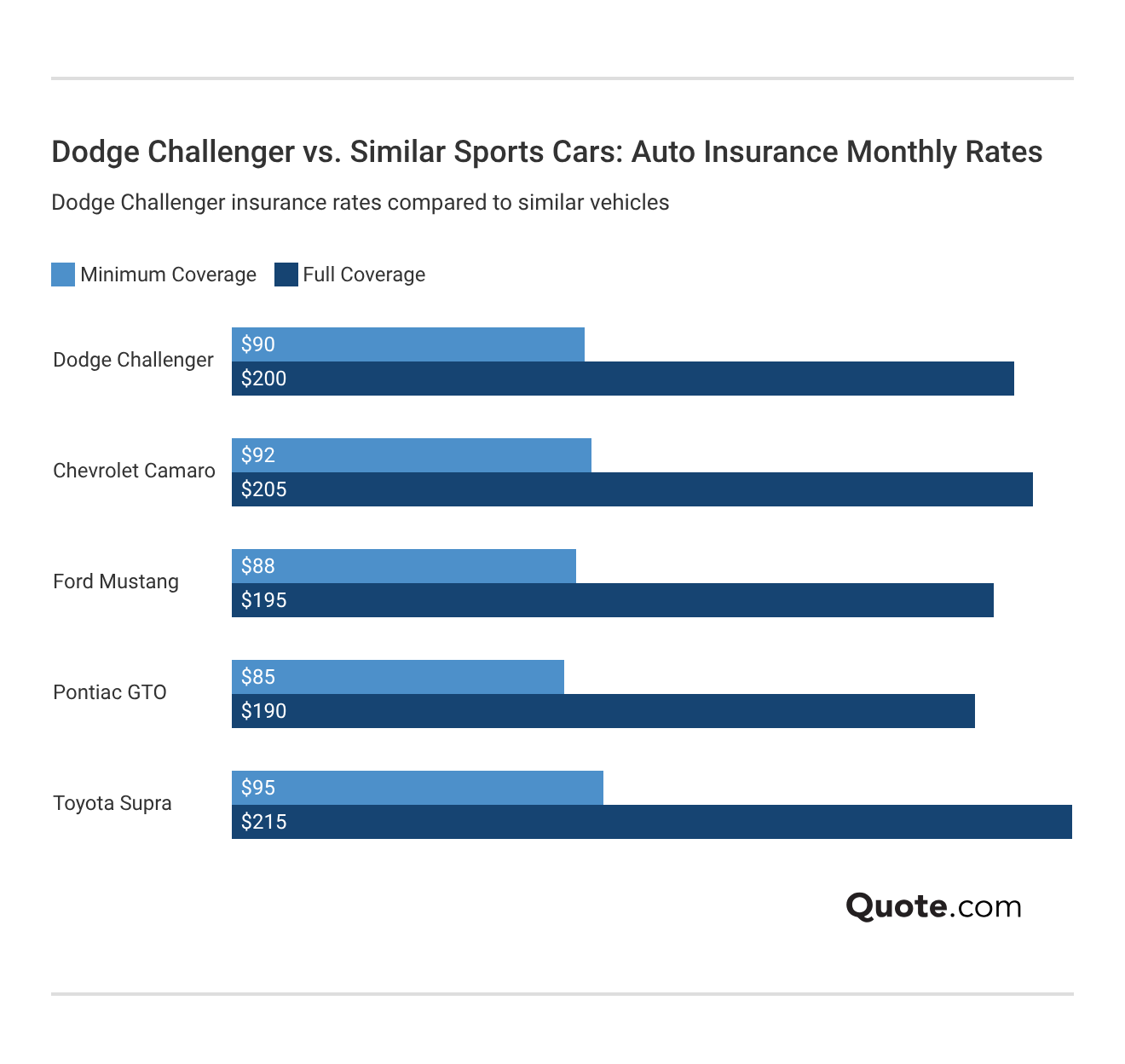

Dodge Challenger & Sports Car Premiums

If you want more affordable rates, picking a sports car like the Charger or Challenger will not be the cheapest option.

When it comes to insurance, Dodge Challenger drivers pay more than drivers with GTOs or Mustangs. Check Out: Best Auto Insurance for Fords

The Challenger is cheaper to insure than a Chevy Camaro or Toyota Supra, but it is one of the more expensive Dodges to insure.

Sports cars cost more to insure, not only because they’re high-performance vehicles and more likely to be involved in a crash, but also because parts are more expensive to repair or replace.

Some Dodge car insurance companies may require you to carry higher limits or add-ons for sports cars to protect your vehicle.

Compare average monthly rates across various companies to ensure you’re getting the Dodge coverage you need.

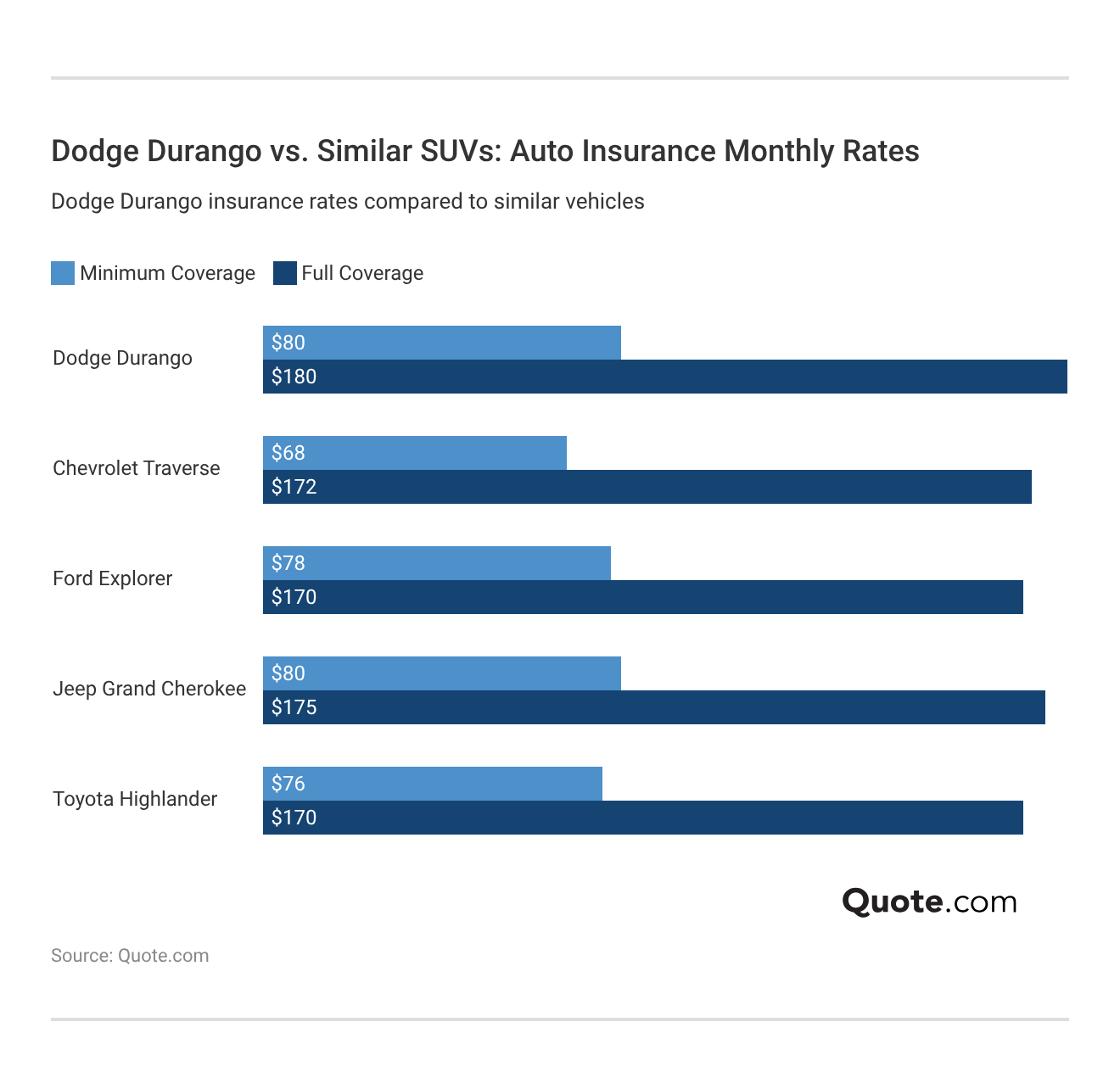

Dodge Durango & SUV Insurance

SUV insurance costs are higher than for sedans and almost as pricey as sports car insurance. These vehicles aren’t designed for speed, but they do cost more to repair, which raises your premiums.

If you drive a Dodge Durango, you’re paying more for insurance than Toyota or Chevy drivers.

Dodge Durangos and Jeep Cherokees are two of the more expensive SUVs to insure. Learn More: Best Auto Insurance for Jeeps

To lower your Dodge insurance rates, maintain a clean driving record and avoid filing claims. If you can prove you’re a good driver, insurance companies will discount your SUV premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Coverage for Your Dodge

The type of policy you choose will affect the monthly cost of Dodge insurance. The cheapest type is basic liability, which meets the minimum auto insurance requirements in each state and can sometimes include uninsured motorist and personal injury coverage.

If you want even more protection, full coverage insurance combines comprehensive and collision insurance to cover accidents and damage to your Dodge not caused by collisions, such as vandalism or animal damage.

Full coverage is recommended for new Dodges, and you’ll want to carry higher limits if you’re buying Dodge Challenger or Dodge Nitro car insurance, since sports cars require extra levels of coverage.

New Dodges also need gap insurance, which covers what’s left on an auto loan if your car is totaled in a collision. Gap plans aren’t available with every Dodge auto insurance company, so shop around for the policies you need.

Dodge Auto Insurance Coverage Options by Provider| Company | Claim Forgiveness | Custom Parts | Gap Plans | Rideshare Coverage |

|---|---|---|---|---|

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ❌ |

| ❌ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ❌ | ❌ |

| ❌ | ✅ | ❌ | ❌ | |

| ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ❌ | ✅ | |

| ❌ | ❌ | ✅ | ❌ |

| ✅ | ✅ | ✅ | ✅ |

Allstate, Auto-Owners, and Travelers are the only top Dodge auto insurance companies that offer most coverage plans. Rates average over $150 a month for full coverage with these providers. Erie and Geico are the cheapest but lack many popular policies.

Choosing specialized options, such as custom parts protection or rideshare insurance, will impact your rate but are often necessary if you’ve added aftermarket parts or use your Dodge for work.

Learn More: How to Buy Auto Insurance

How to Save on Dodge Insurance Costs

When it comes to insuring your Dodge, there are several strategies that can significantly reduce your premiums.

Discounts offered by major insurers can help lower the cost of Dodge auto insurance. Read More: Car Insurance Discounts You Can’t Miss

Top Auto Insurance Discounts for Dodge Drivers by ProviderCompany | Bundling | Good Driver | Safety Features | Usage Based |

|---|---|---|---|---|

| 25% | 25% | 20% | 30% | |

| 16% | 25% | 18% | 30% | |

| 25% | 23% | 10% | 30% |

| 25% | 26% | 15% | 25% | |

| 25% | 20% | 12% | 30% |

| 20% | 40% | 18% | 40% | |

| 10% | 30% | 10% | $231/yr | |

| 17% | 25% | 20% | 30% | |

| 5% | 15% | 15% | 20% |

| 13% | 10% | 13% | 30% |

These include savings for bundling policies, maintaining a clean driving record, being a good student, and participating in usage-based insurance programs.

Beyond discounts, using the best tips to pay less for car insurance, like adjusting your coverage and driving habits, can further reduce what you pay for Dodge auto insurance. Here are a few simple ways to cut costs:

- Increase Deductibles: Raising your deductible lowers monthly premiums. This is a cost-effective option for safe drivers who avoid claims.

- Maintain a Clean Driving Record: Avoid accidents or traffic violations to lower premiums. Some insurers offer additional discounts for completing defensive driving courses.

- Pay Annually: Paying premiums in full annually rather than monthly can save money by avoiding processing fees and interest charges

- Utilize Vehicle Safety Features: If your Dodge has anti-theft devices, airbags, or anti-lock brakes, you may be eligible for discounts for reducing the risk of accidents or theft.

Using a combination of provider discounts and personal strategies can significantly reduce the cost of insuring your Dodge.

Always compare quotes and tailor your policy to match your driving needs for the best possible value.

Don’t just look at the price. Make sure the discounts you qualify for actually align with your driving profile and vehicle features.

Maria Hanson Insurance and Finance Expert

Usage-based programs like Progressive’s Snapshot and Travelers’ IntelliDrive help tech-savvy drivers save more. AARP membership benefits from The Hartford, or teen driver monitoring from Auto-Owners, can also help lower rates.

Staying proactive about your coverage, regularly reviewing your options, and keeping up with available discounts ensures you’re always getting the most for your money.

The Best Dodge Auto Insurance Companies

State Farm, Geico, and Progressive are the largest Dodge car insurance companies. They’re also the most affordable after Erie, which is part of why they’re so popular.

Allstate is also popular for its competitive discounts, offering some of the biggest savings on bundling and multi-vehicle policies.

USAA rounds out the top five with the best auto insurance for military and veterans who drive Dodges.

But finding the best auto insurance for Dodges involves more than price. Erie, Liberty Mutual, and Nationwide have higher claims satisfaction compared to many of the largest and cheapest companies.

Compare Now: State Farm vs. Farmers, Geico, Progressive, and Allstate Auto Insurance

#1 – Erie: Top Pick Overall

Pros

- Customer Satisfaction: Erie has the highest claim satisfaction in the country when it comes to Dodge auto insurance claims and policy changes.

- Affordable Rates: Erie is known for having the cheapest Dodge auto insurance at $48 a month. Compare more quotes in our Erie car insurance review.

- Multi-Policy Discount: Dodge owners can save up to 25% when they bundle their auto and home insurance policies with Erie.

Cons

- Limited Availability: Erie is available in only 12 states, limiting access for some Dodge owners who may not be in the service area.

- Fewer Digital Services: Since it’s a regional provider, Erie’s website and mobile app aren’t as streamlined as national providers like Progressive or Geico.

#2 – Liberty Mutual: Best for Multiple Policies

Pros

- Multi-Policy Discounts: Get up to 25% off Dodge insurance costs when bundling home and auto insurance. See More: Liberty Mutual Insurance Review

- Strong Online Tools: It provides excellent online tools to manage your Dodge insurance policy and file claims.

- Customizable Coverage: Liberty Mutual offers a variety of add-ons and customization options, ensuring the best Dodge auto insurance for drivers who need specific coverage.

Cons

- Higher Premiums for Younger Drivers: Liberty Mutual’s rates tend to be higher for younger drivers or those with a less-than-perfect driving history.

- Limited Physical Locations: Fewer local offices may limit personal interaction for those seeking direct help with their best Dodge auto insurance needs.

#3 – Nationwide: Best for Easy Payments

Pros

- Flexible Payment Plans: Our Nationwide insurance review explores a range of payment options to help Dodge owners find a plan that suits their budget.

- Usage-Based Discounts: Nationwide SmartRide and SmartMiles can save Dodge owners up to 40% by basing rates only on their driving habits and mileage.

- Bundling Benefits: Nationwide provides 20% discounts for bundling auto and home insurance policies.

Cons

- Expensive Premiums for High-Risk Drivers: Nationwide’s premiums can be on the higher side for Dodge drivers with poor driving histories.

- Limited Coverage in Some States: In some regions, Nationwide may not offer all coverage options, limiting choices for Dodge owners in those areas.

#4 – State Farm: Best for Reliable Support

Pros

- Local Agent Networks: State Farm has auto insurance agents in every state who provide personalized service to help drivers customize their Dodge insurance policies.

- High Claims Satisfaction: State Farm has an above-average claims rating from J.D. Power, reflecting fast payouts and fair settlements for many Dodge owners.

- Bundling Discounts: Enjoy up to a 17% discount when you bundle policies, making State Farm an affordable option for Dodge owners who also need home or life insurance.

Cons

- Limited Customization: Some states have fewer policy customization options for Dodge owners. Use our State Farm review to find policies in your area.

- Limited Availability: State Farm is known for not renewing auto insurance policies in high-risk states like California, Florida, Rhode Island, and Massachusetts.

#5 – The Hartford: Best for AARP Benefits

Pros

- Benefits for Senior Drivers: The Hartford’s partnership with AARP provides exclusive benefits and discounts for senior drivers who need cheap Dodge insurance.

- Strong Reputation: With an A+ rating from A.M. Best, The Hartford is known for its reliability and strong claims support for Dodge owners.

- Guaranteed Repairs: The Hartford guarantees repairs for the life of the auto loan or lease for Dodge drivers with gap coverage. See More: The Hartford Insurance Review

Cons

- Not Available to Non-AARP Members: Only seniors with an AARP membership and their families are eligible to buy Dodge auto insurance from The Hartford.

- Less Flexibility in Customization: The Hartford offers fewer customization options compared to other Dodge insurance providers.

#6 – Auto-Owners: Best for Financial Strength

Pros

- Excellent Financial Strength: With an A++ rating from A.M. Best, Auto-Owners provides strong financial stability for paying Dodge insurance claims.

- Strong Claims Service: As per our Auto-Owners insurance review, the company is known for its reliable and efficient claims process.

- Affordable Coverage Options: Auto-Owners offers competitive Dodge auto insurance rates, starting at $53 per month, making it a solid choice for affordable coverage.

Cons

- Limited Availability: Auto-Owners is only available in certain states, limiting access to the best car insurance for Dodges.

- Fewer Discounts: Although it has cheaper rates, Auto-Owners doesn’t offer as many discounts as other Dodge auto insurance companies.

#7 – Geico: Best for Nationwide Availability

Pros

- Nationwide Availability: Geico operates throughout the U.S., offering the best auto insurance for Dodges coast to coast.

- User-Friendly App: Geico’s mobile app makes buying a Dodge insurance policy and claims handling easy. See how it works in our Geico car insurance review.

- Affordable Rates: Geico offers competitive Dodge car insurance rates, with minimum premiums starting at $50 a month.

Cons

- Online-Only Support: Geico’s limited physical agent presence can be a drawback for drivers who prefer in-person assistance for their Dodge insurance needs.

- Basic Coverage Options: Geico offers basic Dodge insurance plans, which may not be as customizable as those of other providers.

#8 – Allstate: Best for Extensive Discounts

Pros

- Multiple Discounts: It offers big discounts on Dodge auto insurance, including 25% off for bundling policies. Get a full list in our Allstate insurance review.

- Customizable Coverage: With a range of coverage options, Allstate allows Dodge owners to tailor their policies for maximum protection and savings.

- Claims Satisfaction: Allstate is known for its dependable claims process and is rated A+ by A.M. Best, offering peace of mind for those who need to file Dodge insurance claims.

Cons

- Expensive Premiums: Dodge insurance premiums can be higher with Allstate, especially for younger drivers or those without a clean driving record.

- Limited Discounts for Some Drivers: Certain Dodge models or drivers may not be eligible for the full range of Allstate’s discounts, which can reduce savings potential.

#9 – Travelers: Best for Custom Plans

Pros

- Customizable Policies: Travelers offers a range of add-ons and endorsements on Dodge insurance policies. Check out coverage options in our Travelers insurance review.

- Industry Experience: With an A++ A.M. Best rating and over 100 years in the insurance industry, Travelers is one of the most reliable Dodge car insurance companies.

- Sage-Based Savings: With the IntelliDrive program, Travelers offers discounts based on driving habits, rewarding safe drivers with lower Dodge auto insurance rates.

Cons

- Limited Local Agent Access: Travelers offers fewer local agents, which might be inconvenient for those who prefer face-to-face service for their Dodge insurance.

- Claims Process Delays: Some customers have reported slow processing of claims, which could be a concern for those in need of quick assistance.

#10 – Progressive: Best for Usage-Based Plans

Pros

- Snapshot Program: Progressive Snapshot usage-based insurance allows drivers to track their driving habits for potential Dodge auto insurance discounts.

- Free Online Tools: Dodge drivers on a budget can use the Name Your Price Tool on Progressive’s website to find more affordable coverage, starting at $55 a month.

- Automatic Accident Forgiveness: Drivers with clean records have free small accident forgiveness automatically added to their Dodge policies when they switch to Progressive.

Cons

- Variable Premiums: Rates can fluctuate based on your driving history, potentially resulting in higher costs for Dodge owners with prior incidents or claims.

- Claims Experience: Some users report delays and dissatisfaction with Progressive’s claims process. Read More: Progressive Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Where to Buy Car Insurance for Dodges

If you’re looking for the best auto insurance for Dodges, State Farm is a great choice for reliable coverage.

Erie, Liberty Mutual, and Nationwide offer excellent claims service, competitive discounts, and flexible payment plans with unique coverage options for newer Dodge models.

Dodge auto insurance rates are influenced by several factors, including age, driving history, and the model. Monthly premiums can start as low as $48 for minimum coverage.

However, younger drivers and those with DUIs typically pay significantly more. Take advantage of discounts for safe driving, bundling, or usage-based programs to get cheap auto insurance for high-risk drivers.

By comparing quotes from top providers, drivers can find the best car insurance for Dodges. Get the lowest rates and the best auto insurance for your Dodge vehicle by entering your ZIP code into our comparison tool today.

Frequently Asked Questions

Who has the best car insurance for Dodges?

Erie, Liberty Mutual, and Nationwide are the top three Dodge insurance companies for claims satisfaction and affordable coverage. Dodge drivers over 65 may also like to shop with The Hartford for exclusive AARP discounts. Compare auto insurance companies to find the best rates and coverage in your area.

How much is Dodge car insurance?

Monthly rates range from $48 to $175, depending on the provider and level of coverage. Your Dodge car insurance cost also varies by model, with Dodge Charger car insurance at $190 a month for full coverage compared to a Dodge Caliber at $135 monthly.

How can I save money on Dodge auto insurance?

Consider bundling policies, maintaining a clean driving record, and increasing your deductible. The best way to get cheap Dodge auto insurance is to compare quotes from multiple providers. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Are Dodges more expensive to insure?

Yes. Sports models like the Dodge Charger or Challenger typically have higher premiums due to their performance capabilities, while more economical models like the Dodge Dart may be less expensive to insure.

What is the cheapest Dodge to insure?

The Dodge Neon has the lowest insurance rates, averaging $48 per month for minimum coverage. It’s the most affordable option for drivers seeking cheap Dodge car insurance.

Read More: Ways You’re Wasting Money on Your Car

How much is insurance for a Dodge Challenger?

Insurance for a Dodge Challenger typically costs $90 per month for basic coverage and $200 for full coverage, which is higher than average. You can budget your Dodge Challenger insurance cost monthly instead of paying in full, and earn autopay discounts to help cut costs.

Why is Dodge Challenger insurance so high?

The steep Dodge Challenger insurance price is due to its high-risk classification as a sports car. High-performance vehicles are more likely to be involved in accidents, but car insurance for Dodge Challenger drivers with clean records or usage-based insurance plans will be cheaper.

How much is Dodge Journey car insurance?

Dodge Journey insurance rates average between $58 a month for minimum coverage and $150 monthly for full coverage.

Is the Dodge Dart considered a sports car for insurance?

No. As a compact sedan, it comes with some of the cheaper premiums. The average Dodge Dart insurance cost starts at $50 a month, although sportier trims or customized parts could raise your rates.

How much is insurance for a Dodge Charger?

How much does Dodge Charger insurance cost? Dodge Charger car insurance has some of the highest rates at $85 a month for minimum coverage and $190 for full coverage. Maintain a clean driving record to get better rates.

Is a Dodge Charger considered a sports car?

Will my insurance go up if I buy a Dodge Charger?

What is the best auto insurance for a Dodge Charger?

Is Dodge offering car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.