Best Auto Insurance for Fords in 2026

Erie, Liberty Mutual, and Nationwide offer the best auto insurance for Fords. Ford insurance rates start at $65 per month, but low-mileage drivers can get even better premiums with pay-as-you-go policies. Ford drivers should consider OEM coverage and accident forgiveness for newer, sports, or hybrid/EV models.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated February 2026

The best auto insurance for Fords comes from Erie, Liberty Mutual, and Nationwide. Erie has the highest claims satisfaction and cheap Ford car insurance at $65 a month.

- Erie and Liberty Mutual have the highest Ford insurance claim satisfaction

- Liberty Mutual gives the biggest anti-theft discount of 35%

- Nationwide offers the best usage-based discount of up to 40%

Nationwide is the best pick for those who drive their Fords less than 10,000 miles a year. You can get 40% off through Nationwide SmartMiles pay-per-mile insurance.

Liberty Mutual is in the top three for its accident forgiveness, which is ideal for drivers of newer or financed Ford models. Compare companies now in our guide: Liberty Mutual vs. Nationwide Auto Insurance

Top 10 Companies: Best Auto Insurance for Fords| Company | Rank | Claim Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 743 / 1,000 | A | Filing Claims |

| #2 | 730 / 1,000 | A | Accident Forgiveness |

| #3 | 729 / 1,000 | A+ | Low Mileage | |

| #4 | 716 / 1,000 | A+ | Customer Service | |

| #5 | 716 / 1,000 | A+ | AARP Benefits |

| #6 | 702 / 1,000 | A | Loyalty Rewards |

| #7 | 697 / 1,000 | A++ | Various Discounts | |

| #8 | 693 / 1,000 | A+ | Safe Drivers | |

| #9 | 691 / 1,000 | A++ | EVs & Hybrids | |

| #10 | 673 / 1,000 | A+ | Usage-Based Discounts |

Insurance for a Ford Mustang and the F-series trucks will have the highest rates, while Ford Fiesta and Ford Escape car insurance is the most affordable.

You can find the best Ford auto insurance no matter what model you drive by entering your ZIP code into our free quote comparison tool.

Comparing Ford Car Insurance Rates

Ford insurance costs can vary widely based on your coverage level, provider, and the model you drive.

Drivers get the best cheap Ford car insurance with Erie, Geico, and Travelers. Read More: Erie vs. MetLife Insurance

Prices for Minimum & Full Coverage Ford Policies

Choosing minimum liability coverage will get you the cheapest Ford insurance quote, but full coverage offers more protection for newer or higher-value Fords, especially hybrid models.

Erie stands out as the most affordable Ford insurance company, with minimum coverage starting at $65 per month and full coverage at $140 monthly.

Ford Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $85 | $175 | |

| $76 | $165 |

| $65 | $140 |

| $69 | $150 | |

| $78 | $169 |

| $74 | $160 | |

| $72 | $158 | |

| $71 | $152 | |

| $79 | $170 |

| $70 | $155 |

Geico and Travelers follow closely, offering minimum rates at $69 and $70 a month, and full coverage for under $160 per month.

On the flip side, when comparing Geico vs. The Hartford and Allstate, the latter are among the most expensive options. Monthly minimum rates reach $85, and full coverage goes over $170 monthly. Get More Details: Allstate vs. Geico Auto Insurance

Ford drivers should check limits, deductibles, and extras like roadside or rental coverage to make sure their policy fits their needs and budget.

Daniel Walker Licensed Insurance Agent

Your Ford auto insurance quote could be higher or lower based on the type of policy you need and your driving history.

Ford insurance rates climb for drivers with accidents or claims, so compare quotes after an incident to make sure you aren’t overpaying for coverage.

How Driving History Impacts Auto Insurance for Fords

If you want the cheapest car insurance for Ford drivers, maintain a safe driving record and avoid filing collision claims.

One speeding ticket can increase monthly rates by over $30 with most companies, while an accident jumps costs by $50 per month.

Ford Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $85 | $119 | $145 | $187 | |

| $76 | $106 | $129 | $167 |

| $68 | $91 | $111 | $143 |

| $69 | $97 | $117 | $152 | |

| $78 | $109 | $133 | $172 |

| $74 | $104 | $126 | $163 | |

| $72 | $101 | $122 | $158 | |

| $71 | $99 | $121 | $156 | |

| $79 | $111 | $134 | $174 |

| $70 | $98 | $119 | $154 |

When comparing top companies, Nationwide vs. Erie, Erie remains the best choice for cheap auto insurance for high-risk drivers. Geico, State Farm, Progressive, and Travelers are also affordable options.

Driving a reliable Ford model can also lower rates. Ford insurance companies will offset higher rates if you drive a model proven to perform well in safety tests.

Ford Taurus car insurance remains affordable for high-risk drivers thanks to its high safety ratings.

Ford Focus car insurance and Ford Fusion insurance rates are also competitive for drivers with accidents, thanks to the vehicles’ crash safety performance in IIHS tests.

Learn More: What does the Insurance Institute for Highway Safety (IIHS) do?

How the Model You Drive Affects Ford Insurance

Model type also plays a major role in what you’ll pay. Ford Escape insurance rates start at $70 per month for minimum coverage, while a Ford F-150 averages $88 monthly for the same policy.

Monthly Ford Fusion car insurance and Ford Focus insurance rates are $70 or less a month because these smaller models are safer on the road and cheaper to repair if you do file a claim.

Ford Mustang and Ford Ranger insurance rates are higher at $80-$82 per month, climbing to $185 a month for full coverage because repairs and replacement parts cost more for these sports models.

Ford Auto Insurance Monthly Rates by Model| Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Ford Bronco | $82 | $185 |

| Ford C-Max | $68 | $150 |

| Ford Crown Victoria | $72 | $160 |

| Ford Edge | $74 | $165 |

| Ford Escape | $70 | $155 |

| Ford Escape Hybrid | $75 | $168 |

| Ford Expedition | $85 | $190 |

| Ford Explorer | $78 | $170 |

| Ford F-150 | $88 | $195 |

| Ford F-250 | $92 | $205 |

| Ford F-350 | $95 | $215 |

| Ford F-450 | $105 | $235 |

| Ford Fiesta | $66 | $145 |

| Ford Flex | $73 | $165 |

| Ford Focus | $68 | $150 |

| Ford Fusion | $70 | $155 |

| Ford Maverick | $78 | $175 |

| Ford Mustang | $80 | $185 |

| Ford Mustang Mach-E | $90 | $210 |

| Ford Ranger | $82 | $185 |

| Ford Taurus | $76 | $168 |

| Ford Transit | $88 | $195 |

Hybrids and electric Fords often cost more to insure due to higher repair costs. The average insurance cost for Ford Escape drivers goes up by $5 or more a month for the hybrid model.

Ford C-Max insurance costs less per month than Ford C-Max hybrid car insurance, and Ford Fusion hybrid car insurance is also higher, but top companies like Travelers offer electric vehicle (EV) insurance discounts to lower rates.

Ford Explorer Insurance Rates Against Similar Vehicles

Larger vehicles, such as the Ford F-Series and Ford Expedition, carry higher premiums. Compare the best auto insurance for trucks to get better rates.

Ford Explorer insurance is also on the higher end at $170 monthly for full coverage, but still cheaper to insure than a Jeep Grand Cherokee.

Ford Explorer vs. Similar SUVs: Auto Insurance Monthly Rates| Vehicle | Minimum Coverage | Full Coverage |

|---|---|---|

| Ford Explorer | $78 | $170 |

| Chevrolet Traverse | $76 | $168 |

| Dodge Durango | $82 | $178 |

| Honda Pilot | $75 | $165 |

| Hyundai Santa Fe | $72 | $158 |

| Jeep Grand Cherokee | $80 | $175 |

| Kia Telluride | $77 | $170 |

| Nissan Pathfinder | $74 | $162 |

| Toyota Highlander | $76 | $168 |

| Volkswagen Atlas | $79 | $172 |

Ford car insurance reviews often list higher rates for these big models because of the damage they cause in accidents.

Comparing multiple companies by both coverage options and coverage costs by vehicle is key to finding the best deal on Ford car insurance.

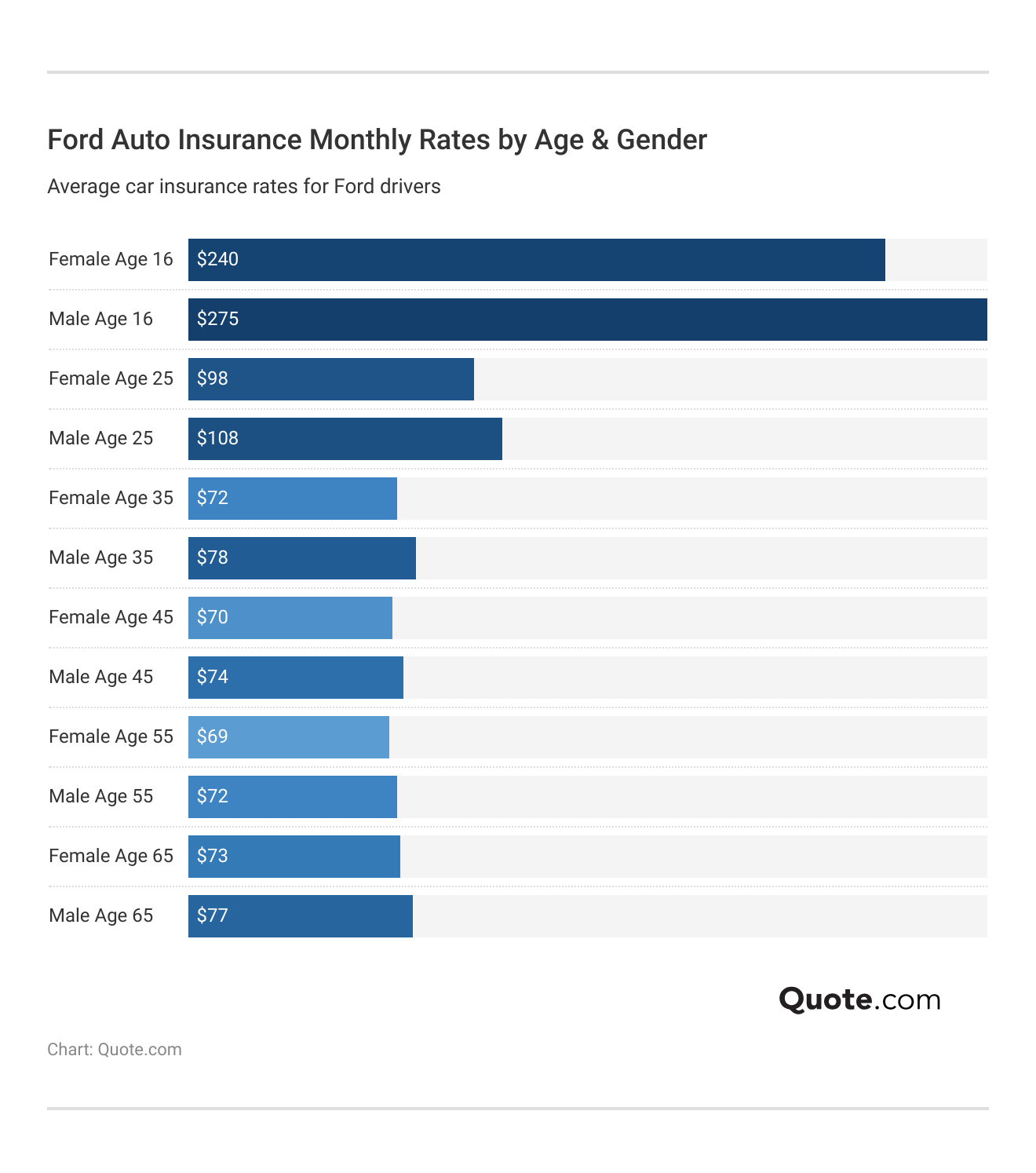

How Ford Insurance Premiums Change With Age

Ford car insurance companies use driver age and gender to assess risk. Teens pay the most because their limited time behind the wheel means insurers expect more claims.

Men under 25 pay the most for Ford auto insurance, and driving a risky model like the Mustang could send monthly minimum coverage rates to $200 or higher.

Monthly premiums drop by half by the time drivers turn 25, and experienced drivers in their 40s and 50s have the cheapest Ford auto insurance rates.

Keeping a clean driving record and avoiding claims will keep Ford auto insurance rates affordable for teens. Compare Now: Cheap Auto Insurance for Teens

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance Coverage Options for Ford Owners

Whether you drive a Ford sedan, SUV, or pickup truck, understanding your coverage options can help you choose a policy that fits your needs and budget.

Each Ford model has different insurance needs. Full coverage is highly recommended for newer or higher-value models, while older Fords may only need liability.

- Collision & Comprehensive Coverage: Pays to repair or replace your Ford if it’s damaged in an accident, theft, vandalism, weather, or fire.

- Full Coverage Insurance: Includes liability, collision, and comprehensive insurance, plus PIP and MedPay if those are required in your state.

- Liability Coverage: Required in most states, it covers damages and injuries you cause to others while driving your Ford.

- Medical Payments (MedPay): Pays the medical bills for you and your passengers up to the policy limit, regardless of who’s at fault for the accident.

- Personal Injury Protection (PIP): Covers medical bills, lost wages, and some household costs while you recover after a claim, no matter who is at fault.

Depending on where you live, state laws can also require uninsured/underinsured motorist coverage, which kicks in if your Ford is hit by a driver with little or no insurance.

Be sure to tailor your policy with add-ons that cater to your vehicle’s age, value, and how often you drive. You may want to add rental reimbursement or roadside assistance.

Important Details: What to Do When You’re Denied Insurance Coverage

Recommended Policy Add-Ons for Fords

Beyond basic liability and full coverage, several optional add-ons provide extra protection for Ford drivers. Add-ons may increase your premium slightly, but they can save you significantly more in the long run.

Top providers offer helpful add-ons like roadside assistance for towing and gas delivery. Accident forgiveness is a popular choice that prevents your premium from increasing after your first at-fault accident.

Ford Auto Insurance Add-On Coverage Options| Company | Gap Plans | New Car Replacement | OEM Parts | Rideshare |

|---|---|---|---|---|

| ✅ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | ✅ |

| ✅ | ❌ | ✅ | ❌ |

| ❌ | ❌ | ✅ | ✅ | |

| ❌ | ✅ | ✅ | ❌ |

| ❌ | ✅ | ✅ | ❌ | |

| ✅ | ❌ | ✅ | ✅ | |

| ❌ | ❌ | ✅ | ✅ | |

| ❌ | ✅ | ❌ | ❌ |

| ✅ | ✅ | ❌ | ✅ |

New car replacement ensures that if your newer Ford is totaled, your insurer pays for a brand-new model rather than the depreciated value.

Gap insurance is another valuable option, especially if you’re financing or leasing your Ford. It covers the difference between what your car is worth and what you still owe if it’s totaled.

If you drive a newer Ford or have a loan, consider add-ons like gap insurance or new car replacement to avoid out-of-pocket losses after a total loss.

Heidi Mertlich Licensed Insurance Agent

OEM parts coverage ensures repairs are made with original manufacturer parts, preserving the quality and value of your Ford.

For added convenience, roadside assistance provides help with flat tires, dead batteries, and towing, while rental reimbursement pays for a temporary vehicle if your Ford is in the shop after a covered claim.

How Ford Drivers Save Money on Insurance

Ford drivers can unlock significant savings by taking advantage of the right discounts. Nationwide stands out with some of the most generous offers.

Nationwide provides up to 40% off for good drivers through usage-based insurance (UBI) programs like SmartRide, and pay-per-mile insurance through SmartMiles, which is ideal for Ford owners who don’t drive often.

Top Auto Insurance Discounts for Ford Drivers by Provider| Company | Anti-Theft | Good Driver | Multi-Policy | Usage Based |

|---|---|---|---|---|

| 10% | 25% | 25% | 40% | |

| 25% | 25% | 25% | 20% |

| 15% | 23% | 25% | 30% |

| 25% | 26% | 25% | 25% | |

| 35% | 20% | 25% | 30% |

| 5% | 40% | 20% | 40% | |

| 25% | 30% | 10% | $231/yr | |

| 15% | 25% | 17% | 30% | |

| 10% | 15% | 5% | 20% |

| 15% | 10% | 13% | 30% |

Erie also offers competitive UBI discounts up to 30% for safe drivers. Progressive’s Snapshot program is another standout, giving Ford drivers up to 30% off for safe driving, with an average annual savings of $231.

Liberty Mutual offers up to 30% off with usage-based insurance for Ford owners and the highest anti-theft discount at 35%, which is especially beneficial for newer Ford models equipped with factory-installed security systems.

What we learned analyzing insurance companies is that discounts aren’t the only way to save. Cost-saving strategies can quickly lower your Ford insurance costs with a few policy changes.

Try out these tricks to lock in the best cheap Ford auto insurance, no matter your age or driving record:

- Get Good Grades: Students under 25 with a B average or better can qualify for savings up to 25%. AmFam and State Farm offer packages for students and young drivers.

- Increase Deductibles: Increasing your Ford insurance deductible from $500 to $1,000 can cut 8%-15% off your annual premiums.

- Reduce Coverage: If your Ford is over 10 years old, dropping full coverage for liability-only can shave 70% your rates.

- Take a Defensive Driving Class: Defensive driving classes, online or in-person, can reduce your risk as a driver and help lower your rates over time, especially for teens.

Compare multiple companies based on your Ford model, driving history, and coverage needs. Your actual savings may be higher or lower when you compare multiple quotes.

Overall, Ford drivers should compare quotes carefully and combine multiple discounts, like bundling, usage-based, and safe driving incentives, for the biggest savings.

The Best Ford Auto Insurance Companies

Erie, Liberty Mutual, and Nationwide have the best auto insurance for Fords, especially drivers with new models looking for new car replacement and accident forgiveness.

State Farm also stands out as the largest Ford insurance company. Its national network of local agents provides tailored service for Ford drivers, and full coverage starts as low as $152 a month.

Geico and Progressive are also popular providers for their low rates, but Erie and Liberty Mutual have better customer satisfaction ratings and policy options. Learn More: Auto Insurance Rates by State

Although not featured on this list, drivers may want to compare a Ford Insure car insurance quote. Ford Insure is available through Ford Motor Company and designs policies with FordPass integration and exclusive OEM parts packages for Ford-specific repairs.

Scroll through the top ten Ford auto insurance companies to find the best provider for your car or truck.

#1 – Erie: Top Pick Overall

Pros

- Lowest Rates: Erie offers the cheapest Ford insurance, with minimum coverage starting at $65 a month and full coverage at $140 a month.

- Policy Options: Ford insurance policy features include pet injury protection, accident forgiveness, and rate lock. Our Erie Insurance review gives a full list of options.

- Claims Satisfaction: Erie has the highest claims and customer satisfaction ratings among Ford drivers.

Cons

- Not Tech-Savvy: Erie’s website and mobile tools lack the features found in other insurers, which may frustrate tech-savvy Ford drivers.

- Limited Access: Erie is not available in every state, which may prevent some Ford owners from accessing its low rates and strong customer service.

#2 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Claim-Free Rewards: Liberty Mutual will forgive first-time accidents for safe drivers and reduce Ford insurance deductibles by $100 every year you remain claim-free.

- Ford-Specific Perks: Includes roadside assistance and OEM parts replacement, helping Fords maintain their original performance and value after a claim.

- Online Management: Manage policies, pay bills, and file Ford auto insurance claims easily through the app. Our Liberty Mutual review walks you through the process.

Cons

- High Premiums: Full coverage for Fords can reach $169 per month, which may be a concern for budget-conscious drivers looking for low-cost comprehensive protection.

- Limited Discounts: Ford drivers with older models or without bundled policies may miss out on Liberty Mutual’s best discounts, including multi-policy and safe driver savings.

#3 – Nationwide: Best for Low Mileage

Pros

- SmartMiles Program: Ford drivers with short commutes can save up to 40% with pay-per-mile insurance, ideal for remote workers or those using a Ford as a second car.

- Decent Rates: Minimum coverage for Fords starts at $74 per month, with full coverage that includes accident forgiveness and good driver discounts.

- Policy Perks: Features like vanishing deductibles and total loss replacement make it a smart option for newer Ford models. Browse options in our Nationwide review.

Cons

- Mileage Penalties: Long-distance Ford drivers may not benefit from SmartMiles pricing and could face higher rates.

- Regional Gaps: SmartMiles and some other perks are not available in every state, limiting flexibility for some Ford owners.

#4 – State Farm: Best for Customer Service

Pros

- Great Support: Ford owners benefit from State Farm’s trusted customer service, including access to local agents and fast, reliable claims handling.

- Low Rates: Minimum coverage for Fords is available for $71 a month. Compare more rates in our State Farm auto insurance review.

- Driver-Friendly Perks: Features like Drive Safe & Save, rental car reimbursement, and multi-policy discounts benefit Ford drivers focused on long-term value.

Cons

- Limited UBI: Drive Safe & Save isn’t offered in all states, restricting access to usage-based discounts for some Ford owners.

- Coverage Restrictions: State Farm is not writing new policies in states like Massachusetts or Rhode Island, limiting availability for Ford drivers in those areas.

#5 – The Hartford: Best for AARP Benefits

Pros

- AARP Savings: Ford drivers eligible for AARP get exclusive benefits, including Lifetime Renewability and RecoverCare, which helps with daily tasks after an accident.

- Senior Discounts: Older Ford drivers get exclusive auto insurance discounts through AARP for retirees driving reliable Ford models.

- Custom Benefits: Offers accident forgiveness, new car replacement, and roadside assistance designed to support long-term Ford ownership.

Cons

- Higher Rates: Full coverage for Fords can reach $170 per month, which may not suit younger or budget-conscious drivers.

- Age Limits: Many Hartford perks apply only to Ford drivers aged 50 and older, limiting access for others. Learn how to qualify in our The Hartford Insurance review.

#6 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Perks: Ford drivers earn long-term rewards like decreasing deductibles and accident-free renewal bonuses with each policy term.

- Reasonable Rates: Offers minimum coverage for Fords at $76 per month. Compare more quotes in our American Family Insurance review.

- Family Coverage Features: Tools like teen driver tracking, OEM parts coverage, and good student discounts make AmFam a top pick for teen drivers and families.

Cons

- Delayed Rewards: Most loyalty benefits activate after the second policy term, delaying savings for new Ford policyholders.

- Higher Full Coverage: Ford drivers may pay up to $165 per month for full coverage, especially on newer or high-value models.

#7 – Geico: Best for Various Discounts

Pros

- Ford Discounts: Ford drivers can qualify for up to 25% off with anti-theft devices, multi-policy bundles, and good driver discounts.

- Low Prices: Minimum coverage for Fords starts at $69 per month, making Geico one of the most affordable national insurers. See how quotes compare in our Geico review.

- Coverage Add-Ons: Includes mechanical breakdown insurance and emergency roadside service, which are helpful for both new and aging Ford vehicles.

Cons

- Less Personalized: Geico operates primarily online, so Ford drivers who want to tailor their coverage with an insurance agent may have to shop elsewhere.

- Selective Offers: Not all Ford drivers may qualify for Geico’s full range of discounts, but eligibility depends on location, model, and driver profile.

#8 – Allstate: Best for Safe Drivers

Pros

- Drivewise Program: Ford owners can save up to 40% by joining Drivewise, Allstate’s usage-based discount program for safe drivers.

- Safe Driver Rewards: Ford drivers without citations or claims save 25% and earn $50 off their deductibles every six months. Find out how much you can save: Allstate Review

- Ford-Ready Coverage: Offers valuable features like OEM parts coverage, accident forgiveness, and deductible rewards for Ford drivers.

Cons

- High Costs: Minimum coverage for Fords starts at $85 a month, and full coverage is priced at $175 monthly.

- Strict Criteria: Not all Ford drivers qualify for top Drivewise savings, especially those with longer commutes or inconsistent driving behavior.

#9 – Travelers: Best for EV & Hybrid Models

Pros

- EV Discounts: Ford owners with an electric or hybrid model automatically save 10% on their policy, which can be stacked with other discounts for even bigger savings.

- Full Protection: Travelers offers strong comprehensive coverage for Fords, including accident forgiveness, new car replacement, and glass repair.

- Low Rates: Ford owners can get minimum coverage starting at $70 per month. Compare premiums side-by-side in our Travelers auto insurance review.

Cons

- Varied Customer Service: Travelers’ Ford customer satisfaction scores vary by region, especially in states with limited in-network repair shops.

- Fewer Discounts: Compared to other insurers, Travelers offers fewer bundling and long-term discount opportunities for Ford policyholders.

#10 – Progressive: Best for Usage-Based Discounts

Pros

- UBI Savings: Ford drivers can lower costs by $200 or more a year by maintaining safe driving habits through Progressive’s Snapshot program.

- Competitive Pricing: Offers minimum coverage for Fords starting at $72 a month. Read our Progressive Insurance review to compare quotes for free.

- Ford Add-Ons: Policies include optional protections like rideshare insurance, OEM parts coverage, and roadside assistance, ideal for modern Ford vehicles.

Cons

- Rate Spikes: Some Ford drivers report premium hikes at renewal, especially if Snapshot driving data reflects risky behaviors like hard braking.

- Discount Limits: High-mileage or rural Ford drivers may benefit less from usage-based pricing compared to low-mileage city drivers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Right Ford Insurance Provider

Finding the best auto insurance for Fords comes down to balancing cost, coverage, and available discounts. See More: The 17 Best Tips to Pay Less for Car Insurance

Whether you drive a compact Ford Fiesta or a full-size F-150, comparing quotes from top companies like Erie, Nationwide, and Liberty Mutual can help you save money.

Ford insurance costs vary by model, coverage level, and driving history, so it’s important to choose a provider that fits your specific needs.

Don’t forget to take advantage of discounts for safe driving, bundling, and safety features, as these can add up to big savings over time. Protect your Ford at the best prices by entering your ZIP code into our free quote comparison tool.

Frequently Asked Questions

Which company has the best Ford auto insurance?

The best car insurance companies for Ford drivers are Erie, Liberty Mutual, and Nationwide. Erie consistently offers low rates and strong coverage options, while Liberty Mutual has helpful add-ons for new Fords. Nationwide is the best provider for Ford owners who qualify for their pay-as-you-go SmartRide and SmartMiles plans.

Is Ford Insurance expensive?

Ford Motor Insurance can be expensive if you tend to speed or drive at night. Your Ford Insure quote is usage-based, so it varies with your driving habits and mileage. Enter your ZIP code to start comparing local Ford insurance prices for free.

What affects Ford car insurance rates the most?

Rates depend on the Ford model, your chosen coverage level (minimum or full), and the insurance company. Other factors include mileage, driving history, ZIP code, age, gender, and available discounts.

How do I get discounts on auto insurance for Fords?

Who qualifies for a Ford discount? You can get Ford insurance discounts by bundling home and auto, installing anti-theft devices, maintaining a clean driving record, enrolling in usage-based programs, or being a student or military member. Ford also offers discounts through Ford X-Plans (Partner Recognition Program) for employees of partner companies.

Read More: Top 7 Ways You’re Wasting Money on Your Car

Are Ford insurance rates higher for young drivers?

Younger drivers usually pay more, but Ford owners under 25 can lower costs by taking defensive driving courses, earning good grades, or driving safer models like the Focus or Escape.

Are Fords expensive to insure compared to other vehicles?

Generally, Ford insurance costs hover around average, but rates depend on the model. Premiums for larger or performance vehicles like the Ford Mustang or F-150 are usually higher than Ford Fiesta insurance rates. Try our free comparison tool to explore which companies have the cheapest car insurance for Ford models.

How do I compare Ford insurance quotes?

Use an online comparison tool to get a Ford car insurance quote from multiple companies. Look closely at coverage types, deductibles, available discounts, and whether the policy includes perks like OEM parts or accident forgiveness. Be sure to compare rates by model, because a Ford Fiesta insurance quote will be much lower than quotes for a Mustang or F-150.

Check It Out: How to Compare Auto Insurance Companies

What’s the best insurance for a Ford Mustang?

The best insurance for a Mustang often comes from companies like Progressive, Liberty Mutual, and State Farm. These providers offer performance-friendly coverage, high liability limits, and discounts for safe driving and anti-theft systems.

How much is Ford Flex car insurance?

Ford Flex insurance rates are affordable, around $73 a month for minimum coverage. However, it’s still more expensive than Ford Fusion insurance at $70 per month, and the average Ford Focus car insurance cost, which is one of the cheapest models, at $68 monthly.

What insurance company does Ford use?

Ford Motor Company Insurance, also known as Ford Insure, is a usage-based program powered by Nationwide. Ford Insure reviews show that drivers can get personalized rates by tracking driving habits through FordPass Connect. If you have questions or need assistance, you can call the Ford insurance phone number for customer service at 1-888-270-0025.

Important Details: Best Auto Insurance Companies for Claims Handling

Is dealership insurance cheaper for Fords?

Do Fords hold their value?

What does usage-based insurance offer Ford drivers?

Is Ford Premium Care bumper-to-bumper?

How much is Ford WearCare?

Do Ford employees get special auto insurance pricing?

Should I get gap insurance for my Ford?

Why did Ford discontinue the Edge?

What is the Ford insurance claim process like?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.